Beruflich Dokumente

Kultur Dokumente

201807071412199687644-TEJASNET ReIterating Apr18

Hochgeladen von

naveenOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

201807071412199687644-TEJASNET ReIterating Apr18

Hochgeladen von

naveenCopyright:

Verfügbare Formate

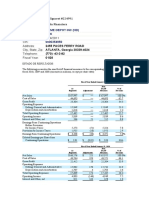

Tejas Networks Limited (TEJASNET)

April 19, 2018 CMP: ₹332

Time Horizon – 12 Months Target: ₹427

Key Data (In ₹ Mn.) FY-17 FY-18E FY-19E FY-20E

Bloomberg Code TEJASNET IN Net Sales 8,782 9,027 12,204 15,133

V NSE Code TEJASNET EBITDA

EBITDA Margin

1,709

19.5%

2,018

22.4%

2,728

22.4%

3,534

23.4%

BSE Code 540595

A Sector

Industry

IT

Technology Hardware & Equip.

PAT

EV/Sales

632

3.5

1,043

3.4

1,599

2.5

2,170

2.0

L Face Value (₹)

BV per share (₹)

10.0

55

EV/EBITDA

P/E (x)

16.7

48.4

14.3

29.3

10.6

19.1

8.2

14.1

U Dividend Yield (%)

52 Week L/H(₹)

0.0%

257 / 472

Price Performance

Absolute

CY14

-

CY15

-

CY17

54%

YTD

-15%

E Market Cap. (₹ mn.) 30,152 Relative - - 39% -13%

Shareholding Pattern (as on Mar’18) Relative stock performance (Jun’17=100)

175

P Promoters

Mar-18

0.0%

Dec-17

0.0%

Sep-17

0.0%

Jun-17

0.0%

150

I Institutions 27.5% 29.9% 30.5% 29.7%

125

100

C Others 72.5% 70.1% 69.5% 70.3%

75

Jul-17

Jul-17

Jun-17

Nov-17

Nov-17

Apr-18

Aug-17

Aug-17

Sep-17

Sep-17

Dec-17

Dec-17

Feb-18

Feb-18

Mar-18

Mar-18

Jan-18

Jan-18

Oct-17

Oct-17

k Total 100% 100% 100% 100%

Nifty 500 TEJASNET

Source: Company, Anand Rathi Research, Bloomberg

Analyst: Narendra Solanki Anand Rathi Research

narendrasolanki@rathi.com

Tejas Networks Limited (TEJASNET)

Better prospects for both top line growth and improvement

in profitability.

Tejas Networks Limited (TEJASNET) is an India-based optical and data networking products company founded in 2000 with

customers in over 60 countries. The company designs, develops and sell high-performance and cost-competitive products to

telecommunications service providers, internet service providers, utility companies, defence companies and government

entities (collectively, “Communication Service Providers”) while maintaining itself asset-light through outsourcing

manufacturing.

The company’s current product portfolio targets access networks, metro networks and long-haul networks. It has also setup an

in house research & development which has enabled it to develop over 40 carrier-grade equipment, over 300 high-speed PCB

and over 250 silicon intellectual properties (“IPs”).

As of Dec-17 it has filed 338 patent applications, with 205 filings in India, 92 filings in the United States and 6 filings in Europe,

out of which 56 patents have been granted and have also filed 35 patent applications under the Patent Cooperation Treaty.

During the latest quarterly results, the company has recorded a de-growth of 14% in its revenues at ₹2,299 million in Q3-FY18

as against ₹2,673 million in Q3-FY17. Its EBITDA margins stood 22.1% at ₹507 million as against 23.5% at ₹627 million. The

decline in revenues was mainly due to few projects getting shifted to the next financial year and lower international revenues.

Going ahead, we expect Tejasnet to end FY-18 with marginal growth over FY-17 due to lumpiness and spillover of order

execution to FY-19. However, the management has confirmed that this spillover of order is over expected growth of early 20%

in FY-19. Thus FY-19 growth could well be higher at around 30% plus rate. The company is also in process to grow its

international business aggressively in few quarters.

In long term it is well-poised to take advantage of the growth in the communication industry due to its end-to-end portfolio of

products coupled with government’s preference for sourcing from domestic suppliers for its projects like Bharat Net.

We expect Tejasnet with its focus on innovation through R&D, expansion ofhigh growth segment product portfolios and asset

light business model to continue to provide traction in business in medium to long term. In medium term, we believe the stock

at current price is attractive owing to better business prospects in FY-19E onwards. We thus re-iterate BUY rating on Tejas

Networks Limited with a target price of ₹427 per share.

2 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

History and key milestone achieved.

