Beruflich Dokumente

Kultur Dokumente

Debit Vs Credit Card

Hochgeladen von

Preeti100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

153 Ansichten3 SeitenA credit card allows purchases on credit from a financial institution, with payment due monthly. A debit card deducts purchases directly from a linked bank account. Key differences are that credit cards don't require a bank account, have higher spending limits based on credit ratings, charge interest on unpaid balances, and provide monthly bills, while debit cards immediately deduct from funds in a required bank account and don't charge interest.

Originalbeschreibung:

portion

Originaltitel

Debit vs Credit Card

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenA credit card allows purchases on credit from a financial institution, with payment due monthly. A debit card deducts purchases directly from a linked bank account. Key differences are that credit cards don't require a bank account, have higher spending limits based on credit ratings, charge interest on unpaid balances, and provide monthly bills, while debit cards immediately deduct from funds in a required bank account and don't charge interest.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

153 Ansichten3 SeitenDebit Vs Credit Card

Hochgeladen von

PreetiA credit card allows purchases on credit from a financial institution, with payment due monthly. A debit card deducts purchases directly from a linked bank account. Key differences are that credit cards don't require a bank account, have higher spending limits based on credit ratings, charge interest on unpaid balances, and provide monthly bills, while debit cards immediately deduct from funds in a required bank account and don't charge interest.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

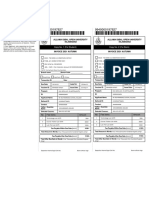

Comparison Chart

BASIS FOR

CREDIT CARD DEBIT CARD

COMPARISON

Meaning Credit card is Debit card is issued by a bank to

issued by a bank or allow its customers to purchase

any financial goods and services, whose

institution to allow payment is made directly through

the holder of the the customer's account linked to

card to purchase the card.

goods and services

on credit. The

payment is made by

the bank on the

customer's behalf.

Implies Pay later Pay now

Bank Account The bank account is The bank account is a must for

not prerequisite for issuing a debit card.

issuing a credit

card.

Limit The maximum limit The maximum limit of

of withdrawing withdrawing money will be less

money is than the money lying in the saving

determined bank account.

according to the

credit rating of the

BASIS FOR

CREDIT CARD DEBIT CARD

COMPARISON

holder.

Bill The holder of the There is no such bill, the amount

card has to pay the is directly deducted from the

credit card bill customer's account.

within 30 days of

every month.

Interest Interest is charged No interest is charged.

when payment is

not made to the

bank within a

specified time

period.

Definition of Credit Card

A credit card is a type of facility which allows its customers to purchase

goods and services on credit, and the payment is made by a third party

(financial institution) on his behalf immediately. The customer has to

pay the credit amount to the third party at a later date. In this regard,

every month, the financial institution sends a bill to the card user for the

amount paid on his behalf. Usually the user is allowed a credit period

of 30 days within which he can pay the amount, afterwards, interest is

charged at a prescribed rate.

Definition of Debit Card

A debit card is a type of facility provided by the banks to its customers to

purchase goods and services against his own saving bank account. So,

whenever the transaction takes place, the amount is deducted from the

customer’s account. Here, the bank charges a nominal amount every

month for the use of the card. It can be used for purchasing goods,

transfer of funds, internet banking services, deposits, etc. Nowadays,

ATM cum debit card is also available in the market which allows you to

avail all the facilities of the ATM card.

Similarly like a credit card, it is also made up of plastic with a magnetic

strip which contains all the basic account details of the customer.

Key Differences Between Credit Card and Debit Card

1. For issuing the Credit card, the bank account is not the

requirement of the bank, but in the case of Debit card the customer

must have a bank account.

2. The major difference between Credit Card and Debit Card is that,

in Debit card the amount is withdrawn from the bank account

linked to it, while in the Credit card the amount is not withdrawn

from the account.

3. In Credit card the bank charges interest, whereas in the Debit card

no interest is charged.

4. The maximum limit of withdrawal in Credit card depends on the

credit rating while the maximum limit of withdrawal in Debit card

depends on the cash balance in the account.

5. The rate of overdraft facility is low on the Credit card, but the rate

of overdraft facility is high in case of a Debit card.

