Beruflich Dokumente

Kultur Dokumente

Indian Terrain Ltd. - Q2FY17 Result Update: Mixed Show CMP INR: 137 Target Price: 195

Hochgeladen von

Arjun Shanker GuptaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Indian Terrain Ltd. - Q2FY17 Result Update: Mixed Show CMP INR: 137 Target Price: 195

Hochgeladen von

Arjun Shanker GuptaCopyright:

Verfügbare Formate

Edel Invest Research BUY

Indian Terrain Ltd. – Q2FY17 Result Update

Mixed show CMP INR: 137 Target Price: 195

Kshitij Kaji After subdued growth of 13% in Q1FY17, Indian Terrain’s topline grew 30% (highest in the industry) as the

Research Analyst demand environment improved in Q2FY17. However margins came in slightly lower and below our

+91-22-4019 4736 estimates. Key highlights were: (i) Revenue grew at 30% to INR 124 Cr in Q2FY17 which was significantly

kshitij.kaji@edelweissfin.com higher than our estimates of a 20% growth. (ii) EBITDA at INR 15cr grew ~27% y-o-y and was slightly

below estimates of INR 15 Cr. EBITDA margins declined from 12.5% to 12.3% and below our expectations

of 14%. (iii) PBT of INR 13cr (up 10% y-o-y) was also below our estimate of INR 15cr due to lower other

income and higher finance and depreciation costs. (iv) PAT at INR 8 Cr degrew ~29% as the company

became fully taxpaying. With its asset light approach, prudent positioning in the lucrative men’s smart

casual wear and Friday Dressing office wear category, its expansion in boys wear, jeans and footwear,

Bloomberg: ITFL:IN Indian Terrain remains an attractive play. We re-iterate “BUY” with a TP of 195.

52-week range (INR): 185 / 102 Working Capital improves; Short term growth trajectory uncertain

Indian Terrain has improved its working capital cycle in this quarter as cash conversion cycle came in at 108

Share in issue (Crs): 3.7

days in Q2FY17 as against 117 days in Q2FY16 mainly due to improvement in debtor days. In 2 of the last 3

M cap (INR crs): 506 quarters, Indian Terrain has surpassed industry growth by a large margin and has done this while improving

their gross margins and keeping their EBITDA margins intact. The recent crackdown on black money has

Avg. Daily Vol. BSE/NSE :(‘000): 4

created a lot of uncertainty regarding the impact on consumer discretionary stocks. We believe that the

impact on smaller ticket items such as apparel is not going to be severe as transactions have moved online

and to LFOs (non cash transactions). However the impact will have to be monitored over time and growth

SHARE HOLDING PATTERN (%) could marginally suffer in the short term.

New product categories, store openings and strong distribution network to spur long term growth

Indian Terrain continued its store expansion plans and entry into new categories by launching their

Promoter, footwear category (largely under penetrated category). The new boyswear category has also seen good

29.7

traction and should aid growth as it is launched in more EBOs and LFOs. This will help the management

achieve higher throughput from each store which will aid in increasing the operating leverage. We believe

that the superior volume growth would be led by growth across all channels – EBOs, LFOs, MBOs and online

Public, 70.3

sales as the company sharpens its distribution footprint.

Outlook and valuations: Attractive; Re-iterate – BUY

Indian Terrain’s positioning in the lucrative men’s smart casual wear and Friday Dressing office wear

category, along with its expansion into boys wear and footwear will ensure robust future revenue growth.

Its asset light model and presence in the uncluttered non-metro cities are positives. The stock currently

trades at 16x FY17E and 13x FY18E EPS of INR 9 and INR 11, respectively. PAT growth will be subdued this

year as it moves to a full taxpaying company (33% plus tax rate vs 20% MAT rates). However one can

expect Indian Terrain to continue its current growth trajectory at the PBT level.

170

150 Financials

130

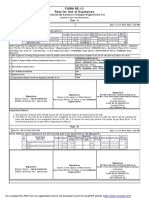

Year to March (INR Cr) Q2FY17 Q2FY16 % change Q1FY17 % change FY16 FY17E FY18E

110

Income from operations 124 96 30% 63 96% 325 390 468

90

70

Growth % 20% 20%

50 Total operating expenses 109 84 30% 57 91% 284 336 403

Nov-15

Jul-16

Jul-15

Sep-16

Sep-15

Mar-15

Mar-16

Jan-15

Jan-16

May-15

May-16

EBITDA 15 12 27% 6 140% 41 54 65

Adjusted net profit 8 12 -29% 3 150% 33 33 39

Indian Terrain Sensex

Growth % 0% 19%

Diluted P/E (x) 15.8 15.8 13.3

RoACE (%) 19.6 20.4 21.0

th EV/EBITDA (x) 11.7 8.9 7.4

Date: 16 November, 2016

1 Edel Invest Research

Indian Terrain Ltd.

