Beruflich Dokumente

Kultur Dokumente

Autobahn - Automation in Reataurant

Hochgeladen von

GAURAV NIGAMCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Autobahn - Automation in Reataurant

Hochgeladen von

GAURAV NIGAMCopyright:

Verfügbare Formate

Credit Approval Memorandum

Of

Autobahn.

Brand by

Chiffonade Ventures Pvt. Ltd.

Fresh Term loan: Rs. 50 lacs Crores for 60 months

___________________________________________________________________

Chiffonade Ventures Pvt. Ltd

Sage CRM No.

CLOS ID

Sourcing

Total No of Deviation ( ASM to fill)

Date & time of login to CPA (DD/MM/YY - HH/MM)

Date & time of query raised by CPA/ACM (DD/MM/YY - HH/MM)

Date & time of query resolved by Sales (DD/MM/YY - HH/MM)

Date & time of uploading of Credit note to approving authority (DD/MM/YY - HH/MM)

Date of approval DD/MM/YY

Total login TAT

Total Credit TAT

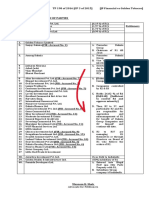

CREDIT APPROVAL MEMORANDUM

Controlling Branch /

Pune Under restricted list: No

Zone

Name of Principal NA Type of exposure: New term loan

Name of customer Chiffonade Ventures Pvt. Ltd. PAN No: AAHCC2063P

CAM type New Client since: New

Core business of

Hospitality

customer

P1 602 Oxford Premiums,Wanowdi, Pune - 411040

Regd Office:

Names of Guarantors Mr Subhahish Roy:- ADTPR0802M :- No Overdue Found.

PAN nos. Mr. Swaroop Agaskar :- AGAPA9939N:- No overdue found.

Corporate Guarantors None

RBI Defaulter List To be checked

BIFR No Negative match found in Latest Online Case Status list.

Watch Out Investors To be checked

Commercial CIBIL No overdues.

Dedupe Mr Subhashish Roy:- Positive Record Found.

RCU Not Applicable FI Not Applicable

Constitution Pvt.Ltd. Incorporation date 21/09/2017

Recommendation Note to take before Stop Supply NA

letter from Corporate disbursement Arrangement

REFERENCE CHECKS:

i) Banker’s reference – NA

Chiffonade Ventures Pvt. Ltd

FACILITY SUMMARY:

Existing limits & facility proposed are as below: - Rs. in Lacs

Nature of

facility Disbursed O/s. Prop. Tenure Security

Existing

NA NA

Proposed new

Personal Guarantee of Investors.

Corporate Loan 0.00 0.00 50 60 Months Hypothecation of Equipment

funded by TCFSL.

Total 30.00

Existing Term Loan Security details: NA

Chiffonade Ventures Pvt. Ltd

SUMMARY OF LIMITS :

Facility I

Facility Type Corporate Loan (New - Proposed)

Purpose General corporate purpose and / or Business expenditure

Proposed Limit Rs. 50 lacs

Maximum tenor 60 Months ( with 6 months moratorium period.)

Renewal NA

Moratorium 6 months.

Disbursement schedule As per customer request

Rate of Interest 12.50% pa.

Repayment schedule Monthly

1.00% of Loan amount + Applicable service Tax, to be collected upfront

Upfront fees

from Borrower

Interest Payment

Interest to be paid on monthly basis on reducing balance

Frequency

6% p.a. on delayed payment over and above normal interest from the

Penal interest

due date till the date of receipt.

Pre-payment penalty 4% of the amount prepaid.

Personal Guarantee of Promoters and Directors.

Security

Hypothecation of Equipment Funded.

1. Accepted sanction letter

Documents to executed 2. Application form

by the company before 3. Board Resolution

disbursement 4. Net worth statement of Guarantors

5. NACH form.

1. The borrower shall submit any other MIS / Information if required by

TCL from time to time.

Undertaking from the

borrower confirming the

2. Audited/ Provisional financial statement to be submitted to TCL

within 90 days from the close of the financial year.

covenants

3. Half yearly financials updates to be submitted within 15 days after

end of the quarter.

