Beruflich Dokumente

Kultur Dokumente

Jan

Hochgeladen von

Anaya RantaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Jan

Hochgeladen von

Anaya RantaCopyright:

Verfügbare Formate

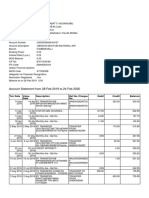

INCEDO TECHNOLOGY SOLUTIONS LIMITED

A-47, Lower Ground Floor, Hauz Khas, New Delhi 110016

Payslip for the Month of January 2019

Code 602458 Bank A/C No. HDFC-******* 8333

Name MR TARUN SHARMA PF Number DLCPM00428970000010656

Department LIFE SCIENCES UAN No. 101148940346

Designation Senior Software Engineer ESI No

Location GURUGRAM PAN Number DYIPS7110E

Band 3 Gender Male

Grade B Payable Days 31.0

Date Of Joining 18/04/2017 Date Of Birth 09/04/1988

Earning Deduction

Description Rate Arrears Actuals Total Description Total

BASIC 27909.00 0.00 27909.00 27909.00 PF 1800.00

HRA 13955.00 0.00 13955.00 13955.00 ITAX & SCH 1272.00

LTA ALLOW 2322.00 0.00 2322.00 2322.00 WELFARE 10.00

CAR ALLOW. 3445.00 0.00 3445.00 3445.00

PROFDEVALL 2791.00 0.00 2791.00 2791.00

TELEALL 1395.00 0.00 1395.00 1395.00

MEALALL 2200.00 0.00 2200.00 2200.00

Total 54017.00 0.00 54017.00 54017.00 Total 3082.00

Net Pay 50935.00 (Rupees fifty thousand nine hundred thirty-five only)

Income Tax Worksheet for the month of January 2019

April 2018-March 2019

Taxable Earnings Deduction U/C VI-A Investments U/S 80 C HRA Calculation

BASIC 334908.00 PF+VPF 21600.00 Rent Paid 99600.00

HRA 101351.00 LIP 55571.00 From 01/04/2018

YTD_PERFBO 6854.00

To 31/03/2019

TAX_LTAALL 23220.00

TAX_CARALL 34450.00 1.Actual HRA 167460.00

TAX_PROFDE 27910.00 2.Rent-10% Basic 66109.00

TAX_TELEAL 13950.00

3.40% of Basic 133963.00

PRJ_MEALAL 26400.00

Least of Above is exempt 66109.00

RFA Calculation

Rent Paid

From

To

Taxable RFA Value

Furniture Cost

Taxable Furniture Perk

Gross Salary 569043.00 Total Deduction u/c VI-A Total Investment u/s 80 C 77171.00

Deductions Any Other Income Leave Details

Standard Deduction 40000.00

Description Opening Entitle Eligible Availed Accumulatio

Professional Tax

Pre.Emp.Professional Tax CF-PL CARRY FORWARD 0.00 0.00 0.00 0.00 0.00

Any Other Income CL-CASUAL LEAVE 7.00 0.00 7.00 0.00 7.00

Chapter VI-A and 80 C 77171.00 CO-COMPENSATORY OFF 0.00 0.00 0.00 0.00 0.00

Taxable Income 451870.00 LE-PL ENCASHMENT 8.00 0.00 8.00 0.00 8.00

Income Tax Liability 10094.00 PL-PL ACCRUED 4.50 0.00 4.50 3.00 1.50

Tax Rebate u/s 87A 0.00

Sub Total 10094.00

Surcharge

Cess 404.00

Total Tax 10498.00

Loan Details

Previous Employer Tax

Net Tax 10498.00 Total Other Income Description Principal Installment Recovered Balance

Tax deducted till last month 6682.00

Tax to be deducted 3816.00

Tax deduction for this month 1272.00

Revised Tax/month 1272.00

This is computer generated Pay slip, hence no signature required!

