Beruflich Dokumente

Kultur Dokumente

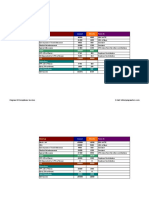

Total Tax Payable - 15142.4: Health Checkup (Max 5000), House Loan Interest Etc.

Hochgeladen von

Kumar Rajadhyaksh0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

27 Ansichten1 SeiteCalculation sheet

Originaltitel

Income Tax Calc

Copyright

© © All Rights Reserved

Verfügbare Formate

XLSX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCalculation sheet

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

27 Ansichten1 SeiteTotal Tax Payable - 15142.4: Health Checkup (Max 5000), House Loan Interest Etc.

Hochgeladen von

Kumar RajadhyakshCalculation sheet

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Income Tax Calculator

1 Income from Gross Salary 0

Standard Deduction 40000

-40000

2 HRA Exemption

Total Basic Actual HRA Received 0

Total DA (If Any) 0 Rent paid in excess of 10% of (Basic+DA) 0 0

Total HRA 50% of (Basic+DA) 0

Total House Rent Paid

-40000

3 Professional Tax 1200 1200

-41200

4 Deduction

80C (LIC, PPF)

PF Employee Share

Donation (80G) 0

Other Deductions if any under 80D,

80DDB, 80EE, 80TTA Health Checkup (Max 5000), House loan Interest etc..

5 Net Taxable Income -41200

6 Calculation of Income Tax

Upto 250000 (NIL) 0

250001 to 500000 (5%) -14560

500001 to 1000000 (20%) 0

1000001 & above (30%) 0

Total Tax -14560

Heath & Education Cess (4%) -582.4

Total Tax Payable -15142.4

Das könnte Ihnen auch gefallen

- Input To Be Provided in The Cells in YellowDokument2 SeitenInput To Be Provided in The Cells in YellowNikhil KautilyaNoch keine Bewertungen

- Income Tax Calculator FY 2015-16 (AY 2016-17) : Particulars Details TypeDokument4 SeitenIncome Tax Calculator FY 2015-16 (AY 2016-17) : Particulars Details TypeKamlesh ChauhanNoch keine Bewertungen

- INCOME TAX CALCULATION For Year 2008-2009: Male Per Year Per YearDokument1 SeiteINCOME TAX CALCULATION For Year 2008-2009: Male Per Year Per Yearpintoo23Noch keine Bewertungen

- Income Tax Calculation SheetDokument8 SeitenIncome Tax Calculation SheetArajrubanNoch keine Bewertungen

- EMP23 Tax Sheet Report202311152219Dokument2 SeitenEMP23 Tax Sheet Report202311152219SoumyaranjanNoch keine Bewertungen

- Income Tax CalculatorDokument4 SeitenIncome Tax CalculatorAchin AgarwalNoch keine Bewertungen

- Tax Calculator Version 2Dokument4 SeitenTax Calculator Version 2SoikotNoch keine Bewertungen

- Quikchex CTC CalculatorDokument8 SeitenQuikchex CTC CalculatoriamgodrajeshNoch keine Bewertungen

- Salary Breakups (Excel 2003)Dokument2 SeitenSalary Breakups (Excel 2003)trickyNoch keine Bewertungen

- QuestionDokument2 SeitenQuestionamar_aliveNoch keine Bewertungen

- Tax DetailsDokument2 SeitenTax DetailsRahul AgarwalNoch keine Bewertungen

- Revised Estimation - FY 2023-24Dokument1 SeiteRevised Estimation - FY 2023-24Debojyoti MukherjeeNoch keine Bewertungen

- Crystal Report Viewer 2Dokument1 SeiteCrystal Report Viewer 2Rahul JadhavNoch keine Bewertungen

- Concentrix Daksh Services India Private Limited: Income Tax Calculation For The PeriodDokument5 SeitenConcentrix Daksh Services India Private Limited: Income Tax Calculation For The Periodgthapliyal31Noch keine Bewertungen

- Income Tax Calculator FY 2014 15Dokument2 SeitenIncome Tax Calculator FY 2014 15Pardeep KumarNoch keine Bewertungen