Das könnte Ihnen auch gefallen

- How To Handle Guest ComplaintDokument20 SeitenHow To Handle Guest ComplaintEldiyar AzamatovNoch keine Bewertungen

- Hotel Facilities DialogDokument2 SeitenHotel Facilities DialogSvensen AngelNoch keine Bewertungen

- Lesson Nine Changing Money PDFDokument10 SeitenLesson Nine Changing Money PDFl_rockgothstar2295Noch keine Bewertungen

- Credit and Debit CardDokument2 SeitenCredit and Debit Cardnouha KABBAJNoch keine Bewertungen

- Banking Practice Unit 5 What Is A 'Credit Card'Dokument6 SeitenBanking Practice Unit 5 What Is A 'Credit Card'Nandhini VirgoNoch keine Bewertungen

- Banking Practice Unit 5 What Is A 'Credit Card'Dokument6 SeitenBanking Practice Unit 5 What Is A 'Credit Card'Nandhini VirgoNoch keine Bewertungen

- Assignment: Name Noor Nihal Ahmad Class 3 Roll No 142Dokument7 SeitenAssignment: Name Noor Nihal Ahmad Class 3 Roll No 142noorNoch keine Bewertungen

- Assignment: Name Noor Nihal Ahmad Class 3 Roll No 142Dokument7 SeitenAssignment: Name Noor Nihal Ahmad Class 3 Roll No 142abdul khaliqueNoch keine Bewertungen

- New Credit CardsDokument68 SeitenNew Credit CardsManish GadekarNoch keine Bewertungen

- Ecommerce Unit 4Dokument12 SeitenEcommerce Unit 4jhanviNoch keine Bewertungen

- Credit Card VS Debit CardDokument3 SeitenCredit Card VS Debit CardS K MahapatraNoch keine Bewertungen

- Plastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank TripathiDokument25 SeitenPlastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank Tripathihaz008Noch keine Bewertungen

- Plastic Money PDFDokument25 SeitenPlastic Money PDFhaz00850% (2)

- Debit and Credit CardsDokument7 SeitenDebit and Credit CardsMahesh KumarNoch keine Bewertungen

- Edited Module NotesDokument44 SeitenEdited Module NotesWalidahmad AlamNoch keine Bewertungen

- Plastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank TripathiDokument25 SeitenPlastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank Tripathitarunavasyani100% (3)

- Payment Method Using A Credit CardDokument1 SeitePayment Method Using A Credit CardmustarNoch keine Bewertungen

- Định nghĩa thanh toán điện tửDokument3 SeitenĐịnh nghĩa thanh toán điện tửHoàng MiiNoch keine Bewertungen

- Innovation in Credit Card and Debit Card Business by Indian BanksDokument21 SeitenInnovation in Credit Card and Debit Card Business by Indian BanksProf S P GargNoch keine Bewertungen

- Credit Cards: Presented By: Abhishek VijayvargiyaDokument15 SeitenCredit Cards: Presented By: Abhishek VijayvargiyaAbhishek VijayvagiyaNoch keine Bewertungen

- Know Your Rupay Debit CardDokument9 SeitenKnow Your Rupay Debit Cardwps gccNoch keine Bewertungen

- CardsDokument17 SeitenCardsPriyal Shah100% (1)

- Credit Card BusinessDokument51 SeitenCredit Card BusinessAsefNoch keine Bewertungen

- Fin 202Dokument23 SeitenFin 202Dorji DelmaNoch keine Bewertungen

- Line of Credit Deposits Credit Card Balance Interest Credit HistoryDokument4 SeitenLine of Credit Deposits Credit Card Balance Interest Credit HistoryJyoti JhajhraNoch keine Bewertungen

- Eco 2ND YrDokument23 SeitenEco 2ND YrKrishna SaklaniNoch keine Bewertungen

- Credit Card by Urmimala MukherjeeDokument47 SeitenCredit Card by Urmimala Mukherjeeurmimala21Noch keine Bewertungen

- Plastic Money-The Future Currency: Sunil HarshaDokument10 SeitenPlastic Money-The Future Currency: Sunil HarshaMuhammad NaeemNoch keine Bewertungen

- Plastic Money PDFDokument6 SeitenPlastic Money PDFJosé BurgeiroNoch keine Bewertungen

- Plastic MoneyDokument15 SeitenPlastic MoneyRazzat AroraNoch keine Bewertungen

- Plastic Money: Subject - Financial ServicesDokument24 SeitenPlastic Money: Subject - Financial Servicesshashikumarb2277Noch keine Bewertungen

- Plastic MoneyDokument3 SeitenPlastic MoneysachinremaNoch keine Bewertungen

- Debit Card and Credit CardDokument8 SeitenDebit Card and Credit CardNeeraj DwivediNoch keine Bewertungen

