Beruflich Dokumente

Kultur Dokumente

Finances

Hochgeladen von

SamerCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Finances

Hochgeladen von

SamerCopyright:

Verfügbare Formate

Game Card

Financial Statements

December 31, 2017

Prepared By Peter Lewis

Purpose To provide financial information about the current state

of the Game Card store

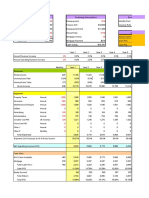

Game Card

Income Statement

January 1, 2017 to December 31, 2017

Income

Gross Sales $ 417,600

Less returns and allowances 34,100

Net Sales 383,500

Cost of Goods

Inventory, January 1 123,200

Purchases 78,000

Delivery Charges 14,400

Total Merchandise Handled 215,600

Less Inventory, December 31 114,600

Cost of Goods Sold 101,000

Gross Profit 282,500

Interest Income 3,700

Total Income 286,200

Expenses

Salaries and Benefits 125,200

Utilities 14,300

Rent 10,100

Office Supplies 6,800

Insurance 4,500

Advertising 9,300

Website 3,100

Taxes & Licenses 8,700

Total Expenses 182,000

Net Income $ 104,200

Game Card Expenses

Taxes & Licenses; 4.78%

Website; 1.70%

Advertising; 5.11%

Insurance; 2.47%

Office Supplies; 3.74%

Rent; 5.55%

Utilities; 7.86%

Salaries and Benefits; 68.79%

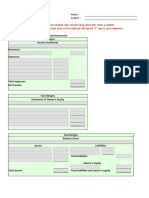

Game Card

Balance Sheet

December 31, 2017

Current

Assets Amounts % of Total

Cash $ 15,500 8.4%

Accounts Receivable 5,500 3.0%

Inventory 114,600 62.1%

Fixed Assets 21,800 11.8%

Other 27,200 14.7%

Total Assets $ 184,600 100.0%

Current Asset s

Cash

Accounts Rec eivable

Inventor y

Fixed Assets

Other

Liabilities Amounts % of Total

Accounts Payable $ 13,100 9.2%

Business Loans 75,200 53.0%

Capital Investments 31,400 22.1%

Other Debts 22,300 15.7%

Total Liabilities $ 142,000 100.0%

Current Liabi li ties

Accounts Paya ble

Business Loans

Capital Investments

Other Debt s

Net Worth $ 42,600 23.1%

Total Liabilities and Equity $ 184,600 100.0%

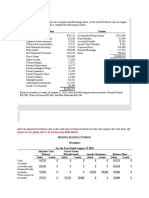

Game Card

Cash Flow Statement

End of Year: 2017

Operating Cash Flow

Net Income After Tax $ 104,200

Depreciation 3,200

Increase in Accounts Receivable (9,100)

Increase in Inventory (15,300)

Decrease in Accounts Payable (4,700)

Increase in Accrued Expenses 6,300

Total Operating Cash Flow 84,600

Investing Cash Flow

Purchase of Equipment $ (31,500)

Decrease in Notes Receivable 700

Total Investing Cash Flow (30,800)

Financing Cash Flow

Increase in Long Term Notes Payable $ 21,500

Increase in Term Loan 4,500

Conversion of Notes to Shareholders -

Total Financing Cash Flow 26,000

Total Cash Flow 79,800

Cash at beginning of the year 73,100

Cash at the end of the year $ 152,900

Das könnte Ihnen auch gefallen

- Work Sheet RatiosDokument4 SeitenWork Sheet Ratiosmohammad mueinNoch keine Bewertungen

- Evening Co. Statement of Financial Position As of December 31 20x1Dokument10 SeitenEvening Co. Statement of Financial Position As of December 31 20x1Kaye Ann Abejuela RamosNoch keine Bewertungen

- M1 C2 Case Study WorkbookDokument25 SeitenM1 C2 Case Study WorkbookfenixaNoch keine Bewertungen

- Statement of Cash Flow - SolutionDokument8 SeitenStatement of Cash Flow - SolutionHân NabiNoch keine Bewertungen

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDokument7 SeitenHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikNoch keine Bewertungen

