Beruflich Dokumente

Kultur Dokumente

12 Accounts Imp Ch1

Hochgeladen von

Tushar TyagiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

12 Accounts Imp Ch1

Hochgeladen von

Tushar TyagiCopyright:

Verfügbare Formate

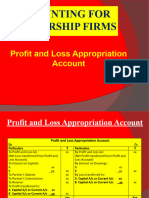

CBSE

Class 12 Accountancy

Important Questions

Chapter 1

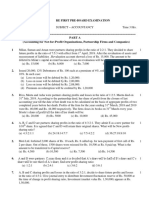

1: Radha and Raman are partners in a firm sharing profits and losses in the ratio of 5:2.

Capital contributed by them is Rs. 50,000 and Rs. 20,000 respectively. Radha was given

salary of Rs. 10,000 and Raman Rs. 7,000 per annum. Radha advanced loan of Rs. 20,000

to firm without any agreement to rate of interest in deed while in deed rate of interest

on capital was mentioned as 6% p.a. Profits for the year are Rs. 29,400. Prepare Profit

and Loss Appropriation Account for the year ending 31st March 2015.

Solution:

Profit and Loss Appropriation account

For the year ending on 31.03.2015

Dr. Cr.

Particulars Rs. Particulars Rs.

To Interest on Capital:

Radha 3,000

Raman 1,200

4,200

To Partner’s Salary By Profit and Loss A/c

17,000

Radha 10,000 (Net Profits)29,400 28,200

Raman 7,000 Less: Interest

7,000

To Profits transferred to capital On Radha’s loan 1,200

A/cs of:

Radha 5,000

Raman 2,000 28,200 28,200

When appropriation are more than available profits

In such case available profits are distributed in the ratio of appropriation.

Material downloaded from myCBSEguide.com. 1 / 22

2: Ram & Sham are partners sharing profits & losses in ratio of 3:2. Ram being non-

working partner contributes Rs. 20,00,000 as his capital & Shyam being a working

parties, gets a salary of Rs. 8000 per month. As per partnership deed interest is paid @

8% p.a. & salary is allowed. Profits before providing that for year ending 31st March

2015 were Rs. 80,000. Show the distribution of profits.

Solution:

Profit & Loss Appropriation Account for the year ended 31.3.15

Dr. Cr.

Particulars Rs. Particulars Rs.

To Ram’s Capital A/c 50,000

(Interest) By Profit & Loss A/c 80,000

30,000

To Shyam’s Capital A/c (Net Profits)

(Salary)

80,000 80,000

working Notes: Interest on capital = = Rs. 1,60,000

Salary = =Rs. 96,000

Total 2,56,000

Ratio of Interest & Salary = 1,600,000 : 96,000 = 5 : 3

Profits share given to Ram = Rs. 50,000

Shyam = = Rs. 30,000

Material downloaded from myCBSEguide.com. 2 / 22

3: Amit and Sumit commenced business as partners on 01.04.2014. Amit contributed Rs.

40,000 and Sumit Rs. 25, 000 as their share of capital. The partners decided to share

their profits in the ratio of 2:1. Amit was entitled to salary of Rs. 6,000 p.a. Interest on

capital was to be provided @ 6% p.a. The drawings of Rs. 4, 000 was made by Amit and

Rs. 8,000 was made by Sumit. The profits after providing salary and interest on capital

for the year ended 31st March, 2015 were Rs. 12,000.

Draw up the capital accounts of the partners

1. When capitals are fluctuating

2. When capitals are Fixed

Solution:

1. When capitals are fluctuating

Capital Accounts of Amit and Sumit

Dr. Cr.

Amit Sumit Amit Sumit

Particulars Particulars

(Rs.) (Rs.) (Rs.) (Rs.)

40,000

By Balance A/c (Capital) 25,000

4,000 8,000 6,000

By Salary A/c 1,500

To Drawing A/c 52,400 22,500 2,400

By Interest on capital A/c 4,000

To Balance c/d 8,000

By Profit and Loss

Appropriation A/c

56,400 30,500 56,400 30,500

When capital are Fixed Capital accounts

Dr. Cr.

Amit Sumit Amit Sumit

Particulars Particulars

(Rs.) (Rs.) (Rs.) (Rs.)

Material downloaded from myCBSEguide.com. 3 / 22

40,000 25,000 40,000 25,000

To Balance c/d By Balance A/c (Capital)

40,000 25,000 40,000 25,000

Current Accounts

Dr. Cr.

Amit Sumit Amit Sumit

Particulars Particulars

(Rs.) (Rs.) (Rs.) (Rs.)