Q2FY17 Result

Highlights

(INR Cr) Q2FY17 Q2FY16 %Change Q1FY17 %Change H1FY17 H1FY16 %Change

Net Revenues 124 96 30% 63 96% 188 152 24%

Operating Expenses 109 84 30% 57 91% 166 134 24%

EBITDA 15 12 27% 6 140% 22 18 22%

Depreciation 1 0 294% 0 200% 2 1 109%

EBIT 14 12 19% 6 136% 20 17 17%

Interest expenses 2 1 97% 2 13% 4 3 64%

Other income 1 1 -4% 1 2% 3 3 -1%

PBT 13 12 9% 5 150% 18 17 7%

Provision for tax 5 0 NA 2 152% 6 0 NA

PAT Before Minority & Associate Share 8 12 -29% 3 150% 12 17 -30%

Share of Associates 0 0 NA 0 NA 0 0 NA

Reported PAT 8 12 -29% 3 150% 12 17 -30%

Equity Capital 7 7 7 7 7

No of Shares 4 4 4 4 4

EPS 2.3 3.3 0.9 3.2 4.7

EBITDA Margin 12% 13% 10% 12% 12%

PAT Margin 7% 12% 5% 6% 11%

Tax Rate 35% 0% 35% 35% 0%

2 Edel Invest Research

Indian Terrain Ltd.

About the Company

Indian Terrain is a renowned branded apparel retailer in India. Its apparel brand in the men’s Smart Casual

category sells under the brand ‘Indian Terrain’. Indian Terrain was incorporated on 29th September, 2009 as

a subsidiary of Celebrity Fashions Ltd. In 2000, it was set up as a division of Celebrity Fashions. In September

2010, the Indian Terrain division of Celebrity Fashions was demerged into the company on a going concern

basis with effect from 1st April, 2010. Indian Terrain’s shares got listed in March 2011. Currently, the brand

offers a product range comprising shirts, trousers, knits, jackets and sweaters.

Investment Theme

Unique positioning in the Men’s Wear category

The Indian branded apparel market has evolved over the years due to the country’s favourable

demographics, high disposable income and growing brand awareness. Indian Terrain has positioned itself as

a contemporary Smart Men’s Casualwear brand. Indian Terrain’s Smart Casuals are uniquely positioned,

targetting the working class in the age group of 25-44 years, who are brand and fashion conscious. The

brand stands for ‘masculine’ sensibility, yet conforms to the popular ‘Friday Dressing’ concept. In spite of

competition from other well-known brands in this category, Indian Terrain has managed to differentiate

itself with contemporary designs and superior product quality. This reflects in its revenue growth, which has

grown at a CAGR of 24% over FY11-FY15 from INR 121 cr to INR 290 cr. Going forward, we expect revenues

to grow at 15% CAGR over FY16-18E.

Revenue growth led by strong distribution network, focused approach on branding

Indian Terrain has established a pan-India distribution network spread across 200 cities and ~1000 touch

points through varied distribution channels. Its strong distribution network comprises EBOs, MBOs as well as

LFOs. It has focused on expanding into Tier 2 and Tier 3 cities with long-term growth in mind. The company

has consciously followed the Hub & Spoke model for expansion, which enables it to enhance its penetration

in a specific region before growing further. Going ahead, the company plans to expand EBOs to 200 (110

EBOs currently), mostly through the franchisee route, which in turn will aid revenues, besides improving the

return ratios.

Asset Light Model – a key to success

Indian Terrain has an efficient procurement team in place, which follows an outsourcing model for

manufacturing its products. 25% of the company’s woven outsourcing requirement is met by Celebrity

Fashions while other suppliers make up for the rest. This outsourced model results in high RoCEs of +20%.

Indian Terrain was demerged from Celebrity Fashions in 2010. Celebrity Fashions was set up in 1988, and

has more than two decades of experience in designing and manufacturing branded apparels. Celebrity

Fashions is one of India’s leading garment exporters. It has manufacturing capabilities in both men’s wear as

well as women’s wear, with a product portfolio of shirts, trousers, shorts, jackets and dresses, among

others. Celebrity Fashions has been making apparels for large international labels like Timberland,

Northface, LL Bean, Marks & Spencers and Vans.

3 Edel Invest Research

Indian Terrain Ltd.

Key Risks

Increase competition:

Many MNC apparel brands as well as several domestic apparel players have begun focusing on the Smart

Casuals segment within men’s wear. Any increase in competition from these players would pose a threat.

Outsourcing of Manufacturing:

Around 25% of woven manufacturing is from Celebrity Fashions. Such high exposure to one vendor poses a

key risk.

Semi-Urban slowdown:

As target consumers are from Tier 1, Tier 2 and Tier 3 cities, any material economic slowdown in the these

areas could result in lower discretionary spending which would impact sales growth.

Key Personnel Risk:

Indian Terrain has done well since its inception under the guidance of its current CEO, Charath Narsimhan.

Going forward, his expertise and experience will be crucial.

4 Edel Invest Research

Indian Terrain Ltd.

