Beruflich Dokumente

Kultur Dokumente

OE0036

Hochgeladen von

kumud kalaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

OE0036

Hochgeladen von

kumud kalaCopyright:

Verfügbare Formate

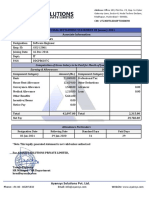

OKS

EDUCATION

PVT. LTD.

Pay Slip for the

month of April-

2018

Employee Code : OE0036 Department : EDUCATION

Name : Ms. Kumud Kala Designation : SR. ANDROID DEVELOPER

Date Of Joining : 01 Sep 2014 Payable Days : 30.00

Birth Date : 30 Nov 1982 Arrear Days : 0.00

Bank Ac No. : CHEQUE LWP : 0.00

PF No. : DS/NHP/0943616/000DSNHP094361600022 Location : DELHI

PAN : BGUPK6514L

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

BASIC 17234.00 17234.00 0.00 17234.00 PF 2068.00

HRA 8617.00 8617.00 0.00 8617.00

SPECIAL ALLOWANCE 6894.00 6894.00 0.00 6894.00

C. C. A 5170.00 5170.00 0.00 5170.00

BONUS 584.00 584.00 0.00 584.00

CONVEYANCE 1600.00 1600.00 0.00 1600.00

GROSS EARNINGS 40099.00 40099.00 0.00 40099.00 GROSS DEDUCTIONS 2068.00

Net Pay : 38,031.00

Net Pay in words : Rupees Thirty Eight Thousand Thirty One Only

Income Tax Worksheet for the Period April 2018 - March 2019(Proposed Investments)

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation(METRO)

BASIC 206808.00 0.00 206808.00 Investments u/s 80C Exempted Qualifying Rent Paid 0.00

HRA 103404.00 0.00 103404.00 ELSS 150000.00 150000.00 From 01/04/2018

SPECIAL ALLOWANCE 82728.00 0.00 82728.00 PROVIDENT FUND 24816.88 150000.00 To 31/03/2019

C. C. A 62040.00 0.00 62040.00 Public Provident Fund 80000.00 150000.00 1. Actual HRA 0.00

BONUS 7008.00 0.00 7008.00 2. 40% or 50% of Basic 0.00

CONVEYANCE 19200.00 0.00 19200.00 3. Rent - 10% Basic 0.00

Least of above is exempt 0.00

Taxable HRA 103404.00

Gross 481188.00 0.00 481188.00 Total of Investments u/s 80C 254816.88 150000.00

Deductions U/S 80C 150000.00 150000.00 TDS Deducted Monthly

Previous Employer Taxable Income 0.00 Total of Ded Under Chapter VI-A 150000.00 150000.00 Month Amount

Professional Tax 0.00 April-2018 0.00

Under Chapter VI-A 150000.00 Tax Deducted on Perq. 0.00

Standard Deduction 40000.00 Total 0.00

Any Other Income 0.00

Taxable Income 291188.00

Total Tax 0.00

Marginal Relief 0.00

Tax Rebate 0.00

Surcharge 0.00

Tax Due 0.00

Educational Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 0.00

Tax to be Deducted 0.00

Tax/Month 0.00 Total of Any Other Income 0.00

Tax on Non-Recurring Earnings 0.00

Tax Credit Amount (87A) 5000.00

Tax Deduction for this month 0.00

Personal Note: This is a system generated payslip, does not require any signature.

..................................................... Cut Here .....................................................

