Beruflich Dokumente

Kultur Dokumente

Check List of Documents For Home Loan

Hochgeladen von

Ravi Agarwal0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

386 Ansichten3 SeitenThis document provides a checklist of required documents for obtaining a home loan from Baroda Home Loans. It lists documents needed for resident Indians, NRIs/PIOs/OCIs, and details on property documents. For resident Indians, it requires identity, address, and income proof documents. For self-employed individuals, it requires bank statements, income tax returns, and business registration documents. The checklist also outlines additional documents needed if taking over an existing home loan from another bank or financial institution.

Originalbeschreibung:

Home loan

Originaltitel

Check List of Documents for Home Loan

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides a checklist of required documents for obtaining a home loan from Baroda Home Loans. It lists documents needed for resident Indians, NRIs/PIOs/OCIs, and details on property documents. For resident Indians, it requires identity, address, and income proof documents. For self-employed individuals, it requires bank statements, income tax returns, and business registration documents. The checklist also outlines additional documents needed if taking over an existing home loan from another bank or financial institution.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

386 Ansichten3 SeitenCheck List of Documents For Home Loan

Hochgeladen von

Ravi AgarwalThis document provides a checklist of required documents for obtaining a home loan from Baroda Home Loans. It lists documents needed for resident Indians, NRIs/PIOs/OCIs, and details on property documents. For resident Indians, it requires identity, address, and income proof documents. For self-employed individuals, it requires bank statements, income tax returns, and business registration documents. The checklist also outlines additional documents needed if taking over an existing home loan from another bank or financial institution.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

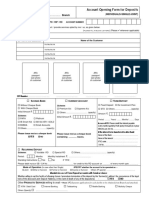

BARODA HOME LOANS

(Check List for Home Loan)

Requirement /Document

All Documents Self –Attested By Applicant /Co-Applicant /Guarantor

A) RESIDENT INDIAN:

I.

1. Duly Filled and Signed Application form along with three Photographs

2. Proof of Identity - PAN CARD (mandatory for loan application above Rs.10.00lacs

3. Driver’s License / Voter ID / Passport / Aadhar Card

4. Proof of Residence(Driver’s License / Ration Card/ Voter ID / Passport / Aadhar Card

/ Registered Rent Agreement)

5. If any previous loan then loan a/c statement for last 1 year along with sanction letter.

( If loan from BoB, Account No / Cust Id required)

6. Proof of assets held like LIC/NSC/KVP/MF/PROPERTY

7. Assets and Liabilities statement

8. ITR Verification report

9. Additional Documents for (Applicants /Co-applicants whose income to be considered

for eligibility)

Salaried Individuals Self-Employed Individuals / Farmers /agriculturist

Professionals /Others

a. Latest 3 months Salary Balance Sheet & Profit & Talati’s/Gram Sevak/Village

Slips & latest 1 month Loss A/c, Computation of Revenue officer Certificate for

salary slip for Income - Last 2 years previous two years income and

Guarantors Mamladaar’s/Block Revenue

officer certificate for last year’s

income.

b. Form 16 & ITR – last 1 Income Tax Returns – last 2

years of Applicants & years for Applicants, 26 AS ,

Guarantors(if any ) Traces

c. Copy of Employee Business proof : Gomasta Land revenue records – Form 6,

identity Card provided License, Registration 7/12, 8A ;

by Employer Certificate, Service Tax

Registration, etc

d. Appointment IT Assessment / Clearance

/Confirmation / Certificate, Income Tax

Promotion /Increment Challans / TDS Certificate

letter evidencing (Form 16A) / Form 26 AS for

duration of employment income declared in ITR.

e. 6 months Bank A/c In Case of Applicants 12 months Bank A/c statement

statement (Salary / engaged in Business (Individual)

Individual) or Account through Partnership

No if account is with Firm/Private Ltd. Company:

BoB.

f. i. Firm’s PAN card,

Address Proof of Firm /

Company

Bank of Baroda, Home Loan Check List Page 1

g. ii. Memorandum & A.O.A

of Co.

h. iii. ITR & Audited Results of

last 2 years of Firm /

Company

i. iv. Current A/c Statement –

last 1 year

B) NRI/ PIO/OCI

1. Duly Filled and Signed Application form along with Photograph

2. Copy of Passport with Visa stamped.

3. Proof of Residence (India & Abroad) (other than identity proof mentioned above) :

Driver’s License /Ration Card /Voter ID /Passport /Aadhar Card /Registered Rent

Agreement

4. Details e.g. name, relation, address, contact numbers of local contact person

5. NRE Savings Bank statement of account for last 6 months

6. Overseas Bank Account Statement for the last 6 months (including for Salary Account)

7. Statement of accounts of all existing Loan accounts for last 1 year. (For Loans from BOB in

India, Account No. & Customer id to be mentioned in the application form)

