Beruflich Dokumente

Kultur Dokumente

Dissertation Project Shama

Hochgeladen von

Shama0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten9 Seitenhelp

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenhelp

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten9 SeitenDissertation Project Shama

Hochgeladen von

Shamahelp

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 9

SWAMI RAMA HIMALAYAN UNIVERSITY

SWAMI RAM NAGAR, JOLLY GRANT, DOIWALA,

DEHRADUN

SCHOOL OF MANAGEMENT STUDIES

PROJECT REPORT ON CASH FLOW AND RATIO

ANALYSIS OF THE COMPANY

SUMMITTED FOR PARTIAL FULFILMENT OF

B.COM (HONS)

6TH SEMESTER IN BATCH 2016-2019

SUBMITTED BY: SUBMITTED TO:

SHAMA PARVEEN SONAM BHAT…

INTRODUCTION

CASH FLOW:

In financial accounting, a cash flow statement, also known

as statement of cash flows, is a financial statement that

shows how changes in balance sheet accounts and income

affect cash and cash equivalents, and breaks the analysis

down to operating, investing, and financing activities.

Essentially, the cash flow statement is concerned with the

flow of cash in and out of the business. The statement

captures both the current operating results and the

accompanying changes in the balance sheet. As an

analytical tool, the statement of cash flows is useful in

determining the short-term viability of a company,

particularly its ability to pay bills. International Accounting

Standard 7 (IAS 7), is the International Accounting

Standard that deals with cash flow statements.

CASH FLOW ACTIVITIES:

The cash flow statement is partitioned into three segments,

namely:

Cash flow resulting from operating activities,

Cash flow resulting from investing activities,

Cash flow resulting from financing activities.

The money coming into the business is called cash inflow,

and money going out from the business is called cash

outflow.

Operating activities:

Operating activities include the production, sales and

delivery of the company's product as well as collecting

payment from its customers. This could include purchasing

raw materials, building inventory, advertising, and shipping

the product.

Under IAS 7, operating cash flows include:

Receipts for the sale of loans, debt or equity instruments

in a trading portfolio

Interest received on loans

Payments to suppliers for goods and services

Payments to employees or on behalf of employees

Interest payments (alternatively, this can be reported

under financing activities in IAS 7)

buying Merchandise

Items which are added back to [or subtracted from, as

appropriate] the net income figure (which is found on the

Income Statement) to arrive at cash flows from operations

generally include:

Depreciation (loss of tangible asset value over time)

Deferred tax

Amortization (loss of intangible asset value over time)

Any gains or losses associated with the sale of a non-

current asset; because associated cash flows do not

belong in the operating section (unrealized gains/losses

are also added back from the income statement).

Dividends received general reserves

Investing activities:

Examples of investing activities are:

Purchase or Sale of an asset (assets can be land, building,

equipment, marketable securities, etc.)

Loans made to suppliers or received from customers

Payments related to mergers and acquisition.

Financing activities:

Financing activities include the inflow of cash

from investors such as banks and shareholders, as well as

the outflow of cash to shareholders as dividends as the

company generates income. Other activities which impact

the long-term liabilities and equity of the company are also

listed in the financing activities section of the cash flow

statement.

Under IAS 7,

Payments of dividends

Payments for repurchase of company shares

For non-profit organizations, receipts of donor-restricted

cash that is limited to long-term purposes

Items under the financing activities section include:

Dividends paid

Sale or repurchase of the company's stock

Net borrowings

Repayment of debt principal, including capital leases.

