Beruflich Dokumente

Kultur Dokumente

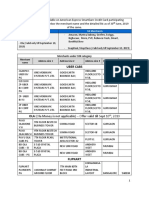

Clemente v. Court of Appeals

Hochgeladen von

AnjOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Clemente v. Court of Appeals

Hochgeladen von

AnjCopyright:

Verfügbare Formate

Clemente v.

Court of Appeals

312 Phil 823 March 27, 1995

FACTS: Petitioners sought to be declared the owners of a piece of land situated in Calamba, Laguna bought by

"Sociedad Popular Calambeña". The “sociedad” was organized at the advent of the early American occupation of the

Philippines. It did business and held itself out as a corporation from 1909 up to 1932. Its principal business was

cockfighting or the operation and management of a cockpit. The "Sociedad" acquired the subject parcel of land from

the Friar Lands Estate of Calamba. Patent was issued and the Real Property Tax Register of the Office of the

Treasurer of Calamba, Laguna showed that the lot was declared and assessed for taxation purposes.

Plaintiffs show that Mariano Elepaño and Pablo Clemente, now both deceased, were the original stockholders of the

"sociedad." Pablo Clemente's shares of stocks were later distributed and apportioned to his heirs. The "sociedad" then

issued stock certificates to the heirs. On the basis of their respective stocks certificates, they, along with the heirs of

Mariano Elepaño jointly claimed ownership over the subject parcel of land, asserting that their fathers being the only

known stockholders of the "sociedad" they, to the exclusion of all others, are entitled to be declared owners of the lot.

Private respondents, in their answer likewise claimed ownership of the property by virtue of acquisitive prescription.

The trial court dismissed the complaint on the grounds of insufficiency of evidence and absent a corporate

liquidation, it is the corporation, not the stockholders, which can assert, if at all, any title to the corporate assets. The

CA sustained the dismissal of the complaint.

ISSUE: Whether or not petitioners can be held to have succeeded in establishing for themselves a firm title to the

property in question.

RULING: NO. Except in showing that they are the successors-in-interest of Elepaño and Clemente, petitioners have

been unable to come up with any evidence to substantiate their claim of ownership of the corporate asset.

If, indeed, the sociedad has long become defunct, it should behoove petitioners, or anyone else who may have any

interest in the corporation, to take appropriate measures before a proper forum for a peremptory settlement of its

affairs. We might invite attention to the various modes provided by the Corporation Code for dissolving, liquidating

or winding up, and terminating the life of the corporation.

Among the causes for such dissolution are when the corporate term has expired or when, upon a verified complaint

and after notice and hearing, the SEC orders the dissolution of a corporation for its continuous inactivity for at least 5

years. The corporation continues to be a body corporate for 3 years after its dissolution for purposes of prosecuting

and defending suits by and against it and for enabling it to settle and close its affairs, culminating in the disposition

and distribution of its remaining assets. It may, during the 3-year term, appoint a trustee or a receiver who may act

beyond that period. If the 3-year extended life has expired without a trustee or receiver having been expressly

designated by the corporation, the board of directors (or trustees) itself may be permitted to so continue as "trustees"

by legal implication to complete the corporate liquidation. Still in the absence of a board of directors or trustees, those

having any pecuniary interest in the assets, including not only the shareholders but likewise the creditors of the

corporation, acting for and in its behalf, might make proper representations with the SEC for working out a final

settlement of the corporate concerns.

Das könnte Ihnen auch gefallen

- Financial Ratio Analysis AssignmentDokument10 SeitenFinancial Ratio Analysis Assignmentzain5435467% (3)

- Case DigestsDokument11 SeitenCase DigestsJei-jei PernitezNoch keine Bewertungen

- Lee vs. TambagoDokument3 SeitenLee vs. TambagoAnj100% (1)

- Study of Inventory Control System and Trend Analysis in Mangalam Cement, Mangalam Cement LTDDokument64 SeitenStudy of Inventory Control System and Trend Analysis in Mangalam Cement, Mangalam Cement LTDMustafa S TajaniNoch keine Bewertungen

- Confidence Cement Ltd. Ratio AnalysisDokument42 SeitenConfidence Cement Ltd. Ratio AnalysisShehab Mahmud0% (1)

