Beruflich Dokumente

Kultur Dokumente

Investment Accounts-Master Mind Answers PDF

Hochgeladen von

Ram IyerOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Investment Accounts-Master Mind Answers PDF

Hochgeladen von

Ram IyerCopyright:

Verfügbare Formate

No.

1 for CA/CWA & MEC/CEC MASTER MINDS

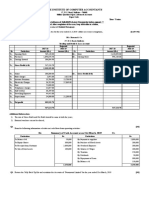

6. INVESTMENT ACCOUNTS

SOLUTIONS TO ASSIGNMENT PROBLEMS

PROBLEM NO.1

9% Central Government Bonds (Investment) Account

Face Face

Particulars Interest Principal Particulars Interest Principal

value value

2008 Rs. Rs. Rs. 2008 Rs. Rs. Rs.

Jan. 1 To Bal b/d 1,20,000 2,700 1,18,000 Mar 31 By Bank A/c 6,300

Mar 1 To Bank A/c 20,000 750 19,600 July 1 By Bank A/c 50,000 1,125 50,000

July 1 To P&L A/c - - 833 Sep 30 By Bank A/c - 4,050 -

Oct 1 To Bank A/c 15,000 - 14,700 Nov 1 By Bank A/c 30,000 225 29,700

Nov 1 To P&L A/c - - 200 Dec 31 By Bal c/d 75,000 1,688 73,633

Dec 31 To P&L A/c

(Transfer) 9,938

1,55,000 13,388 1,53,333 1,55,000 13,388 1,53,333

Working Note:

Calculation of closing balance : Nominal Cost

value Rs.

Bonds in hand remained in hand at 31st December 2008

From original holding (1,20,000 – 50,000 – 30,000) = 40,000 (1,18,000/1,20,000 x 39,333

40,000)

Purchased on 1st March 20,000 19,600

Purchased on 1st October 15,000 14,700

75,000 73,633

Working note1: Computation of profit/loss on sale of investments on 01-07-2008

Nominal value 50000

Ex-int selling price(500x100) 50000

Less: Cost of investments sold (118000x50000/120000 49167

Profi on sale 833

Ex-int accrued 50000x9/100x3/12 1125

Working note 2:

Interest received on 31-03-2008 (140000x9%x6/12) 6300

Working note 3:

Interest received on 30-09-2008

(1,20,000+20,000-50,000)=90,000x9%x6/12 4050

Working note 4:

Investments sold on 01-11-2008

Nominal value 30,000

Ex-int. selling price (300x99) 29,700

Less: Cost of investments sold (1,18,000x30,000/120000) 29,500

Profit on sale 200

Ex-int accrued on the above 30,000x9% /12 225

IPCC_34e_Accounts_Group-I_Investment Accounts_Assignment Solutions___1

Ph: 9885125025/26 www.mastermindsindia.com

PROBLEM NO.2

Investment A/c of Mr. Purohit

For the year ending on 31-3-2010

(Scrip: 8% Debentures of p ltd.)

th st

(Interest Payable on 30 September and 31 March)

Nominal Nominal

Date Particulars INT Cost Date Particulars INT Cost

Value value

1.4.09 To Balance b/d 1,20,000 - 1,18,000 30.9.09 By Bank - 5,200 -

1.7.09 To Bank (ex-interest) 10,000 200 9,898 1.10.09 By Bank 20,000 - 19,800

1.10.09 To P & L A/c 133

5,000 100 1.2.10 By Bank (ex- 20,000 533 19,602

1.1.10 To Bank (Cum- Interest) 4,849 interest)

To P & L A/c - 9,233 1.2.10

31.3.10 31.3.10 By P& L A/c 3,800 64

31.3.10 By Bank 95,000

1,35,000 9,533

By Bal c/d 93,414

1,32,880 1,35,000 9,533

1,32,880

Working Notes:

1. Valuation of closing balance as on 31.3.2010:

Market value of 950 Debentures at Rs.99 = Rs.94,050 Cost

Price of

1,18,000

800 Debentures cost = X 80,000 = 78,667

1,20,000

100 Debentures cost = 9,898

50 Debentures cost = 4,849

93,414

Value at the end = Rs. 93,414 i.e whichever is less

2. Profit on sale of debentures as on 1.10.2009

Rs.