Year Key Milestones

Tejas Networks incorporatedin Bangalore; Sanjay Nayak, Dr. Kumar N Sivarajan and Arnob Roy joined the

2000

company

2001 Procured order from TATA Power Company Limited

2004 Procured order from Railtel Corporation of India Limited through Electronics Corporation of India Limited

2005 Named in the ‘Red Herring 100 Asia’ by Red Herring

2006 Received the CSIR Diamond Jubilee Technology Award from the Council for Industrial and Scientific Research

2007 Received Carrier Ethernet certification from Iometrix

Named in the ‘Red Herring 100 Global’ by Red Herring

2008 Tejas receives ISO9001:2008 and TL9000-H certification

2009 Received the NASSCOM Innovation Award from NASSCOM

2010 Signs an OEM contract with an international partner to supply complementary products

2011 Procured order for 3G rollout in multiple circles

2012 Entered into a new OEM contract to supply complementary products

Recognized amongst the top five Indian applicants for patents in the field of information technology by the Office

2013

of the Controller General of Patents, Designs, Trademarks and Geographical Indication

2014 Selected as a supplierfor Africa’s West Indian Ocean Cable Company network

2015 Procured order under Optical Fiber Cable Network Development in 1,000 Union Parishad Project

2016 Tejas recognized as a Two Star Export House by Ministry of Commerce

Received Carrier Ethernet 2.0 certification from Iometrix certifying TJ1400, TJ1400P, TJ1600

Procured international order for 100G upgrade on TJ1600 equipment

Tejas procured order for installation, commissioning and maintenance of GPON equipment for a national fiber

2017

optic network project

Tejas Networks executes Terabit-Scale Optical Backbone Network in Bangladesh.

Tejas Networks successfully completes supply and deployment of over 40,000 GPON equipment for BharatNet

2018

Phase-1 project

Tejas Networks wins expansion order of Rs. 336 Cr from BSNL for BharatNet

Source: Company, Anand Rathi Research,

3 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Telecom Industry Eco-system and Tejasnet presence

Telecom Industry

Network Infrastructure

Active Equipment Passive Infrastructure

Wireless Access Tower Operators

Optical Transmission Cables & Accessories

Switches & Routers System Integrators

Tejas Networks is currently operating out of optical transmission vertical within the telecom industry network

infrastructure industry. The company’s prospective customers range from telecom operators in both private as

well as Government space along with various internet service providers.

The key competitors for the company within this segment are Ciena, infinera and ALU type of companies.

Source: Company, Anand Rathi Research,

4 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Focus from Access to Metro networks

Long-haul Networks: Networks that interconnect metro networks using high bandwidth transmission) networks.

Metro Networks: Networks that aggregate and distribute traffic collected from access networks within a large city or region.

Access Networks: The outer perimeter of a telecommunications network which connects to the end consumers.

Source: Company, Anand Rathi Research,

5 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Offering differentiated products with software defined

hardware.

Incorporates key

Multi-gen Support Seamless Network Cost effective

requirements of

2G-3G-4G Transformation lifecycle upgrades

markets

Programmable Advanced Catering to NFW,

hardwares with hardware-software CPO transport

uniform code base integration networks

Advantage to costumers Advantage to Tejas

Source: Company, Anand Rathi Research,

6 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Enabling it to maintain leadership in high-capacity circuit

emulation.

Core PTN Equipment extracts

emulated circuits and hands-off

over high-speed TDM interfaces

Edge PTN Equipment "emulates"

low-speed TDM circuits over

Tejas hardware can be reprogrammed to

high-speed Packet interface support a seamless and phased transition

Source: Company, Anand Rathi Research,

7 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Strong pick-up in optical capex in near future expected as

Indian data market is under invested in fiber and data usage

Internet Penetration Braodband Subscribers (Mn.)

Optical Capex vs Mobile Broadban Subscribers Ratio of Optical capex to subscribers

Source: Company, Anand Rathi Research

8 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Higher fiber connectivity of cell cites drives higher bandwidth

needs which further drives capex; benefiting Tejasnet.

Optical Capex Distributoin

Undersea &

Bandwidth

Management,

5%

LH/ULH, 32%

Metro &

Access, 63%

Tejas is focusing on high-growth Metro & Access segments with focus on Intra-city networks where there is need

for large investments in both capacity and fiber-reach and Inter-city backbone- investments for upgrade in

capacity

Also, the significant investments by government in rural areas for delivering broadband connectivity under

Bharate Net project also augurs well for companies like Tejasnet as it enhances business proposition.

