Beruflich Dokumente

Kultur Dokumente

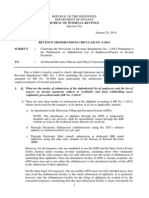

BIR Ruling (DA - (DT-001) 001-08)

Hochgeladen von

Dyan de la FuenteOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BIR Ruling (DA - (DT-001) 001-08)

Hochgeladen von

Dyan de la FuenteCopyright:

Verfügbare Formate

July 1, 2008

!

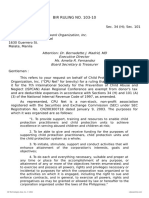

BIR RULING [DA-(DT-001) 001-08]

!

Section

101 (A)

" (3); BIR

Ruling

No. DA-

028-98

Salvador & Associates

815-816, Tower One & Exchange Plaza

Ayala Triangle, Ayala Avenue

Makati City

Attention: Atty. Serafin U. Salvador, Jr.

Atty. Rabiev Tobias M. Racho

Atty. Marie Cherylle Z. Hular

Gentlemen :

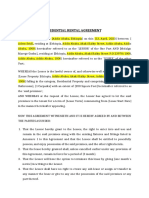

This refers to your letter dated May 22, 2008

requesting on behalf of your client, The Henry Sy

Foundation, Inc. (the "Foundation" for brevity) for

confirmation of your opinion that donations made

to the Foundation are exempt from donor's tax

prescribed under Section 101 (A) (3) and

documentary stamp tax (DST) under Section 175,

both of the National Internal Revenue Code

(NIRC), as amended. DCcHIS

As represented, the Foundation, which is in

the process of incorporation and registration with

the Securities and Exchange Commission (SEC)

will be a non-stock and non-profit charitable

corporation. The primary purposes for which the

Foundation is being organized are as follows:

"1. To promote the general

well-being of the human individual,

developing his potential to the fullest and

instilling desirable values;

2. For educational purposes,

including, without limiting the generality

of the foregoing, to foster an education

which would equip the individual for a

productive life, by providing assistance,

scholarships endowments, or otherwise

establishing facilities for the study,

education, training, and instruction of the

individual through formal, informal, or

non-formal education and to build the

character of the individual to become

useful members of society;

3. Without limiting the

generality of the foregoing, to provide

assistance education training and

resources to teachers and school staff

and education specialists within the

Philippines;

4. For scientific research and

the advancement of scientific

knowledge, including without limiting the

generality of the foregoing, to provide

endowment or scholarship grants and

any form of assistance for applied

scientific research in any frontier of

knowledge which the Board of Trustees,

or any committee validly constituted and

with sufficient authority, may deem

useful, beneficial, and adequate;

5. For medical research and

the advancement of medical knowledge,

including without limiting the generality

of the foregoing, to support studies and

research in various fields of medicine,

particularly those geared towards

improving health in urban and rural

communities in the Philippines;

6. To promote health, safety

and sanitation programs and fund

projects in selected urban and rural

communities aimed at controlling,

preventing and treating communicable

and degenerative diseases and other

health disabilities including research into

diseases and disease control and health

issues; aCSEcA

7. To accept and receive

contributions, donations and/or

endowments from the government or

from the general public, by deeds,

grants, devises, bequests, or gifts, and

to make use of this in operating

enterprises, activities, or businesses as

may be necessary to carry out the

objectives of the Foundation;"

After its registration with the SEC, the Foundation

intends to obtain accreditation as a donee-

institution pursuant to Executive Order No. 671

dated October 22, 2007. In order to implement its

programs, the Foundation shall require funding.

Such funding shall necessarily come from gifts,

donations and other contributions, given that the

Foundation does not intend to engage in activities

for profit. In this regard, cash and shares of stock

in a domestic corporation will be contributed to the

Foundation, initially as part of the initial contribution

to the capital of the Foundation. After

incorporation, the Foundation will likewise likely

receive various donations from prospective donors

either in cash or property.