Print Date - 02/05/2018

Das könnte Ihnen auch gefallen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- 157salaryslip g5sxl3g6Dokument1 Seite157salaryslip g5sxl3g6Shakti NaikNoch keine Bewertungen

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDokument3 SeitenCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNoch keine Bewertungen

- Employee DataDokument1 SeiteEmployee DataomkassNoch keine Bewertungen

- ACK158216300200523Dokument1 SeiteACK158216300200523Ritu RajNoch keine Bewertungen

- Cryoliten India Softwares: A-5 Faizabad Road Near Bhootnath Market Uttar, Pradesh India - 226016Dokument1 SeiteCryoliten India Softwares: A-5 Faizabad Road Near Bhootnath Market Uttar, Pradesh India - 226016Rohit raagNoch keine Bewertungen

- Salary SlipDokument1 SeiteSalary SlipPranav Kumar100% (1)

- Amount in Words Is Rupees Eleven Thousand Six OnlyDokument1 SeiteAmount in Words Is Rupees Eleven Thousand Six OnlyGunaganti MaheshNoch keine Bewertungen

- Pushparaj R PayslipDokument3 SeitenPushparaj R PayslipHenry suryaNoch keine Bewertungen

- Salary Slip - February 2023 - Gurjeet Singh SainiDokument1 SeiteSalary Slip - February 2023 - Gurjeet Singh SainiGurjeet SainiNoch keine Bewertungen

- Payslip For The Month of November 2020: Cms It Services Private LimitedDokument2 SeitenPayslip For The Month of November 2020: Cms It Services Private LimitedKrishna AryanNoch keine Bewertungen

- Gane 1824Dokument1 SeiteGane 1824govindansanNoch keine Bewertungen

- Salma Saifi May SlipDokument2 SeitenSalma Saifi May Slipsalma saifiNoch keine Bewertungen

- Itr Acknowledgement 2020Dokument1 SeiteItr Acknowledgement 2020AJAY KUMAR JAISWALNoch keine Bewertungen

- Pay Slip - 604316 - May-22Dokument1 SeitePay Slip - 604316 - May-22ArchanaNoch keine Bewertungen

- Salary SlipDokument1 SeiteSalary SlipSanjay SolankiNoch keine Bewertungen

- Payslip March 2023Dokument1 SeitePayslip March 2023kaushalNoch keine Bewertungen

- Techfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032Dokument1 SeiteTechfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032manoj mohanNoch keine Bewertungen

- PDF 472850270150723Dokument1 SeitePDF 472850270150723Pijush SinhaNoch keine Bewertungen

- Payslip 172820180712150142Dokument1 SeitePayslip 172820180712150142LakshmananNoch keine Bewertungen

- SalarySlipwithTaxDetailsDokument2 SeitenSalarySlipwithTaxDetailsVivek ViviNoch keine Bewertungen

- PayslipSalary Slips - 9-2020 PDFDokument1 SeitePayslipSalary Slips - 9-2020 PDFSukant ChampatiNoch keine Bewertungen

- Salary Slip Feb 2019 of SandeepDokument1 SeiteSalary Slip Feb 2019 of SandeepSawan YadavNoch keine Bewertungen

- Payslip 11860967 AugDokument1 SeitePayslip 11860967 Augshreya arunNoch keine Bewertungen

- PDF 237557810150623Dokument1 SeitePDF 237557810150623sgkv vasaNoch keine Bewertungen

- This Is My Money. I Earned It by Doing My Best For Our CustomersDokument3 SeitenThis Is My Money. I Earned It by Doing My Best For Our CustomersAbzi SyedNoch keine Bewertungen

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Dokument1 SeiteMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNoch keine Bewertungen

- FNP00765Dokument1 SeiteFNP00765Rajaram RayNoch keine Bewertungen

- Full and Final Settlement Statement of January 2021 Associate InformationDokument1 SeiteFull and Final Settlement Statement of January 2021 Associate InformationB BhaskarNoch keine Bewertungen

- Pay Slip - 604316 - Jul-23Dokument1 SeitePay Slip - 604316 - Jul-23ArchanaNoch keine Bewertungen

- 100000000420152Dokument1 Seite100000000420152Sandeep SranNoch keine Bewertungen

- Itr 2023 2024Dokument1 SeiteItr 2023 2024Deepak ThangamaniNoch keine Bewertungen

- Payslip 5 2021Dokument1 SeitePayslip 5 2021Mehraj PashaNoch keine Bewertungen

- EPF Universal Account Number: LIC ID / Policy IDDokument2 SeitenEPF Universal Account Number: LIC ID / Policy IDBiswajit DasNoch keine Bewertungen