8. Credit Check Reports from Overseas Credit Bureau (e.g. D&B etc) (if already obtained)

9. Additional Documents for PIO

A photocopy of the PIO Card or any of the under noted documents:-

a. Current passport indicating birth place in India/abroad.

b. Indian Passport, if held earlier

c. Parents or grandparents passport with details there in substantiating his claim of

being a PIO

10. Additional Documents for

Salaried Individuals Self Employed

a. Copy of the employment Contract (in a. Balance Sheets and profit & loss

vernacular language) accounts of the business /profession

along with

b. Copies of individual income-tax returns b. Copies of individual income-tax returns

for the last two years (India /Overseas). for the last three years (India /Overseas)

c. Certified copy of the latest salary slips for c. A note giving information on the nature

the last 6 months. of business /profession

d. Copy of the Identity card issued by the d. Business Proof (Valid Registrations Any

current Employer. Two) , Place of Business & its Proof of

Address.

e. Continuous Discharge Certificate, if e. Continuous Discharge Certificate, if

applicable. applicable.

f. Copy of latest work permit.

C) A) Copies of Property Documents (It may vary from State to State)

Ready Flat /House Flat under Construction For Construction of House

1.

Agreement for Sale

2.

Blueprint (Approved Plan Copy) P.S: Gram Panchyat approvals Not admissible by Bank if

not supported by Town Planning approvals.

3. Non-Agriculture (NA) Certificate.

Bank of Baroda, Home Loan Check List Page 2

4. Commencement Certificate(CC) - (For Flat, if applicable)

5. Completion Certificate in case of ready flat ./Old Flat/House, if applicable

6. Occupancy Certificate (OC) - in case of ready flat /Old Flat/House, if applicable

7. Latest Tax Paid Receipt (property) - in case of Old Flat/House

8. Society Registration Certificate - in case of ready Old Flat/House, if applicable

9. Share Certificate- in case of Old Flat/House, if applicable

10. All payment receipts to Builder / Seller. –New & Old both

11. Development Agreement of Builder Registered copy), if applicable

12. Chain of old Agreement/s (for resale flat)- - in case of Old Flat/House

13. Title Clearance Report from approved advocate

14. Valuation report from bank’s approved valuer

B) Additional Documents for Takeover from Other Bank/F.I.

1. Existing Loan A/c statement (last 12 months)

2. List of Documents, in respect of property submitted to Bank / F.I. duly acknowledged by the

Bank / F.I.

3. Sanction Letter

4. Foreclosure letter (if available)

Bank of Baroda, Home Loan Check List Page 3

Das könnte Ihnen auch gefallen

- Home Loan Lap Login ChecklistDokument1 SeiteHome Loan Lap Login ChecklistAditya KhareNoch keine Bewertungen

- Document Check ListDokument1 SeiteDocument Check ListSubhashis ChatterjeeNoch keine Bewertungen

- MSME SchemesDokument53 SeitenMSME SchemesKalyani BorkarNoch keine Bewertungen

- Deceased With Nomination PDFDokument11 SeitenDeceased With Nomination PDFmindhunter786Noch keine Bewertungen

- Karnataka Gramin Bank: Hand Book ON Legal Aspects of BankingDokument64 SeitenKarnataka Gramin Bank: Hand Book ON Legal Aspects of BankingDevaki Pradhan KamathNoch keine Bewertungen

- ICICI Housing LoansDokument3 SeitenICICI Housing LoansAdv Sheetal SaylekarNoch keine Bewertungen

- MSMEs BookletDokument72 SeitenMSMEs Bookletlucky_rishikNoch keine Bewertungen

- Assessment of Working Capital Requirements Form Ii - Operating StatementDokument42 SeitenAssessment of Working Capital Requirements Form Ii - Operating StatementkhajuriaonlineNoch keine Bewertungen

- Promotion Study Material I To II and II To III-1Dokument131 SeitenPromotion Study Material I To II and II To III-1Shuvajoy ChakrabortyNoch keine Bewertungen

- Important One Liners For Promotion Exam 2016 For Clerk To OfficerDokument34 SeitenImportant One Liners For Promotion Exam 2016 For Clerk To OfficerNavneet PatelNoch keine Bewertungen