Financials Financial Statements (INR Cr)

Year to March FY14 FY15 FY16 FY17E FY18E

Net revenue 232 290 325 390 468

Ma teri a l s cos ts 118 149 159 189 227

Gros s profi t 114 142 166 201 241

Other expens es 78 95 109 129 154

Empl oyee cos ts 11 13 17 18 22

EBITDA 24 34 41 54 65

Depreci a tion & Amortiza tion 2 3 2 5 5

EBIT 22 31 39 50 60

Other i ncome 0 1 5 5 4

EBIT i ncl . other i ncome 22 31 44 54 64

Interes t expens es 10 9 7 5 6

Profi t before tax 13 23 37 49 58

Provi s i on for tax 3 5 4 16 19

Adjus ted Profi t 10 18 33 33 39

Ba s i c s ha res outs tandi ng (Cr) 3 4 4 4 4

EPS (INR) 3.5 5.0 8.9 8.8 10.5

Di vi dend per s ha re (INR) 0.0 0.0 0.0 0.0 0.0

Di vi dend pa yout (%) 0% 0% 0% 0% 0%

Common size metrics ‐ as % of net revenues

Year to March FY14 FY15 FY16 FY17E FY18E

COGS 51.0% 51.2% 48.8% 48.5% 48.5%

Di s tri bution & Sel l i ng Exp 33.8% 32.7% 33.5% 33.0% 33.0%

Empl oyee Exp 4.8% 4.6% 5.1% 4.6% 4.6%

G&A Exp 0.0% 0.0% 0.0% 0.0% 0.0%

Depreci a tion 1.1% 1.0% 0.7% 1.2% 1.0%

EBITDA ma rgi ns 10.4% 11.5% 12.7% 13.9% 13.9%

EBIT ma rgi ns 9.4% 10.5% 11.9% 12.7% 12.9%

Adj profi t ma rgi ns 4.2% 6.2% 10.2% 8.5% 8.3%

Net profi t ma rgi ns 4.3% 6.2% 10.2% 8.5% 8.3%

Growth ratios (%)

Year to March FY14 FY15 FY16 FY17E FY18E

Revenues 48.1% 25.1% 11.9% 20.0% 20.0%

EBITDA 59.3% 38.3% 22.7% 31.8% 20.0%

PBT 162.0% 81.3% 62.6% 32.9% 18.6%

Adj profi t 162.5% 82.7% 83.8% -0.3% 18.6%

Net profi t 141.6% 81.1% 83.8% -0.3% 18.6%

5 Edel Invest Research

Indian Terrain Ltd.

Balance sheet (INR Cr)

As on 31st March FY14 FY15 FY16 FY17E FY18E

Equi ty ca pi ta l 6 7 7 7 7

Res erves & s urpl us 30 119 152 185 224

Borrowi ngs 56 39 51 58 63

Other l ong-term l i a bi l i ti es 5 8 12 14 15

Sources of funds 98 174 223 265 310

Gros s Bl ock 10 9 31 31 31

Accumul a ted Depreci a ti on (2) (2) (5) (10) (14)

CWIP - - - - -

Net Fi xed As s ets 8 7 26 21 17

Net i nta ngi bl e a s s ets - - - - -

Inves tments - 59 - - -

Inventori es 43 36 45 55 64

Sundry debtors 77 96 117 118 141

Ca s h a nd equi va l ents 3 2 70 101 123

Loa ns a nd a dva nces 1 2 2 3 4

Tota l current a s s ets 124 136 235 276 331

Sundry credi tors a nd others 37 31 52 49 59

Provi s i ons 6 11 1 1 1

Tota l current l i a bi l i ti es & provi s i ons 43 42 52 50 60

Net current a s s ets 81 94 183 226 271

Deferred ta x a s s ets - - - - -

Other l ong-term a s s ets 9 14 14 18 22

Uses of funds 98 174 223 265 310

Book va l ue per s ha re (INR) 12.7 35.2 42.9 51.7 62.3

Free cash flow

Year to March FY14 FY15 FY16 FY17E FY18E

Net profi t 9.9 18.0 33.0 33.0 39.1

Add : Depreci a ti on -0.1 0.5 2.3 4.6 4.6

Others 11.4 9.1 1.8 0.4 2.1

Gros s ca s h fl ow 21.2 27.6 37.2 38.0 45.8

Cha nges i n WC -7.4 -16.9 -20.7 -12.8 -23.7

Opera ti ng ca s h fl ow 13.9 10.7 16.5 25.2 22.1

Ca pex 0.5 0.7 22.0 - -

Free ca s h fl ow 14.4 11.4 38.5 25.2 22.1

Cash flow metrics

Year to March FY14 FY15 FY16 FY17E FY18E

Ca s h fl ow from opera ti ons 13.9 10.7 16.5 25.2 22.1

Ca s h Fl ow from i nves ti ng a cti vi ti es 0.7 -58.3 -16.9 4.5 4.0

Ca s h Fl ow from fi na nci ng a cti vi ti es -14.4 47.3 5.3 2.0 -1.1

Ca pex 0.5 0.7 -22.0 - -

Di vi dends - - - - -

6 Edel Invest Research

Indian Terrain Ltd.

