Beruflich Dokumente

Kultur Dokumente

The EU List of Non-Cooperative Jurisdictions For Tax Purposes ST - 8828 - 2019 - REV - 1 - EN

Hochgeladen von

Anonymous UpWci5Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The EU List of Non-Cooperative Jurisdictions For Tax Purposes ST - 8828 - 2019 - REV - 1 - EN

Hochgeladen von

Anonymous UpWci5Copyright:

Verfügbare Formate

Council of the

European Union

Brussels, 15 May 2019

(OR. en)

8828/1/19

REV 1

FISC 244

ECOFIN 440

'I/A' ITEM NOTE

From: General Secretariat of the Council

To: Permanent Representatives Committee/Council

Subject: The EU list of non-cooperative jurisdictions for tax purposes

• Report by the Code of Conduct Group (Business Taxation) suggesting

amendments to the Annexes of the Council conclusions of 12 March

2019, including the de-listing of jurisdictions

1. On 12 March 2019, the ECOFIN Council adopted Council conclusions1 that revised the EU

list of non-cooperative jurisdictions for tax purposes (Annex I) and the state of play with

respect to commitments taken by cooperative jurisdictions to implement tax good governance

principles (Annex II) initially endorsed by the ECOFIN Council on 5 December 20172 and

subsequently modified/updated by the Council on 23 January 20183, 13 March 20184,

25 May 20185, 2 October 20186, 6 November 20187 and 4 December 20188.

1 Official Journal of the European Union, C 114, 26.03.2019, pages 2-8.

2 Official Journal of the European Union, C 438 2017 pages 5-24.

3 Official Journal of the European Union, C 29 2018 page 2.

4 Official Journal of the European Union, C 100 2018 pages 4-5.

5 Official Journal of the European Union, C 191 2018 pages 1-3.

6 Official Journal of the European Union, C 359 2018 pages 3-5.

7 Official Journal of the European Union, C 403 2018 pages 4-6.

8 Official Journal of the European Union, C 441 2018 pages 3-4.

8828/1/19 REV 1 AS/AR/mf 1

ECOMP.2.B EN

2. Furthermore, recalling paragraph 11 of the Council conclusions of 5 December 2017, the

Council conclusions of 12 March 2019 confirmed that the Code of Conduct Group "should

recommend to the Council to update at any time, and at least once a year, the EU list set out

in Annex I as well as the state of play set out in Annex II on the basis of any new commitment

taken or of the implementation thereof; but, as from 2020 onwards, such updates of the EU

list should be done no more than twice a year, leaving sufficient time, where appropriate, for

Member States to amend their domestic legislation" (paragraph 16), thereby agreeing to keep

a dynamic process throughout 2019.

3. Barbados' Minister for international business and industry sent letters to the Code of Conduct

Group (hereafter "COCG") Chair on 2 and 9 April 20199 committing to amend or abolish by

the end of 2019 the measure of similar effect that replaced its harmful preferential regimes

and which the COCG had identified on 30 January 2019 as falling under criterion 2.210.

The COCG agreed at its meeting of 11 April 2019 that Barbados' commitment letters should

be considered as sufficient and therefore that Barbados should be moved from Annex I to

Annex II of the Council conclusions of 12 March 2019 (de-listing), in a new sub-section of

section 2.2.

4. Bermuda adopted additional amendments to its Economic Substance Regulation on

4 March 2019, thereby resolving the last area of concern, i.e. the wording related to core

income generating activities for intellectual property assets. This legislative change was

adopted after the cut-off date agreed by the COCG (24 February 2019)11 and could therefore

not be examined at technical level in time for the ECOFIN Council of 12 March 2019.

The COCG subgroup on third countries examined the above legislative amendments at its

meeting of 27 March 2019 and concluded that Bermuda had implemented its commitment to

introduce substance requirements under criterion 2.2 and could therefore be removed from

Annex I (delisting). The COCG confirmed this conclusion at its meeting of 11 April 2019.

