Beruflich Dokumente

Kultur Dokumente

Projects Topics - Law of Taxation - 1

Hochgeladen von

AnshuSinghOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Projects Topics - Law of Taxation - 1

Hochgeladen von

AnshuSinghCopyright:

Verfügbare Formate

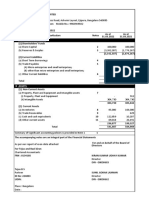

PROJECTS TOPICS – LAW OF TAXATION -1

Name of the Teacher: Dr. P. Sree Sudha,

Semester: VIII

Signature

Sl. Register of the

No Number. Name of the Students Title of the Project Topic Student

Section 2 (1A) Agricultural

1 2014001 Abhijeet Kumar Pandey Income

2 2014002 AbhijitPrabhat Section 2 (7) Assessee

3 2014003 Abhinav Mishra Section 2(8) Assessment

Black Money (Undisclosed

Foreign Income and Assets ) &

Imposition of Tax Act’2015

4 2014004 AbhisekMohanty

Section 245D Procedure on

receipt of an application under

5 2014005 AbhishekDwivedy section 245 C

Section 263 Revision of orders

6 2014006 Aditya Amar prejudicial to revenue

Section 245F Powers and

procedure of Settlement

7 2014007 AishwaryaSarkar Commission

8 2014008 AkankshaBammi Section 2 (31) Person

Section 240 Refund on appeal,

9 2014009 Alla Yoga Priya etc

Section 251 Powers of the

10 2014010 Amber Jain Singhai Commissioner (Appeals)

Section 260A Appeal to High

11 2014012 AnmolSrivastava Court

12 2014013 AnshikaShukla Section 2 (15) Charitable Purpose

Section 260A Appeal to High

13 2014014 Anshu Rani Court

Section 278B Offences by

14 2014015 Anshu Singh companies

AnuparthiMamathaDee Section 278 Abetment of false

15 2014016 nDayal return, etc

Section 276C Wilful attempt to

16 2014017 Anurag Sharma evade tax, etc

Section 276CC Failure to furnish

17 2014018 ApoorbaBiswas returns of income

Section 292C Presumption as to

18 2014020 Avinash Singh assets, books of account, etc.

Section 281B Provisional

attachment to protect revenue in

19 2014021 Avnish Mishra certain cases

20 2014022 AyushPathak

Section 278E Presumption as to

21 2014023 BishalBaivab culpable mental state

22 2014024 ChintalapudiVirajitha Section 192 Salary

Section 194A(3) Interest other

23 2014025 ChiragRanjanSahoo than “interest on securities “

Section 201(1), (1A)

Consequences of failure to deduct

24 2014027 CV NitinKoushik or pay

Section 9 Income deemed to

25 2014029 D.K. Balkrisnan accrue or arise in India

Section 201(1), (1A)

Damodar Singh Consequences of failure to deduct

26 2014030 Rajpurohit or pay 190

Section 204 Meaning of “person

27 2014034 Deepesh Raj responsible for paying”

Section 88 of F(2A)

1998

28 2014035 Devbrat Singh Kar Vivad Samadhan Scheme

29 2014036 DhruvRajpurohit Section 4 Charge of Income Tax

30 2014037 Faiz Ahmed Qureshi

Section 190 Deduction at source

31 2014038 Garima Singh and advance payment

32 2014039 Garvit Jain Section 2(24)

Section 214 Interest payable by

33 2014040 GeetanjaliBisht Government

34 2014041 GitanjaliSanyal Section 195

35 2014043 GouriSaxena Section 11

36 2014044 Himanshu Sharma Section 2(22)(e)

Meaning of Expression “BODY

OF INDIVIDUALS” and

37 2014045 IshaTripathi “ASSOCIATION of Persons

38 2014046 Jyotsna Jain section 276B

39 2014049 KeerthiYesupongu Section 5 Scope of Total Income

Section 92 CD Advanced Pricing

40 2014050 KritiSehgal Agreements

Section 6 (3) Residential Status

41 2014051 Kumar Prateek of Companies

42 2014052 KumariRanjita Section 10A Income not to be

Included in the Total Income

Section 44B Presumptive

43 2014053 KumariShailja Taxation

Section 92 Computation of

M Santhosh Kumar income from transaction with

44 2014054 Reddy non-resident

MaddalaVijayaRatna Section 6(1) Residential Status of

45 2014055 Prasad Individuals

Section 195 Tax Deducted at

46 2014056 MadhurKumria Source

Taxation of Business Process

47 2014057 MadhuriKrishnani Outsourcing Units in India

Special Provisions Applicable to

Non Resident Indian investing in

certain foreign exchange assets

48 2014059 ManasiBais and deriving income thereof

Methods for Determining Arm's

Length Price under Income Tax

49 2014060 MansiTiwari Act

Section 94 Transactions in

50 2014061 Maturi Murthy Maan Securities

Section 90A Tax Residency

51 2014062 MayankYadav Certificate

Place of Effective Managment

52 2014064 Md Adnan SalimQasmi (POEM)

