Beruflich Dokumente

Kultur Dokumente

Stocks On Radar: Retail Research

Hochgeladen von

koppioaisOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Stocks On Radar: Retail Research

Hochgeladen von

koppioaisCopyright:

Verfügbare Formate

STOCKS ON RADAR

Retail Research

Tan Kai Bin

tan-kai-bin@ambankgroup.com 21 March 2019

03-2036 2300

JHM Consolidation (0127)

RM1.40

JHM Consolidation broke the RM1.22 mark during its latest

RM1.28

session. With a rising RSI level, a bullish bias may be present RM1.22

above this point with a target price of RM1.28, followed by

RM1.40. Meanwhile, it may continue trending sideways if it falls RM1.12

back below the RM1.22 mark in the near term. In this case,

support is anticipated at R1.12 whereby traders may exit on a

breach to avoid the risk of a further correction.

Trading Call: Buy on further rebound above RM1.22

Target: RM1.28, RM1.40 (time frame: 3-6 weeks)

Exit: RM1.12

GD Express Carrier (0078)

RM0.41

GD Express Carrier was testing the RM0.375 level in its latest RM0.375

session. With a healthy RSI level, a bullish bias may be present

above this mark with a target price of RM0.395, followed by

RM0.41. Meanwhile, it may continue moving sideways if it fails to

RM0.335

cross the RM0.375 mark in the near term. In this case, the

immediate support is anticipated at RM0.335, whereby traders

may exit on a breach to avoid the risk of a further correction.

Trading Call: Buy on further rebound above RM0.375

Target: RM0.395, RM0.41 (time frame: 3-6 weeks)

Exit: RM0.335

d

Rohas Tecnic (9741)

Rohas Tecnic was testing the RM0.66 resistance level in its

latest session, With a moderate RSI level, it may move higher

above this mark with a target price of RM0.75. Meanwhile, it may

continue to drift sideways if it fails to cross the RM0.66 mark in RM0.75

the near term. In this case, support is anticipated at RM0.61, RM0.66

whereby traders may exit on a breach to avoid the risk of a further

RM0.61

correction.

Trading Call: Buy on technical rebound above RM0.66

Target: RM0.75 (time frame: 3-6 weeks)

Exit: RM0.61

S P Setia (8664)

S P Setia was testing the RM2.29 level in its latest session. With RM2.60

a neutral RSI level, it may move higher above this mark with a RM2.48

target price of RM2.48, followed by RM2.60. Meanwhile, it may

continue moving sideways if it fails to cross the RM2.29 mark in

RM2.29

the near term. In this case, support is anticipated at RM2.17,

whereby traders may exit on a breach to avoid the risk of a further RM2.17

correction.

Trading Call: Buy on further rebound above RM2.29

Target: RM2.48, RM2.60 (time frame: 3-6 weeks)

Exit: RM2.17

Source: AmInvestment Bank, www.amesecurities.com.my

Stocks on Radar 21 March 2019

DISCLOSURE AND DISCLAIMER

This report is prepared for information purposes only and it is issued by AmInvestment Bank Berhad (“AmInvestment”)

without regard to your individual financial circumstances and objectives. Nothing in this report shall constitute an offer to

sell, warranty, representation, recommendation, legal, accounting or tax advice, solicitation or expression of views to

influence any one to buy or sell any real estate, securities, stocks, foreign exchange, futures, investment or other

products. AmInvestment recommends that you evaluate a particular investment or strategy based on your individual

circumstances and objectives and/or seek financial, legal or other advice on the appropriateness of the particular

investment or strategy.

The information in this report was obtained or derived from sources that AmInvestment believes are reliable and correct at

the time of issue. While all reasonable care has been taken to ensure that the stated facts are accurate and views are fair

and reasonable, AmInvestment has not independently verified the information and does not warrant or represent that they

are accurate, adequate, complete or up-to-date and they should not be relied upon as such. All information included in this

report constitute AmInvestment’s views as of this date and are subject to change without notice. Notwithstanding that,

AmInvestment has no obligation to update its opinion or information in this report. Facts and views presented in this report

may not reflect the views of or information known to other business units of AmInvestment’s affiliates and/or related

corporations (collectively, “AmBank Group”).