You now request for confirmation of your

opinion that:

1. Various gifts, donations and other

contributions made by residents

and/or nonresidents to the Foundation

in the form of cash and/or shares of

stock or other property, are exempt

from donor's tax; and

2. The Deed of Donation or Contribution

of Capital wherein shares of stock in a

domestic corporation are donated to

the Foundation is not subject to DST

under Section 175 of the NIRC, as

amended. However, the

acknowledgment on the deed is

subject to DST of P15.00 imposed

under Section 188 of the same Code.

In reply, please be informed as follows:

Donations made to the Foundation are exempt

from donor's tax.

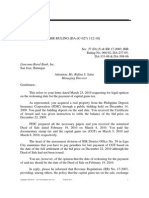

In BIR Ruling No. DA-058-04 dated

February 9, 2008, the prospective donors were

willing to donate real properties to the donee-

foundations for the purpose of putting up a retreat

house and seminary pending the issuance of the

Certificate of Tax Exemption and Accreditation with

the Philippine Council for NGO Certification

(PCNC). This Office ruled that —

". . . pursuant to Section 101(A)

(3) of the Tax Code of 1997, the

proposed donations to Merkaba

Foundation, Inc. and Redemptoris Mater

Missionary Seminary, Archdiocese of

Manila, Inc. are exempt from the

payment of donor's tax, subject to the

condition that not more than 30% of the

said gift shall be used by the donee for

administration purposes. TSCIEa

However, it is the opinion of this

Office that Merkaba Foundation, Inc. and

Redemptoris Mater Missionary

Seminary, Archdiocese of Manila, Inc.

are required to first secure accreditation

as donee institutions, from the Philippine

Council for NGO Certification (PCNC),

6th Floor SCC Bldg., CFA-MA

Compound, 4427 Interior Old Sta. Mesa,

Manila, in order that donations made to

them by natural and juridical persons

may be treated as fully deductible for

income tax purposes."

In another case, which is on all squares with

the present case, this Office opined as follows:

"Inasmuch as the donee is a

charitable institution, donation from its

benefactors is exempt from the payment

of donor's tax pursuant to Section

101(A)(3) of the Tax Code of 1997,

subject to the condition that not more

than thirty percent (30%) of said gift shall

be used for administration purposes.

Moreover, the Deed of Donation

is not subject to documentary stamp tax.

However, the acknowledgment on said

deed is subject to the documentary

stamp tax of P15.00 imposed under

Section 188 of the Tax Code of 1997, as

amended." (BIR Ruling No. DA-120-08

dated March 4, 2008). AEcTCD

Inasmuch as the donee is a charitable

institution, donations in cash and/or shares of stock

or other properties in a domestic corporation to the

Foundation, both as part of the process of

incorporation and thereafter, on an ongoing basis,

are exempt from payment of donor's tax pursuant

to Section 101 (A) (3) and (B) (2) of the NIRC, as

amended, subject to the condition that not more

than 30% of the gift shall be used by the donee for

administration purposes. (BIR Ruling No. DA-467-

07 dated August 24, 2007).

Moreover, in the case of donations of real

properties, Section 185 of Regulations No. 26,

otherwise known as the Revised Documentary

Stamp Tax Regulations, implementing Title VII of

the NIRC, as amended, provides that conveyances

of realties not in connection with a sale, to trustees

or other persons without consideration are not

taxable. Accordingly, the Deed of Donation of real

property is not subject to the DST prescribed under

Section 196 of the NIRC, as amended, but only to

the DST of P15.00 imposed under Section 188 of

the same Code. (BIR Ruling No. DA-28-98 dated

January 29, 1998 and BIR Ruling No. DA-123-

2001 dated July 18, 2001).

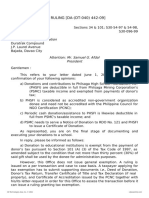

Donations of shares of stock to the Foundation is

not subject to DST under Section 175.

