Beruflich Dokumente

Kultur Dokumente

Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The Answer

Hochgeladen von

JINENDRA JAINOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The Answer

Hochgeladen von

JINENDRA JAINCopyright:

Verfügbare Formate

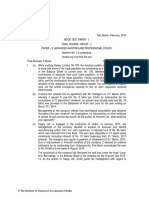

Test Series: October, 2017

MOCK TEST PAPER – 2

FINAL COURSE : GROUP – I

PAPER – 2 : STRATEGIC FINANCIAL MANAGEMENT

Question No. 1 is compulsory. Attempt any five questions from the remaining six questions.

Working notes should form part of the answer.

Time Allowed – 3 Hours Maximum Marks – 100

1. (a) TMC Holding Ltd. has a portfolio of shares of diversified companies valued at Rs. 400 crore

enters into a swap arrangement with None Bank on the terms that it will get 1.15% quarterly

on notional principal of Rs. 80 crore in exchange of return on portfolio which is exactly

tracking the Sensex which is presently 21600.

You are required to determine the net payment to be received/ paid at the end of each

quarter if Sensex turns out to be 21,860, 21,780, 22,080 and 21,960. (5 Marks)

(b) IPL already in production of Fertilizer is considering a proposal of building a new plant to

produce pesticides. Suppose, the PV of proposal is Rs. 100 crore without the abandonment

option. However, if market conditions for pesticide turns out to be favourable the PV of

proposal shall increase by 30%. On the other hand if market conditions remain sluggish the

PV of the proposal shall be reduced by 40%. In case company is not interested in

continuation of the project it can be disposed off for Rs. 80 crore.

If the risk free rate of interest is 8% than what will be value of abandonment option. (5 Marks)

(c) Using Lintner’s Model determine the dividend per share of S Ltd. for the year 2016-17 with

the help of following information:

EPS for the year 2016-17 (per share) Rs. 6

Dividend Per Share for 2015-16 Rs. 2.40

Target payout ratio 0.50

Adjustment Factor 0.80

(5 Marks)

(d) Bank A enters into a Repo for 14 days with Bank B in 12% GOI Bonds 2017 at a rate of

5.25% for Rs.5 Crore. Assuming that the clean price be 99.42, initial margin be 2% and days

of accrued interest be 292, you are required to determine:

(a) Dirty Price

(b) Start Proceeds (First Leg)

(c) Repayment at Maturity (Second Leg)

Note: Number of days in a year is 360. (5 Marks)

2. (a) The credit sale and receivables of A Ltd. at the end of the year are estimated at Rs. 3.2

crores and its average collection period is 90 days. The past experience indicates that bad-

debt losses are 1.5% on Sales. The expenditure incurred by the firm in administering its

receivable collection efforts are Rs. 5,00,000. A factor is prepared to buy the firm’s

receivables on recourse basis by charging 2% Commission. The factor will pay advance on

receivables to the firm at an interest rate of 18% p.a. after withholding 10% as reserve.

Calculate the effective cost of factoring to the Firm assuming 360 days a year. (6 Marks)

© The Institute of Chartered Accountants of India

(b) Hanky Ltd. and Shanky Ltd. operate in the same field, manufacturing newly born babies’ s

clothes. Although Shanky Ltd. also has interests in communication equipments, Hanky Ltd.

is planning to take over Shanky Ltd. and the shareholders of Shanky Ltd. do not regard it as

a hostile bid.

The following information is available about the two companies.

Hanky Ltd. Shanky Ltd.

Current earnings Rs. 6,50,00,000 Rs. 2,40,00,000

Number of shares 50,00,000 15,00,000

Percentage of retained earnings 20% 80%

Return on new investment 15% 15%

Return required by equity shareholders 21% 24%

Dividends have just been paid and the retained earnings have already been reinvested in

new projects. Hanky Ltd. plans to adopt a policy of retaining 35% of earnings after the

takeover and expects to achieve a 17% return on new investment.

Saving due to economies of scale are expected to be Rs. 85,00,000 per annum.

Required return to equity shareholders will fall to 20% due to portfolio effects.

Requirements

(i) Calculate the existing share prices of Hanky Ltd. and Shanky Ltd.

(ii) Find the value of Hanky Ltd. after the takeover

(iii) Advise Hanky Ltd. on the maximum amount it should pay for Shanky Ltd. (10 Marks)

3. (a) Project X and Project Y are under the evaluation of XY Co. The estimated cash flows and

their probabilities are as below:

Project X : Investment (year 0) Rs. 70 lakhs

Probability weights 0.30 0.40 0.30

Years Rs. lakhs Rs. lakhs Rs. lakhs

1 30 50 65

2 30 40 55

3 30 40 45

Project Y: Investment (year 0) Rs. 80 lakhs.

Probability weighted Annual cash flows through life

Rs. lakhs

0.20 40

0.50 45

0.30 50

(i) Which project is better based on NPV, criterion with a discount rate of 10%?