Source: Company, Anand Rathi Research

9 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Investments into R&D to pay off as higher patent filings and

product innovation could add niche to its offerings

Source: Company, Anand Rathi Research

10 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Sustained focus on digitisation and increase in data

consumption to drive capex leading to higher revenues.

Sales (₹ Mn.) & EBITDA Estimates

16,000 24%

12,000 18%

8,000 12%

4,000 6%

- 0%

FY-16 FY-17 FY-18E FY-19E FY-20E

Revenues (₹Mn.) EBITDA Margins % (RHS)

We expect Tejas networks Limited to grow its revenues at a CAGR of around 20% for the next three years to reach

almost around ₹1,500 million by FY-20E. The main drivers for the growth are increased capex in data

infrastructure from telecom industry, BharatNet project, Rail, Electric and Smart City networks.

On profitability front, we expect the company to improve its operating margins gradually going ahead as

operating leverage due to its asset light model kicks in. While at profit after tax levels we expect Tejasnet to post

mid double digits margins by FY-20E.

11 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Valuation and Recommendation:

With large investment outlay in rural connectivity Relative stock performance (Jun’17=100)

through BharatNet project, higher connectivity 175

infrastructure spend by telecom industry coupled with 150

preference for domestic players augurs well for

125

companies like Tejasnet.

100

Tejas Networks Ltd stands to benefit being one of the

bigger and incumbent player to benefit from pent- 75

Jul-17

Jul-17

Jun-17

Apr-18

Aug-17

Aug-17

Nov-17

Nov-17

Dec-17

Dec-17

Mar-18

Mar-18

Sep-17

Sep-17

Jan-18

Jan-18

Feb-18

Feb-18

Oct-17

Oct-17

updemand for data & Government.

At CMP the stock is trading around 19x times FY19E Source: Bloomberg, Anand Rathi Research

earnings and 14x times FY20E earnings.

We initiate our coverage on Tejas Networks Limited

with a BUY rating and a target price of ₹427 per share. (In ₹ mn) FY-17 FY-18E FY-19E FY-20E

EPS (₹) 7.0 11.5 17.6 23.9

P/E (x) 47.7 28.9 18.9 13.9

P/B (x) 6.0 2.8 2.5 2.1

ROE 12.6% 9.8% 13.1% 15.0%

ROCE 18.5% 13.7% 17.6% 20.2%

EV/EBIDTA (x) 16.7 14.3 10.6 8.2

Source: Company, Anand Rathi Research

12 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Consolidated Financials:

(In ₹ Mn.) FY-17 FY-18E FY-19E FY-20E (In ₹ Mn.) FY-17 FY-18E FY-19E FY-20E

Net Sales 8,782 9,027 12,204 15,133 Liabilities

Operating Expense 7,073 7,009 9,477 11,600 Equity Share Capital 740 902 902 902

EBITDA 1,709 2,018 2,728 3,534 Reserves & Surplus 4,267 9,747 11,347 13,517

Other Income 120 124 167 207 Totat Shareholder's Funds 5,007 10,649 12,249 14,419

Depreciation 564 652 705 787 Minority Interest - - - -

EBIT 1,265 1,489 2,190 2,954 Long-Term Liabilities 20 20 20 20

Interest 315 152 139 172 Other Long-term Liabilities 166 166 166 166

Deferred Tax Liability - - - -

Misc. items (305) - - -

Short-term Liabilities 4,100 3,048 3,613 4,480

PBT 645 1,337 2,051 2,782

Total 9,292 13,884 16,048 19,085

Tax 13 294 451 612

Assets

Minority Interest - - - -

Net Fixed Assets 1,107 1,367 1,071 913

PAT 632 1,043 1,599 2,170

Long-Term L&A 591 591 591 591

Non Current Investments - - - -

Margins FY-17 FY-18E FY-19E FY-20E Other Non-Current Assets 1,000 1,000 1,000 1,000

Sales Growth % 40.0% 2.8% 35.2% 24.0%

Current Asset 6,594 10,925 13,385 16,580

Operating Margin % 19.5% 22.4% 22.4% 23.4%

Net Margin % 7.2% 11.6% 13.1% 14.3% Total 9,292 13,884 16,048 19,085

Source: Company, Anand Rathi Research

NOTE: *FY-16 number are for 9 month period due to accounting year change.

13 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Key Risks:

The company’s business is exposed to swift technological changes and any delay by the company in adapting could

affect its business negatively.