Medikonda Krishna

53 2014065 Kousiki Taxation of Agricultural Income

Section 80 A - Deductions to be

54 2014066 MittameediManasa made in computing total Income

Mulugu Lakshmi Naga Section 206 AA - Requirement to

55 2014067 Annapoorna Furnish PAN

56 2014068 Neeharika Dave Section 195 of Income Tax Act

57 2014069 Nitish Chandra What is Permnant Establishment

General Anti-avoidance Rules

58 2014070 P Advika (GAAR)

Residential Status and Scope of

59 2014074 Parker NileshKaria Income

60 2014075 Pramit Bhattacharya Foreign Collagoration in India

Section 28 - Profits and gains of

61 2014076 Pramita Mukherjee business or Profession

Section 22 - Income from

62 2014077 PeelaBhavana Household Property

63 2014078 Piyush Kumar Mishra Section 139 Return of Income

64 2014080 PrakharBharadwaj Equalisation Levy

Section 50C-Computation of

Capital gains in the case of land

65 2014081 Prakhar Jain and building

66 2014082 PranjalMaurya Section 80DD - Deduction in

respects of dependant being a

person with disability

Section 80 G Deduction in

Pushpendra Singh respect of donation to certain

67 2014084 Bhadoriya funds, charitable institutions

Section 115 JB - Minimum

68 2014085 RachitRanjan Alternate Tax

Section 80P(2) (A) (I) Income of

69 2014086 Raghupatruni Sai Phani Banking Business

Section 246 A - Appeal to the

70 2014087 Rahul Kumar Dubey Commissioner

Section 253 Appeal to Appellate

71 2014091 Risabh Mishra Tribunal

Section 131 - Powers regarding

72 2014092 Rishika Seal discovery, production of evidence

Section 92C- Computation of

73 2014093 Ritu Sharma Arm's Length Price

74 2014094 Rohan Ahluwalia Section 132 - Search and Seizure

Section 35AB -Income Tax

Implications of Business

2014096 Roselin Sara Alex Restructuring

76 2014097 Rupal Rajput What is tax Planning

77 2014098 Ryan Singh Section 115V - Tonnave Tax

Sabbisetti BNV Advance Rullings for non-

78 2014099 Gowtham residents

79 2014100 SahityaSubhash Securities Transactions Tax

80 2014101 SameeraBokka Tax Clearance Certificate

81 2014102 Sanjana Singh Income Exempt from Tax

82 2014103 Saptarshi Ghosh Income from House Property

83 2014105 SouravNaug What is tax Evasion

84 2014106 Satyam Kumar pandey Taxation of Parternship Firms

Difference between Revenue

85 2014107 Sekhar Sarkar Receipts and Capital Receipts

Section 245D(6) Settlement of

86 2014108 Shaitan Singh Cases

Computation of Income of an

Association of Persons or Body

87 2014109 Shashi Ranjan Kumar of Individuals

Section 54 Capital Gains arising

88 2014111 Shilpa Shree Katiyar from transfer of residential house

89 2014112 Shivam Pandey What is tax Avoidance

90 2014113 Shivam Singh Section 65 Recovery of Tax

Section 13 - Forfeiture of

91 2014114 Shivani Exemption

92 2014115 Shobhit Tiwari Section 51 - Prerequisities

Principle of Mutuality visa-a-vis

93 2014116 Shourya Rajput Section 22

94 2014118 Shubham Singh Penalties and Prosecutions

95 2014119 Snigdha Bhatia Advance Payment of Tax

96 2014120 SonamModani Central Board of Direct Taxes

Business Restructuring in relation

to Conversion of Firm into

97 2014121 Soumya Jain Company

98 2014122 Sri ChandanaSontyana Income Tax on FringeBenefit

Srivatsava Reddy Alternate Dispute Resolution

99 2014123 Beerapalli Scheme under Income Tax Act

100 2014124 SrishtiTelang Income from Other Sources

Section 54B -Capital Gains

arising from the transfer ofland

101 2014125 Sudanshu Singh used for agricultural purpose