(ii) Using Hiller’s Model compute the standard deviation of the present value distribution

and analyse the inherent risk of the projects. (10 Marks)

(b) An exporter is a UK based company. Invoice amount is $3,50,000. Credit period is three

months. Exchange rates in London are:

Spot Rate $ 1.5865 – 1.5905 per £

© The Institute of Chartered Accountants of India

Rates of interest in Money Market:

Deposit Loan

$ 7% 9%

£ 5% 8%

Compute the forward rates for US$ at which the exporter will be indifferent between money

market hedge and a forward contract assuming the same spread shall be continued after 3

months. (6 Marks)

4. (a) Following are the details of a portfolio consisting of three shares:

Share Portfolio weight Beta Expected return in % Total variance

A 0.20 0.40 14 0.015

B 0.50 0.50 15 0.025

C 0.30 1.10 21 0.100

Standard Deviation of Market Portfolio Returns = 10%

You are given the following additional data:

Covariance (A, B) = 0.030

Covariance (A, C) = 0.020

Covariance (B, C) = 0.040

Calculate the following:

(i) The Portfolio Beta

(ii) Residual variance of each of the three shares

(iii) Portfolio variance using Sharpe Index Model

(iv) Portfolio variance (on the basis of modern portfolio theory given by Markowitz)

(10 Marks)

(b) Closing values of BSE Sensex from 6th to 17th day of the month of January of the year 200X

were as follows:

Days Date Day Sensex

1 6 THU 14522

2 7 FRI 14925

3 8 SAT No Trading

4 9 SUN No Trading

5 10 MON 15222

6 11 TUE 16000

7 12 WED 16400

8 13 THU 17000

9 14 FRI No Trading

10 15 SAT No Trading

11 16 SUN No Trading

12 17 MON 18000

© The Institute of Chartered Accountants of India

Calculate Exponential Moving Average (EMA) of Sensex during the above period. The 30

days simple moving average of Sensex can be assumed as 15,000. The value of exponent

for 30 days EMA is 0.062.

Give detailed analysis on the basis of your calculations. (6 Marks)

5. (a) Using the chop-shop approach (or Break-up value approach), assign a value for Cranberry

Ltd. whose stock is currently trading at a total market price of €4 million. For Cranberry Ltd,

the accounting data set forth three business segments: consumer wholesale, retail and

general centers. Data for the firm’s three segments are as follows:

Business Segment Segment Segment Operating

Segment

Sales Assets Income

Wholesale €225,000 €600,000 €75,000

Retail €720,000 €500,000 €150,000

General € 2,500,000 €4,000,000 €700,000

Industry data for “pure-play” firms have been compiled and are summarized as follows:

Business Sales/ Capitalization Assets/ Operating Income/

Segment Capitalization Capitalization

Wholesale 1.18 1.43 0.11

Retail 0.83 1.43 0.125

General 1.25 1.43 0.25

(8 Marks)

(b) The HLL has Rs. 8.00 crore of 10% mortgage bonds outstanding under an indenture. The

indenture allows additional bonds to be issued as long as all of the following conditions are

met:

Income before tax Bond Interest

(1) Pre - tax interest coverage remains greater than 4.

Bond Interest

(2) Net depreciated value of mortgage assets remains twice the amount of the mortgage

debt.

(3) Debt-to-equity ratio remains below 0.50.

The HLL has net income after taxes of Rs. 2 crores and a 40% tax-rate, Rs. 40 crores

in equity and Rs. 30 crores in depreciated assets, covered by the mortgage.

Assuming that 50% of the proceeds of a new issue would be added to the base of

mortgaged assets and that the company has no Sinking Fund payments until next year, how

much more 10% debt could be sold under each of the three conditions? Which protective

covenant is binding? (8 Marks)

6. (a) Based on the following data, estimate the Net Asset Value (NAV) 1st July 2016 on per unit

basis of a Debt Fund:

Name of Face Purchase Maturity Date No. of Coupon Date(s) Duration

Security Value Price Securities of Bonds

Rs. Rs.

10.71% 100 104.78 31st March, 2028 100000 31st March 7.3494

GOI 2028

10 % 100 100.00 31st March, 2023 50000 31st March & 5.086

GOI 2023 30th September

4

© The Institute of Chartered Accountants of India

9.5 % 100 97.93 31st December, 40000 30th June & 4.3949

GOI 2021 2021 31st December

8.5% 100 91.36 30th June 2025 20000 30th June 6.5205

SGL 2025

Number of Units (Rs. 10 face value each): 100000

All securities were purchased at a time when applicable Yield to Maturity (YTM) was 10%.

On NAV date, the required yield increased by 75 basis point and Cash in hand and accrued

expenses were Rs. 6,72,800 and Rs. 2,37,400 respectively. (10 Marks)

(b) Odessa Limited has proposed to expand its operations for which it requires funds of $ 15

million, net of issue expenses which amount to 2% of the issue size. It proposed to raise the

funds though a GDR issue. It considers the following factors in pricing the issue:

(i) The expected domestic market price of the share is Rs. 300

(ii) 3 shares underly each GDR

(iii) Underlying shares are priced at 10% discount to the market price

(iv) Expected exchange rate is Rs. 60/$

You are required to compute the number of GDR's to be issued and cost of GDR to Odessa

Limited, if 20% dividend is expected to be paid with a growth rate of 20%. (6 Marks)

7. Write short notes on any of four of the following:

(a) Cross Border Leasing

(b) Three basis questions that can be answered by Corporate Level Strategy

(c) Inter Bank Participation Certification (IBPC).