- Finance Quiz 3Dokument43 SeitenFinance Quiz 3Peak ChindapolNoch keine Bewertungen

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDokument19 SeitenAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNoch keine Bewertungen

- Practice Problems, CH 5Dokument7 SeitenPractice Problems, CH 5scridNoch keine Bewertungen

- Case 1 Format IdeaDokument5 SeitenCase 1 Format IdeaMarina StraderNoch keine Bewertungen

- Quiz 1Dokument2 SeitenQuiz 1jevieconsultaaquino2003Noch keine Bewertungen

- Karkits Company Statement of Comprehensive Income For The Year Ended December 31,2014Dokument4 SeitenKarkits Company Statement of Comprehensive Income For The Year Ended December 31,2014Kaira GoNoch keine Bewertungen

- CH 12 Wiley Plus Kimmel Quiz & HWDokument9 SeitenCH 12 Wiley Plus Kimmel Quiz & HWmkiNoch keine Bewertungen

- HW 4Dokument4 SeitenHW 4Mishalm96Noch keine Bewertungen

- Blue Bill Corp Module 6 Assignment-1cxlc8byxz6r5 - 1euusngisn9vlDokument4 SeitenBlue Bill Corp Module 6 Assignment-1cxlc8byxz6r5 - 1euusngisn9vlKimberley WrightNoch keine Bewertungen

- 01 - Exercises Session 1 - EmptyDokument4 Seiten01 - Exercises Session 1 - EmptyAgustín RosalesNoch keine Bewertungen

- Accrual Basis AccountingDokument149 SeitenAccrual Basis AccountingManzoor AlamNoch keine Bewertungen

- Practice Problems 2Dokument10 SeitenPractice Problems 2Luigi NocitaNoch keine Bewertungen

- Question 2 Water CorporationDokument7 SeitenQuestion 2 Water Corporationyusuf pashaNoch keine Bewertungen

- Appendix ADokument7 SeitenAppendix AJehrehmiah MuyahNoch keine Bewertungen

- Template - MIDTERM EXAM INTERMEDIATE 1Dokument7 SeitenTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNoch keine Bewertungen

- Problem 1: Cash Flow Statement (Class Practice)Dokument2 SeitenProblem 1: Cash Flow Statement (Class Practice)ronamiNoch keine Bewertungen

- DifferenceDokument10 SeitenDifferencethalibritNoch keine Bewertungen

- Balance Sheet Formula Excel TemplateDokument5 SeitenBalance Sheet Formula Excel TemplateD suhendarNoch keine Bewertungen

- Balance Sheet and Income Statement (2016-2020)Dokument20 SeitenBalance Sheet and Income Statement (2016-2020)XienaNoch keine Bewertungen

- Annual Report: Balance SheetDokument2 SeitenAnnual Report: Balance Sheetdummy GoodluckNoch keine Bewertungen

- 4 Statements PTDokument10 Seiten4 Statements PTjoshua korylle mahinayNoch keine Bewertungen

- Excercises of Chapter Two-SolutionDokument7 SeitenExcercises of Chapter Two-SolutionMohammad Al AkoumNoch keine Bewertungen

- A011231114 - Hengky Kusuma TUGAS 4 Pengantar AkuntansiDokument13 SeitenA011231114 - Hengky Kusuma TUGAS 4 Pengantar AkuntansiHengky NaraNoch keine Bewertungen

- Course Folder Fall 2022Dokument26 SeitenCourse Folder Fall 2022Areeba QureshiNoch keine Bewertungen

- 20190312220046BN001184625Dokument10 Seiten20190312220046BN001184625Roifah AmeliaNoch keine Bewertungen

- FIN1000 Module06 Forecasting AssignmentDokument4 SeitenFIN1000 Module06 Forecasting AssignmentfaithNoch keine Bewertungen

- ACCT 3061 Asignación Cap 4 y 5Dokument4 SeitenACCT 3061 Asignación Cap 4 y 5gpm-81Noch keine Bewertungen

- Exercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationDokument10 SeitenExercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationJohn Kenneth Bohol50% (2)