Other terms and 1. The Company not to borrow without prior written intimation to TCL.

conditions 2. Interest rate is subject to review / change at the discretion of TCL.

1. Absence of any material adverse change in the condition of the

borrower.

2. The borrower or its associates not having defaulted under any

The commitment of the

financing obligation to any bank or institution in past.

proposed facility is

contingent upon 3. Compliance by the borrower of all laws and regulations applicable to

its operations.

4. The borrower fulfilling all its financial obligations under various

taxation, retrial and applicable laws prevalent from time to time

1. Undertaking letter to be obtained from the applicant and all

promoters/directors for disclosure of their names in the defaulter’s

CIBIL/ RBI and other

lists in the event of default on the part of the borrower as per RBI

conditions

guidelines

2. Undertaking letter to be obtained from the applicant (including the

Chiffonade Ventures Pvt. Ltd

directors) that their names does not furnish in the RBI caution list,

defaulters list, willful defaulters list, ECGC list and in CIBIL

3. The TCL will have the right to examine at all times, the company’s

books of accounts and to have the company’s Project sites

inspected from time to time, by Officer(s) of the TCL and / or

qualified auditors or concurrent auditors appointed by the TCL

and/or technical experts and/or management consultants or other

persons of the TCL’s choice

4. The company should maintain separate books and records which

should correctly reflect their financial position and scope of

operations and should submit to the bank / TCL at regular intervals

such statements as may be prescribed by the bank / TCL in terms of

RBI instructions issued from time to time

Post-disbursement CA Certified End-use certificate to be taken clearly certifying the end use

Documents of the funds as stated by the firm within 30 days from disbursement

Validity of sanction letter Sanction is valid for a period of 90 days from the date of Offer letter

Chiffonade Ventures Pvt. Ltd

BRIEF BACKGROUND:

Autobahn ( brand) has been floated by Chiffonade Ventures Private Limited (start up) i.e. New

Fooding & Hotel Business as a private firm and was enlisted under Mumbai Shops &

Establishment Act by Ms. Tanushree Roy, Mrs. Hetal Swaroop Agaskar & Mr. Ritesh Kumar

Mohanty are the key person behind the day to day functioning and success of the business. The

Hotel is situated Phoenix Market City, Vimannagar.

List of Esteemed Investors includes Mr. Subhasis Kumar Roy, Mr. Swaroop Agaskar , Dr. Anil

Lamba & Chef. Sanjay Kak.

Promoters Background :-

Subhasis Roy:

An NRI business leader, based out of Kaula Lumpur with 25 years of domain knowledge in

sales and marketing, boht at national and international level from Sea, Mid East to latin America

with specialization in food and packaging industries.

A chemical engineer from NIT has initially worked with Tetra- Laval , a Swedish multinational

company and global leader in Food Processing for nearly 15 years and handled projects like

dairy plants, breweries, distilleries, vegetable oil refineries, processed food etc..,

For the past 14 years he has been working for BOBST SA which is regarded as global leader in

the field of folding carton ,corrugated board and flexible packaging industries.

Well known for his conceptual and strategic skills for the entire value chain of farm produce to

packaged food.

Swaroop Agaskar:

Leads the india office of KTGY- planning + architecture.

Brings more than 20 years of experience and technical expertise in the design and construction

of residential , mixed use , retail and hospitality projects.

Assocaited with the design of Sothe by restaurant ,NY, Vera Wang Suite, Halekulani Honolulu,

Grand Hyatt entrance and retail lobby, Chartered Hotel,Ahmedabad.

Hetal Agaskar:

Interior Deisgner, interior portfolio ranges from commercial to retail to residential.

Associated with Bindra’s Hospitality services, a leading food factory and restaurateur ensemble.

Successful started and runs “Tea Trials Café” in Pune..

Chef Sanjay Kak:

Chiffonade Ventures Pvt. Ltd

Presently the Director of culinary arts at the Indismart group of hotels and IIHM hotel Schools.

