Beruflich Dokumente

Kultur Dokumente

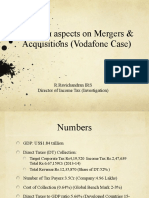

Director of Income Tax International Tax Vs Copal D141897COM153041

Hochgeladen von

nikhilspareek0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

22 Ansichten18 SeitenJudgment under Indina Income Tax law and DTAAs

Originaltitel

Director of Income Tax International Tax vs Copal D141897COM153041

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenJudgment under Indina Income Tax law and DTAAs

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

22 Ansichten18 SeitenDirector of Income Tax International Tax Vs Copal D141897COM153041

Hochgeladen von

nikhilspareekJudgment under Indina Income Tax law and DTAAs

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 18

MANU/DE/1905/2014

Equivalent Citation: (2014)270C TR(Del)223, [2015]371ITR114(Delhi), [2014]226TAXMAN226(Delhi)

IN THE HIGH COURT OF DELHI

W.P.(C) 2033, 2470, 2590 and 2597/2013

Decided On: 14.08.2014

Appellants: Director of Income Tax (international Tax)*

Vs.

Respondent: Copal Research Limited

Hon'ble Judges/Coram:

S. Ravindra Bhat and Vibhu Bakhru, JJ.

Counsels:

F or Appellant/Petitioner/Plaintiff: Balbir Singh, Sr. Standing Counsel, Arjun Harkauli,

Jr. Standing Counsel, Monica Benjamin, Abhishek Singh Baghel

For Respondents/Defendant: S. Ganesh, Sr. Adv. Satyen Sethi, Prakash Kumar, Arta

Trana Panda

Head Note:

Income Tax Act, 1961

• Double taxation relief - Agreement between India and Mauritius Capital gains--

By the impugned ruling, the AAR held that the capital gains arising out of the sale of

shares of an Indian company-C R I (P) Ltd., sold by a company incorporated in

Mauritius (CRL) to a Cyprus company (M/s. Moody's Cyprus) and sale of shares of a

US company (Exevo us) sold by the Mauritius company (CMRL) to another US

company (Moody's USA) were not liable to tax, in India, in the hands of the seller

companies. Consequently, the purchasing companies-M/s. Moody's Cyprus and

Moody's USA had no obligation to withhold tax under section 195 from the

consideration payable to the sellers-the Mauritian companies. Assessee contended

that the shares of CRIL and shares of Exevo-USA were sold to Moody Group as they

insisted on acquiring 100 per cent shareholding of these companies. However, with

respect to shares of Copal-Jersey only 67 per cent of its shares were sold to a

separate entity of the Moody Group. That transaction, thus, ought to be considered as

a transaction independent of Transaction-I and Transaction-II. Held: The gains

arising to the shareholders of Copal-Jersey from sale of their shares in Copal-Jersey

to Moody-UK would not be taxable under section 9(1)(i) as their value could not be

stated to be derived substantially from assets in India. In this view, the contention of

the Revenue that the entire transaction of sale of Copal-Jersey shares has been

structured in a manner so as to include the sale of shares in CRIL and Exevo-US by

the Mauritian companies only to avoid the incidence of tax and take benefit of the

DTAA is ex facie flawed.

The transactions of 3-11-2011 (i.e., SPA-I and SPA-II) resulted in Copal Group

shareholders receiving (i) dividend constituting 67 per cent of the fixed consideration

paid by Moody-Cyprus and Moody-USA for acquisition of the shares of CRIL and

Exevo-US respectively; and (ii) sale consideration for the shares of Copal-Jersey. The

banks and the financial institutions which held shares in Copal-Jersey also

04-04-2019 (Page 1 of 18) www.manupatra.com Phoenix Legal

participated in the dividends that were distributed from the funds received from the

sale proceeds of the sales of CRIL and Exevo-US. It would be obvious that this could

not have been commercially achieved if the overall transaction had been structured in

the manner as suggested by the Revenue i.e., by simplicitor sale of shares of Copal-

Jersey. Thus, even if it is assumed that the transactions for sale of shares of CRIL

and Exevo-US as well as the sale of 67 per cent shares of Copal-Jersey are

considered as a singular transaction which essentially entails exit by the shareholders

of Copal-Jersey, commercially, the structure of transfer as suggested by the Revenue

would not be an alternative to the transactions in question; First of all, for the reason

that the Moody Group would not acquire 100 per cent direct control over CRIL and

Exevo-US but only an indirect 67 per cent economic interest therein and secondly,

the banks and financial institutions holding 33 per cent shares in Copal-Jersey would

not have received their share of the consideration from sale of shares of CRIL and

Exevo-US. The respondents explained that there is a commercial rationale for the sale

of shares of CRIL and Exevo-US as those companies represented holding interest in

Indian companies and Moody's had insisted on acquiring the entire 100 per cent

capital of those companies. Accordingly, the transfer of those shares took place at the

Mauritian level and not by sale of shares of the upstream holding

company/companies at the Jersey level. Sale of shares of the ultimate holding

company i.e., Copal-Jersey could be effected only to the extent of 67 per cent of the

shareholding which was held by the Copal Group shareholders as the balance 33 per

cent was held by banks and financial institutions and their shares were not being

acquired by Moody-UK. There is no material to indicate that this commercial

transaction was not bona fide. Thus, the contention of the Revenue that the

transaction as presently structured has been done only for the purposes of avoiding

tax and as an alternative to sale of shares by shareholders of Copal-Jersey (which

would not be as tax friendly) is not sustainable as the transaction structured in the

manner as suggested by the Revenue i.e., sale of shares of Copal-Jersey alone,

would not achieve the same commercial results and thus, could not be considered as

a real transaction which has been structured differently to avoid an incidence of tax.

[Para 21] Contention of the Revenue cannot be accepted for the reason that even if

the sale of shares by the Copal Group shareholders to Moody-UK has been structured

in the manner as suggested by the Revenue, there would be no incidence of tax.

According to the Revenue, the real transaction is sale of shares by shareholders of

Copal-Jersey to Moody-UK. This would mean that shareholders holding 67 per cent of

the equity in Copal-Jersey, namely the Copal Group shareholders would transfer their

shares to Moody-UK without there being any sale of shares by CRL and CMRL of their

equity holdings in CRIL and Exevo-US respectively. While the value of the said shares

derived from assets situated outside India was USD 93,509,220, the value of sale

(sic) shares derived from assets situated in India would be USD 28,530,435.8 (67

per cent of the fixed consideration). The earn-out consideration payable is ignored as

the same was contemplated to be paid after sale of Copal-Jersey shares and, thus,

would not add to the value of the said shares. [Para 25] It is apparent from the above

that only a fraction of the value of shares of Copal-Jersey was derived indirectly from

the value of the shares of CRIL and Exevo-India. The question, thus, arises is

whether the sale of shares of an overseas company which derives only a minor part

of its value from the assets located in India could be deemed to be situated in India

by virtue of Explanation 5 to section 9(1)(i). This question can be answered by

reference to the express language of section 9 (1)(i) as well as by applying the

principle that income sought to be taxed under the Act must have a territorial nexus

with India. By virtue of section 9(1)(i) all income arising from transfer of a capital

asset situated in India would be deemed to accrue or arise in India and would thus

04-04-2019 (Page 2 of 18) www.manupatra.com Phoenix Legal

be exigible to tax under the Act. A share of a company incorporated outside India is

not an asset which is situated in India and, but for Explanation 5 to section 9(1)(i)

the gains arising out of any transaction of sale and purchase of a share of an

overseas company between non-residents would not be taxable in India. This would

be true even if the entire value of the shares of an overseas company was derived

from the value of assets situated in India. [Para 26] The notes to clauses explained

the introduction of the Explanations 4 and 5 to section 9(1)(i) as being clarificatory.

A plain reading of Explanation 5 also indicates that the given reason for its

introduction was for removal of any doubts. In other words, the language of the said

legislative amendment suggests that it was always the intention of the legislature that

an asset which derives its value from assets in India should be considered as one

which is situated in India. The clear object of section 9(1)(i) is inter alia to cast the

net of tax also on income which arises from transfer of assets in India irrespective of

the residential status of the recipient of the income. Since the assets are situated in

India, the entire income arising from their transfer could be said to arise in India.