Section 35AC - Expenditure on

102 2014126 SudarshanaBasu eligible projects or Scheme

103 2014127 SuyogayaAwasthy Section 36 (1) (vii) Bad Debts

Section 48 Computation of

104 2014128 Swastika Raushni capital gain

Section 10 (37A) Exemption of

105 2014129 SwetaMohanty Capital Gains

Section 56 (2) (i) Taxability of

106 2014130 Sweta Singh Dividend

Section 10 (1) Treatment of

107 2014131 Swetabh Singh Agricultural Income

108 2014132 Talluri Sai Sumanth Procedure for Assessment

109 2014133 Utkarsh Section 139 (1)Return of Income

Section 140 - Verification of

110 2014134 UtkarshShrivastava return

Section 147 Income Escaping

111 2014136 Vaibhav Sharma Assessment

Section 70 to 80 - Set off or Carry

112 2014137 VaishnaviEshwar Forward of Losses

Judicial Decisions from 2000 to

113 2014138 VaishnaviJha 2016 on Tax Deducted at Source

Section 60-65 Clubbing of

114 2014139 VaishnaviKanduri Income

Judicial Decisions from 2005 to

115 2014140 Vanya Srikant 2015 on Residential Status

Case Summary - Voda Phone

116 2014141 VikaramTholia Case

Section 142 - Inquiry before

117 2014142 VipulVinopum Assessment

Chapter XII - Taxation of Non-

118 2014144 YamanKhandelwal residents

Assessment of Association of

119 2013022 AnandAnkur Persons

PodipireddiVivekvardha Section 56 (2) Income from Other

120 2013081 n Soruces

Income Tax Implications of

Consortium contracts with

121 2013085 Prateek Kumar Government

Das könnte Ihnen auch gefallen

- PIIS00206 DrillconDokument1 SeitePIIS00206 DrillconSabhyaNoch keine Bewertungen

- E-Receipt For Central Service Tax PaymentsDokument1 SeiteE-Receipt For Central Service Tax PaymentsAshwani TiwariNoch keine Bewertungen

- 10000271-3-2023-Potlakayala NaveenDokument1 Seite10000271-3-2023-Potlakayala NaveenG Yugandhar Alwaz UniqueNoch keine Bewertungen

- 2023-2024 FormNo12BBDokument1 Seite2023-2024 FormNo12BBvivek070176Noch keine Bewertungen

- PIIX00260 Dev AutomationDokument1 SeitePIIX00260 Dev AutomationSabhyaNoch keine Bewertungen

- Report 1710572511683Dokument2 SeitenReport 1710572511683Mcnet WideNoch keine Bewertungen

- Form 16Dokument9 SeitenForm 16Satyam MaramNoch keine Bewertungen

- 12th MarksheetDokument26 Seiten12th Marksheetnishanegi9375Noch keine Bewertungen

- 12th Marksheet - CompressedDokument26 Seiten12th Marksheet - Compressednishanegi9375Noch keine Bewertungen

- Statement TataSteelLimitedDokument2 SeitenStatement TataSteelLimitedsumantakumar.sitakanta.biswalNoch keine Bewertungen

- KCSRs 2017 PDFDokument658 SeitenKCSRs 2017 PDFSandeep L ShettyNoch keine Bewertungen

- LKINV24250006 ICICI Prudential Life Insurance Company LimitedDokument2 SeitenLKINV24250006 ICICI Prudential Life Insurance Company LimitedsheetalsshiriskarNoch keine Bewertungen

- GNFC Annual Report 2019 20Dokument248 SeitenGNFC Annual Report 2019 20Sandeep ThatheraNoch keine Bewertungen

- Govati Financials FY 2021-22Dokument19 SeitenGovati Financials FY 2021-22Anjali JainNoch keine Bewertungen

- AG0000001339Dokument4 SeitenAG0000001339Puneet GuptaNoch keine Bewertungen

- M/s ABC LTDDokument2 SeitenM/s ABC LTDArya RajNoch keine Bewertungen

- Dipakshi Balance Sheet 2016-17Dokument25 SeitenDipakshi Balance Sheet 2016-17shyam chaudharyNoch keine Bewertungen

- (77030) Tax Payment Successful. Your Transaction Reference No. Is 64296787Dokument1 Seite(77030) Tax Payment Successful. Your Transaction Reference No. Is 64296787hardik anandNoch keine Bewertungen