(d) Nostro, Vostro and Loro Accounts

(e) Exposure Netting (4 × 4 = 16 Marks)

© The Institute of Chartered Accountants of India

Test Series: October, 2017

MOCK TEST PAPER – 2

FINAL COURSE: GROUP – I

PAPER – 2: STRATEGIC FINANCIAL MANAGEMENT

SUGGESTED ANSWERS/HINTS

1. (a)

Qtrs. Sensex Sensex Amt Payable Fixed Return Net (Rs.

Return (%) (Rs. Crore) (Receivable) (Rs. Crore) Crore)

(1) (2) (3) (4) (5) (5) – (4)

0 21,600 - - - -

1 21,860 1.2037 4.8148 4.6000 - 0.2148

2 21,780 -0.3660 -1.4640 4.6000 6.0640

3 22,080 1.3774 5.5096 4.6000 - 0.9096

4 21,960 -0.5435 -2.1740 4.6000 6.7740

(b) Decision Tree showing pay off

Year 0 Year 1 Pay off

130 0

100

60 80-60 = 20

First of all we shall calculate probability of high demand (p) using risk neutral method as

follows:

8% = p x 30% + (1-p) x (-40%)

0.08 = 0.30 p - 0.40 + 0.40p

0.48

p= = 0.686

0.70

The value of abandonment option will be as follows:

Expected Payoff at Year 1

= p x 0 + [(1-p) x 20]

= 0.686 x 0 + [0.314 x 20]

= Rs. 6.28 crore

Since expected pay off at year 1 is 6.28 crore. Present value of expected pay off will be:

6.28

= 5.81 crore.

1.08

This, the value of abandonment option (Put Option).

(c) Formula as per Lintner’s Model

D1 = D0 + [(EPS1 X Target Payout) – D0] X AF

Where

D1 = Dividend in year 1

© The Institute of Chartered Accountants of India

D0 = Dividend in year 0

EPS1 = Earning Per Share of year 1

AF = Adjustment Factor

Accordingly, Dividend for 2017-18 shall be:

= Rs. 2.40 + [(Rs. 6 x 0.50) – Rs. 2.40] x 0.80

= Rs. 2.88

(d) (i) Dirty Price

= Clean Price + Interest Accrued

12 292

= 99.42 + 100 × ×

100 360

= 109.1533

(ii) First Leg (Start Proceed)

Dirty Price 100 - Initial Margin

= Nominal Value x ×

100 100

109.1533 100 - 2

= Rs.5,00,00,000 x ×

100 100

= Rs.5,34,85,117 say Rs. 5,34,85,000

(iii) Second Leg (Repayment at Maturity)

No. of days

= Start Proceed x (1+ Repo rate × )

360

14

= Rs. 5,34,85,000 x (1+ 0.0525 × )

360

= Rs.5,35,94,199

2. (a)

Particulars Rs.

Average level of Receivables = 3,20,00,000 90/360 80,00,000

Factoring commission = 80,00,000 2/100 1,60,000

Factoring reserve = 80,00,000 10/100 8,00,000

Amount available for advance =

Rs. 80,00,000 – (1,60,000 + 8,00,000) 70,40,000

Factor will deduct his interest @ 18%:-

` 70,40,000 18 90

Interest Rs.

100 360

3,16,800

Advance to be paid = (Rs. 70,40,000 Rs. 3,16,800)

67,23,200

Annual Cost of Factoring to the Firm: Rs.

Factoring commission (Rs. 1,60,000 360/90) 6,40,000

Interest charges (Rs. 3,16,800 360/90) 12,67,200

Total 19,07,200

© The Institute of Chartered Accountants of India

Firm’s Savings on taking Factoring Service:

Cost of credit administration saved 5,00,000

Net cost to the Firm (Rs. 19,07,200 – Rs. 5,00,000) 14,07,200

` 14,07,200 × 100

Effective rate of interest to the firm = 20.93%

67,23,200

(b) (i) Existing share price of Hanky Ltd.

g=rxb

r = 15%

b = 20%

g = 0.15 x 0.2

= 0.03 or 3%

Next year's dividend

Ex dividend market value =

ke g

6,50,00,000 x 0.8 x1.03

= = Rs. 29,75,55,556

0.21 0.03

Rs. 29,75,55,556

Value of one share = = Rs. 59.51 per share

5000000

Existing share price Shanky (P) Ltd.

g=rxb

= 0.15 x 0.8 = 0.12

Next year's dividend

Ex dividend market value =

ke g

2,40,00,000 x 0.2 x 1.12

= = Rs. 4,48,00,000

0.24 - 0.12

Rs. 4,48,00,000

Value of one share = = Rs. 29.87 per share

1500000

(ii) Value of Hanky Ltd. after the takeover

Care must be taken in calculating next year’s dividend and the subsequent growth rate.

Next year’s earnings are already determined, because both companies have already

reinvested their retained earnings at the current rate of return. In addition, they will get

cost savings of Rs. 85,00,000.

