Beruflich Dokumente

Kultur Dokumente

Banking Theory and Practice - Session 2

Hochgeladen von

Demetrios Balaskas0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten3 SeitenOriginaltitel

Banking Theory and Practice - Session 2.docx

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten3 SeitenBanking Theory and Practice - Session 2

Hochgeladen von

Demetrios BalaskasCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

Banking Theory and Practice Session 2 1st March 2019

Federal Reserve’s Balance sheet (Central Bank)

Assets Liabilities

Government Securities Currency in circulation

Discount Loans Reserves

Central banks are responsible for the liquidity of commercial banks, reserves are called the

minimum reserve requirement.

Third Party Funds (Dana Pihak Ketiga(DPK)) is all the money that is collected by the banks,

such as saving deposits (tabungan), current accounts (giro) and time deposits (deposito).

When supply of Rp. is too

Purchase of bonds increases the money supply much the fed needs to

Making discount loans increases the money supply absorb the liquidity of Rp.

in the market by selling

Open Market Operations (OMO) government securities or

1. Dynamic: Meant to change reserves bonds to reduce the

2. Defensive: Meant to offset other factors affecting Reserves, supply of Rp. in the

typically uses repos market and vice versa.

Open market operations at the Trading Desk

The trading desk typically uses 2 types of transactions to implement their strategy:

o Repurchase Agreements: The fed purchases securities, but agrees to sell

them back within about 15 days. So, the desired effect is reversed when the

Fed sells the securities back – good for taking defense strategies that will

reverse.

o Matched sale-purchase transaction: essentially a reverse repo, where the fed

sells securities and agree to buy it back

Discount Loans

The Fed’s discount loans are primarily of three types

Primary Credit: Policy whereby healthy banks are permitted to borrow as they wish

from the primary credit facility.

Secondary Credit: Given to troubled banks experiencing liquidity problems.

Seasonal Credit: Designed for small, regional banks that have seasonal patterns of

deposit.

Lender of last resort

1. To prevent banking panics

2. When no one else wants to lend money, the commercial banks can borrow from

central bank

Reserve Requirements

Everyone is subject to the same rule for checkable deposits:

3% of first $48.3M, 10% above said amount

Fed can change the 10%

Rarely used as a tool

1. Raising liquidity problems for banks

2. Makes liquidity management unnecessarily difficult

For BI, 6.5% of total Third-Party Funds

Loan to funding ratio 80-92% -> if more than 92, must put more on reserve requirement

BI -> 7 Days reverse repo rate

Interbank overnight rate

Bank’s interest rate

Price stability goal and the nominal anchor

Policymakers have come to recognize the social and economic costs of inflation.

Price stability, therefore, has become a primary focus

High inflation seems to create uncertainty, hampering economic growth

Indeed, Hyperinflation has proven damaging to countries

Other goals of monetary policy

Goals

1. High employment

2. Economic growth

3. Stability of financial markets

4. Interest rate stability

5. Forex market stability

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- MKTG 361 Phase 2Dokument10 SeitenMKTG 361 Phase 2api-486202971Noch keine Bewertungen

- TB Chapter 05 Risk and Risk of ReturnsDokument80 SeitenTB Chapter 05 Risk and Risk of Returnsabed kayaliNoch keine Bewertungen

- Suarez, Francis - FORM 1 - 2009 PDFDokument3 SeitenSuarez, Francis - FORM 1 - 2009 PDFal_crespoNoch keine Bewertungen

- Raki RakiDokument63 SeitenRaki RakiRAJA SHEKHARNoch keine Bewertungen

- Drivers of International BusinessDokument38 SeitenDrivers of International BusinessAKHIL reddyNoch keine Bewertungen

- List of Important International Organizations and Their Headquarter 2017Dokument6 SeitenList of Important International Organizations and Their Headquarter 2017Kalaivani BaskarNoch keine Bewertungen

- Level 2 Los 2018Dokument46 SeitenLevel 2 Los 2018Loan HuynhNoch keine Bewertungen

- Revision MAT Number Securing A C Sheet BDokument1 SeiteRevision MAT Number Securing A C Sheet Bmanobilli30Noch keine Bewertungen

- ECO 303 PQsDokument21 SeitenECO 303 PQsoyekanolalekan028284Noch keine Bewertungen

- International Management+QuestionsDokument4 SeitenInternational Management+QuestionsAli Arnaouti100% (1)

- Cfdcir 04Dokument3 SeitenCfdcir 04subodhmallyaNoch keine Bewertungen

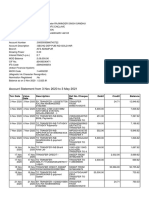

- Account Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument8 SeitenAccount Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRajwinder SandhuNoch keine Bewertungen

- Evaluation Sheet For Extension ServicesDokument1 SeiteEvaluation Sheet For Extension Servicesailine donaireNoch keine Bewertungen

- How NGOs Can Develop Budgets in Their ProposalsDokument10 SeitenHow NGOs Can Develop Budgets in Their ProposalsMurali PrasadNoch keine Bewertungen

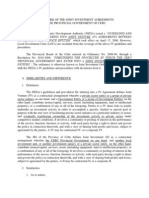

- Law University SynopsisDokument3 SeitenLaw University Synopsistinabhuvan50% (2)

- T1 General PDFDokument4 SeitenT1 General PDFbatmanbittuNoch keine Bewertungen

- GDP For 1st QuarterDokument5 SeitenGDP For 1st QuarterUmesh MatkarNoch keine Bewertungen

- History of Tata SteelDokument13 SeitenHistory of Tata Steelmanoj rakesh100% (4)

- Malabon AIP 2014+amendments PDFDokument81 SeitenMalabon AIP 2014+amendments PDFCorics HerbuelaNoch keine Bewertungen

- GlobalDokument6 SeitenGlobalarvindNoch keine Bewertungen

- Teaching GDDokument26 SeitenTeaching GDanishkrishnannayarNoch keine Bewertungen

- Challan Form SargodhaDokument1 SeiteChallan Form SargodhaUsama NazirNoch keine Bewertungen

- UPODokument3 SeitenUPOcaue69343Noch keine Bewertungen

- Public - Private PartnershipDokument2 SeitenPublic - Private PartnershipRyan T. PacabisNoch keine Bewertungen

- Melinda Coopers Family Values Between Neoliberalism and The New Social ConservatismDokument4 SeitenMelinda Coopers Family Values Between Neoliberalism and The New Social ConservatismmarianfelizNoch keine Bewertungen

- Viney - Financial Markets and InstitutionsDokument37 SeitenViney - Financial Markets and InstitutionsVilas ShenoyNoch keine Bewertungen

- MSC Chain of Custody StandardDokument10 SeitenMSC Chain of Custody StandardIMMASNoch keine Bewertungen

- Case Study Class 12 IEDDokument7 SeitenCase Study Class 12 IEDAkshayaram Viswanathan100% (2)

- VAT Registration CertificateDokument1 SeiteVAT Registration Certificatelucas.saleixo88Noch keine Bewertungen

- Full Download Strategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt Solutions ManualDokument36 SeitenFull Download Strategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt Solutions Manualowen4ljoh100% (25)