- Invoice PDFDokument1 SeiteInvoice PDFRamesh PatelNoch keine Bewertungen

- LKINV24250005 ICICI Prudential Life Insurance Company LimitedDokument2 SeitenLKINV24250005 ICICI Prudential Life Insurance Company LimitedsheetalsshiriskarNoch keine Bewertungen

- A A F P D 6 7 3 6 P S D 0 0 1: Taxpayers CounterfoilDokument1 SeiteA A F P D 6 7 3 6 P S D 0 0 1: Taxpayers CounterfoilCA Cma MK JhaNoch keine Bewertungen

- Full Final Setllements TemplateDokument3 SeitenFull Final Setllements TemplateBinita SinhaNoch keine Bewertungen

- Form 16: TLG India Private LimitedDokument9 SeitenForm 16: TLG India Private LimitedcagopalofficebackupNoch keine Bewertungen

- Sanmati Agrizone Private Limited: Total Equity & LiabilitesDokument13 SeitenSanmati Agrizone Private Limited: Total Equity & Liabiliteszuhaib habibNoch keine Bewertungen

- The Accompanying Notes Are An Integral Part of The Financial StatementsDokument7 SeitenThe Accompanying Notes Are An Integral Part of The Financial Statementsravibhartia1978Noch keine Bewertungen

- LKINV24250004 HDFC Life Insurance Company LimitedDokument2 SeitenLKINV24250004 HDFC Life Insurance Company LimitedsheetalsshiriskarNoch keine Bewertungen

- IN-1203 Salary APRIL2023Dokument1 SeiteIN-1203 Salary APRIL2023Habibur KhanNoch keine Bewertungen

- Rahul Aug'23Dokument1 SeiteRahul Aug'23Sachin RajakNoch keine Bewertungen

- Ca ReportDokument8 SeitenCa ReportHarjot SinghNoch keine Bewertungen

- Kesarp .... Tro Roducrslimiied: Dear SirDokument4 SeitenKesarp .... Tro Roducrslimiied: Dear Sirmd zafarNoch keine Bewertungen

- Citizens' Charter Public Accounts Department SR No Type of Services Normal Time RequiredDokument2 SeitenCitizens' Charter Public Accounts Department SR No Type of Services Normal Time RequiredAman JainNoch keine Bewertungen

- P403FSA4332740 Statement of AccountDokument5 SeitenP403FSA4332740 Statement of AccountANANDARAJ KNoch keine Bewertungen

- Annual Report 2020-21 - TIICDokument98 SeitenAnnual Report 2020-21 - TIICMrs.D.Mythili Computer TechnologyNoch keine Bewertungen

- State Bank of India: Balance Sheet As On 31 March, 2018Dokument103 SeitenState Bank of India: Balance Sheet As On 31 March, 2018Anonymous ckTjn7RCq8Noch keine Bewertungen

- Tax Invoice: Oneiric Appliances Private Limited (Haryana)Dokument2 SeitenTax Invoice: Oneiric Appliances Private Limited (Haryana)oneapl121Noch keine Bewertungen

- Balance Sheet ProvisionalDokument2 SeitenBalance Sheet ProvisionalRaja AdhikariNoch keine Bewertungen

- VBRViewer PDFDokument1 SeiteVBRViewer PDFAshokdheena 619Noch keine Bewertungen

- Computation of Total Income Income From Salary (Chapter IV A) 182370Dokument2 SeitenComputation of Total Income Income From Salary (Chapter IV A) 182370Krishna AgarwAlNoch keine Bewertungen

- Listing Compliance Department Listing Compliance Department: For Integra Essentia LimitedDokument17 SeitenListing Compliance Department Listing Compliance Department: For Integra Essentia LimitedViJaY HaLdErNoch keine Bewertungen

- 2014Dokument203 Seiten2014adam.novysedlakNoch keine Bewertungen

- Tax Invoice: For Gunatheetha Earth Moving Solutions PVT LTD.Dokument1 SeiteTax Invoice: For Gunatheetha Earth Moving Solutions PVT LTD.nagaraj spNoch keine Bewertungen

- Form 16 Data 1 PDFDokument5 SeitenForm 16 Data 1 PDFRISHABH JAINNoch keine Bewertungen

- IN-1203 Salary MARCH2023Dokument1 SeiteIN-1203 Salary MARCH2023Habibur KhanNoch keine Bewertungen

- Draft Letter of Offer (Company Update)Dokument43 SeitenDraft Letter of Offer (Company Update)Shyam SunderNoch keine Bewertungen