Explanation 5 introduced a legal fiction for the limited purpose of imputing that

assets which substantially derive their value from assets situated in India would also

be deemed to be situated in India. [Para 27] It is trite law that a legal fiction must be

restricted to the purpose for which it was enacted. The object of Explanation 5 was

not to extend the scope of section 9(1)(i) to income, which had no territorial nexus

with India, but to tax income that had a nexus with India, irrespective of whether the

same was reflected in a sale of an asset situated outside India. Viewed from this

standpoint there would be no justification to read Explanation 5 to provide recourse

to section 9(1)(i) for taxing income which arises from transfer of assets overseas and

which do not derive bulk of their value from assets in India. In this view, the

expression "substantially" occurring in Explanation 5 would necessarily have to be

read as synonymous to "principally", "mainly" or at least "majority". Explanation 5

having been stated to be clarificatory must be read restrictively and at best to cover

situations where, in substance, the assets in India are transacted by transacting in

shares of overseas holding companies and not to transactions where assets situated

overseas are transacted which also derive some value on account of assets situated in

India. There can be no recourse to Explanation 5 to enlarge the scope of section 9(1)

so as to cast the net of tax on gains or income that may arise from transfer of an

asset situated outside India, which derives bulk of its value from assets outside

India. [Para 28] It is also relevant to refer to the draft report submitted by the Expert

Committee appointed by the Prime Minister in 2012 to report on the retrospective

amendment relating to indirect transfer of assets (Shome Committee). The said

Committee had, in its draft report, considered the import of the expression

'substantially' as used in Explanation 5 to section 9(1)(i). The Committee considered

the submissions of stakeholders that the expression 'substantially' did not have any

fixed meaning and was vague. After analysis, the Committee noted that it was

necessary to pin down a definition of the said expression and for that purpose, there

were no reasons to depart from the Direct Tax Code Bill, 2010 (DTC) that had been

put in the public domain. Under the DTC, gains from the sale of assets situated

overseas, which derived more than 50 per cent of their value from assets situated in

India, were liable to be taxed in India. [Para 29] The 'United Nations Model Double

Taxation Convention between Developed and Developing Countries' and the 'OECD

Model Tax Convention on Income and on Capital' provide that the taxation rights in

case of sale of shares are ceded to the country where the underlying assets are

situated only if more than 50 per cent of the value of such shares is derived from

such property. [Para 30] Paragraph (4) of Article 13 of the United Nations Model

Double Taxation Convention between Developed and Developing Countries provides

04-04-2019 (Page 3 of 18) www.manupatra.com Phoenix Legal

that a Contracting State is allowed to tax a gain on alienation of shares of a company

or on alienation of interests in other entities the property of which consists

principally of immovable property situated in that State. For this purpose, the term

'principally' in relation to the ownership of an immovable property means the value of

such immovable property exceeding 50 per cent of the aggregate value of all assets

owned by such company, partnership, trust or estate. It is also relevant to note that

India has signed a treaty with Korea incorporating this clause. [Para 31] Article 13(1)

provides that the gains derived by a resident of a Contracting State from the

alienation of immovable property situated in another Contracting State may be taxed

in that other State. Article 13(4) of the said Convention provides that the 'gains

derived by a resident of a Contracting State from the alienation of shares or

comparable interests deriving more than 50 per cent of their value directly or

indirectly from immovable property situated in the other Contracting State may be

taxed in that other State. ' [Para 32] In view of the above, gains arising from sale of

a share of a company incorporated overseas, which derives less than 50 per cent of

its value from assets situated in India would certainly not be taxable under section

9(1)(i) read with Explanation 5 thereto. [Para 33] Thus, in the present case, even if

the transaction had been structured in the manner as suggested on behalf of the

Revenue, the gains arising to the shareholders of Copal-Jersey from sale of their

shares in Copal-Jersey to Moody-UK would not be taxable under section 9(1)(i) as

their value could not be stated to be derived substantially from assets in India. In

this view, the contention of the Revenue that the entire transaction of sale of Copal-

Jersey shares has been structured in a manner so as to include the sale of shares in

CRIL and Exevo-US by the Mauritian companies only to avoid the incidence of tax and

take benefit of the DTAA is ex facie flawed. [Para 34] The CRL and CMRL cannot be

stated to be shell companies so as to ignore their corporate identities. Even according

to the Revenue, the companies are generating revenue from intra-group services. The

fact that a company may render services to its related enterprise would not render

the company to be non-existent or give reasons for lifting its corporate veil. The

financial statements placed on record indicate that CRL and CMRL have been

generating revenues and Court also has no reason to doubt the statement that CRL

and CMRL have been providing services in relation to business of financial research

and market research respectively. [Para 38] The next issue that needs to be

addressed is whether CRL and CMRL should be considered as residents of UK on

account of the alleged role of R K in its affairs. Undoubtedly, R K has a vital role to

play in the affairs of the Copal Group. This also indicates that the role of R K in the

affairs of the Copal Group would be significant and he cannot be stated to be playing

a role of a mere agent employed for concluding the transactions as contemplated

under various agreements (SPA-I, SPA-II and SPA-III). However, this by itself would

not be sufficient to assume CRL and CMRL to be tax residents of United Kingdom. The

AAR had considered this aspect and held that the Revenue was unable to show that

the effective management of the companies was not where the board of directors of

the companies situated. It was held that although R K may have played a role larger

than that of a normal agent but circumstances did not warrant an inference that the

control and management of the companies vested with him and not with the

respective board of directors. [Para 39] This court concur with the above-quoted

conclusion of the AAR that by the impugned ruling, the AAR held that the capital

gains arising out of the sale of shares of an Indian company-C R I (P) Ltd., sold by a

company incorporated in Mauritius (CRL) to a Cyprus company (M/s Moody's Cyprus)

and sale of shares of a US company (Exevo us) sold by the Mauritius company

(CMRL) to another US company (Moody's USA) were not liable to tax, in India, in the

hands of the seller companies. The material on record is insufficient to conclude that

04-04-2019 (Page 4 of 18) www.manupatra.com Phoenix Legal

the corporate structure of CRL and CMRL should be ignored and the residence of R K

be considered as the situs of the said companies. [Para 40] This writ petitions are,

accordingly, dismissed.

Income Tax Act, 1961, Section 90

Income Tax Act, 1961 Sections 9(1)(i), expln. 5, 245 R (2)

DTAA Between India and Mauritius

JUDGMENT

Vibhu Bakhru, J.

1. These writ petitions have been filed by the Revenue challenging a common ruling

dated 31.07.2012 (hereinafter referred to as the 'impugned ruling') passed by the

Authority for Advance Ruling (hereinafter referred to as 'AAR').

2. By the impugned ruling, the AAR held that the capital gains arising out of the sale

of shares of an Indian Company - Copal Research India Private Limited, sold by a

company incorporated in Mauritius (Copal Research Limited) to a Cyprus company

(M/s Moody's Group Cyprus Ltd.) and sale of shares of a US company (Exevo Inc.)

sold by the Mauritius Company (Copal Market Research Limited) to another US

company (Moody's Analytics, Inc.) were not liable to tax, in India, in the hands of the

seller companies. Consequently, the purchasing companies - M/s Moody's Group

Cyprus Ltd. and Moody's Analytics, Inc.- had no obligation to withhold tax under

Section 195 of the Income Tax Act, 1961 (hereinafter referred to as the 'Act') from

the consideration payable to the sellers the Mauritian companies.

3. The details of various companies involved in the present writ petition are:-

i. Copal Research Limited ('CRL') - a company incorporated on 17.03.2004

under the laws of Mauritius.

ii. Copal Research India Private Limited ('CRIL') - an Indian company

incorporated on 31.12.2002. iii. Copal Market Research Limited ('CMRL') - a

company incorporated on 01.04.2008 under the laws of Mauritius.

iv. Copal Partners Limited ('Copal-Jersey') - a company incorporated in

Jersey on 21.07.2006.

v. Exevo India Private Limited ('Exevo-India') - an Indian company

incorporated on 22.03.2002.

vi. Exevo Inc. ('Exevo-US') - a company incorporated on 24.07.2002 in

United States of America. vii. Moody's Group Cyprus Ltd. ('Moody-Cyprus') -

a company incorporated in Cyprus. viii. Moody's Analytics, Inc. ('Moody-

USA') - a company incorporated in United States of America.

ix. Moody's Group UK Ltd. ('Moody-UK') - a company incorporated in United

Kingdom in 2007.

CRL, CRIL, CMRL and Copal-Jersey are hereinafter collectively referredto as the

'Copal Group'. Moody-Cyprus, Moody-USA and Moody-UK are hereinaftercollectively

referred to as the 'Moody Group'. Exevo-India and Exevo-USA arehereinafter

04-04-2019 (Page 5 of 18) www.manupatra.com Phoenix Legal

collectively referred to as the 'Exevo Group'.