By Salary A/c

40,000 1,500

4,000 8,000 By Interest on capital A/c

2,400 4,000

To Drawing A/c 12,400 - By Profit and Loss

8,000 2,500

To Balance c/d Appropriation A/c

To Balance c/d

(Closing Balance)

16,400 8,000 16,400 8,000

Working Notes: Profits after salary and interest Rs. 12,000

Amit share = = 8,000

Sumit share = = 4,000

Difference between Fixed Capital Account & Fluctuating Capital Account:

Basis Fixed Capital Account Fluctuating Capital Account

1. No. of Accounts Two accounts for each partner Only one account is

maintained Fixed Capital Account & current maintained for each partner,

Account. i.e., capital Account.

Material downloaded from myCBSEguide.com. 4 / 22

Balance does not change except

under specific circumstances Balance changes frequently

2. Balance chane

(introduction of additional from period to period.

capital and capital withdrawn)

All adjustments for drawing All adjustments for drawings,

interest on drawing, interest on interest on drawing & capital,

3. Adjustments

capital, salary and profit/loss are salary, profit/loss are made in

made in current account. Capital Accounts.

Fixed Capital Account. Capital

Account has credit balance Fluctuating Capital account

4. Balance always However, current can have debit or credit

account may have debit or credit balance.

balance.

4: X and Y invested Rs. 20,000 & Rs. 10,000. Interest on capital is allowed @ 6% per

annum. Profits are shared in ratio of 2 : 3. Profits for year ending 11.3.2015 is Rs. 1,500.

Show allocation of profits when partnership deed.

(a) Allows interest on capital & deed is silent on treating interest as charge.

(b) Interest is charge against profit.

Solution:

(a) When partnership deed is silent on treating interest as a charge,

Profit & Loss Appropriation Account for the year ending 31.3.2015

Dr. Cr.

Particulars (Rs.) Particulars (Rs.)

To Interest on Capital 1,500 By Profit & Loss A/c 1,500

X 1000 (Net Profits)

Material downloaded from myCBSEguide.com. 5 / 22

Y 500

1,500 1,500

Working Notes: Interest on X’s Capital = = 1200

Y’s Capital = = 600

Total Interest = 1800

Ratio of Interest = 1200 : 600 = 2 : 1

Interest allowed to partner =

Interest to X = = Rs. 1000

Interest allowed by y = = Rs. 500

(b) Interest is charge on profit – In such case full interest will be given & loss is transferred to

partner’s capital accounts.

Profit & Loss Appropriation is not prepared in this case instead profit & Loss Account is

prepared & deficit is treated as loss.

Profit & Loss Account

For the year ending on 31.3.2015

Dr. Cr.

Particulars (Rs.) Particulars (Rs.)

By Profit before Interest

1,500

To Interest on Capital By Loss transferred to Capital

1800 300

Material downloaded from myCBSEguide.com. 6 / 22

X1200 A/cs

Y 600 X120

Y 180

1800 1800

(a) In case of Sufficient Profits

Profit and Loss Appropriation A/c Dr.

To Interest on Capital A/c

(Being interest on capital transferred to P & L Appropriation A/c

(b) In case of Insufficient Profits or Losses

Profit & Loss/Profit and Loss Adjustment A/c Dr.

To Interest on Capital A/c

(Being interest on capital transferred to P & L Adjustment A/c)

5: A and B are partners in business. Their capitals at the end of year were Rs. 48,000 &

Rs. 36,000 respectively. During the year ended March 31st 2015 A’s Drawings and B’s

drawings were Rs. 8, 000 & Rs. 12, 000 respectively. Profits before charging interest on

capital during the year were Rs. 32, 000. Calculate Interest on partners’ capitals @ 10%

p.a.

Solution

Statement showing calculation of opening capitals

Particulars A(Rs.) B(Rs.)

48,000 36,000

8000 12,000

Closing Capital

Material downloaded from myCBSEguide.com. 7 / 22

Add: Drawings already credited 56,000 48,000

Less: Profits already credited 16,000 16,000

Opening capitals or capitals in the beginning

Interest on Capital @ 10% p.a. 40,000 32,000

4,000 3,200

For additional capital interest is calculated for period for which capital is utilized e.g. if

additional capital is introduced on 1 April in firm where accounts are closed on 31st

December.

Interest =

As money is utilized for 9 months

6: Aarushi and Simran are partners in a firm. During the year ended on 1st March, 2015

Aarushi makes the drawings as under:

Date of Drawing Amount (Rs.)

