Beruflich Dokumente

Kultur Dokumente

Gujarat Technological University

Hochgeladen von

Chirag SabhayaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Gujarat Technological University

Hochgeladen von

Chirag SabhayaCopyright:

Verfügbare Formate

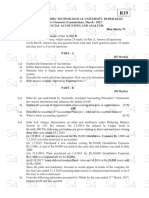

Seat No.: ________ Enrolment No.

___________

GUJARAT TECHNOLOGICAL UNIVERSITY

MAM - SEMESTER–III • EXAMINATION – WINTER • 2014

Subject Code: 4130504 Date: 08-12-2014

Subject Name: Elements of Direct and Indirect Taxes

Time: 10:30 am - 01:30 pm Total Marks: 70

Instructions:

1. Attempt all questions.

2. Make suitable assumptions wherever necessary.

3. Figures to the right indicate full marks.

Q.1 (a) Define the following terms: (a) Assessment Year; (b) Previous Year; (c) Person; and 07

(d) Income

(b) What will be the residential status of individuals mentioned under following two 07

cases for AY 2013-14?

(i) Mr. Dhoni left India for the first time on 29-06-2012 for employment.

(ii) Mr. Jadeja is residing in Canada but he is a person of Indian origin. Since the

year 1999-2000, every year he comes to visit India for a period of 100 days.

Q.2 (a) What are the various heads of income? How GTI is calculated for individual? 07

(b) What do you mean by ‘Allowances’ and ‘Perquisites’? What is the difference 07

between them? List out any three allowances and any three perquisites available to

employees.

OR

(b) Explain the meaning of Salary as per Section 17 (1). Explain in detail various 07

incomes to be included in Gross Salary.

Q.3 (a) What is Annual Value u/s 23(1) (a)? Explain the process of computation of annual 07

value of a house property.

(b) Explain the meaning of Business and Profession u/s 2 (13) and 2(36). Explain any 07

four general principles for computing business income in detail.

OR

Q.3 (a) Explain the basis of charge of capital gain u/s 45 (1). Explain short term capital asset 07

as per sec. 2 (42A), and Long term capital asset Sec. 2 (29A).

(b) Explain any seven deductions available in computing total income u/s 80C to 80U in 07

detail.

Q.4 (a) What do you mean by service tax? Explain in detail. What are the service tax rate 07

applicable from 1st April, 2012?

(b) What is VAT? Explain the advantages and limitations of VAT. 07

OR

Q.4 (a) Give the definitions of: (i) Dealers; (ii) Goods; (iii) Resale; and (iv) Turnover of 07

Sales

(b) Explain the services that are excluded from service tax. 07

Q.5 (a) Under which conditions service tax registration is required? Explain the process of 07

service tax registration.

(b) Define: (i) Business; (ii) Importer; (iii) Sales; and (iv) Services 07

OR

Q.5 (a) Distinguish between Direct Tax and Indirect Tax. 07

(b) Explain any seven services included in negative list (outside the scope of service tax) 07

*************

Das könnte Ihnen auch gefallen

- Gujarat Technological UniversityDokument1 SeiteGujarat Technological UniversityChirag SabhayaNoch keine Bewertungen

- Gujarat Technological UniversityDokument2 SeitenGujarat Technological UniversityChirag SabhayaNoch keine Bewertungen

- Gujarat Technological UniversityDokument3 SeitenGujarat Technological UniversityChirag SabhayaNoch keine Bewertungen

- Gujarat Technological UniversityDokument2 SeitenGujarat Technological UniversityHimanshu KachaNoch keine Bewertungen

- Gujarat Technological UniversityDokument1 SeiteGujarat Technological UniversityKhan RukhsarNoch keine Bewertungen

- Summer 13Dokument28 SeitenSummer 13Adnan SethiNoch keine Bewertungen

- Gujarat Technological University: InstructionsDokument1 SeiteGujarat Technological University: InstructionsShyamsunder SinghNoch keine Bewertungen

- Gujarat Technological UniversityDokument2 SeitenGujarat Technological UniversityJay ModiNoch keine Bewertungen

