Beruflich Dokumente

Kultur Dokumente

Scan 0001

Hochgeladen von

Zeyad El-sayedCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Scan 0001

Hochgeladen von

Zeyad El-sayedCopyright:

Verfügbare Formate

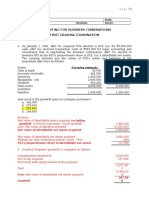

MODULE 36 TAXES: CORPORATE 563

Corporations are separate taxable entities, organized under state law. Although corporations may have

many of the same income and deduction items as individuals, corporations are taxed at different rates and

some tax rules are applied differently. There also are special provisions applicable to transfers of property to a

corporation, and issuance of stock.

A. Transfers to a Controlled Corporation (Sec. 351)

1. No gain or loss is recognized if property is transferred to a corporation solely in exchange for

stock

and immediately after the exchange those persons transferring property control the corporation.

2. Property includes everything but services.

3. Control means ownership of at least 80% of the total combined voting power and 80% of each

class of nonvoting stock.

4. Receipt of boot (e.g., cash, short-term notes, securities, etc.) will cause recognition of gain (but

not loss).

(1) Corporation's assumption of liabilities is treated as boot only if there is a tax avoidance pur-

pose, or no business purpose.·

(2) Shareholder recognizes gain if liabilities assumed by corporation exceed the total basis of

property transferred by the shareholder.

5. Shareholder's basis for stock = Adjusted basis of property transferred

6. + Gain recognized

7. - Boot received (assumption of liability always treated as boot for purposes of

determining stock

basis)

3. Corporation's basis for property = Transferor's adjusted basis + Gain recognized to transferor.

_C_

EXAMPLE: Individuals A, B, & C form ABC Corp. and make the following transfer to their corporation:

Item transferred _A__ __B_ $

Property - FMV $10,000 $8,000

- Adjusted basis 1,500 3,000 . 1,00

Liability assumed by ABC Corp. 2,000 0

Services

Consideration received

Stock (FMV) $ 8,000 $7,600 $1,000

Two- ear note (FMV)

Gain recognized to shareholder $ soo« 40 $1,OO

Basis of stock received 0 OC

Basis of propertyto corp. 2,000 $ 40 1,000

a Liability in excess of basis: $2,000 - $1,500 = $500 3,000 t.coo

b Assumes B elects out of the installment method 3,400 !

c Ordinary compensation income

d Expense or asset depending on nature of services rendered

8. For Sec. 351 transactions after October 22, 2004, if the aggregate adjusted basis of transferred

property exceeds its aggregate FMV, the corporate transferee's aggregate basis for the property is

generally limited to its aggregate FMV immediately after the transaction. Any required basis

reduction is allocated among the transferred properties in proportion to their built-in loss

immediately before the transaction.

9. Alternatively, the transferor and the corporate transferee are allowed to make an irrevocable

election to limit the basis in the stock received by the transferor to the aggregate FMV of the

transferred property.

EXAMPLE: Amy transferred Lossacre with a basis of $6,000 (FMV of $2,000) and Gainacre with a basis of

$4,000 (FMV of $5,000) to ABE Corp. in exchange for stock in a Sec. 351 transaction. Since the aggregate

adjusted basis of the transferred property ($10,000) exceeds its aggregate FMV ($7,000), ABE's aggregate basis

for the property is limited to $7,000. The required basis reduction of $3,000 would reduce ABE's basis for

Lossacre to $3,000 ($6,000 - $3,000). Amy's basis for her stock would equal the total basis of the transferred

property, $10,000.

Alternatively, if Amy and ABE elect, ABE's basis for the transferred property will be $6,000 for Lossacre and

,$4,000 for Gainacre, and Amy's basis for her stock will be limited to its FMV of $7,000. -

Das könnte Ihnen auch gefallen

- Scan 0001Dokument2 SeitenScan 0001Zeyad El-sayedNoch keine Bewertungen

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDokument3 SeitenModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNoch keine Bewertungen

- Wassim Zhani Income Taxation of Corporations (Chapter 2)Dokument46 SeitenWassim Zhani Income Taxation of Corporations (Chapter 2)wassim zhaniNoch keine Bewertungen