Over two decades of experience as a Chef at Taj Group of Hotels across various locations,

flight catering operations, standalone multiband group restaurants.

He did pioneering work in starting the new restaurant brands GLOBAL GRILL & CAFÉ

MEZZUNA.

Experience in multi brand food retail & product development, he is also a Founding member of

the “International Young Chef Olympiad “& leading member of the Technical Committee.

He has done product development for prestigious airlines such as United Airlines, Virgin

Atlantic, Cathay pacific, Singapore Airlines & Air India.

Dr. Anil Lamba:-

Bestselling author, financial literacy activist & International Corporate Trainer, Dr. Anil Lamba is

a practicing chartered Accountant & holds degrees in commerce, Law & a Doctorate in

Taxation.

His training programs are held internationally, with a client list exceeding 2000 large & medium-

sized corporations spread across several countries.

With over two decades of experience in training & consulting in finance, he has created &

developed 2 series of training videos, ‘Figure Out of the World of Figures’ & “Anil Lamba on

Finance” & has done pioneering work in distance education & e-learning.

Ritesh Kumar Mohanty:-

Has done Masters in Business Administration, IMI Kolkata & B-Tech in Electrical – BPUT

Rourkela, Odisha.

Has vast working experience in GVK MIAL, Bobst India, Thermax, Encotec Engineer.

Tanushree Roy:-

Has done Masters in Business Administration, IMI Kolkata & BSC in Microbiology in Pune

University.

Has vast working experience in Reliance Textiles, ITC Packaging Material for fruit & Serum

Institute of India.

Chiffonade Ventures Pvt. Ltd

Innovative Food Delivery System will be the 1st of its kind in India, after Singapore, Kuala

Lumpur, London & New York.

It’s a fully digital restaurant having Automatic Ordering Systems, Cashless Payments &

Automatic POS & Billing Systems.

Targeted Customers will be Mass market covering the whole age demographic &

psychographics.

Target income group will be Middle to High Income group.

Restaurant covering around 70 to 75 at a time customers with Semi Casual Dining.

Restaurant will be focusing on Efficiency, Maximum Space utilization, Less Food wastage, more

focus on Customer relationship management, Differentiation from Buffet, Can taste many

dishes, Hygiene conditions etc.

The backgrounds of the Directors are as follows:

Name Ms. Tanushree Roy

Father’s Name Subhasis Kumar Roy

Date Of Birth 30.04.1993

Address P1/602 Oxford Village, Near Kedari petrol Pump, Wanawadi , Pune

- 411040

Contact No. 9765715764

Name Mrs. Hetal Swaroop Agaskar

Father’s Name M.K.Mehta

Date Of Birth 14.06.1972

Address F-1104, Sylvania, Magarpatta City , Pune - 411029

Contact No.

Name Mr. Ritesh Kumar Mohanty

Father’s Name Debendra Kumar Mohanty

Date Of Birth 28.09.1987

Address F-15, Sector-7, Raurkela-3, Sundergarh, Odisha - 769003

Contact No. 8697479057

Share Holding Pattern as of 15/12/2017:

Chiffonade Ventures Pvt. Ltd

Name of shareholders Existing %

No of

Shares

Tanshuree Roy 60000 60.00%

Ritesh Mohanty Kumar 10000 10.00%

Swaroop Agaskar 15000 15.00%

Hetal Agaskar 15000 15.00%

Total 100000

External ratings (if any): NA

Chiffonade Ventures Pvt. Ltd

Financial Analysis:

Sr. Parameters Projected Projected Projected Projected

No.

2018 2019 2020 2021

Number of months 12 12 12 12

1 Total Operating Income(TOI) 108.1 407.6 448.4 493.3

2 EBIDTA 20.4 85.9 91.9 105.5

3 E B I D T A/ TOI (%) 18.8% 21.1% 20.5% 21.4%

4 Interest 2.5 6.6 5.4 4.0

5 Depreciation 13.6 23.8 18.4 15.0

Operating Profit after Dep.&

6 4.3 55.5 68.1 86.5

Int.