- Gujarat Technological University: InstructionsDokument1 SeiteGujarat Technological University: InstructionsVasim ShaikhNoch keine Bewertungen

- MBA Integrated WINTER 2020Dokument1 SeiteMBA Integrated WINTER 2020Anchal kalwaniNoch keine Bewertungen

- Gujarat Technological University: InstructionsDokument2 SeitenGujarat Technological University: InstructionsJay ModiNoch keine Bewertungen

- Afm 2810001 Dec 2018Dokument4 SeitenAfm 2810001 Dec 2018PILLO PATELNoch keine Bewertungen

- OSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05Dokument5 SeitenOSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05mehaik patwa , 20Noch keine Bewertungen

- Question Papers Supplementary Exam 2007Dokument24 SeitenQuestion Papers Supplementary Exam 2007ce1978Noch keine Bewertungen

- Guidelines For Preparation of DPRDokument1 SeiteGuidelines For Preparation of DPRSabhaya ChiragNoch keine Bewertungen

- Direct TaxationDokument39 SeitenDirect TaxationSethu SangurajanNoch keine Bewertungen

- Commercial Studies: (Two Hours)Dokument4 SeitenCommercial Studies: (Two Hours)Om PramanikNoch keine Bewertungen

- Gujarat Technological University: InstructionsDokument1 SeiteGujarat Technological University: InstructionsDipti MalakarNoch keine Bewertungen

- Finance Management Specialisation - Ii 304 - B: Direct TaxationDokument3 SeitenFinance Management Specialisation - Ii 304 - B: Direct TaxationRohit ParmarNoch keine Bewertungen

- Ecomomics TestDokument1 SeiteEcomomics TestHarsh ShahNoch keine Bewertungen

- FPDokument20 SeitenFPRadhika ParekhNoch keine Bewertungen

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Dokument10 SeitenReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGNoch keine Bewertungen

- Gujarat Technological UniversityDokument2 SeitenGujarat Technological Universitywehoxak452Noch keine Bewertungen

- Question Paper With Model Answers For Online Examination - Inter/P11-ITX/S1Dokument9 SeitenQuestion Paper With Model Answers For Online Examination - Inter/P11-ITX/S1Hemmu sahuNoch keine Bewertungen

- Bba 705Dokument2 SeitenBba 705api-3782519Noch keine Bewertungen

- 63 Question PaperDokument4 Seiten63 Question PaperSam NayakNoch keine Bewertungen

- Business Laws (70) : Summer Exam-2013Dokument21 SeitenBusiness Laws (70) : Summer Exam-2013Khalid MahmoodNoch keine Bewertungen

- Gujarat Technological UniversityDokument2 SeitenGujarat Technological UniversitymansiNoch keine Bewertungen

- 12th Accountacy Model Test PaperDokument5 Seiten12th Accountacy Model Test PaperJas Singh DevganNoch keine Bewertungen

- T.Y.B.B.A. (Sem.-V) Examination Nov - Dec.-2019 - Service Manage.-IDokument2 SeitenT.Y.B.B.A. (Sem.-V) Examination Nov - Dec.-2019 - Service Manage.-Ivaghasiyadixa7Noch keine Bewertungen

- Auditing AnalysisDokument13 SeitenAuditing AnalysisAmmarah Rajput ParhiarNoch keine Bewertungen

- Answer Key (IDT Model Paper)Dokument12 SeitenAnswer Key (IDT Model Paper)RKSiranjeeviRamanNoch keine Bewertungen

- K 2830202mfsDokument2 SeitenK 2830202mfsFaisal MalekNoch keine Bewertungen

- Practice Questions Income Tax Bba-Vi Sem Short & Long Practice QuestionsDokument15 SeitenPractice Questions Income Tax Bba-Vi Sem Short & Long Practice QuestionsRahulNoch keine Bewertungen

- Mba Summer 2015Dokument1 SeiteMba Summer 2015NitishNoch keine Bewertungen

- December 2014 Examination FM 11 / eFM 11 Financial & Management AccountingDokument5 SeitenDecember 2014 Examination FM 11 / eFM 11 Financial & Management AccountingNaman RawatNoch keine Bewertungen