- HRA and SalaruDokument1 SeiteHRA and SalaruAnushree DeyNoch keine Bewertungen

- August 19 My Salary Slip BCWDokument4 SeitenAugust 19 My Salary Slip BCWJai Prakash BahroliyaNoch keine Bewertungen

- Computation of Total Income: Zenit - A KDK Software Software ProductDokument2 SeitenComputation of Total Income: Zenit - A KDK Software Software Productkunjal mistryNoch keine Bewertungen

- Heads of Income Monthly Actual YTD Projected TotalDokument2 SeitenHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNoch keine Bewertungen

- Salary Break Up 3 PSLDokument6 SeitenSalary Break Up 3 PSLvirag_shahsNoch keine Bewertungen

- Salary TaxDokument4 SeitenSalary Taxapi-3810632Noch keine Bewertungen

- Income Tax Calculator FY 2014 15Dokument2 SeitenIncome Tax Calculator FY 2014 15atul bansalNoch keine Bewertungen

- Case Study 2Dokument2 SeitenCase Study 2Anil NagarajNoch keine Bewertungen

- August PDFDokument1 SeiteAugust PDFnivash chinnasamyNoch keine Bewertungen

- Coi 23-24 Lalu YadavDokument2 SeitenCoi 23-24 Lalu Yadavtejpalsinghyadav786Noch keine Bewertungen

- Tax CalculatorDokument3 SeitenTax CalculatorRohit KumarNoch keine Bewertungen

- Doc-20230725-Wa0011. (2)Dokument1 SeiteDoc-20230725-Wa0011. (2)s0026637Noch keine Bewertungen

- Tuv Sud Employee Tax ComputationDokument2 SeitenTuv Sud Employee Tax Computationprashanth kumarNoch keine Bewertungen

- Dcss p6Dokument1 SeiteDcss p6Jesse RiveraNoch keine Bewertungen

- Yadnya-Income Tax Regime CalculatorDokument16 SeitenYadnya-Income Tax Regime CalculatorRaghavendra DeshpandeNoch keine Bewertungen

- Salary Structure Breakdown by Company SizeDokument26 SeitenSalary Structure Breakdown by Company SizeDivyansh GoyalNoch keine Bewertungen

- TAX COMPUTATION FOR 2017-18Dokument1 SeiteTAX COMPUTATION FOR 2017-18Ravi KumarNoch keine Bewertungen

- Tax Calculator FY 23-24Dokument6 SeitenTax Calculator FY 23-24Arish BallanaNoch keine Bewertungen

- Luminous Power Technologies Private Limited: Earnings DeductionsDokument1 SeiteLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNoch keine Bewertungen

- Employee tax statement Apr 2021Dokument2 SeitenEmployee tax statement Apr 2021Lady KillerNoch keine Bewertungen

- Income Tax Return for FY 2016-17Dokument2 SeitenIncome Tax Return for FY 2016-17Suman jhaNoch keine Bewertungen

- AliDokument38 SeitenAliAzam JamalNoch keine Bewertungen

- Head Description: Income Tax Ratio Gross Income/Tax LiabilityDokument4 SeitenHead Description: Income Tax Ratio Gross Income/Tax LiabilityGhodawatNoch keine Bewertungen

- IT Saving Declaration - 2109Dokument2 SeitenIT Saving Declaration - 2109bala govindamNoch keine Bewertungen

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDokument1 SeitePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNoch keine Bewertungen

- Month Net Taxable Income Tax Slabs Tax RateDokument2 SeitenMonth Net Taxable Income Tax Slabs Tax RateBhargav ChintalapatiNoch keine Bewertungen

- COMPUTATIONDokument2 SeitenCOMPUTATIONjaredford913Noch keine Bewertungen

- Salaried Tax Calculator Ay 23-24Dokument2 SeitenSalaried Tax Calculator Ay 23-24Proddut BasakNoch keine Bewertungen

- EPF Universal Account Number: 100618268345 LIC ID / Policy IDDokument1 SeiteEPF Universal Account Number: 100618268345 LIC ID / Policy IDHoly ReaperNoch keine Bewertungen