14 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Rating and Target Price history:

TEJASNET rating history & price chart TEJASNET rating details

175

Date Rating Target Price (₹) Share Price (₹)

150

23-Aug-17 BUY 418 325

125

25-Oct-17 BUY 418 321

100

19-Apr-18 BUY 427 332

75

Jul-17

Jul-17

Jun-17

Nov-17

Nov-17

Apr-18

Aug-17

Aug-17

Sep-17

Sep-17

Dec-17

Dec-17

Jan-18

Jan-18

Feb-18

Feb-18

Mar-18

Mar-18

Oct-17

Oct-17

Source: Bloomberg, Anand Rathi Research Source: Bloomberg, Anand Rathi Research

NOTE: Prices are as on 19th Apr 2018 close.

15 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Disclaimer:

Research Disclaimer and Disclosure inter-alia as required under Securities and Exchange Board of India (Research Analysts) Regulations, 2014

Anand Rathi Share and Stock Brokers Ltd. (hereinafter refer as ARSSBL) (Research Entity, SEBI Regn No. INH000000834, Date of Regn. 29/06/2015) is a subsidiary of the

Anand Rathi Financial Services Ltd. ARSSBL is a corporate trading and clearing member of Bombay Stock Exchange Ltd, National Stock Exchange of India Ltd. (NSEIL),

Multi Stock Exchange of India Ltd (MCX-SX), United stock exchange and also depository participant with National Securities Depository Ltd (NSDL) and Central

Depository Services Ltd. ARSSBL is engaged into the business of Stock Broking, Depository Participant, Mutual Fund distributor.

The research analysts, strategists, or research associates principally responsible for the preparation of Anand Rathi Research have received compensation based upon

various factors, including quality of research, investor client feedback, stock picking, competitive factors, firm revenues.

General Disclaimer: - This Research Report (hereinafter called “Report”) is meant solely for use by the recipient and is not for circulation. This Report does not

constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. The

recommendations, if any, made herein are expression of views and/or opinions and should not be deemed or construed to be neither advice for the purpose of

purchase or sale of any security, derivatives or any other security through ARSSBL nor any solicitation or offering of any investment /trading opportunity on behalf of

the issuer(s) of the respective security (ies) referred to herein. These information / opinions / views are not meant to serve as a professional investment guide for the

readers.No action is solicited based upon the information provided herein. Recipients of this Report should rely on information/data arising out of their own

investigations. Readers are advised to seek independent professional advice and arrive at an informed trading/investment decision before executing any trades or

making any investments. This Report has been prepared on the basis of publicly available information, internally developed data and other sources believed by ARSSBL

to be reliable. ARSSBL or its directors, employees, affiliates or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy

and reliability of such information / opinions / views. While due care has been taken to ensure that the disclosures and opinions given are fair and reasonable, none of

the directors, employees, affiliates or representatives of ARSSBL shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary

damages, including lost profits arising in any way whatsoever from the information / opinions / views contained in this Report. The price and value of the investments

referred to in this Report and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide

for future performance. ARSSBL does not provide tax advice to its clients, and all investors are strongly advised to consult with their tax advisers regarding taxation

aspects of any potential investment.

Continued…

16 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Disclaimer:

Contd…

Opinions expressed are our current opinions as of the date appearing on this Research only. We do not undertake to advise you as to any change of our views

expressed in this Report. Research Report may differ between ARSSBL’s RAs and/ or ARSSBL’s associate companies on account of differences in research methodology,

personal judgment and difference in time horizons for which recommendations are made. User should keep this risk in mind and not hold ARSSBL, its employees and

associates responsible for any losses, damages of any type whatsoever.

ARSSBL and its associates or employees may; (a) from time to time, have long or short positions in, and buy or sell the investments in/ security of company (ies)

mentioned herein or (b) be engaged in any other transaction involving such investments/ securities of company (ies) discussed herein or act as advisor or lender /

borrower to such company (ies) these and other activities of ARSSBL and its associates or employees may not be construed as potential conflict of interest with respect

to any recommendation and related information and opinions. Without limiting any of the foregoing, in no event shall ARSSBL and its associates or employees or any

third party involved in, or related to computing or compiling the information have any liability for any damages of any kind.

Details of Associates of ARSSBL and Brief History of Disciplinary action by regulatory authorities & its associates are available on our website i. e. www.rathi.com

Disclaimers in respect of jurisdiction: This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or

located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would

subject ARSSBL to any registration or licensing requirement within such jurisdiction(s). No action has been or will be taken by ARSSBL in any jurisdiction (other than

India), where any action for such purpose(s) is required. Accordingly, this Report shall not be possessed, circulated and/or distributed in any such country or jurisdiction

unless such action is in compliance with all applicable laws and regulations of such country or jurisdiction. ARSSBL requires such recipient to inform himself about and to

observe any restrictions at his own expense, without any liability to ARSSBL. Any dispute arising out of this Report shall be subject to the exclusive jurisdiction of the

Courts in India.