4 . The facts necessary for considering the present petitions relate to three

transactions pertaining to sale of shares of the constituents of Copal Group to the

constituents of the Moody Group. The tax incidence in respect of two transactions -

sale of shares of CRIL by CRL (hereinafter also referred to Transaction-I or the first

transaction) and sale of shares of Exevo-US by CMRL (hereinafter also referred to as

Transaction-II or the second transaction) - were the subject matter of applications

filed before the AAR.

5. The first transaction entails sale of shares of CRIL by CRL to Moody-Cyprus: CRL

entered into a Share Purchase Agreement dated 03.11.2011 (hereinafter referred to

as the 'SPA-I') with Moody-Cyprus whereby CRL sold its entire 100% holding in CRIL

to Moody-Cyprus. The sale consideration under the said SPA-I for the transfer of

shares comprised of two components: Fixed sum of USD 31,406,740 payable in

lump-sum (referred to as initial consideration in the SPA-I) and Deferred

consideration in the form of an 'Earn-out' payable in one full and final installment as

per Clause 5 of SPA-I read with Schedule 5 thereto. It is relevant to note that Copal-

Jersey acquired 100% shares of CRL on 18.10.2006 and CRL is a wholly owned

subsidiary of Copal-Jersey. Out of the 1,24,424 shares of CRIL that were sold to

Moody Cyprus 1,14,425 (constituting 92% of the entire shareholding of CRIL) were

acquired by CRL on 10.08.2004, by way of subscription and the balance 9,999 shares

(constituting 8% of the subscribed and issued share capital) were purchased on

21.05.2010.

6. The relevant facts with respect to Transaction-II are: CRL acquired 100% shares of

CMRL on 01.04.2008. Thereafter, CMRL acquired 100% shares of Exevo-USA. Exevo-

USA holds 100% of the shareholding (10,06,550 shares) of Exevo-India.

Subsequently, CMRL entered into a Share Purchase Agreement dated 03.11.2011

(hereinafter referred to as the 'SPA-II') with Moody-USA whereby CMRL sold all the

shares of Exevo- USA to Moody-USA. Theeffect of the said transaction was that the

control of the Indian Company (Exevo-India), which was a wholly owned subsidiary

of Exevo-USA, was also indirectly transferred to Moody-USA (an American Company).

The sale consideration under the said SPA-II comprised of two components being a

f i x e d sum of USD 11,176,000 payable in lump-sum (referred to as initial

consideration in the SPA-II) and deferred consideration in the form of an 'Earn-out'

payable in one full and final installment as per Clause 5 of the SPA-II read with

Schedule 5 thereto.

7. Copal-Jersey was, at the material time, the ultimate holding company of the Copal

Group and its certain shareholders (other than banks and financial institutions) held

approximately 67% of the issued and paid up capital of the company (the said

shareholders are hereinafter referred to as the 'Copal Group Shareholders'). Banks

and other Financial Institutions held the balance 33% shares (approx.) of Copal-

Jersey. Copal Group Shareholders entered into a Share Purchase Agreement dated

04.11.2011 (hereinafter referred to as the 'SPA-III') with Moody-UK for sale of

approximately 67% of the shares of Copal-Jersey to Moody-UK for an aggregate

consideration of USD 93,509,220 (this transaction is hereinafter also referred to as

'Transaction-III').

8 . Four applications were filed before the AAR under section 245R of the Act in

respect of the two transactions - Transaction-I and Transaction- II. Moody-USA and

CMRL filed applications with respect to Transaction-II being AAR No.1186/2011 and

04-04-2019 (Page 6 of 18) www.manupatra.com Phoenix Legal

AAR No.1189/2011 respectively. It was contended by the said applicants that in view

of the India-Mauritius Double Taxation Avoidance Agreement (DTAA) read with

section 90(2) of the Act, gains arising in the hands of CMRL from Transaction-II were

not taxable under the Act and, consequently, Moody-USA was not required to

withhold any tax. An advance ruling to the said effect was sought from the AAR.

Applications seeking a similar ruling with respect to Transaction-I were filed by

Moody-Cyprus and CRL being AAR 1187/2011 and AAR 1188/2011 respectively.

9 . The AAR admitted the applications for consideration and framed the following

questions in AAR No.1186/2011:-

"1)Whether on facts and in law, the applicant is justified in its view that

capital gains arising on the sale of shares of Exevo Inc., US ('Exevo Inc') by

Copal Market Research Ltd. ("CMRL") to the applicant would not be

chargeable to tax in India in the hands of CMRL?

) Whether on facts and in law, the Applicant is justified in its view that the

full value of consideration receivable by CMRL for the sale of shares of Exevo

Inc. to the applicant shall be the total consideration including the 'Earn-Out'

consideration for the purposes of computing 'Capital Gains'?

) If the 'Earn-Out' consideration is to be treated as business profits, whether

such profits would be taxable in India under the Act in the absence of any

'Business Connection' of CMRL in India?

) If the answer to question no. 3 above is in the affirmative, whether the

'Earn-Out' consideration would be chargeable to tax in the assessment year

relevant to the previous year in which transfer took place or the year in

which Earn-Out consideration is received by CMRL?

) If the 'Earn-Out' consideration is to be treated as other income, whether

such income would be taxable under the Act by virtue of any income having

accrued or arisen to CMRL in India through or from:

i. Any property in India; or

ii. Any asset or source in India?

) If the answer to question no. 5, is in the affirmative, whether the 'Earn-Out'

consideration would be chargeable to tax in the assessment year relevant to

the previous year in which transfer took place or the year in which Earn-Out

is received by CMRL?

) Whether on the stated facts, the Applicant, being a foreign company and in

absence of a place of business in India, would be subject to tax under the

provisions to Section 115JB of the Act?

) Whether on the facts and in law, the Applicant is required to withhold tax

under section 195 of the Act on the income chargeable to tax in India in the

hands of CMRL from sale of shares in Exevo Inc. to the Applicant?

) If the answer to question 8 is in the affirmative, then, whether the

Applicant would be liable to interest under section 201(1A) of the Act?"

10. The AAR framed the following questions in AAR No.1188/2011:-

04-04-2019 (Page 7 of 18) www.manupatra.com Phoenix Legal

"1) Whether on facts and in law, the applicant is justified in its view that

capital gains, if any, arising on the sale of shares of Copal Research India

Private Limited ('CRIPL) by the applicant to Moody's Group Cyprus Ltd.

(Moody's) will not be chargeable to tax in India in the hands of the applicant,

as per the provisions of paragraph 4 of Article 13 of the Double Taxation

Avoidance Agreement entered into between India and Mauritius ('the

DTAA'/'the Treaty')?

) Whether on facts and in law, the Applicant is justified in its view that the

full value of consideration receivable by the Applicant for the sale of shares

of CRIPL to Moody's shall be the total consideration including the 'Earn-Out'

consideration for the purposes of computing 'Capital Gains'?

) If the 'Earn-Out' consideration is to be treated as business profits, whether

such profits shall be taxable in India as per the provisions of Article 7 read

with Article 5 of DTAA?

) If the answer to question no. 3 above is in the affirmative, whether the

Earn-Out would be chargeable to tax in the assessment year relevant to the

previous year in which transfer took place of or the year in which Earn-Out is

received by the Applicant?

) If the 'Earn-out' consideration is to be treated as Other Income, whether

such income shall be taxable in India as per the provisions of Article 22 of

the DTAA?

) If the answer to question 5 above is in the affirmative, whether the Earn-

Out would be chargeable to tax in the assessment year relevant to the

previous year in which transfer took place or the year in which Earn-Out is

received by the Applicant?

) Whether on the stated facts, the Applicant, being a foreign company and in

absence of a place of business or a Permanent Establishment ('PE') in India,

would be subject to tax under the provisions of section 115JB of the Act?

) Whether on the stated facts and in law, Moody's Group Cyprus Ltd. another

non-resident is required to withhold tax under section 195 of the Act on the

income chargeable to tax in India in the hands of the applicant from the sale

of shares?"

1 1 . The AAR adopted the questions framed in AAR No.1186/2011 in AAR

No.1189/2011, which were also answered in terms of the ruling in AAR 1186/2011.

Similarly, the questions framed in AAR No.1188/2011 were adopted by the Authority

in AAR No.1187/2011 and answered accordingly. The AAR passed a common order in

all the four applications and by the impugned ruling held that the capital gains

arising out of the said transaction were not liable to tax in India in the hands of the

respondents. The AAR further ruled that the Earn-Outconsideration would also be a

part of the consideration receivable by the respondents. The AAR held that there was

no obligation on Moody-USA and Moody- Cyprus to withhold tax under Section 195

of the Act. Aggrieved by the impugned ruling, the Revenue has filed the present writ

petitions.