- Advanced Tax (Acct 407) Chapter 17, 2, 3, 4, and 5Dokument14 SeitenAdvanced Tax (Acct 407) Chapter 17, 2, 3, 4, and 5barlie3824Noch keine Bewertungen

- Soal Bab 1Dokument4 SeitenSoal Bab 1Wido Fiverz FabregasNoch keine Bewertungen

- IFRS Chap 2Dokument42 SeitenIFRS Chap 2Yousef Abdullah GhundulNoch keine Bewertungen

- Assignment - Chapter 4 - Problem 40 (Due 10.04.20)Dokument1 SeiteAssignment - Chapter 4 - Problem 40 (Due 10.04.20)Tenaj KramNoch keine Bewertungen

- South Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFDokument45 SeitenSouth Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFSarahSweeneyjpox100% (8)

- Practice ProblemsDokument15 SeitenPractice ProblemsBringinthehypeNoch keine Bewertungen

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDokument5 SeitenBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Accounting For Business Combination - Practice Material 3Dokument2 SeitenAccounting For Business Combination - Practice Material 3ZYRENE HERNANDEZNoch keine Bewertungen

- Full Solution Manual Applying International Financial Reporting Standards 3nd Edition by Ruth Picker SLW1019Dokument42 SeitenFull Solution Manual Applying International Financial Reporting Standards 3nd Edition by Ruth Picker SLW1019Sm Help80% (5)

- ACC 430 Chapter 9Dokument13 SeitenACC 430 Chapter 9vikkiNoch keine Bewertungen

- Business CombinationsDokument41 SeitenBusiness CombinationsShiena Marie VillapandoNoch keine Bewertungen

- Taxes: Transactions in Property:) S - C S - S S o y S y S - S" e S A A A S G S. X S, ADokument3 SeitenTaxes: Transactions in Property:) S - C S - S S o y S y S - S" e S A A A S G S. X S, AZeyad El-sayedNoch keine Bewertungen

- Business Combination: Expense ImmediatelyDokument7 SeitenBusiness Combination: Expense ImmediatelyKristel SumabatNoch keine Bewertungen

- General Questions: Pal SipDokument9 SeitenGeneral Questions: Pal SipAura DewaNoch keine Bewertungen

- Business Combination ActivityDokument5 SeitenBusiness Combination ActivityAndy LaluNoch keine Bewertungen

- CH 02 PDFDokument24 SeitenCH 02 PDFAurcus JumskieNoch keine Bewertungen

- ABC FX Summer 22 23Dokument16 SeitenABC FX Summer 22 23Patricia EsplagoNoch keine Bewertungen

- Survey of Accounting 8th Edition Warren Solutions ManualDokument35 SeitenSurvey of Accounting 8th Edition Warren Solutions Manualdevinsmithddsfzmioybeqr100% (14)

- Taxes: Corporate: But D N LDokument2 SeitenTaxes: Corporate: But D N LZeyad El-sayedNoch keine Bewertungen

- Assets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesDokument2 SeitenAssets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesTine Vasiana DuermeNoch keine Bewertungen

- Debt RestructuringDokument4 SeitenDebt RestructuringAra BellaNoch keine Bewertungen

- Dwnload Full Survey of Accounting 7th Edition Warren Solutions Manual PDFDokument22 SeitenDwnload Full Survey of Accounting 7th Edition Warren Solutions Manual PDFfactivesiennesewwz2jj100% (12)

- Survey of Accounting 7th Edition Warren Solutions ManualDokument35 SeitenSurvey of Accounting 7th Edition Warren Solutions Manualandrefloresxudd100% (25)

- Document 4 FS OverviewDokument17 SeitenDocument 4 FS OverviewPrashant MakwanaNoch keine Bewertungen

- Chapter 10Dokument26 SeitenChapter 10IstikharohNoch keine Bewertungen

- Acc 496 Chapter 3Dokument2 SeitenAcc 496 Chapter 3Abdul HassonNoch keine Bewertungen

- Stock KKDokument7 SeitenStock KKamir rabieNoch keine Bewertungen

- Chapter 9 PDFDokument17 SeitenChapter 9 PDFJay BrockNoch keine Bewertungen

- Corporate Tax HW SolutionsDokument12 SeitenCorporate Tax HW SolutionsbiziakmNoch keine Bewertungen