Profitability & efficiency ratios

Year to March FY14 FY15 FY16 FY17E FY18E

ROAE (%) 32% 22% 23% 19% 18%

ROACE (%) 23% 23% 20% 20% 21%

ROIC (%) 21% 27% 31% 22% 25%

Inventory da y 133 88 104 106 103

Debtors da ys 121 120 132 110 110

Pa ya bl e da ys 115 76 119 95 95

Ca s h convers i on cycl e (da ys ) 123 115 126 117 116

Current ra tio 2.8 3.2 3.2 3.5 3.5

Debt/Equi ty 1.6 0.3 0.3 0.3 0.3

Core ROACE (%) 23% 30% 29% 31% 34%

Operating ratios

Year to March FY14 FY15 FY16 FY17E FY18E

Total a s s et turnover 2.4 2.1 1.6 1.6 1.6

Fi xed a s s et turnover 23.2 31.3 16.4 12.7 15.2

Equi ty turnover 7.5 3.6 2.3 2.2 2.2

Du pont analysis

Year to March FY14 FY15 FY16 FY17E FY18E

NP ma rgi n (%) 4.2% 6.2% 10.2% 8.5% 8.3%

Total a s s ets turnover 2.4 2.1 1.6 1.6 1.6

Levera ge mul tipl i er 3.1 1.7 1.4 1.4 1.4

ROAE (%) 31.8% 22.1% 23.1% 18.7% 18.4%

Valuation parameters

Year to March FY14 FY15 FY16 FY17E FY18E

Di l uted EPS (INR) 3.5 5.0 8.9 8.8 10.5

Y‐o‐Y growth (%) 158.8 44.6 77.3 -0.3 18.7

Di l uted PE (x) 40.5 28.0 15.8 15.8 13.3

Pri ce/BV (x) 11.0 4.0 3.3 2.7 2.2

EV/Sa l es (x) 2.1 1.7 1.5 1.2 1.0

EV/EBITDA (x) 19.9 14.4 11.7 8.9 7.4

Di vi dend yi el d (%) 0.0 0.0 0.0 0.0 0.0

7 Edel Invest Research

Edelweiss Broking Limited, 1st Floor, Tower 3, Wing B, Kohinoor City Mall, Kohinoor City, Kirol Road, Kurla(W)

Board: (91-22) 4272 2200

Vinay Khattar

Head Research

vinay.khattar@edelweissfin.com

Rating Expected to

Buy appreciate more than 15% over a 12-month period

Hold appreciate between 5-15% over a 12-month period

Reduce Return below 5% over a 12-month period

Indian Terrain 5 years price chart

200

180

160

140

120

100

80

60

40

20

0

Apr-12

Apr-13

Apr-14

Apr-15

Apr-16

Jul-12

Jul-13

Jul-14

Jul-15

Jul-16

Jan-12

Jan-13

Jan-14

Jan-15

Jan-16

Oct-12

Oct-13

Oct-14

Oct-15

Oct-16

8 Edel Invest Research

Disclaimer

Edelweiss Broking Limited (“EBL” or “Research Entity”) is regulated by the Securities and Exchange Board of India (“SEBI”) and is licensed to carry on the business of broking, depository services and related activities. The business of EBL and its

Associates (list available on www.edelweissfin.com) are organized around five broad business groups – Credit including Housing and SME Finance, Commodities, Financial Markets, Asset Management and Life Insurance.

Broking services offered by Edelweiss Broking Limited under SEBI Registration No.: INZ000005231; Name of the Compliance Officer: Mr. Dhirendra Rautela, Email ID: complianceofficer.ebl@edelweissfin.com Corporate Office: Edelweiss House,

Off CST Road, Kalina, Mumbai - 400098; Tel. (022) 4009 4400/ 4088 5757/4088 6278

This Report has been prepared by Edelweiss Broking Limited in the capacity of a Research Analyst having SEBI Registration No.INH000000172 and distributed as per SEBI (Research Analysts) Regulations 2014. This report does not constitute an

offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The information contained herein is from publicly available data or other sources believed to be reliable. This report is

provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this report should make such

investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult his own advisors to determine

the merits and risks of such investment. The investment discussed or views expressed may not be suitable for all investors.

This information is strictly confidential and is being furnished to you solely for your information. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied,

in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject EBL and associates / group companies to any registration or licensing requirements within such jurisdiction. The distribution of this report in certain

jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. The information given in this report is as of the date of this report and there can be no assurance that future

results or events will be consistent with this information. This information is subject to change without any prior notice. EBL reserves the right to make modifications and alterations to this statement as may be required from time to time. EBL or

any of its associates / group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. EBL is committed to providing independent

and transparent recommendation to its clients. Neither EBL nor any of its associates, group companies, directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including

loss of revenue or lost profits that may arise from or in connection with the use of the information. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed

herein. Past performance is not necessarily a guide to future performance .The disclosures of interest statements incorporated in this report are provided solely to enhance the transparency and should not be treated as endorsement of the

views expressed in the report. The information provided in these reports remains, unless otherwise stated, the copyright of EBL. All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and copyright

of EBL and may not be used in any form or for any purpose whatsoever by any party without the express written permission of the copyright holders.

EBL shall not be liable for any delay or any other interruption which may occur in presenting the data due to any reason including network (Internet) reasons or snags in the system, break down of the system or any other equipment, server

breakdown, maintenance shutdown, breakdown of communication services or inability of the EBL to present the data. In no event shall EBL be liable for any damages, including without limitation direct or indirect, special, incidental, or

consequential damages, losses or expenses arising in connection with the data presented by the EBL through this report.

We offer our research services to clients as well as our prospects. Though this report is disseminated to all the customers simultaneously, not all customers may receive this report at the same time. We will not treat recipients as customers by

virtue of their receiving this report.