- Criminal Procedure Atty. David Michael C. Go Assistant City Prosecutor Office of The City Prosecutor of Taguig CityDokument7 SeitenCriminal Procedure Atty. David Michael C. Go Assistant City Prosecutor Office of The City Prosecutor of Taguig CityJames Patrick NarcissoNoch keine Bewertungen

- Bravo Vs CaDokument10 SeitenBravo Vs CaAngela Kristine PinedaNoch keine Bewertungen

- Reyes vs. DiazDokument1 SeiteReyes vs. DiazJan Mar Gigi GallegoNoch keine Bewertungen

- 176 - National Abaca and Other Fibers Corporation v. PoreDokument2 Seiten176 - National Abaca and Other Fibers Corporation v. Poremimiyuki_Noch keine Bewertungen

- Gulang vs. NadayagDokument7 SeitenGulang vs. NadayagAJ AslaronaNoch keine Bewertungen

- Adorable V CADokument1 SeiteAdorable V CABoyet CariagaNoch keine Bewertungen

- Agency Case DigestDokument17 SeitenAgency Case DigestMarlon SevillaNoch keine Bewertungen

- ProvRem DigestsDokument7 SeitenProvRem DigestsKen LimNoch keine Bewertungen

- Padilla Vs - Reyes G - R - No - L-37435, November 28, 1934, 60 Phil - 967Dokument1 SeitePadilla Vs - Reyes G - R - No - L-37435, November 28, 1934, 60 Phil - 967ben carlo ramos srNoch keine Bewertungen

- People Vs Cilot GR 208410Dokument14 SeitenPeople Vs Cilot GR 208410norzeNoch keine Bewertungen

- Aquino V Pacific PlansDokument2 SeitenAquino V Pacific PlansJean Mary AutoNoch keine Bewertungen

- UP Sales Reviewer 2007Dokument50 SeitenUP Sales Reviewer 2007minNoch keine Bewertungen

- Abellana V CADokument2 SeitenAbellana V CANikki Estores GonzalesNoch keine Bewertungen

- Buan v. Matugas - DIGESTDokument2 SeitenBuan v. Matugas - DIGESTKarez MartinNoch keine Bewertungen

- St. Paul Fire and Marine Insurance v. Dray 70 SCRA 122 (1976)Dokument9 SeitenSt. Paul Fire and Marine Insurance v. Dray 70 SCRA 122 (1976)Fides DamascoNoch keine Bewertungen

- Yun Kwan Byung V PagcorDokument3 SeitenYun Kwan Byung V Pagcorsigfridmonte100% (3)

- GR No. 163338 Luzon DB V Conquilla Et AlDokument9 SeitenGR No. 163338 Luzon DB V Conquilla Et AlMichelle de los Santos100% (1)

- Homestead Patent - Miguel v. CA - MarianoDokument2 SeitenHomestead Patent - Miguel v. CA - MarianoPaul MarianoNoch keine Bewertungen

- 160 Tanedo v. CADokument3 Seiten160 Tanedo v. CARochelle De la CruzNoch keine Bewertungen

- Philippine National Bank vs. Agudelo, G.R. No. L-39037, 30 October 1933Dokument2 SeitenPhilippine National Bank vs. Agudelo, G.R. No. L-39037, 30 October 1933Carie LawyerrNoch keine Bewertungen

- Uy Tina Vs AvilaDokument1 SeiteUy Tina Vs AvilaMargie Marj GalbanNoch keine Bewertungen

- INSULAR LUMBER COMPANY vs. CA DDokument1 SeiteINSULAR LUMBER COMPANY vs. CA DJuris Doctor100% (2)

- KAPUNAN Vs CASILANDokument4 SeitenKAPUNAN Vs CASILANjames zaraNoch keine Bewertungen

- URBAN BANK vs. PENA G.R. No. 145817, 145822 & 162562 October 19, 2011Dokument2 SeitenURBAN BANK vs. PENA G.R. No. 145817, 145822 & 162562 October 19, 2011kateNoch keine Bewertungen

- Atty. Florencio Alay Binalay v. Judge Elias Lelina, Jr. - A.M. RTJ-08, 2132, 7-31-09 - MONSALUDDokument2 SeitenAtty. Florencio Alay Binalay v. Judge Elias Lelina, Jr. - A.M. RTJ-08, 2132, 7-31-09 - MONSALUDEvander ArcenalNoch keine Bewertungen