The issue on whether or not the donation of

shares of stock is subject to DST under Section

175 of the NIRC, as amended, has been answered

by this Office in BIR Ruling No. DA-492-07 dated

September 14, 2007. In the aforecited ruling, this

Office held that the transfer of shares is not subject

to DST since the monetary consideration in the

conveyance from which the tax shall be based is

wanting.

On the other hand, this Office opined in BIR

Ruling No. DA-311-05 dated July 6, 2005 that in

order that the DST may be imposed on the transfer

of shares or certificates of stock, there must be a

consideration and an actual or constructive transfer

of beneficial ownership of the shares from one

person to another. Although there may be a

transfer of beneficial ownership, if, however, the

transfer is without consideration, it is not within the

contemplation of Section 175 (then Section 176) of

the same Code. Thus, the transfer of shares by

virtue of a Deed of Donation is not subject to DST

prescribed in Section 175 of the NIRC as

amended, viz.: HITEaS

". . . this Office holds that the

transfer of the 10,000 shares of stock, in

Seaboard Eastern Insurance, from Lily

M. Co to Jacqueline Halili M. Co by

virtue of a Deed of Donation is not

subject to the documentary stamp tax

prescribed in Section 176 of the Tax

Code of 1997, as amended by R.A. No.

9243, as implemented by Revenue

Regulations No. 13-2004."

However, donations in shares of stock in a

domestic corporation, are subject to the DST of

P15.00 imposed under Section 188 of the NIRC,

as amended. (BIR Ruling No. DA-001-05 dated

January 5, 2005).

Subsequent transfer by the Foundation of donated

property is taxable.

If the same property acquired by gift is

subsequently conveyed by way of sale or

exchange, the sale will be subject to corporate

income tax on the gain realized which is

determined by deducting from the gross selling

price the historical cost or the adjusted basis

thereof, as it would be in the hands of the donor,

pursuant to Section 27 in relation to Section 101,

both of the NIRC, as amended, and consequently

to the creditable expanded withholding tax under

Revenue Regulations (RR) No. 2.57.2 of RR No. 2-

98, as amended. If it is donated to a nonexempt

donee, the donor shall be liable for donor's tax

pursuant to Section 98 of the same Code.

Donations to the Foundation are deductible from

donor's taxable business income.

Donations to the accredited Foundation shall

be deductible in full from the taxable business

income of the donor depending on the donee's

compliance with the level of administrative

expense and utilization requirements. Otherwise, it

shall be entitled only to the limited deductions as

provided for under Section 34 (H) (1) of the Tax

Code (BIR Ruling No. S-30-054-98 dated

September 30, 1998).

Finally, in case of donations from non-

resident citizens, they are required to submit to this

Office the notarized Deed of Donation duly

authenticated by the Philippine Consul General of

the donor's residence. (BIR Ruling No. DA-120-

2008 dated March 4, 2008).

This ruling is being issued on the basis of

the foregoing facts as represented. However, if

upon investigation, it will be disclosed that the facts

are different, then this ruling shall be considered

null and void.AaIDCS

Very truly

yours,

(SGD.)

JAMES H.

ROLDAN

Assistant

Commissioner

Legal Service

Das könnte Ihnen auch gefallen

- Donor's TaxDokument4 SeitenDonor's TaxEunice ParraNoch keine Bewertungen

- Ra 7899Dokument2 SeitenRa 7899Ia BolosNoch keine Bewertungen

- Doing BusinessDoing Business in The PhilDokument54 SeitenDoing BusinessDoing Business in The PhilDavid JesusNoch keine Bewertungen

- Price Ceiling For Economic HousingDokument2 SeitenPrice Ceiling For Economic HousingAnnNoch keine Bewertungen

- Reportorial RequirementsDokument2 SeitenReportorial RequirementsNathalie QuinonesNoch keine Bewertungen

- Articles of Incorporation and by Laws Non Stock CorporationDokument11 SeitenArticles of Incorporation and by Laws Non Stock Corporationjoonee09Noch keine Bewertungen

- Cancellation of Encumbrance Sec 7 Ra 26 - Google SearchDokument2 SeitenCancellation of Encumbrance Sec 7 Ra 26 - Google Searchbatusay575Noch keine Bewertungen