1 2 . The learned counsel appearing for the Revenue has submitted that the

transactions for sale of shares of Exevo-USA and CRIL must not be viewed in

04-04-2019 (Page 8 of 18) www.manupatra.com Phoenix Legal

isolation but in conjunction with the sale of shares of Copal- Jersey to Moody-UK as

contemplated under SPA-III dated 04.11.2011. And, all the transactions i.e.

Transaction-I, Transaction-II and Transaction- III were an integral part of a single

transaction. It was argued that the commercial understanding between Copal Group

Shareholders and Moody- UK was to structurally transfer the entire businesses and

interest of the Copal Group to the Moody Group and the same was effectuated by the

three transactions (Transaction-I, Transaction-II and Transaction-III). It was stated

that Copal Group Shareholders held approximately 67% shareholding of Copal-Jersey

and Banks and Financial Institutions held the balance shares constituting

approximately 33% of the share capital of Copal-Jersey. Given the shareholding

structure of the Copal Group, the transfer of shares of Copal-Jersey by the Copal

Group Shareholders would consummate the transfer of the entire Copal Group i.e. the

businesses and the downstream subsidiaries of Copal-Jersey, to the Moody Group.

This, it was contended, was the real transaction between the Copal Group

Shareholders and Moody-UK.

13. It was submitted that the sale and purchase agreements read together indicate

that, structurally, the entire Copal Group was transferred to the Moody Group. It was

argued that but for the separate sale transactions in respect of shares of CRIL and

Exevo-US (i.e. SPA-I and SPA-II) executed one day prior to the sale of shares of

Copal-Jersey (i.e. SPA-III), the gains arising from sale of shares of Copal-Jersey in

the hands of Copal Group Shareholders would be taxable under the Act, as the shares

of Copal-Jersey would derive their value substantially on account of the value of the

assets situated in India namely shares of Exevo-India and CRIL. It was reasoned that

by virtue of Section 9(1)(i) of the Act read with Explanation 5 thereto, the capital

gains arising in the hands of the Copal Group Shareholders (who were non-residents)

would be taxable under the Act as the said gains would be deemed to accrue and

arise in India. It was submitted that in order to avoid this incidence of tax, the

transaction of sale of the businesses and interests of the Copal Group to the Moody

Group was structured in a manner so as to include two separate transactions for sale

of shares of CRIL held by CRL to Moody-Cyprus and shares of Exevo-USA to Moody-

USA. Sellers in both these transactions, namely, CRL and CMRL were companies

incorporated in Mauritius and the tax chargeable on gains arising from sale of shares

in the hands of the Mauritius entities could be avoided by virtue of India-Mauritius

Double Taxation Avoidance Agreement. It was submitted that in the given

circumstances, the transactions in question, namely, sale of shares of CRIL and

Exevo-US, were interspersed and as such were transactions structured prima facie for

avoidance of tax.

1 4 . The learned counsel for the assessee had objected to the contentions of the

revenue and submitted that the same were neither raised before the AAR nor pleaded

in the writ petition. He further submitted that the shares of CRIL and shares of Exevo-

USA were sold to Moody Group as they insisted on acquiring 100% shareholding of

these companies. However, with respect to shares of Copal-Jersey only 67% of its

shares were sold to a separate entity of the Moody Group. That transaction, thus,

ought to be considered as a transaction independent of Transaction-I and

Transaction- II.

15. Before proceeding to consider the rival submissions, it would be necessary to

refer to Clause (iii) of Proviso to Section 245R(2) of the Act which reads as under:-

"245R. Procedure on receipt of application.--

04-04-2019 (Page 9 of 18) www.manupatra.com Phoenix Legal

(1) xxxx xxxx xxxx xxxx

(2) The Authority may, after examining the application and the records called

for, by order, either allow or reject the application: Provided that the

Authority shall not allow the application where the question raised in the

application,-

(i) xxxx xxxx xxxx xxxx

(ii) xxxx xxxx xxxx xxxx

(iii) relates to a transaction or issue which is designed prima facie

f o r the avoidance of income-tax except in the case of a resident

applicant falling in sub-clause (iii) of clause (b) of section 245N or

in the case of an applicant falling in sub-clause (iiia) of clause (b) of

section 245N:"

1 6 . The principal questions for consideration are whether the two transactions in

question - for sale and purchase of CRIL shares and Exevo- USA shares (SPA-I and

SPA-II) are designed prima facie for avoidance of income tax under the Act and

whether the applications in respect of the said transactions were liable to be

disallowed by the AAR in terms of Clause (iii) of Proviso to Section 245R(2) of the

Act.

1 7 . Before proceeding to address the rival contentions, it would be relevant to

examine the shareholding/investment structure and the inter- relation between the

various entities of the Copal Group. This could be understood by a chart

demonstrating the structure of the Copal Group of companies, which is reproduced

below:-

04-04-2019 (Page 10 of 18) www.manupatra.com Phoenix Legal

18. A bare perusal of the above structure indicates that sale of 67% of the shares of

Copal-Jersey by Copal Group Shareholders to Moody-UK would result inthe Moody

Group acquiring 67% indirect economic interest in Copal Partners Limited, Jersey

Ethos Data Holdings Limited Cyprus Copal Partners Middle EastLimited Copal

Partners (UK) Limited Copal Partners (US) Inc. Copal BusinessConsulting (Beijing)

Co. Limited Copal Partners (HK) Limited Exevo Research Pte.Ltd., Singapore Exevo

India Private Limited Ethos Data (UK) Limited, UKIndividual Shareholders 67%

(approx.) Banks & Financial Institutions 33% (approx.) Copal Research Limited,

Mauritius Copal Research India Private Limited Copal Market Research Limited,

Mauritius Exevo Inc., US CRL and CMRL (being thewholly owned downstream

subsidiaries of Copal-Jersey) and this would obviously include interest in any

consideration paid by Moody-Cyprus and Moody-USA to CRLand CMRL respectively

for acquiring shares of CRIL and Exevo-US as contemplatedunder SPA-I and SPA-II.

This obviously would be illogical as on one hand the concerned entities of Moody

Group would pay for assets of CRL and CMRL(Transaction I and Transaction-II) and

on the other hand another entity of the Moody Group would pay to re-acquire a

significant part of the consideration paid a day earlier (Transaction-III). This was

explained by the learned counsel for the respondents. He stated that the

consideration paid by Moody-USA to CMRL was distributed by CMRL as dividend to

CRL. CRL distributed the funds received as dividend and consideration for sale of

shares of CRIL to Copal-Jersey, which in turn distributed the amounts received as

dividends to its shareholders.

19. It follows from the above that the transactions of 03.11.2011 (i.e. SPA-I and

04-04-2019 (Page 11 of 18) www.manupatra.com Phoenix Legal

SPA-II) resulted in Copal Group Shareholders receiving (i) dividend constituting 67%

of the fixed consideration paid by Moody- Cyprus and Moody-USA for acquisition of

the shares of CRIL and Exevo- US respectively; and (ii) sale consideration for the

shares of Copal-Jersey. The banks and the financial institutions which held shares in

Copal-Jersey also participated in the dividends that were distributed from the funds

received from the sale proceeds of the sales of CRIL and Exevo-US. It would be

obvious that this could not have been commercially achieved if the overall transaction

had been structured in the manner as suggested by the Revenue i.e. by simplicitor

sale of shares of Copal-Jersey. Thus, even if it is assumed that the transactions for

sale of shares of CRIL and Exevo-US as well as the sale of 67% shares of Copal-

Jersey are considered as a singular transaction which essentially entails exit by the

shareholders of Copal-Jersey, commercially, the structure of transfer as suggested by

the Revenue would not be an alternative to the transactions in question; First of all,

for the reason that the Moody Group would not acquire 100% direct control over

CRIL and Exevo-US but only an indirect 67% economic interest therein and secondly,

the banks and financial institutions holding 33% shares in Copal-Jersey would not

have received their share of the consideration from sale of shares of CRIL and Exevo-

US.

20. The respondents explained that there is a commercial rationale for the sale of

shares of CRIL and Exevo-US as those companies represented holding interest in

Indian companies and Moody's had insisted on acquiring the entire 100% capital of

those companies. Accordingly, the transfer of those shares took place at the Mauritian

level and not by sale of shares of the upstream holding company/companies at the

Jersey level. Sale of shares of the ultimate holding company i.e. Copal-Jersey could

be effected only to the extent of 67% of the shareholding which was held by the

Copal Group Shareholders as the balance 33% was held by banks and financial

institutions and their shares were not being acquired by Moody-UK. There is no

material to indicate that this commercial transaction was not bonafide.