Das könnte Ihnen auch gefallen

- Cash Flow StatementDokument4 SeitenCash Flow Statementmajaykumar1349810Noch keine Bewertungen

- Cash Flow ActivitiesDokument1 SeiteCash Flow ActivitiesDenied StellNoch keine Bewertungen

- Cash Flow StatementDokument11 SeitenCash Flow StatementHemanshu MehtaNoch keine Bewertungen

- Ch-5 Cash Flow AnalysisDokument9 SeitenCh-5 Cash Flow AnalysisQiqi GenshinNoch keine Bewertungen

- Summary Report - Group 2: Definition of TermsDokument8 SeitenSummary Report - Group 2: Definition of TermsRigor Salonga BaldemosNoch keine Bewertungen

- Brindha Csash Flow StatementDokument32 SeitenBrindha Csash Flow Statementgkvimal nathan100% (1)

- Cash Flow StatementDokument2 SeitenCash Flow Statementmark_torreonNoch keine Bewertungen

- Statement of Cash Flow - Simple ExampleDokument5 SeitenStatement of Cash Flow - Simple ExampleVinnie VermaNoch keine Bewertungen

- (Ana) Slide 1: What Is A Cash Flow Statement?Dokument4 Seiten(Ana) Slide 1: What Is A Cash Flow Statement?ketiNoch keine Bewertungen

- Unit Ii Accounting PDFDokument11 SeitenUnit Ii Accounting PDFMo ToNoch keine Bewertungen

- Cash ManagementDokument8 SeitenCash ManagementsujkubvsNoch keine Bewertungen

- Operating Activities:: What Are The Classification of Cash Flow?Dokument5 SeitenOperating Activities:: What Are The Classification of Cash Flow?samm yuuNoch keine Bewertungen

- Cash FlowsDokument24 SeitenCash Flowst4fgmwcb2kNoch keine Bewertungen

- J.Welc Module5Dokument73 SeitenJ.Welc Module5aNoch keine Bewertungen

- Cash FlowDokument4 SeitenCash FlowHrituparna_Pau_2988Noch keine Bewertungen

- Understanding Cash Flow StatementDokument3 SeitenUnderstanding Cash Flow StatementImran IdrisNoch keine Bewertungen

- Cash Flow StatementDokument14 SeitenCash Flow StatementTrending TamizhanNoch keine Bewertungen

- Cash Flow Analysis PresentationDokument44 SeitenCash Flow Analysis Presentationkojo2kg100% (1)

- Acc201 Su6Dokument15 SeitenAcc201 Su6Gwyneth LimNoch keine Bewertungen

- International Accounting Standard 7 Statement of Cash FlowsDokument8 SeitenInternational Accounting Standard 7 Statement of Cash Flowsইবনুল মাইজভাণ্ডারীNoch keine Bewertungen

- Accounting Assignment 2Dokument4 SeitenAccounting Assignment 2Laddie LMNoch keine Bewertungen

- Operating ActivitiesDokument3 SeitenOperating Activitiesah7anNoch keine Bewertungen

- Cash Flow AnalysisDokument15 SeitenCash Flow AnalysisElvie Abulencia-BagsicNoch keine Bewertungen

- Karan 2Dokument17 SeitenKaran 2harishNoch keine Bewertungen

- IAS 7, Statement of Cash Flows - A Closer Look: ArticleDokument10 SeitenIAS 7, Statement of Cash Flows - A Closer Look: ArticlevcdsvcdsvsdfNoch keine Bewertungen

- Cash Flow Statements: Deepti Gurvinder Jitender Niraj PalakDokument29 SeitenCash Flow Statements: Deepti Gurvinder Jitender Niraj PalakPalak GoelNoch keine Bewertungen

- What Does Accrued Expense MeanDokument12 SeitenWhat Does Accrued Expense MeanjerryhangoNoch keine Bewertungen

- Cash Flow and BudgetingDokument3 SeitenCash Flow and BudgetingAdil MehmoodNoch keine Bewertungen

- Libby Financial Accounting Chapter13Dokument11 SeitenLibby Financial Accounting Chapter13Jie Bo Ti0% (2)

- Prepare The Statement of Cash Flows Using The Indirect MethodDokument4 SeitenPrepare The Statement of Cash Flows Using The Indirect MethodcindywNoch keine Bewertungen

- Cash FlowDokument50 SeitenCash FlowAnant AJNoch keine Bewertungen

- Cima F1 Chapter 4Dokument20 SeitenCima F1 Chapter 4MichelaRosignoli100% (1)

