Beruflich Dokumente

Kultur Dokumente

For BIR Compliance

Hochgeladen von

John Rey Bantay Rodriguez0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

16 Ansichten1 SeiteOriginaltitel

For BIR Compliance.docx

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

16 Ansichten1 SeiteFor BIR Compliance

Hochgeladen von

John Rey Bantay RodriguezCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

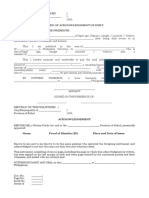

For BIR Compliance:

1. Annual inventory list of assets (due December 31 every year)

2. Quarterly Income Tax Return

3. Quarterly Percentage Tax

4. Withholding Tax on Compensation (for Employees)

5. Withholding Tax - expanded

6. List of Employees

7. Annual Income Tax Return with Financial Statements (due April 15 of the following year)

8. Annual registration Fee

Das könnte Ihnen auch gefallen

- Republic Act No. 10627Dokument5 SeitenRepublic Act No. 10627Lloyl Yosores MonteroNoch keine Bewertungen

- Inventory Sample ProblemDokument2 SeitenInventory Sample ProblemJohn Rey Bantay RodriguezNoch keine Bewertungen

- Owwa Programs and ServicesDokument1 SeiteOwwa Programs and ServicesJohn Rey Bantay RodriguezNoch keine Bewertungen

- BR NewDokument24 SeitenBR NewJohn Rey Bantay RodriguezNoch keine Bewertungen

- Midterm ExamDokument4 SeitenMidterm ExamJohn Rey Bantay RodriguezNoch keine Bewertungen

- For BIR ComplianceDokument1 SeiteFor BIR ComplianceJohn Rey Bantay RodriguezNoch keine Bewertungen

- NIL EXAM QUESTIONSDokument3 SeitenNIL EXAM QUESTIONSJohn Rey Bantay RodriguezNoch keine Bewertungen

- Manual For ProsecutorsDokument51 SeitenManual For ProsecutorsArchie Tonog0% (1)

- Requirements For IncorporationDokument1 SeiteRequirements For IncorporationJohn Rey Bantay RodriguezNoch keine Bewertungen

- Ideography Ervices GreementDokument4 SeitenIdeography Ervices GreementRadenko IvanovicNoch keine Bewertungen

- A3 Long ProblemDokument1 SeiteA3 Long ProblemJohn Rey Bantay RodriguezNoch keine Bewertungen

- CamiguinDokument1 SeiteCamiguinJohn Rey Bantay RodriguezNoch keine Bewertungen

- College of Business and Accountancy Law 3 Prelim ExamDokument5 SeitenCollege of Business and Accountancy Law 3 Prelim ExamJohn Rey Bantay RodriguezNoch keine Bewertungen

- Mas ExercisesDokument2 SeitenMas ExercisesJohn Rey Bantay RodriguezNoch keine Bewertungen

- Sworn Declaration for Inventory SchedulesDokument2 SeitenSworn Declaration for Inventory SchedulesPatrick DazaNoch keine Bewertungen

- Deed of Acknowledgment of Debt Know All Men by These PresentsDokument3 SeitenDeed of Acknowledgment of Debt Know All Men by These PresentsJohn Rey Bantay RodriguezNoch keine Bewertungen

- Affidavit of Filing and ServiceDokument1 SeiteAffidavit of Filing and ServiceJohn Rey Bantay RodriguezNoch keine Bewertungen

- Action Verbs For ObjectivesDokument4 SeitenAction Verbs For ObjectivesAnn Michelle TarrobagoNoch keine Bewertungen

- Promissory NoteDokument1 SeitePromissory NoteJohn Rey Bantay RodriguezNoch keine Bewertungen

- A 22Dokument2 SeitenA 22John Rey Bantay RodriguezNoch keine Bewertungen

- Accounting 2Dokument4 SeitenAccounting 2John Rey Bantay Rodriguez100% (1)

- Nil StudentsDokument10 SeitenNil StudentsJohn Rey Bantay RodriguezNoch keine Bewertungen

- Law 3 PrelimDokument5 SeitenLaw 3 PrelimJohn Rey Bantay RodriguezNoch keine Bewertungen

- Nil StudentsDokument10 SeitenNil StudentsJohn Rey Bantay RodriguezNoch keine Bewertungen

- Letter of RequestDokument1 SeiteLetter of RequestJohn Rey Bantay RodriguezNoch keine Bewertungen

- Cover Sheet DownloadDokument1 SeiteCover Sheet DownloadJohn Rey Bantay RodriguezNoch keine Bewertungen

- Republic of the Philippines Representatives File Joint Complaint Against Former COMELEC CommissionerDokument16 SeitenRepublic of the Philippines Representatives File Joint Complaint Against Former COMELEC CommissionerJulius Harvey Prieto BalbasNoch keine Bewertungen

- Cover Sheet Download PDFDokument1 SeiteCover Sheet Download PDFJohn Rey Bantay RodriguezNoch keine Bewertungen

- Cover Sheet Download PDFDokument1 SeiteCover Sheet Download PDFJohn Rey Bantay RodriguezNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)