Sales price of debentures (200 x Rs.100) 20,000

Less: Brokerage @ 1% (200)

19,800

Less: Cost price of Debentures x 20,000 (19,667)

133

Profit on sale

3. Loss on sale of debentures as on 1.2.2010

Rs.

Sales price of debentures (200 x Rs.99) 19,800

Less: Brokerage @ 1% (198)

19,602

1,18,000

Less: Cost price of Debentures x 20,000 (19,666)

1,20,000

64

Loss on sale

Copy Rights Reserved

To MASTER MINDS, Guntur

IPCC_34e_Accounts_Group-I_Investment Accounts_Assignment Solutions___2

No.1 for CA/CWA & MEC/CEC MASTER MINDS

PROBLEM NO.3

Investment Account – Equity Shares in X Ltd.

No. of No. of

Date Dividend Amount Date Dividend Amount

Shares shares

Rs. Rs. Rs. Rs.

2010 2010

Jan 1 To Balance b/d 20,000 - 3,20,000 Sep 30 By Bank 7,500

(Sale of rights)

Jun 1 To Bank 5,000 - 70,000 5,000 @ Rs.1.5

Aug 2 To Bonus Issue 5,000 - - Oct 20 By Bank

(dividend) 30,000 7,500

Sep 30 To Bank 5,000 75,000 Nov 1

(Right) - By Bank 20,000 2,60,000

Nov 1 Dec 31

To P & L A/c - 2,857 By Balance c/d 15,000 1,92,857

(Profit on Sale) -

Nov 1 To P & L A/c

(Dividend income) 30,000

35,000 30,000 4,67,857 35,000 30,000 4,67,857

Jan 1 To Balance b/d

15,000 1,92,857

Working Notes:

1. Cost of shares sold – Amount paid for 35,000 shares

Rs.

(Rs. 3,20,000 + Rs. 70,000 + Rs. 75,000) 4,65,000

Less: Dividend on shares purchased on June 1 & sale of rights(7,500+7,500) 15,000

Cost of 35,000 shares 4,50,000

Cost of 20,000 shares (Average cost basis) 2,57,143

Sale proceeds 2,60,000

Profit 2,857

2. Value of investment at the end of the year: Assuming investment as current investment, closing

balance will be valued based on lower of cost or net realizable value. Here, Net realizable value is

Rs.13 per share i.e. 15,000 shares x Rs.13 = Rs. 1,95,000 and cost = 4,50,000/35,000x15,000 =

Rs. 1,92,857. Therefore, value of investment at the end of the year will be Rs. 1,92,857

3. Dividend (pre acquisition) on shares adjusted against cost of investment.

4. Proceeds from sale of rights entitlement credited to cost of investment.

PROBLEM NO.4

In the books of XY Ltd.

Investment in equity shares of ABC Ltd.

st

For the year ended 31 March, 2010

Income Amount Income Amount

Date Particulars No Date Particulars No

Rs. Rs. Rs. Rs.

2009 To Balance b/d 15,000 - 2,25,000 2009 By Bank A/c - - 16,000

Apr 1 Sep 1 (W.N 3)

Jun 1 To Bank A/c 5,000 - 1,00,000 2009 By Bank A/c (W.N. - 30,000 10,000

Oct 31 5)

July 1 To Bonus issue (W.N.1) 4,000 - -

2010 By Bank A/c (W.N.4) 13,000 - 2,12,355

To Bank A/c (W.N.2) Jan 1

Sep 1 2,000 - 24,000 By Bal c/d (W.N.6)

To P & L A/c (W.N. 4) March 31 13,000

- 1,61,500

2010 Mar To P & L A/c - - 50,855

31

30,000 26,000

26,000 30,000 3,99,855 30,000 3,99,855

IPCC_34e_Accounts_Group-I_Investment Accounts_Assignment Solutions___3

Ph: 9885125025/26 www.mastermindsindia.com

Working Notes:

1. Calculation of no. of bonus shares issued:

15,000 Shares + 5,000 Shares

Bonus Shares = x 1 = 4,000 shares

5

2. Calculation of right shares subscribed:

15,000 Shares + 5,000 Shares + 400 Shares

Right shares = = 4,000 shares

6

Shares subscribed by XY Ltd. = 4,000/2 = 2,000 shares

Value of right shares subscribed = 2,000 shares @ Rs. 12 per share = Rs. 24,000

3. Calculation of sale of right entitlement:

2,000 shares x Rs. 8 per share = Rs. 16,000

(Since shares are purchased cum right basis, therefore, amount received from sale of rights will be

credited to investment a/c)

4. Calculation of profit on sale of shares:

Total holding = 15,000 shares original

5,000 shares purchased

4,000 shares bonus

2,000 shares right shares

26,000 shares

50% of the holdings were sold

i.e. 13,000 shares (26,000 x ½) were sold

cost of total holdings of 26,000 shares (on average basis)

= Rs. 2,25,000 + Rs. 1,00,000 + Rs. 24,000 – Rs. 16,000 – Rs. 10,000 = Rs. 3,23,000.