EBL and its associates, officer, directors, and employees, research analyst (including relatives) worldwide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company(ies), mentioned herein or (b)

be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the subject company/company(ies) discussed herein or act as advisor or

lender/borrower to such company(ies) or have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public

appearance. EBL may have proprietary long/short position in the above mentioned scrip(s) and therefore should be considered as interested. The views provided herein are general in nature and do not consider risk appetite or investment

objective of any particular investor; readers are requested to take independent professional advice before investing. This should not be construed as invitation or solicitation to do business with EBL.

EBL or its associates may have received compensation from the subject company in the past 12 months. EBL or its associates may have managed or co-managed public offering of securities for the subject company in the past 12 months. EBL or

its associates may have received compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months. EBL or its associates may have received any compensation for products or

services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. EBL or its associates have not received any compensation or other benefits from the Subject Company or third

party in connection with the research report. Research analyst or his/her relative or EBL’s associates may have financial interest in the subject company. EBL, its associates, research analyst and his/her relative may have other potential/material

conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance.

Participants in foreign exchange transactions may incur risks arising from several factors, including the following: ( i) exchange rates can be volatile and are subject to large fluctuations; ( ii) the value of currencies may be affected by numerous

market factors, including world and national economic, political and regulatory events, events in equity and debt markets and changes in interest rates; and (iii) currencies may be subject to devaluation or government imposed exchange

controls which could affect the value of the currency. Investors in securities such as ADRs and Currency Derivatives, whose values are affected by the currency of an underlying security, effectively assume currency risk.

Research analyst has served as an officer, director or employee of subject Company: No

EBL has financial interest in the subject companies: No

EBL’s Associates may have actual / beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report.

Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No

EBL has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No

Subject company may have been client during twelve months preceding the date of distribution of the research report.

There were no instances of non-compliance by EBL on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years.

A graph of daily closing prices of the securities is also available at www.nseindia.com

Analyst Certification:

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will

be, directly or indirectly related to specific recommendations or views expressed in this report.

Additional Disclaimer for U.S. Persons

Edelweiss is not a registered broker – dealer under the U.S. Securities Exchange Act of 1934, as amended (the“1934 act”) and under applicable state laws in the United States. In addition Edelweiss is not a registered investment adviser under

the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any

brokerage and investment services provided by Edelweiss, including the products and services described herein are not available to or intended for U.S. persons.

This report does not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services and/or shall not be considered as an advertisement tool. "U.S. Persons" are generally

defined as a natural person, residing in the United States or any entity organized or incorporated under the laws of the United States. US Citizens living abroad may also be deemed "US Persons" under certain rules.

Transactions in securities discussed in this research report should be effected through Edelweiss Financial Services Inc.

Additional Disclaimer for U.K. Persons

The contents of this research report have not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000 ("FSMA").

In the United Kingdom, this research report is being distributed only to and is directed only at (a) persons who have professional experience in matters relating to investments falling within Article 19(5) of the FSMA (Financial Promotion) Order

2005 (the “Order”); (b) persons falling within Article 49(2)(a) to (d) of the Order (including high net worth companies and unincorporated associations); and (c) any other persons to whom it may otherwise lawfully be communicated (all such

persons together being referred to as “relevant persons”).

This research report must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this research report relates is available only to relevant persons and will be engaged in only with

relevant persons. Any person who is not a relevant person should not act or rely on this research report or any of its contents. This research report must not be distributed, published, reproduced or disclosed (in whole or in part) by recipients to

any other person.

Additional Disclaimer for Canadian Persons

Edelweiss is not a registered adviser or dealer under applicable Canadian securities laws nor has it obtained an exemption from the adviser and/or dealer registration requirements under such law. Accordingly, any brokerage and investment

services provided by Edelweiss, including the products and services described herein, are not available to or intended for Canadian persons.

This research report and its respective contents do not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services.

Disclosures under the provisions of SEBI (Research Analysts) Regulations 2014 (Regulations)

Edelweiss Broking Limited ("EBL" or "Research Entity") is regulated by the Securities and Exchange Board of India ("SEBI") and is licensed to carry on the business of broking, depository services and related activities. The business of EBL and its

associates are organized around five broad business groups – Credit including Housing and SME Finance, Commodities, Financial Markets, Asset Management and Life Insurance. There were no instances of non-compliance by EBL on any matter

related to the capital markets, resulting in significant and material disciplinary action during the last three years. This research report has been prepared and distributed by Edelweiss Broking Limited ("Edelweiss") in the capacity of a Research

Analyst as per Regulation 22(1) of SEBI (Research Analysts) Regulations 2014 having SEBI Registration No.INH000000172.