The dividend actually paid out at the end of next year will be determined by the new

35% retention and the future growth rate will take into account the increased return on

new investment.

Growth rate for combined firm, g = 0.17 x 0.35 = 0.06

New cost of equity = 20%

Next year’s earnings = (Rs. 6,50,00,000 + Rs. 2,40,00,000 + Rs. 85,00,000) x 1.06

= Rs. 10,33,50,000

© The Institute of Chartered Accountants of India

Next year’s dividend = Rs. 10,33,50,000 x 0.65

= Rs. 6,71,77,500

` 6,71,77,50 0

Market value = = Rs. 47,98,39,286

0.20 - 0.06

(iii) Maximum Hanky Ltd. should pay for Shanky Ltd.

Combined value = Rs. 47,98,39,286

Present Value of Hanky Ltd. = Rs. 29,75,55,556

= Rs. 18,22,83,730

3. (i) Calculation of NPV of XY Co.:

Project X Cash flow PVF PV

Year

1 (30 0.3) + (50 0.4) + (65 0.3) 48.5 0.909 44.09

2 (30 0.3) + (40 0.4) + (55 0.3) 41.5 0.826 34.28

3 (30 0.3) + (40 0.4) + (45 0.3) 38.5 0.751 28.91

107.28

NPV: (107.28 – 70.00) = (+) 37.28

Project Y (For 1-3 Years)

1-3 (40 0.2) + (45 0.5) + (50 0.3) 45.5 2.487 113.16

NPV (113.16 – 80.00) (+) 33.16

(ii) Calculation of Standard deviation

As per Hiller’s model

n

M= (1+r)-1 Mi

i0

n

2 (1+r)-2i i2

i0

Hence

Project X

Year

1 (30 - 48.5)2 0.30 + (50 - 48.5)2 0.40 + (65 - 48.5)2 0.30 = 185.25 =13.61

2 (30 - 41.5)2 0.30 + (40 - 41.5)2 0.40 + (55 - 41.5)2 0.30 = 95.25 = 9.76

3 (30 - 38.5)2 0.30 + (40 - 38.5)2 0.40 + (45 - 38.5)2 0.30 = 35.25 = 5.94

Standard Deviation about the expected value

185.25 95.25 35.25

= 2 + 4 +

(1+ 0.10) (1+ 0.10) (1+ 0.10)6

185.25 95.25 35.25

= + + = 153.10+65.06+19.90

1.21 1.4641 1.7716

= 238.06 = 15.43

Project Y (For 1-3 Years)

© The Institute of Chartered Accountants of India

(40 - 45.5)2 0.20 + (45 - 45.5)2 0.50 + (50 - 45.5)2 0.30 = 12.25 = 3.50

Standard Deviation about the expected value

12.25 12.25 12.25

= 2 + 4 +

(1+ 0.10) (1+ 0.10) (1+ 0.10)6

12.25 12.25 12.25

= + + = 10.12+8.37+6.91

1.21 1.4641 1.7716

= 25.4 = 5.03

Analysis: Project Y is less risky as its Standard Deviation is less than Project X.

(b) The spread between Bid and Ask Rate = $1.5905 - $1.5865 = $0.004

The forward rate bid rate for US$ at which the exporter will be indifferent between money

market hedge and a forward contract will be the rate as per Money Market Hedge involving

following steps.

Identify: Foreign currency is an asset. Amount $ 3,50,000.

Create: $ Liability.

Borrow: In $. The borrowing rate is 9% per annum or 2.25% per quarter.

Amount to be borrowed: 3,50,000 / 1.0225 = $ 3,42,298.29

Convert: Sell $ and buy £. The relevant rate is the Ask rate, namely, 1.5905 per £,

(Note: This is an indirect quote). Amount of £s received on conversion is 2,15,214.27

(3,42,298.29/1.5905).

Invest: £ 2,15,214.27 will be invested at 5% for 3 months and get £ 2,17,904.45

Settle: The liability of $3,42,298.29 at interest of 2.25 per cent quarter matures to $3,50,000

receivable from customer.

Amount received through money market hedge is £ 2,17,904.45 in lieu of $ 3,50,000 i.e. the

effective ask rate for £ is $1.6062 and since spread is $0.004 the bid rate shall be $1.6062 -

$0.004 = $1.6022 i.e. = $ 1.6022 - $1.6062 per £

4. (a) (i) Portfolio Beta

0.20 x 0.40 + 0.50 x 0.50 + 0.30 x 1.10 = 0.66

(ii) Residual Variance

To determine Residual Variance first of all we shall compute the Systematic Risk as

follows:

β2A σ M

2

= (0.40)2(0.01) = 0.0016

βB2 σ M

2

= (0.50)2(0.01) = 0.0025

β2C σ M

2

= (1.10)2(0.01) = 0.0121

Residual Variance

A 0.015 – 0.0016 = 0.0134

B 0.025 – 0.0025 = 0.0225

C 0.100 – 0.0121 = 0.0879

5

© The Institute of Chartered Accountants of India

(iii) Portfolio variance using Sharpe Index Model

Systematic Variance of Portfolio = (0.10) 2 x (0.66)2 = 0.004356

Unsystematic Variance of Portfolio = 0.0134 x (0.20) 2 + 0.0225 x (0.50) 2 + 0.0879 x