- SUNAKSHI Income Taxation Laws & PracticeS - BBA-301Dokument3 SeitenSUNAKSHI Income Taxation Laws & PracticeS - BBA-301Adesh YadavNoch keine Bewertungen

- Delhi Public School Jodhpur: General InstructionsDokument2 SeitenDelhi Public School Jodhpur: General Instructionssamyak patwaNoch keine Bewertungen

- Gujarat Technological UniversityDokument1 SeiteGujarat Technological UniversityShyamsunder SinghNoch keine Bewertungen

- MBA Question PaperDokument155 SeitenMBA Question Papersanjaysalve50% (2)

- Gujarat Technological UniversityDokument3 SeitenGujarat Technological UniversitymansiNoch keine Bewertungen

- Gujarat Technological UniversityDokument2 SeitenGujarat Technological Universityfeyayel990Noch keine Bewertungen

- 2013 PDFDokument126 Seiten2013 PDFomiraskar1212Noch keine Bewertungen

- Standard High School Zzana: Paper 1Dokument3 SeitenStandard High School Zzana: Paper 1Omuzaana HabibahNoch keine Bewertungen

- Crescent - AuditingDokument2 SeitenCrescent - AuditingMuhammad Uzair AbbasiNoch keine Bewertungen

- Economic Legislation II 1005Dokument26 SeitenEconomic Legislation II 1005api-26541915Noch keine Bewertungen

- Gujarat Technological UniversityDokument1 SeiteGujarat Technological Universityaak530481Noch keine Bewertungen

- MBA Integrated WINTER 2021Dokument1 SeiteMBA Integrated WINTER 2021Anchal kalwaniNoch keine Bewertungen

- 3 Hours / 80 Marks: Seat NoDokument4 Seiten3 Hours / 80 Marks: Seat NoInFiNiTyNoch keine Bewertungen

- 631 CST1 - 2020Dokument4 Seiten631 CST1 - 2020BUSTA LIMENoch keine Bewertungen

- R2.TAXM - .L Question CMA June 2021 Exam.Dokument7 SeitenR2.TAXM - .L Question CMA June 2021 Exam.Pavel DhakaNoch keine Bewertungen

- 761ac - Financial Accounting and Analysis25-Mar-23Dokument3 Seiten761ac - Financial Accounting and Analysis25-Mar-23vijay kumarNoch keine Bewertungen

- EEM PapersDokument18 SeitenEEM PapersHrishikesh Bhavsar100% (1)

- P230/1 Entrepreneurship Education Paper 1 Jul/Aug 2019 3 HoursDokument2 SeitenP230/1 Entrepreneurship Education Paper 1 Jul/Aug 2019 3 HoursMale DaviesNoch keine Bewertungen

- Mba 3 Sem Banking and Insurance 839905 Winter 2014Dokument1 SeiteMba 3 Sem Banking and Insurance 839905 Winter 2014Hansa PrajapatiNoch keine Bewertungen

- Gujarat Technological UniversityDokument1 SeiteGujarat Technological Universityaak530481Noch keine Bewertungen

- Gujarat Technological University: InstructionsDokument2 SeitenGujarat Technological University: InstructionsMoin VahoraNoch keine Bewertungen

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)Von EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Bewertung: 3 von 5 Sternen3/5 (1)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Von EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Noch keine Bewertungen

- Declaration: District " Is My Original Work and Is A Result of My Own Effort and DedicationDokument1 SeiteDeclaration: District " Is My Original Work and Is A Result of My Own Effort and DedicationChirag SabhayaNoch keine Bewertungen

- Summer Training at GCMMF LTD.: SubjectDokument1 SeiteSummer Training at GCMMF LTD.: SubjectChirag SabhayaNoch keine Bewertungen

- Cost Sheet: TrividDokument7 SeitenCost Sheet: TrividChirag SabhayaNoch keine Bewertungen

- "To Check Feasibility of Hilti Office in Kutch District": A Summer Training Report ONDokument1 Seite"To Check Feasibility of Hilti Office in Kutch District": A Summer Training Report ONChirag SabhayaNoch keine Bewertungen