Copyright: - This report is strictly confidential and is being furnished to you solely for your information. All material presented in this report, unless specifically indicated

otherwise, is under copyright to ARSSBL. None of the material, its content, or any copy of such material or content, may be altered in any way, transmitted, copied or

reproduced (in whole or in part) or redistributed in any form to any other party, without the prior express written permission of ARSSBL. All trademarks, service marks

and logos used in this report are trademarks or service marks or registered trademarks or service marks of ARSSBL or its affiliates, unless specifically mentioned

otherwise.

Contd…

17 Anand Rathi Research

Tejas Networks Limited (TEJASNET)

Disclaimer:

Contd.

Statements on ownership and material conflicts of interest, compensation - ARSSBL and Associates

Answers to the Best of the knowledge

Sr. and belief of the ARSSBL/ its

Statement

No. Associates/ Research Analyst who is

preparing this report

ARSSBL/its Associates/ Research Analyst/ his Relative have any financial interest in the subject company? Nature of Interest (if applicable), is given

1 against the company’s name?. NO

ARSSBL/its Associates/ Research Analyst/ his Relative have actual/beneficial ownership of one per cent or more securities of the subject company, at the

2 end of the month immediately preceding the date of publication of the research report or date of the public appearance?. NO

ARSSBL/its Associates/ Research Analyst/ his Relative have any other material conflict of interest at the time of publication of the research report or at

3 the time of public appearance?. NO

4 ARSSBL/its Associates/ Research Analyst/ his Relative have received any compensation from the subject company in the past twelve months. NO

ARSSBL/its Associates/ Research Analyst/ his Relative have managed or co-managed public offering of securities for the subject company in the past

5

twelve months.

NO

ARSSBL/its Associates/ Research Analyst/ his Relative have received any compensation for investment banking or merchant banking or brokerage

6 services from the subject company in the past twelve months. NO

ARSSBL/its Associates/ Research Analyst/ his Relative have received any compensation for products or services other than investment banking or

7 merchant banking or brokerage services from the subject company in the past twelve months. NO

ARSSBL/its Associates/ Research Analyst/ his Relative have received any compensation or other benefits from the subject company or third party in

8 connection with the research report. NO

ARSSBL/its Associates/ Research Analyst/ his Relative have served as an officer, director or employee of the subject company.

9 NO

10 ARSSBL/its Associates/ Research Analyst/ his Relative has been engaged in market making activity for the subject company. NO

18 Anand Rathi Research

Das könnte Ihnen auch gefallen

- Littlewood - Chess Tactics - 309 Chess Tactics PositionsDokument52 SeitenLittlewood - Chess Tactics - 309 Chess Tactics PositionspablomatusNoch keine Bewertungen

- 50 - Motor Blower AssemblyDokument1 Seite50 - Motor Blower Assemblyadmam jones50% (2)

- 2 Semester 2010/2011 WMES3108 IT Project Management Tutorial 1Dokument4 Seiten2 Semester 2010/2011 WMES3108 IT Project Management Tutorial 1faizah_898881% (16)

- InternetBilling Sep OctDokument1 SeiteInternetBilling Sep OctPitabas PradhanNoch keine Bewertungen

- Odwalla Inc Case StudyDokument3 SeitenOdwalla Inc Case StudyTiên PhạmNoch keine Bewertungen

- Best Buy Co., Inc. Customer-CentricityDokument8 SeitenBest Buy Co., Inc. Customer-CentricityjddykesNoch keine Bewertungen

- Ap - IcDokument21 SeitenAp - IcAnkur AgarwalNoch keine Bewertungen

- Financial Report ExampleDokument18 SeitenFinancial Report ExampleelizaroyNoch keine Bewertungen

- TATA MOTORS Financial PerformanceDokument4 SeitenTATA MOTORS Financial PerformanceKaushal RautNoch keine Bewertungen

- Blessing Art GalDokument9 SeitenBlessing Art GalJulius EjaNoch keine Bewertungen

- Private Equity DemystifiedDokument16 SeitenPrivate Equity Demystifiedadamzane133Noch keine Bewertungen

- LoR Rulebook ENG 280x280mm 2Dokument12 SeitenLoR Rulebook ENG 280x280mm 2David MillerNoch keine Bewertungen

- FDOH County Report 9/15Dokument136 SeitenFDOH County Report 9/15ABC Action NewsNoch keine Bewertungen

- Body Casting Hushalva Ämne: Linköping SwedenDokument1 SeiteBody Casting Hushalva Ämne: Linköping SwedenKishan SolankeNoch keine Bewertungen

