Beruflich Dokumente

Kultur Dokumente

Form VAT003

Hochgeladen von

Tamara Wilson0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

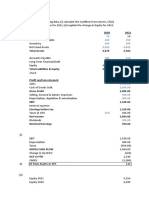

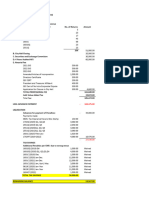

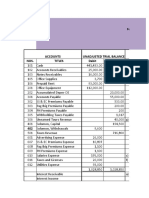

36 Ansichten1 SeiteThis document is a VAT (value added tax) return filed by Kenneth P. Punnett for the tax period of March 2019. It shows sales, purchases, imports, output tax, input tax, tax payable, and excess credit. The key figures are total sales of $34,695.44, output tax of $4,785.58, input tax of $1,869.04, and tax payable of $1,194.19.

Originalbeschreibung:

Application form

Originaltitel

Form_VAT003 (4)

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document is a VAT (value added tax) return filed by Kenneth P. Punnett for the tax period of March 2019. It shows sales, purchases, imports, output tax, input tax, tax payable, and excess credit. The key figures are total sales of $34,695.44, output tax of $4,785.58, input tax of $1,869.04, and tax payable of $1,194.19.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

36 Ansichten1 SeiteForm VAT003

Hochgeladen von

Tamara WilsonThis document is a VAT (value added tax) return filed by Kenneth P. Punnett for the tax period of March 2019. It shows sales, purchases, imports, output tax, input tax, tax payable, and excess credit. The key figures are total sales of $34,695.44, output tax of $4,785.58, input tax of $1,869.04, and tax payable of $1,194.19.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

St.

Vincent & the Grenadines VAT 003 April 2007

Inland Revenue Department

VAT TAX RETURN

Submission date 09/04/2019

PART 1 - TAXPAYER AND TAX IDENTIFICATION

Name KENNETH P. PUNNETT

Address

VAT Identification No.: Tax Period: Assessment Period date: Due date:

02037353 MARCH 2019 From: 01/03/2019 To: 31/03/2019 15/04/2018

PART 2 - TAX DECLARATION AND CALCULATION

FROM THE PREVIOUS PERIOD

(100) Credit brought forward from a previous tax period (s) (100) $ 1722.35

COMPUTATION OF OUTPUT TAX

(200) Standard Rated Supplies (sales) : – VAT Inclusive (16%) (200) $ 34695.44

(210) Accommodation, Land, Marine & Sea tours : – VAT Inclusive 11% (210) $

(220) Zero-rated Supplies (sales) (220) $

(230) Exempt Supplies (sales) (230) $

(240) TOTAL SUPPLIES (sales) (add Lines 200 to 230) (240) $ 34695.44

(250) VAT Payable on Standard Rated Supplies (sales) (Line 200 x (16/116)) (250) $ 4785.58

(260) VAT Payable on Accommodation, Land, Marine & Sea tours (sales) (Line 210 x (11/111)) (260) $ 0.00

(270) VAT Adjustments (e.g. debit notes issued / credit notes received) (270) $

(295) TOTAL OUTPUT TAX FOR THIS TAX PERIOD (add Lines 250 to 270) (295) $ 4785.58

COMPUTATION OF INPUT TAX DEDUCTIONS

(300) Value of Imports (300) $ 7362.11

(310) Value of domestic purchases on which VAT was paid (310) $ 1499.21

(320) VAT paid to the Comptroller of Customs on imports (320) $ 1721.61

(330) VAT paid or payable on local Taxable Supplies (purchases) (330) $ 147.43

(340) VAT adjustments (e.g. debit notes received / credit notes issued) (340) $

(395) TOTAL INPUT TAX FOR THIS TAX PERIOD (Add lines 320 to 340) (395) $ 1869.04

COMPUTATION OF TAX PAYABLE TO INLAND REVENUE

(400) Tax payable for this tax period (If line 295 is greater than line 395, enter difference here) (400) $ 2916.54