- Annexure To Form 16 Part B (2020)Dokument3 SeitenAnnexure To Form 16 Part B (2020)Dharmendra ParmarNoch keine Bewertungen

- V5PaySlip 1Dokument1 SeiteV5PaySlip 1ajaystudio668878Noch keine Bewertungen

- Billing Production Call-Feb, 16Dokument6 SeitenBilling Production Call-Feb, 16Andrei CaşmirNoch keine Bewertungen

- Digitally Signed by Anwar Abdul Haque Shaikh Date: 2023.08.14 16:03:21 +05'30'Dokument3 SeitenDigitally Signed by Anwar Abdul Haque Shaikh Date: 2023.08.14 16:03:21 +05'30'naresh kayadNoch keine Bewertungen

- OctoberDokument1 SeiteOctoberDivyesh KambleNoch keine Bewertungen

- 16-State Bank of India (Standalone)Dokument76 Seiten16-State Bank of India (Standalone)Pooja JainNoch keine Bewertungen

- Invoice Shipment PLUM854329 Order PDFDokument1 SeiteInvoice Shipment PLUM854329 Order PDFLima msNoch keine Bewertungen

- Kumar Baban APRILDokument1 SeiteKumar Baban APRILInsta LoginNoch keine Bewertungen

- PRF UpdatedDokument14 SeitenPRF Updatedabhineet.jkaiNoch keine Bewertungen

- 1 2023 MevqT2rpAUDokument1 Seite1 2023 MevqT2rpAUG Yugandhar Alwaz UniqueNoch keine Bewertungen

- Assessment Questionnaire FormDokument137 SeitenAssessment Questionnaire ForminfoNoch keine Bewertungen

- 12BBDokument3 Seiten12BBcont2chanduNoch keine Bewertungen

- PaysliP Mathavan May 2015Dokument1 SeitePaysliP Mathavan May 2015gokulvaratharajanNoch keine Bewertungen

- IIHMR Question PapersDokument1 SeiteIIHMR Question PapersRishi TripathiNoch keine Bewertungen

- Right to Work?: Assessing India's Employment Guarantee Scheme in BiharVon EverandRight to Work?: Assessing India's Employment Guarantee Scheme in BiharNoch keine Bewertungen

- Respondant MemorialDokument49 SeitenRespondant MemorialAnshuSinghNoch keine Bewertungen

- Case Synopsis Alka Shukla Vs LICDokument2 SeitenCase Synopsis Alka Shukla Vs LICAnshuSinghNoch keine Bewertungen

- Final Thesis Women and Law Mayank and AnshuDokument47 SeitenFinal Thesis Women and Law Mayank and AnshuAnshuSinghNoch keine Bewertungen

- Resignation LetterDokument1 SeiteResignation LetterAnshuSinghNoch keine Bewertungen

- Example: A Commercial Venture Engaged in Xeroxing Business Purchased One Xerox Machine, IsDokument2 SeitenExample: A Commercial Venture Engaged in Xeroxing Business Purchased One Xerox Machine, IsAnshuSinghNoch keine Bewertungen

- Laws and Schemes Governing Agricultural Labour in India: A Critical EvaluationDokument64 SeitenLaws and Schemes Governing Agricultural Labour in India: A Critical EvaluationAnshuSinghNoch keine Bewertungen

- Form:: Form 20.2 All Rights ReservedDokument3 SeitenForm:: Form 20.2 All Rights ReservedAnshuSinghNoch keine Bewertungen

- State SuccessionDokument5 SeitenState SuccessionAnshuSinghNoch keine Bewertungen

- Left Front Ends Congress' Wait in Bengal, Announces First List of 25 Candidates Reserves 17 For Grand Old Party in Lok Sabha PollsDokument2 SeitenLeft Front Ends Congress' Wait in Bengal, Announces First List of 25 Candidates Reserves 17 For Grand Old Party in Lok Sabha PollsAnshuSinghNoch keine Bewertungen

- PEPA ProjectDokument16 SeitenPEPA ProjectAnshuSingh50% (2)

- Taxation Law Section 278B: Offences by CompaniesDokument1 SeiteTaxation Law Section 278B: Offences by CompaniesAnshuSinghNoch keine Bewertungen

- Contract ProjectDokument19 SeitenContract ProjectAnshuSingh0% (1)

- Chapter 4 (Salosagcol)Dokument4 SeitenChapter 4 (Salosagcol)Lauren Obrien100% (1)