- NL9262 PDFDokument1 SeiteNL9262 PDFMuhammad ShofiyansyahNoch keine Bewertungen

- Financial Model Asian PaintsDokument19 SeitenFinancial Model Asian Paintssantoshj423Noch keine Bewertungen

- MB 501Dokument1 SeiteMB 501M'ur-ali Krsh-naNoch keine Bewertungen

- Triangulation sensor background suppressionDokument4 SeitenTriangulation sensor background suppressionWilson Araujo BarrozoNoch keine Bewertungen

- PHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities January 31, 2022Dokument6 SeitenPHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities January 31, 2022inata takeshiNoch keine Bewertungen

- Home DepotDokument4 SeitenHome Depotaleonor90Noch keine Bewertungen

- A - A Section Potongan: Peta Situasi Peta SituasiDokument1 SeiteA - A Section Potongan: Peta Situasi Peta Situasijimmy ajaNoch keine Bewertungen

- YUMUL JANNAH SHANE B - Archi 2cDokument1 SeiteYUMUL JANNAH SHANE B - Archi 2cJannah ShaneNoch keine Bewertungen

- Mini Catalogo Cabine PDFDokument80 SeitenMini Catalogo Cabine PDFWilas Borges DiasNoch keine Bewertungen

- Human/Machine Interfaces: Magelis GTO Advanced Optimum PanelsDokument41 SeitenHuman/Machine Interfaces: Magelis GTO Advanced Optimum PanelsDan MircescuNoch keine Bewertungen

- RCC Area-3.250m2 Cut Area-13.931m2 PCC Area-0.320m2 Filter Material-10.240m2Dokument1 SeiteRCC Area-3.250m2 Cut Area-13.931m2 PCC Area-0.320m2 Filter Material-10.240m2SudipNoch keine Bewertungen

- F80 BK - Manta System ConnectionsDokument1 SeiteF80 BK - Manta System ConnectionsMark Gelo Patacsil BacolodNoch keine Bewertungen

- CCSP Sungai Waskita DakDokument1 SeiteCCSP Sungai Waskita DakBudi SNoch keine Bewertungen

- Docs 07 5356 18 0zse Zigbee Smart Energy Profile SpecificationDokument356 SeitenDocs 07 5356 18 0zse Zigbee Smart Energy Profile SpecificationSang tae KimNoch keine Bewertungen

- 304.5 HydraulicDokument2 Seiten304.5 Hydraulicjulianmata100% (4)

- BONDARY-PENGASINAN For Budget Konstruksi KPM v3.0 For Contractors-ModelDokument1 SeiteBONDARY-PENGASINAN For Budget Konstruksi KPM v3.0 For Contractors-ModelAlenta ArchitectureNoch keine Bewertungen

- PEGASUS Model PDFDokument1 SeitePEGASUS Model PDFEduardo Mauricio LaraNoch keine Bewertungen

- Engineering drawing dimensionsDokument1 SeiteEngineering drawing dimensionsEduardo Mauricio LaraNoch keine Bewertungen

- P-23-003321 - Gang CostingDokument1 SeiteP-23-003321 - Gang CostingPunit ShawNoch keine Bewertungen

- Order To Cash Demo - EN (EUR) StudioDokument1 SeiteOrder To Cash Demo - EN (EUR) Studioatul kumarNoch keine Bewertungen

- Implement Oracle Taleo Cloud Fixed Scope - V3Dokument60 SeitenImplement Oracle Taleo Cloud Fixed Scope - V3Osama TebryNoch keine Bewertungen

- ARQUITECTURA 1-ModelDokument1 SeiteARQUITECTURA 1-ModelMaria julia Fernández FernándezNoch keine Bewertungen

- Highway Construction in India Growth and TrendsDokument1 SeiteHighway Construction in India Growth and TrendsABCNoch keine Bewertungen

- Kotov - Chess Tactics - 484 Chess Tactics Positions TO SOLVE - BWC PDFDokument78 SeitenKotov - Chess Tactics - 484 Chess Tactics Positions TO SOLVE - BWC PDFpablomatusNoch keine Bewertungen

- Muchnik - Chess Combinations - 185 Chess Positions To SolveDokument31 SeitenMuchnik - Chess Combinations - 185 Chess Positions To SolvepablomatusNoch keine Bewertungen

- Country Profile PE - IMD Business School 2021Dokument10 SeitenCountry Profile PE - IMD Business School 2021Lucero RuizNoch keine Bewertungen

- Ir 02Dokument2 SeitenIr 02Ahmad SaqqaNoch keine Bewertungen

- Malaysia Madani - Alto Sax 2Dokument1 SeiteMalaysia Madani - Alto Sax 2Kamarul HadliNoch keine Bewertungen