- Addresses of Ex-Employees of GCMMFDokument5 SeitenAddresses of Ex-Employees of GCMMFChirag SabhayaNoch keine Bewertungen

- SWOT AnalysisDokument7 SeitenSWOT AnalysisChirag SabhayaNoch keine Bewertungen

- An Integrated One Stop Communication Partner.Dokument13 SeitenAn Integrated One Stop Communication Partner.Chirag SabhayaNoch keine Bewertungen

- Skill ApproachDokument66 SeitenSkill ApproachChirag SabhayaNoch keine Bewertungen

- 9 PageDokument1 Seite9 PageChirag SabhayaNoch keine Bewertungen

- NoticeDokument1 SeiteNoticeChirag SabhayaNoch keine Bewertungen

- Importance of ValuesDokument6 SeitenImportance of ValuesChirag SabhayaNoch keine Bewertungen

- 13 PowerPoint - RevDokument31 Seiten13 PowerPoint - RevChirag SabhayaNoch keine Bewertungen

- Institute For Learning: Putting Professionalism in Your HandsDokument28 SeitenInstitute For Learning: Putting Professionalism in Your HandsChirag SabhayaNoch keine Bewertungen

- Skill ApproachDokument66 SeitenSkill ApproachChirag SabhayaNoch keine Bewertungen

- Cultural Environment Facing Business: Learning ObjectivesDokument12 SeitenCultural Environment Facing Business: Learning ObjectivesChirag SabhayaNoch keine Bewertungen

- Attitude: Atmiya Institute of Technology and ScienceDokument4 SeitenAttitude: Atmiya Institute of Technology and ScienceChirag SabhayaNoch keine Bewertungen

- Basic Managerial Skills: Role of The Front Line Manager By: Pradeep SharmaDokument25 SeitenBasic Managerial Skills: Role of The Front Line Manager By: Pradeep SharmaChirag SabhayaNoch keine Bewertungen

- Governmental Influence On Trade: 7-2 DR Shivam PopatDokument8 SeitenGovernmental Influence On Trade: 7-2 DR Shivam PopatChirag SabhayaNoch keine Bewertungen

- Chapter Objectives: International BusinessDokument8 SeitenChapter Objectives: International BusinessChirag SabhayaNoch keine Bewertungen

- Northouse Skill ApproachDokument22 SeitenNorthouse Skill ApproachTaha Al-abed100% (1)

- TeamsDokument20 SeitenTeamsChirag SabhayaNoch keine Bewertungen

- Organizational Behavior: Stephen P. RobbinsDokument20 SeitenOrganizational Behavior: Stephen P. RobbinsChirag SabhayaNoch keine Bewertungen

- Leadership: Chapter 1 - IntroductionDokument18 SeitenLeadership: Chapter 1 - IntroductionChirag SabhayaNoch keine Bewertungen

- Political and Economic Environment: Learning ObjectivesDokument13 SeitenPolitical and Economic Environment: Learning ObjectivesChirag SabhayaNoch keine Bewertungen

- Tax Invoice: Home Carpets & Furnishing Invoice 109 17/04/2022Dokument1 SeiteTax Invoice: Home Carpets & Furnishing Invoice 109 17/04/2022Sivaprakasam ThamizharasanNoch keine Bewertungen

- Bir Ruling (Da-056-05) Nraetb 180 DaysDokument2 SeitenBir Ruling (Da-056-05) Nraetb 180 DaysAloy DulayNoch keine Bewertungen

- Encep Suryana Indonesia: Perum Griya Permata 2 Kopkarin Blok A8 Gunungmanik, TanjungsariDokument1 SeiteEncep Suryana Indonesia: Perum Griya Permata 2 Kopkarin Blok A8 Gunungmanik, TanjungsariEncep SuryanaNoch keine Bewertungen

- MF0012Dokument3 SeitenMF0012Rajesh SinghNoch keine Bewertungen

- Annex A - 1701A Jan 2018 - RMC 17-2019Dokument2 SeitenAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- Payments: 40 Queens Gate Street Miss Andreea ManeaDokument1 SeitePayments: 40 Queens Gate Street Miss Andreea ManeaErika RaulNoch keine Bewertungen