01-08-2015 5,000

31-12-2014 10,000

31-03-2015 15,000

Partnership Deed provided that partners are to be charged interest on drawing @ 12%

p.a. Calculate the interest chargeable to Aarushi Drawing by using Simple Interest

Method and Product Method.

Solution:

1. Simple Interest Method

Material downloaded from myCBSEguide.com. 8 / 22

Months till March Interest @ 12%

Date of Drawing Amount (Rs.)

31, 2014 pm(Rs.)

400

01-08-2015 5,000 08 300

31-12-2014 10,000 03 000

31-03-2015 15,000 00

700

Before charging interest on capital the year were Rs. 32,000. Calculate Interest on partners’

capitals @ 10% p.a.

Solution:

Statement showing calculation of opening capitals

Particulars A(Rs.) B(Rs.)

48,000 36,000

8000 12,000

Closing Capital

Add: Drawings already credited 56,000 48,000

Less: Profits already credited 16,000 16,000

Opening capitals or capitals in the beginning

40,000 32,000

Interest on Capital @ 10% p.a.

4,000 3,200

For additional capital interest is calculated for period for which capital is utilized e.g. if

additional capital is introduced on 1 April in firm where accounts are closed on 31st

December.

Interest =

As money is utilized for 9 months

2. Product Method

Material downloaded from myCBSEguide.com. 9 / 22

Months for which Amount has

Amount of Product

Date of Drawing Withdrawn till December 31,

Drawings (Rs.) (Rs.)

2014

40,00

01-08-2015 5,000 08 30,00

31-12-2014 10,000 03 00000

31-03-2015 15,000 00

70,000

Interest on Drawing = (in months)

= = Rs. 700

7: Calculate interest on drawings of Mr. X @ 10% p.a. if he withdrawn Rs. 1000 per

month (i) in the beginning of each Month (ii) In the middle each of month (iii) at end of

each month.

Total Amount with withdrawn = Rs. =12, 000.

Solution:

(i) Interest on Drawing =

= Rs. 650

(ii) Interest on drawing =

= Rs. 600

(iii) Interest on drawing =

Material downloaded from myCBSEguide.com. 10 / 22

= Rs. 550

8: Calculate interest on drawing of Vimal if the withdrew Rs. 48000 Quarter withdrawn

evenly (i) at beginning of each Quarter (ii) in the middle of each of at end (iii) Quarter.

Rate of interest is 10% p.a.

Solution:

Case I - Drawing made on beginning of each Quarter

Interest on drawing =

= Rs. 3,000

Case II - Drawing made in middle of each quarter

Interest on drawing =

= Rs. 2,400

Case III - Drawing made at end of each quarter

Interest on drawing =

= Rs. 1,800

Similarly Interest can be calculated by following formulas Half yearly Drawings for year

when

(a) Drawings are made in the beginning of each period (half-year)

Material downloaded from myCBSEguide.com. 11 / 22

Interest on drawing =

(b) Drawings are made in the middle of each period (half year)

Interest on drawing =

(c) Drawings are made at the end of each period (half year)

Interest on drawing =

For monthly drawings for 6 months (Last 6 months)

For monthly drawings for 6 months (Last 6 months)

(a) Drawings are made in the beginning of each month

Interest =

(b) Drawings are made in the middle of each month

Interest =

(c) Drawings are made at the end of each month

Interest =

9: A and B entered into partnership on 1st April, 2014 without any partnership deed.

They introduced capitals of Rs. 5,00,000 and Rs. 3,00,000 respectively. On 31st October,

2014, A advanced Rs. 2,00,000 by way of loan to the firm without any agreement as to

interest.

Material downloaded from myCBSEguide.com. 12 / 22

The Profit and Loss Account for the year ended 31-03-2015 showed a profit of Rs.

4,30,000 but the partners could not agree upon the amount of interest on Loan to be

charged and the basis of division of profits. Pass a Journal Entry for the distribution of

the Profits between the partners and prepare the Capital A/cs of both the partners and

Loan A/c of ‘A’.

Solution:

Profit and Loss Appropriation Account

For the year ending on 31st March, 2015

Dr. Cr.

Particulars (Rs.) Particulars (Rs.)

To Profits transferred to By Profit and Loss A/c

Capital A/c of : Net Profits 4,30,000 1,500

A 2,12,500 Less : Int. on

B 2,12,500 A’s Loan 5,000

4,25,000 4,25,000

Partner’s Capital A/cs

Dr. Cr.

Date Particulars A Rs. B Rs. Date Particulars A Rs. B Rs.