- Datasheet - HK k3702 3696473Dokument4 SeitenDatasheet - HK k3702 3696473Leoned Cova OrozcoNoch keine Bewertungen

- Gspublisherengine 0.0.100.100 GseducationalversionDokument1 SeiteGspublisherengine 0.0.100.100 GseducationalversionPetre FranguleaNoch keine Bewertungen

- 4 Seakeeper 26 Hardware Scope of Supply 21aug2020Dokument1 Seite4 Seakeeper 26 Hardware Scope of Supply 21aug2020Abrham B. GMNoch keine Bewertungen

- DH161899 01Dokument1 SeiteDH161899 01skedgroupNoch keine Bewertungen

- 12 December Bansiloy MD & Co. OBLIGATEDokument8 Seiten12 December Bansiloy MD & Co. OBLIGATEBPH MaramagNoch keine Bewertungen

- Sanitarias Aqp-Desague 1Dokument1 SeiteSanitarias Aqp-Desague 1Maylin AlvaroNoch keine Bewertungen

- TRF SCREEN PU FLIPFLOP SCREEN (2710x328) MatsDokument1 SeiteTRF SCREEN PU FLIPFLOP SCREEN (2710x328) Matsseil iexNoch keine Bewertungen

- Delta Manual 3063Dokument2 SeitenDelta Manual 3063Ahmed AbdelazimNoch keine Bewertungen

- Revised TRF SCREEN PU FLIPFLOP SCREEN (2710x328)Dokument1 SeiteRevised TRF SCREEN PU FLIPFLOP SCREEN (2710x328)seil iexNoch keine Bewertungen

- TRF SCREEN PU FLIPFLOP SCREEN (2710x328) MatsDokument1 SeiteTRF SCREEN PU FLIPFLOP SCREEN (2710x328) Matsseil iexNoch keine Bewertungen

- KPI PresentationDokument5 SeitenKPI PresentationPraise KoobeeNoch keine Bewertungen

- Option1 1Dokument1 SeiteOption1 1mohamedNoch keine Bewertungen

- Despiece de Vigas - Despiece de Viguetas: Edificio Vargas GarciaDokument1 SeiteDespiece de Vigas - Despiece de Viguetas: Edificio Vargas GarciaDiego Esteban Gomez DuqueNoch keine Bewertungen

- Key Performance Indicators: Building CommunitiesDokument2 SeitenKey Performance Indicators: Building CommunitiesMohammed AbdoNoch keine Bewertungen

- PHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities May 31, 2021Dokument6 SeitenPHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities May 31, 2021Ichsan HudayaNoch keine Bewertungen

- Name of Project:: 2 X 4.4Mw Rudi Khola HepDokument2 SeitenName of Project:: 2 X 4.4Mw Rudi Khola HepapsNoch keine Bewertungen

- Ground Floor Electrical Plan Second Floor Electrical Plan: A B C D E F G H A B C D E F G HDokument1 SeiteGround Floor Electrical Plan Second Floor Electrical Plan: A B C D E F G H A B C D E F G Hjerick calingasanNoch keine Bewertungen

- Ground Floor Plan Second Floor Plan: A B C D E F G H A B C D E F G HDokument1 SeiteGround Floor Plan Second Floor Plan: A B C D E F G H A B C D E F G Hjerick calingasanNoch keine Bewertungen

- Laporan Administrasi Pompy Oct 2020Dokument7 SeitenLaporan Administrasi Pompy Oct 2020Pompy Syaiful RizalNoch keine Bewertungen

- Common Core Connections Math, Grade 3Von EverandCommon Core Connections Math, Grade 3Bewertung: 3 von 5 Sternen3/5 (1)

- Internet Service Providers & Web Search Portal Lines World Summary: Market Values & Financials by CountryVon EverandInternet Service Providers & Web Search Portal Lines World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- RAC 004 Auxiliary Systems & Components For R & Ac ApplicationsDokument30 SeitenRAC 004 Auxiliary Systems & Components For R & Ac ApplicationsnaveenNoch keine Bewertungen

- Uxiliary Systems&Components For R&ac Other Systems r0 (Read Only)Dokument54 SeitenUxiliary Systems&Components For R&ac Other Systems r0 (Read Only)naveenNoch keine Bewertungen

- Uxiliary Systems&Components For R&ac Other Systems r0 (Read Only)Dokument54 SeitenUxiliary Systems&Components For R&ac Other Systems r0 (Read Only)naveenNoch keine Bewertungen

- Uxiliary Systems&Components For R&ac Other Systems r0 (Read Only)Dokument54 SeitenUxiliary Systems&Components For R&ac Other Systems r0 (Read Only)naveenNoch keine Bewertungen