- Chapter 02 - Consolidation of Financial Information: PROBLEMS 2-20, 2-21, 2-27, 2-22Dokument33 SeitenChapter 02 - Consolidation of Financial Information: PROBLEMS 2-20, 2-21, 2-27, 2-22Su Ed100% (1)

- Akl Ii TM 11Dokument4 SeitenAkl Ii TM 11Amalia FillahNoch keine Bewertungen

- Accounting For Business Combinations First Grading ExaminationDokument18 SeitenAccounting For Business Combinations First Grading ExaminationNhel AlvaroNoch keine Bewertungen

- QUIZ AccountingDokument5 SeitenQUIZ AccountingEzy Tri TANoch keine Bewertungen

- Answers To Lecture 1Dokument10 SeitenAnswers To Lecture 1Mohamed ZaitoonNoch keine Bewertungen

- CPA Exam REG - Corporation TaxationDokument3 SeitenCPA Exam REG - Corporation TaxationManny MarroquinNoch keine Bewertungen

- Prelim Exam - Doc2Dokument16 SeitenPrelim Exam - Doc2alellie100% (1)

- Business Combination Part 2Dokument8 SeitenBusiness Combination Part 2Aljenika Moncada GupiteoNoch keine Bewertungen

- MOCK UP SOAL UAS AKL II Dan ADV II 2018Dokument5 SeitenMOCK UP SOAL UAS AKL II Dan ADV II 2018Nathalie Christnindita DecidNoch keine Bewertungen

- 01 Handout FINAC2 Lease Accounting Debt Restructuring PDFDokument4 Seiten01 Handout FINAC2 Lease Accounting Debt Restructuring PDFNil Allen Dizon FajardoNoch keine Bewertungen

- Module 8 - Derecognition of ReceivablesDokument6 SeitenModule 8 - Derecognition of Receivablesshaira doctorNoch keine Bewertungen

- FTCXSXSXSP - Seminar 8 - AnswersDokument4 SeitenFTCXSXSXSP - Seminar 8 - AnswersLewis FergusonNoch keine Bewertungen

- L2 - Business Combinations II (2023)Dokument12 SeitenL2 - Business Combinations II (2023)waiwaichoi112Noch keine Bewertungen

- Taxes: Transactions in Property: Involuntary ConversionsDokument1 SeiteTaxes: Transactions in Property: Involuntary ConversionsEl Sayed AbdelgawwadNoch keine Bewertungen

- Module 7.2Dokument9 SeitenModule 7.2Althea mary kate MorenoNoch keine Bewertungen

- HI5020 Corporate Accounting: Session 7c Accounting For Group StructuresDokument30 SeitenHI5020 Corporate Accounting: Session 7c Accounting For Group StructuresFeku RamNoch keine Bewertungen

- Instructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Dokument7 SeitenInstructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Leila OuanoNoch keine Bewertungen

- Mock Up Soal Uas Akl II Dan Adv II 2018Dokument4 SeitenMock Up Soal Uas Akl II Dan Adv II 2018nadea06_20679973Noch keine Bewertungen

- S S S - (3) A S S V S y I S S Tion Wi S C S V S.: 534 Module 35 Taxes: PartnershipsDokument1 SeiteS S S - (3) A S S V S y I S S Tion Wi S C S V S.: 534 Module 35 Taxes: PartnershipsEl Sayed AbdelgawwadNoch keine Bewertungen

- Business Combi Quiz (Part1)Dokument9 SeitenBusiness Combi Quiz (Part1)Rica Joy RuzgalNoch keine Bewertungen

- Prelim ExamDokument12 SeitenPrelim ExamCyd Chary Limbaga BiadnesNoch keine Bewertungen

- Chapter 4 Consolidated Financial Statements Piecemeal AcquisitionDokument11 SeitenChapter 4 Consolidated Financial Statements Piecemeal AcquisitionKE XIN NGNoch keine Bewertungen

- Partnership Testbank Part 1Dokument17 SeitenPartnership Testbank Part 1Klay LuisNoch keine Bewertungen

- Accounting 7an Business CombinationDokument8 SeitenAccounting 7an Business CombinationLabLab ChattoNoch keine Bewertungen