9 Edel Invest Research

Das könnte Ihnen auch gefallen

- Pidilite Industries: Robust Recovery Margin Pressure AheadDokument15 SeitenPidilite Industries: Robust Recovery Margin Pressure AheadIS group 7Noch keine Bewertungen

- 5 30 2007 (Edelweiss) Page Industries-Initiatin - Edw01610Dokument9 Seiten5 30 2007 (Edelweiss) Page Industries-Initiatin - Edw01610api-3740729Noch keine Bewertungen

- Kalpataru Power - 1QFY20 Result - EdelDokument14 SeitenKalpataru Power - 1QFY20 Result - EdeldarshanmadeNoch keine Bewertungen

- Cyient: Services Guidance Revision Concerns Us Rating: AccumulateDokument7 SeitenCyient: Services Guidance Revision Concerns Us Rating: AccumulateADNoch keine Bewertungen

- Asian Paints JefferiesDokument12 SeitenAsian Paints JefferiesRajeev GargNoch keine Bewertungen

- State Ment of Cash FlowsDokument22 SeitenState Ment of Cash Flowslakshay chawlaNoch keine Bewertungen

- IndoStar Capital - Initiating Coverage - Centrum 30082018Dokument44 SeitenIndoStar Capital - Initiating Coverage - Centrum 30082018SiddharthNoch keine Bewertungen

- SobhaDokument21 SeitenSobhadigthreeNoch keine Bewertungen

- Diwalipicks 2020Dokument4 SeitenDiwalipicks 2020Vimal SharmaNoch keine Bewertungen

- Teamlease Services: IndiaDokument4 SeitenTeamlease Services: IndiaAshokNoch keine Bewertungen

- Kotak Daily 06.02.23 SBI BOB MnMFinDokument157 SeitenKotak Daily 06.02.23 SBI BOB MnMFinApoorva ParikhNoch keine Bewertungen

- Dish+TV Initiation Centrum 04042011Dokument16 SeitenDish+TV Initiation Centrum 04042011Raghu BharatNoch keine Bewertungen

- Dollar Industries - Result Update - Q1FY24Dokument5 SeitenDollar Industries - Result Update - Q1FY24SiddharthNoch keine Bewertungen

- HDFC AMC Initiation - 9april2019Dokument31 SeitenHDFC AMC Initiation - 9april2019Sunita ShrivastavaNoch keine Bewertungen

- Equity Research: India UpdateDokument20 SeitenEquity Research: India UpdateRavichandra BNoch keine Bewertungen

- Nirmal Bang 26th July 2018 IPO NoteDokument13 SeitenNirmal Bang 26th July 2018 IPO NoteNiruNoch keine Bewertungen

- Spanco Telesystems Initiating Cov - April 20 (1) .Dokument24 SeitenSpanco Telesystems Initiating Cov - April 20 (1) .KunalNoch keine Bewertungen

- Broking - Update - Mar19 - HDFC Sec-201903191711243793044Dokument16 SeitenBroking - Update - Mar19 - HDFC Sec-201903191711243793044Sanjay RijhwaniNoch keine Bewertungen

- Godrej Consumer: Investment Rationale IntactDokument24 SeitenGodrej Consumer: Investment Rationale IntactbradburywillsNoch keine Bewertungen

- Infinite Computer Solutions: Credible Transformation in PlayDokument14 SeitenInfinite Computer Solutions: Credible Transformation in Playrajesh palNoch keine Bewertungen

- Infosys Tech NomuraDokument15 SeitenInfosys Tech NomuraameyahardasNoch keine Bewertungen

- Infosys Investor Report Fundamental AnalysisDokument4 SeitenInfosys Investor Report Fundamental AnalysisVASANTADA SRIKANTH (PGP 2016-18)Noch keine Bewertungen

- Insurance Stocks AnalysisDokument38 SeitenInsurance Stocks AnalysisAnjaiah PittalaNoch keine Bewertungen

- Hindustan Unilever Outlook Remains BuoyantDokument10 SeitenHindustan Unilever Outlook Remains BuoyantVishakha RathodNoch keine Bewertungen

- India Grid Trust: Recalibrating The Growth PitchDokument19 SeitenIndia Grid Trust: Recalibrating The Growth Pitchrchawdhry123Noch keine Bewertungen

- InvestmentIdea - Larsen Toubro300821Dokument5 SeitenInvestmentIdea - Larsen Toubro300821vikalp123123Noch keine Bewertungen

- DLF - Ara - Fy23 - Hsie-202307260810490672012Dokument13 SeitenDLF - Ara - Fy23 - Hsie-202307260810490672012mahlawat.ajaykumarNoch keine Bewertungen

- Tata Consultancy Services LTD.: Result UpdateDokument7 SeitenTata Consultancy Services LTD.: Result UpdateanjugaduNoch keine Bewertungen

- HSIE Results Daily - 16 Aug 22-202208160700271020770Dokument10 SeitenHSIE Results Daily - 16 Aug 22-202208160700271020770Denish GalaNoch keine Bewertungen

- Supreme Industries: Margin Surprises PositivelyDokument12 SeitenSupreme Industries: Margin Surprises Positivelysaran21Noch keine Bewertungen

- Aavas Financiers - Result Update-Oct 19-EDEL PDFDokument16 SeitenAavas Financiers - Result Update-Oct 19-EDEL PDFPrakhar AgarwalNoch keine Bewertungen

- Angel One: IndiaDokument9 SeitenAngel One: IndiaRam JaneNoch keine Bewertungen

- Affle Stock PricingDokument8 SeitenAffle Stock PricingSandyNoch keine Bewertungen

- Britannia Industries - Initiating coverage-Jan-16-EDEL PDFDokument58 SeitenBritannia Industries - Initiating coverage-Jan-16-EDEL PDFRecrea8 EntertainmentNoch keine Bewertungen

- Hindustan Unilever - Update - Jun18 - HDFC Sec-201806071158251089975Dokument22 SeitenHindustan Unilever - Update - Jun18 - HDFC Sec-201806071158251089975anand1kumar-31Noch keine Bewertungen