- KVIC PMEGP ManualDokument13 SeitenKVIC PMEGP ManualD SRI KRISHNANoch keine Bewertungen

- Cash Credit: OverviewsDokument1 SeiteCash Credit: OverviewsViswa KeerthiNoch keine Bewertungen

- Provident Fund in India - An OverviewDokument9 SeitenProvident Fund in India - An Overviewedwards1steveNoch keine Bewertungen

- About Non-Resident External (NRE) AccountDokument6 SeitenAbout Non-Resident External (NRE) AccountSunil KumarNoch keine Bewertungen

- IOB9540Foot Service Charges 01.07.2017 PDFDokument39 SeitenIOB9540Foot Service Charges 01.07.2017 PDFHarishPratabhccNoch keine Bewertungen

- DCB NRE Account OpeningDokument8 SeitenDCB NRE Account OpeningAbhay AgrawalNoch keine Bewertungen

- Dishonest of ChequeDokument14 SeitenDishonest of ChequeRaghuveer Rajput100% (1)

- Non Face To Face Account Opening FormDokument10 SeitenNon Face To Face Account Opening FormAlvin Samuel PandianNoch keine Bewertungen

- Partnership Firm Registration - Partnership Firm Registration Documents RequiredDokument14 SeitenPartnership Firm Registration - Partnership Firm Registration Documents RequireddeAsra Foundation100% (1)

- One-Time Settlement (Ots) Scheme of Npas For Micro, Small & Medium Enterprises (Msme) SectorDokument7 SeitenOne-Time Settlement (Ots) Scheme of Npas For Micro, Small & Medium Enterprises (Msme) SectorMadhav KotechaNoch keine Bewertungen

- Corp EMI Calculator 0Dokument7 SeitenCorp EMI Calculator 0Pardeep WadhwaNoch keine Bewertungen

- Rtgs Axis BankDokument2 SeitenRtgs Axis BankIrfan Male60% (5)

- Types of Bank Accounts in IndiaDokument18 SeitenTypes of Bank Accounts in IndiaPriya SharmaNoch keine Bewertungen

- ServletDokument498 SeitenServletankit-malhotra-3456100% (1)

- Ubi Process Note of Shourya Virat Trading CompanyDokument11 SeitenUbi Process Note of Shourya Virat Trading CompanyTripurari KumarNoch keine Bewertungen

- Credit Appraisal & Risk ManagementDokument90 SeitenCredit Appraisal & Risk ManagementRaj Singh RajputNoch keine Bewertungen

- SB - Account Closure Form - Axis BankDokument2 SeitenSB - Account Closure Form - Axis BankRaghuraj Nanda62% (13)

- Module-III Banking Regulation: Course OutlineDokument36 SeitenModule-III Banking Regulation: Course OutlineSanjay ParidaNoch keine Bewertungen

- SARFAESI Act in Layman WordsDokument2 SeitenSARFAESI Act in Layman WordsAsim Javed100% (1)

- Banking Products Assignment FINAL 2Dokument19 SeitenBanking Products Assignment FINAL 2satyabhagatNoch keine Bewertungen

- RBI NPA Classification CircularDokument93 SeitenRBI NPA Classification CircularMoHiT chaudharyNoch keine Bewertungen

- Punjab & Sind Bank: For Official Use OnlyDokument22 SeitenPunjab & Sind Bank: For Official Use OnlySurender RanaNoch keine Bewertungen

- Pre-Sanction Visit Report For Retail LendingDokument5 SeitenPre-Sanction Visit Report For Retail Lendingneeraj guptaNoch keine Bewertungen

- Bank Form IbDokument4 SeitenBank Form IbRocky singhNoch keine Bewertungen

- Project Profile On Children GarmentsDokument2 SeitenProject Profile On Children GarmentsPankaj GogoiNoch keine Bewertungen

- SAT Remittance Form For BRAC BankDokument1 SeiteSAT Remittance Form For BRAC BankArman HossainNoch keine Bewertungen

- Format For Tripartite Agreement - UBIDokument5 SeitenFormat For Tripartite Agreement - UBInpmehendale0% (1)

- Tripartite Agreement1Dokument8 SeitenTripartite Agreement1saniyasenNoch keine Bewertungen

- Home Loan - Master BCC BR 106 380Dokument158 SeitenHome Loan - Master BCC BR 106 380binalamitNoch keine Bewertungen

