Beruflich Dokumente

Kultur Dokumente

Residential Status PDF

Hochgeladen von

Pai0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

228 Ansichten14 SeitenOriginaltitel

residential-status ppt.pdf

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

228 Ansichten14 SeitenResidential Status PDF

Hochgeladen von

PaiCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 14

An Individual is said to be resident in India

in any previous year, if he satisfies at least

one of the following conditions:

1) He is in India in the previous year for a

period of 182 days or more.

2) a) He is in India for a period of 60 days

or more during the previous year

and

b) 365 days or more during 4 years

immediately preceding the previous year.

Period 60 Days is extended to 182 days

in the following cases.

i) An Indian citizen who leaves India during

the previous year for the purpose of

employment outside India

ii) Indian citizen who leaves India during the

previous year as a member of crew of

Indian ship.

iii) Indian citizen or person of Indian origin

who comes on a visit to India during the

previous year.

A person is deemed to be of Indian origin if

he, or either of his parents or any of his

grand-parents was born in undivided India.

Individual is treated as Resident and

Ordinarily Resident in India if he satisfies

the following additional conditions:

i) He has been resident in India in at lest 2

out of 10 previous year immediately

preceding the previous year.

ii) He has been in India for a period of 730

days or more during 7 years immediately

preceding the relevant previous year.

Individual who satisfies at least one of the

basic conditions u/s 6 (1) but does not satisfy

the additional conditions under u/s 6 (6)

Non Resident

Individual who does not satisfy at least one of

the basic conditions

u/s 6 (1).

A Hindu undivided family is said to be

resident in India if control and management

of its affairs is wholly or partly situated in

India.

A Hindu undivided family is said to be non-

resident in India if control and management

of its affairs is situated wholly outside India.

Residential status of Karta is considered for

determining whether a Resident family is

ordinarily Resident.

A partnership firm and a association of

persons are said to be resident in India if

control and management of their affairs are

wholly or partly situated within India during

the relevant previous year.

They are, however, treated as Non Resident

in India if control and management of their

affairs are situated wholly outside India.

Indian company is always resident in India.

Foreign company is resident in India only if,

during the previous year, control and

management of its affairs is situated wholly

in India.

Foreign company is Non resident in India

only if, during the previous year, control

and management of its affairs wholly or

partly situated out of India.

Every Other person is said to be resident in

India if control and management of his affairs

are wholly or partly situated within India

during the relevant previous year.

However they are treated as Non Resident in

India if control and management of their

affairs are situated wholly outside India.

ROR RNOR NR

Indian Income

Income Received in India T T T

Income Accrued in India T T T

Income Deemed to be

received in India T T

T

Income Deemed to Accrue in

India T T T

Income from Business is controlled

from India T T NT

Income from Profession

set up in India T T NT

Income from Business is controlled

outside India T NT NT

Income from Profession set up

outside India T NT NT

Other Foreign Income

( Rent, Interest etc.) T NT NT

Income from house property (residential or

commercial) in India

Income from any other asset in India

Capital gain from asset located in India

Income from business connection in India

Salary from services rendered in India

Salary from services rendered by a citizen for

government of India outside India

Interest income or royalty/fee income from

government of India

Interest income or royalty/fee income received from a

resident Indian (for purpose other than overseas

business)

Interest income or royalty/fee income received from a

non-resident Indian for running business in India

Das könnte Ihnen auch gefallen

- Yodlee User Guide PDFDokument211 SeitenYodlee User Guide PDFy2kmvrNoch keine Bewertungen

- The Due Process of LawDokument8 SeitenThe Due Process of LawPai100% (2)

- 7-Day Pre-Training for a Fresh Body and Fit MindDokument14 Seiten7-Day Pre-Training for a Fresh Body and Fit MindMargarita Kotova100% (7)

- ACCA F9 Notes by Seah Chooi KhengDokument75 SeitenACCA F9 Notes by Seah Chooi KhengHuzaifa Ahmed100% (2)

- NutritionDokument22 SeitenNutritionMilena Thumbelina100% (2)

- Impact of Fii and Fdi On Indian Stock MarketDokument69 SeitenImpact of Fii and Fdi On Indian Stock MarketRamgarhia SandhuNoch keine Bewertungen