9 The second letter clarified the timeline of the foreseen reform.

10 Doc. 5981/19.

11 Doc. 7212/19 DCL 1.

8828/1/19 REV 1 AS/AR/mf 2

ECOMP.2.B EN

Bermuda should however be added to section 2.2 of Annex II in relation to its commitment to

address the concerns relating to economic substance in the area of collective investment funds

by the end of 2019.

5. Aruba adopted on 4 April 2019 a National Ordinance introducing substance requirements for

its transparency regime (AW013), whilst the respective National Decree containing the

detailed substance requirements was officially published on 10 April 2019 and came into

force the day following its publication.

The COCG subgroup on third countries examined the above legislative amendments at its

meeting of 6 May 2019 and concluded that Aruba had implemented its commitment to

remove the harmful features of its transparency regime and could therefore be removed from

Annex I (delisting). The COCG confirmed this conclusion by silence procedure on

7 May 2019.

6. Morocco having joined the Inclusive Framework on BEPS in March 2019, the Code of

Conduct Group agreed on 11 April 2019 that Morocco should be removed from section 3.1 of

Annex II.

7. Furthermore, Dominica having ratified on 30 April 2019 the OECD Multilateral Convention

on Mutual Administrative Assistance ("MAC") as amended, the COCG subgroup on third

countries agreed at its meeting on 6 May 2019 that Annex I should be updated accordingly,

but that Dominica should remain listed until it complies with criterion 1.1. The COCG

confirmed this conclusion by silence procedure on 7 May 2019.

8. To be noted that all commitments officially taken by jurisdictions are carefully monitored by

the Code of Conduct Group, supported by the General Secretariat of the Council, with

technical assistance of the European Commission, in order to evaluate their effective

implementation (see Annex IV of the Council conclusions of 5 December 2017 and the

Procedural guidelines of 15 February 201812).

12 Doc. 6213/18.

8828/1/19 REV 1 AS/AR/mf 3

ECOMP.2.B EN

9. The Permanent Representatives Committee is therefore invited to suggest that the ECOFIN

Council in May 2019:

– adopt the amended Annexes I and II to the Council conclusions of 12 March 2019 as

attached to the present note, reflecting the changes set out above, as an "A" item on the

agenda,

– agree on their publication in the Official Journal.

8828/1/19 REV 1 AS/AR/mf 4

ECOMP.2.B EN

ANNEX

With effect from the day of publication in the Official Journal of the European Union, Annexes I

and II of the Council conclusions of 12 March 2019 on the revised EU list of non-cooperative

jurisdictions for tax purposes13 are replaced by the following new Annexes I and II:

ANNEX I

The EU list of non-cooperative jurisdictions for tax purposes

1. American Samoa

American Samoa does not apply any automatic exchange of financial information, has not signed

and ratified, including through the jurisdiction they are dependent on, the OECD Multilateral

Convention on Mutual Administrative Assistance as amended, did not commit to apply the BEPS

minimum standards and did not commit to addressing these issues.

2. Belize

Belize has not yet amended or abolished one harmful preferential tax regime.

Belize's commitment to amend or abolish its newly identified harmful preferential tax regime by the

end of 2019 will be monitored.

3. Dominica

Dominica does not apply any automatic exchange of financial information and has not yet resolved

this issue.

13 Official Journal of the European Union, C 114, 26.03.2019, pages 2-8.

8828/1/19 REV 1 AS/AR/mf 5

ANNEX ECOMP.2.B EN

4. Fiji

Fiji has not yet amended or abolished its harmful preferential tax regimes.

Fiji's commitment to comply with criteria 1.2, 1.3 and 3.1 by the end of 2019 will continue to be

monitored.

5. Guam

Guam does not apply any automatic exchange of financial information, has not signed and ratified,

including through the jurisdiction they are dependent on, the OECD Multilateral Convention on

Mutual Administrative Assistance as amended, did not commit to apply the BEPS minimum

standards and did not commit to addressing these issues.