This report is prepared for the clients of AmBank Group and it cannot be altered, copied, reproduced, distributed or

republished for any purpose without AmInvestment’s prior written consent. AmInvestment, AmBank Group and its

respective directors, officers, employees and agents (“Relevant Person”) accept no liability whatsoever for any direct,

indirect or consequential losses, loss of profits and/or damages arising from the use or reliance of this report and/or further

communications given in relation to this report. Any such responsibility is hereby expressly disclaimed.

AmInvestment is not acting as your advisor and does not owe you any fiduciary duties in connection with this report. The

Relevant Person may provide services to any company and affiliates of such companies in or related to the securities or

products and/or may trade or otherwise effect transactions for their own account or the accounts of their customers which

may give rise to real or potential conflicts of interest.

This report is not directed to or intended for distribution or publication outside Malaysia. If you are outside Malaysia, you

should have regard to the laws of the jurisdiction in which you are located.

If any provision of this disclosure and disclaimer is held to be invalid in whole or in part, such provision will be deemed not

to form part of this disclosure and disclaimer. The validity and enforceability of the remainder of this disclosure and

disclaimer will not be affected.

AmInvestment Bank Bhd 2

Das könnte Ihnen auch gefallen

- Betterworks Goal Setting Ebook PDFDokument13 SeitenBetterworks Goal Setting Ebook PDFArtur Furtado100% (3)

- DAFgtRqQ1CGxCpisVyyQ BRITANNIA REPORT PDFDokument4 SeitenDAFgtRqQ1CGxCpisVyyQ BRITANNIA REPORT PDFtummalaajaybabuNoch keine Bewertungen

- Rent To Own ContractDokument5 SeitenRent To Own Contractjepoy100% (1)

- Mott Macdonald Case StudyDokument4 SeitenMott Macdonald Case StudyPanthrosNoch keine Bewertungen

- RSI Trading Strategies: Highly Profitable Trading Strategies Using The Relative Strength Index: Day Trading Made Easy, #1Von EverandRSI Trading Strategies: Highly Profitable Trading Strategies Using The Relative Strength Index: Day Trading Made Easy, #1Bewertung: 5 von 5 Sternen5/5 (8)

- Exercise Books EthiopiaDokument23 SeitenExercise Books EthiopiaDilip Kumar Ladwa100% (3)

- MNM3702 Full Notes - Stuvia PDFDokument57 SeitenMNM3702 Full Notes - Stuvia PDFMichaelNoch keine Bewertungen

- Bpo Management SystemDokument12 SeitenBpo Management SystembaskarbalachandranNoch keine Bewertungen

- Poliform Kitchens Aust (855KB) PDFDokument12 SeitenPoliform Kitchens Aust (855KB) PDFsage_9290% (1)

- Professional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.Von EverandProfessional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.Noch keine Bewertungen

- Corporate SustainabilityDokument17 SeitenCorporate SustainabilityShiloh Williams0% (1)

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar 190404Dokument2 SeitenStocks On Radar 190404koppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar 190322Dokument2 SeitenStocks On Radar 190322koppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar 190408Dokument2 SeitenStocks On Radar 190408koppioaisNoch keine Bewertungen

- Stocks On Radar 190315Dokument2 SeitenStocks On Radar 190315koppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar 190327Dokument2 SeitenStocks On Radar 190327koppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchBrian StanleyNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchBrian StanleyNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchabahNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar 190410Dokument2 SeitenStocks On Radar 190410abahNoch keine Bewertungen

- Stocks On Radar 20220208Dokument2 SeitenStocks On Radar 20220208iamamusleemNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchBrian StanleyNoch keine Bewertungen

- Stocks On Radar 20220207Dokument2 SeitenStocks On Radar 20220207iamamusleemNoch keine Bewertungen

- Eastern & Oriental Berhad: Revisiting The Tough Resistance of RM1.20 Soon - 12/04/2010Dokument2 SeitenEastern & Oriental Berhad: Revisiting The Tough Resistance of RM1.20 Soon - 12/04/2010Rhb InvestNoch keine Bewertungen