21. Thus, in our view, the contention of the Revenue that the transaction as presently

structured has been done only for the purposes of avoiding tax and as an alternative

to sale of shares by shareholders of Copal-Jersey (which would not be as tax

friendly) is not sustainable as the transaction structured in the manner as suggested

by the Revenue i.e. sale of shares of Copal-Jersey alone, would not achieve the same

commercial results and thus, could not be considered as a real transaction which has

been structured differently to avoid an incidence of tax.

22. In view of our conclusion that the commercial transaction as structured could not

be structured at the Jersey level and the sale of shares of Exevo-US and CRIL at

Mauritius level cannot be stated to be without any commercial reason but only to

avoid tax, it is not necessary to examine whether the gains arising in the hands of the

Copal Group Shareholders from sale of shares of Copal-Jersey would be exigible to

tax assuming that the shares of Exevo-US and CRIL had not been transacted at the

Mauritius level.

23. However, as the edifice of the arguments advanced by the Revenue is based on

the substratal assumption that the gains arising from sale of shares of Copal-Jersey

would be subject to tax, if shares of Exevo-US and CRIL had not been sold by CRL

and CMRL, we consider it appropriate to consider the this contention.

24. In our view, the aforesaid contention of the Revenue also cannot be accepted for

the reason that even if the sale of shares by the Copal Group Shareholders to Moody-

04-04-2019 (Page 12 of 18) www.manupatra.com Phoenix Legal

UK has been structured in the manner as suggested by the Revenue, there would be

no incidence of tax. According to the Revenue, the real transaction is sale of shares

by shareholders of Copal- Jersey to Moody-UK. This would mean that shareholders

holding 67% of the equity in Copal-Jersey namely the Copal Group Shareholders

would transfer their shares to Moody-UK without there being any sale of shares by

CRL and CMRL of their equity holdings in CRIL and Exevo-US respectively.

25. The consideration payable by Moody-UK to Copal Group Shareholders for their

67% shareholding was agreed as USD 93,509,220. This consideration obviously does

not include the fixed value of the shares of CRIL or Exevo-India as 100% economic

interest of those companies was acquired by the Moody Group one day prior to the

sale and purchase of shares of Copal-Jersey and the fixed consideration thereof had

been distributed as dividends. If the sale and purchase transactions under SPA-I and

SPA-II had not been executed and only 67% shares of Copal-Jersey would have been

acquired by Moody-UK then the value of the Copal- Jersey shares would also include

the value of shares of CRIL and Exevo- US. In other words, 67% of USD 42,582,740

(being the aggregate of the fixed consideration payable for the shares of CRIL and

Exevo-US), would represent the value of shares of Copal-Jersey held by Copal Group

Shareholders, which was derived from assets situated in India. Thus, while the value

of the said shares derived from assets situated outside India was USD 93,509,220,

the value of Sale Shares derived from assets situated in India would be USD

28,530,435.8 (67% of the fixed consideration). The Earn-Out consideration payable

is ignored as the same was contemplated to be paid after sale of Copal-Jersey shares

and, thus, would not add to the value of the said shares.

26. It is apparent from the above that only a fraction of the value of shares of Copal-

Jersey was derived indirectly from the value of the shares of CRIL and Exevo-India.

The question, thus, arises is whether the sale of shares of an overseas company

which derives only a minor part of its value from the assets located in India could be

deemed to be situated in India by virtue of Explanation 5 to Section 9(1)(i) of the

Act. This question can be answered by reference to the express language of Section

9(1)(i) of the Act as well as by applying the principle that income sought to be taxed

under the Act must have a territorial nexus with India. By virtue of Section 9(1)(i) of

the Act all income arising from transfer of a capital asset situated in India would be

deemed to accrue or arise in India and would thus be exigible to tax under the Act. A

share of a company incorporated outside India is not an asset which is situated in

India and, but for Explanation 5 to Section 9(1)(i) of the Act, the gains arising out of

any transaction of sale and purchase of a share of an overseas company between

non-residents would not be taxable in India. This would be true even if the entire

value of the shares of an overseas company was derived from the value of assets

situated in India. This issue arose in the case of Vodafone International Holdings BV

v. Union of India and Anr.: MANU/SC/0051/2012 : (2012) 6 SCC 613 and the

Supreme Court held that the transaction of sale and purchase of a share of an

overseas company between two non-residents would fall outside the ambit of Section

9(1)(i) of the Act. Subsequently, Section 9(1) was amended by virtue of Finance Act,

2012 by introduction of Explanations 4 & 5 to Section 9(1)(i) of the Act, which read

as under:-

"Explanation 4.--For the removal of doubts, it is hereby clarified that the

expression "through" shall mean and include and shall be deemed to have

always meant and included "by means of", "in consequence of" or "by reason

of".

04-04-2019 (Page 13 of 18) www.manupatra.com Phoenix Legal

Explanation 5.--For the removal of doubts, it is hereby clarified that an asset

or a capital asset being any share or interest in a company or entity

registered or incorporated outside India shall be deemed to be and shall

always be deemed to have been situated in India, if the share or interest

derives, directly or indirectly, its value substantially from the assets located

in India;"

27. The notes to clauses explained the introduction of the Explanations 4 and 5 to

Section 9(1)(i) of the Act as being clarificatory. A plain reading of Explanation 5 also

indicates that the given reason for its introduction was for removal of any doubts. In

other words, the language of the said legislative amendment suggests that it was

always the intention of the legislature that an asset which derives its value from

assets in India should be considered as one which is situated in India. The clear

object of Section 9(1)(i) of the Act is inter alia to cast the net of tax also on income

which arises from transfer of assets in India irrespective of the residential status of

the recipient of the income. Since the assets are situated in India, the entire income

arising from their transfer could be said to arise in India. Explanation 5 introduced a

legal fiction for the limited purpose of imputing that assets which substantially derive

their value from assets situated in India would also be deemed to be situated in

India.

28. It is trite law that a legal fiction must be restricted to the purpose for which it

was enacted. The object of Explanation 5 was not to extend the scope of Section 9(1)

(i) of the Act to income, which had no territorial nexus with India, but to tax income

that had a nexus with India, irrespective of whether the same was reflected in a sale

of an asset situated outside India. Viewed from this standpoint there would be no

justification to read Explanation 5 to provide recourse to section 9(1)(i) for taxing

income which arises from transfer of assets overseas and which do not derive bulk of

their value from assets in India. In this view, the expression "substantially" occurring

in Explanation 5 would necessarily have to be read as synonymous to " principally",

"mainly" or at least "majority". Explanation 5 having been stated to be clarificatory

must be read restrictively and at best to cover situations where in substance the

assets in India are transacted by transacting in shares of overseas holding companies

and not to transactions where assets situated overseas are transacted which also

derive some value on account of assets situated in India. In our view, there can be

no recourse to Explanation 5 to enlarge the scope of Section 9(1) of the Act so as to

cast the net of tax on gains or income that may arise from transfer of an asset

situated outside India, which derives bulk of its value from assets outside India.

29. It is also relevant to refer to the draft report submitted by the expert committee

appointed by the Prime Minister in 2012 to report on the retrospective amendment

relating to indirect transfer of assets (Shome Committee). The said Committee had,

in its draft report, considered the import of the expression 'substantially' as used in

Explanation 5 to Section 9(1)(i) of the Act. The Committee considered the

submissions of stakeholders that the expression 'substantially' did not have any fixed

meaning and was vague. After analysis, the Committee noted that it was necessary to

pin down a definition of the said expression and for that purpose, there were no

reason to depart from the Direct Tax Code Bill, 2010 (DTC) that had been put in the

public domain. Under the DTC, gains from the sale of assets situated overseas, which

derived more than 50% of their value from assets situated in India, were liable to be

taxed in India. The Shome Committee in its draft report recommended as under:-

"The word "substantially" used in Explanation 5 should be defined as a

04-04-2019 (Page 14 of 18) www.manupatra.com Phoenix Legal

threshold of 50 per cent of the total value derived from assets of the

company or entity. In other words, a capital asset being any share or interest

in a company or entity registered or incorporated outside India shall be

deemed to be situated in India, if the share or interest derives, directly or

indirectly, its value from the assets located in India being more than 50% of

the global assets of such company or entity. This has been explained through

the above illustration."

30. In addition to the above, the 'United Nations Model Double Taxation Convention

between Developed and Developing Countries' and the 'OECD Model Tax Convention

on Income and on Capital' may also be referred to since the said conventions deal

with a regime whereunder the right to tax capital gains can be fairly and reasonably

apportioned between contracting States. Since the models propose a regime which is

generally accepted in respect of indirect transfers, the same, although not binding on

Indian authorities, would certainly have a persuasive value in interpreting the

expression 'substantially' in a reasonable manner and in its contextual perspective.