6. Marshall Islands

Marshall Islands facilitates offshore structures and arrangements aimed at attracting profits without

real economic substance and has not yet resolved this issue.

Marshall Islands' commitment to comply with criterion 1.2 will continue to be monitored: it is

waiting for a supplementary review by the Global Forum.

7. Oman

Oman does not apply any automatic exchange of financial information, has not signed and ratified

the OECD Multilateral Convention on Mutual Administrative Assistance as amended, and has not

yet resolved these issues.

8828/1/19 REV 1 AS/AR/mf 6

ANNEX ECOMP.2.B EN

8. Samoa

Samoa has a harmful preferential tax regime and did not commit to addressing this issue.

Furthermore, Samoa committed to comply with criterion 3.1 by the end of 2018 but has not

resolved this issue.

9. Trinidad and Tobago

Trinidad and Tobago has a “Non-Compliant” rating by the Global Forum on Transparency and

Exchange of Information for Tax Purposes for Exchange of Information on Request.

Trinidad and Tobago's commitment to comply with criteria 1.1, 1.2, 1.3 and 2.1 by the end of 2019

will be monitored.

10. United Arab Emirates

United Arab Emirates facilitates offshore structures and arrangements aimed at attracting profits

without real economic substance and has not yet resolved this issue.

11. US Virgin Islands

US Virgin Islands does not apply any automatic exchange of financial information, has not signed

and ratified, including through the jurisdiction they are dependent on, the OECD Multilateral

Convention on Mutual Administrative Assistance as amended, has harmful preferential tax regimes,

did not commit to apply the BEPS minimum standards and did not commit to addressing these

issues.

12. Vanuatu

Vanuatu facilitates offshore structures and arrangements aimed at attracting profits without real

economic substance and has not yet resolved this issue.

8828/1/19 REV 1 AS/AR/mf 7

ANNEX ECOMP.2.B EN

ANNEX II

State of play of the cooperation with the EU with respect to commitments taken to implement

tax good governance principles

1. Transparency

1.1 Commitment to implement the automatic exchange of information, either by signing the

Multilateral Competent Authority Agreement or through bilateral agreements

The following jurisdictions are committed to implement automatic exchange of information by end

2019:

Palau and Turkey

1.2 Membership of the Global Forum on transparency and exchange of information for tax

purposes ("Global Forum") and satisfactory rating in relation to exchange of information on

request

The following jurisdictions, which committed to have a sufficient rating by end 2018, are waiting

for a supplementary review by the Global Forum:

Anguilla and Curaçao.

The following jurisdictions are committed to become member of the Global Forum and/or have a

sufficient rating by end 2019:

Jordan, Namibia, Palau, Turkey and Vietnam.

8828/1/19 REV 1 AS/AR/mf 8

ANNEX ECOMP.2.B EN

1.3 Signatory and ratification of the OECD Multilateral Convention on Mutual Administrative

Assistance (MAC) or network of agreements covering all EU Member States

The following jurisdictions are committed to sign and ratify the MAC or to have in place a network

of agreements covering all EU Member States by end 2019:

Armenia, Bosnia and Herzegovina, Botswana, Cabo Verde, Eswatini, Jordan, Maldives,

Mongolia, Montenegro, Morocco, Namibia, Republic of North Macedonia, Palau, Serbia,

Thailand and Vietnam.

2. Fair Taxation

2.1 Existence of harmful tax regimes

The following jurisdictions, which committed to amend or abolish their harmful tax regimes

covering manufacturing activities and similar non-highly mobile activities by end 2018 and

demonstrated tangible progress in initiating these reforms in 2018, were granted until end 2019 to

adapt their legislation:

Costa Rica and Morocco.

The following jurisdictions, which committed to amend or abolish their harmful tax regimes by end

2018 but were prevented from doing so due to genuine institutional or constitutional issues despite

tangible progress in 2018, were granted until end 2019 to adapt their legislation:

Cook Islands, Maldives and Switzerland.