Das könnte Ihnen auch gefallen

- Citizens Bank Statements Format PDFDokument3 SeitenCitizens Bank Statements Format PDFErvin Scsad60% (5)

- BSBMGT617 - Assessment TasksDokument30 SeitenBSBMGT617 - Assessment TasksAnaya Ranta67% (9)

- BSBINM601 - Assessment Tasks PDFDokument62 SeitenBSBINM601 - Assessment Tasks PDFAnaya Ranta22% (9)

- Assignment SITHCCC012Dokument22 SeitenAssignment SITHCCC012Anaya Ranta50% (4)

- May Salary PDFDokument1 SeiteMay Salary PDFomkassNoch keine Bewertungen

- Bsbinn601 Assessment Tool Task 1 and 2 - v2019 t2 1.2Dokument18 SeitenBsbinn601 Assessment Tool Task 1 and 2 - v2019 t2 1.2Anaya Ranta0% (1)

- 19 ALG Assignment Part1 2Dokument6 Seiten19 ALG Assignment Part1 2Anaya RantaNoch keine Bewertungen

- SITXFIN004 - Prepare and Monitor BudgetDokument5 SeitenSITXFIN004 - Prepare and Monitor BudgetAnaya Ranta50% (4)

- Substitute Form W-8BEN: (Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding)Dokument1 SeiteSubstitute Form W-8BEN: (Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding)Manuel Aguilar100% (1)

- Peepper StoryDokument1 SeitePeepper StoryAnonymous ce49esgnveNoch keine Bewertungen

- April Salary PDFDokument1 SeiteApril Salary PDFomkassNoch keine Bewertungen

- Earnings Deductions: Eicher Motors LimitedDokument1 SeiteEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNoch keine Bewertungen

- ACFrOgAV2XgI1b zVCMDg2879xlLDEaYvRJ7N7aUsvDPxVD99J3VG 1qNF8qIBpJmhRxZsL - 3xykAgyGd2JLaTa0z6LVHn3Et08c7Zr0tcPgESfmUl8AEFFQfvYqmh4 PDFDokument1 SeiteACFrOgAV2XgI1b zVCMDg2879xlLDEaYvRJ7N7aUsvDPxVD99J3VG 1qNF8qIBpJmhRxZsL - 3xykAgyGd2JLaTa0z6LVHn3Et08c7Zr0tcPgESfmUl8AEFFQfvYqmh4 PDFMohan PraveenNoch keine Bewertungen

- June Salry PDFDokument1 SeiteJune Salry PDFomkassNoch keine Bewertungen

- May 2023 0930Dokument1 SeiteMay 2023 0930Keerthi rajaNoch keine Bewertungen

- Payroll Insights - Farsight IT SolutionsDokument1 SeitePayroll Insights - Farsight IT SolutionsyogeshNoch keine Bewertungen

- Gujarat Narmada Valley Fertilizers & Chemicals LTD: Pay - SlipDokument1 SeiteGujarat Narmada Valley Fertilizers & Chemicals LTD: Pay - Slipkeyur patelNoch keine Bewertungen

- April2018 PDFDokument1 SeiteApril2018 PDFomkassNoch keine Bewertungen

- Income Tax Computation Sheet: Assessment Year: 2017-2018 April, 2016 To March, 2017 PeriodDokument1 SeiteIncome Tax Computation Sheet: Assessment Year: 2017-2018 April, 2016 To March, 2017 PeriodAshok kumarNoch keine Bewertungen

- Employee DataDokument1 SeiteEmployee DataomkassNoch keine Bewertungen

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDokument2 SeitenDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNoch keine Bewertungen

- Earnings Deductions: Eicher Motors LimitedDokument1 SeiteEarnings Deductions: Eicher Motors LimitedBarath BiberNoch keine Bewertungen

- Salary SlipDokument1 SeiteSalary SlipPhagun BehlNoch keine Bewertungen

- Xerox India Limited: Pay Slip For The Month of October 2017Dokument1 SeiteXerox India Limited: Pay Slip For The Month of October 2017ashish10mca9394Noch keine Bewertungen

- Payslip 2018 2019 3 2380 SVATANTRADokument1 SeitePayslip 2018 2019 3 2380 SVATANTRAsunil.srfcNoch keine Bewertungen

