Beruflich Dokumente

Kultur Dokumente

SPF 1984

Hochgeladen von

sakthijack100%(2)100% fanden dieses Dokument nützlich (2 Abstimmungen)

5K Ansichten4 Seitenspf 1984

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenspf 1984

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

100%(2)100% fanden dieses Dokument nützlich (2 Abstimmungen)

5K Ansichten4 SeitenSPF 1984

Hochgeladen von

sakthijackspf 1984

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

PROCEEDINGS OF THE COMMERCIAL TAX OFFICER PERIYAKULAM

PRESENT:

ROC.NO. /2019/B2 DATED -04-2019.

SUB: Tamilnadu Government Employees Special Provident Fund-cum-Gratuity

Scheme 1984 – Final payment to Thiru.M.Thangavel formerly Assistant of

this office– Retired on 28-02-2019– sanctioned.

REF: 1. G.O. Ms.No.136(F) Pen., Department dated 29-02-1984

2. Government Finance (Pen.) Letter No.64 PSC/1984

dated 20-03-88

3. Government Letter No.Fin.(Pen.)Department No.177735/P-85-1 dated

08-11-1985.

4. Government Letter Fin. (Pen.) Department 15578/P.86/01

dated 02-01-1987.

5. G.O. Ms.No.694, Fin.(P & A) Fin.(P & A) Department

dated 29-09-87.

6. G.O. Ms. No.694, Fin.(Pen.) Department dated 06-03-90.

7. G.O. Ms.No.609/Fin. (Pen.) Department dated 30-08-93.

8. G.O. Ms.No.357/Fin.(Pen.) Department dated 25-04-94.

9. G.O. Ms.No.62/Fin.(Pen.) Department dated 11-02-97.

10. G.O. Ms.No.429/Fin.(Pen.) Department dated 15-09-2000.

11. G.O.Ms.No.473/Fin. (Pen.) Department dated 17-10-2003.

12. G.O.Ms.No.125/Fin.(All) Department dated 17-04-2003.

*****

ORDER:

Thiru.M.Thangavel formerly Assistant of Office of the Commercial Tax Officer

Periyakulam was retired on 28-02-2019. He was admitted to Tamil Nadu Government

Employees Special Provident Fund-Cum-Gratuity Scheme 1984 with effect from

1.4.1984 and she had contributed the subscription regularly from 01.10.2001 to February

2019.

In exercise of the powers conferred in rule 9B of the TNGE SPF-Cum-Gratuity

rules issued in G.O. Ms.No.607, Finance (Pension) Department dated 10-08-1993 and

G.O. Ms.No.62, Finance (Pension) Department dated 11-02-1997, sanction is hereby

accorded for the drawal of an aggregate amount of Rs.17,555/- (Rupees Seventeen

thousand five hundred and fifty five only) to Thiru.M.Thangavel, formerly Assistant due

to Retired Government Servant as detailed below:-

..2..

Subscription (Rs.20 x 148) Rs. 2,960-00

Interest 01.03.2001 to June 2013 Rs. 4,595-00

Government Contribution Rs.10,000-00

-----------------

Total Rs.17,555-00

-----------------

The expenditure is debitable under the following heads of accounts:-

1. Government servant Subscription Debitable in Rs.2,960/-

8031-00-Other Savings Deposits-102-STate Savings Bank Deposits-

AB – Tamilnadu Government Employees Special Provident Fund Cum

Gratuity Scheme-Employees Subscription

(D.P.Code 8031-00-102-AB-0009)

2. Interest Debitable in Rs.4,595/-

8031-00-Other Saving Deposits-102-State Savings Bank Deposits

AC-Tamilnadu Government Employees Special Provident Fund

cum-Gratuity Scheme Interest

(DP Code 8031-00-102-AC-0007)

3. Government Contribution in Debitable in Rs.10,000/-

8031-Other savings Deposits 102-State Bank Deposits-AD Tamilnadu

Govenment Employees Special Provident Fund-cum-Gratuity Scheme

Government Contribution.

(DP Code 8031-00-102-AD-0005).

The above amounts are to be drawn in Separate Bill in T.N.T.C.40a bill form

Commercial Tax Officer

Periyakulam

To

Thiru.M.Thangavel,

Office Assistant (Retired on 28.02.2019)

Copy to the bill.

Copy to the Sub-Treasury Officer, Periyakulam.