- Consolidated Interim Financial Information (Unaudited) As of March 31, 2021 and 2020Dokument45 SeitenConsolidated Interim Financial Information (Unaudited) As of March 31, 2021 and 2020Fernando SeminarioNoch keine Bewertungen

- Income Statement: Company NameDokument9 SeitenIncome Statement: Company NameAkshay SinghNoch keine Bewertungen

- Camille ManufacturingDokument4 SeitenCamille ManufacturingChristina StephensonNoch keine Bewertungen

- Section B:: 1. Are The Following Balance Sheet Items (A) Assets, (L) Liabilities, or (E) Stockholders' Equity?Dokument11 SeitenSection B:: 1. Are The Following Balance Sheet Items (A) Assets, (L) Liabilities, or (E) Stockholders' Equity?18071369 Nguyễn ThànhNoch keine Bewertungen

- Chapter 7. Student CH 7-14 Build A Model: AssetsDokument5 SeitenChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNoch keine Bewertungen

- Entity ADokument4 SeitenEntity Ataeyung kimNoch keine Bewertungen

- Basic Rental Analysis WorksheetDokument8 SeitenBasic Rental Analysis WorksheetGleb petukhovNoch keine Bewertungen

- PepsiCo Financial StatementsDokument9 SeitenPepsiCo Financial StatementsBorn TaylorNoch keine Bewertungen

- Pwdee: Empowerment & EmploymentDokument30 SeitenPwdee: Empowerment & EmploymentCy Libo-OnNoch keine Bewertungen

- Cash Flow - HandoutDokument3 SeitenCash Flow - HandoutMichelle ManuelNoch keine Bewertungen

- Crash Landing On You Company Financial StatementsDokument6 SeitenCrash Landing On You Company Financial StatementsEmar KimNoch keine Bewertungen

- Chapter 13 Homework Assignment #2 QuestionsDokument8 SeitenChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- QUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDokument4 SeitenQUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDaffa Ramadhan ArcheryNoch keine Bewertungen

- Practice Problems, CH 12Dokument6 SeitenPractice Problems, CH 12scridNoch keine Bewertungen

- Fernandez CoDokument3 SeitenFernandez CoNorie FernandezNoch keine Bewertungen

- Mini CaseDokument7 SeitenMini CaseHarrisha Arumugam0% (1)

- Ch23 StatementofCashFlowExamples Zeke and ZoeDokument4 SeitenCh23 StatementofCashFlowExamples Zeke and ZoeHossein ParvardehNoch keine Bewertungen

- Coffee Shop Business Plan - Financial PL PDFDokument18 SeitenCoffee Shop Business Plan - Financial PL PDFSamenNoch keine Bewertungen

- WEEK 4 FINANCIAL STATEMENT ANALYSIS Part 2Dokument42 SeitenWEEK 4 FINANCIAL STATEMENT ANALYSIS Part 2GIRLNoch keine Bewertungen

- Ch02 P14 Build A Model SolutionDokument6 SeitenCh02 P14 Build A Model SolutionSeee OoonNoch keine Bewertungen

- 5.2 Monahan Manufacturing: Preparing and Interpreting A Statement of Cash FlowsDokument2 Seiten5.2 Monahan Manufacturing: Preparing and Interpreting A Statement of Cash FlowsvedeshNoch keine Bewertungen

- 648235Dokument5 Seiten648235mohitgaba19Noch keine Bewertungen

- Addtional Cash Flow Problems and SolutionsDokument7 SeitenAddtional Cash Flow Problems and SolutionsHossein ParvardehNoch keine Bewertungen

- Comp XMDokument1 SeiteComp XMlogeshkounderNoch keine Bewertungen

- Revisi Tugas Cash Flow AnalysisDokument29 SeitenRevisi Tugas Cash Flow AnalysisNovilia FriskaNoch keine Bewertungen

- Ratio Analysis For CADokument7 SeitenRatio Analysis For CAShahid MahmudNoch keine Bewertungen

- ECN 2020 Syllabus-FALL 2020Dokument4 SeitenECN 2020 Syllabus-FALL 2020SamerNoch keine Bewertungen