Rs.

Average cost of 13,000 shares (13,000 x Rs. 16.50) 2,14,500

Less: 1% Brokerage (2,145)

2,12,355

Less: Cost of 13,000 shares (1,61,500)

Profit on sale 50,855

st

5. Dividend received on investment held as on 1 April, 2009:

= 15,000 shares x Rs. 10 x 20%

= Rs.30,000 will be transferred to Profit and Loss A/c

st

Dividend received on shares purchased on 1 June, 2009

= 5,000 shares x Rs. 10 x 20% = Rs.10,000 will be adjusted to investment A/c

Note: It is presumed that no dividend is received on bonus shares as bonus shares are

st

declared on 1 July, 2009 and dividend pertains to the year ended 31.3.2009.

st

6. Calculation of closing value of shares (on average basis) as on 31 March, 2010:

13,000 x 3,23,000/26,000 = Rs.1,61,500

Closing value of shares would be Rs. 1,61,500.

Copy Rights Reserved

To MASTER MINDS, Guntur

I PCC_34e_Accounts_Group-I_Investment Accounts_Assignment Solutions___4

No.1 for CA/CWA & MEC/CEC MASTER MINDS

PROBLEM NO.5

In the books of Rajat

Investments Account (Equity shares in P Ltd.)

No. of Amount No. of Amount

Date Particulars Date Particulars

Shares (Rs.) Shares (Rs.)

1.4.11 To Bal b/d 50,000 7,50,000 5.11.11 By Bank A/c

20.6.11 To Bank A/c 10,000 1,60,000 (Sale of rights)

(W.N.3) - 20,000

1.8.11 To Bonus issue 10,000 -

-W.N.1 31.3.12 By Balance c/d 90,000 11,90,000

5.11.11 To bank 20,000 3,00,000 (Bal. fig.)

(W N 3)

90,000 12,10,000 90,000 12,10,000

Working Notes:

50,000 + 10,000

1. Bonus shares = = 10,000 shares

6

50,000 + 10,000 + 10,000

2. Right shares = x 3 = 30,000 shares

7

3. Sale of rights = 30,000 shares x 1/3 x Rs.2 = Rs.20,000 credited to investments A/c.

Right subscribed = 30,000 shares x 2/3 x Rs.15 = Rs.3,00,000

PROBLEM NO.6

As per AS-13 “ Accounting for Investments”, long term investments should be carried at cost except

when there is decline, other than temporary, in value. In the instant case, the loss is other than

temporary and hence the investments should be written down to Rs. 80,000, loss Rs. 4,20,000 being

recognized in profit and loss account.

PROBLEM NO.7

As per AS-13, where investments are reclassified from current to long term, transfers are made at the

lower of cost and fair value at the date of transfer.

1. In the first case, the market value of the investment is 25 lakhs, which is higher than its cost i.e., Rs.

20 lakhs. Therefore, the transfer to long term investments should be carried at cost i.e. Rs. 20

lakhs.

2. In the second case, the market value of investment is Rs. 6.5 lakhs, which is lower than its cost i.e.

Rs. 15 lakhs. Therefore, transfer to long term investments should be carried in the books at the

market value i.e. Rs. 6.5 lakhs. The loss of Rs. 8.5 lakhs should be charged to profit and loss

account. As per AS 13, where long-term investments are re-classified as current investments,

transfers are made at the lower of cost and carrying amount at the date of transfer.

3. In the third case, the book value of the investment is Rs. 12 lakhs, which is lower than its cost i.e.

Rs. 18 lakhs. Here, the transfer should be at carrying amount and hence this re-classified current

investment should be carried at Rs. 12 lakhs.

Copy Rights Reserved

To MASTER MINDS, Guntur

I PCC_34e_Accounts_Group-I_Investment Accounts_Assignment Solutions___5

Ph: 9885125025/26 www.mastermindsindia.com

PROBLEM NO – 8

INVESTMENT ACCOUNT (EQUITY SHARE OF ABC Co. Ltd.)