- Actual Costing SystemDokument30 SeitenActual Costing SystemkhldHANoch keine Bewertungen

- RISK AND COST OF CAPITAL UpdateDokument3 SeitenRISK AND COST OF CAPITAL UpdateNguyễn Trần Hoàng YếnNoch keine Bewertungen

- Carrie Lee The President of Lee Enterprises Was Concerned AbouDokument1 SeiteCarrie Lee The President of Lee Enterprises Was Concerned AbouAmit PandeyNoch keine Bewertungen

- Techcombank PresentationDokument41 SeitenTechcombank PresentationbinhNoch keine Bewertungen

- The Impact of International Experience On Firm Economic Per - 2023 - Journal ofDokument14 SeitenThe Impact of International Experience On Firm Economic Per - 2023 - Journal ofSamuel SilitongaNoch keine Bewertungen

- 2021 Answer Chapter 5Dokument15 Seiten2021 Answer Chapter 5prettyjessyNoch keine Bewertungen

- Brand and Branding: Jean - Noel KapfererDokument19 SeitenBrand and Branding: Jean - Noel Kapferersun girlNoch keine Bewertungen

- Learning's From TMG Simulation: Product FeaturesDokument6 SeitenLearning's From TMG Simulation: Product FeaturesPrabir AcharyaNoch keine Bewertungen

- Airtel EcrmDokument9 SeitenAirtel EcrmParker SenNoch keine Bewertungen

- Chapter 1 - The Systems Development Environment - 2Dokument23 SeitenChapter 1 - The Systems Development Environment - 2Mahdi GhulamiNoch keine Bewertungen

- Final Term Assignment 3 On Cost of Production Report - FIFO CostingDokument2 SeitenFinal Term Assignment 3 On Cost of Production Report - FIFO CostingUchiha GokuNoch keine Bewertungen

- Why Are We Writing To Someone Who Isnt ReadingDokument41 SeitenWhy Are We Writing To Someone Who Isnt Readingmailbocks96Noch keine Bewertungen

- Enterprise Resource Planning: MPC 6 Edition Chapter 1aDokument25 SeitenEnterprise Resource Planning: MPC 6 Edition Chapter 1aKhaled ToffahaNoch keine Bewertungen

- Ross 2012Dokument179 SeitenRoss 2012JadNoch keine Bewertungen

- Management Leading and Collaborating in A Competitive World 12th Edition Bateman Snell Konopaske Solution ManualDokument76 SeitenManagement Leading and Collaborating in A Competitive World 12th Edition Bateman Snell Konopaske Solution Manualamanda100% (24)

- 62 SBD PDFDokument51 Seiten62 SBD PDFaneeshp_4Noch keine Bewertungen

- Aud339 Audit ReportDokument22 SeitenAud339 Audit ReportNur IzzahNoch keine Bewertungen

- S4 Financial Projections Spreadsheet Feb2019Rev1Dokument36 SeitenS4 Financial Projections Spreadsheet Feb2019Rev1Ruffa Mae MatiasNoch keine Bewertungen

- Funda of PlanDokument11 SeitenFunda of PlanWorkout motivationNoch keine Bewertungen

- What Is Marketing?: Sameer MathurDokument12 SeitenWhat Is Marketing?: Sameer MathurTadi SaiNoch keine Bewertungen

- Outsourcing ofDokument19 SeitenOutsourcing ofsaranevesNoch keine Bewertungen

- Group Asssignment CHAP11Dokument5 SeitenGroup Asssignment CHAP11Lê Trọng Nhân67% (3)

- Rajiv Kumar Srivastava: ObjectivesDokument4 SeitenRajiv Kumar Srivastava: ObjectivesRajiv SrivastavaNoch keine Bewertungen

- International Business New 11Dokument66 SeitenInternational Business New 11tubenaweambroseNoch keine Bewertungen

- Chapter 31 - Multiple ChoiceDokument4 SeitenChapter 31 - Multiple ChoiceLorraineMartinNoch keine Bewertungen

- SHV in 2015 - 0 PDFDokument38 SeitenSHV in 2015 - 0 PDFBruno CesarNoch keine Bewertungen

- Hyperion Training DetailsDokument19 SeitenHyperion Training DetailsAmit SharmaNoch keine Bewertungen

- Accounting 111B (Journalizing)Dokument3 SeitenAccounting 111B (Journalizing)Yrica100% (1)

- P & G Inventory OptimizationDokument2 SeitenP & G Inventory OptimizationdenisvervantesNoch keine Bewertungen