ANNEXURE

1. SL.No. : 1

2. Name and Designation : Thiru. M.Thangavel,

Office Assistant

3. Office to which attached : O/o Commercial Tax Officer

Periyakulam

4. Date of birth : 15.02.1961

5. Date of entry into the service : 23.04.1998

6. Date from which services were

regularized. : 12.08.1992

7. Date from which the Government

servant opted for the scheme. : 01-10-2001

8. Date of retirement : 28-02-2019

9. Period of total amount of SPF

Subscription recovered from the 01.10.2001 to January 2014 148 x 20

individual. : Rs. 2,960-00

10. Interest. : Rs.4,595-00

11. Government Contribution : Rs.10,000-00

12. Total amount eligible. : Rs. 17,555-00

13. In case of death, name and relationship

of the nominee and whom paid : Does not arise.

14. Sanction order No. and date. : Roc /2019 B2 dated

15. Remarks. : Nil.

Commercial Tax Officer

Periyakulam

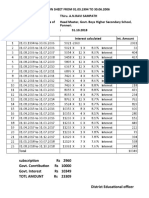

INTEREST CALCULATION SHEET FOR TAMILNALDU SPECIAL

PROVIDENT FUND CUM GRATUITY SCHEME 1984 IN RESPECT

OF THIRU.M.THANGAVEL WHO IS RETIRED ON 28.02.2019.

Period Rate of Month Principle Interest Total

Interest

Total Amount of Subscription recovered from

01.10.2001 to January 2014 at Rs.20/- per month

in 148 installments and admissible interest as per

Table 2960 2061 5021

01.02.2014 31.03.2014 8.7% 2 5021 73 5094

01.04.2014 31.03.2015 8.7% 12 5094 443 5537

01.04.2015 31.03.2016 8.7% 12 5537 482 6019

01.04.2016 31.06.2016 8.7% 3 6019 131 6150

01.07.2016 30.09.2016 8.1% 3 6150 125 6275

01.10.2016 31.03.2017 8% 6 6275 251 6526

01.04.2017 30.06.2017 7.9% 3 6526 129 6655

01.07.2017 31.12.2017 7.8% 6 6655 260 6915

01.01.2018 31.09.2018 7.6% 9 6915 395 7310

01.10.2018 31.12.2018 8% 3 7310 146 7456

01.01.2019 28.02.2019 8% 2 7456 99 7555

Total 7555

Less: Subscription 2960

Interest 4595

ABSTRACT

Subscription Rs. 2,960/-

Interest Rs. 4,595 /-

Contribution Rs.10,000/-

---------------

Total Rs.17,555 /-

---------------

( Seventeen thousand five hundred and fifty five only)

Commercial Tax Officer

Periyakulam

Das könnte Ihnen auch gefallen

- SPF 2000Dokument5 SeitenSPF 2000sakthijack67% (3)

- CJM Philomine Chinna Roja SPFDokument5 SeitenCJM Philomine Chinna Roja SPFMohan NagaiNoch keine Bewertungen

- Aeo Karur SPF CalculationDokument30 SeitenAeo Karur SPF Calculationperumal krNoch keine Bewertungen

- Sumathi Organiser SPFDokument27 SeitenSumathi Organiser SPFPalani AppanNoch keine Bewertungen

- Fin504 eDokument14 SeitenFin504 eGuna SeelanNoch keine Bewertungen

- SPFG Final Payment FORMAT PDFDokument3 SeitenSPFG Final Payment FORMAT PDFMuralitharan Kriahnamoorthy100% (1)

- SPF 1984 Interest Calculation Percentage Table2Dokument1 SeiteSPF 1984 Interest Calculation Percentage Table2Yuva Raj75% (57)

- 3.SPF - Calculation SheetDokument5 Seiten3.SPF - Calculation Sheet7 TN BN NCC MADURAINoch keine Bewertungen

- SPF 50Dokument10 SeitenSPF 50மணிகண்டன் பிரியா100% (1)

- SPF 2000 Calculation Sheet Rs 50Dokument8 SeitenSPF 2000 Calculation Sheet Rs 50avk197565% (17)

- SPF 2000 Bill FormsDokument17 SeitenSPF 2000 Bill Formskarunamoorthi_p220957% (7)

- A N Ravi Sampth SPF 070419Dokument8 SeitenA N Ravi Sampth SPF 070419Murali CheyapalanNoch keine Bewertungen