- Example One Sample T TestDokument1 SeiteExample One Sample T TestSamerNoch keine Bewertungen

- Argentine InfoDokument1 SeiteArgentine InfoSamerNoch keine Bewertungen

- Anscombe's Data WorkbookDokument5 SeitenAnscombe's Data WorkbookSamerNoch keine Bewertungen

- Argentine InfoDokument1 SeiteArgentine InfoSamerNoch keine Bewertungen

- Monetary and Fiscal Policies in 2008Dokument7 SeitenMonetary and Fiscal Policies in 2008SamerNoch keine Bewertungen

- Example Paired SamplesDokument3 SeitenExample Paired SamplesSamerNoch keine Bewertungen

- NeedlesPOA12e - P 02-05Dokument9 SeitenNeedlesPOA12e - P 02-05SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 3-16Dokument8 SeitenNeedlesPOA 12e - P 3-16SamerNoch keine Bewertungen

- Example Selecting Cases in SPSSDokument1 SeiteExample Selecting Cases in SPSSSamerNoch keine Bewertungen

- NeedlesPOA 12e - P 07-06Dokument4 SeitenNeedlesPOA 12e - P 07-06SamerNoch keine Bewertungen

- NeedlesPOA12e - P 14-04Dokument4 SeitenNeedlesPOA12e - P 14-04SamerNoch keine Bewertungen

- Needles POA 12e - P 12-07Dokument4 SeitenNeedles POA 12e - P 12-07SamerNoch keine Bewertungen

- NeedlesPOA12e - P 14-05Dokument2 SeitenNeedlesPOA12e - P 14-05SamerNoch keine Bewertungen

- NeedlesPOA12e - P 05-03Dokument6 SeitenNeedlesPOA12e - P 05-03SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 07-01Dokument4 SeitenNeedlesPOA 12e - P 07-01SamerNoch keine Bewertungen

- Example Independent SamplesDokument3 SeitenExample Independent SamplesSamerNoch keine Bewertungen

- NeedlesPOA 12e - P 07-02Dokument6 SeitenNeedlesPOA 12e - P 07-02SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 07-02Dokument6 SeitenNeedlesPOA 12e - P 07-02SamerNoch keine Bewertungen

- NeedlesPOA12e - P 05-06Dokument4 SeitenNeedlesPOA12e - P 05-06SamerNoch keine Bewertungen

- NeedlesPOA12e - P 14-08Dokument4 SeitenNeedlesPOA12e - P 14-08SamerNoch keine Bewertungen

- NeedlesPOA12e - P 05-03Dokument6 SeitenNeedlesPOA12e - P 05-03SamerNoch keine Bewertungen

- NeedlesPOA12e - P 05-06Dokument4 SeitenNeedlesPOA12e - P 05-06SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 01-08Dokument2 SeitenNeedlesPOA 12e - P 01-08SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 06-09Dokument3 SeitenNeedlesPOA 12e - P 06-09SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 01-04Dokument3 SeitenNeedlesPOA 12e - P 01-04SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 01-08Dokument2 SeitenNeedlesPOA 12e - P 01-08SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 01-03Dokument2 SeitenNeedlesPOA 12e - P 01-03SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 06-03Dokument3 SeitenNeedlesPOA 12e - P 06-03SamerNoch keine Bewertungen

- NeedlesPOA12e - P 16-01Dokument3 SeitenNeedlesPOA12e - P 16-01SamerNoch keine Bewertungen

- Project For Atma NirbharDokument11 SeitenProject For Atma NirbharBanajit SahaNoch keine Bewertungen

- The Influences of Cogs (Cost of Goods Sold) and Sales VolumeDokument19 SeitenThe Influences of Cogs (Cost of Goods Sold) and Sales VolumeAnnisaNurfaidahNoch keine Bewertungen

- Trend AnalysisDokument3 SeitenTrend AnalysisAniket KedareNoch keine Bewertungen

- $nit 3 Accounting Concepts StandardsDokument12 Seiten$nit 3 Accounting Concepts StandardsPhonepaxa PhoumbundithNoch keine Bewertungen