- Sols-Dr RajniDokument5 SeitenSols-Dr Rajnialex breymannNoch keine Bewertungen

- Latest Tax Calculation RevisedDokument4 SeitenLatest Tax Calculation RevisedmitulkingNoch keine Bewertungen

- HCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Dokument1 SeiteHCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Kittu SinghNoch keine Bewertungen

- POWIBA NOTICE CORPORATE TAX AssessmentDokument2 SeitenPOWIBA NOTICE CORPORATE TAX AssessmentHassan OmaryNoch keine Bewertungen

- IBCC Tax Projection Sheet 2022-23Dokument1 SeiteIBCC Tax Projection Sheet 2022-23Ankush SinghNoch keine Bewertungen

- Projected Income Tax Computation Statement For The Month of Feb 2021Dokument2 SeitenProjected Income Tax Computation Statement For The Month of Feb 2021LokeswaraRaoNoch keine Bewertungen

- Comprehensive Tax Practices and ExercisesDokument45 SeitenComprehensive Tax Practices and ExercisesWS KNIGHTNoch keine Bewertungen

- Calculate income tax liability under old and new tax regimesDokument6 SeitenCalculate income tax liability under old and new tax regimesJigeesha BhargaviNoch keine Bewertungen

- FF PayslipDokument1 SeiteFF PayslipYviie VANoch keine Bewertungen

- Income Tax 2019-2020Dokument49 SeitenIncome Tax 2019-2020myjioNoch keine Bewertungen

- Developed By-Office Automation Division, IIT Kanpur Page No.1Dokument2 SeitenDeveloped By-Office Automation Division, IIT Kanpur Page No.1Kishan OmarNoch keine Bewertungen

- EPF Universal Account Number: LIC ID / Policy IDDokument1 SeiteEPF Universal Account Number: LIC ID / Policy IDRapole DathatriNoch keine Bewertungen

- Salary Breakup CalculatorDokument4 SeitenSalary Breakup CalculatorHR Sri Sri Ayurveda HospitalNoch keine Bewertungen

- Salary Slip NovDokument1 SeiteSalary Slip NovRahul RajawatNoch keine Bewertungen

- Inter CA DT Revision Notes For Nov 21Dokument126 SeitenInter CA DT Revision Notes For Nov 21chalu account100% (2)

- Mrunal Diaspora - Pravasi Bharatiya Divas 2015, OCI-PIODokument7 SeitenMrunal Diaspora - Pravasi Bharatiya Divas 2015, OCI-PIOKumar RajadhyakshNoch keine Bewertungen

- Mrunal (GS3) Clean Energy - Floating Solar Plants, Agnisumukh LPGDokument9 SeitenMrunal (GS3) Clean Energy - Floating Solar Plants, Agnisumukh LPGSatishKumarNoch keine Bewertungen

- PDT Not Present For Given ClientDokument2 SeitenPDT Not Present For Given ClientKumar RajadhyakshNoch keine Bewertungen

- Quality Certificate CHEPDokument2 SeitenQuality Certificate CHEPKumar RajadhyakshNoch keine Bewertungen

- Housekeeping Schedule: Arehouse CleaningDokument1 SeiteHousekeeping Schedule: Arehouse CleaningKumar RajadhyakshNoch keine Bewertungen

- Railway Amendments RefundRules 2406Dokument13 SeitenRailway Amendments RefundRules 2406yogi10Noch keine Bewertungen

- Android Complete Reference by KavitaDokument35 SeitenAndroid Complete Reference by KavitaKumar RajadhyakshNoch keine Bewertungen

- History12 - 1 - Colonialism Official Archives PDFDokument31 SeitenHistory12 - 1 - Colonialism Official Archives PDFKumar RajadhyakshNoch keine Bewertungen

- Android Syllabus DaywiseDokument2 SeitenAndroid Syllabus DaywiseKumar RajadhyakshNoch keine Bewertungen

- Logistics Private Limited Visitor ProtocolDokument3 SeitenLogistics Private Limited Visitor ProtocolKumar RajadhyakshNoch keine Bewertungen