(410) Tax due (line 400 – line 100, If result is less than 0, then enter 0 here) (410) $ 1194.19

(420) Amount paid on filing (420) $

(430) Balance due - if any (line 410 minus line 420) (430) $ 1194.19

COMPUTATION OF EXCESS CREDIT TO TAXPAYER

(500) Excess credit for this tax period (if line 395 is greater than line 295 enter the difference) (500) $ 0.00

(510) Total excess credit to be carried forward to the next tax period (510) $ 0.00

(600) VAT on major capital acquisitions (600) $

(610) Amount of zero-rated exports (610)

Range of tax invoices used this period: from (620) to (630)

Das könnte Ihnen auch gefallen

- Account Summary: Past Due Current Charges Total Amount DueDokument2 SeitenAccount Summary: Past Due Current Charges Total Amount DueGuillermina HerreraNoch keine Bewertungen

- 2022 Proposed BudgetDokument66 Seiten2022 Proposed BudgetAnna MooreNoch keine Bewertungen

- Acct2015 - 2021 Paper Final SolutionDokument128 SeitenAcct2015 - 2021 Paper Final SolutionTan TaylorNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- 67 Winebrenner v. CIRDokument2 Seiten67 Winebrenner v. CIRVon Lee De LunaNoch keine Bewertungen

- Rosemarie Sumalpong Indonto: Statement of AccountDokument4 SeitenRosemarie Sumalpong Indonto: Statement of Accountpaul dave manaitNoch keine Bewertungen

- Tugas Minggu 7 Akl Nama: Hidayani Puteri NIM: 20043136Dokument8 SeitenTugas Minggu 7 Akl Nama: Hidayani Puteri NIM: 20043136Hidayani Puteri100% (1)

- Numericals On National Income AccountingDokument3 SeitenNumericals On National Income AccountingSamirRastogi100% (1)

- CC Stat222Dokument2 SeitenCC Stat222darshil thakkerNoch keine Bewertungen

- Galileo!!! Ticketing Traning!!!!!!!!!!!!!!! Learn Free!!!!!!!!! - Air Ticketing (GDS)Dokument8 SeitenGalileo!!! Ticketing Traning!!!!!!!!!!!!!!! Learn Free!!!!!!!!! - Air Ticketing (GDS)afzaal0% (1)

- 6 Club Financial Statement SampleDokument2 Seiten6 Club Financial Statement SampleTamara Wilson67% (3)

- Puzzle + Accounting AssignmentDokument6 SeitenPuzzle + Accounting AssignmentAli RebbajNoch keine Bewertungen

- GST 210 October 2023Dokument2 SeitenGST 210 October 2023L.B. HardwareNoch keine Bewertungen

- Rio Feb2Dokument2 SeitenRio Feb2Elyonie TillettNoch keine Bewertungen

- CBDT e Payment Request FormDokument2 SeitenCBDT e Payment Request Formsaurabh100% (1)

- GSTR9 23apjps3159l1zg 032022Dokument8 SeitenGSTR9 23apjps3159l1zg 032022sales candoNoch keine Bewertungen

- WEEK 9 Solution To Questions On Statement of Cash FlowsDokument3 SeitenWEEK 9 Solution To Questions On Statement of Cash Flowsvictoriaahmad95Noch keine Bewertungen

- Sampras SolutionDokument3 SeitenSampras SolutionSiphesihleNoch keine Bewertungen

- GSTR9 29aahcv2115k1z5 032021Dokument8 SeitenGSTR9 29aahcv2115k1z5 032021MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNoch keine Bewertungen

- GSTR9 29aahcv2115k1z5 032020Dokument8 SeitenGSTR9 29aahcv2115k1z5 032020MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNoch keine Bewertungen

- GSTR9 33aahcb1010d1zn 032023Dokument8 SeitenGSTR9 33aahcb1010d1zn 032023arpindlavNoch keine Bewertungen