- Affin Holdings Berhad: Supported by The 10-Day and 40-Day SMAs - 23/08/2010Dokument2 SeitenAffin Holdings Berhad: Supported by The 10-Day and 40-Day SMAs - 23/08/2010Rhb InvestNoch keine Bewertungen

- Sime Darby Berhad: Will Likely Head Towards RM10.00-10.80 Resistance Zone - 12/10/2010Dokument2 SeitenSime Darby Berhad: Will Likely Head Towards RM10.00-10.80 Resistance Zone - 12/10/2010Rhb InvestNoch keine Bewertungen

- Alliance Financial Group BHD: A "Double Buy" Signal On The Momentum Indicators - 21/6/2010Dokument2 SeitenAlliance Financial Group BHD: A "Double Buy" Signal On The Momentum Indicators - 21/6/2010Rhb InvestNoch keine Bewertungen

- Axiata Group Berhad: Could Retest RM4.40 and RM4.80 in The Near Term... - 12/7/2010Dokument2 SeitenAxiata Group Berhad: Could Retest RM4.40 and RM4.80 in The Near Term... - 12/7/2010Rhb InvestNoch keine Bewertungen

- Mandarin Version: Genting Plantations Berhad: Likely To Move Higher in The Near Term - 12/10/2010Dokument2 SeitenMandarin Version: Genting Plantations Berhad: Likely To Move Higher in The Near Term - 12/10/2010Rhb InvestNoch keine Bewertungen

- UEM Land Holdings Berhad: A Chance To Scale Higher To RM1.80 - 19/7/2010Dokument2 SeitenUEM Land Holdings Berhad: A Chance To Scale Higher To RM1.80 - 19/7/2010Rhb InvestNoch keine Bewertungen

- Genting Malaysia Berhad: Possible Reversal From The Recent Downswing - 04/10/2010Dokument2 SeitenGenting Malaysia Berhad: Possible Reversal From The Recent Downswing - 04/10/2010Rhb InvestNoch keine Bewertungen

- Report Technical Analyzer Trading Stocks 20220317 - Retail-Research - R-909684516893427576413a38cbb705 - 1679103856Dokument4 SeitenReport Technical Analyzer Trading Stocks 20220317 - Retail-Research - R-909684516893427576413a38cbb705 - 1679103856adibNoch keine Bewertungen

- Mah Sing Group BHD (Trading BUY)Dokument2 SeitenMah Sing Group BHD (Trading BUY)JazzyNoch keine Bewertungen

- Trading-Stocks 20220220 Retail-Research R-37864540398152263f2af127280e 1676851266Dokument4 SeitenTrading-Stocks 20220220 Retail-Research R-37864540398152263f2af127280e 1676851266ngNoch keine Bewertungen

- Genting Plantations Berhad: Likely To Move Higher in The Near Term - 12/10/2010Dokument2 SeitenGenting Plantations Berhad: Likely To Move Higher in The Near Term - 12/10/2010Rhb InvestNoch keine Bewertungen

- Mandarin Version - Scomi Group Berhad: Breaking Out From The Downtrend Resistance Line - 06/04/2010Dokument2 SeitenMandarin Version - Scomi Group Berhad: Breaking Out From The Downtrend Resistance Line - 06/04/2010Rhb InvestNoch keine Bewertungen

- Mandarin Version - Petra Perdana Berhad: The Smooth Recovery May Lead To A Retest of RM1.78 Soon - 05/04/2010Dokument2 SeitenMandarin Version - Petra Perdana Berhad: The Smooth Recovery May Lead To A Retest of RM1.78 Soon - 05/04/2010Rhb InvestNoch keine Bewertungen

- Mandarin Version - Eastern & Oriental: Revisiting The Tough Resistance of RM1.20 Soon - 12/04/2010Dokument2 SeitenMandarin Version - Eastern & Oriental: Revisiting The Tough Resistance of RM1.20 Soon - 12/04/2010Rhb InvestNoch keine Bewertungen

- UEM Land Holdings: Confirmed Breakout From The RM1.46 Resistance Level - 29/03/2010Dokument2 SeitenUEM Land Holdings: Confirmed Breakout From The RM1.46 Resistance Level - 29/03/2010Rhb InvestNoch keine Bewertungen