- (CRIMPRO) Case AssignmentDokument19 Seiten(CRIMPRO) Case AssignmentMasterboleroNoch keine Bewertungen

- Sansio Philippines Vs MogolDokument5 SeitenSansio Philippines Vs MogolChaoSisonNoch keine Bewertungen

- Bordador v. LuzDokument2 SeitenBordador v. LuzdelayinggratificationNoch keine Bewertungen

- SUMAWAY - Nevada V CasugaDokument2 SeitenSUMAWAY - Nevada V CasugaTintin SumawayNoch keine Bewertungen

- Casilao DigestDokument1 SeiteCasilao DigestAndrew GallardoNoch keine Bewertungen

- Ortiz Vs KayananDokument1 SeiteOrtiz Vs KayananRatani Unfriendly0% (1)

- Rural Bank of Sariaya Vs YaconDokument2 SeitenRural Bank of Sariaya Vs YaconGillian Caye Geniza BrionesNoch keine Bewertungen

- Citizen Surety CaseDokument2 SeitenCitizen Surety CaseKent UgaldeNoch keine Bewertungen

- Priscilla Susan Po v. Hon. Court of Appeals, Hon. Judge Julian Lustre and Jose P. MananzanDokument2 SeitenPriscilla Susan Po v. Hon. Court of Appeals, Hon. Judge Julian Lustre and Jose P. MananzanJong PerrarenNoch keine Bewertungen

- 13 - Gonzalo L. Manuel & Co., Inc. vs. Central Bank 38 SCRA 524, No. L-20871 April 30, 1971Dokument8 Seiten13 - Gonzalo L. Manuel & Co., Inc. vs. Central Bank 38 SCRA 524, No. L-20871 April 30, 1971gerlie22Noch keine Bewertungen

- Constantino Vs EspirituDokument4 SeitenConstantino Vs EspirituMac Duguiang Jr.Noch keine Bewertungen

- Fort Bonifacio Development CorpDokument3 SeitenFort Bonifacio Development CorpKaren Selina AquinoNoch keine Bewertungen

- Relationship Must Be Alleged For Murder To Become PARRICIDEDokument20 SeitenRelationship Must Be Alleged For Murder To Become PARRICIDEJaye Querubin-FernandezNoch keine Bewertungen

- Rafferty vs. Province of Cebu - CDDokument1 SeiteRafferty vs. Province of Cebu - CDmenforeverNoch keine Bewertungen

- Siredy Enterprises, Inc. V CADokument1 SeiteSiredy Enterprises, Inc. V CARufhyne DeeNoch keine Bewertungen

- Credit Transaction Cases 2015Dokument11 SeitenCredit Transaction Cases 2015ronhuman14Noch keine Bewertungen

- 17 PERKIN ELMER SINGAPORE Vs DAKILA TRADING CORP.Dokument3 Seiten17 PERKIN ELMER SINGAPORE Vs DAKILA TRADING CORP.Marc LopezNoch keine Bewertungen

- McCarty vs. LangdeauDokument1 SeiteMcCarty vs. LangdeauCindee YuNoch keine Bewertungen

- Rule 16 To Rule 19Dokument65 SeitenRule 16 To Rule 19Jaime PinuguNoch keine Bewertungen

- 48 - Pioneer Insurance vs. CADokument1 Seite48 - Pioneer Insurance vs. CAJohn Lorie BacalingNoch keine Bewertungen

- Land Bank of The Philippines V PerezDokument2 SeitenLand Bank of The Philippines V PerezIrish AnnNoch keine Bewertungen

- Martinez Vs RepublicDokument2 SeitenMartinez Vs Republicmaginoo69Noch keine Bewertungen

- Macondray V Pinon Case DigestDokument2 SeitenMacondray V Pinon Case DigestZirk TanNoch keine Bewertungen

- Aleman v. de Catera, GR L-13693, Mar. 25, 1961, 1 SCRA 776Dokument1 SeiteAleman v. de Catera, GR L-13693, Mar. 25, 1961, 1 SCRA 776Gia DimayugaNoch keine Bewertungen

- CAPISTRANO vs. LIMCUANDODokument1 SeiteCAPISTRANO vs. LIMCUANDOElaine Grace R. AntenorNoch keine Bewertungen

- 106 Madrigal - Co. v. ZamoraDokument1 Seite106 Madrigal - Co. v. Zamoramimiyuki_Noch keine Bewertungen