(0.30)2 = 0.014072

Total Variance = 0.004356 + 0.014072 = 0.018428

(iv) Portfolio variance on the basis of Markowitz Theory

2

= (wA x wAx σ A ) + (wA x wBxCovAB) + (wA x wCxCovAC) + (wB x wAxCovAB) + (wB x

2 2

wBx σ B ) + (wB x wCxCovBC) + (wC x wAxCovCA) + (wC x wBxCovCB) + (wC x wCx σ c )

= (0.20 x 0.20 x 0.015) + (0.20 x 0.50 x 0.030) + (0.20 x 0.30 x 0.020) + (0.20 x 0.50 x

0.030) + (0.50 x 0.50 x 0.025) + (0.50 x 0.30 x 0.040) + (0.30 x 0.20 x 0.020) + (0.30 x

0.50 x 0.040) + (0.30 x 0.30 x 0.10)

= 0.0006 + 0.0030 + 0.0012 + 0.0030 + 0.00625 + 0.0060 + 0.0012 + 0.0060 + 0.0090

= 0.0363

(b)

Date 1 2 3 4 5

Sensex EMA for EMA

Previous day 1-2 3×0.062 2+4

6 14522 15000 (478) (29.636) 14970.364

7 14925 14970.364 (45.364) (2.812) 14967.55

10 15222 14967.55 254.45 15.776 14983.32

11 16000 14983.32 1016.68 63.034 15046.354

12 16400 15046.354 1353.646 83.926 15130.28

13 17000 15130.28 1869.72 115.922 15246.202

17 18000 15246.202 2753.798 170.735 15416.937

Conclusion – The market is bullish. The market is likely to remain bullish for short term to

medium term if other factors remain the same. On the basis of this indicator (EMA) the

investors/brokers can take long position.

5. (a)

Business Segment Capital-to-Sales Segment Sales Theoretical Values

Wholesale (1/1.18) 0.85 €225000 €191250

Retail (1/0.83) 1.2 €720000 €864000

General (1/1.25) 0.8 €2500000 €2000000

Total value €3055250

Business Segment Capital-to-Assets Segment Assets Theoretical Values

Wholesale (1.43) 0.7 €600000 €420000

Retail (1.43) 0.7 €500000 €350000

General (1.43) 0.7 €4000000 €2800000

Total value €3570000

© The Institute of Chartered Accountants of India

Business Segment Capital-to- Operating Income Theoretical Values

Operating

Income

Wholesale (1/0.11) 9 €75000 €675000

Retail (1/0.125) 8 €150000 €1200000

General (1/0.25) 4 €700000 €2800000

Total value €4675000

3055250 3570000 4675000

Average theoretical value 3766750

3

Average theoretical value of Cranberry Ltd. = €3766750

(b) Let x be the crores of Rupees of new 10% debt which would be sold under each of the three

given conditions. Now, the value of x under each of the three conditions is as follows:

Income before tax Bond Interest

1. Pre - tax interest coverage remains greater than 4.

Bond Interest

` 2 crores / (1 0.4) 8 crores 0.1 x 0.1

=4

(8 crores 0.1) (x 0.1)

` 3.33 crores 0.80 crores 0.10x

Or =4

(0.80 crores ` 0.10x)

` 4.13 crores 0.10x

Or =4

` 0.80 crores ` 0.10x

Or Rs. 4.13 crores + 0.10x = 4 (Rs. 0.80 crores + Rs. 0.10x)

Or Rs. 4.13 crores + 0.10x = Rs. 3.2 crores + Rs. 0.40x

Or Rs. 0.30 x = 0.93

Or x = Rs. 0.93/0.30

Or x = Rs. 3.10 crores

Additional mortgage required shall be a maximum of Rs. 3.10 crores.

2. Net depreciated value of mortgage assets remains twice the amount of mortgage debt

(Assuming that 50% of the proceeds of new issue would be added to the base of

mortgaged assets)

` 30 crores 0.5 x

i.e. 2

` 8 crores x

or Rs. 30 crores + 0.5x = 2 (Rs. 8 crores + x)

or Rs. 1.5x = Rs. 14 crores

` 14 crores

or x

1.5

or x = 9.33 crores

Additional mortgage required to satisfy condition No. 2 is Rs. 9.33 crores

© The Institute of Chartered Accountants of India

3. Debt to equity ratio remains below 5

` 8 crores + x

i.e. =0.50

` 40 crores

or Rs. 8 crores + x = Rs. 20 crores

or x = Rs. 12 crores

Since all the conditions are to be met, the least i.e. Rs. 3.10 crores (as per condition – 1)

can be borrowed by issuing additional bonds.

Thus, binding conditions are met and it limits the amount of new debt to 3.10 crore.

6. (a) Working Notes:

(i) Calculation of Interest Accrued

Name of Security Maturity Date Amount (Rs.)

10.71% GOI 2028 3

100 x 100000 x 10.71% x 2,67,750

12

10 % GOI 2023 3

100 x 50000 x 10.00% x 1,25,000

12

Total 3,92,750

(ii)

Name of Purchase Duration Volatility (+)/(-) Total

Security Amount Rs. of Bonds (%) Amount Rs.