- Donor's Tax Quizzer-2Dokument5 SeitenDonor's Tax Quizzer-2Monina Cabalag0% (1)

- Maritime Industry Authority Advisory No 2017-17Dokument3 SeitenMaritime Industry Authority Advisory No 2017-17PortCalls100% (2)

- ECC Online Application Procedures (Category B-IEEC)Dokument1 SeiteECC Online Application Procedures (Category B-IEEC)Joseph CajoteNoch keine Bewertungen

- National Building CodeDokument81 SeitenNational Building CodeJulca Lou M. AguilarNoch keine Bewertungen

- Republic of The Philippines Court of Appeals Manila: PetitionersDokument12 SeitenRepublic of The Philippines Court of Appeals Manila: PetitionersNetweightNoch keine Bewertungen

- Ra 8756 - Rules & Regulations To Implement RHQ & RohqDokument17 SeitenRa 8756 - Rules & Regulations To Implement RHQ & Rohqdpadlan0% (1)

- RR 2-98Dokument85 SeitenRR 2-98Elaine LatonioNoch keine Bewertungen

- 2013 NEDA JV Guidelines PDFDokument44 Seiten2013 NEDA JV Guidelines PDFCharlie dela RosaNoch keine Bewertungen

- BIR Ruling 242-18Dokument7 SeitenBIR Ruling 242-18anntomarong100% (1)

- Special Visa For Employment Generation (Sveg)Dokument6 SeitenSpecial Visa For Employment Generation (Sveg)gerrymalgapoNoch keine Bewertungen

- ASC Code of EthicsDokument28 SeitenASC Code of EthicsEisset JuanichNoch keine Bewertungen

- MR Omb SampleDokument5 SeitenMR Omb SampleVinz G. VizNoch keine Bewertungen

- Toyota Avanza 2016 09 Workshop Service ManualDokument20 SeitenToyota Avanza 2016 09 Workshop Service Manualpriscillasalas040195ori100% (123)

- Application For Issuance of TX Exemption RulingDokument2 SeitenApplication For Issuance of TX Exemption RulingfileksNoch keine Bewertungen

- Bcda IrrDokument28 SeitenBcda IrrAlan TanNoch keine Bewertungen

- Games Strategies and Decision Making 2nd Edition Harrington Solutions ManualDokument22 SeitenGames Strategies and Decision Making 2nd Edition Harrington Solutions ManualDaleQuinnwnbx98% (54)

- Taguig Ord No.21 S.1998 Insurance (CGL)Dokument4 SeitenTaguig Ord No.21 S.1998 Insurance (CGL)Renz MonteroNoch keine Bewertungen

- Iee Subdivision Housing Less PemapsDokument7 SeitenIee Subdivision Housing Less PemapsAredal SemrehNoch keine Bewertungen

- 05 July 2019 DHSUD DRAFT IRRDokument37 Seiten05 July 2019 DHSUD DRAFT IRRChiara Pica AxibalNoch keine Bewertungen

- QuezonCityGovt PPP CodeDokument52 SeitenQuezonCityGovt PPP CodeMitz FranciscoNoch keine Bewertungen

- Research CAR and Nominal SharesDokument5 SeitenResearch CAR and Nominal Sharesarkina_sunshineNoch keine Bewertungen

- Century Peak v. Sec of FinanceDokument32 SeitenCentury Peak v. Sec of Financeaudreydql5Noch keine Bewertungen

- TOR - Process and Procedure Audit - NGCPDokument22 SeitenTOR - Process and Procedure Audit - NGCPJoshua GarbinNoch keine Bewertungen

- BIR Ruling (DA-433-07) - APIC As DividendsDokument3 SeitenBIR Ruling (DA-433-07) - APIC As DividendsCkey ArNoch keine Bewertungen

- DOF Local Finance Circular 03-93Dokument4 SeitenDOF Local Finance Circular 03-93Peggy SalazarNoch keine Bewertungen