- Republic v. Bantigue Point Development, GR No. 162322, Mar. 14, 2012Dokument2 SeitenRepublic v. Bantigue Point Development, GR No. 162322, Mar. 14, 2012RENGIE GALONoch keine Bewertungen

- Heirs of Restar v. Heirs of Cichon, 475 SCRA 731Dokument4 SeitenHeirs of Restar v. Heirs of Cichon, 475 SCRA 731Angelette BulacanNoch keine Bewertungen

- Cristobal vs. Court of AppealsDokument1 SeiteCristobal vs. Court of AppealsDeniel Salvador B. MorilloNoch keine Bewertungen

- Cavite Development Bank Vs SpsDokument2 SeitenCavite Development Bank Vs SpsJug HeadNoch keine Bewertungen

- Clemente vs. CADokument1 SeiteClemente vs. CAReghz De Guzman PamatianNoch keine Bewertungen

- Clemente v. CADokument2 SeitenClemente v. CADanielle DacuanNoch keine Bewertungen

- 182 - Clemente v. CADokument2 Seiten182 - Clemente v. CAmimiyuki_Noch keine Bewertungen

- Clemente Vs CADokument2 SeitenClemente Vs CAAisha Tejada100% (1)

- Bernas Vs CincoDokument18 SeitenBernas Vs CincoAnjNoch keine Bewertungen

- Advance Paper Corp Vs Arma Traders CorpDokument13 SeitenAdvance Paper Corp Vs Arma Traders CorpAnjNoch keine Bewertungen

- ABS CBN Vs CADokument18 SeitenABS CBN Vs CAAnjNoch keine Bewertungen

- Lao Vs LaoDokument8 SeitenLao Vs LaoAnjNoch keine Bewertungen

- Loyola Grand Villas Vs CADokument10 SeitenLoyola Grand Villas Vs CAAnjNoch keine Bewertungen

- Legaspi Towers Vs MuerDokument8 SeitenLegaspi Towers Vs MuerAnjNoch keine Bewertungen

- Majority Stockholders of Ruby Vs LimDokument32 SeitenMajority Stockholders of Ruby Vs LimAnjNoch keine Bewertungen

- Esquivel Vs AlegreDokument9 SeitenEsquivel Vs AlegreAnjNoch keine Bewertungen

- Valley Golf & Country Club Vs Vda de CaramDokument13 SeitenValley Golf & Country Club Vs Vda de CaramAnjNoch keine Bewertungen

- MERALCO v. La Campana Food Products, Inc.Dokument9 SeitenMERALCO v. La Campana Food Products, Inc.AnjNoch keine Bewertungen

- 4 Salazar vs. SalazarDokument7 Seiten4 Salazar vs. SalazarAnjNoch keine Bewertungen

- 5 Philippine Phospate Fertilizer Corp Vs CIRDokument21 Seiten5 Philippine Phospate Fertilizer Corp Vs CIRAnjNoch keine Bewertungen

- Joselito Puno Vs Puno EnterprisesDokument5 SeitenJoselito Puno Vs Puno EnterprisesAnjNoch keine Bewertungen

- 12 Security Bank and Trust Co. vs. CuencaDokument25 Seiten12 Security Bank and Trust Co. vs. CuencaAnjNoch keine Bewertungen

- Vda de Ramos V CADokument2 SeitenVda de Ramos V CAAnjNoch keine Bewertungen

- Caneda vs. CADokument4 SeitenCaneda vs. CAAnjNoch keine Bewertungen

- Gan v. YapDokument1 SeiteGan v. YapAnjNoch keine Bewertungen

- 10 Habaluyas Enterprises Inc. v. JapsonDokument3 Seiten10 Habaluyas Enterprises Inc. v. JapsonAnjNoch keine Bewertungen

- Ortega v. ValmonteDokument2 SeitenOrtega v. ValmonteAnjNoch keine Bewertungen

- Republic of The Philippines Vs Bisaya Land TransportationDokument4 SeitenRepublic of The Philippines Vs Bisaya Land TransportationAnjNoch keine Bewertungen

- Aluad v. AluadDokument3 SeitenAluad v. AluadAnjNoch keine Bewertungen

- Municipality Ofbinan vs. Garcia: Eminent Domain Two Stages of Procedure Of. 1. There AreDokument19 SeitenMunicipality Ofbinan vs. Garcia: Eminent Domain Two Stages of Procedure Of. 1. There AreAnjNoch keine Bewertungen