By Bank A/c

500000 300000

7,12,500 5,12,500 By Profit and

To balance 1.4.2014 2,12,500 2,12,500

1.3.2015 Loss

c/d 31.3.2015

appropriation

A/c

7,12,500 5,12,500 7,12,500 5,12,500

Material downloaded from myCBSEguide.com. 13 / 22

Journal

Dr. Cr.

Date Particulars LF. Debit(Rs.) Debit(Rs.)

Profit and Loss Appropriation A/C Dr.

To A’s Capital A/c

2,12,500

31.3.2015 To B’s Capital A/c 4,25,000

2,12,500

(Being profit distributed among the

partners)

A’s Loan A/c

Dr. Cr.

Amount Amount

Date Particulars Date Particulars

(Rs.) (Rs.)

2014 2,00,000

2,05,000 By Bank A/c

2015 Oct., 31 5,000

To A’s Capital c/d By interest on

March, 31 2015

Loan A/c

Mar., 31

2,05,000 2,05,000

10: Manoj Sahil and Dipankar are partners in a firm sharing profit and losses equally.

The have omitted interest on Capital @ 10% per annum for there years ended on 31st

March, 2015. Their fixed Capital on which interest was to be calculated throughout

were:

Material downloaded from myCBSEguide.com. 14 / 22

Manoj Rs. 3,00,000

Sahil Rs. 2,00,000

Dipankar Rs. 1,00,000

Give the necessary adusting journal entry with working notes.

Solution:

Books of Manoj, Sahil and Dipankar

Journal

Debit Debit

Date Particulars LF.

(Rs.) (Rs.)

Dipankar’s Current A/c Dr.

31.3.2015 To Manoj’s Current A/c 30,000 30,000

(Being adjustment entry passed)

STATEMENT SHOWING ADJUSTMENT

Manoj Sahil Dipankar

Date Particulars (Rs.)

(Rs.) (Rs.) (Rs.)

Amount to be given

90,000 60,000 30,000

----- Interest on Capital

Total A 90,000 60,000 30,000

Amount already given to be taken

Material downloaded from myCBSEguide.com. 15 / 22

back now ------) :

---- Profit taken back from the 60,000 60,000 60,000

partners in their profit sharing ratio

------------ 160,000+30,000 = 1,80,000)

30,000 Nil 30,000

Effect (A-B)

Credit Debit

11: A and B are partners in a firm sharing profits and losses in the into 3:2. The

following was the Balance Sheet of the firm as on 31.3.2015.

Balance Sheet

As on 31-3-2015

Date Particulars Rs. Rs. Assets Rs.

------- 80,000 Sundry Assets 80,000

31.3.2015 60,000

20,000

80,000 80,000

The profits Rs. 30,000 for the year ended 31-03-2015 were divided between the partner,

without allowing interest on capital @ 12% p.a. and salary to A Rs. 1,000 per month. During

the year A withdrew Rs 10,000 and B Rs. 20,000.

Pass the necessary adjustment entry and show your working clearly.

Solution

Book of A and B

Material downloaded from myCBSEguide.com. 16 / 22

Journal

Debit Debit

Date Particulars LF.

(Rs.) (Rs.)

B’s Capital A/c Dr.

To A’s Capital A/c

31.3.2015 5,280 5,280

(Being interest on capital and salary to

A not Charged, now rectified)

Working Notes :

1. Calculation of Opening Capital: As Closing Balance Sheet is given so before calculation of

interest opening capital should be calculated.

Particulars A (Rs.) B (Rs.)

60,000 20,000

Capital at the End 10,000 20,000

Add : Drawings

70,000 40,000

Less : Profits during the year

(18,000) (12,000)

Opening Capital

52,000 28,000

2. Calculation of Net Effect

STATEMENT SHOWING ADJUSTMENT

Particulars A (Rs.) B (Rs.)

Material downloaded from myCBSEguide.com. 17 / 22

A. Amount to be given (credited) 5,280

5,280

Interest on Capital -

12,000

(Not provided) 3,360

Salary to A

(Not provided)

18,240

Total A

B. Amount already given to be taken back

Now (Debited) :

12,960 8,640

Loss to the firm due to Interest on Capital and Sal A be

12,960 8,640

debited to the partners in their profit sharing ratio

(Rs. 18,240+3,360=21,600)

Total B

5,280 5,280

NET E NET Effect (A-B)

Credit Debit

12: Ram, shyam & Mohan are partners in a firm sharing profit & losses in the ratio of

2:1:2. Their fixed capitals were Rs. 3,00,000, Rs. 1,00,000 an Rs. 2,00,000 respectively.

Interest on capital for the year ending 31st March, 201 was credited to them @ 9% p.a.

instead of 10% p.a. The profits for the year before charging interest was Rs. 2,50,000.