- Centuria Medical Frequently Asked Questions - Nov 15Dokument10 SeitenCenturia Medical Frequently Asked Questions - Nov 15Dennis Esik MaligayaNoch keine Bewertungen

- Instant Download Ebook PDF America The Essential Learning Edition Second Edition Vol Volume 2 2nd Edition PDF ScribdDokument31 SeitenInstant Download Ebook PDF America The Essential Learning Edition Second Edition Vol Volume 2 2nd Edition PDF Scribdbrett.smith315100% (47)

- How To Register A Foundation in The PhilippinesDokument2 SeitenHow To Register A Foundation in The PhilippinesArlene Estrebillo100% (1)

- BIR RMC No. 62-2005Dokument15 SeitenBIR RMC No. 62-2005dencave1Noch keine Bewertungen

- RR No. 13-98Dokument16 SeitenRR No. 13-98Ana DocallosNoch keine Bewertungen

- Review XXXX ("Petition") Filed by Complainant-Appellant XXXXXX inDokument2 SeitenReview XXXX ("Petition") Filed by Complainant-Appellant XXXXXX inIpe Closa100% (1)

- Treasurer'S Affidavit: Republic of The Philippines) City of Cebu) S.S. Province of Cebu)Dokument2 SeitenTreasurer'S Affidavit: Republic of The Philippines) City of Cebu) S.S. Province of Cebu)Princess de GuzmanNoch keine Bewertungen

- Sales PromotionDokument16 SeitenSales PromotionAlyaSabbanNoch keine Bewertungen

- RMC No 5-2014 - Clarifying The Provisions of RR 1-2014Dokument18 SeitenRMC No 5-2014 - Clarifying The Provisions of RR 1-2014sj_adenipNoch keine Bewertungen

- Local Government Code On ZoningDokument2 SeitenLocal Government Code On ZoningJDR JDRNoch keine Bewertungen

- Ms. Luisa M. LabadDokument14 SeitenMs. Luisa M. LabadLaarnie ManalastasNoch keine Bewertungen

- Ralph Sarmiento's Certificate of Non-Forum ShoppingDokument1 SeiteRalph Sarmiento's Certificate of Non-Forum Shoppingdan0409Noch keine Bewertungen

- HDMF Circular 258Dokument6 SeitenHDMF Circular 258Jay O CalubayanNoch keine Bewertungen

- NEA Memo To ECs No. 2017-019 - Revised Procurement Guidelines and Simplified Bidding Procedures For Electric Cooperatives IRR-RA 10531 (2017) PDFDokument3 SeitenNEA Memo To ECs No. 2017-019 - Revised Procurement Guidelines and Simplified Bidding Procedures For Electric Cooperatives IRR-RA 10531 (2017) PDFJeromeo Hallazgo de LeonNoch keine Bewertungen

- 1302134458-k10.SPP DA E.Service - Agree-1Dokument11 Seiten1302134458-k10.SPP DA E.Service - Agree-1Jeanine ClarkNoch keine Bewertungen

- PD 1216 PDFDokument2 SeitenPD 1216 PDFgivemeasign24100% (1)

- Residential Rental AgreementDokument4 SeitenResidential Rental Agreementspark TubeNoch keine Bewertungen

- Notice of Cancellation MOADokument1 SeiteNotice of Cancellation MOAJose Vicente Nuguid ErictaNoch keine Bewertungen

- Pag Ibig FundDokument3 SeitenPag Ibig FundAwesomeworldNoch keine Bewertungen

- Panglao Island Tourism Development Guidelines Final EditedDokument23 SeitenPanglao Island Tourism Development Guidelines Final EditedTonyTonyNoch keine Bewertungen

- Guidelines and Instruction For BIR Form No 1702 RTDokument2 SeitenGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- Cagayan River Dredging Project (MGB Group) PDFDokument6 SeitenCagayan River Dredging Project (MGB Group) PDFAnonymous JVD8bLSxNoch keine Bewertungen