7 Non Operating Income/Exps. 0.0 0.0 0.0 0.0

8 PBT 4.3 55.5 68.1 86.5

9 PAT 3.0 38.3 47.1 59.8

10 PAT/ TOI (%) 2.8% 9.4% 10.5% 12.1%

11 Net Cash Accruals (NCA) 16.6 62.1 65.4 74.8

12 Net Fixed Assets 151.1 127.4 109.0 94.0

13 Tangible Networth (TNW) 128.0 166.3 213.4 273.2

14 Exposure in Group Co./Sub.

--- Investments 0.0 0.0 0.0 0.0

Chiffonade Ventures Pvt. Ltd

--- Loans and

0.0 0.0 0.0 0.0

Advances

15 Adjusted T N W (ATNW) 128.0 166.3 213.4 273.2

16 Quasi Equity 0.0 0.0 0.0 0.0

17 Long Term Debt (LTD) 72.6 65.0 56.2 45.9

18 Short Term Debt (STD) 0.0 0.0 0.0 0.0

19 Working Cap. Bank Finance 0.0 0.0 0.0 0.0

20 Financial guarantees 0.0 0.0 0.0 0.0

21 Total Debt 72.6 65.0 56.2 45.9

21 TOL 72.6 65.0 56.2 45.9

22 Total Debt/ ATNW 0.6 0.4 0.3 0.2

23 L T D / AT N W 0.6 0.4 0.3 0.2

24 TOL/TNW 0.6 0.4 0.3 0.2

25 TOL/ATNW 0.6 0.4 0.3 0.2

26 Total Current Assets 17.0 73.4 131.8 198.2

27 Total Current Liabilities 0.0 0.0 0.0 0.0

28 Net Working Capital 17.0 73.4 131.8 198.2

29 Current Ratio #DIV/0! #DIV/0! #DIV/0! #DIV/0!

30 R O C E (%) 4.0% 33.7% 33.3% 34.0%

31 Interest Coverage Ratio 7.8 10.4 13.1 19.8

32 Total Debt/Net Cash Accrual 4.4 1.0 0.9 0.6

33 Inventory Turnover days 0.0 0.0 0.0 0.0

Chiffonade Ventures Pvt. Ltd

34 Debtors Turnover days 0.0 0.0 0.0 0.0

35 Creditors Turnover days 0.0 #VALUE! #VALUE! #VALUE!

36 DSCR (in case of term loan) 10.4 13.1 19.8

Revenue:

The company is expecting turn over of approx.. 108 lacs in 2018.

Creditors and Debtors:-

Since the restaurant would getting payment immediately from customers there would be no debtors.

Also the company would be paying money in advance to their supplier there would be no creditors.

Chiffonade Ventures Pvt. Ltd

Fund Based Limit: Rs in Crores

O/S bal

Name of the bank Facility Sanctioned

30/09/15

Working Capital Facility (including CF, CC etc)

Total Working Capital

0 0

facility

Term Loan

0 0

Total Term Loan 0 0

Total Banking Exposure 0 0

Reference Checks:

Customers Reference: NA

The net worth of investors:-

1. .Subhasis Roy - Net worth - INR 5 cr

2. Mr. Swaroop Agaskar - Net worth - INR 1.8 cr

Equipment’s available as security:-

Sl Asset Name Asset Vendor details Description Attachment Name

No. Value (INR)

1. SL Large Sushi 2450808.37 Modu System, Conveyor chain used Final-SA CIE 17 138-

Conveyor System Malaysia in the dining area for Commercial Invoice

and Food Delivery conveying food on the

robot go and Robot for Ala-

carte

2. Imported items in 271909.00 HariOm Equipment like IMPORTED KITCHEN

kitchen Equipments, Pulverizer, Meat ITEMS_PI

Mumbai mincer, Buffalo

chopper, Pizza oven

3. 4 Door 911070.00 Middleby 4 Door ventilated PO_MIDDLEBYCELLFROST

Refrigerators and Cellfrost, refrigerators

Combi Oven Mumbai Ice Cream fridge

Combi oven

Chiffonade Ventures Pvt. Ltd

4. Kitchen equipment 2365652.00 HariOm Descrption is as per KITCHEN EQUIPMENT_PI

Equipments, attachment BAR EQUIPMENT_PI

Mumbai SS HOOD EQUIPMENT_PI

DRAINAGE

EQUIPMENT_PI

5. Tablets 368950.00 Asolute IT 31 tablets for TABLET_PI

Solutions, automatic ordering

Mumbai system

Chiffonade Ventures Pvt. Ltd

Deviation Matrix:

Selection Parameter & Deviation Matrix

Sr. Deviation

Criteria Conditions Deviation authority Actual

No Y/N

Minimum 3 years

or Promoter

should be in Less than 3 yrs & upto 2

1 Vintage New Entity Y

similar line of yrs - RSM & RCM

business for 2

years

RBI

2 Positive CH & BH (*) Not appearing in list N

defaulters list

3 Dedupe Positive CH & BH (*) No match found Y

4 RCU/FI Positive NSM & NCM (**) NA N

Upto 84 months @ – BH &

5 Tenure Upto 60 months 60 Months N

CH

Positive for last Cash Profit for last two

6 PAT NA Y

three years years –NSM & NCM

Upto 0.9 times – NSM &

7 Current Ratio Upto 1.17 NA Y

NCM

Upto 5: RSM & RCM

8 TOL/TNW Upto 4 times NA Y

Upto 6: NCM & NSM

Credit card/Other

Overdues up to Rs 50000

& write off up to Rs 5000 –

All A/c Standard as

9 CIBIL check Positive CH & BH N

per latest report

Credit card/Other overdues

beyond Rs 50000 & write

off beyond Rs 5000 – COO

Maximum two Upto 4 - NCM &NSM

Bank inward Cheque Above 4 & upto 6 – CH &

10 NA Y

Statement bounces during BH

last 6 months More than 6 –COO

Proposed by:

Pankaj Kulkarni – ASE – Equipment Finance (Pune)

Recommended by:

Abhijeet Komawar – ASM – Equipment Finance (Pune)

Ravishankar Kadle – ACM – Equipment Finance (Pune)

Chiffonade Ventures Pvt. Ltd

Das könnte Ihnen auch gefallen

- Tata Capital Financial Service Limited – Varun Agro Processing Foods Private Limited Credit Approval MemorandumDokument22 SeitenTata Capital Financial Service Limited – Varun Agro Processing Foods Private Limited Credit Approval MemorandumGAURAV NIGAM100% (1)

- Project Report - UMW Dongshin MotechDokument22 SeitenProject Report - UMW Dongshin MotechGAURAV NIGAM0% (1)

- Pune Portfolio Mid Corp Jun 2019Dokument52 SeitenPune Portfolio Mid Corp Jun 2019GAURAV NIGAMNoch keine Bewertungen

- Indiabulls ThesisDokument5 SeitenIndiabulls Thesisdivyanshu kumarNoch keine Bewertungen

- Intelligent Advisory Portfolios PDFDokument9 SeitenIntelligent Advisory Portfolios PDFCASrinivasaRaoGuduruNoch keine Bewertungen

- Live stock deals data with exchange detailsDokument32 SeitenLive stock deals data with exchange detailsSabyasachi BaralNoch keine Bewertungen

- S. No. Housing Finance Companies (HFCS) WebsiteDokument17 SeitenS. No. Housing Finance Companies (HFCS) WebsiteJitu PrajapatiNoch keine Bewertungen

- NPOP Certification BodiesDokument11 SeitenNPOP Certification BodiesVivek VatsNoch keine Bewertungen

- Candidates Summary for Finance Head RoleDokument18 SeitenCandidates Summary for Finance Head RolearoravikasNoch keine Bewertungen

- Commercial Clients Group (CCG)Dokument2 SeitenCommercial Clients Group (CCG)KgkprasanthNoch keine Bewertungen

- Dropped Live EDDsDokument886 SeitenDropped Live EDDsINDRESH YadavNoch keine Bewertungen