10.71% GOI 2028 1,04,78,000 7.3494 7.3494 - 5,25,053 99,52,947

x 0.75 =

1.10

5.0110

10 % GOI 2023 50,00,000 5.086 5.086 - 1,81,645 48,18,355

x 0.75 =

1.05

3.6329

9.5 % GOI 2021 39,17,200 4.3949 4.3949 - 1,22,969 37,94,231

x 0.75 =

1.05

3.1392

8.5% SGL 2025 18,27,200 6.5205 6.5205 - 81,233 17,45,967

x 0.75 =

1.10

4.4458

2,03,11,500

Calculation of NAV

Particulars Rs. crores

Value of Securities as computed above 2,03,11,500

Cash in hand 6,72,800

Interest accrued 3,92,750

Sub total assets (A) 2,13,77,050

© The Institute of Chartered Accountants of India

Less: Liabilities

Expenditure accrued 2,37,400

Sub total liabilities (B) 2,37,400

Net Assets Value (A) – (B) 2,11,39,650

No. of units 1,00,000

Net Assets Value per unit (Rs. 2,11,39,650/ 1,00,000) Rs. 211.40

(b) Net Issue Size = $15 million

$15 million

Gross Issue = = $15.306 million

0.98

Issue Price per GDR in Rs. (300 x 3 x 90%) Rs. 810

Issue Price per GDR in $ (Rs. 810/ Rs. 60) $13.50

Dividend Per GDR (D1) = Rs. 2* x 3 = Rs. 6

* Assumed to be on based on Face Value of Rs. 10 each share.

Net Proceeds Per GDR = Rs. 810 x 0.98 = Rs. 793.80

(a) Number of GDR to be issued

$15.306 million

= 1.1338 million

$13.50

(b) Cost of GDR to Odessa Ltd.

6.00

ke = + 0.20 = 20.76%

793.80

7. (a) Cross-border leasing is a leasing agreement where lessor and lessee are situated in

different countries. This raises significant additional issues relating to tax avoidance and tax

shelters. It has been widely used in some European countries, to arbitrage the difference in

the tax laws of different countries.

Cross-border leasing have been in practice as a means of financing infrastructure

development in emerging nations. Cross-border leasing may have significant applications in

financing infrastructure development in emerging nations - such as rail and air transport

equipment, telephone and telecommunications, equipment, and assets incorporated into

power generation and distribution systems and other projects that have predictable revenue

streams.

A major objective of cross-border leases is to reduce the overall cost of financing through

utilization by the lessor of tax depreciation allowances to reduce its taxable income, The tax

savings are passed through to the lessee as a lower cost of finance. The basic prerequisites

are relatively high tax rates in the lessor's country, liberal depreciation rules and either very

flexible or very formalistic rules governing tax ownership.

(b) Corporate level strategy should be able to answer three basic questions:

Suitability - Whether the strategy would work for the accomplishment of common objective of

the company.

Feasibility - Determines the kind and number of resources required to formulate and

implement the strategy.

© The Institute of Chartered Accountants of India

Acceptability - It is concerned with the stakeholders’ satisfaction and can be financial and

non-financial.

(c) Inter Bank Participation Certificate (IBPC): The Inter Bank Participation Certificates are short

term instruments to even out the short-term liquidity within the Banking system particularly

when there are imbalances affecting the maturity mix of assets in Banking Book.

The primary objective is to provide some degree of flexibility in the credit portfolio of banks.

It can be issued by schedule commercial bank and can be subscribed by any commercial

bank.

The IBPC is issued against an underlying advance, classified standard and the aggregate

amount of participation in any account time issue. During the currency of the participation,

the aggregate amount of participation should be covered by the outstanding balance in

account.

There are two types of participation certificates, with risk to the lender and without risk to the

lender. Under ‘with risk participation’, the issuing bank will reduce the amount of participation

from the advances outstanding and participating bank will show the participation as part of

its advances. Banks are permitted to issue IBPC under ‘with risk’ nomenclature classified

under Health Code-I status and the aggregate amount of such participation in any account

should not exceed 40% of outstanding amount at the time of issue. The interest rate on

IBPC is freely determined in the market. The certificates are neither transferable nor

prematurely redeemable by the issuing bank.

Under without risk participation, the issuing bank will show the participation as borrowing

from banks and participating bank will show it as advances to bank.

The scheme is beneficial both to the issuing and participating banks. The issuing bank can

secure funds against advances without actually diluting its asset-mix. A bank having the

highest loans to total asset ratio and liquidity bind can square the situation by issuing IBPCs.

To the lender, it provides an opportunity to deploy the short-term surplus funds in a secured

and profitable manner. The IBPC with risk can also be used for capital adequacy

management.

This is simple system as compared to consortium tie up.