- Indian Brokerage Industry Insights: Shift to Flat Fee Models and Rising Client AdditionDokument23 SeitenIndian Brokerage Industry Insights: Shift to Flat Fee Models and Rising Client AdditionManu DvNoch keine Bewertungen

- Affle India Limited 05-Dec-2019Dokument6 SeitenAffle India Limited 05-Dec-2019Adarsh PoojaryNoch keine Bewertungen

- Avenue Supermarts: New Frontiers: Losing Tenacity?Dokument21 SeitenAvenue Supermarts: New Frontiers: Losing Tenacity?Parth prajapatiNoch keine Bewertungen

- Avenue Supermarts: New Frontiers: Losing Tenacity?Dokument21 SeitenAvenue Supermarts: New Frontiers: Losing Tenacity?Parth prajapatiNoch keine Bewertungen

- HDFC Bank: Fundamentals Stay Strong Amid UncertaintyDokument6 SeitenHDFC Bank: Fundamentals Stay Strong Amid UncertaintydarshanmadeNoch keine Bewertungen

- Godrej Consumer 09-06-2021 MotiDokument18 SeitenGodrej Consumer 09-06-2021 MotiAnkit SinghNoch keine Bewertungen

- Fin-O-Menal 16th Apr Issue7Dokument4 SeitenFin-O-Menal 16th Apr Issue7FinterestNoch keine Bewertungen

- Adani Ports and Sez Economic Zone Companyname: Strong Quarter Encouraging GuidanceDokument13 SeitenAdani Ports and Sez Economic Zone Companyname: Strong Quarter Encouraging GuidanceAmey TiwariNoch keine Bewertungen

- Indian IT Services: Spring Is Back!Dokument36 SeitenIndian IT Services: Spring Is Back!marketinfoNoch keine Bewertungen

- Sheela Foam: Newer Long-Term Opportunities Are (Likely) Opening UpDokument6 SeitenSheela Foam: Newer Long-Term Opportunities Are (Likely) Opening UpshahavNoch keine Bewertungen

- Cement Small Caps: House Is in Order Small Caps Ripe For Re-RatingDokument48 SeitenCement Small Caps: House Is in Order Small Caps Ripe For Re-RatingTejesh GoudNoch keine Bewertungen

- Reliance Capital: Reliance Home Finance: A Deep Dive Into Business ModelDokument15 SeitenReliance Capital: Reliance Home Finance: A Deep Dive Into Business Modelsharkl123Noch keine Bewertungen

- Trent - Update - Oct23 - HSIE-202310090927441183889Dokument8 SeitenTrent - Update - Oct23 - HSIE-202310090927441183889sankalp111Noch keine Bewertungen

- MSFL Research: India Weekly RoadmapDokument17 SeitenMSFL Research: India Weekly RoadmapNimesh ThakerNoch keine Bewertungen

- Amber Enterprises (India) Ltd. (Aeil) : Aeil'S Rac Sales Volumes Rose by A Robust 127% Yoy To 0.4 MN UnitsDokument4 SeitenAmber Enterprises (India) Ltd. (Aeil) : Aeil'S Rac Sales Volumes Rose by A Robust 127% Yoy To 0.4 MN UnitsdarshanmadeNoch keine Bewertungen

- Apollo Hospitals Enterprise Companyname: Sets The Stage For ExpansionDokument13 SeitenApollo Hospitals Enterprise Companyname: Sets The Stage For Expansionakumar4uNoch keine Bewertungen

- Safari Industries BUY: Growth Momentum To Continue.Dokument20 SeitenSafari Industries BUY: Growth Momentum To Continue.dcoolsamNoch keine Bewertungen

- IIFL Growth PotentialDokument24 SeitenIIFL Growth Potentialanu nitiNoch keine Bewertungen

- Equity Research (Titan Biotech Limited)Dokument9 SeitenEquity Research (Titan Biotech Limited)Dhruv ThakkarNoch keine Bewertungen

- Dabur India (DABUR IN) : Upgrade From N To OW - Stock Correction, Accretive Acquisition Leads To Buying OpportunityDokument9 SeitenDabur India (DABUR IN) : Upgrade From N To OW - Stock Correction, Accretive Acquisition Leads To Buying OpportunityAmit0828Noch keine Bewertungen

- Indo Count Industries LTD (ICIL) : P: R .170 R: Buy T P: R .225 FY19E PE: 9.0Dokument19 SeitenIndo Count Industries LTD (ICIL) : P: R .170 R: Buy T P: R .225 FY19E PE: 9.0V KeshavdevNoch keine Bewertungen

- Divi's Laboratories: ADD Target Price (INR) 894 Mature Cash Flows, Strong Growth Make A Good MixDokument22 SeitenDivi's Laboratories: ADD Target Price (INR) 894 Mature Cash Flows, Strong Growth Make A Good MixSamad PatanwalaNoch keine Bewertungen

- India Strategy 3qfy23 20230109 Mosl RP Pg0240Dokument240 SeitenIndia Strategy 3qfy23 20230109 Mosl RP Pg0240coinage capitalNoch keine Bewertungen