Prepare necessary adjustment entry.

Solution:

Journal

Date Particulars L.F. A (Rs.) B (Rs.)

Shyam’s Current A/c Dr.

Mohan’s Current A/c Dr.

200

31.3.2015 To Ram’s Current A/c 600

400

(For interest less charged on capital

now rectified)

Material downloaded from myCBSEguide.com. 18 / 22

Working Notes:

Table showing Adjustment

Ram Shyam Mohan

Total

(Rs.) (Rs.) (Rs.)

27,000 9,000 18,000 54,000

Interest already credited @ 9%

30,000 10,000 20,000 60,000

Interest that should have been credited @

10% 3,000 1,000 2,000 6,000

Partners less credited 2,400 1,200 2,400 6,000

Debit profits which were reduced

600 200 400

By Rs. 6,000 in ratio of 2:1:2

Cr. Dr. Dr.

When interest charged is more

13: A, B & C are patterns in a firm sharing profits & losses in ration of 2:3:5. Their fixed

capitals were Rs. 15,00,000, Rs.30,00,000 & Rs. 60,00,000 reactively. For the year ended

31st March 2015, interest was credited 12% intend of 10%. Pass the necessary

adjustment entry.

Solution

Journal

Date Particulars L.F. A (Rs.) B (Rs.)

C’s Current A/c Dr.

Material downloaded from myCBSEguide.com. 19 / 22

To A’s Current A/c 12,000

31.3.2015 15,000

To B’s Current A/c 3,000

(For interest excessive charged now

rectified)

Working Notes:

Table showing Adjustment

A B C

Total

(Rs.) (Rs.) (Rs.)

Interest already credited @ 12% 1,80,000 3,60,000 7,20,00 12,60,00

Interest that should have been 1,50,000 3,00,000 6,00,000 10,50,000

credited @ 10%

30,000 60,000 1,20,000 2,10,000

Partners less credited with

42,000 63,000 1,05,000 2,10,000

By recovering this interest profits will

be increased by Rs. 2,10,000 & divided

12,000 3,000 15,000 __

in 2:3:5

Cr. Cr. Dr. __

Net Effect

14: A and B were partners in a firm sharing profits and losses in the ratio of 3:2. They

admit C for 1/6th share in profits and guaranteed that his share of profits will not be

less then Rs. 25,000. Total profits of the firm for the year ended 1st March, 2015 were Rs.

90,000. Calculate share of profits for each partner when.

1. Guarantee is given by firm.

2. Guarantee is given by A

3. Guarantee is given by A and B equally.

Solution:

Material downloaded from myCBSEguide.com. 20 / 22

Case 1. When Guarantee is given by firm.

Profit and Loss Appropriation Account

For the year ending on 31st March, 2015

Dr. Cr.

Particulars (Rs.) Particulars Rs.)

To A’s Capital A/c

(3/s of Rs. 65,000) 39,000

To B’s Capital A/c 26,000 By Profit and Loss A/c 90,000

(2/s of Rs. 65,000) 25,000

To C’s Capital A/c

(1/6 of Rs. 90,000 or

Rs. 25,000 whichever is more

90,000 90,000

Profit and Loss Appropriation Account

For the year ending on 31st March, 2015

Dr. Cr.

Particulars (Rs.) Particulars Rs.)

To A’s Capital A/c

(3/6 of Rs. 90,000) 45,000

Less : Deficiency

Borne for C (10,000)

35,000 By Profit and Loss A/c

To B’s Capital A/c 90,000

30,000 (Net Profits)

(2/6 of Rs. 90,000)

To C’s Capital A/c

(1/6 of Rs. 90,000) 15,000

Add : Deficiency

Recover form A10,000

Material downloaded from myCBSEguide.com. 21 / 22

90,000 90,000

Cose: 3. When Guarantee is given by A & B equally.

Profit and Loss Appropriation Account

For the year ending on 31st March, 2015

Dr. Cr.

Particulars (Rs.) Particulars Rs.)