- Islamic Credit CardsDokument2 SeitenIslamic Credit CardsArShid WahaGNoch keine Bewertungen

- Banking Law & Practice: Atm, Debit Card, Credit CardDokument16 SeitenBanking Law & Practice: Atm, Debit Card, Credit CardAAAANoch keine Bewertungen

- 3.2 Credit and Debt ManagementDokument35 Seiten3.2 Credit and Debt Managementsuhada asriNoch keine Bewertungen

- Credit Card PDFDokument15 SeitenCredit Card PDFTarun TiwariNoch keine Bewertungen

- Credit CardDokument51 SeitenCredit CardSmita JainNoch keine Bewertungen

- Card Buisiness Crdit Card EtcDokument5 SeitenCard Buisiness Crdit Card EtcTarun GargNoch keine Bewertungen

- English GlossaryDokument7 SeitenEnglish GlossaryWaqarNoch keine Bewertungen

- Credit ServicesDokument4 SeitenCredit ServicesMs. Anitharaj M. SNoch keine Bewertungen

- Tiderc Drac (Credit Card)Dokument74 SeitenTiderc Drac (Credit Card)Abhijeet KulshreshthaNoch keine Bewertungen

- Unit 5 E Commerce Payment SystemDokument4 SeitenUnit 5 E Commerce Payment SystemAltaf HyssainNoch keine Bewertungen

- Credit Card: Presented By, Manju SDokument28 SeitenCredit Card: Presented By, Manju SDeepak R PatelNoch keine Bewertungen

- Make Una Accept An 1Dokument1 SeiteMake Una Accept An 1Private NetworkNoch keine Bewertungen

- What Are Debitcards??Dokument10 SeitenWhat Are Debitcards??lavanyasundar7Noch keine Bewertungen

- Da Afghanistan Bank Afghanistan Payments System: "The National E-Payment Switch of Afghanistan"Dokument34 SeitenDa Afghanistan Bank Afghanistan Payments System: "The National E-Payment Switch of Afghanistan"Asef KhademiNoch keine Bewertungen

- Credit Card Industry: Pooja Jain Senior Lecturer, JUIT WaknaghatDokument26 SeitenCredit Card Industry: Pooja Jain Senior Lecturer, JUIT WaknaghatAbhay MalhotraNoch keine Bewertungen

- Glossary of Terms Financing Products (English and Urdu)Dokument12 SeitenGlossary of Terms Financing Products (English and Urdu)Mustafa SoomroNoch keine Bewertungen

- Yes.. Today Its Not Hard To Hear That We Can Make Withdrawals With Different Bank's ATMDokument5 SeitenYes.. Today Its Not Hard To Hear That We Can Make Withdrawals With Different Bank's ATMHabtamu AssefaNoch keine Bewertungen

- Knowledge TPDokument4 SeitenKnowledge TPELIANA RAMIREZ SAMBONINoch keine Bewertungen

- Anita Mam Bank ProjectDokument19 SeitenAnita Mam Bank ProjectNisha AroraNoch keine Bewertungen

- Credit and Debit CardsDokument16 SeitenCredit and Debit CardsPriyal Shah100% (1)

- By Ankit Chauhan (ITM Universe) VadodaraDokument10 SeitenBy Ankit Chauhan (ITM Universe) VadodaraRaman KumarNoch keine Bewertungen

- Latest Trends in Banking: Debit CardDokument10 SeitenLatest Trends in Banking: Debit CardChristineNoch keine Bewertungen

- E Commrce Payment SystemDokument2 SeitenE Commrce Payment SystemReza Ur RahmanNoch keine Bewertungen

- Credit CardsDokument21 SeitenCredit Cardsdixita_chotalia3829100% (1)

- Credit Card: Dr. Yamini Sharma D.M.SDokument31 SeitenCredit Card: Dr. Yamini Sharma D.M.SJames RossNoch keine Bewertungen

- Credit Cards: Muralidhar PrasadDokument17 SeitenCredit Cards: Muralidhar PrasadAnkit Kumar PattnayakNoch keine Bewertungen

- Bank of Baroda Bank of Baroda Bank of Baroda: No.: 2086601 No.: 2086601 No.: 2086601Dokument1 SeiteBank of Baroda Bank of Baroda Bank of Baroda: No.: 2086601 No.: 2086601 No.: 2086601Såñdèëp KNoch keine Bewertungen