- Limcoma Rural Bank, Inc. June 25, 2010Dokument4 SeitenLimcoma Rural Bank, Inc. June 25, 2010Ronnie RimandoNoch keine Bewertungen

- ACC 550 SyllabusDokument8 SeitenACC 550 Syllabusjvj1234Noch keine Bewertungen

- Tax ExemptionDokument2 SeitenTax ExemptionHeber BacolodNoch keine Bewertungen

- BIR EscrowDokument20 SeitenBIR Escrowlorkan19Noch keine Bewertungen

- ST Ending:: CincinnatiDokument3 SeitenST Ending:: CincinnatiMassiNoch keine Bewertungen

- NPO PresentationDokument17 SeitenNPO PresentationMuhammad HusnainNoch keine Bewertungen

- 2009 BIR - Ruling - DA - DT 040 - 442 09 - 20210505 13 5mraj9Dokument3 Seiten2009 BIR - Ruling - DA - DT 040 - 442 09 - 20210505 13 5mraj9catherine joy sangilNoch keine Bewertungen

- Notice of Penalty - Hindu Mission of MississaugaDokument53 SeitenNotice of Penalty - Hindu Mission of MississaugaJordan GinsbergNoch keine Bewertungen

- 8088 2010 BIR - Ruling - No. - 103 1020210505 12 Mijt7dDokument4 Seiten8088 2010 BIR - Ruling - No. - 103 1020210505 12 Mijt7dcatherine joy sangilNoch keine Bewertungen

- Engineering Connections FoundationDokument4 SeitenEngineering Connections FoundationPSHNoch keine Bewertungen

- Requirements - Setting Up A FoundationDokument2 SeitenRequirements - Setting Up A FoundationVanessa MallariNoch keine Bewertungen

- Dwnload Full Intimate Relationships 2nd Edition Bradbury Test Bank PDFDokument13 SeitenDwnload Full Intimate Relationships 2nd Edition Bradbury Test Bank PDFphumilorlyna100% (11)

- BT Toyota Forklift Collections Repair Manual Training ManualDokument15 SeitenBT Toyota Forklift Collections Repair Manual Training Manualanthonystafford030799oct100% (71)

- Full Download Current Diagnosis and Treatment Obstetrics and Gynecology by Alan Test Bank PDF Full ChapterDokument22 SeitenFull Download Current Diagnosis and Treatment Obstetrics and Gynecology by Alan Test Bank PDF Full Chapterperulaalienatorrbw36100% (13)

- Solution Manual For Search Engines Information Retrieval in Practice 0136072240Dokument15 SeitenSolution Manual For Search Engines Information Retrieval in Practice 0136072240michellelewismqdacbxijt100% (45)

- Instant Download Test Bank For Medical Surgical Nursing 7th Edition Adrianne Dill Linton PDF FullDokument10 SeitenInstant Download Test Bank For Medical Surgical Nursing 7th Edition Adrianne Dill Linton PDF FullJosephWoodsdbjt100% (15)

- JCB Excavator Js140 Js200 Js205 Js215 Sevice ManualDokument22 SeitenJCB Excavator Js140 Js200 Js205 Js215 Sevice Manualamberjenkins010496iqc100% (134)

- Lexus Ct200h 2015 2017 Electrical Wiring DiagramDokument13 SeitenLexus Ct200h 2015 2017 Electrical Wiring Diagramzekaqab100% (45)

- The Creative Impulse Introduction To The Arts 8th Edition Sporre Test BankDokument17 SeitenThe Creative Impulse Introduction To The Arts 8th Edition Sporre Test Bankerewhileaffinehwmjya100% (14)

- The Educational Value of Alumni For Public SchoolDokument22 SeitenThe Educational Value of Alumni For Public SchoolAlexNoch keine Bewertungen

- Organizational Behavior Arab World Edition 1st Edition Robbins Test BankDokument24 SeitenOrganizational Behavior Arab World Edition 1st Edition Robbins Test Bankflogernevi3ij9100% (23)