The 'United Nations Model Double Taxation Convention between Developed and

Developing Countries' and the 'OECD Model Tax Convention on Income and on

Capital' provide that the taxation rights in case of sale of shares are ceded to the

country where the underlying assets are situated only if more than 50% of the value

of such shares is derived from such property.

3 1 . Paragraph (4) of Article 13 of the United Nations Model Double Taxation

Convention between Developed and Developing Countries provides that a Contracting

State is allowed to tax a gain on alienation of shares of a company or on alienation of

interests in other entities the property of which consists principally of immovable

property situated in that State. For this purpose, the term 'principally' in relation to

the ownership of an immovable property means the value of such immovable

property exceeding 50 per cent of the aggregate value of all assets owned by such

company, partnership, trust or estate. It is also relevant to note that India has signed

a treaty with Korea incorporating this clause. The relevant portion of Article 13 of the

said UN Convention is quoted below:-

"Article 13

CAPITAL GAINS

xxxx xxxx xxxx xxxx

4. Gains from the alienation of shares of the capital stock of a company, or

of an interest in a partnership, trust or estate, the property of which consists

directly or indirectly principally of immovable property situated in a

Contracting State may be taxed in that State. In particular:

(1) Nothing contained in this paragraph shall apply to a company,

partnership, trust or estate, other than a company, partnership, trust

o r estate engaged in the business of management of immovable

properties, the property of which consists directly or indirectly

principally of immovable property used by such company,

partnership, trust or estate in its business activities.

(2) For the purposes of this paragraph, "principally" in relation to

ownership of immovable property means the value of such

immovable property exceeding 50 per cent of the aggregate value of

04-04-2019 (Page 15 of 18) www.manupatra.com Phoenix Legal

all assets owned by the company, partnership, trust or estate."

32. The 'OECD Model Tax Convention on Income and on Capital' provides a meansof

settling on a uniform basis the most common problems that arise in the field of

international juridical double taxation. Article 13 of the said Convention deals with

the taxes on capital gains. Article 13(1) provides that the gains derived by a resident

of a Contracting State from the alienation of immovable property situated in another

Contracting State may be taxed in that other State. Article 13(4) of the said

Convention provides that the 'gains derived by a resident of a Contracting State from

the alienation of shares or comparable interests deriving more than 50 per cent of

their value directly or indirectly from immovable property situated in the other

Contracting State may be taxed in that other State.'

3 3 . In view of the above, gains arising from sale of a share of a company

incorporated overseas, which derives less than 50% of its value from assets situated

in India would certainly not be taxable under section 9(1)(i) of the Act read with

Explanation 5 thereto.

3 4 . Thus, in the present case, even if the transaction had been structured in the

manner as suggested on behalf of the Revenue, the gains arising to the shareholders

of Copal-Jersey from sale of their shares in Copal-Jersey to Moody UK would not be

taxable under Section 9(1)(i) of the Act, as their value could not be stated to be

derived substantially from assets in India. In this view, the contention of the Revenue

that the entire transaction of sale of Copal-Jersey shares has been structured in a

manner so as to include the sale of shares in CRIL and Exevo-US by the Mauritian

companies only to avoid the incidence of tax and take benefit of the DTAA is ex facie

flawed.

35. The learned counsel for the Revenue has contended that the entire structure of

investments to hold the companies in India had been evolved only with the object of

avoiding tax and intermediary companies in Mauritius had been incorporated only

with a view to avoid tax in the event of a future sale. In our view, this contention is

also devoid of any merit. The investment structure evolved over a period of time and

it also cannot be ignored that 92% of the share capital of the CRIL was subscribed by

CRL.

36. It has been contended on behalf of the Revenue that Rishi Khosla is the prime

mover of the Copal Group. It is stated that he alongwith one Jeol Perlman left their

earlier employment and promoted Copal-Jersey and are in de facto control and

management of the entire Copal Group. It is contended that other

companies/subsidiaries of the Copal Group are only shell companies. It is further

alleged that CRL and CMRL are not operative since their revenues are generated from

within the Copal Group. It is, therefore, urged that since Rishi Khosla is a resident of

the United Kingdom, the situs of CRL and CMRL ought to be taken as United Kingdom

- from where the affairs of the Copal Group, including CRL and CMRL are alleged to

be conducted - and not Mauritius. The learned counsel for the Revenue had submitted

that Rishi Khosla had also varied the terms of the transactions. According to him, the

same indicated that management of the companies was synonymous with Rishi

Khosla.

37. The learned counsel for the respondents contested these contentions urged by

the petitioner. It was stated that the companies were managed by their respective

Board of Directors. It is also disputed that CRL and CMRL were not operative

04-04-2019 (Page 16 of 18) www.manupatra.com Phoenix Legal

companies. It is stated that both CRL and CMRL held category-I Global Business

Licenses (GBL) w.e.f. 18.03.2004 and 03.04.2008 respectively. CRL received

substantial revenues from provision of services relating to business of financial

research and CMRL also received revenues from provision of services relating to

business of market research. The financial statements of both the said companies

indicated that the companies had received substantial revenues. The respondent also

disputed the contentions that CRL and CMRL were shell companies and asserted that

the said companies were companies with substance. In the alternative, it was

submitted that the India-Mauritius Double Taxation Avoidance Agreement did not

include a Limitation of Benefits (LOB) clause and thus, it was not open for the

revenue to contend that the said companies should be denied the treaty benefit with

India.

38. In our view, the CRL and CMRL cannot be stated to be shell companies so as to

ignore their corporate identities. Even according to the revenue, the companies are

generating revenue from intra-group services. The fact that a company may render

services to its related enterprise would not render the company to be non-existent or

give reasons for lifting its corporate veil. The financial statements placed on record

indicate that CRL and CMRL have been generating revenues and we also have no

reason to doubt the statement that CRL and CMRL have been providing services in

relation to business of financial research and market research respectively.

39. The next issue that needs to be addressed is whether CRL and CMRL should be

considered as residents of UK on account of the alleged role of Rishi Khosla in its

affairs. Undoubtedly, Rishi Khosla has a vital role to play in the affairs of the Copal

Group. The respondents have placed on record the Business Advisory Agreement

entered into with Rishi Khosla, which defines his role as an advisor. The 'Earn-Out'

consideration payable is also based on a formula which is to be applied with

reference to a "computation date" which is defined to mean the date when Rishi

Khosla is disentitled to act as a Director. This also indicates that the role of Rishi

Khosla in the affairs of the Copal Group would be significant and he cannot be stated

to be playing a role of a mere agent employed for concluding the transactions as

contemplated under various agreements (SPA-I, SPA-II and SPA-III). However, in our

opinion, this by itself would not be sufficient to assume CRL and CMRL to be tax

residents of United Kingdom. The AAR had considered this aspect and held that the

Revenue was unable to show that the effective management of the companies was

not where the Board of Directors of the companies situated. It was held that although

Rishi Khosla may have played a role larger than that of a normal agent but

circumstances did not warrant an inference that the control and management of the

companies vested with him and not with the respective Board of Directors. The

relevant findings of the AAR are as under:-

"11. Assuming that learned counsel for the Revenue is right in his

submission the decision in Vodafone has modified the ratio of the decision in

Azadi Bachao Andolan on the conclusiveness of a tax residency certificate, it

cannot be said that it has been shown that the effective management of the

companies is not from where their Board of Directors function. Normally, the

management of a company vests in its Board of Directors as authorized by

the General Body. The role of Rishi Khosla highlighted by the Revenue is in

respect of the sale transactions undertaken and in pushing them through. It

does not appear to be a role in connection with the running of the businesses

of the companies concerned. It is not shown that the management of the

companies in Mauritius in general, is not with a Board of Directors of those

04-04-2019 (Page 17 of 18) www.manupatra.com Phoenix Legal

companies sitting in Mauritius and that the management and control is from

United Kingdom of which Rishi Khosla is a resident. Even if one were to take

the Business Advisory Agreement relied on by the applicants with a pinch of

salt, it cannot be said that the role played by Rishi Khosla in these

transactions establish that the management and control of the Mauritian

companies is with Rishi Khosla. It is therefore not possible to accept the

contention of learned counsel for the Revenue that by applying the place of

management test, the seller companies could be held to be non-Mauritian

companies.

12. It was contended that Rishi Khosla has not acted in terms of the Board

Resolution relied on and that he had varied the terms of the transaction at

his pleasure and this demonstrates that he had dominion over the

companies. He had in fact acted beyond the authority conferred on him by

the resolution of the Board relied on. The Board Resolution was a sham put

forward to achieve the object of avoidance of tax. Though there may be some

substance in the argument that Rishi Khosla has not merely played the role

of a normal agent, the circumstances relied on are not sufficient to warrant

an inference that the control and management of the seller companies rested

with Rishi Khosla and not with the Board of these companies.