(d) In interbank transactions, foreign exchange is transferred from one accou nt to another

account and from one centre to another centre. Therefore, the banks maintain three types of

current accounts in order to facilitate quick transfer of funds in different currencies. These

accounts are Nostro, Vostro and Loro accounts meaning “our”, “your” and “their”. A bank’s

foreign currency account maintained by the bank in a foreign country and in the home

currency of that country is known as Nostro Account or “our account with you”. For example,

An Indian bank’s Swiss franc account with a bank in Switzerland. Vostro account is the local

currency account maintained by a foreign bank/branch. It is also called “your account with

us”. For example, Indian rupee account maintained by a bank in Switzerland with a bank in

India. The Loro account is an account wherein a bank remits funds in foreign currency to

another bank for credit to an account of a third bank.

(e) Exposure Netting refers to offsetting exposures in one currency with Exposures in the same

or another currency, where exchange rates are expected to move in such a way that losses

or gains on the first exposed position should be offset by gains or losses on the second

currency exposure.

The objective of the exercise is to offset the likely loss in one exposure by likely gain in

another. This is a manner of hedging foreign exchange exposures though different from

forward and option contracts. This method is similar to portfolio approach in handling

systematic risk.

© The Institute of Chartered Accountants of India

For example, let us assume that a company has an export receivables of US$ 10,000 due 3

months hence, if not covered by forward contract, here is a currency exposure to US$.

Further, the same company imports US$ 10,000 worth of goods/commodities and therefore

also builds up a reverse exposure. The company may strategically decide to leave both

exposures open and not covered by forward, it would be doing an exercise in exposure

netting.

Despite the difficulties in managing currency risk, corporates can now take some concrete

steps towards implementing risk mitigating measures, which will reduce both actual and

future exposures. For years now, banking transactions have been based on the principle of

netting, where only the difference of the summed transactions between the parties is actually

transferred. This is called settlement netting. Strictly speaking in banking terms this is known

as settlement risk. Exposure netting occurs where outstanding positions are netted against

one another in the event of counter party default.

11

© The Institute of Chartered Accountants of India

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Department of Management StudiesDokument1 SeiteDepartment of Management StudiesJINENDRA JAINNoch keine Bewertungen

- Audit Question 15Dokument4 SeitenAudit Question 15JINENDRA JAINNoch keine Bewertungen

- "Form No. 15GDokument2 Seiten"Form No. 15GJayvin ShiluNoch keine Bewertungen

- Information BookletDokument29 SeitenInformation BookletJINENDRA JAINNoch keine Bewertungen

- Final Ca: Revision NotesDokument18 SeitenFinal Ca: Revision NotesJINENDRA JAINNoch keine Bewertungen

- Paper - 2: Strategic Financial Management Questions Risk Analysis in Capital BudgetingDokument25 SeitenPaper - 2: Strategic Financial Management Questions Risk Analysis in Capital BudgetingJINENDRA JAINNoch keine Bewertungen

- CA Final Audit NewDokument52 SeitenCA Final Audit NewJINENDRA JAINNoch keine Bewertungen

- Application Form Mba 2019: Jai Narain Vyas University JodhpurDokument3 SeitenApplication Form Mba 2019: Jai Narain Vyas University JodhpurJINENDRA JAINNoch keine Bewertungen

- Last Date For Online Form Submission 06th May 2019 Till 5:30 PMDokument1 SeiteLast Date For Online Form Submission 06th May 2019 Till 5:30 PMJINENDRA JAINNoch keine Bewertungen

- Amalgamation PDFDokument39 SeitenAmalgamation PDFJINENDRA JAINNoch keine Bewertungen

- Summary Notes - AS - Ind As Comparatives and Carve OutsDokument7 SeitenSummary Notes - AS - Ind As Comparatives and Carve OutsJINENDRA JAIN0% (1)

- Concept Kit 1Dokument11 SeitenConcept Kit 1JINENDRA JAINNoch keine Bewertungen

- Final Ca: MAY '19 Financial ReportingDokument13 SeitenFinal Ca: MAY '19 Financial ReportingJINENDRA JAINNoch keine Bewertungen

- Admission of A New Partner-New PDFDokument10 SeitenAdmission of A New Partner-New PDFJINENDRA JAIN100% (1)

- 5 6176943427335225437Dokument46 Seiten5 6176943427335225437JINENDRA JAINNoch keine Bewertungen

- Unit 12Dokument14 SeitenUnit 12JINENDRA JAINNoch keine Bewertungen

- 21322cpt ProspectusDokument40 Seiten21322cpt Prospectussa_mishraNoch keine Bewertungen

- Hapter 9-Company AccountsDokument48 SeitenHapter 9-Company AccountsJINENDRA JAINNoch keine Bewertungen

- Fin 1 PDFDokument26 SeitenFin 1 PDFsurabhi jainNoch keine Bewertungen

- Hapter 9-Company Accounts PDFDokument116 SeitenHapter 9-Company Accounts PDFJINENDRA JAINNoch keine Bewertungen

- Final Acc Tts 08 Nov 2016Dokument12 SeitenFinal Acc Tts 08 Nov 2016JINENDRA JAINNoch keine Bewertungen

- NPO Part 1Dokument10 SeitenNPO Part 1JINENDRA JAINNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- نشاط الإنجليزيةDokument4 Seitenنشاط الإنجليزيةsaleh.01chfNoch keine Bewertungen