Dr. Cr.

Particulars 2010 (`) 2009 (`) Particulars 2010 (`) 2009 (`)

To Balance b/d 50,000 62,500 By Bank A/c 50,000 45,000

To Bonus shares A/c 50,000 - By Balance c/d 50,000 31,250

To Profit & loss

A/c (Profit on sale) - 13,750

1,00,000 76,250 1,00,000 76,250

Working Notes:

a. Profit on sale of bonus shares = (`45,000 –(`62,500 X 50,000/1,00,000) = `13,750

b. Value of investment will be least of market value `46,250 (i.e. 92.5% of `50,000) or average cost

price (i.e. `31,250)

PROBLEM NO.9

7% Government Loan A/c

Date Particulars N.V. Int. Cost Date Particulars N.V. Int. Cost

01.01.02 To Bal. b/d 60,000 1,050 57,000 04.04 By Bank A/c - 2100 -

(60 k x 7% x 3/12) (60 k x 7% x 6/12)

31.05.02 To Bank A/c 24,000 280 22,760 31.06 By Bank A/c 18,000 420 16,920

(WN – 1) (W.N-2)

31.12.02 To Profit & Loss A/c - 4,585 - 30.09 By Bank A/c - 2,310 -

(WN-3)

30.11 By Bank A/c 12,000 140 11,380

(WN-4)

31.12 By Int. Accrued - 945 -

(WN-5)

31.12 By Balance c/d 54,000 - 51,274

(WN-6)

31/12 By Profit & Loss A/c - - 186

84,000 5,915 79,760 84,000 5,915 79,760

st

WN – 1: Calculation of cost of debenture purchased on 31 May, 2002

Total Face value of debenture purchased = 24,000

No. of Debenture purchased = 24,000 / 10 = 240

Cum interest price (240 x 96) = 23,040

(-) Interest (24,000 x 7% x 6/12) = 280

EX Interest Price 22,760

WN-2: Calculation of Net Sale proceeds:

Total Face value of Debenture sold = 18,000

F.V. = 100. No. of debenture = 180

Net sale proceeds:

Ex: Interest – 180 x 94 = 16,920

Int.: (18,000 x 3% x 4/12) = 420

I PCC_34e_Accounts_Group-I_Investment Accounts_Assignment Solutions___6

No.1 for CA/CWA & MEC/CEC MASTER MINDS

th

WN-3: Int. on 30 September:

Face value of debentures held (60 + 24 - 18) = 66,000

Interest (66,000 x 7% x 6/12) = 2,310

WN-4: Calculation of Net sale proceeds:

Total Face value of Debentures sold = 12,000

No. of Debenture sold = 120

Quotation Price: cum int. price (120 x 96) = 11,520

Interest: 12,000 x 7% x 2/12 = 140

Net sale proceeds 11,380

st

WN-5: Accrued int. on 31 Dec.

Face value of debentures held (60 + 24 – 18 - 12) = 54,000

Interest accrued (54,000 x 7% x 3/12) = 945

WN-6: Calculation of closing value of investments:

A) Cost of Debenture: (W.Avg. method)

Cost of 54,000 debenture (79,760 / 84,000 x 54,000) =Rs. 51,274

B) Market value of debentures: (540 x 96) = Rs.51,840

Closing value of investment (A or B which ever is lower) = Rs.51, 274

THE END

Verified By: Amaranth Garu

Executed By: Mr. Uday

I PCC_34e_Accounts_Group-I_Investment Accounts_Assignment Solutions___7

Das könnte Ihnen auch gefallen

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisVon EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNoch keine Bewertungen

- 1 Investment F PDFDokument35 Seiten1 Investment F PDFShrikant Mahajan100% (2)

- Investment Accounts PDFDokument35 SeitenInvestment Accounts PDFRam Iyer80% (10)

- Investment Accounts: Basic ConceptsDokument13 SeitenInvestment Accounts: Basic ConceptsDebasis KarNoch keine Bewertungen

- RTP Group IDokument202 SeitenRTP Group Iravi_bansal85Noch keine Bewertungen

- BSC (Hons) Financial Services (General) : Cohort: Bfsg/08/Ft - Year 1 Examinations For 2008 - 2009 Semester IiDokument8 SeitenBSC (Hons) Financial Services (General) : Cohort: Bfsg/08/Ft - Year 1 Examinations For 2008 - 2009 Semester Iipriyadarshini212007Noch keine Bewertungen