13. There may be some substance in the argument of the learned counsel

that this Authority has to consider only the negative, namely that the control

of the companies is not in Mauritius and it is not necessary for this Authority

to find positively that the control and management is with Rishi Khosla,

before coming to a conclusion that the applicants are not entitled to claim

the benefit of the India Mauritius DTAC. But on the available facts, the

presumption that the control and management of the companies rest with the

Board of Directors cannot be said to have been rebutted by sufficient or

cogent material. I overrule the arguments in this behalf."

40. We concur with the above quoted conclusion of the AAR. The material on record

is insufficient to conclude that the corporate structure of CRL and CMRL should be

ignored and the residence of Rishi Khosla be considered as the situs of the said

companies.

41. The writ petitions are, accordingly, dismissed. The parties are left to bear their

own costs.

* Related order: MANU/AR/0040/2012

© Manupatra Information Solutions Pvt. Ltd.

04-04-2019 (Page 18 of 18) www.manupatra.com Phoenix Legal

Das könnte Ihnen auch gefallen

- Status Note On Collective Investment Schemes - 1326177032722-ADokument225 SeitenStatus Note On Collective Investment Schemes - 1326177032722-AVivek Agrawal67% (3)

- Page 1 of 29Dokument29 SeitenPage 1 of 29vv222vvNoch keine Bewertungen

- Becton Dickinson Flyer 005 (Updated)Dokument7 SeitenBecton Dickinson Flyer 005 (Updated)Pulkit AgarwalNoch keine Bewertungen

- Ashish Kumar AFB 2011-13003Dokument26 SeitenAshish Kumar AFB 2011-13003Kumar BishalNoch keine Bewertungen

- ITAT Ruling Excludes Oman Investment from Section 14A DisallowanceDokument43 SeitenITAT Ruling Excludes Oman Investment from Section 14A DisallowanceTrisha MajumdarNoch keine Bewertungen

- 04 - Vodafone Case AnalysisDokument17 Seiten04 - Vodafone Case AnalysisSakthi NathanNoch keine Bewertungen

- Vodafone Case Analysis: Internal Assignment-2Dokument7 SeitenVodafone Case Analysis: Internal Assignment-2KK SinghNoch keine Bewertungen

- Vodafone CaseDokument125 SeitenVodafone CaseMridul CrystelleNoch keine Bewertungen

- Vodafone SummaryDokument4 SeitenVodafone SummaryAbhinav AggarwalNoch keine Bewertungen

- CS Executive Old Paper 3 Economic and Commercial Law SA V0.3Dokument25 SeitenCS Executive Old Paper 3 Economic and Commercial Law SA V0.3Raunak AgarwalNoch keine Bewertungen

- Trends in Mergers and Acquisitions in Past Five Years in Indian Corporate SectorDokument21 SeitenTrends in Mergers and Acquisitions in Past Five Years in Indian Corporate SectorsecondtononeNoch keine Bewertungen

- Vodafone Tax Saga: Group 4Dokument17 SeitenVodafone Tax Saga: Group 4Saharsh SaraogiNoch keine Bewertungen

- Management and Organization: Company OverviewDokument6 SeitenManagement and Organization: Company Overviewbanti022Noch keine Bewertungen

- Order in Respect of Mr. Abhijit RajanDokument13 SeitenOrder in Respect of Mr. Abhijit RajanShyam SunderNoch keine Bewertungen

- Instructions for legal knowledge questions and drafting practiceDokument5 SeitenInstructions for legal knowledge questions and drafting practiceInsiya MerchantNoch keine Bewertungen

- Taxguru - In-Vodafone Case AnalysisDokument22 SeitenTaxguru - In-Vodafone Case AnalysisGokul RaviNoch keine Bewertungen

- Taxability of offshore share transactionsDokument5 SeitenTaxability of offshore share transactionsNishit SaraiyaNoch keine Bewertungen

- Global Depository Receipts (GDR) / American Deposit Receipts (ADR) / Foreign Currency Convertible Bonds (FCCB)Dokument5 SeitenGlobal Depository Receipts (GDR) / American Deposit Receipts (ADR) / Foreign Currency Convertible Bonds (FCCB)Mayank AnandNoch keine Bewertungen

- Supreme Court rules in Vodafone caseDokument4 SeitenSupreme Court rules in Vodafone caseAlex FrancisNoch keine Bewertungen

- Mergers & Acquisitions: in 60 Jurisdictions WorldwideDokument8 SeitenMergers & Acquisitions: in 60 Jurisdictions WorldwideVivveck NayuduNoch keine Bewertungen

- Vodafone International Holdings B.V. vs. Union of India 1. About Hutchision Essar LimitedDokument6 SeitenVodafone International Holdings B.V. vs. Union of India 1. About Hutchision Essar LimitedasdfqwerasdNoch keine Bewertungen

- Richter Holding Ltd vs Revenue on Indirect Transfer TaxationDokument3 SeitenRichter Holding Ltd vs Revenue on Indirect Transfer TaxationUsman KhanNoch keine Bewertungen

- Vodafone International Holdings ... Vs Union of India & Anr On 20 January, 2012Dokument82 SeitenVodafone International Holdings ... Vs Union of India & Anr On 20 January, 2012silvernitrate1953Noch keine Bewertungen

- 19017comp Sugans Pe2 Accounting Cp9 4Dokument56 Seiten19017comp Sugans Pe2 Accounting Cp9 4Maaz KaziNoch keine Bewertungen

- Alpex Solar 123 Limited - GidDokument40 SeitenAlpex Solar 123 Limited - GidxvhotyNoch keine Bewertungen

- Kenton Meadows Company, Inc., A West Virginia Corporation, Kenton Meadows and Acel I. Meadows, Husband and Wife v. Commissioner of Internal Revenue, 766 F.2d 142, 4th Cir. (1985)Dokument5 SeitenKenton Meadows Company, Inc., A West Virginia Corporation, Kenton Meadows and Acel I. Meadows, Husband and Wife v. Commissioner of Internal Revenue, 766 F.2d 142, 4th Cir. (1985)Scribd Government DocsNoch keine Bewertungen

- Group01 - Sec CDokument15 SeitenGroup01 - Sec CAdarsh NethwewalaNoch keine Bewertungen

- Law of Tax Question PaperDokument8 SeitenLaw of Tax Question PaperAnkit MalhotraNoch keine Bewertungen

- CompiledDokument17 SeitenCompiledMeghna SinghNoch keine Bewertungen

- ADR, GDR norms relaxed for Indian firms to raise funds overseasDokument4 SeitenADR, GDR norms relaxed for Indian firms to raise funds overseasAmritMohantyNoch keine Bewertungen

- Mergers & Acquisitions: Regulatory ConsiderationsDokument64 SeitenMergers & Acquisitions: Regulatory ConsiderationsjenishaNoch keine Bewertungen

- BIR Ruling No. 377-19Dokument9 SeitenBIR Ruling No. 377-19keithNoch keine Bewertungen

- Reduction of Capital ExplainedDokument4 SeitenReduction of Capital ExplainedRoyal funNoch keine Bewertungen

- Question-1: Investment in Peppers CoDokument6 SeitenQuestion-1: Investment in Peppers CoFarman ShaikhNoch keine Bewertungen

- Regulatory Framework of M&ADokument5 SeitenRegulatory Framework of M&ARaghuramNoch keine Bewertungen

- Company Law II ProjectDokument21 SeitenCompany Law II ProjectBhawna JoshiNoch keine Bewertungen

- Ebook Corporate Partnership Estate and Gift Taxation 6Th Edition Pratt Solutions Manual Full Chapter PDFDokument29 SeitenEbook Corporate Partnership Estate and Gift Taxation 6Th Edition Pratt Solutions Manual Full Chapter PDFselenatanloj0xa100% (10)

- Corporate Partnership Estate and Gift Taxation 6th Edition Pratt Solutions ManualDokument21 SeitenCorporate Partnership Estate and Gift Taxation 6th Edition Pratt Solutions Manualtaylorhughesrfnaebgxyk100% (21)

- Reliance Industries Limited Rights Issue Abridged Letter of Offer PDFDokument12 SeitenReliance Industries Limited Rights Issue Abridged Letter of Offer PDFMayank AsthanaNoch keine Bewertungen

- Final Case Law Pack - Updated - FY 2023 v1Dokument14 SeitenFinal Case Law Pack - Updated - FY 2023 v12389551Noch keine Bewertungen