- Conceptual Framework and Accounting Standards Q A 4Dokument5 SeitenConceptual Framework and Accounting Standards Q A 4James DetallaNoch keine Bewertungen

- Corporation Part 1Dokument9 SeitenCorporation Part 11701791Noch keine Bewertungen

- Statement of AffairsDokument7 SeitenStatement of AffairsJaene L.Noch keine Bewertungen

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossDokument3 SeitenSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedNoch keine Bewertungen

- Fede Al Securities Acts: OvervieDokument2 SeitenFede Al Securities Acts: OvervieZeyad El-sayedNoch keine Bewertungen

- I y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateDokument2 SeitenI y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateZeyad El-sayedNoch keine Bewertungen

- S Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateDokument3 SeitenS Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateZeyad El-sayedNoch keine Bewertungen

- Scan 0013Dokument2 SeitenScan 0013Zeyad El-sayedNoch keine Bewertungen

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDokument3 SeitenP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedNoch keine Bewertungen

- Scan 0012Dokument2 SeitenScan 0012Zeyad El-sayedNoch keine Bewertungen

- Module 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Dokument2 SeitenModule 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Zeyad El-sayedNoch keine Bewertungen

- Deduct From Book Income: - B - T F Dul - .Dokument2 SeitenDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedNoch keine Bewertungen

- Scan 0010Dokument3 SeitenScan 0010Zeyad El-sayedNoch keine Bewertungen

- 80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateDokument2 Seiten80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateZeyad El-sayedNoch keine Bewertungen

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDokument2 SeitenModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedNoch keine Bewertungen

- Scan 0018Dokument1 SeiteScan 0018Zeyad El-sayedNoch keine Bewertungen

- Scan 0010Dokument2 SeitenScan 0010Zeyad El-sayedNoch keine Bewertungen

- The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Dokument2 SeitenThe Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Zeyad El-sayedNoch keine Bewertungen

- B Nkruptcy: Discharge of A BankruptDokument2 SeitenB Nkruptcy: Discharge of A BankruptZeyad El-sayedNoch keine Bewertungen

- Professional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsDokument2 SeitenProfessional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsZeyad El-sayedNoch keine Bewertungen

- Revocation of Discharge: 2M Module27 BankruptcyDokument2 SeitenRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedNoch keine Bewertungen

- Scan 0006Dokument2 SeitenScan 0006Zeyad El-sayedNoch keine Bewertungen

- Bankruptcy:: y y S e S Owed SDokument3 SeitenBankruptcy:: y y S e S Owed SZeyad El-sayedNoch keine Bewertungen

- Scan 0008Dokument2 SeitenScan 0008Zeyad El-sayedNoch keine Bewertungen

- Module 21 Professional Responsibilities: Interpretation 101-2. A FirmDokument2 SeitenModule 21 Professional Responsibilities: Interpretation 101-2. A FirmZeyad El-sayedNoch keine Bewertungen

- Scan 0009Dokument2 SeitenScan 0009Zeyad El-sayedNoch keine Bewertungen

- Scan 0008Dokument2 SeitenScan 0008Zeyad El-sayedNoch keine Bewertungen

- Article I Responsibilities. Article Il-The Public InterestDokument2 SeitenArticle I Responsibilities. Article Il-The Public InterestZeyad El-sayedNoch keine Bewertungen

- ET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsDokument2 SeitenET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsZeyad El-sayedNoch keine Bewertungen

- Scan 0008Dokument2 SeitenScan 0008Zeyad El-sayedNoch keine Bewertungen

- Scan 0009Dokument2 SeitenScan 0009Zeyad El-sayedNoch keine Bewertungen

- Promotional Strategies of Kotak Life InsuranceDokument88 SeitenPromotional Strategies of Kotak Life InsuranceMayank AhujaNoch keine Bewertungen

- Financial Report (October 2017)Dokument2 SeitenFinancial Report (October 2017)Marija DukićNoch keine Bewertungen

- Quote - Q2045201Dokument2 SeitenQuote - Q2045201makhanyasibusisiwe7Noch keine Bewertungen

- LAtihan CH 18Dokument19 SeitenLAtihan CH 18laurentinus fikaNoch keine Bewertungen