- Blackbook Project On Venture Capital PDFDokument83 SeitenBlackbook Project On Venture Capital PDFSam ShaikhNoch keine Bewertungen

- Non Resident Ordy Rupee Nro AccountDokument5 SeitenNon Resident Ordy Rupee Nro AccountAmar SinhaNoch keine Bewertungen

- IndusInd BankDokument67 SeitenIndusInd BankbhatiaharryjassiNoch keine Bewertungen

- Comparative Analysis of Working Capital Management of Different Companies in Textile SectorDokument39 SeitenComparative Analysis of Working Capital Management of Different Companies in Textile SectorMahmudul Hassan100% (1)

- DIssertation Aradhya 003Dokument38 SeitenDIssertation Aradhya 003Komal KaurNoch keine Bewertungen

- "Retail in India": A Seminar Report ONDokument31 Seiten"Retail in India": A Seminar Report ONShaqib A KadriNoch keine Bewertungen

- Customer Awareness About ICICI Prudential Life InsuranceDokument67 SeitenCustomer Awareness About ICICI Prudential Life InsuranceAnil BatraNoch keine Bewertungen

- EXIMDokument17 SeitenEXIMTrichy MaheshNoch keine Bewertungen

- Income Tax Guide 2011-12: Residential Status, Rates, Salary, DeductionsDokument156 SeitenIncome Tax Guide 2011-12: Residential Status, Rates, Salary, DeductionsSalman Ansari100% (1)

- Tax ProjectDokument33 SeitenTax Projectnithin_p_m0% (1)

- Reportsudipa PaulDokument65 SeitenReportsudipa Paulnaman99Noch keine Bewertungen

- A Study On Deposit Mobilization With Reference To Indian Overseas Bank, Velachery byDokument44 SeitenA Study On Deposit Mobilization With Reference To Indian Overseas Bank, Velachery byvinoth_17588Noch keine Bewertungen

- A Comparison Between Life Insurance and Mutual FundsDokument74 SeitenA Comparison Between Life Insurance and Mutual FundsRibhanshu RajNoch keine Bewertungen

- MRPDokument52 SeitenMRPJAI SINGHNoch keine Bewertungen

- Project On Kotak Mahindra BankDokument67 SeitenProject On Kotak Mahindra BankMitesh ShahNoch keine Bewertungen

- Sbi Project ReportDokument54 SeitenSbi Project ReportVikas Choudhary100% (1)

- Rahul PepsiDokument76 SeitenRahul PepsiAnshul SharmaNoch keine Bewertungen

- Study of Investment Planing Among Working Womens PDFDokument113 SeitenStudy of Investment Planing Among Working Womens PDFAjay S PatilNoch keine Bewertungen

- Role of FII in Developing Indian FirmsDokument77 SeitenRole of FII in Developing Indian Firmskaran patelNoch keine Bewertungen

- Axis Bank - FINANCIAL OVERVIEW OF AXIS BANK & COMPARATIVE STUDY OF CURRENT ACCOUNT AND SAVING ACCDokument93 SeitenAxis Bank - FINANCIAL OVERVIEW OF AXIS BANK & COMPARATIVE STUDY OF CURRENT ACCOUNT AND SAVING ACCAmol Sinha56% (9)

- Assessment of Tax Liability under Key HeadsDokument51 SeitenAssessment of Tax Liability under Key HeadsDhanashreeNoch keine Bewertungen

- Financial Futures With Reference To NiftyDokument73 SeitenFinancial Futures With Reference To Niftyjitendra jaushik75% (4)

- Stock Market Analysis of Steel City Securities LtdDokument86 SeitenStock Market Analysis of Steel City Securities LtdKella PradeepNoch keine Bewertungen

- ICICI Securities IPO NoteDokument7 SeitenICICI Securities IPO NoteSachinShingoteNoch keine Bewertungen

- Full Paper PDFDokument10 SeitenFull Paper PDFSuhasini DurveNoch keine Bewertungen

- Impact of FII on Indian Stock MarketDokument28 SeitenImpact of FII on Indian Stock MarketNitish TanwarNoch keine Bewertungen

- IL & FS Investsmart: "Analysis of Mutual Fund & Customer Preference Towards Mutual Fund"Dokument56 SeitenIL & FS Investsmart: "Analysis of Mutual Fund & Customer Preference Towards Mutual Fund"Vijetha EdduNoch keine Bewertungen