- DRDO-ADA - LCA Tejas IOC2 Brochure Final - Dec 2013Dokument24 SeitenDRDO-ADA - LCA Tejas IOC2 Brochure Final - Dec 2013cheenu100% (3)

- KFC Resource Based Operation Strategy MatrixDokument6 SeitenKFC Resource Based Operation Strategy MatrixRamalu Dinesh ReddyNoch keine Bewertungen

- Fall 2022 Exam Erm GCDokument32 SeitenFall 2022 Exam Erm GCSuperswag CollieNoch keine Bewertungen

- Introduction To Part 1: Understanding Brand Desire: Nicholas IndDokument10 SeitenIntroduction To Part 1: Understanding Brand Desire: Nicholas IndLuigi CastilloNoch keine Bewertungen

- CGSRDokument19 SeitenCGSRayush singlaNoch keine Bewertungen

- The Comparison of The Deming Prize and The Baldrige Award: - HandoutsDokument37 SeitenThe Comparison of The Deming Prize and The Baldrige Award: - HandoutsKristy Anne Habito-Corpuz0% (1)

- Module 2 ReceivablesDokument16 SeitenModule 2 ReceivablesEarl ENoch keine Bewertungen

- Multiple ChoiceDokument87 SeitenMultiple ChoiceNhã ThanhNoch keine Bewertungen

- Airborne Express Discussion QuestionsDokument5 SeitenAirborne Express Discussion QuestionsPeter LiedmanNoch keine Bewertungen

- 1022-Ect-3291281-2023-Triple Pane Window Rebate - FillableDokument3 Seiten1022-Ect-3291281-2023-Triple Pane Window Rebate - Fillablejoseolivero31Noch keine Bewertungen

- Personal Selling Process ExplainedDokument11 SeitenPersonal Selling Process ExplainedReXX GamingNoch keine Bewertungen

- Lecture Topic 1.2 ENVIORNMENT SCANNING TECHNIQUESDokument35 SeitenLecture Topic 1.2 ENVIORNMENT SCANNING TECHNIQUESKertik Singh100% (1)

- Is It Wise To Challenge The Usefulness of Cost andDokument3 SeitenIs It Wise To Challenge The Usefulness of Cost andMomoh PessimaNoch keine Bewertungen

- BS 4190 Spec 4 Hex Bolt Screw - Black PDFDokument43 SeitenBS 4190 Spec 4 Hex Bolt Screw - Black PDFvikramadithan renugopalNoch keine Bewertungen

- Overall Equipment Effectiveness: GuideDokument13 SeitenOverall Equipment Effectiveness: GuideJunjie ChenNoch keine Bewertungen

- Lit - Ch01 - Kimmel Et Al. 2013 - Ch13-2Dokument28 SeitenLit - Ch01 - Kimmel Et Al. 2013 - Ch13-2trinaNoch keine Bewertungen

- VirtualMarketing WaitroseInternetStrategy by Andidas PDFDokument24 SeitenVirtualMarketing WaitroseInternetStrategy by Andidas PDFEslam A. AliNoch keine Bewertungen

- Ans OpDokument4 SeitenAns OpShivansh SaxenaNoch keine Bewertungen

- STAT0013 Introductory SlidesDokument126 SeitenSTAT0013 Introductory SlidesMusa AsadNoch keine Bewertungen

- Business English 8Dokument0 SeitenBusiness English 8Ioana GavrasNoch keine Bewertungen

- 2023 EBAD401 - Chapter 5 PPT LecturerDokument36 Seiten2023 EBAD401 - Chapter 5 PPT Lecturermaresa bruinersNoch keine Bewertungen

- Sales Manager Seeks Pricing AdviceDokument11 SeitenSales Manager Seeks Pricing AdvicebiggykhairNoch keine Bewertungen

- ACC 307 Final Project Workbook - 9-5-19Dokument14 SeitenACC 307 Final Project Workbook - 9-5-19Michele AllenNoch keine Bewertungen

- XI Account Questions PDFFDokument9 SeitenXI Account Questions PDFFnazwaniiharshNoch keine Bewertungen

- The Changing Role of Managerial Accounting in A Dynamic Business EnvironmentDokument56 SeitenThe Changing Role of Managerial Accounting in A Dynamic Business EnvironmentKatherine Cabading InocandoNoch keine Bewertungen

- GE Dry Type Transformers ListDokument1 SeiteGE Dry Type Transformers ListAlbertNoch keine Bewertungen

- Section One: Six Sigma Principles and ConceptsDokument7 SeitenSection One: Six Sigma Principles and ConceptsDrMohamed Mansour0% (1)