- Comparative Balance Sheet and Income Statement Yr 1 &2Dokument2 SeitenComparative Balance Sheet and Income Statement Yr 1 &2Edmalyn CantonNoch keine Bewertungen

- Bacc210 Assig 1Dokument6 SeitenBacc210 Assig 1TarusengaNoch keine Bewertungen

- GSTR9 19GCBPS5582Q1ZH 032023Dokument8 SeitenGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061Noch keine Bewertungen

- JAN FEB MAR Projected Amount Total Amount: EarningsDokument2 SeitenJAN FEB MAR Projected Amount Total Amount: EarningsSubhankarNoch keine Bewertungen

- Numericals On National Income Accounting 2017-2Dokument3 SeitenNumericals On National Income Accounting 2017-2VIBHOR SETHIANoch keine Bewertungen

- GSTR9 29aaqfm8617b1zz 032022Dokument8 SeitenGSTR9 29aaqfm8617b1zz 032022helloNoch keine Bewertungen

- GSTR9 27aahcb1010d1zg 032023Dokument8 SeitenGSTR9 27aahcb1010d1zg 032023arpindlavNoch keine Bewertungen

- Windowlux - Case SolutionDokument2 SeitenWindowlux - Case SolutionanisaNoch keine Bewertungen

- GSTR9 08aaafu3205h1zh 032022Dokument8 SeitenGSTR9 08aaafu3205h1zh 032022Deepanshu AgarwalNoch keine Bewertungen

- Thegodfather CF Student CdADokument8 SeitenThegodfather CF Student CdAPablo MichavilaNoch keine Bewertungen

- Ratios TaskDokument3 SeitenRatios Taskiceman2167Noch keine Bewertungen

- B. 13 BULAN ABDULLAH SHAHABDokument2 SeitenB. 13 BULAN ABDULLAH SHAHABHizba SabilillahNoch keine Bewertungen

- SupportDokument1 SeiteSupportdaryl canozaNoch keine Bewertungen

- GSTR9 19anypg3791m1zy 032022 PDFDokument8 SeitenGSTR9 19anypg3791m1zy 032022 PDFManprit MahalNoch keine Bewertungen

- Goods and Services Tax (//WWW - Gst.gov - In/)Dokument1 SeiteGoods and Services Tax (//WWW - Gst.gov - In/)samaadhuNoch keine Bewertungen

- FIN AL: Form GSTR-9Dokument8 SeitenFIN AL: Form GSTR-9mani samiNoch keine Bewertungen

- GSTR9 10JHBPS7007C1ZR 032019Dokument8 SeitenGSTR9 10JHBPS7007C1ZR 032019karanNoch keine Bewertungen

- Assignment E & L Env 4 BusiDokument9 SeitenAssignment E & L Env 4 BusiSyed Hamza RasheedNoch keine Bewertungen

- Statement of Comprehensive IncomeDokument1 SeiteStatement of Comprehensive IncomeNur FikriyahNoch keine Bewertungen

- GSTR9 22aabcn2864p1z7 032018Dokument8 SeitenGSTR9 22aabcn2864p1z7 032018Sumit K JhaNoch keine Bewertungen

- JamilAhmed - 2355 - 19750 - 1 - Lecture 3 Demo ProblemsDokument20 SeitenJamilAhmed - 2355 - 19750 - 1 - Lecture 3 Demo Problemsmuskan.j.talrejaNoch keine Bewertungen

- 2307 1600-E ATC Income Payments RateDokument2 Seiten2307 1600-E ATC Income Payments RateJOHN JERALD P. MIRANDANoch keine Bewertungen

- GSTR9 09abepk8302l1zh 032018Dokument8 SeitenGSTR9 09abepk8302l1zh 032018Capraful PrabhakaranNoch keine Bewertungen

- GSTR9 33AAACA7962L1ZH 032022-FinalDokument8 SeitenGSTR9 33AAACA7962L1ZH 032022-FinalVASUMATHY SURESHNoch keine Bewertungen