- Mar18 PDFDokument1 SeiteMar18 PDFomkassNoch keine Bewertungen

- Salary SlipDokument1 SeiteSalary SlipPhagun BehlNoch keine Bewertungen

- MarchDokument1 SeiteMarchSushmita BaraikNoch keine Bewertungen

- Servlet ControllerDokument1 SeiteServlet Controllermukesh sahuNoch keine Bewertungen

- Servlet ControllerDokument1 SeiteServlet Controllermukesh sahuNoch keine Bewertungen

- Jan18 PDFDokument1 SeiteJan18 PDFomkassNoch keine Bewertungen

- A-28, Lawrence Road,, New Delhi - 110035 Delhi Pay Slip For The Month of January-2018Dokument2 SeitenA-28, Lawrence Road,, New Delhi - 110035 Delhi Pay Slip For The Month of January-2018Reiki Channel Anuj BhargavaNoch keine Bewertungen

- Pay Slip DecDokument1 SeitePay Slip DecMalix EagleNoch keine Bewertungen

- Payslip EV0402 October - 2023Dokument1 SeitePayslip EV0402 October - 2023shubham.sNoch keine Bewertungen

- Gannon Dunkerley & Co., LTD.: Civil Engineering Division, HyderabadDokument1 SeiteGannon Dunkerley & Co., LTD.: Civil Engineering Division, HyderabadNaga GeeNoch keine Bewertungen

- Dec07 PDFDokument1 SeiteDec07 PDFomkassNoch keine Bewertungen

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDokument1 SeitePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNoch keine Bewertungen

- Salary Slip, Oct - 19 - EIPL - 109Dokument1 SeiteSalary Slip, Oct - 19 - EIPL - 109akhilesh singhNoch keine Bewertungen

- Slip PDFDokument1 SeiteSlip PDFPratikDutta0% (1)

- SlipDokument1 SeiteSlipPratikDuttaNoch keine Bewertungen

- Slip PDFDokument1 SeiteSlip PDFPratikDuttaNoch keine Bewertungen

- Payslip 4 2022Dokument1 SeitePayslip 4 2022Sunil B R SunilshettyNoch keine Bewertungen

- SalarySlipwithTaxDetails 2021 MayDokument1 SeiteSalarySlipwithTaxDetails 2021 MaySameer KulkarniNoch keine Bewertungen

- Sunil Kumar (DELS0210)Dokument1 SeiteSunil Kumar (DELS0210)SUNIL KUMARNoch keine Bewertungen

- Aptus Value Housing Finance India LTD: Salary Slip For The Month of February - 2023Dokument1 SeiteAptus Value Housing Finance India LTD: Salary Slip For The Month of February - 2023msathish7428100% (1)

- RPT Pay SlipDokument1 SeiteRPT Pay SlipAllia sharmaNoch keine Bewertungen

- Mitali Garg E01392Dokument1 SeiteMitali Garg E01392Mitali GargNoch keine Bewertungen

- PDFDokument2 SeitenPDFkumar Ranjan 22Noch keine Bewertungen

- Employee DataDokument1 SeiteEmployee DataomkassNoch keine Bewertungen

- GA55Dokument2 SeitenGA55Devesh AgarwalNoch keine Bewertungen

- Salary Nov 2020Dokument2 SeitenSalary Nov 2020Tarun RawatNoch keine Bewertungen

- Page No.: Financial YearDokument10 SeitenPage No.: Financial Yearprofessional gamersNoch keine Bewertungen

- Nadeem Bhai FamousDokument6 SeitenNadeem Bhai Famoussarah IsharatNoch keine Bewertungen

- Pay Slip Dec-2019Dokument1 SeitePay Slip Dec-2019Ratnakar AryasomayajulaNoch keine Bewertungen

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Dokument1 SeitePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNoch keine Bewertungen

- Tele:: Total Tax, Fee and InterestDokument1 SeiteTele:: Total Tax, Fee and Interestamarnath ojhaNoch keine Bewertungen

- Page No.: Financial YearDokument3 SeitenPage No.: Financial YearWwe Full matchesNoch keine Bewertungen