To A’s Capital A/c

(3/6 of Rs. 90,000) 45,000

Less : Deficiency Borne for C

(1/2 of Rs.10,000) 5,000

To B’s Capital A/c

40,000

(2/6 of Rs. 90,000) 30,000 By Profit and Loss A/c

25,000 90,000

Less : Deficiency Borne for C (Net Profits)

25,000

(1/2 of Rs. 10,000) 5,000

To C’s Capital A/c

(1/6 of Rs. 90,000) 15,000

Add : Deficiency

Recover form A 5,000

Deficiency Recovered From B 5,000 90,000 90,000

Material downloaded from myCBSEguide.com. 22 / 22

Das könnte Ihnen auch gefallen

- CBSE Class 12 Accountancy Question Paper 2015 Foreign Set 1Dokument42 SeitenCBSE Class 12 Accountancy Question Paper 2015 Foreign Set 1Ashish GangwalNoch keine Bewertungen

- Account Ch-1 Partnership Firm - FundamentalsDokument19 SeitenAccount Ch-1 Partnership Firm - Fundamentalsapsonline8585Noch keine Bewertungen

- Partnership - Admission of Partner - DPP 04 (Of Lecture 06) - (Kautilya)Dokument6 SeitenPartnership - Admission of Partner - DPP 04 (Of Lecture 06) - (Kautilya)DevanshuNoch keine Bewertungen

- Acc Book 1st SemDokument74 SeitenAcc Book 1st Semlanguage hub100% (1)

- 12 Accounts Imp Ch3Dokument11 Seiten12 Accounts Imp Ch3Ashish GangwalNoch keine Bewertungen

- Fundamentals PDFDokument103 SeitenFundamentals PDFDhairya JainNoch keine Bewertungen

- Marking Scheme: PRE - BOARD-2 (2023 - 2024)Dokument11 SeitenMarking Scheme: PRE - BOARD-2 (2023 - 2024)Kaustav DasNoch keine Bewertungen

- Unit 2 Partmership Firms FundamentsDokument10 SeitenUnit 2 Partmership Firms FundamentsSunlight SirSundeepNoch keine Bewertungen

- 1 VJP 0 LTVX WHN RV ZUCj NLDokument10 Seiten1 VJP 0 LTVX WHN RV ZUCj NLVanshika BhatiNoch keine Bewertungen

- CBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot QuestionsDokument6 SeitenCBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot Questionsdakshrwt06Noch keine Bewertungen

- Admission Test No. 2Dokument5 SeitenAdmission Test No. 2Mitesh Sethi0% (1)

- CTF Edited Solved Paper 1Dokument2 SeitenCTF Edited Solved Paper 1Umesh JaiswalNoch keine Bewertungen

- MLM Xii Accountancy 22-23 PDFDokument34 SeitenMLM Xii Accountancy 22-23 PDFayush5sharma805Noch keine Bewertungen

- G Awa Mil 5 D ADIi FZ DJ HV ADokument10 SeitenG Awa Mil 5 D ADIi FZ DJ HV APriyankadevi PrabuNoch keine Bewertungen

- 12th MCQDokument17 Seiten12th MCQkalpbhatia9898Noch keine Bewertungen

- TB Meningitis Fact Sheet Dec 2017Dokument13 SeitenTB Meningitis Fact Sheet Dec 2017Brix ArriolaNoch keine Bewertungen

- Additional Illustratiions 2Dokument14 SeitenAdditional Illustratiions 2Naman ChotiaNoch keine Bewertungen

- HHW Accounts Class 12-2Dokument6 SeitenHHW Accounts Class 12-2Pari AggarwalNoch keine Bewertungen

- MS 6 Marker Set 1Dokument24 SeitenMS 6 Marker Set 1Harini NarayananNoch keine Bewertungen

- SQ AcoountaciiDokument75 SeitenSQ AcoountaciiAditya bansal100% (1)

- Soln PT2 Acc XII (Session 2023-24)Dokument14 SeitenSoln PT2 Acc XII (Session 2023-24)Vaidehi BagraNoch keine Bewertungen

- Ch 1 Accounting of Partnership Basic ConceptDokument15 SeitenCh 1 Accounting of Partnership Basic Concepthk6206131516Noch keine Bewertungen

- 12 Acc Accoun Partner Firm Fundamentals Im6 PDFDokument12 Seiten12 Acc Accoun Partner Firm Fundamentals Im6 PDFDID You KNOWNoch keine Bewertungen

- Study Note 4.3, Page 198-263Dokument66 SeitenStudy Note 4.3, Page 198-263s4sahithNoch keine Bewertungen

- 12 Accountancy 2023-24Dokument37 Seiten12 Accountancy 2023-24chiragdahiya0602Noch keine Bewertungen

- Aidcom Financial Accounting AnalysisDokument17 SeitenAidcom Financial Accounting AnalysisAjmal K HussainNoch keine Bewertungen

- Xyhhj 3 of 1 Aud 1 W EKXw QLDokument11 SeitenXyhhj 3 of 1 Aud 1 W EKXw QLhk6206131516Noch keine Bewertungen