- MCQ For Bank PromotionDokument12 SeitenMCQ For Bank PromotionRahul GadheNoch keine Bewertungen

- HDFC - Saving AccountsDokument11 SeitenHDFC - Saving Accountsপ্রিয়াঙ্কুর ধরNoch keine Bewertungen

- Account Tariff Structure Basic Savings AccountDokument1 SeiteAccount Tariff Structure Basic Savings Accountgaddipati_ramuNoch keine Bewertungen

- (Policy On Dishonour of Cheques) Page 1 of 4Dokument4 Seiten(Policy On Dishonour of Cheques) Page 1 of 4Anurag AggarwalNoch keine Bewertungen

- Annexure BGDokument2 SeitenAnnexure BGSumit Chopra100% (1)

- Ots 2011 Application Format AcknowledgementDokument3 SeitenOts 2011 Application Format AcknowledgementRajesh SkNoch keine Bewertungen

- Account Opening Form BOIDokument4 SeitenAccount Opening Form BOIhrocking1Noch keine Bewertungen

- Account Closure and Term Deposit Premature Withdrawal FormDokument2 SeitenAccount Closure and Term Deposit Premature Withdrawal FormSonali SarkarNoch keine Bewertungen

- Project Report-Final - Sens Revised Final 22-07-2020Dokument38 SeitenProject Report-Final - Sens Revised Final 22-07-2020Abhishek RaiNoch keine Bewertungen

- Project Profile On Battery WaterDokument2 SeitenProject Profile On Battery WaterSantosh Basnet100% (1)

- NpaDokument182 SeitenNpaabhishek heerfNoch keine Bewertungen

- Requirements of Individual Cases: (Name) (Father's/Husband's Name)Dokument5 SeitenRequirements of Individual Cases: (Name) (Father's/Husband's Name)Sriramulu MuralidharanNoch keine Bewertungen

- TnCs Platinum 1105 Clean VersionDokument6 SeitenTnCs Platinum 1105 Clean Versionbibekananda87Noch keine Bewertungen

- Types of Customers and Nature of AccountsDokument18 SeitenTypes of Customers and Nature of Accountssagarg94gmailcomNoch keine Bewertungen

- Decesed Claim For SBIDokument18 SeitenDecesed Claim For SBIAjay GargNoch keine Bewertungen

- Jaiib QuesDokument30 SeitenJaiib QuesMuralidhar GoliNoch keine Bewertungen

- RODokument37 SeitenROscribdaashishNoch keine Bewertungen

- Document Checklist For NRI Car Loan PDFDokument1 SeiteDocument Checklist For NRI Car Loan PDFarunkumarNoch keine Bewertungen

- Checlist Car LoanDokument1 SeiteCheclist Car LoanBaljeet SinghNoch keine Bewertungen

- Document ChecklistDokument2 SeitenDocument ChecklistSuresh IndhumathiNoch keine Bewertungen

- Checklist For Home Loan - Plot LoanDokument3 SeitenChecklist For Home Loan - Plot LoanNishant RoyNoch keine Bewertungen

- 1 Account Opening Form PDFDokument3 Seiten1 Account Opening Form PDFRavi AgarwalNoch keine Bewertungen

- Transaction Purpose (As KYC)Dokument1 SeiteTransaction Purpose (As KYC)Sabareesh KumarNoch keine Bewertungen

- Housing Policy UitDokument1 SeiteHousing Policy UitRavi AgarwalNoch keine Bewertungen

- D D M M Y Y Y Y: Instruction Overleaf)Dokument2 SeitenD D M M Y Y Y Y: Instruction Overleaf)Ravi AgarwalNoch keine Bewertungen

- Demat Account BobDokument28 SeitenDemat Account BobRavi AgarwalNoch keine Bewertungen

- Advertisement Vs JE - Electrical FinalDokument6 SeitenAdvertisement Vs JE - Electrical Finalmenan PatelNoch keine Bewertungen

- Mahindra Finance Education LoanDokument21 SeitenMahindra Finance Education Loanjaspreet singhNoch keine Bewertungen

- Shuaib AS Room No. 105, Trinity Building, KundhanahalliDokument4 SeitenShuaib AS Room No. 105, Trinity Building, KundhanahalliHOMOSAPIENNoch keine Bewertungen

- Our Lady Fatima Registration FormDokument2 SeitenOur Lady Fatima Registration FormKrishan LohanNoch keine Bewertungen

- Admit Card - Candidate LoginDokument2 SeitenAdmit Card - Candidate LoginBHOLASANKAR BEHERANoch keine Bewertungen