- Sept 2010Dokument1 SeiteSept 2010sshhiriNoch keine Bewertungen

- 157salaryslip g5sxl3g6Dokument1 Seite157salaryslip g5sxl3g6Shakti NaikNoch keine Bewertungen

- FNF 02 I33514 Ankit ShuklaDokument3 SeitenFNF 02 I33514 Ankit ShuklaAnkit ShuklaNoch keine Bewertungen

- Narpavi - Honda Amaze InvoiceDokument2 SeitenNarpavi - Honda Amaze InvoiceSRI VAIKUNTH MOTORSNoch keine Bewertungen

- HTMLReportsDokument1 SeiteHTMLReportsRashmi Awanish PandeyNoch keine Bewertungen

- 0T7517 JULY 2017salary SlipDokument1 Seite0T7517 JULY 2017salary SlipmukeshkatarnavareNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- Herjit Budget CateringDokument5 SeitenHerjit Budget CateringAnaya RantaNoch keine Bewertungen

- Assignment 2Dokument2 SeitenAssignment 2Anaya RantaNoch keine Bewertungen

- Bsbfim601 Nirvair Ann002 Feb 130218 1500Dokument22 SeitenBsbfim601 Nirvair Ann002 Feb 130218 1500Anaya Ranta100% (1)

- Bsbmgt615 Assessment Tool Task 1 and 2 - v2019 t1 1.2Dokument16 SeitenBsbmgt615 Assessment Tool Task 1 and 2 - v2019 t1 1.2Anaya Ranta0% (3)

- CITS5502 ASSIGNMENT 3 - Software Process Data CollectionDokument12 SeitenCITS5502 ASSIGNMENT 3 - Software Process Data CollectionAnaya RantaNoch keine Bewertungen

- BSBINM601 - Assessment TasksDokument68 SeitenBSBINM601 - Assessment TasksAnaya Ranta0% (1)

- BSBWHS605 - Handouts and NotesDokument51 SeitenBSBWHS605 - Handouts and NotesAnaya Ranta100% (1)

- BSBMKG609 - Assessment TasksDokument7 SeitenBSBMKG609 - Assessment TasksAnaya Ranta50% (2)

- Term Planner - 2018-19Dokument2 SeitenTerm Planner - 2018-19Anaya RantaNoch keine Bewertungen

- BSBWHS605 - Assessment TasksDokument46 SeitenBSBWHS605 - Assessment TasksAnaya Ranta33% (6)

- BSBCOM603 - Assessment TasksDokument12 SeitenBSBCOM603 - Assessment TasksAnaya Ranta0% (8)

- BSBMGT616 - Assessment TasksDokument20 SeitenBSBMGT616 - Assessment TasksAnaya Ranta0% (2)

- Written AssessmentDokument12 SeitenWritten AssessmentAnaya RantaNoch keine Bewertungen

- Feasibility Study Into A Gisborne Facility To Convert Waste Into EnergyDokument10 SeitenFeasibility Study Into A Gisborne Facility To Convert Waste Into EnergyAnaya RantaNoch keine Bewertungen

- Assignment 1Dokument17 SeitenAssignment 1Anaya RantaNoch keine Bewertungen

- Domino AssignmentDokument20 SeitenDomino AssignmentAnaya RantaNoch keine Bewertungen

- BM2008I002097905Dokument6 SeitenBM2008I002097905Nishant MeghwalNoch keine Bewertungen

- Statement - 652900 XXXX XXXX 2982 - 022023Dokument2 SeitenStatement - 652900 XXXX XXXX 2982 - 022023Vikrant JaiswalNoch keine Bewertungen

- Water - Bill - BTKP NDP6481 - 2024 06 2 15 42 11Dokument1 SeiteWater - Bill - BTKP NDP6481 - 2024 06 2 15 42 11sameemgridNoch keine Bewertungen

- Just Dial Limited: Tax InvoiceDokument2 SeitenJust Dial Limited: Tax InvoicePushpendu RajNoch keine Bewertungen