- Etf Playbook 1Dokument12 SeitenEtf Playbook 1langlinglung1985Noch keine Bewertungen

- Commercial Property Advisors Due Diligence ChecklistsDokument8 SeitenCommercial Property Advisors Due Diligence ChecklistsAnonymous xcxC7m100% (1)

- Welcome To Momentum Trading SetupDokument12 SeitenWelcome To Momentum Trading SetupSunny Deshmukh0% (1)

- Jabatan Bendahari: Tarikh Kredit Debit Keterangan Nombor Rujukan KampusDokument1 SeiteJabatan Bendahari: Tarikh Kredit Debit Keterangan Nombor Rujukan KampusArief HakimiNoch keine Bewertungen

- Chapter 17 Capital Structure-TestbankDokument12 SeitenChapter 17 Capital Structure-TestbankLâm Thanh Huyền NguyễnNoch keine Bewertungen

- Index For Capital Gains TaxDokument15 SeitenIndex For Capital Gains TaxWilma P.Noch keine Bewertungen

- 83592481 (1)Dokument3 Seiten83592481 (1)MedhaNoch keine Bewertungen

- Non Face To Face Form With AMB Declaration PDFDokument10 SeitenNon Face To Face Form With AMB Declaration PDFrohit.godhani9724Noch keine Bewertungen

- Kamran Acca f1 Mcqs.Dokument96 SeitenKamran Acca f1 Mcqs.Renato Wilson67% (3)

- Dipolog Rice Mill Journal EntriesDokument4 SeitenDipolog Rice Mill Journal EntriesRenz RaphNoch keine Bewertungen

- Eliminating Emotions With Candlestick Signals: by Stephen W. Bigalow The Candlestick ForumDokument122 SeitenEliminating Emotions With Candlestick Signals: by Stephen W. Bigalow The Candlestick Forumbruce1976@hotmail.comNoch keine Bewertungen

- 2307 For EBS Private Individual Percenateg TaxDokument4 Seiten2307 For EBS Private Individual Percenateg TaxAGrace MercadoNoch keine Bewertungen

- Producers Bank Vs CADokument2 SeitenProducers Bank Vs CA001nooneNoch keine Bewertungen

- You Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalDokument28 SeitenYou Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalSamima KhatunNoch keine Bewertungen

- Mmm-List of DocsDokument8 SeitenMmm-List of Docsmadhukar sahayNoch keine Bewertungen

- HSBC iPad-iPod Touch Application FormDokument1 SeiteHSBC iPad-iPod Touch Application FormBc CyNoch keine Bewertungen

- New BIT Structure For 081 AboveDokument17 SeitenNew BIT Structure For 081 Aboveعلي برادةNoch keine Bewertungen

- Payout Policy: Price Per Share $ 1.6billion Shares Repurchased $ 120 Million $64Dokument5 SeitenPayout Policy: Price Per Share $ 1.6billion Shares Repurchased $ 120 Million $64SachitNoch keine Bewertungen

- Factors Affecting Valuation of SharesDokument6 SeitenFactors Affecting Valuation of SharesSneha ChavanNoch keine Bewertungen

- IDFCFIRSTBankstatement 10094802422Dokument33 SeitenIDFCFIRSTBankstatement 10094802422vikas jainNoch keine Bewertungen

- Badze Tongai Accountancy PDFDokument58 SeitenBadze Tongai Accountancy PDFmosab mNoch keine Bewertungen

- List of Groups and Topic For Practical Assignment 1Dokument5 SeitenList of Groups and Topic For Practical Assignment 1pareek gopalNoch keine Bewertungen

- Payslip Gacang-BernardinoDokument1 SeitePayslip Gacang-BernardinoMichelle SyNoch keine Bewertungen

- Coca ColaDokument13 SeitenCoca Colaramonese100% (2)

- Kumkum YadavDokument51 SeitenKumkum YadavHarshit KashyapNoch keine Bewertungen

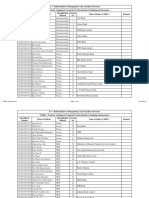

- Number of Barangays City Household Population Household NumberDokument40 SeitenNumber of Barangays City Household Population Household NumberIvan Jon FerriolNoch keine Bewertungen