- OrphanageDokument5 SeitenOrphanageMansur Ahmed SheikhNoch keine Bewertungen

- Full Download Solution Manual For Computer Architecture 6th by Hennessy PDF Full ChapterDokument17 SeitenFull Download Solution Manual For Computer Architecture 6th by Hennessy PDF Full Chapterparraquarekindlepoxp100% (10)

- Revenue Regulations No. 13-98Dokument5 SeitenRevenue Regulations No. 13-98saintkarriNoch keine Bewertungen

- Instant Download Test Bank For Nutrition Essentials and Diet Therapy 11th Edition Nancy J Peckenpaugh PDF FullDokument21 SeitenInstant Download Test Bank For Nutrition Essentials and Diet Therapy 11th Edition Nancy J Peckenpaugh PDF Fulltammiedavilaifomqycpes100% (9)

- Solutions Manual To Accompany Miller Freunds Probability and Statistics For Engineers 8th Edition 0321640772Dokument23 SeitenSolutions Manual To Accompany Miller Freunds Probability and Statistics For Engineers 8th Edition 0321640772paulsuarezearojnmgyiNoch keine Bewertungen

- Instant Download Principles of Macroeconomics 1st Edition Mankiw Test Bank PDF Full ChapterDokument15 SeitenInstant Download Principles of Macroeconomics 1st Edition Mankiw Test Bank PDF Full ChapterAndrewDeleonjxwc100% (5)

- Donors Tax in The Philippines Under TRAINDokument4 SeitenDonors Tax in The Philippines Under TRAINAnna Dominique VillanuevaNoch keine Bewertungen

- Atlas Copco Portable Compressors Xrxs Xrvs 566 606 CD Xrxs CD Xrvs 1200 1250 Cd6 Parts List 2955 0960-01-2008Dokument21 SeitenAtlas Copco Portable Compressors Xrxs Xrvs 566 606 CD Xrxs CD Xrvs 1200 1250 Cd6 Parts List 2955 0960-01-2008destinywashington051185xqi100% (68)

- Instant Download Solution Manual For Environmental Economics and Management Theory Policy and Applications 6th Edition PDF ScribdDokument8 SeitenInstant Download Solution Manual For Environmental Economics and Management Theory Policy and Applications 6th Edition PDF Scribdbasenesswisher.l10wyu100% (16)

- Solution Manual For Laboratory Manual For Anatomy Physiology Featuring Martini Art Main Version Plus Masteringap With Etext Package 5 e Michael G WoodDokument25 SeitenSolution Manual For Laboratory Manual For Anatomy Physiology Featuring Martini Art Main Version Plus Masteringap With Etext Package 5 e Michael G Woodkivikiviaries2wxmcy100% (47)

- Fundamentals of Multinational Finance 6th Edition Moffett Test BankDokument27 SeitenFundamentals of Multinational Finance 6th Edition Moffett Test Bankblockagecourtapfrwv100% (33)

- Managerial Accounting Tools For Business Decision Making Canadian 5th Edition Weygandt Test BankDokument8 SeitenManagerial Accounting Tools For Business Decision Making Canadian 5th Edition Weygandt Test Bankfaburdenmascledjvqg7100% (22)

- Basic Environmental Technology Water Supply Waste Management and Pollution Control 5th Edition Nathanson Solutions ManualDokument10 SeitenBasic Environmental Technology Water Supply Waste Management and Pollution Control 5th Edition Nathanson Solutions ManualBrandyClarkaemf100% (9)

- College Algebra and Trigonometry 3rd Edition Ratti Test BankDokument11 SeitenCollege Algebra and Trigonometry 3rd Edition Ratti Test Bankkavass.quothad29l100% (26)

- Instant Download Strategic Compensation A Human Resource Management Approach 9th Edition e Book PDF Version Ebook PDF Version PDF FREEDokument10 SeitenInstant Download Strategic Compensation A Human Resource Management Approach 9th Edition e Book PDF Version Ebook PDF Version PDF FREEmary.brinks380100% (47)