- Tugas Ch10 10-5 10-6 10-7 10-8Dokument8 SeitenTugas Ch10 10-5 10-6 10-7 10-8Apri IpraNoch keine Bewertungen

- Investment Accounts: Question 1Dokument2 SeitenInvestment Accounts: Question 1Rehan PathanNoch keine Bewertungen

- Adobe Scan 01-Nov-2022Dokument5 SeitenAdobe Scan 01-Nov-2022Suthersan SoundarrajNoch keine Bewertungen

- 5 Investment AccountsDokument11 Seiten5 Investment AccountsBAZINGANoch keine Bewertungen

- 21 Financial - Asset - FV - Reclassification - Sample - ProblemsDokument4 Seiten21 Financial - Asset - FV - Reclassification - Sample - ProblemsSheila Grace BajaNoch keine Bewertungen

- Business Accounting and Analysis249 8MHDyx07qXDokument3 SeitenBusiness Accounting and Analysis249 8MHDyx07qXShikha GargNoch keine Bewertungen

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDokument3 SeitenG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNoch keine Bewertungen

- Far510 Test Dec 2020 SSDokument6 SeitenFar510 Test Dec 2020 SS2022478048Noch keine Bewertungen

- Intermediate Accounting CH 8 Vol 1 2012 AnswersDokument6 SeitenIntermediate Accounting CH 8 Vol 1 2012 AnswersPrincessAngelaDeLeon100% (5)

- MS Set2 SP AccDokument14 SeitenMS Set2 SP AccJohn JoshyNoch keine Bewertungen

- Chapter 8 - Notes Payable and Debt Restructuring: Problem 8-7Dokument3 SeitenChapter 8 - Notes Payable and Debt Restructuring: Problem 8-7Pau LaguertaNoch keine Bewertungen

- Accounts Paper Answer 24.06.2020Dokument17 SeitenAccounts Paper Answer 24.06.2020Prathmesh JambhulkarNoch keine Bewertungen

- Bangladesh IFRS Project Extended Question - SanganaDokument13 SeitenBangladesh IFRS Project Extended Question - SanganaShakhawatNoch keine Bewertungen

- Departmental Accounts PDFDokument10 SeitenDepartmental Accounts PDFMINTU SARAFNoch keine Bewertungen

- Book-Keeping and Accounts Level 2/series 2-2009Dokument13 SeitenBook-Keeping and Accounts Level 2/series 2-2009Hein Linn Kyaw60% (10)

- Accounting Level 3/ Series 4 2008 (3001)Dokument19 SeitenAccounting Level 3/ Series 4 2008 (3001)Hein Linn Kyaw100% (1)

- Chap 12 PDFDokument15 SeitenChap 12 PDFTrishna Upadhyay50% (2)

- Solman NRDokument13 SeitenSolman NRMeeka CalimagNoch keine Bewertungen

- Is and BS For FinalsDokument5 SeitenIs and BS For FinalsRehan FarhatNoch keine Bewertungen

- BudgetDokument7 SeitenBudgetvasanthgurusamynsNoch keine Bewertungen

- ACC3201Dokument7 SeitenACC3201natlyhNoch keine Bewertungen

- Accountancy Answer Key - II Puc Annual Exam March 2019Dokument8 SeitenAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNoch keine Bewertungen

- Incomplete RecordsDokument27 SeitenIncomplete RecordsSteven Raintung0% (1)

- SBM Errata Sheet 2020 - 080920Dokument11 SeitenSBM Errata Sheet 2020 - 080920Hamza AliNoch keine Bewertungen

- Q.3-Question and SolutionDokument4 SeitenQ.3-Question and SolutionFIROZ KHANNoch keine Bewertungen

- Tutorial 12 Answers: Answer To Question 1Dokument3 SeitenTutorial 12 Answers: Answer To Question 1hjbjflaefaifnaerfNoch keine Bewertungen

- The Institute of Computer AccountantsDokument1 SeiteThe Institute of Computer AccountantsankitNoch keine Bewertungen

- Financial Reporting Week 1 Class 1 Important!Dokument18 SeitenFinancial Reporting Week 1 Class 1 Important!Lin SongNoch keine Bewertungen