- Town of Morris: JULY 1, 2010-JUNE 30, 2011 Prepared by The Board of FinanceDokument36 SeitenTown of Morris: JULY 1, 2010-JUNE 30, 2011 Prepared by The Board of FinanceRepublican-AmericanNoch keine Bewertungen

- Assigment Week 6 Laila Fitriana 12030120120020 DDokument17 SeitenAssigment Week 6 Laila Fitriana 12030120120020 DLaila FitrianaNoch keine Bewertungen

- GSTR9 33dgwpp5135e1z4 032021Dokument8 SeitenGSTR9 33dgwpp5135e1z4 032021newquper2022Noch keine Bewertungen

- Partnership - Jaboy - v2.1.1Dokument19 SeitenPartnership - Jaboy - v2.1.1Van DahuyagNoch keine Bewertungen

- GSTR9Dokument8 SeitenGSTR9legendry007Noch keine Bewertungen

- Book 1Dokument6 SeitenBook 1sky wayNoch keine Bewertungen

- Ratios 2 TaskDokument2 SeitenRatios 2 Taskiceman2167Noch keine Bewertungen

- Tugas AklDokument5 SeitenTugas AklJessica HutabaratNoch keine Bewertungen

- GSTR9 09bwbpk7755a1zk 032021Dokument8 SeitenGSTR9 09bwbpk7755a1zk 032021Ankit JainNoch keine Bewertungen

- Goods and Services Tax: 3.1 Details of Outward Supplies and Inward Supplies Liable To Reverse Charge HelpDokument1 SeiteGoods and Services Tax: 3.1 Details of Outward Supplies and Inward Supplies Liable To Reverse Charge HelpsamaadhuNoch keine Bewertungen

- Chapter 4 SpreadsheetDokument5 SeitenChapter 4 SpreadsheetChâu Trần Dương MinhNoch keine Bewertungen

- GSTR9 18acvpa7546a1zk 032022Dokument8 SeitenGSTR9 18acvpa7546a1zk 032022SUBHASH MOURNoch keine Bewertungen

- Cpa Review Center Itatbus Final OutputDokument49 SeitenCpa Review Center Itatbus Final Outputablay logeneNoch keine Bewertungen

- Total 23,500 23,500Dokument3 SeitenTotal 23,500 23,500Vania DNoch keine Bewertungen

- Numericals On National Income Accounting 2019-20Dokument2 SeitenNumericals On National Income Accounting 2019-20NIKITA SONINoch keine Bewertungen

- Jireh Manufacturing LLC - P&L From Jan.1, 2024 To March 31, 2024Dokument1 SeiteJireh Manufacturing LLC - P&L From Jan.1, 2024 To March 31, 2024adrianareyesro07Noch keine Bewertungen

- General JournalDokument3 SeitenGeneral JournalLyra Ivy ManaligodNoch keine Bewertungen

- No Items RM'000 Working (RM'000)Dokument4 SeitenNo Items RM'000 Working (RM'000)Chushan TehNoch keine Bewertungen

- Jawaban LKS Nasional 2017 PDFDokument13 SeitenJawaban LKS Nasional 2017 PDFadebsb100% (2)

- 2023 Income Tax TablesDokument5 Seiten2023 Income Tax TablesKhushboo GuptaNoch keine Bewertungen

- 1 226 Mapua Monica Lukbaytourschptr8Dokument18 Seiten1 226 Mapua Monica Lukbaytourschptr8T-226 Mapua, Monica Isabel Nepomuceno100% (1)

- SVG Vat Act 2006Dokument133 SeitenSVG Vat Act 2006Tamara WilsonNoch keine Bewertungen

- SVG Tax Tables-2018Dokument16 SeitenSVG Tax Tables-2018Tamara Wilson0% (1)

- Accounting 04Dokument91 SeitenAccounting 04Tamara WilsonNoch keine Bewertungen

- PRABHAVATHI Form26QBDokument2 SeitenPRABHAVATHI Form26QBPrakash BattalaNoch keine Bewertungen