- Companies:: FM Assignment, Part - 1Dokument8 SeitenCompanies:: FM Assignment, Part - 1MYLAVARAPU SAMPATHNoch keine Bewertungen

- HDFC: Bank's Focus Area, Marketing or OperationsDokument48 SeitenHDFC: Bank's Focus Area, Marketing or OperationsShubham SinghalNoch keine Bewertungen

- A Project Study Report On Titled "Comparative Study of HDFC Standard Life With Tata - Aig Life Insurance"Dokument114 SeitenA Project Study Report On Titled "Comparative Study of HDFC Standard Life With Tata - Aig Life Insurance"garish009100% (1)

- Financial Planning - IDBI FederalDokument75 SeitenFinancial Planning - IDBI FederalGaurav LalNoch keine Bewertungen

- Comparative Study of Mutual Funds in India: Project Report ONDokument70 SeitenComparative Study of Mutual Funds in India: Project Report ONMaurya RahulNoch keine Bewertungen

- CRM in BankDokument78 SeitenCRM in BankSaurabh MaheshwariNoch keine Bewertungen

- Ind As 1Dokument64 SeitenInd As 1vijaykumartaxNoch keine Bewertungen

- A Project Report On Financial Ratio Analysis of Sri Halsidhnath S.S.K LTD NipaniDokument76 SeitenA Project Report On Financial Ratio Analysis of Sri Halsidhnath S.S.K LTD NipaniArun Sankar P100% (1)

- Gaurav Fdi Project 9103Dokument77 SeitenGaurav Fdi Project 9103dhanraj patadia100% (1)

- Final Ojt ReportDokument57 SeitenFinal Ojt ReportLove GumberNoch keine Bewertungen

- FInal Black Book VISHAKAHA PROJECTDokument46 SeitenFInal Black Book VISHAKAHA PROJECTrutuja ambreNoch keine Bewertungen

- Corporate GovernanceDokument50 SeitenCorporate GovernanceYash BiyaniNoch keine Bewertungen

- Euro India Fresh Food Internship ReportDokument130 SeitenEuro India Fresh Food Internship Reporthelna francisNoch keine Bewertungen

- FDI Report on Impact of Foreign Investment in Indian Retail SectorDokument104 SeitenFDI Report on Impact of Foreign Investment in Indian Retail SectorSugar PlumsNoch keine Bewertungen

- Project Report On Capital MarketDokument16 SeitenProject Report On Capital MarketHarsha Vardhan Reddy0% (1)

- Blackbook Retail PDFDokument87 SeitenBlackbook Retail PDFurmila ghoshNoch keine Bewertungen

- Final Project Report (Pooja) PDFDokument54 SeitenFinal Project Report (Pooja) PDFRinkesh K MistryNoch keine Bewertungen

- NTCC REPORT Hero Motocorp LTDDokument31 SeitenNTCC REPORT Hero Motocorp LTDsagar sharmaNoch keine Bewertungen

- Unit - 3 Credit SyndicationDokument7 SeitenUnit - 3 Credit SyndicationPraveen KumarNoch keine Bewertungen

- "A Study On Capital Budgeting of Honda Co PVT LTD": Title NO. Executive SummaryDokument44 Seiten"A Study On Capital Budgeting of Honda Co PVT LTD": Title NO. Executive SummaryHARI HARINoch keine Bewertungen

- Security Analysis and Portfolio Management Project by TanveerDokument77 SeitenSecurity Analysis and Portfolio Management Project by TanveeradeenNoch keine Bewertungen

- An Empirical Analysis of Relationship Between Gold Market and Stock Market of IndiaDokument75 SeitenAn Empirical Analysis of Relationship Between Gold Market and Stock Market of IndiaDillip Khuntia82% (11)

- Innovations in InsuranceDokument47 SeitenInnovations in InsuranceDouglas StoneNoch keine Bewertungen

- Residential Status: Vaibhav BanjanDokument14 SeitenResidential Status: Vaibhav Banjandeepika gawasNoch keine Bewertungen

- Residential Status: Vaibhav BanjanDokument14 SeitenResidential Status: Vaibhav BanjanAnmolNoch keine Bewertungen