- Chapter Vi: Rights of Stockholders and MembersDokument7 SeitenChapter Vi: Rights of Stockholders and MembersAlvin Aparijado EmolagaNoch keine Bewertungen

- Northern Motors vs. CoquiaDokument13 SeitenNorthern Motors vs. CoquiadanexrainierNoch keine Bewertungen

- Chapter 3 HomeworkDokument4 SeitenChapter 3 Homeworkmzvette234100% (1)

- Journalizing CorporationsDokument61 SeitenJournalizing CorporationsBridgett Florence CaldaNoch keine Bewertungen

- Accounting 202 Chapter 12 TestDokument2 SeitenAccounting 202 Chapter 12 TestLương Thế CườngNoch keine Bewertungen

- Hedge Funds: Origins and Evolution: John H. MakinDokument17 SeitenHedge Funds: Origins and Evolution: John H. MakinHiren ShahNoch keine Bewertungen

- Kavya SrivastavaDokument100 SeitenKavya Srivastavakavya srivastavaNoch keine Bewertungen

- Emerging Market Carry Trade ChangedDokument7 SeitenEmerging Market Carry Trade ChangedYinghong chen100% (2)

- SSRN Id3442539 PDFDokument29 SeitenSSRN Id3442539 PDFbrineshrimpNoch keine Bewertungen

- Merchantlist PDFDokument201 SeitenMerchantlist PDFrahulNoch keine Bewertungen

- Capital Ideas Revisited - Part 2 - Thoughts On Beating A Mostly-Efficient Stock MarketDokument11 SeitenCapital Ideas Revisited - Part 2 - Thoughts On Beating A Mostly-Efficient Stock Marketpjs15Noch keine Bewertungen

- Capital Market V/s Money MarketDokument23 SeitenCapital Market V/s Money Marketsaurabh kumarNoch keine Bewertungen

- Commercial Real Estate Case StudyDokument2 SeitenCommercial Real Estate Case StudyKirk SummaTime Henry100% (1)

- Assign No 5 - OpleDokument3 SeitenAssign No 5 - OpleLester Nazarene OpleNoch keine Bewertungen

- Mastering Stock Market LeadMagnet PDFDokument11 SeitenMastering Stock Market LeadMagnet PDFSushant DumbreNoch keine Bewertungen

- The Theoretical Foundations of Accounting StandardsDokument21 SeitenThe Theoretical Foundations of Accounting Standardslamoma389Noch keine Bewertungen

- Aimr - Investing Separately Alpha and Beta PDFDokument102 SeitenAimr - Investing Separately Alpha and Beta PDFAnonymous Mgq9dupCNoch keine Bewertungen

- Daftar Riwayat HidupDokument3 SeitenDaftar Riwayat HidupDhawy Al-MarbawyNoch keine Bewertungen

- Faraz Case StudyDokument4 SeitenFaraz Case StudyDrMunir Hussain SiddiquiNoch keine Bewertungen

- Ancilliary Services of BanksDokument25 SeitenAncilliary Services of Bankspawan_019Noch keine Bewertungen

- Chief Financial Officer CFO in Chicago IL Resume Linda O'KeefeDokument4 SeitenChief Financial Officer CFO in Chicago IL Resume Linda O'KeefeLindaOKeefeNoch keine Bewertungen

- IFRS 9 WebinarDokument18 SeitenIFRS 9 WebinarMovie MovieNoch keine Bewertungen

- A.J. Frost Robert Prechter Elliott Wave PrincipleDokument3 SeitenA.J. Frost Robert Prechter Elliott Wave PrincipleingenierohannerNoch keine Bewertungen

- CH 08Dokument37 SeitenCH 08Azhar Septari100% (1)

- Credit Suisse Long Term AnalysisDokument64 SeitenCredit Suisse Long Term Analysiscclaudel09Noch keine Bewertungen

- Sources of Long-Term FinanceDokument26 SeitenSources of Long-Term Financerrajsharmaa100% (2)

- Future of Alternatives London Preqin Breakfast Seminar Sept 18Dokument32 SeitenFuture of Alternatives London Preqin Breakfast Seminar Sept 18Sheila EnglishNoch keine Bewertungen