- Eco 1 RPDokument20 SeitenEco 1 RPAishani ChakrabortyNoch keine Bewertungen

- Incoterms 2013 PDFDokument1 SeiteIncoterms 2013 PDFDon BraithwaiteNoch keine Bewertungen

- The Kenya Revenue Authority Has Implemented A VAT Special TableDokument2 SeitenThe Kenya Revenue Authority Has Implemented A VAT Special Tablebenedict KulobaNoch keine Bewertungen

- Adobe Scan Nov 02, 2022Dokument1 SeiteAdobe Scan Nov 02, 2022Soma HazraNoch keine Bewertungen

- Arti FeeDokument4 SeitenArti Feessndeep kumarNoch keine Bewertungen

- Financial Statements From Financial Statements From The Accounting EquationDokument34 SeitenFinancial Statements From Financial Statements From The Accounting Equationoussama elNoch keine Bewertungen

- Special and Combination JournalsDokument1 SeiteSpecial and Combination JournalsVivienne LayronNoch keine Bewertungen

- State Bank of India NPCILDokument1 SeiteState Bank of India NPCILAshwin GRNoch keine Bewertungen

- F FDYpk RZGK MMVX 4 WDokument4 SeitenF FDYpk RZGK MMVX 4 WRaghu Varma PorankiNoch keine Bewertungen

- JNPT Div A Group1Dokument36 SeitenJNPT Div A Group1Akanksha ShuklaNoch keine Bewertungen

- Amts Bus, Bus Terminus and Bus Shelter AdvertisementDokument3 SeitenAmts Bus, Bus Terminus and Bus Shelter AdvertisementBrian MurphyNoch keine Bewertungen

- Tax System in IndiaDokument14 SeitenTax System in IndiaShivanshu DwivediNoch keine Bewertungen

- GAURAVDokument2 SeitenGAURAVGaurav MishraNoch keine Bewertungen

- PSPCL Bill 3002893131 Due On 2020-JUL-27Dokument2 SeitenPSPCL Bill 3002893131 Due On 2020-JUL-27Gurvinder SinghNoch keine Bewertungen

- Mi BillDokument1 SeiteMi BillJagannath MandalNoch keine Bewertungen

- People Soft List of IMP TablesDokument8 SeitenPeople Soft List of IMP Tablesnarasimha4u11Noch keine Bewertungen

- Service and Price GuideDokument1 SeiteService and Price GuideindradewajiNoch keine Bewertungen

- Accounting CH 5Dokument32 SeitenAccounting CH 5Nguyen Dac ThichNoch keine Bewertungen

- Statement of Axis Account No:912010049541859 For The Period (From: 30-04-2022 To: 29-05-2022)Dokument5 SeitenStatement of Axis Account No:912010049541859 For The Period (From: 30-04-2022 To: 29-05-2022)Rahul BansalNoch keine Bewertungen

- Web Generated Bill: Feeder: Industrial - 1 Sub Division: Hamza Town Division: Kot LakhpatDokument1 SeiteWeb Generated Bill: Feeder: Industrial - 1 Sub Division: Hamza Town Division: Kot LakhpatAbdul MannanNoch keine Bewertungen

- Monthly Remittance Return of Value-Added Tax Withheld 2 0: BIR Form NoDokument2 SeitenMonthly Remittance Return of Value-Added Tax Withheld 2 0: BIR Form NoMark Joseph Baja67% (3)

- FI BBP TemplateDokument59 SeitenFI BBP TemplateManjunathreddy SeshadriNoch keine Bewertungen

- The High Cost of Free Parking: Donald Shoup Donald ShoupDokument27 SeitenThe High Cost of Free Parking: Donald Shoup Donald ShoupCamNoch keine Bewertungen

- B.Tech B.Arch.2020Dokument2 SeitenB.Tech B.Arch.2020Himanshu Rao SahabNoch keine Bewertungen