- Cash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareDokument135 SeitenCash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareMariel de Lara100% (2)

- Accounting Assignment V3Dokument4 SeitenAccounting Assignment V3Fahad KhanNoch keine Bewertungen

- Cash Flow StatementDokument10 SeitenCash Flow Statementhitesh26881Noch keine Bewertungen

- Mid Term TopicsDokument10 SeitenMid Term TopicsТемирлан АльпиевNoch keine Bewertungen

- Cash Flow StatementDokument12 SeitenCash Flow StatementChikwason Sarcozy MwanzaNoch keine Bewertungen

- Pas 7 - Statement of Cash FlowsDokument8 SeitenPas 7 - Statement of Cash FlowsJohn Rafael Reyes PeloNoch keine Bewertungen

- Accounting Standard 3Dokument2 SeitenAccounting Standard 3Veda ShahNoch keine Bewertungen

- ACC501 - Lecture 22Dokument45 SeitenACC501 - Lecture 22Shivati Singh Kahlon100% (1)

- Accounting Standard (AS) - 3 Cash Flow StatementsDokument20 SeitenAccounting Standard (AS) - 3 Cash Flow StatementsPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (2)

- Classification Issues in Cash Flow Statements: PrefaceDokument3 SeitenClassification Issues in Cash Flow Statements: PrefaceFahad KhanNoch keine Bewertungen

- FIN3702 SummaryDokument26 SeitenFIN3702 SummaryQuentin SchwartzNoch keine Bewertungen

- Cash Flow StatementDokument17 SeitenCash Flow StatementSwapnil ManeNoch keine Bewertungen

- Calculating Cash Flow From Operating ExpensesDokument15 SeitenCalculating Cash Flow From Operating Expenseskyungsoo100% (1)

- Cash Flow Statement TheoryDokument30 SeitenCash Flow Statement Theorymohammedakbar88100% (5)

- Cash Flow Statement 1Dokument5 SeitenCash Flow Statement 1furqanNoch keine Bewertungen

- Accounting Standard (AS) - 3: Cash Flow Statements - Pratap Karmokar (ACA)Dokument20 SeitenAccounting Standard (AS) - 3: Cash Flow Statements - Pratap Karmokar (ACA)Jasmeen GhaiNoch keine Bewertungen

- Cash Flow Statement Wit SumDokument27 SeitenCash Flow Statement Wit SumSunay KhaireNoch keine Bewertungen

- FFS and CFSDokument28 SeitenFFS and CFSAnuj DhamaNoch keine Bewertungen

- Accounting Standard (AS) - 3: Cash Flow StatementsDokument20 SeitenAccounting Standard (AS) - 3: Cash Flow Statementsmkumar_pdfNoch keine Bewertungen

- Ias 3Dokument21 SeitenIas 3JyotiNoch keine Bewertungen

- What Is A Statement of Cash Flow?Dokument3 SeitenWhat Is A Statement of Cash Flow?Bea Marella CapundanNoch keine Bewertungen

- Cash Flow StaementDokument14 SeitenCash Flow StaementKhizar Hayat JiskaniNoch keine Bewertungen

- Accounting For ManagerDokument7 SeitenAccounting For ManagerMasara OwenNoch keine Bewertungen

- Statement of Cash FlowsDokument4 SeitenStatement of Cash Flowspattym_041281100% (1)

- Cash Flow StatementDokument3 SeitenCash Flow Statementguetniabdelrezak19Noch keine Bewertungen

- REPORTING AND ANALYZING Cash FlowsDokument39 SeitenREPORTING AND ANALYZING Cash FlowsmarieieiemNoch keine Bewertungen

- General Mathematics 2nd Quarter ExamDokument3 SeitenGeneral Mathematics 2nd Quarter ExamDeped TambayanNoch keine Bewertungen

- CIVREV!!!!Dokument5 SeitenCIVREV!!!!aypod100% (1)