- Proton Holdings Berhad: Could Cut Above RM5.00 Soon - 20/09/2010Dokument2 SeitenProton Holdings Berhad: Could Cut Above RM5.00 Soon - 20/09/2010Rhb InvestNoch keine Bewertungen

- Malaysian Pacific Industries Berhad: An Oppurtunity To Collect On Weakness - 26/04/2010Dokument2 SeitenMalaysian Pacific Industries Berhad: An Oppurtunity To Collect On Weakness - 26/04/2010Rhb InvestNoch keine Bewertungen

- HEXTAR - Research Hive - 02 June 2020Dokument2 SeitenHEXTAR - Research Hive - 02 June 2020JazzyNoch keine Bewertungen

- Genting Malaysia Berhad: Further Upside Will Confirm The Upswing... 28/06/2010Dokument2 SeitenGenting Malaysia Berhad: Further Upside Will Confirm The Upswing... 28/06/2010Rhb InvestNoch keine Bewertungen

- Mandarin Version: Scomi Marine: in Anticipation of A Tchnical Rebound Soon - 26/07/2010Dokument2 SeitenMandarin Version: Scomi Marine: in Anticipation of A Tchnical Rebound Soon - 26/07/2010Rhb InvestNoch keine Bewertungen

- Bajaj AutoDokument4 SeitenBajaj AutoSathyamurthy RamanujamNoch keine Bewertungen

- Zelan Berhad: Overall Recovery Trend Remains Intact - 16/08/2010Dokument2 SeitenZelan Berhad: Overall Recovery Trend Remains Intact - 16/08/2010Rhb InvestNoch keine Bewertungen

- IOI Corporation Berhad: A Possible Breakout Rally Ahead - 12/10/2010Dokument2 SeitenIOI Corporation Berhad: A Possible Breakout Rally Ahead - 12/10/2010Rhb InvestNoch keine Bewertungen

- AEMULUS - Technical View - 11 June 2020Dokument2 SeitenAEMULUS - Technical View - 11 June 2020Mohd Amiruddin Abd RahmanNoch keine Bewertungen

- Kencana Petroleum Berhad: Medium-Term Outlook Has Turned Bearish - 31/5/2010Dokument2 SeitenKencana Petroleum Berhad: Medium-Term Outlook Has Turned Bearish - 31/5/2010Rhb InvestNoch keine Bewertungen

- GENM - Technical View - 09 June 2020Dokument2 SeitenGENM - Technical View - 09 June 2020Mohd Amiruddin Abd RahmanNoch keine Bewertungen

- AirAsia Berhad: Bargain-Hunting Activities To Resurface Soon - 19/04/2010Dokument2 SeitenAirAsia Berhad: Bargain-Hunting Activities To Resurface Soon - 19/04/2010Rhb InvestNoch keine Bewertungen

- OPENSYS - Technical View - 05 June 2020Dokument2 SeitenOPENSYS - Technical View - 05 June 2020MegatzimranNoch keine Bewertungen

- ASIAPLY - Research Hive - 17 Nov 2020Dokument2 SeitenASIAPLY - Research Hive - 17 Nov 2020JazzyNoch keine Bewertungen

- BSTEAD - Research Hive - 22 Sept 2020Dokument2 SeitenBSTEAD - Research Hive - 22 Sept 2020JazzyNoch keine Bewertungen

- Weekly Trading Highlights & OutlookDokument5 SeitenWeekly Trading Highlights & OutlookDevang VisariaNoch keine Bewertungen

- ECONBHD - Technical View - 10 June 2020Dokument2 SeitenECONBHD - Technical View - 10 June 2020Mohd Amiruddin Abd RahmanNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar 190408Dokument2 SeitenStocks On Radar 190408koppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar 190401Dokument2 SeitenStocks On Radar 190401koppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar 190315Dokument2 SeitenStocks On Radar 190315koppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar 190322Dokument2 SeitenStocks On Radar 190322koppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar 190327Dokument2 SeitenStocks On Radar 190327koppioaisNoch keine Bewertungen