- Corporate Tutorial FinalDokument12 SeitenCorporate Tutorial Finalshikha khanejaNoch keine Bewertungen

- 18 Dec 2020 ADokument8 Seiten18 Dec 2020 AYIN LING CHOYNoch keine Bewertungen

- Problem 6-1: Interest Expense Present ValueDokument3 SeitenProblem 6-1: Interest Expense Present ValueAngieNoch keine Bewertungen

- JAIBB Accounting Solution - Final AccountingDokument6 SeitenJAIBB Accounting Solution - Final AccountingShakil MahmodNoch keine Bewertungen

- Investment in Associate ExercisesDokument7 SeitenInvestment in Associate ExercisesJo KeNoch keine Bewertungen

- Midterm Ifrs - Data Sheet - Workings and RulesDokument11 SeitenMidterm Ifrs - Data Sheet - Workings and RulesHuong LanNoch keine Bewertungen

- Degree - Swe - Acc - Resit Session - Marking GuideDokument2 SeitenDegree - Swe - Acc - Resit Session - Marking GuideDidier ChautyNoch keine Bewertungen

- Assessment 1 Far-2 SolutionDokument3 SeitenAssessment 1 Far-2 SolutionHadeed HafeezNoch keine Bewertungen

- LQ 1 - Set B SolutionDokument14 SeitenLQ 1 - Set B SolutionRyan Joseph Agluba Dimacali100% (1)

- CH 8 LiabilitiesDokument10 SeitenCH 8 LiabilitiesKrizia Oliva100% (1)

- Intermediate Accounting 2008 SolutionDokument6 SeitenIntermediate Accounting 2008 Solutionchin leaNoch keine Bewertungen

- PQ3 BondsDokument2 SeitenPQ3 BondsElla Mae MagbatoNoch keine Bewertungen

- 73264bos59105 Inter P1aDokument12 Seiten73264bos59105 Inter P1aRaish QURESHINoch keine Bewertungen

- 2021 - A2S2 Solution-OplossingDokument19 Seiten2021 - A2S2 Solution-OplossingmeghdyckNoch keine Bewertungen

- L1-June 2013-FINANCIAL REPORTINGDokument25 SeitenL1-June 2013-FINANCIAL REPORTINGMetick MicaiahNoch keine Bewertungen

- Accounting Level 3/series 3 2008 (Code 3012)Dokument15 SeitenAccounting Level 3/series 3 2008 (Code 3012)Hein Linn Kyaw100% (1)

- IA BorrowingDokument4 SeitenIA Borrowingczarina salazarNoch keine Bewertungen

- AE121-PPE Lecture Prob SolDokument7 SeitenAE121-PPE Lecture Prob SolGero MarinasNoch keine Bewertungen

- Corporate Actions: A Guide to Securities Event ManagementVon EverandCorporate Actions: A Guide to Securities Event ManagementNoch keine Bewertungen

- Using Economic Indicators to Improve Investment AnalysisVon EverandUsing Economic Indicators to Improve Investment AnalysisBewertung: 3.5 von 5 Sternen3.5/5 (1)

- Equity Valuation: Models from Leading Investment BanksVon EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNoch keine Bewertungen

- Rental-Property Profits: A Financial Tool Kit for LandlordsVon EverandRental-Property Profits: A Financial Tool Kit for LandlordsNoch keine Bewertungen

- A Strategic Analysis of the Construction Industry in the United Arab Emirates: Opportunities and Threats in the Construction BusinessVon EverandA Strategic Analysis of the Construction Industry in the United Arab Emirates: Opportunities and Threats in the Construction BusinessNoch keine Bewertungen

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceVon EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNoch keine Bewertungen

- Set Off and Carry Forward of Losses An AnalysisDokument6 SeitenSet Off and Carry Forward of Losses An AnalysisRam IyerNoch keine Bewertungen

- Taxguru - In-Incorporation of Producer Company Companies Act 2013Dokument12 SeitenTaxguru - In-Incorporation of Producer Company Companies Act 2013Ram IyerNoch keine Bewertungen

- Taxguru - In-Procedure For Formation of Private and Public Company in IndiaDokument15 SeitenTaxguru - In-Procedure For Formation of Private and Public Company in IndiaRam IyerNoch keine Bewertungen

- FAQs On Producer Companies ICSI PDFDokument35 SeitenFAQs On Producer Companies ICSI PDFsandeepNoch keine Bewertungen