- Salary SlipsDokument6 SeitenSalary SlipsIMSaMiNoch keine Bewertungen

- Itr 2022.2023Dokument1 SeiteItr 2022.2023MoghAKaranNoch keine Bewertungen

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDokument1 SeiteIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNoch keine Bewertungen

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDokument1 SeiteIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAryan KulhariNoch keine Bewertungen

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDokument1 SeiteIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSiyad KvNoch keine Bewertungen

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDokument1 SeiteIndian Income Tax Return Acknowledgement 2021-22: Assessment YearTitiksha JoshiNoch keine Bewertungen

- Payslip For The Month of November 2016Dokument1 SeitePayslip For The Month of November 2016chittaNoch keine Bewertungen

- Payslip 2023 2024 4 h112231215 KNOAH - 230506 - 200245Dokument2 SeitenPayslip 2023 2024 4 h112231215 KNOAH - 230506 - 200245SRIANJANNoch keine Bewertungen

- Employee Details Payment & Leave Details: Arrears Current AmountDokument1 SeiteEmployee Details Payment & Leave Details: Arrears Current AmountAkhila ChinniNoch keine Bewertungen

- Payslip For BeginnerDokument1 SeitePayslip For BeginnerKhan SahbNoch keine Bewertungen

- Sampangi Sowbhagya (POL11622)Dokument1 SeiteSampangi Sowbhagya (POL11622)Sowbhagya VaderaNoch keine Bewertungen

- ACK431792790120723Dokument1 SeiteACK431792790120723ThiruNoch keine Bewertungen

- India Payslip January 2022Dokument1 SeiteIndia Payslip January 2022Mir KazimNoch keine Bewertungen

- Salary Slip MayDokument1 SeiteSalary Slip MayhappytiwariNoch keine Bewertungen

- Pay Slip - 604316 - Feb-23Dokument1 SeitePay Slip - 604316 - Feb-23ArchanaNoch keine Bewertungen

- Salary Slip EDIT-JULYDokument4 SeitenSalary Slip EDIT-JULYpathyashisNoch keine Bewertungen

- HCCBK0799 SalarySlip February 2019 PDFDokument1 SeiteHCCBK0799 SalarySlip February 2019 PDFShalini100% (1)

- Ack - AY 2022-23 MeenaDokument1 SeiteAck - AY 2022-23 Meenakdsss pNoch keine Bewertungen

- Employee Details Payment & Working Days Details Location Details Nilu KumariDokument1 SeiteEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNoch keine Bewertungen

- PayslipDokument6 SeitenPayslipmohamed arabathNoch keine Bewertungen

- Rutansh Itr 2022-23Dokument1 SeiteRutansh Itr 2022-23Rutansh JagtapNoch keine Bewertungen

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDokument1 SeiteIndian Income Tax Return Acknowledgement 2021-22: Assessment YearPrateek GuptaNoch keine Bewertungen

- Dbkps7123e - Ay 2017 18Dokument5 SeitenDbkps7123e - Ay 2017 18Damodar SurisettyNoch keine Bewertungen

- Luminous Power Technologies Private Limited: Earnings DeductionsDokument1 SeiteLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNoch keine Bewertungen

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDokument1 SeitePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNoch keine Bewertungen

- Earnings Deductions: Eicher Motors LimitedDokument1 SeiteEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNoch keine Bewertungen

- Form 16Dokument3 SeitenForm 16Bijay TiwariNoch keine Bewertungen

- Chapter 9 Percentage TaxDokument25 SeitenChapter 9 Percentage TaxTrisha Mae BoholNoch keine Bewertungen

- CHAPTER 14 Regular Income Tax IndividualDokument28 SeitenCHAPTER 14 Regular Income Tax IndividualAvada Kedavra100% (1)

- Guyana's: Tax GuideDokument9 SeitenGuyana's: Tax GuideKris NauthNoch keine Bewertungen

- T776-17e-Rental Statement Fill Up FormDokument3 SeitenT776-17e-Rental Statement Fill Up FormjoanaNoch keine Bewertungen