- Stocks On Radar 190315Dokument2 SeitenStocks On Radar 190315koppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- QES MK Mar19 InitiationDokument14 SeitenQES MK Mar19 InitiationkoppioaisNoch keine Bewertungen

- Stocks On Radar 190307Dokument2 SeitenStocks On Radar 190307koppioaisNoch keine Bewertungen

- Stocks On Radar 190308Dokument2 SeitenStocks On Radar 190308koppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Alpha Ideas Revenue Group 20190417Dokument2 SeitenAlpha Ideas Revenue Group 20190417koppioaisNoch keine Bewertungen

- Stocks On Radar: Retail ResearchDokument2 SeitenStocks On Radar: Retail ResearchkoppioaisNoch keine Bewertungen

- Canon MP287 Error E08 ResetDokument2 SeitenCanon MP287 Error E08 ResetkoppioaisNoch keine Bewertungen

- Example of RFP For Credit ScoringDokument4 SeitenExample of RFP For Credit ScoringadaquilaNoch keine Bewertungen

- Upcoming Exhibition Schedule - UAEDokument3 SeitenUpcoming Exhibition Schedule - UAEAjay KrishnanNoch keine Bewertungen

- w9 - L2 - Review For Lecture Midterm 2Dokument14 Seitenw9 - L2 - Review For Lecture Midterm 2Rashid AyubiNoch keine Bewertungen

- 1st Mid Term Exam Fall 2014 AuditingDokument6 Seiten1st Mid Term Exam Fall 2014 AuditingSarahZeidat100% (1)

- INTERN 1 DefinitionsDokument2 SeitenINTERN 1 DefinitionsJovis MalasanNoch keine Bewertungen

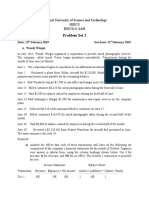

- Problem Set 2Dokument2 SeitenProblem Set 2Rubab MirzaNoch keine Bewertungen

- OpinionLab v. Iperceptions Et. Al.Dokument34 SeitenOpinionLab v. Iperceptions Et. Al.PriorSmartNoch keine Bewertungen

- Internal Audit Checklist (For Core Processes) : Issue Number: Effective Date: Document CodeDokument5 SeitenInternal Audit Checklist (For Core Processes) : Issue Number: Effective Date: Document CodejulyenfortunatoNoch keine Bewertungen

- Indo Gold Mines PVT LTDDokument30 SeitenIndo Gold Mines PVT LTDSiddharth Sourav PadheeNoch keine Bewertungen

- Saji DDDD DDDDDokument37 SeitenSaji DDDD DDDDTalha Iftekhar Khan SwatiNoch keine Bewertungen

- BCDR AT&T Wireless CommunicationsDokument17 SeitenBCDR AT&T Wireless CommunicationsTrishNoch keine Bewertungen

- Swot Analysis of BSNLDokument2 SeitenSwot Analysis of BSNLNiharika SinghNoch keine Bewertungen

- XII Acc CH 4 and 5 Study Material 2024Dokument28 SeitenXII Acc CH 4 and 5 Study Material 2024bhawanar674Noch keine Bewertungen

- Nestle CSRDokument309 SeitenNestle CSRMaha AbbasiNoch keine Bewertungen

- Latihan AdvanceDokument9 SeitenLatihan AdvanceMellya KomaraNoch keine Bewertungen

- Introduction of Icici BankDokument6 SeitenIntroduction of Icici BankAyush JainNoch keine Bewertungen

- Managerial Level-1: Part - Aweightage 20%Dokument6 SeitenManagerial Level-1: Part - Aweightage 20%fawad aslamNoch keine Bewertungen

- Appendix V-Honda CSR 003Dokument11 SeitenAppendix V-Honda CSR 003SowdayyaNoch keine Bewertungen

- TrimaxdrhpDokument348 SeitenTrimaxdrhpArjun ArikeriNoch keine Bewertungen

- QuestionnaireDokument5 SeitenQuestionnaireDivya BajajNoch keine Bewertungen

- El 1204 HHDokument6 SeitenEl 1204 HHLuis Marcelo HinojosaNoch keine Bewertungen