- 2020-BPS - Pre - Board II-Accountancy Answer KeyDokument16 Seiten2020-BPS - Pre - Board II-Accountancy Answer KeyJoshi DrcpNoch keine Bewertungen

- FYJC Book Keeping and Accuntancy Topic Final AccountDokument4 SeitenFYJC Book Keeping and Accuntancy Topic Final AccountRavichandraNoch keine Bewertungen

- 12 Accountancy Accounting For Partnership Firms FundamentalsDokument6 Seiten12 Accountancy Accounting For Partnership Firms FundamentalsIqra MughalNoch keine Bewertungen

- 2 Fundamentals of PartnershipDokument11 Seiten2 Fundamentals of PartnershipKartik JainNoch keine Bewertungen

- Suggested Answers-Partnership-3Dokument4 SeitenSuggested Answers-Partnership-3Pulkit MarwahNoch keine Bewertungen

- CCP402Dokument13 SeitenCCP402api-3849444Noch keine Bewertungen

- 07 Sample PaperDokument42 Seiten07 Sample Papergaming loverNoch keine Bewertungen

- Chapter 2 Distrubution of ProfitsDokument9 SeitenChapter 2 Distrubution of ProfitsAparna PNoch keine Bewertungen

- XII Accts Re First Board Exam 20-21Dokument9 SeitenXII Accts Re First Board Exam 20-21Sagar SharmaNoch keine Bewertungen

- Accounts KV MaterialDokument109 SeitenAccounts KV MaterialDiya Khandelwal100% (1)

- Master QuestionsDokument5 SeitenMaster QuestionsSumit VermaNoch keine Bewertungen

- CA Inter Adv. Accounting Top 50 Question May 2021Dokument117 SeitenCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNoch keine Bewertungen

- Additional Questions-2Dokument6 SeitenAdditional Questions-2NDA AspirantNoch keine Bewertungen

- Accounts SamplepaperDokument29 SeitenAccounts SamplepaperPawni JadhavNoch keine Bewertungen

- 12 Accounts CBSE Sample Papers 2019 Marking SchemeDokument16 Seiten12 Accounts CBSE Sample Papers 2019 Marking SchemeSalokya KhandelwalNoch keine Bewertungen

- Module - 8 Topic Name-Guarantee of ProfitDokument3 SeitenModule - 8 Topic Name-Guarantee of ProfitRahul SahNoch keine Bewertungen

- Class 12 Accountancy Solutions VP 02Dokument13 SeitenClass 12 Accountancy Solutions VP 02Ankit KumarNoch keine Bewertungen

- M and A ExercisesDokument4 SeitenM and A ExercisesSweet tripathiNoch keine Bewertungen

- 4 General Accounts of Partnership FirmDokument16 Seiten4 General Accounts of Partnership FirmNisarga T DaryaNoch keine Bewertungen

- Admission Capital AdjustmentsDokument6 SeitenAdmission Capital AdjustmentsHamza MudassirNoch keine Bewertungen

- Amalgamation and Sale of FirmDokument57 SeitenAmalgamation and Sale of FirmShrutika singhNoch keine Bewertungen

- PB 2 - Accounts QPDokument11 SeitenPB 2 - Accounts QPNaresh RainaNoch keine Bewertungen

- Partnership Firms Part 2 Appropriation of ProfitDokument14 SeitenPartnership Firms Part 2 Appropriation of ProfitDeepti BistNoch keine Bewertungen

- Assessement Test 5 - Admission of PartnerDokument2 SeitenAssessement Test 5 - Admission of PartnerShreya PushkarnaNoch keine Bewertungen

- Accountancy PB 1 Mock Test PaperDokument10 SeitenAccountancy PB 1 Mock Test PaperUjwal Anish ReddyNoch keine Bewertungen

- Partnership Accounts - IDokument23 SeitenPartnership Accounts - IM JEEVARATHNAM NAIDU100% (1)

- Leverage & Risk AnalysisDokument11 SeitenLeverage & Risk AnalysisAnkush ChoudharyNoch keine Bewertungen

- Acc-Sample Paper-04Dokument8 SeitenAcc-Sample Paper-04guneet uberoiNoch keine Bewertungen

- NCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 1 PDFDokument74 SeitenNCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 1 PDFÀñüpäm MíshråNoch keine Bewertungen

- UNIT-4Dokument33 SeitenUNIT-4b21ai008Noch keine Bewertungen

- 15 Sample Papers Accountancy 2019-20Dokument119 Seiten15 Sample Papers Accountancy 2019-20hardik50% (2)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Forces and Motion Chapter ExplainedDokument11 SeitenForces and Motion Chapter ExplainedMaridjan WiwahaNoch keine Bewertungen