The following jurisdiction is committed to amend or abolish the identified harmful tax regimes by

9 November 2019:

Namibia.

8828/1/19 REV 1 AS/AR/mf 9

ANNEX ECOMP.2.B EN

The following jurisdictions are committed to amend or abolish harmful tax regimes by end 2019:

Antigua and Barbuda, Australia, Curaçao, Mauritius, Morocco, Saint Kitts and Nevis, Saint

Lucia and Seychelles.

The following jurisdictions are committed to amend or abolish harmful tax regimes by end 2020:

Jordan.

2.2. Existence of tax regimes that facilitate offshore structures which attract profits without real

economic activity

The following jurisdictions, which committed to addressing the concerns relating to economic

substance in the area of collective investment funds, have engaged in a positive dialogue with the

Group and have remained cooperative, but require further technical guidance, were granted until

end 201914 to adapt their legislation:

Bahamas, Bermuda, British Virgin Islands and Cayman Islands.

The following jurisdiction is committed to addressing the concerns related to economic substance

by end 2019:

Barbados.

3. Anti-BEPS Measures

3.1 Membership of the Inclusive Framework on BEPS or commitment to implementation of OECD

anti-BEPS minimum standards

The following jurisdictions are committed to become member of the Inclusive Framework on BEPS

or implement OECD anti-BEPS minimum standards by end 2019:

Albania, Bosnia and Herzegovina, Eswatini, Jordan, Montenegro and Namibia.

14 This deadline may be reviewed depending on the technical guidance to be agreed by the

Group and ongoing dialogue with the jurisdictions concerned.

8828/1/19 REV 1 AS/AR/mf 10

ANNEX ECOMP.2.B EN

The following jurisdictions are committed to become member of the Inclusive Framework on BEPS

or implement OECD anti-BEPS minimum standards if and when such commitment will become

relevant:

Nauru, Niue and Palau.

8828/1/19 REV 1 AS/AR/mf 11

ANNEX ECOMP.2.B EN

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Getting Past Sexual ResistanceDokument6 SeitenGetting Past Sexual ResistanceNuqman Tehuti ElNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- FRQs OutlinesDokument33 SeitenFRQs OutlinesEunae ChungNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Machiavelli The Prince: AdviceDokument6 SeitenMachiavelli The Prince: AdviceshannonNoch keine Bewertungen

- Magsumbol V People GR No. 207175 (2014) - Thief Based On Cutting of Coconut TreesDokument7 SeitenMagsumbol V People GR No. 207175 (2014) - Thief Based On Cutting of Coconut TreesDuko Alcala EnjambreNoch keine Bewertungen

- President Corazon Aquino's Speech Before The Joint Session of The U.S CongressDokument27 SeitenPresident Corazon Aquino's Speech Before The Joint Session of The U.S CongressPat Ty0% (1)

- Narrative Tenses WorksheetDokument3 SeitenNarrative Tenses WorksheetankadianaaNoch keine Bewertungen

- Abaya v. EbdaneDokument2 SeitenAbaya v. EbdaneJesse MoranteNoch keine Bewertungen

- Carlo M. Cipolla - Guns, Sails, and Empires - Technological Innovation and The Early Phases of European Expansion 1400-1700-Minerva Press (1965)Dokument203 SeitenCarlo M. Cipolla - Guns, Sails, and Empires - Technological Innovation and The Early Phases of European Expansion 1400-1700-Minerva Press (1965)Ishaan RajpalNoch keine Bewertungen

- People vs. Veridiano, 132 SCRA 523, October 12, 1984Dokument3 SeitenPeople vs. Veridiano, 132 SCRA 523, October 12, 1984EmNoch keine Bewertungen

- Calasanz Vs CommDokument4 SeitenCalasanz Vs CommEANoch keine Bewertungen

- Uson Vs Del RosarioDokument2 SeitenUson Vs Del RosarioNic NalpenNoch keine Bewertungen

- Consolidated Bank Vs CADokument1 SeiteConsolidated Bank Vs CAcmv mendozaNoch keine Bewertungen