- Direct Taxes Case Laws by CA Durgesh SinghDokument28 SeitenDirect Taxes Case Laws by CA Durgesh Singhpriyamvatha_c50% (2)

- Conveyancing Rough Draft 2Dokument23 SeitenConveyancing Rough Draft 2Sylvia G.Noch keine Bewertungen

- Jet Airways Is An International Airline Which Was Founded by Naresh Goyal in The Year 1992 and Its Headquarter Is Situated in Delhi NCRDokument7 SeitenJet Airways Is An International Airline Which Was Founded by Naresh Goyal in The Year 1992 and Its Headquarter Is Situated in Delhi NCRanshulrao29Noch keine Bewertungen

- Foreign Investment Through GdrsDokument6 SeitenForeign Investment Through GdrsRadha Krishna BhimavarapuNoch keine Bewertungen

- Legal and Regulatory Frameworks For M&A in India: Domestic Mergers and AcquisitionsDokument5 SeitenLegal and Regulatory Frameworks For M&A in India: Domestic Mergers and AcquisitionsShivam TomarNoch keine Bewertungen

- Cross-Border Mergers and Acquisition and Related LawsDokument5 SeitenCross-Border Mergers and Acquisition and Related Lawsdevendra bankarNoch keine Bewertungen

- New Colonial Ice Co. v. Helvering, 292 U.S. 435 (1934)Dokument6 SeitenNew Colonial Ice Co. v. Helvering, 292 U.S. 435 (1934)Scribd Government DocsNoch keine Bewertungen

- 2 Heads of ChargeDokument32 Seiten2 Heads of Chargexiu yingNoch keine Bewertungen

- Difference between CE and RE testsDokument26 SeitenDifference between CE and RE testspriyaNoch keine Bewertungen

- Bombay High Court Rules On Taxability of Dividends Held In TrustDokument16 SeitenBombay High Court Rules On Taxability of Dividends Held In TrustRavi RanjanNoch keine Bewertungen

- U P & e S: B.a., Ll.b. (H .) eDokument5 SeitenU P & e S: B.a., Ll.b. (H .) ePintu RaoNoch keine Bewertungen

- Taxation aspects of the Vodafone Case/TITLEDokument110 SeitenTaxation aspects of the Vodafone Case/TITLEravichandranNoch keine Bewertungen

- Annual Report AnalysisDokument22 SeitenAnnual Report AnalysisshirishsakalleyNoch keine Bewertungen

- Double Tax Avoidance AgreementDokument20 SeitenDouble Tax Avoidance AgreementSuchismita PatiNoch keine Bewertungen

- Transfer Pricing CasesDokument6 SeitenTransfer Pricing CasesShreya SinghNoch keine Bewertungen

- DemergerDokument5 SeitenDemergerSunil SoniNoch keine Bewertungen

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyVon EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNoch keine Bewertungen

- Delhi Andrews Ganj Land Scam: A Comprehensive Guideline the True Story Behind Congress Government ScandalVon EverandDelhi Andrews Ganj Land Scam: A Comprehensive Guideline the True Story Behind Congress Government ScandalNoch keine Bewertungen

- Integral JudgmentDokument17 SeitenIntegral JudgmentnikhilspareekNoch keine Bewertungen

- Company Master DataDokument1 SeiteCompany Master DatanikhilspareekNoch keine Bewertungen

- Lu 3463Dokument5 SeitenLu 3463nikhilspareekNoch keine Bewertungen

- List of Israeli Companies Quoted On The Nasdaq - WikipediaDokument3 SeitenList of Israeli Companies Quoted On The Nasdaq - Wikipedianikhilspareek100% (1)

- Legal Research and Social ResearchDokument24 SeitenLegal Research and Social ResearchnikhilspareekNoch keine Bewertungen

- Bengali (Code No - 005) COURSE Structure Class - Ix (2020 - 21Dokument11 SeitenBengali (Code No - 005) COURSE Structure Class - Ix (2020 - 21Břîšťỹ ÃhmęđNoch keine Bewertungen

- KPUPDokument38 SeitenKPUPRoda ES Jimbert50% (2)

- Todo Matic PDFDokument12 SeitenTodo Matic PDFSharrife JNoch keine Bewertungen

- C4 ISRchapterDokument16 SeitenC4 ISRchapterSerkan KalaycıNoch keine Bewertungen

- How To Text A Girl - A Girls Chase Guide (Girls Chase Guides) (PDFDrive) - 31-61Dokument31 SeitenHow To Text A Girl - A Girls Chase Guide (Girls Chase Guides) (PDFDrive) - 31-61Myster HighNoch keine Bewertungen

- Tutorial 1 Discussion Document - Batch 03Dokument4 SeitenTutorial 1 Discussion Document - Batch 03Anindya CostaNoch keine Bewertungen

- Product Data Sheet For CP 680-P and CP 680-M Cast-In Firestop Devices Technical Information ASSET DOC LOC 1540966Dokument1 SeiteProduct Data Sheet For CP 680-P and CP 680-M Cast-In Firestop Devices Technical Information ASSET DOC LOC 1540966shama093Noch keine Bewertungen

- PEDs and InterferenceDokument28 SeitenPEDs and Interferencezakool21Noch keine Bewertungen

- Breaking NewsDokument149 SeitenBreaking NewstigerlightNoch keine Bewertungen

- Factors of Active Citizenship EducationDokument2 SeitenFactors of Active Citizenship EducationmauïNoch keine Bewertungen

- Beauty ProductDokument12 SeitenBeauty ProductSrishti SoniNoch keine Bewertungen

- Dermatology Study Guide 2023-IvDokument7 SeitenDermatology Study Guide 2023-IvUnknown ManNoch keine Bewertungen

- Shopping Mall: Computer Application - IiiDokument15 SeitenShopping Mall: Computer Application - IiiShadowdare VirkNoch keine Bewertungen

- Propoxur PMRADokument2 SeitenPropoxur PMRAuncleadolphNoch keine Bewertungen

- Consumers ' Usage and Adoption of E-Pharmacy in India: Mallika SrivastavaDokument16 SeitenConsumers ' Usage and Adoption of E-Pharmacy in India: Mallika SrivastavaSundaravel ElangovanNoch keine Bewertungen

- Key Fact Sheet (HBL FreedomAccount) - July 2019 PDFDokument1 SeiteKey Fact Sheet (HBL FreedomAccount) - July 2019 PDFBaD cHaUhDrYNoch keine Bewertungen

- Joining Instruction 4 Years 22 23Dokument11 SeitenJoining Instruction 4 Years 22 23Salmini ShamteNoch keine Bewertungen

- Hi-Line Sportsmen Banquet Is February 23rd: A Chip Off The Ol' Puck!Dokument8 SeitenHi-Line Sportsmen Banquet Is February 23rd: A Chip Off The Ol' Puck!BS Central, Inc. "The Buzz"Noch keine Bewertungen

- Alternate Tuning Guide: Bill SetharesDokument96 SeitenAlternate Tuning Guide: Bill SetharesPedro de CarvalhoNoch keine Bewertungen

- Dance Appreciation and CompositionDokument1 SeiteDance Appreciation and CompositionFretz Ael100% (1)

- Mrs. Universe PH - Empowering Women, Inspiring ChildrenDokument2 SeitenMrs. Universe PH - Empowering Women, Inspiring ChildrenKate PestanasNoch keine Bewertungen

- List of Reactive Chemicals - Guardian Environmental TechnologiesDokument69 SeitenList of Reactive Chemicals - Guardian Environmental TechnologiesGuardian Environmental TechnologiesNoch keine Bewertungen

- Staffing Process and Job AnalysisDokument8 SeitenStaffing Process and Job AnalysisRuben Rosendal De Asis100% (1)

- Command List-6Dokument3 SeitenCommand List-6Carlos ArbelaezNoch keine Bewertungen

- Audi Q5: First Generation (Typ 8R 2008-2017)Dokument19 SeitenAudi Q5: First Generation (Typ 8R 2008-2017)roberto100% (1)

- SEC QPP Coop TrainingDokument62 SeitenSEC QPP Coop TrainingAbdalelah BagajateNoch keine Bewertungen

- Worksheet 5 Communications and Privacy: Unit 6 CommunicationDokument3 SeitenWorksheet 5 Communications and Privacy: Unit 6 Communicationwh45w45hw54Noch keine Bewertungen

- LEARNING ACTIVITY Sheet Math 7 q3 M 1Dokument4 SeitenLEARNING ACTIVITY Sheet Math 7 q3 M 1Mariel PastoleroNoch keine Bewertungen

- Lecture NotesDokument6 SeitenLecture NotesRawlinsonNoch keine Bewertungen