- Concept of Small Shareholder DirectorDokument4 SeitenConcept of Small Shareholder DirectorRam IyerNoch keine Bewertungen

- CGST Act 2017 PDFDokument103 SeitenCGST Act 2017 PDFRam IyerNoch keine Bewertungen

- Penalties Under The Income Tax Act 1961Dokument10 SeitenPenalties Under The Income Tax Act 1961Ram IyerNoch keine Bewertungen

- Working Paper 173 PDFDokument40 SeitenWorking Paper 173 PDFRam IyerNoch keine Bewertungen

- Working Paper 173Dokument40 SeitenWorking Paper 173Ram IyerNoch keine Bewertungen

- Critical Issues - SEBI Listing Regulations 2015-7.4.2018 by CS S Sudhakar PDFDokument91 SeitenCritical Issues - SEBI Listing Regulations 2015-7.4.2018 by CS S Sudhakar PDFRam IyerNoch keine Bewertungen

- Listing Agreement ClausesDokument3 SeitenListing Agreement ClausesMrudula NutakkiNoch keine Bewertungen

- No - SEBI/LAD-NRO/GN/2015-16/013In Exercise of The Powers Conferred by Section 11, SubDokument101 SeitenNo - SEBI/LAD-NRO/GN/2015-16/013In Exercise of The Powers Conferred by Section 11, SubPatrickLnanduNoch keine Bewertungen

- Critical Issues - SEBI Listing Regulations 2015-7.4.2018 by CS S Sudhakar PDFDokument91 SeitenCritical Issues - SEBI Listing Regulations 2015-7.4.2018 by CS S Sudhakar PDFRam IyerNoch keine Bewertungen

- 74 PDFDokument3 Seiten74 PDFRam IyerNoch keine Bewertungen

- Nagpur BranchDokument21 SeitenNagpur BranchRam IyerNoch keine Bewertungen

- Corporate Governance Case Studies CataloguesDokument12 SeitenCorporate Governance Case Studies CataloguesAnita PanthakiNoch keine Bewertungen

- Summarize MCQs PDFDokument32 SeitenSummarize MCQs PDFRam IyerNoch keine Bewertungen

- A Study On The Corporate Governance Issues at SATYAMDokument18 SeitenA Study On The Corporate Governance Issues at SATYAMSomiya91% (22)

- CSR Final 02022015 PDFDokument84 SeitenCSR Final 02022015 PDFRam IyerNoch keine Bewertungen

- Gtal - 2016 - Valuations of Sme Pres Phill R PDFDokument21 SeitenGtal - 2016 - Valuations of Sme Pres Phill R PDFRam IyerNoch keine Bewertungen

- CSR Final 02022015Dokument84 SeitenCSR Final 02022015Ram IyerNoch keine Bewertungen

- Satyam Fiasco Corporate Governance FailuDokument11 SeitenSatyam Fiasco Corporate Governance FailuRam IyerNoch keine Bewertungen

- Valuation ProblemsDokument2 SeitenValuation ProblemsRam IyerNoch keine Bewertungen

- Director LMRDokument17 SeitenDirector LMRPriyanshi SinghNoch keine Bewertungen

- Aclp 2018Dokument728 SeitenAclp 2018Ram IyerNoch keine Bewertungen

- Brealey. Myers. Allen Chapter 21 TestDokument15 SeitenBrealey. Myers. Allen Chapter 21 TestSasha100% (1)

- Practice Questions Valuations & Business Modelling PDFDokument103 SeitenPractice Questions Valuations & Business Modelling PDFRam Iyer0% (1)

- Costing Formula SheetDokument16 SeitenCosting Formula SheetRam Iyer100% (1)

- Private CompanyDokument180 SeitenPrivate CompanyRam IyerNoch keine Bewertungen

- Green Shoe Options in IndiaDokument32 SeitenGreen Shoe Options in IndiaRajeev AroraNoch keine Bewertungen

- Application For H. O. Limits Branch: Corporate Credit DateDokument7 SeitenApplication For H. O. Limits Branch: Corporate Credit DatehasanthakNoch keine Bewertungen

- HLF124 AuthorityToDeduct V04Dokument1 SeiteHLF124 AuthorityToDeduct V04Jemuel CastilloNoch keine Bewertungen

- Cash Flow Statement Presentation)Dokument12 SeitenCash Flow Statement Presentation)Arun GuleriaNoch keine Bewertungen