- Debt J-LDokument414 SeitenDebt J-LkenindiNoch keine Bewertungen

- Lapl SRDokument190 SeitenLapl SRHarneet SinghNoch keine Bewertungen

- Sundae Capital Advisors ProfileDokument19 SeitenSundae Capital Advisors ProfileSourabh GargNoch keine Bewertungen

- LIST OF ACCREDITED CERTIFICATION BODIESDokument10 SeitenLIST OF ACCREDITED CERTIFICATION BODIESFirdaus AliNoch keine Bewertungen

- Unified License of Indian - IsP Authorization GrantedDokument138 SeitenUnified License of Indian - IsP Authorization GrantedMikhail ChubaisNoch keine Bewertungen

- Emerging Delivery Locations in India ReportDokument89 SeitenEmerging Delivery Locations in India Reportrashmivikramb5255Noch keine Bewertungen

- E32 Experts' View: India'S Top 500 CompaniesDokument17 SeitenE32 Experts' View: India'S Top 500 CompaniesShailesh Vasudeo KukrejaNoch keine Bewertungen

- Analysis Report of TIME TECHNOPLAST LTDDokument23 SeitenAnalysis Report of TIME TECHNOPLAST LTDAnju SinghNoch keine Bewertungen

- RCI India Directory 2020Dokument37 SeitenRCI India Directory 2020Neeraj KumarNoch keine Bewertungen

- 2b720725-7bc8-49e5-9508-e5f0e0085db8Dokument3 Seiten2b720725-7bc8-49e5-9508-e5f0e0085db8Ashish PatilNoch keine Bewertungen

- India Tech Unicorn Report-2021Dokument18 SeitenIndia Tech Unicorn Report-2021YogendraJadavNoch keine Bewertungen

- Indian Salon Hair and Skin Products Industry ReportDokument24 SeitenIndian Salon Hair and Skin Products Industry ReportReevolv Advisory Services Private LimitedNoch keine Bewertungen

- Iim Indore: Final Placement Report 2011 - 2013Dokument5 SeitenIim Indore: Final Placement Report 2011 - 2013Abdal LalitNoch keine Bewertungen

- Audited Financial Results For The Quarter and Year Ended 31st March, 2021Dokument21 SeitenAudited Financial Results For The Quarter and Year Ended 31st March, 2021Vilas ShahNoch keine Bewertungen

- Job Consultant ListDokument11 SeitenJob Consultant ListNimit MalhotraNoch keine Bewertungen

- ICICI Lombard - WikipediahhhDokument2 SeitenICICI Lombard - Wikipediahhhsomu9006Noch keine Bewertungen

- Types of Co-operative and Public Sector Banks in IndiaDokument4 SeitenTypes of Co-operative and Public Sector Banks in IndiaIMPEL Learning SolutionsNoch keine Bewertungen

- Banking Awareness August Set 2: Dr. Gaurav GargDokument3 SeitenBanking Awareness August Set 2: Dr. Gaurav Gargkarunakaran09Noch keine Bewertungen

- Apr2014 EirDokument3 SeitenApr2014 EirSanjay KoriNoch keine Bewertungen

- Business Women 2010Dokument1 SeiteBusiness Women 2010JayNoch keine Bewertungen

- NMFI012014FLDokument10 SeitenNMFI012014FLDhananjayan GopinathanNoch keine Bewertungen

- Debt C-EDokument1.236 SeitenDebt C-EFirdaus AliNoch keine Bewertungen

- BVG Group Corporate Brochure PDFDokument20 SeitenBVG Group Corporate Brochure PDFVISHWAJEET VERMANoch keine Bewertungen

- Extn ListDokument69 SeitenExtn Listsarika333Noch keine Bewertungen

- Meghmani Organics 2017-18 Annual ReportDokument219 SeitenMeghmani Organics 2017-18 Annual ReportPuneet367Noch keine Bewertungen

- Final Placement Brochure June 19 WebDokument65 SeitenFinal Placement Brochure June 19 WebSurya KantNoch keine Bewertungen

- Business EnvironmentDokument6 SeitenBusiness EnvironmentSarabjeet SinghNoch keine Bewertungen