- Thiru - Esakiyappan, Noonmeal Organiser - T.D.T.A. Primary School, Puthaneri S.P.F. Interest Calculation Working SheetDokument2 SeitenThiru - Esakiyappan, Noonmeal Organiser - T.D.T.A. Primary School, Puthaneri S.P.F. Interest Calculation Working SheetNAN NMPNoch keine Bewertungen

- Ta Bill PreparationDokument3 SeitenTa Bill PreparationkarthiamjathNoch keine Bewertungen

- SPF Bacialakshmi CookDokument2 SeitenSPF Bacialakshmi CookNAN NMPNoch keine Bewertungen

- Surrender Leave - Government of Tamil NaduDokument3 SeitenSurrender Leave - Government of Tamil NaduDr.Sagindar83% (12)

- TAMIL NADU GOVERNMENT - CONTRIBUTORY PENSION SCHEME - FAQsDokument4 SeitenTAMIL NADU GOVERNMENT - CONTRIBUTORY PENSION SCHEME - FAQsDr.Sagindar100% (1)

- G.O.Ms - No.321 DT 02.07.1998Dokument1 SeiteG.O.Ms - No.321 DT 02.07.1998bksridhar196873% (15)

- Junior Getting More Payfor Giving Advance Increment GODokument5 SeitenJunior Getting More Payfor Giving Advance Increment GObksridhar196884% (19)

- Government of Tamil Nadu Abstract EstablishmentDokument166 SeitenGovernment of Tamil Nadu Abstract Establishmentkarthi_vanjith88% (8)

- Compassionate GO 16Dokument17 SeitenCompassionate GO 16kailasasundaram92% (13)

- Fin - e - 197 - 2021 FBFDokument3 SeitenFin - e - 197 - 2021 FBFsubramaniam vNoch keine Bewertungen

- Fin-E-268-2002 SPF Rs20Dokument5 SeitenFin-E-268-2002 SPF Rs20The PrincipalNoch keine Bewertungen

- 2019fin MS19Dokument4 Seiten2019fin MS19ShanmukhamNoch keine Bewertungen

- YDokument4 SeitenYBernadette RajNoch keine Bewertungen

- AP GIS GO NO 131 W.E.F Oct 2018 - 30-06-2019Dokument6 SeitenAP GIS GO NO 131 W.E.F Oct 2018 - 30-06-2019Sivareddy50% (2)

- Go Fin 268 02 pg630 PDFDokument2 SeitenGo Fin 268 02 pg630 PDFMani BaluNoch keine Bewertungen

- Go Fin 268 02 pg630Dokument2 SeitenGo Fin 268 02 pg630R.p. VenkatNoch keine Bewertungen

- Double Number Merging FormatDokument4 SeitenDouble Number Merging Formatgkamalk79Noch keine Bewertungen

- Government of West B Ngal FI Ance Department Audit BranchDokument3 SeitenGovernment of West B Ngal FI Ance Department Audit BranchsudipNoch keine Bewertungen

- Presence Book ReviewDokument2 SeitenPresence Book Reviewvanjinathan_aNoch keine Bewertungen

- Interest CertificateDokument1 SeiteInterest Certificatebhagyaraju67% (15)

- Fin e 57 2016 PDFDokument2 SeitenFin e 57 2016 PDFGowtham RajNoch keine Bewertungen

- Fin e 57 2016Dokument2 SeitenFin e 57 2016IambalaNoch keine Bewertungen

- Fin e 57 2016 PDFDokument2 SeitenFin e 57 2016 PDFGowtham RajNoch keine Bewertungen

- 216-2001 (PLG) Settlement of Overdue NCL in Simple InterestDokument4 Seiten216-2001 (PLG) Settlement of Overdue NCL in Simple InterestArun JerardNoch keine Bewertungen

- KumaresanDokument8 SeitenKumaresanEsi VadalurNoch keine Bewertungen

- G.O.Ms .No .177-Dt.19.07.2022Dokument6 SeitenG.O.Ms .No .177-Dt.19.07.2022mdakshareefNoch keine Bewertungen

- PDFDokument2 SeitenPDFninad charatkarNoch keine Bewertungen

- Contributory PensionDokument2 SeitenContributory PensionvenkatasubramaniyanNoch keine Bewertungen

- Tamilnadu Govt Pongal Bonus G.O No 1 Date 03.01.2011 English VersionDokument4 SeitenTamilnadu Govt Pongal Bonus G.O No 1 Date 03.01.2011 English VersionMohankumar P KNoch keine Bewertungen