- Record Point of Sale (POS) Transaction in TallyPrimeDokument6 SeitenRecord Point of Sale (POS) Transaction in TallyPrimeSubham DuttaNoch keine Bewertungen

- Tutorial 1Dokument8 SeitenTutorial 1malak aymanNoch keine Bewertungen

- Johnson Tax Statement 10.22.18Dokument2 SeitenJohnson Tax Statement 10.22.18Andrew KochNoch keine Bewertungen

- Term Paper Monetary PolicyDokument5 SeitenTerm Paper Monetary Policyc5m07hh9100% (1)

- MT103 522286795pdfDokument3 SeitenMT103 522286795pdfMasoud Dastgerdi100% (4)

- Bank Bumiputra (M) BHD V Hashbudin Bin HashiDokument10 SeitenBank Bumiputra (M) BHD V Hashbudin Bin HashiNorlia Md DesaNoch keine Bewertungen

- Amazon Financial Statement Analysis PT 2 PaperDokument5 SeitenAmazon Financial Statement Analysis PT 2 Paperapi-242679288Noch keine Bewertungen

- Partnership Dissolution QuestionsDokument3 SeitenPartnership Dissolution QuestionsArkkkNoch keine Bewertungen

- Libby7ce PPT Ch09Dokument47 SeitenLibby7ce PPT Ch09Moussa ElsayedNoch keine Bewertungen

- LD Case Study - Auditing Leases (PARTICIPANT)Dokument26 SeitenLD Case Study - Auditing Leases (PARTICIPANT)Jefri SNoch keine Bewertungen

- 2 Partnership Dissolution 0 Liquidation 2022Dokument16 Seiten2 Partnership Dissolution 0 Liquidation 2022Kimberly IgnacioNoch keine Bewertungen

- TCW Economic Globalization (4 Files Merged)Dokument77 SeitenTCW Economic Globalization (4 Files Merged)Jan Rey GregorioNoch keine Bewertungen

- Financial and Managerial Accounting PDFDokument1 SeiteFinancial and Managerial Accounting PDFcons theNoch keine Bewertungen

- PT Arwana Citramulia Tbk Consolidated Financial Statements 1H 2020Dokument76 SeitenPT Arwana Citramulia Tbk Consolidated Financial Statements 1H 2020hendraNoch keine Bewertungen

- Unit 1 ActvitiesDokument6 SeitenUnit 1 ActvitiesLeslie Mae Vargas ZafeNoch keine Bewertungen

- Moniepoint Document 2023-07-28T05 05.xlaDokument42 SeitenMoniepoint Document 2023-07-28T05 05.xlacurtispengeleroyNoch keine Bewertungen

- Canadian Banking PDFDokument41 SeitenCanadian Banking PDFFuria_hetalNoch keine Bewertungen

- Account Statement: Penyata AkaunDokument3 SeitenAccount Statement: Penyata AkaunMuhd ShahrulNoch keine Bewertungen

- New Business-Studies-Paper-2-Revision-BookletDokument108 SeitenNew Business-Studies-Paper-2-Revision-BookletRogue12layeNoch keine Bewertungen

- Financial Planning and Forecasting: Dendry Baringin Ericson Diandra Renya Rosari Emba A 49 ADokument12 SeitenFinancial Planning and Forecasting: Dendry Baringin Ericson Diandra Renya Rosari Emba A 49 AReza MuhammadNoch keine Bewertungen

- Acctg Bond PayableDokument44 SeitenAcctg Bond PayableThea ShangNoch keine Bewertungen

- Module 5 (TOPIC 7) - IMPAIRMENT OF ASSETS (INDIVIDUAL ASSETS)Dokument5 SeitenModule 5 (TOPIC 7) - IMPAIRMENT OF ASSETS (INDIVIDUAL ASSETS)Khamil Kaye GajultosNoch keine Bewertungen

- 3B Binani GlassfibreDokument2 Seiten3B Binani GlassfibreData CentrumNoch keine Bewertungen

- Romona Taylor Williams & Anne-Sophie Gintzburger - Examining The Impact of Economic Exclusion On Low Wealth and Communities of Color in ST - Louis, MO: A Simulation of Pay LendingDokument15 SeitenRomona Taylor Williams & Anne-Sophie Gintzburger - Examining The Impact of Economic Exclusion On Low Wealth and Communities of Color in ST - Louis, MO: A Simulation of Pay LendingFondation Singer-PolignacNoch keine Bewertungen

- Trading and Profit and Loss Account Format: DR CRDokument14 SeitenTrading and Profit and Loss Account Format: DR CRHarshini AkilandanNoch keine Bewertungen

- CPSPM 8979918 1689405315Dokument65 SeitenCPSPM 8979918 168940531533sensesinfoNoch keine Bewertungen

- Project On Credit Management 222Dokument82 SeitenProject On Credit Management 222Karthik Kartu J71% (7)

- An Overview of Money Laundering Causes, Methods and EffectsDokument46 SeitenAn Overview of Money Laundering Causes, Methods and EffectsMunir Ahmed KakarNoch keine Bewertungen

- Karla Company P-WPS OfficeDokument14 SeitenKarla Company P-WPS OfficeKris Van HalenNoch keine Bewertungen