- 9 IS-LM Model and Policy EffectivenessDokument21 Seiten9 IS-LM Model and Policy EffectivenessShajeer HamNoch keine Bewertungen

- 01 The CorporationDokument10 Seiten01 The CorporationWesNoch keine Bewertungen

- Millenium Card StatementDokument3 SeitenMillenium Card Statementshahid2opu100% (1)

- Task 1Dokument1 SeiteTask 1Robin ScherbatskyNoch keine Bewertungen

- Business and Financial Risk Answer: D Diff: EDokument1 SeiteBusiness and Financial Risk Answer: D Diff: EKaye JavellanaNoch keine Bewertungen

- BD20303 Topic 4 Risk and Return IDokument42 SeitenBD20303 Topic 4 Risk and Return IVanna Chan Weng YeeNoch keine Bewertungen

- Module1 FAR1 MergedDokument53 SeitenModule1 FAR1 MergedKin LeeNoch keine Bewertungen

- 2011 Aug Tutorial 2 Time Value of Money (Financial Calculator)Dokument16 Seiten2011 Aug Tutorial 2 Time Value of Money (Financial Calculator)Harmony TeeNoch keine Bewertungen

- Bofa MarzoDokument12 SeitenBofa MarzoDavid SanchezNoch keine Bewertungen

- Tax Notes On Capital GainsDokument15 SeitenTax Notes On Capital GainsGarima GarimaNoch keine Bewertungen

- Assignment 3Dokument5 SeitenAssignment 3Shubham DixitNoch keine Bewertungen

- Amazon DCF: Ticker Implied Share Price Date Current Share PriceDokument4 SeitenAmazon DCF: Ticker Implied Share Price Date Current Share PriceFrancesco GliraNoch keine Bewertungen

- Retirement Planning (Finally Done)Dokument47 SeitenRetirement Planning (Finally Done)api-3814557100% (5)

- Eftnet 17593053999Dokument2 SeitenEftnet 17593053999saimohan SubudhiNoch keine Bewertungen

- 1 30 2012 4Dokument546 Seiten1 30 2012 4Dante FilhoNoch keine Bewertungen

- Revised Business Plan JefamDokument65 SeitenRevised Business Plan JefamISAAC TAGOE100% (3)

- Abbott Company and Its Financial Statement Analysis Using Ratios Abbott CompanyDokument17 SeitenAbbott Company and Its Financial Statement Analysis Using Ratios Abbott CompanyMaryam EjazNoch keine Bewertungen

- It-Form 2020 GPF S.samuel Selvaraj B.SC, M.a.,b.ed., Science BT, Coimbatore-38 DownloadDokument16 SeitenIt-Form 2020 GPF S.samuel Selvaraj B.SC, M.a.,b.ed., Science BT, Coimbatore-38 DownloadMurugesan UmaNoch keine Bewertungen

- GOLD BrochureDokument8 SeitenGOLD BrochurelaxmiccNoch keine Bewertungen

- Askari Bank LTDDokument3 SeitenAskari Bank LTDNayab AliNoch keine Bewertungen

- Concept - Note - Implementation - of - RuPay - qSPARC - Based - NCMC v2.1Dokument43 SeitenConcept - Note - Implementation - of - RuPay - qSPARC - Based - NCMC v2.1Luiz Fernando Galdino DubielaNoch keine Bewertungen

- Investment Declaration Format FY 2022-23Dokument3 SeitenInvestment Declaration Format FY 2022-23Divya WaghmareNoch keine Bewertungen

- Name: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDokument4 SeitenName: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDuren JayaNoch keine Bewertungen

- UBL Internship ReportDokument58 SeitenUBL Internship Reportbbaahmad89100% (1)

- Delivery Address Billing Address: Invoice Number Invoice Date Order Reference Order DateDokument1 SeiteDelivery Address Billing Address: Invoice Number Invoice Date Order Reference Order DateTaj Md SunnyNoch keine Bewertungen

- Private Equity and Leveraged Buyouts Study - European Parliament Nov-2007Dokument65 SeitenPrivate Equity and Leveraged Buyouts Study - European Parliament Nov-2007AsiaBuyoutsNoch keine Bewertungen

- Invest in Real Estate For Inflationary TimesDokument8 SeitenInvest in Real Estate For Inflationary TimesCraigNoch keine Bewertungen