- Contacts For Greeting CardsDokument730 SeitenContacts For Greeting Cards1MG SamplesNoch keine Bewertungen

- Vdocuments - MX Corporate Data 2Dokument11 SeitenVdocuments - MX Corporate Data 2Anonymous bdUhUNm7JNoch keine Bewertungen

- BIS Sample Database - IIIDokument2 SeitenBIS Sample Database - IIIAarti IyerNoch keine Bewertungen

- Agricultural Finance Manual UpdateDokument616 SeitenAgricultural Finance Manual Updateamanbhati200810% (1)

- All Products ProposalDokument3 SeitenAll Products ProposalSarika YadavNoch keine Bewertungen

- Ravi Pandit: Name Phone No Email ID Sunday, August 25, 2019Dokument4 SeitenRavi Pandit: Name Phone No Email ID Sunday, August 25, 2019Ankit GuptaNoch keine Bewertungen

- Bank Statement 010419 To 310320Dokument10 SeitenBank Statement 010419 To 310320Mrinal ChowdhuryNoch keine Bewertungen

- Startup Ecosytem Survey PuneDokument32 SeitenStartup Ecosytem Survey Punepavan reddyNoch keine Bewertungen

- LIST OF ACCREDITED CERTIFICATION BODIESDokument10 SeitenLIST OF ACCREDITED CERTIFICATION BODIESAnubhav SrivastavaNoch keine Bewertungen

- Infratech Limited Apco Construction Pvt. LTD.: Purchase OrderDokument2 SeitenInfratech Limited Apco Construction Pvt. LTD.: Purchase OrderRajeshKumarJainNoch keine Bewertungen

- Jsa ListDokument400 SeitenJsa ListAbraham DeVilliersNoch keine Bewertungen

- CA FirmsDokument5 SeitenCA FirmsbobbydebNoch keine Bewertungen

- Approved List of PCU'sDokument2 SeitenApproved List of PCU'sSidharth SubodhNoch keine Bewertungen

- NCLT, Ahmedabad TP 198 of 2016 (CP 3 of 2015) (JP Financial Vs Golden Tobacco)Dokument3 SeitenNCLT, Ahmedabad TP 198 of 2016 (CP 3 of 2015) (JP Financial Vs Golden Tobacco)masoom shahNoch keine Bewertungen

- Tranche II Prospectus-201905091526497973703 PDFDokument193 SeitenTranche II Prospectus-201905091526497973703 PDFAnil GuptaNoch keine Bewertungen

- Mehsana ZoneDokument4 SeitenMehsana Zonetan-mayNoch keine Bewertungen

- WabagDokument1.804 SeitenWabagRajeev C RNoch keine Bewertungen

- Form 144 CLA-DALALCHI S.A.R.LDokument4 SeitenForm 144 CLA-DALALCHI S.A.R.LALOK DHANUKANoch keine Bewertungen

- NabkisanDokument24 SeitenNabkisanDnyaneshwar Dattatraya PhadatareNoch keine Bewertungen

- HNIDokument5 SeitenHNIAmrita MishraNoch keine Bewertungen

- Final ReportDokument30 SeitenFinal ReportPankaj JunejaNoch keine Bewertungen

- RHB - PDS - OverdraftDokument6 SeitenRHB - PDS - OverdraftjoekaledaNoch keine Bewertungen

- Consolidated Financial Statements of Miguel CorporationDokument9 SeitenConsolidated Financial Statements of Miguel CorporationAra Mae Sta CatalinaNoch keine Bewertungen

- Chua Guan Vs Samahang MagsasakaDokument12 SeitenChua Guan Vs Samahang MagsasakaDexter CircaNoch keine Bewertungen

- Cash Flows and Life Cycle of FirmDokument6 SeitenCash Flows and Life Cycle of FirmSharath ChandraNoch keine Bewertungen

- Unit 3rd Financial Management BBA 4thDokument18 SeitenUnit 3rd Financial Management BBA 4thYashfeen FalakNoch keine Bewertungen