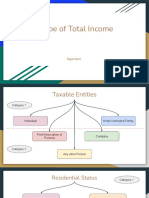

- Scope of Total IncomeDokument17 SeitenScope of Total IncomeAvishiNoch keine Bewertungen

- Residential Status and Tax IncedenceDokument46 SeitenResidential Status and Tax IncedenceAmit YadavNoch keine Bewertungen

- Presentation On Residential Status & Its Incidence On Tax LiabilityDokument13 SeitenPresentation On Residential Status & Its Incidence On Tax LiabilitypriyaniNoch keine Bewertungen

- Residential Status and Tax IncidenceDokument46 SeitenResidential Status and Tax IncidenceÄbhíñävJäíñNoch keine Bewertungen

- Direct Tax Summary NotesDokument88 SeitenDirect Tax Summary NotesAlisha LukeNoch keine Bewertungen

- Moot Problem 1 Alongwith ListDokument7 SeitenMoot Problem 1 Alongwith ListPai100% (1)

- Pi Professional Accountants The Future PDFDokument88 SeitenPi Professional Accountants The Future PDFramen pandey100% (1)

- Set Off and Carry ForwardDokument25 SeitenSet Off and Carry ForwardPaiNoch keine Bewertungen

- 25th DeadlineDokument1 Seite25th DeadlinePaiNoch keine Bewertungen

- Untangling F9 Terminology PDFDokument22 SeitenUntangling F9 Terminology PDFPaiNoch keine Bewertungen

- Acca Global April 26th 2016Dokument17 SeitenAcca Global April 26th 2016Cef LeCefNoch keine Bewertungen

- Cut-Off Dates For The Year 2020Dokument1 SeiteCut-Off Dates For The Year 2020PaiNoch keine Bewertungen

- D - A-61 T BLS/LLB: Efamation BY Amruta Pai YDokument16 SeitenD - A-61 T BLS/LLB: Efamation BY Amruta Pai YPaiNoch keine Bewertungen

- GST in India: An IntroductionDokument33 SeitenGST in India: An IntroductionPaiNoch keine Bewertungen

- Online Investments: The iFOREX Guide ToDokument11 SeitenOnline Investments: The iFOREX Guide ToPaiNoch keine Bewertungen

- There Are 4 Circuits Each Circuti Do Into 4minuits and One 1 Min Wall-Sit After Each Circuit 1 CircuitDokument2 SeitenThere Are 4 Circuits Each Circuti Do Into 4minuits and One 1 Min Wall-Sit After Each Circuit 1 CircuitPaiNoch keine Bewertungen

- F9 Investment Appraisal Notes PDFDokument26 SeitenF9 Investment Appraisal Notes PDFPaiNoch keine Bewertungen

- Top 100 Law FirmsDokument17 SeitenTop 100 Law FirmsPaiNoch keine Bewertungen

- Top 100 Law FirmsDokument17 SeitenTop 100 Law FirmsPaiNoch keine Bewertungen

- Transaction ConfirmationDokument2 SeitenTransaction ConfirmationPaiNoch keine Bewertungen

- There Are 4 Circuits Each Circuti Do Into 4minuits and One 1 Min Wall-Sit After Each Circuit 1 CircuitDokument2 SeitenThere Are 4 Circuits Each Circuti Do Into 4minuits and One 1 Min Wall-Sit After Each Circuit 1 CircuitPaiNoch keine Bewertungen

- Chapter 1 - Introduction To AccountingDokument18 SeitenChapter 1 - Introduction To AccountingPaiNoch keine Bewertungen

- Journal EntriesDokument40 SeitenJournal EntriesPai100% (4)

- F9-11 Weighted Average Cost of Capital and GearingDokument22 SeitenF9-11 Weighted Average Cost of Capital and GearingPaiNoch keine Bewertungen

- F3 Study NotesDokument132 SeitenF3 Study NotesPaiNoch keine Bewertungen

- Chapter 5Dokument24 SeitenChapter 5PaiNoch keine Bewertungen

- Clprs Debate Rules 1Dokument3 SeitenClprs Debate Rules 1PaiNoch keine Bewertungen

- There Are 4 Circuits Each Circuti Do Into 4minuits and One 1 Min Wall-Sit After Each Circuit 1 CircuitDokument2 SeitenThere Are 4 Circuits Each Circuti Do Into 4minuits and One 1 Min Wall-Sit After Each Circuit 1 CircuitPaiNoch keine Bewertungen