- Kotak Bank Edel 220118Dokument19 SeitenKotak Bank Edel 220118suprabhattNoch keine Bewertungen

- Arjun Shanker Gupta: Hartered Inancial NalystDokument1 SeiteArjun Shanker Gupta: Hartered Inancial NalystArjun Shanker GuptaNoch keine Bewertungen

- Premco Global ICICIDokument6 SeitenPremco Global ICICIArjun Shanker GuptaNoch keine Bewertungen

- Shree Krishna InfrastructureDokument1 SeiteShree Krishna InfrastructureArjun Shanker GuptaNoch keine Bewertungen

- Spinoff Market Analysis Report v5 PDFDokument5 SeitenSpinoff Market Analysis Report v5 PDFArjun Shanker GuptaNoch keine Bewertungen

- HDFC Top Dividend Yield Stocks 2012Dokument2 SeitenHDFC Top Dividend Yield Stocks 2012Pritam BhandariNoch keine Bewertungen

- 2014 mlc703 AssignmentDokument6 Seiten2014 mlc703 AssignmentToral ShahNoch keine Bewertungen

- Sharp Ar5731 BrochureDokument4 SeitenSharp Ar5731 Brochureanakraja11Noch keine Bewertungen

- Sarvali On DigbalaDokument14 SeitenSarvali On DigbalapiyushNoch keine Bewertungen

- PESO Online Explosives-Returns SystemDokument1 SeitePESO Online Explosives-Returns Systemgirinandini0% (1)

- Books of AccountsDokument18 SeitenBooks of AccountsFrances Marie TemporalNoch keine Bewertungen

- Audit Acq Pay Cycle & InventoryDokument39 SeitenAudit Acq Pay Cycle & InventoryVianney Claire RabeNoch keine Bewertungen

- Sysmex Xs-800i1000i Instructions For Use User's ManualDokument210 SeitenSysmex Xs-800i1000i Instructions For Use User's ManualSean Chen67% (6)

- Good Ethics Is Good BusinessDokument9 SeitenGood Ethics Is Good BusinesssumeetpatnaikNoch keine Bewertungen

- Iso 9001 CRMDokument6 SeitenIso 9001 CRMleovenceNoch keine Bewertungen

- Disaster Management Plan 2018Dokument255 SeitenDisaster Management Plan 2018sifoisbspNoch keine Bewertungen

- Udaan: Under The Guidance of Prof - Viswanathan Venkateswaran Submitted By, Benila PaulDokument22 SeitenUdaan: Under The Guidance of Prof - Viswanathan Venkateswaran Submitted By, Benila PaulBenila Paul100% (2)

- Multiple Choice: CH142 Sample Exam 2 QuestionsDokument12 SeitenMultiple Choice: CH142 Sample Exam 2 QuestionsRiky GunawanNoch keine Bewertungen

- DIN Flange Dimensions PDFDokument1 SeiteDIN Flange Dimensions PDFrasel.sheikh5000158Noch keine Bewertungen

- DLL - The Firm and Its EnvironmentDokument5 SeitenDLL - The Firm and Its Environmentfrances_peña_7100% (2)

- 2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTDokument5 Seiten2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTIbrahim JaberNoch keine Bewertungen

- Complete Guide To Sports Training PDFDokument105 SeitenComplete Guide To Sports Training PDFShahana ShahNoch keine Bewertungen

- 15142800Dokument16 Seiten15142800Sanjeev PradhanNoch keine Bewertungen

- Ir35 For Freelancers by YunojunoDokument17 SeitenIr35 For Freelancers by YunojunoOlaf RazzoliNoch keine Bewertungen

- Decision Maths 1 AlgorithmsDokument7 SeitenDecision Maths 1 AlgorithmsNurul HafiqahNoch keine Bewertungen

- Ancient Greek Divination by Birthmarks and MolesDokument8 SeitenAncient Greek Divination by Birthmarks and MolessheaniNoch keine Bewertungen

- Yellowstone Food WebDokument4 SeitenYellowstone Food WebAmsyidi AsmidaNoch keine Bewertungen

- Casting Procedures and Defects GuideDokument91 SeitenCasting Procedures and Defects GuideJitender Reddy0% (1)

- India: Kerala Sustainable Urban Development Project (KSUDP)Dokument28 SeitenIndia: Kerala Sustainable Urban Development Project (KSUDP)ADBGADNoch keine Bewertungen

- Web Api PDFDokument164 SeitenWeb Api PDFnazishNoch keine Bewertungen

- Coffee Table Book Design With Community ParticipationDokument12 SeitenCoffee Table Book Design With Community ParticipationAJHSSR JournalNoch keine Bewertungen

- Conv VersationDokument4 SeitenConv VersationCharmane Barte-MatalaNoch keine Bewertungen

- Electronics Project Automatic Bike Controller Using Infrared RaysDokument16 SeitenElectronics Project Automatic Bike Controller Using Infrared RaysragajeevaNoch keine Bewertungen

- PointerDokument26 SeitenPointerpravin2mNoch keine Bewertungen

- Entity Level ControlsDokument45 SeitenEntity Level ControlsNiraj AlltimeNoch keine Bewertungen

- Propiedades Grado 50 A572Dokument2 SeitenPropiedades Grado 50 A572daniel moreno jassoNoch keine Bewertungen