- Chapter 10 Outline PDFDokument2 SeitenChapter 10 Outline PDFjanellennuiNoch keine Bewertungen

- One Way Slab DesignDokument10 SeitenOne Way Slab DesignBijendra PradhanNoch keine Bewertungen

- Longley Rice PropagationDokument11 SeitenLongley Rice Propagationy_m_algbaliNoch keine Bewertungen

- Resume (Suyash Garg)Dokument1 SeiteResume (Suyash Garg)Suyash GargNoch keine Bewertungen

- NumaConcert ManualDokument96 SeitenNumaConcert ManualPippo GuarneraNoch keine Bewertungen

- Che 342 Practice Set I IDokument4 SeitenChe 342 Practice Set I IDan McNoch keine Bewertungen

- WTO & MFA AnalysisDokument17 SeitenWTO & MFA Analysisarun1974Noch keine Bewertungen

- Hilti AnchorDokument5 SeitenHilti AnchorGopi KrishnanNoch keine Bewertungen

- Setup LogDokument221 SeitenSetup LogCarlos MendezNoch keine Bewertungen

- Problem SetDokument61 SeitenProblem SetEmily FungNoch keine Bewertungen

- Lecture 3 - Marriage and Marriage PaymentsDokument11 SeitenLecture 3 - Marriage and Marriage PaymentsGrace MguniNoch keine Bewertungen

- Biotechnology WebquestDokument2 SeitenBiotechnology Webquestapi-353567032Noch keine Bewertungen

- 25 - Marketing Channels - Value Networks.Dokument2 Seiten25 - Marketing Channels - Value Networks.zakavision100% (1)

- A Study On Impact of Smartphone AddictioDokument4 SeitenA Study On Impact of Smartphone AddictiotansuoragotNoch keine Bewertungen

- EE FlowchartDokument1 SeiteEE Flowchartgoogley71Noch keine Bewertungen

- War As I Knew ItDokument2 SeitenWar As I Knew ItShreyansNoch keine Bewertungen

- Tankguard AR: Technical Data SheetDokument5 SeitenTankguard AR: Technical Data SheetAzar SKNoch keine Bewertungen

- Firmware Upgrade To SP3 From SP2: 1. Download Necessary Drivers For The OMNIKEY 5427 CKDokument6 SeitenFirmware Upgrade To SP3 From SP2: 1. Download Necessary Drivers For The OMNIKEY 5427 CKFilip Andru MorNoch keine Bewertungen

- Midterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsDokument3 SeitenMidterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsGarp Barroca100% (1)

- Application Form New - Erik WitiandikaDokument6 SeitenApplication Form New - Erik Witiandikatimmy lauNoch keine Bewertungen

- Balanza Pediatrica Health o Meter 549KL Mtto PDFDokument18 SeitenBalanza Pediatrica Health o Meter 549KL Mtto PDFFix box Virrey Solís IPSNoch keine Bewertungen

- Blockchain Technology in The Banking SectorDokument2 SeitenBlockchain Technology in The Banking Sectorvaralakshmi aNoch keine Bewertungen

- Median FilteringDokument30 SeitenMedian FilteringK.R.RaguramNoch keine Bewertungen

- Business English Question PaperDokument4 SeitenBusiness English Question PaperKhizra AliNoch keine Bewertungen

- LS Series Hand Crimping ToolsDokument4 SeitenLS Series Hand Crimping ToolsbaolifengNoch keine Bewertungen

- Risk, Return & Capital BudgetingDokument18 SeitenRisk, Return & Capital BudgetingMuhammad Akmal HussainNoch keine Bewertungen

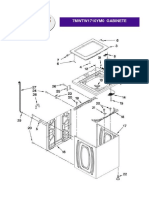

- 7MWTW1710YM0Dokument8 Seiten7MWTW1710YM0Izack-Dy JimZitNoch keine Bewertungen

- DenmarkDokument4 SeitenDenmarkFalcon KingdomNoch keine Bewertungen