- Gover Rnment of Andhra PradeshDokument15 SeitenGover Rnment of Andhra PradeshChoppa RamachandraiahNoch keine Bewertungen

- Pongal Bonus 2010Dokument4 SeitenPongal Bonus 2010thogamalaiphc5747Noch keine Bewertungen

- GO (P) No 1142-98-Fin Dated 25-03-1998Dokument6 SeitenGO (P) No 1142-98-Fin Dated 25-03-1998Saravanan SubramaniNoch keine Bewertungen

- FINANCE (Allowances) DEPARTMENT G.O.Ms - No.151, Dated 20 May 2019Dokument3 SeitenFINANCE (Allowances) DEPARTMENT G.O.Ms - No.151, Dated 20 May 2019Ram RajNoch keine Bewertungen

- Notes To Investment Proof SubmissionDokument10 SeitenNotes To Investment Proof SubmissionVinayak DhotreNoch keine Bewertungen

- 03-PDPS AD (STAT) CRS, Chakwal 2003-15Dokument4 Seiten03-PDPS AD (STAT) CRS, Chakwal 2003-15Waqas GhulamnabiNoch keine Bewertungen

- FINANCE (Allowances) DEPARTMENT G.O.Ms - No.25, Dated 21 January 2019Dokument2 SeitenFINANCE (Allowances) DEPARTMENT G.O.Ms - No.25, Dated 21 January 2019vanjinathan_aNoch keine Bewertungen

- Microsoft Word - 2019FIN - MS36Dokument6 SeitenMicrosoft Word - 2019FIN - MS36nagalaxmi manchalaNoch keine Bewertungen

- FINANCE (Allowances) DEPARTMENT G.O.Ms - No.14, Dated 27 January, 2020Dokument2 SeitenFINANCE (Allowances) DEPARTMENT G.O.Ms - No.14, Dated 27 January, 2020vivek anandanNoch keine Bewertungen

- Tamil Nadu Government OrderDokument3 SeitenTamil Nadu Government OrderChandru ArcNoch keine Bewertungen

- FINANCE (Allowances) DEPARTMENT G.O.Ms - No.153, Dated 20 May 2019Dokument3 SeitenFINANCE (Allowances) DEPARTMENT G.O.Ms - No.153, Dated 20 May 2019NAZIR AHAMEDNoch keine Bewertungen

- GO - MS.NO.60 DT 6-7-19 INTERIM RELIEF TO THE STATE GOVERNEMENT EMPLOYEESDokument3 SeitenGO - MS.NO.60 DT 6-7-19 INTERIM RELIEF TO THE STATE GOVERNEMENT EMPLOYEESSrinu VasuNoch keine Bewertungen

- 27 Useful Charts of Service Tax 2016 17 PDFDokument24 Seiten27 Useful Charts of Service Tax 2016 17 PDFJosef AnthonyNoch keine Bewertungen

- GIS-Revised Rates of Intrest 2010Dokument18 SeitenGIS-Revised Rates of Intrest 2010SEKHARNoch keine Bewertungen

- Wage Revision Clarification PDFDokument4 SeitenWage Revision Clarification PDFbraghavNoch keine Bewertungen

- Loan & AdvancesDokument31 SeitenLoan & Advancesmacbook28487Noch keine Bewertungen

- Finance (Allowances) Department: G.O.No.262, Dated 16.10.2015Dokument4 SeitenFinance (Allowances) Department: G.O.No.262, Dated 16.10.2015Gowtham RajNoch keine Bewertungen

- Fin e 9 2023 PDFDokument2 SeitenFin e 9 2023 PDFSelva KumarNoch keine Bewertungen

- Affidavit Cum DeclarationDokument5 SeitenAffidavit Cum DeclarationyasinNoch keine Bewertungen

- Aptitude 1Dokument12 SeitenAptitude 1Sathishkumar PalanippanNoch keine Bewertungen

- Function To Convert Number Into Currency (Rupees) in ExcelDokument7 SeitenFunction To Convert Number Into Currency (Rupees) in ExcelShaan BhasinNoch keine Bewertungen

- PF All Forms in Excel (Challan Monthly Return Annual Return)Dokument20 SeitenPF All Forms in Excel (Challan Monthly Return Annual Return)Pardeep K AggarwalNoch keine Bewertungen