- Bbap2103 - Management Accounting 2016Dokument16 SeitenBbap2103 - Management Accounting 2016yooheechulNoch keine Bewertungen

- Worksheet Financial StatementsDokument11 SeitenWorksheet Financial StatementsTanishkNoch keine Bewertungen

- Test Bank 3b A Practice or Test Bank For Fundamental of Cost Accounting and ControlDokument46 SeitenTest Bank 3b A Practice or Test Bank For Fundamental of Cost Accounting and ControlLuz De Castro DueñasNoch keine Bewertungen

- Senate Bill 365Dokument5 SeitenSenate Bill 365samtlevinNoch keine Bewertungen

- CH 08Dokument46 SeitenCH 08Phát TNNoch keine Bewertungen

- Chapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingDokument54 SeitenChapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingnikkaaaNoch keine Bewertungen

- CH 14 Wiley Kimmel Homework QuizDokument16 SeitenCH 14 Wiley Kimmel Homework QuizmkiNoch keine Bewertungen

- Joint and by ProductDokument6 SeitenJoint and by ProductJeric Lagyaban AstrologioNoch keine Bewertungen

- Second Grading ExaminationDokument17 SeitenSecond Grading ExaminationAmie Jane MirandaNoch keine Bewertungen

- GUIDELINES To Make Your Final Presentation A "World-Class" Final Pitch DeckDokument27 SeitenGUIDELINES To Make Your Final Presentation A "World-Class" Final Pitch DeckSweta JhaNoch keine Bewertungen

- EL201 Accounting Learning Module Lessons 51Dokument19 SeitenEL201 Accounting Learning Module Lessons 51BabyjoyNoch keine Bewertungen

- Chapter 1-2 Examples OnlineDokument9 SeitenChapter 1-2 Examples Onlinedeniz turkbayragi100% (1)

- CMPC 221 Finals Part 1: Mulitple ChoiceDokument7 SeitenCMPC 221 Finals Part 1: Mulitple ChoiceIyarna YasraNoch keine Bewertungen

- Labor: Controlling and Accounting For Costs: Multiple ChoiceDokument21 SeitenLabor: Controlling and Accounting For Costs: Multiple ChoiceRujean Salar AltejarNoch keine Bewertungen

- General Accounting Cheat SheetDokument35 SeitenGeneral Accounting Cheat Sheetazulceleste0_0100% (1)

- Chapter 9 ProblemsDokument55 SeitenChapter 9 Problemsashibhallau0% (2)

- Topic 4 Overview of Analysis TechniquesDokument37 SeitenTopic 4 Overview of Analysis TechniquesSir FELSIRXNNoch keine Bewertungen

- Deductions From Gross Income: (Sec. 65, Rev. Reg. No. 2)Dokument69 SeitenDeductions From Gross Income: (Sec. 65, Rev. Reg. No. 2)Brian TorresNoch keine Bewertungen

- I. Accounting Methods For By-Products: Exercise 3Dokument2 SeitenI. Accounting Methods For By-Products: Exercise 3Crescent OsamuNoch keine Bewertungen

- Inventory AccountingDokument4 SeitenInventory AccountingIndra ThamilarasanNoch keine Bewertungen

- Instapdf - in Accounting Ratios Class 12 All Formulas 176Dokument18 SeitenInstapdf - in Accounting Ratios Class 12 All Formulas 176Subhavi DikshitNoch keine Bewertungen

- Sample Chart of AccountsDokument5 SeitenSample Chart of AccountssnsdyurijjangNoch keine Bewertungen

- IAS-2 Inventories-StudentsDokument8 SeitenIAS-2 Inventories-StudentsButt ArhamNoch keine Bewertungen

- CH - 08 - Valuation of Inventories, A Cost Basic ApproachDokument46 SeitenCH - 08 - Valuation of Inventories, A Cost Basic Approachfadlidirut100% (1)

- ch4 PDFDokument94 Seitench4 PDFMekanchha Dhakal100% (1)

- Chapter 14 Fill-In NotesDokument5 SeitenChapter 14 Fill-In Noteslowell MooreNoch keine Bewertungen