- Weekly Shipping March 23 2024Dokument1 SeiteWeekly Shipping March 23 2024Anonymous UpWci5Noch keine Bewertungen

- Senate - 2024 March 21Dokument2 SeitenSenate - 2024 March 21Anonymous UpWci5Noch keine Bewertungen

- October 2023 CPI ReportDokument5 SeitenOctober 2023 CPI ReportAnonymous UpWci5Noch keine Bewertungen

- Order of Business - 6th March, 2024Dokument2 SeitenOrder of Business - 6th March, 2024Anonymous UpWci5Noch keine Bewertungen

- FinTech Year End Report 2023Dokument6 SeitenFinTech Year End Report 2023Anonymous UpWci5Noch keine Bewertungen

- Winners Edge Mountain Bike Cross Country National ChampionshipsDokument3 SeitenWinners Edge Mountain Bike Cross Country National ChampionshipsAnonymous UpWci5Noch keine Bewertungen

- Senate - 2024 March 18Dokument3 SeitenSenate - 2024 March 18Anonymous UpWci5Noch keine Bewertungen

- Road Sobriety Checkpoint Notice 2024Dokument2 SeitenRoad Sobriety Checkpoint Notice 2024Anonymous UpWci5Noch keine Bewertungen

- Senate - 2024 March 13Dokument3 SeitenSenate - 2024 March 13Anonymous UpWci5Noch keine Bewertungen

- Weekly Shipping February 17 2024Dokument1 SeiteWeekly Shipping February 17 2024Anonymous UpWci5Noch keine Bewertungen

- Senate - 2024 Feb 14Dokument3 SeitenSenate - 2024 Feb 14Anonymous UpWci5Noch keine Bewertungen

- Bermuda Budget Snapshot 2024 - FinalDokument1 SeiteBermuda Budget Snapshot 2024 - FinalAnonymous UpWci5Noch keine Bewertungen

- Order of Business - 1st March, 2024Dokument2 SeitenOrder of Business - 1st March, 2024Anonymous UpWci5Noch keine Bewertungen

- Order of Business - 28th February, 2024Dokument2 SeitenOrder of Business - 28th February, 2024Anonymous UpWci5Noch keine Bewertungen

- Order of Business Friday, 10th November, 2023Dokument2 SeitenOrder of Business Friday, 10th November, 2023Anonymous UpWci5Noch keine Bewertungen

- Decision 43 2023 Bermuda Police ServiceDokument11 SeitenDecision 43 2023 Bermuda Police ServiceAnonymous UpWci5Noch keine Bewertungen

- June 2023 RSI ReportDokument4 SeitenJune 2023 RSI ReportAnonymous UpWci5Noch keine Bewertungen

- Weekly Shipping February 3 2024Dokument1 SeiteWeekly Shipping February 3 2024Anonymous UpWci5Noch keine Bewertungen

- Decision 37 2023 Ministry of Health Headquarters FINALDokument13 SeitenDecision 37 2023 Ministry of Health Headquarters FINALAnonymous UpWci5Noch keine Bewertungen

- Butterfield Mile Trials Bermuda Dec 8 2023Dokument5 SeitenButterfield Mile Trials Bermuda Dec 8 2023Anonymous UpWci5Noch keine Bewertungen

- Order of Business Friday, 21st July, 2023Dokument2 SeitenOrder of Business Friday, 21st July, 2023Anonymous UpWci5Noch keine Bewertungen

- Weekly Shipping January 20 2024Dokument1 SeiteWeekly Shipping January 20 2024Anonymous UpWci5Noch keine Bewertungen

- Weekly Shipping June 3 2023Dokument1 SeiteWeekly Shipping June 3 2023Anonymous UpWci5Noch keine Bewertungen

- Weekly Shipping July 22 2023Dokument1 SeiteWeekly Shipping July 22 2023Anonymous UpWci5Noch keine Bewertungen