- GSDP ChecklistDokument8 SeitenGSDP ChecklistKumar Rajadhyaksh0% (1)

- Inter Location Movement: Rack Location Error Not Showing Multiple Ops: Batch, MFG, ExpDokument1 SeiteInter Location Movement: Rack Location Error Not Showing Multiple Ops: Batch, MFG, ExpKumar RajadhyakshNoch keine Bewertungen

- Summer Internship Completion Certificate FormatDokument1 SeiteSummer Internship Completion Certificate FormatQasim Peerzada50% (2)

- IBAMDokument10 SeitenIBAMSameer SalamNoch keine Bewertungen

- Housekeeping Schedule: Arehouse CleaningDokument1 SeiteHousekeeping Schedule: Arehouse CleaningKumar RajadhyakshNoch keine Bewertungen

- Datetime Temperature (Fr-01) Temperature (Fr-03)Dokument33 SeitenDatetime Temperature (Fr-01) Temperature (Fr-03)Kumar RajadhyakshNoch keine Bewertungen

- IASbabas Daily Current Affairs 01 August 2015Dokument6 SeitenIASbabas Daily Current Affairs 01 August 2015Kumar RajadhyakshNoch keine Bewertungen

- Fr05 07Dokument31 SeitenFr05 07Kumar RajadhyakshNoch keine Bewertungen

- April 2015 Insights Current Events PDFDokument91 SeitenApril 2015 Insights Current Events PDFKumar RajadhyakshNoch keine Bewertungen

- Customers Trip Date Destination Capacity Fulfilled Capacity Customer Details 1 Weight Boxes Weight Boxes Pick Up DD 1Dokument9 SeitenCustomers Trip Date Destination Capacity Fulfilled Capacity Customer Details 1 Weight Boxes Weight Boxes Pick Up DD 1Kumar RajadhyakshNoch keine Bewertungen

- HR Report-Rajashri CementDokument75 SeitenHR Report-Rajashri CementKumar RajadhyakshNoch keine Bewertungen

- MPSC Books ListDokument9 SeitenMPSC Books ListPravin Salunkhe100% (1)

- Sonali BankDokument45 SeitenSonali BankMohiuddin MuhinNoch keine Bewertungen

- 6-4-17 Coldex BKDokument1 Seite6-4-17 Coldex BKKumar RajadhyakshNoch keine Bewertungen

- HR Report-Rajashri CementDokument75 SeitenHR Report-Rajashri CementKumar RajadhyakshNoch keine Bewertungen

- HACCP Tree TemplateDokument16 SeitenHACCP Tree TemplateKumar RajadhyakshNoch keine Bewertungen

- Hired VehiclesDokument2 SeitenHired VehiclesKumar RajadhyakshNoch keine Bewertungen

- First AidDokument1 SeiteFirst AidKumar RajadhyakshNoch keine Bewertungen

- Project Swatch - Elaboration For CFA's - NLDokument16 SeitenProject Swatch - Elaboration For CFA's - NLKumar RajadhyakshNoch keine Bewertungen

- Roger Weliner v. CirDokument1 SeiteRoger Weliner v. CirChiiNoch keine Bewertungen

- Federal Democratic Republic of Ethiopia Casual Property Rental Tax DeclarationDokument2 SeitenFederal Democratic Republic of Ethiopia Casual Property Rental Tax DeclarationMaddahayota CollegeNoch keine Bewertungen

- Customer Perception Towards Mobile Wallets Among YouthDokument7 SeitenCustomer Perception Towards Mobile Wallets Among YouthMoideenNoch keine Bewertungen

- Chapter 6: Donor'S Tax: "Transfer of Property in Trust or Otherwise, Direct or Indirect"Dokument5 SeitenChapter 6: Donor'S Tax: "Transfer of Property in Trust or Otherwise, Direct or Indirect"Kiana FernandezNoch keine Bewertungen

- Asaan Remittance Account - FAQsDokument3 SeitenAsaan Remittance Account - FAQsqazi12Noch keine Bewertungen

- GLs and Tax Codes For ProdnDokument9 SeitenGLs and Tax Codes For ProdnAbhishek MehtaNoch keine Bewertungen