- Electrical Engineering (Diploma) Mechanical Engineering (Diploma) Electronics / Telecommunication (Radio/ Power) Engineering (Diploma)Dokument15 SeitenElectrical Engineering (Diploma) Mechanical Engineering (Diploma) Electronics / Telecommunication (Radio/ Power) Engineering (Diploma)NDTVNoch keine Bewertungen

- Dhanashri Naik Form PDFDokument4 SeitenDhanashri Naik Form PDFdipNoch keine Bewertungen

- Abstract EVoting DjangoDokument4 SeitenAbstract EVoting DjangoShivareddy GangamNoch keine Bewertungen

- Revenue Administration Wing Ra-3 (2) SectionDokument7 SeitenRevenue Administration Wing Ra-3 (2) SectionGnanam SekaranNoch keine Bewertungen

- List of Acceptable Supporting Documents For Verification: POI (Proof of Identity) Documents Containing Name and PhotoDokument3 SeitenList of Acceptable Supporting Documents For Verification: POI (Proof of Identity) Documents Containing Name and PhotoJsjsjsjsjsjsjjNoch keine Bewertungen

- Peon Recruitment Advertisement 08.03.2022Dokument3 SeitenPeon Recruitment Advertisement 08.03.2022Gaurav SNoch keine Bewertungen

- 63f26d66dc25f23fc3aef5ff All SignDokument25 Seiten63f26d66dc25f23fc3aef5ff All Signsa3823330Noch keine Bewertungen

- Design Emgineering PDFDokument31 SeitenDesign Emgineering PDFsbgbpcNoch keine Bewertungen

- AGJKYDokument7 SeitenAGJKYArbaz KhanNoch keine Bewertungen

- Chennai Police - Format For Information On TenantsDokument6 SeitenChennai Police - Format For Information On TenantsSenthil Kumar50% (4)

- KYC Documents Required For ..Dokument1 SeiteKYC Documents Required For ..Iasam Groups'sNoch keine Bewertungen

- Form 1-A (To Claim 1st Instalment Under PMMVYDokument6 SeitenForm 1-A (To Claim 1st Instalment Under PMMVYDanish MushtaqNoch keine Bewertungen

- CAA Microproject FinalDokument20 SeitenCAA Microproject FinalMac357GNoch keine Bewertungen

- WWW Instem Res inDokument7 SeitenWWW Instem Res inSarveshNoch keine Bewertungen

- Hall Complaint Against Surry County Board Members (W Exhibit)Dokument6 SeitenHall Complaint Against Surry County Board Members (W Exhibit)FOX8Noch keine Bewertungen

- Virginia Acceptable Voter IDDokument1 SeiteVirginia Acceptable Voter IDKate AnnNoch keine Bewertungen

- Demo - Nism 6 - Depository ModuleDokument7 SeitenDemo - Nism 6 - Depository ModuleNitin BNoch keine Bewertungen

- PVT LTD BookDokument16 SeitenPVT LTD BookSantanu RoyNoch keine Bewertungen

- AME User Manual DgcaDokument64 SeitenAME User Manual Dgcas adak100% (2)

- Aadhaar Update FormateDokument2 SeitenAadhaar Update FormateA.K. BHAI JINoch keine Bewertungen

- New EPIC Card (PVC) - Issuance of Voter ID-User Manual For Kiosk Ver 1.0Dokument7 SeitenNew EPIC Card (PVC) - Issuance of Voter ID-User Manual For Kiosk Ver 1.0ameen9956Noch keine Bewertungen

- Aadhaar: List of Acceptable Supporting Documents For VerificationDokument4 SeitenAadhaar: List of Acceptable Supporting Documents For VerificationSiddharth BansalNoch keine Bewertungen

- Booking Confirmation: K.H ROAD, Bengaluru - 560027, Karnataka, IndiaDokument2 SeitenBooking Confirmation: K.H ROAD, Bengaluru - 560027, Karnataka, Indiamanu kumarNoch keine Bewertungen

- The Joining Process Is Divided Into Seven Parts:: (Service Agreement & Affidavit/Notarized Undertaking)Dokument8 SeitenThe Joining Process Is Divided Into Seven Parts:: (Service Agreement & Affidavit/Notarized Undertaking)ACOUSTIC GUITAR TRAININGNoch keine Bewertungen

- FAQ SodexoDokument3 SeitenFAQ Sodexopinky_y2kNoch keine Bewertungen