- F7-03 Substance Over FormDokument10 SeitenF7-03 Substance Over FormPaiNoch keine Bewertungen

- 2017 BPP Passcard F6 PDFDokument177 Seiten2017 BPP Passcard F6 PDFPaiNoch keine Bewertungen

- Joseph Showry MBADokument3 SeitenJoseph Showry MBAjosephshowryNoch keine Bewertungen

- Breaking The Time Barrier PDFDokument70 SeitenBreaking The Time Barrier PDFCalypso LearnerNoch keine Bewertungen

- Comparison of Equity Mutual FundsDokument29 SeitenComparison of Equity Mutual Fundsabhishekbehal5012Noch keine Bewertungen

- Income Declaration FormDokument1 SeiteIncome Declaration Formavi_3107Noch keine Bewertungen

- Yakult Report Version 2Dokument30 SeitenYakult Report Version 2darraNoch keine Bewertungen

- Jharkhand Govt Gazette Regarding Stipend For LawyersDokument6 SeitenJharkhand Govt Gazette Regarding Stipend For LawyersLatest Laws TeamNoch keine Bewertungen

- Small Business Loan Application Form For Individual - Sole - BDODokument2 SeitenSmall Business Loan Application Form For Individual - Sole - BDOjunco111222Noch keine Bewertungen

- NMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYDokument5 SeitenNMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYRushil ShahNoch keine Bewertungen

- Business Plan 1. Executive SummaryDokument2 SeitenBusiness Plan 1. Executive SummaryBeckieNoch keine Bewertungen

- Britannia IndsDokument16 SeitenBritannia IndsbysqqqdxNoch keine Bewertungen

- QUIZDokument15 SeitenQUIZCarlo ConsuegraNoch keine Bewertungen

- Research Proposal On Challenges of Local GovernmentDokument26 SeitenResearch Proposal On Challenges of Local GovernmentNegash LelisaNoch keine Bewertungen

- Debit Note PDFDokument3 SeitenDebit Note PDFMani ShuklaNoch keine Bewertungen

- Abaya vs. EbdaneDokument30 SeitenAbaya vs. Ebdanealexandra recimoNoch keine Bewertungen

- Major Assignment #3Dokument17 SeitenMajor Assignment #3Elijah GeniesseNoch keine Bewertungen

- 10 - Chapter 1Dokument22 Seiten10 - Chapter 1SowntharieaNoch keine Bewertungen

- Jacob Investigates Bretton FraudDokument2 SeitenJacob Investigates Bretton FraudMilcah De GuzmanNoch keine Bewertungen

- Atria Convergence Technologies Limited, Due Date: 15/11/2021Dokument2 SeitenAtria Convergence Technologies Limited, Due Date: 15/11/2021NaveenKumar S NNoch keine Bewertungen

- Fin 444 CHP 4 SlidesDokument24 SeitenFin 444 CHP 4 SlidesBappi MahiNoch keine Bewertungen

- CBSE Class 12 Economics Sample Paper (For 2014)Dokument19 SeitenCBSE Class 12 Economics Sample Paper (For 2014)cbsesamplepaperNoch keine Bewertungen

- Construction Budget: Project InformationDokument2 SeitenConstruction Budget: Project InformationAlexandruDanielNoch keine Bewertungen

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Dokument32 SeitenCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Sakura AvhrynNoch keine Bewertungen

- Regression Analysis Application in LitigationDokument23 SeitenRegression Analysis Application in Litigationkatie farrellNoch keine Bewertungen

- 2nd Sem PDM SyllabusDokument11 Seiten2nd Sem PDM SyllabusVinay AlagundiNoch keine Bewertungen

- Auditing and Assurance Services A Systematic Approach 10th Edition Messier Test Bank 1Dokument62 SeitenAuditing and Assurance Services A Systematic Approach 10th Edition Messier Test Bank 1willie100% (36)

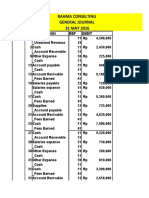

- Rahma ConsutingDokument6 SeitenRahma ConsutingEko Firdausta TariganNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument2 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- Internship Report (11504725) PDFDokument39 SeitenInternship Report (11504725) PDFpreetiNoch keine Bewertungen