- Confusion or Merger of Rights: Section 4Dokument17 SeitenConfusion or Merger of Rights: Section 4Rowena Shaira AbellarNoch keine Bewertungen

- TOA Midterm Exam 2010Dokument22 SeitenTOA Midterm Exam 2010Patrick WaltersNoch keine Bewertungen

- LeverageDokument64 SeitenLeveragePRECIOUSNoch keine Bewertungen

- PEFINDO Key Success FactorsDokument2 SeitenPEFINDO Key Success Factorsanubhav saxenaNoch keine Bewertungen

- Central Bank of The Philippines vs. Court of AppealsDokument4 SeitenCentral Bank of The Philippines vs. Court of AppealsphiaNoch keine Bewertungen

- (FINAL) Assignment 2 (Literature Review) - Financial Distress Among UNIMAS StudentsDokument31 Seiten(FINAL) Assignment 2 (Literature Review) - Financial Distress Among UNIMAS StudentsChristinus NgNoch keine Bewertungen

- Manage Finances BiblicallyDokument31 SeitenManage Finances BiblicallyBea SayasaNoch keine Bewertungen

- Debt Considered Publicly TradedDokument5 SeitenDebt Considered Publicly TradedQ100% (4)

- Grade 12: Business Ethics and Social Reponsibility Second Semester Quarter 2 - Module 1Dokument25 SeitenGrade 12: Business Ethics and Social Reponsibility Second Semester Quarter 2 - Module 1Sheena Kyla Guillermo100% (1)

- LKISSK 2021 Winners Tackle Financial Stability IssuesDokument2 SeitenLKISSK 2021 Winners Tackle Financial Stability IssuesRezha Nursina YuniNoch keine Bewertungen

- Pablo P. Garcia V. Yolanda Valdez Villar G.R. No. 158891, June 27, 2012, J. Leonardo-DecastroDokument2 SeitenPablo P. Garcia V. Yolanda Valdez Villar G.R. No. 158891, June 27, 2012, J. Leonardo-DecastroBianca Nerizza A. Infantado IINoch keine Bewertungen

- BPI vs. St. Michael Medical CenterDokument3 SeitenBPI vs. St. Michael Medical CenterKaren Patricio LusticaNoch keine Bewertungen

- Debts Recovery Tribunal - Laws & ProceduresDokument3 SeitenDebts Recovery Tribunal - Laws & ProceduresankitaNoch keine Bewertungen

- Time Value of MoneyDokument1 SeiteTime Value of MoneyAlelie dela CruzNoch keine Bewertungen

- CH 14Dokument31 SeitenCH 14Bui Thi Thu Hang (K13HN)Noch keine Bewertungen

- Article 1270Dokument4 SeitenArticle 1270Anonymous WmvilCEFNoch keine Bewertungen

- BoJ Project FInance Third EditionDokument142 SeitenBoJ Project FInance Third EditionbagirNoch keine Bewertungen

- RatingsDokument3 SeitenRatingsAnonymous SA40GK6Noch keine Bewertungen

- Walmart Financial AnalysisDokument187 SeitenWalmart Financial AnalysisKareem L SayidNoch keine Bewertungen

- Comparison Between Traditional Plan &ULIP's AT ICICIDokument70 SeitenComparison Between Traditional Plan &ULIP's AT ICICIBabasab Patil (Karrisatte)100% (1)

- B5 PsafDokument926 SeitenB5 PsafIRIBHOGBE OSAJIENoch keine Bewertungen

- Fin533 July 2021 Past YearDokument11 SeitenFin533 July 2021 Past Yeardr4ppp72xcNoch keine Bewertungen

- 69, Siddhant Raj, Banking LawDokument13 Seiten69, Siddhant Raj, Banking LawSiddhant RajNoch keine Bewertungen

- BUD 2242 Budgeting Small SchoolsDokument73 SeitenBUD 2242 Budgeting Small SchoolsMaria Faye MarianoNoch keine Bewertungen

- Finanical Statments RajDokument30 SeitenFinanical Statments RajAsħîŞĥLøÝåNoch keine Bewertungen