- Damu Coins 2Dokument73 SeitenDamu Coins 2musham9Noch keine Bewertungen

- Distinctive Names of CountriesDokument18 SeitenDistinctive Names of CountriesChandru Pgs100% (2)

- Adw e 95 2003Dokument13 SeitenAdw e 95 2003Paapu ChellamNoch keine Bewertungen

- Partnership SheetDokument2 SeitenPartnership SheetAnkit ShuklaNoch keine Bewertungen

- ACFrOgAmsxYbVgKOWBPyw89ls07MhwWAYD1vfIy UQWRSRPTAHcPuRkrTstm XE YKYn86fl-l290CBeHwS8DYlXYhjfgMvIOnKVirARgQ2o5FfN2gttIX3qJ6YMSWUJE0gv9Um1uXmzdhdCq6u2Dokument36 SeitenACFrOgAmsxYbVgKOWBPyw89ls07MhwWAYD1vfIy UQWRSRPTAHcPuRkrTstm XE YKYn86fl-l290CBeHwS8DYlXYhjfgMvIOnKVirARgQ2o5FfN2gttIX3qJ6YMSWUJE0gv9Um1uXmzdhdCq6u2Kavya Gupta 4E SNNoch keine Bewertungen

- Intro KunalDokument30 SeitenIntro KunalRaghunath AgarwallaNoch keine Bewertungen

- Pharma IndustryDokument69 SeitenPharma IndustryAnuj Tambe100% (1)

- Cash VoucherDokument1 SeiteCash Voucherabhishek200918177825Noch keine Bewertungen

- 11 Accountancy TP Ch03 01 Journal EntriesDokument2 Seiten11 Accountancy TP Ch03 01 Journal EntriesBhavi ChaudharyNoch keine Bewertungen

- Possession Letter: Ft. More or Less On The Third Floor, Consisting 3 (Three) Rooms, 1 (One)Dokument2 SeitenPossession Letter: Ft. More or Less On The Third Floor, Consisting 3 (Three) Rooms, 1 (One)Jayanta RayNoch keine Bewertungen

- Suri's ReformsDokument1 SeiteSuri's ReformsEhtiSham khanNoch keine Bewertungen

- Indian Stamp (Tamil Nadu Amendment) Act, 1958Dokument125 SeitenIndian Stamp (Tamil Nadu Amendment) Act, 1958Latest Laws TeamNoch keine Bewertungen

- UntitledDokument28 SeitenUntitledapi-233604231Noch keine Bewertungen

- Class 6 Math CRA Revision WorksheetDokument2 SeitenClass 6 Math CRA Revision WorksheetPraneeth kumar Dola100% (1)

- Challan FormDokument2 SeitenChallan FormKarunakara CheerlaNoch keine Bewertungen

- Summary (Lau Yong King & Lim Pui Ling)Dokument2 SeitenSummary (Lau Yong King & Lim Pui Ling)Lau Yong KingNoch keine Bewertungen

- Sanco Annual Report 2019Dokument187 SeitenSanco Annual Report 2019Sonu KumariNoch keine Bewertungen

- NIFT, MFM Mock TestDokument8 SeitenNIFT, MFM Mock TestBlacksheepResources100% (1)

- Bainama 4534Dokument24 SeitenBainama 4534atul guptaNoch keine Bewertungen

- GO ChangeInStampDutyDokument9 SeitenGO ChangeInStampDutySANTHOSH SANTHOSHNoch keine Bewertungen

- Bank Notes of Portuguese India PDFDokument25 SeitenBank Notes of Portuguese India PDFSoubhik ChatterjeeNoch keine Bewertungen

- Bank Copy Candidate Copy College Copy: Client Code: Kdplm1 Client Code: Kdplm1 Client Code: Kdplm1Dokument2 SeitenBank Copy Candidate Copy College Copy: Client Code: Kdplm1 Client Code: Kdplm1 Client Code: Kdplm1Shyam RajapuramNoch keine Bewertungen

- Request For Grant Under Working Capital Maitree Mahila 27 Nov 2019Dokument3 SeitenRequest For Grant Under Working Capital Maitree Mahila 27 Nov 2019Sp SeerviNoch keine Bewertungen

- Agreement ShopDokument8 SeitenAgreement ShoprahulkishnaniNoch keine Bewertungen

- BahriaTown JudgmentDokument16 SeitenBahriaTown JudgmentNoor Ejaz ChaudhryNoch keine Bewertungen