- A Tidy GhostDokument13 SeitenA Tidy Ghost12345aliNoch keine Bewertungen

- Seminar On Biodegradable PolymersDokument19 SeitenSeminar On Biodegradable Polymerskeyur33% (3)

- Cybersecurity Case 4Dokument1 SeiteCybersecurity Case 4Gaurav KumarNoch keine Bewertungen

- Accounting Income and Assets: The Accrual ConceptDokument40 SeitenAccounting Income and Assets: The Accrual ConceptMd TowkikNoch keine Bewertungen

- OHIO SCHOOL MILK AUCTION COLLUSIONDokument21 SeitenOHIO SCHOOL MILK AUCTION COLLUSIONmhafner88Noch keine Bewertungen

- Marguerite Musica, Mezzo Soprano - Upcoming Roles, Training & MoreDokument1 SeiteMarguerite Musica, Mezzo Soprano - Upcoming Roles, Training & MoreHaley CoxNoch keine Bewertungen

- 06 Traffic Flow Fundamentals PDFDokument27 Seiten06 Traffic Flow Fundamentals PDFDaryl ChanNoch keine Bewertungen

- Banking Sector Project ReportDokument83 SeitenBanking Sector Project ReportHarshal FuseNoch keine Bewertungen

- BAMBUDokument401 SeitenBAMBUputulNoch keine Bewertungen

- Political Internet Memes On Corruption Issue Surrounding The Philippine Health Insurance CorporationDokument9 SeitenPolitical Internet Memes On Corruption Issue Surrounding The Philippine Health Insurance CorporationFeline Joy SarinopiaNoch keine Bewertungen

- Integrated Farming System: A ReviewDokument12 SeitenIntegrated Farming System: A ReviewIndian Journal of Veterinary and Animal Sciences RNoch keine Bewertungen

- Nadig Reporter Newspaper Chicago June 19 2013 EditionDokument20 SeitenNadig Reporter Newspaper Chicago June 19 2013 EditionchicagokenjiNoch keine Bewertungen

- Leak Proof Engineering I PVT LTDDokument21 SeitenLeak Proof Engineering I PVT LTDapi-155731311Noch keine Bewertungen

- Life of A Loan, GM FinancialDokument12 SeitenLife of A Loan, GM Financialed_nycNoch keine Bewertungen

- Work-Experience-Sheet CSC Form 212Dokument5 SeitenWork-Experience-Sheet CSC Form 212Marc AbadNoch keine Bewertungen

- Web TPI MDF-TC-2016-084 Final ReportDokument35 SeitenWeb TPI MDF-TC-2016-084 Final ReportKrishnaNoch keine Bewertungen

- See Repair Manual PDFDokument1.050 SeitenSee Repair Manual PDFJorge MonteiroNoch keine Bewertungen

- Tutorial Question 4 TORTDokument2 SeitenTutorial Question 4 TORTNBT OONoch keine Bewertungen

- Trash and Recycling Space Allocation GuideDokument24 SeitenTrash and Recycling Space Allocation GuideJohan RodriguezNoch keine Bewertungen

- Deckers v. Comfy - Minute OrderDokument2 SeitenDeckers v. Comfy - Minute OrderSarah BursteinNoch keine Bewertungen

- Respharma Company BrochureDokument7 SeitenRespharma Company BrochureHiteshi Parekh100% (1)

- Module Combustion Engineering-1-2Dokument13 SeitenModule Combustion Engineering-1-2Julie Ann D. GaboNoch keine Bewertungen

- Manual LubDokument25 SeitenManual LubMota Guine InformaçõesNoch keine Bewertungen

- Paradeep Refinery Project: A Sunrise Project For A Sunshine FutureDokument35 SeitenParadeep Refinery Project: A Sunrise Project For A Sunshine Futuremujeebtalib80% (5)

- Group Project in Patient RoomDokument14 SeitenGroup Project in Patient RoomMaida AsriNoch keine Bewertungen

- What Digital Camera - May 2016Dokument100 SeitenWhat Digital Camera - May 2016Alberto ChazarretaNoch keine Bewertungen

- CJ718 Board Functional Test ProcedureDokument13 SeitenCJ718 Board Functional Test ProcedureYudistira MarsyaNoch keine Bewertungen

- PAS Install Lab Guide - v11.2Dokument145 SeitenPAS Install Lab Guide - v11.2Muhammad Irfan Efendi SinulinggaNoch keine Bewertungen

- 00 2 Physical Science - Zchs MainDokument4 Seiten00 2 Physical Science - Zchs MainPRC BoardNoch keine Bewertungen