- Telus 26941340 2023 12 27Dokument12 SeitenTelus 26941340 2023 12 27kristyn.phillips26Noch keine Bewertungen

- PIS - Processing or Manufacturing - Fish Processing, Chili Paste, Fruit Jam, Meat Processing, Etc.Dokument2 SeitenPIS - Processing or Manufacturing - Fish Processing, Chili Paste, Fruit Jam, Meat Processing, Etc.HermisNoch keine Bewertungen

- Tax 1 SyllabusDokument5 SeitenTax 1 SyllabusAprille S. AlviarneNoch keine Bewertungen

- Abdullin Modernpaymentssecurity Emvnfcetc 121127044827 Phpapp02Dokument100 SeitenAbdullin Modernpaymentssecurity Emvnfcetc 121127044827 Phpapp02Sratix100% (1)

- Week 6 - Introduction To Optimal TaxationDokument26 SeitenWeek 6 - Introduction To Optimal TaxationZyra Angela BlasNoch keine Bewertungen

- Comagascas Elementary School: Statement of AccountDokument4 SeitenComagascas Elementary School: Statement of Accountrex hussein lamoste100% (1)

- Donors TaxDokument3 SeitenDonors TaxMaris Joy BartolomeNoch keine Bewertungen

- Malhotra Rajiv & Co Chartered Accountant: Turnover CertificateDokument3 SeitenMalhotra Rajiv & Co Chartered Accountant: Turnover Certificateamit22505Noch keine Bewertungen

- Cir V. Central Luzon Drug Corporation, GR No. 148512, 2006-06-26Dokument2 SeitenCir V. Central Luzon Drug Corporation, GR No. 148512, 2006-06-26Crisbon ApalisNoch keine Bewertungen

- Bam031 Sas 15 PDFDokument4 SeitenBam031 Sas 15 PDFIan Eldrick Dela CruzNoch keine Bewertungen

- Purchase Order - Report PDFDokument2 SeitenPurchase Order - Report PDFAnonymous dnflChvoCoNoch keine Bewertungen

- Flexible Benefit Plan For LTTS FTCDokument1 SeiteFlexible Benefit Plan For LTTS FTCDavidNoch keine Bewertungen

- L-27, Set Off and Carry Forward of LossesDokument20 SeitenL-27, Set Off and Carry Forward of LosseswhoreNoch keine Bewertungen

- Assessment Types and Procedures in Indian Income TaxDokument12 SeitenAssessment Types and Procedures in Indian Income TaxTanvi JawdekarNoch keine Bewertungen

- Challan of Cash Paid in To Challan NoDokument2 SeitenChallan of Cash Paid in To Challan NoWnc WestridgeNoch keine Bewertungen

- Munch Catering LTD Whose Financial Year Runs From 1 DecemberDokument1 SeiteMunch Catering LTD Whose Financial Year Runs From 1 DecemberMiroslav GegoskiNoch keine Bewertungen

- Bank StatDokument1 SeiteBank StatabolazmfodaNoch keine Bewertungen

- Tax - Sababan's NotesDokument120 SeitenTax - Sababan's NotesfranceheartNoch keine Bewertungen

- Indian Oil Corporation Limited: Supplier ConsigneeDokument1 SeiteIndian Oil Corporation Limited: Supplier ConsigneeDiwakar MinzNoch keine Bewertungen

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherDokument15 SeitenREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGoogleNoch keine Bewertungen

- TAX REGULATION IMPACT ON INDONESIA HOSPITALITYDokument14 SeitenTAX REGULATION IMPACT ON INDONESIA HOSPITALITYDiana RahayuNoch keine Bewertungen

- Tax Mod 3Dokument7 SeitenTax Mod 3Ayushi TiwariNoch keine Bewertungen

- MCQ Donorx27s TaxesDokument6 SeitenMCQ Donorx27s TaxesMary Joyce GarciaNoch keine Bewertungen

- Payoneer Checkout Method 2k23Dokument6 SeitenPayoneer Checkout Method 2k23Scam 171100% (1)