- Gepco Online BillDokument2 SeitenGepco Online BillHafiz RizwanNoch keine Bewertungen

- SalarySlipwithTaxDetails 2021 JuneDokument1 SeiteSalarySlipwithTaxDetails 2021 JuneSameer KulkarniNoch keine Bewertungen

- Description From Currency To Currency Recipient Receive Exchange Rate Amount DueDokument1 SeiteDescription From Currency To Currency Recipient Receive Exchange Rate Amount DueJOMBANG TIMOERNoch keine Bewertungen

- Your Account Statement: Contact UsDokument4 SeitenYour Account Statement: Contact UsAll PeaceNoch keine Bewertungen

- Jawaban Pertemuan 5 PDFDokument2 SeitenJawaban Pertemuan 5 PDFiqbal farisNoch keine Bewertungen

- Important : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadDokument1 SeiteImportant : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadMuhammad Sohail0% (1)

- Lear Automotive India Private Limited: Current Month April To DateDokument1 SeiteLear Automotive India Private Limited: Current Month April To Datesanket shahNoch keine Bewertungen

- Rajasthan State Road Transport Corporation E-Reservation TicketDokument1 SeiteRajasthan State Road Transport Corporation E-Reservation TicketAbhijeet SinghNoch keine Bewertungen

- Audit ChecklistDokument32 SeitenAudit ChecklistParth Joshi100% (1)

- Company Profile of ST JohnDokument79 SeitenCompany Profile of ST Johnpruthviraj0% (1)

- FunimationDokument8 SeitenFunimationtrickmodder אNoch keine Bewertungen

- Walk Through ChecklistDokument2 SeitenWalk Through ChecklistJa'maine John Agdeppa ManguerraNoch keine Bewertungen

- Accounts G11 Term 1 2009Dokument2 SeitenAccounts G11 Term 1 2009chicochaxNoch keine Bewertungen

- BRT in Metro Dhaka: Towards Achieving A Sustainable Urban Public Transport SystemDokument5 SeitenBRT in Metro Dhaka: Towards Achieving A Sustainable Urban Public Transport SystemRaja RumiNoch keine Bewertungen

- Pes2017xls 2Dokument522 SeitenPes2017xls 2Paulina Arriagada ArancibiaNoch keine Bewertungen

- Ms PANWAR COMPUTERS 17 Nov 2011Dokument1 SeiteMs PANWAR COMPUTERS 17 Nov 2011Asterism TechPro RajasthanNoch keine Bewertungen

- CTS Form ADokument4 SeitenCTS Form AsezulfiqarNoch keine Bewertungen

- Tax 1 Income Taxation Midterm ReviewerDokument6 SeitenTax 1 Income Taxation Midterm ReviewerMiaNoch keine Bewertungen

- Planning Commission Working Group Report On The Logistics SectorDokument57 SeitenPlanning Commission Working Group Report On The Logistics SectorPiyush KhandelwalNoch keine Bewertungen

- Terms & Conditions - Airport Transfer Service: Eligible Cards: FAB Credit Card Number of Transfers (Per Annum)Dokument3 SeitenTerms & Conditions - Airport Transfer Service: Eligible Cards: FAB Credit Card Number of Transfers (Per Annum)sbtharanNoch keine Bewertungen

- Form 231Dokument9 SeitenForm 231sanjay jadhav100% (5)

- Myungsoo YooDokument3 SeitenMyungsoo YooITNoch keine Bewertungen

- Final Accounts of Banking CompaniesDokument28 SeitenFinal Accounts of Banking CompaniesAmit_Agarwal_7219Noch keine Bewertungen

- Terms & Conditions - Insta Jumbo Loan: Please Note ThatDokument3 SeitenTerms & Conditions - Insta Jumbo Loan: Please Note ThatZaed QasmiNoch keine Bewertungen

- Passenger Name 02Dokument2 SeitenPassenger Name 02CarmeloNoch keine Bewertungen

- Taxperts TipsDokument23 SeitenTaxperts TipsKelsey ReedNoch keine Bewertungen

- Printreciept RequestDokument1 SeitePrintreciept RequestJohn Francis KanwaiNoch keine Bewertungen

- GL Codes List 9100 Co CodeDokument19 SeitenGL Codes List 9100 Co Codechatpong100% (2)

- MM300 - Introduction To MM: Intro/Overview of MM MM - 300 - 1.1Dokument7 SeitenMM300 - Introduction To MM: Intro/Overview of MM MM - 300 - 1.1arunvasamNoch keine Bewertungen