- Bermuda Ombudsman - Annual Report 2022 - SecureDokument40 SeitenBermuda Ombudsman - Annual Report 2022 - SecureAnonymous UpWci5Noch keine Bewertungen

- Order of Business Friday, 16th June, 2023Dokument2 SeitenOrder of Business Friday, 16th June, 2023Anonymous UpWci5Noch keine Bewertungen

- Butterfield Bermuda Championship Report 2022 FINALDokument17 SeitenButterfield Bermuda Championship Report 2022 FINALAnonymous UpWci5Noch keine Bewertungen

- Decision 34 2023 Bermuda Police ServiceDokument19 SeitenDecision 34 2023 Bermuda Police ServiceAnonymous UpWci5Noch keine Bewertungen

- Deloitte Synopsis of Bermuda Government Economic Development Strategy - June.22.2023Dokument3 SeitenDeloitte Synopsis of Bermuda Government Economic Development Strategy - June.22.2023BernewsAdminNoch keine Bewertungen

- Order of Business Friday, 2nd June, 2023Dokument3 SeitenOrder of Business Friday, 2nd June, 2023Anonymous UpWci5Noch keine Bewertungen

- Book Trailer - The WitcherDokument2 SeitenBook Trailer - The WitcherRadu TartaNoch keine Bewertungen

- Suits by and Against The Government: Jamia Millia IslamiaDokument17 SeitenSuits by and Against The Government: Jamia Millia IslamiaIMRAN ALAMNoch keine Bewertungen

- Charge NurseDokument7 SeitenCharge NurseM Xubair Yousaf XaiNoch keine Bewertungen

- Types of WritsDokument4 SeitenTypes of WritsAnuj KumarNoch keine Bewertungen

- Camdens Tkam Template InfographicDokument2 SeitenCamdens Tkam Template Infographicapi-402621060Noch keine Bewertungen

- 36 de Castro V de CastroDokument4 Seiten36 de Castro V de CastroCorina CabalunaNoch keine Bewertungen

- Garcia Et Al v. Corinthian Colleges, Inc. - Document No. 13Dokument2 SeitenGarcia Et Al v. Corinthian Colleges, Inc. - Document No. 13Justia.comNoch keine Bewertungen

- Fromm QUIZDokument3 SeitenFromm QUIZMary Grace Mateo100% (1)

- WPR - 2Dokument3 SeitenWPR - 2farazNoch keine Bewertungen

- Ballymun, Is The Place To Live inDokument10 SeitenBallymun, Is The Place To Live inRita CahillNoch keine Bewertungen

- 50 Cent SongsDokument9 Seiten50 Cent SongsVincent TalaoNoch keine Bewertungen

- Arigo V SwiftDokument21 SeitenArigo V SwiftKristine KristineeeNoch keine Bewertungen

- Scope of Application of Section 43 of The Transfer of Property Act, 1882.Dokument8 SeitenScope of Application of Section 43 of The Transfer of Property Act, 1882.অদ্ভুত তিনNoch keine Bewertungen

- 9B Working UndercoverDokument4 Seiten9B Working UndercoverJorge Khouri JAKNoch keine Bewertungen

- Topic-Act of God As A General Defence: Presented To - Dr. Jaswinder Kaur Presented by - Pulkit GeraDokument8 SeitenTopic-Act of God As A General Defence: Presented To - Dr. Jaswinder Kaur Presented by - Pulkit GeraPulkit GeraNoch keine Bewertungen

- Italy SchengenVisaApplication PDFDokument4 SeitenItaly SchengenVisaApplication PDFcargym raeNoch keine Bewertungen

- Neviton Alternate MRADokument5 SeitenNeviton Alternate MRARajbikram NayarNoch keine Bewertungen

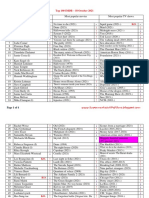

- Top 100 IMDB - 18 October 2021Dokument4 SeitenTop 100 IMDB - 18 October 2021SupermarketulDeFilmeNoch keine Bewertungen