- Revenue DetailsDokument1 SeiteRevenue Detailsviratkant143Noch keine Bewertungen

- UP vs. City Treasurer of Quezon City, GR No. 214044, 19 Jun 2019Dokument2 SeitenUP vs. City Treasurer of Quezon City, GR No. 214044, 19 Jun 2019Bernalyn Domingo AlcanarNoch keine Bewertungen

- Monthly VAT Return SampleDokument35 SeitenMonthly VAT Return SampleJohnHKyeyuneNoch keine Bewertungen

- 80G Certificate: Donation ReceiptDokument1 Seite80G Certificate: Donation ReceiptNeeraj Raushan KanthNoch keine Bewertungen

- Legal Environment: Mcarthur Highway, Poblacion (Sto - Rosario), Capas, 2315tarlac, PhilippinesDokument12 SeitenLegal Environment: Mcarthur Highway, Poblacion (Sto - Rosario), Capas, 2315tarlac, PhilippinesLea Lyn AquinoNoch keine Bewertungen

- Mepco BillDokument2 SeitenMepco BillRao M. YasirNoch keine Bewertungen

- Biva 2 PDFDokument1 SeiteBiva 2 PDFVinayak Trading CompanyNoch keine Bewertungen

- Learning Activity 3 - Inc TaxDokument3 SeitenLearning Activity 3 - Inc TaxErica FlorentinoNoch keine Bewertungen

- New FORM 15H Applicable PY 2016-17Dokument2 SeitenNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- DT 0107a Employer Monthly Tax Deductions Schedule v1 2Dokument2 SeitenDT 0107a Employer Monthly Tax Deductions Schedule v1 2Gael OrtizNoch keine Bewertungen

- Gmail - Booking Cancellation - Treebo N Square - TRB-51067051663Dokument2 SeitenGmail - Booking Cancellation - Treebo N Square - TRB-51067051663kaustavmukherjee1978Noch keine Bewertungen

- Chapter 10 Student Answer Sheet 2020Dokument2 SeitenChapter 10 Student Answer Sheet 2020api-534566718Noch keine Bewertungen

- Solved Carlos Opens A Dry Cleaning Store During The Year He PDFDokument1 SeiteSolved Carlos Opens A Dry Cleaning Store During The Year He PDFAnbu jaromiaNoch keine Bewertungen

- Renewal Premium Receipt: Har Pal Aapke Sath!!Dokument1 SeiteRenewal Premium Receipt: Har Pal Aapke Sath!!Ritu SoniNoch keine Bewertungen

- Multiple Choice - Problems Part 1: A. Percentage TaxDokument8 SeitenMultiple Choice - Problems Part 1: A. Percentage TaxWearIt Co.Noch keine Bewertungen

- Corporate Tax Chapter 2 HomeworkDokument3 SeitenCorporate Tax Chapter 2 HomeworkAndrew Steven0% (1)

- Salary Slip (30177449 February, 2019)Dokument1 SeiteSalary Slip (30177449 February, 2019)saqib naveedNoch keine Bewertungen

- Income Tax Basic Definitions and TermsDokument13 SeitenIncome Tax Basic Definitions and TermsshivamNoch keine Bewertungen

- 1098-T Copy B: Tuition StatementDokument2 Seiten1098-T Copy B: Tuition StatementVampire LadyNoch keine Bewertungen

- Owner StatementDokument8 SeitenOwner StatementJack LeeNoch keine Bewertungen

- Stamp Duty and Registration Charges Extra: Payment Plan For Grand ArchDokument1 SeiteStamp Duty and Registration Charges Extra: Payment Plan For Grand ArchDhruv SainiNoch keine Bewertungen

- Partnership-CIR Vs Suter Case DigestDokument2 SeitenPartnership-CIR Vs Suter Case DigestDesiree Jane Espa Tubaon100% (1)

- Od 329783056775680100Dokument1 SeiteOd 329783056775680100adityashastrakar6Noch keine Bewertungen

- Capgemini Technology Services India LimitedDokument2 SeitenCapgemini Technology Services India LimitedFlawsome FoodsNoch keine Bewertungen