- InternationalStudentHealthFee Ish Ish X37002062188 Invoice 2022 12 06Dokument3 SeitenInternationalStudentHealthFee Ish Ish X37002062188 Invoice 2022 12 06TareqAFC 408Noch keine Bewertungen

- Orient Cables (India) Pvt. LTD: Party DetailsDokument1 SeiteOrient Cables (India) Pvt. LTD: Party DetailsShashank SaxenaNoch keine Bewertungen

- Acc 111 #18Dokument1 SeiteAcc 111 #18Trina AquinoNoch keine Bewertungen

- Cash BookDokument33 SeitenCash BookShaloom TVNoch keine Bewertungen

- Project One and TwoDokument3 SeitenProject One and TwoAliyi BenuraNoch keine Bewertungen

- Wasssim Zhani Income Taxation of Corporations SMDokument293 SeitenWasssim Zhani Income Taxation of Corporations SMwassim zhaniNoch keine Bewertungen

- Anil Neerukonda Institute of Technology & Sciences: Fee Structure For B.Tech., 1 Year 2018 - 2019Dokument5 SeitenAnil Neerukonda Institute of Technology & Sciences: Fee Structure For B.Tech., 1 Year 2018 - 2019p.narendraNoch keine Bewertungen

- SalamatDokument132 SeitenSalamatCaila Chin DinoyNoch keine Bewertungen

- Tutorial 8Dokument3 SeitenTutorial 8Aaron Tan Wayne JieNoch keine Bewertungen

- Cameron Fisher Excel Budget ProjectDokument2 SeitenCameron Fisher Excel Budget Projectapi-340519862Noch keine Bewertungen

- Group-I and Group-II Categories For PG StudentsDokument12 SeitenGroup-I and Group-II Categories For PG Studentsjefeena saliNoch keine Bewertungen

- Bill Overview: Jlb9Hznfdskgxfivcivc Ykpfivba5Kywibxmvc4Ewpcaxgaf 7FDokument5 SeitenBill Overview: Jlb9Hznfdskgxfivcivc Ykpfivba5Kywibxmvc4Ewpcaxgaf 7FEric LauNoch keine Bewertungen

- Multiple Choice Questions 1 Eddie A Single Taxpayer Has W 2 IncomeDokument1 SeiteMultiple Choice Questions 1 Eddie A Single Taxpayer Has W 2 IncomeTaimour HassanNoch keine Bewertungen

- 581616893-BMO-Bank-Statement-Tina Vennessa MullinsDokument3 Seiten581616893-BMO-Bank-Statement-Tina Vennessa MullinsAlex NeziNoch keine Bewertungen

- Checks Issued by The City of Boise Idaho - 4Dokument52 SeitenChecks Issued by The City of Boise Idaho - 4Mark ReinhardtNoch keine Bewertungen

- IntxDokument6 SeitenIntxSophia KeratinNoch keine Bewertungen

- 1yera PDFDokument15 Seiten1yera PDFMandalabatti noorasabuNoch keine Bewertungen

- Solved The Revenues and Expenses of Sentinel Travel Service For TheDokument1 SeiteSolved The Revenues and Expenses of Sentinel Travel Service For TheAnbu jaromiaNoch keine Bewertungen

- Igst Exemptions Approved by GST Council 11.06.2017Dokument2 SeitenIgst Exemptions Approved by GST Council 11.06.2017Kalees PalaniNoch keine Bewertungen

- Role of TaxationDokument5 SeitenRole of TaxationCarlo Francis Palma100% (1)

- Invoice #1 - 179-PNQDELQP114822102306294-oFXDokument1 SeiteInvoice #1 - 179-PNQDELQP114822102306294-oFXManish NairNoch keine Bewertungen

- ProductDokument1 SeiteProductAbhijitChandraNoch keine Bewertungen

- Income Tax Return Forms ArdraDokument25 SeitenIncome Tax Return Forms ArdraGangothri AsokNoch keine Bewertungen

- Income Taxation by NickAduana (Answer Key)Dokument113 SeitenIncome Taxation by NickAduana (Answer Key)Samantha Andrea Grefaldia100% (2)