- Format For Computation of Income Under Income Tax ActDokument3 SeitenFormat For Computation of Income Under Income Tax ActAakash67% (3)

- CGT Tomanda AntokDokument1 SeiteCGT Tomanda AntokNvision PresentNoch keine Bewertungen

- Kuenzle & Streiff, Inc., vs. The Collector of Internal RevenueDokument7 SeitenKuenzle & Streiff, Inc., vs. The Collector of Internal RevenueVincent OngNoch keine Bewertungen

- CCH Federal TaxationDokument14 SeitenCCH Federal Taxation50shadesofjohnNoch keine Bewertungen

- Ofelia Diana FalcesoDokument5 SeitenOfelia Diana FalcesoOfelia Diana FalcesoNoch keine Bewertungen

- Irs New Form 1040Dokument2 SeitenIrs New Form 1040ForkLogNoch keine Bewertungen

- Kim Gilbert 2018 PDFDokument25 SeitenKim Gilbert 2018 PDFKim Gilbert50% (2)

- Taxation - Final ExamDokument4 SeitenTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Residents in St. Lawrence County Have An Extension Issued by The IRS For Tax FilingsDokument1 SeiteResidents in St. Lawrence County Have An Extension Issued by The IRS For Tax FilingsNewzjunkyNoch keine Bewertungen

- Cir vs. General Foods Inc.Dokument2 SeitenCir vs. General Foods Inc.Dexter Lee GonzalesNoch keine Bewertungen

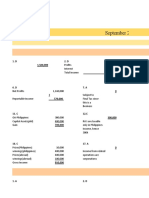

- September 22 - Chapter 9-Regular Income Tax: Inclusion From Gross Income (Assignment)Dokument8 SeitenSeptember 22 - Chapter 9-Regular Income Tax: Inclusion From Gross Income (Assignment)anitaNoch keine Bewertungen

- Lorenzo vs. Posadas Jr.Dokument2 SeitenLorenzo vs. Posadas Jr.Lizzy Way100% (1)

- Woolworth Payslip 2Dokument1 SeiteWoolworth Payslip 2sunny singh100% (1)

- Income Tax 2nd Quiz PrelimDokument5 SeitenIncome Tax 2nd Quiz PrelimRenalyn ParasNoch keine Bewertungen

- Computationofincome2023 1Dokument2 SeitenComputationofincome2023 1rtaxhelp helpNoch keine Bewertungen

- New Tax RatesDokument2 SeitenNew Tax RatesSIVAKUMARNoch keine Bewertungen

- Computation - Computation (23-24)Dokument2 SeitenComputation - Computation (23-24)BIKASH KUMARNoch keine Bewertungen

- R450215048 and R450215037 Tax ProDokument13 SeitenR450215048 and R450215037 Tax ProSankarSinghNoch keine Bewertungen

- Chap 010 - Taxation of Individuals and Business EntitiesDokument63 SeitenChap 010 - Taxation of Individuals and Business Entitiesaffy714Noch keine Bewertungen

- No Proceeds in Tax Evasion.: Tax Avoidance, Often Called Tax Planning, Is The Use by The Taxpayer of Legally PermissibleDokument3 SeitenNo Proceeds in Tax Evasion.: Tax Avoidance, Often Called Tax Planning, Is The Use by The Taxpayer of Legally PermissibleMarceline AbadeerNoch keine Bewertungen

- Child Tax Credit Rates 2005-7Dokument3 SeitenChild Tax Credit Rates 2005-7frankieb99Noch keine Bewertungen

- Tax PlanDokument2 SeitenTax PlanMrigendra MishraNoch keine Bewertungen

- Basics & House Property - PaperDokument4 SeitenBasics & House Property - Papervishwajeetpatil0542Noch keine Bewertungen

- Self Assessment Scheme of PakistanDokument5 SeitenSelf Assessment Scheme of Pakistanamjadnawaz85100% (1)

- US Internal Revenue Service: f1040 - 1991Dokument2 SeitenUS Internal Revenue Service: f1040 - 1991IRSNoch keine Bewertungen