Beruflich Dokumente

Kultur Dokumente

RBI Bans Circular Trading ETBG 2010 11-5-17

Hochgeladen von

FountainheadOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

RBI Bans Circular Trading ETBG 2010 11-5-17

Hochgeladen von

FountainheadCopyright:

Verfügbare Formate

THE ECONOMIC TIMES BANGALORE FRIDAY 5 NOVEMBER 2010

FINANCE 17

RBI bans some MNC banks from trading in gilts

Probes Circular Trading Deals; More Banks Likely To Be Pulled Up eign institutional investors who

borrow cheap dollar offshore to

that the banks in question will

not be able to sell the securities

holding in government bonds. As

part of the statutory liquidity re-

Sugata Ghosh & Sangita Mehta days ago, the paper was traded at `101 — a buy Indian government bonds they buy from the market or sub- quirement, banks have to hold

MUMBAI price at which the bank’s stop-loss limit that promise a much higher re- scribe through auctions to main- 25% of the deposits in govern-

gets triggered. As a result, the bank finds it- turns. A ban on trading will mean tain the minimum mandatory ment papers.

T HE Reserve Bank of India (RBI) has

pulled up some foreign banks in In-

dia amid investigation on circular

trading in government bonds — transac-

tions where securities change hands at off-

self at a point where it has to dump the pa-

per; and, since it’s a security for which there

are no ready buyers the price it may fetch

can go even below `101.

To wriggle out of the situation the bank ENGINEERS

market prices to hide losses.

The Board for Financial Supervision

sells a part of that bond holding to a second

bank at `101.50, which in turn sells to a

_ _

Y YINDL LIMITED

_

(BFS) of the banking regulator discussed third bank for `101.55, and then again to a

_ _

sr sq u .i)

_ _

(A Govt. of India Undertaking)

the matter at its last meeting when a deci- fourth bank for `101.58. Regd . Office : 1, Bhikaiji Cama Place, New Delhi - 110066

sion was taken to impose certain restric- During the final leg, the fourth bank sells

tions on their market operations. it to the first bank. Even though the first

The central bank has decided on a six- bank may have sold just `5 crore of the `25 ( in Iakhs)

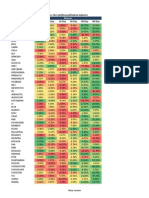

month trading ban on three multinational crore of the illiquid security it is holding, SI . Particulars QUARTER ENDED HALF YEAR ENDED Financial

banks, said a senior banker familiar with traded volumes add up to ` 20 crore as the No . year ended

the development. The Reserve Bank of In- paper moves from one bank to another. _________ _________

Standalone ___________

dia spokesperson was not available for Since adequate volumes get generated, the 30-Sep.10 30-Sep-09 30-Sep.09

30-Sep10 31-M -10

comments, but according to regulatory last traded price (`101.58) becomes the (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Audited)

and custodian sources, Standard Chartered new price of the paper. — — ________________________________________

(1) (2) (3) (4) (5) (6) (7)

Bank which has a significant presence in “This may be high enough to avoid a fire

a) Net Sales! Income From Operations 59361.30 46819.70 119965.03 85963.62 199379.70

India, Societe Generale and Calyon are sale by the bank. Besides, it also revalues

b) Other Operating Income

among the banks that have come under the entire `25 crore bonds, though just `5

the RBI lens. crore has been traded,” said a trader. There Expenditure

a) Increase/decrease in stock in trade and work

A StanChart official said that the bank are occasions when banks also do this to at- in progre ss

“will not comment on market specula- The central bank has decided on a 6-month ban on three multinational banks tract other unsuspecting buyers, but this b) Consumption of raw materials

tion”. Calyon officials could not be reached may not have happened in the present c) Purchase of traded traded

goods

despite repeated attempts while a mail to a (or repurchase of securities) transactions The off-market trades relate to deals that case, he said. According to another trader, d) Employees cost 11812.95 13130.41 23671.35 23153.17 48690.06

senior SocGen official remained unan- with the central bank. banks cut in illiquid and semi-liquid bonds such trades are common between mutual e) Depreciation 328.59 315.16 610.06 576.50 1290.54

swered. These banks, according to the RBI “There are a few more banks, including to dress up their books and even ramp up funds and banks when the former wants to f) Other expenditure

decision, cannot carry out proprietary a large European bank whose trading pat- the market. For instance, a bank that is an prop up the month-end valuations to I) Sub-Contract payment 10153,41 7943.54 22161.82 14728.62 30024,75

trades in government bonds, but can par- terns have drawn the RBI’s attention. In- illiquid paper it bought at `102 may be show a high net asset value (or, the price of II) Construction material 17470.57 11884.73 34921.21 20267.14 55609.92

ticipate in primary auctions, open market vestigation is on and there could be more tempted to strike such deals with a few oth- a mutual fund unit) of some of the debt III) Other expenses 5252.90 4265.12 10003.36 8122.23 15954.66

operations conducted by the RBI, buy- regulatory action,” said a person familiar er banks when the last traded price of the schemes. In some cases, off-market deals g) Total 45018.42 37538.96 91367.80 66847.66 151569.93

back offers from the government and repo with the development. security is well below that rate. Say, three also happen between large banks and for- Profit from Operations before Other Income, Interest

& Exceptional items (1.2) 14342.88 9280.74 28597.23 19115.96 47809.77

4 Other Income 3486.37 5940.79 6383.49 10393.77 18367.10

With target pressure gone, 5.

6.

7.

Profit before Interest & Exceptional Items (3+4)

Interest

Profit after Interest but before Exceptional Items

(5-6)

17829.25

0.20

17829.05

15221.53

17.05

15204.48

34980.72

0.27

34980.45

29509.73

17.05

29492.68

66176.87

129.08

66047.79

banks report less loan nos 8.

9.

Exceptional items

Profit (+)!Loss(-) from Ordinary Activities before

tax (7-8)

10.a Provision for Taxation

17829.05

6731.20

15204.48

5398.00

34980.45

13192.88

29492.68

10788.00

66047.79

24485.00

Our Bureau said. “Rough estimates showed that the total

FILLING UP OF THE POST OF 10.b Short! (Excess) Provision for caner years - 135.49 - 135.49 487.04

MUMBAI flow of financial resources from banks, non- SECRETARY ON DEPUTATION BASIS 10.c Provision for Deferred Tax Liability/(Asset)

banks and external sources to the commer- including earlier years adjustment (896.19) (865.68) (1662.35) (1389.78) (2481.76)

LOAN growth in the banking system is fal- cial sector during the first half of 2010-11 Central Electricity Regulatory Commission 11. Net Profit (+)ILoss(.) from Ordinary Activities

tering as borrowers shift to market funding was higher at `4,85,000 crore, up from after tax (9.10) 11994.04 10536.67 23449.92 19958.97 43557.51

had earlier invited applications for the post of 12. Extraordinary Items (net of tax expense)

and due to the tapering off of window-dress- `3,29,000 crore during the same period of

ing that boosted numbers at the end of the the previous year,” he added. Secretary in the Pay Band of Rs.37400 13. Profit (+)! Loss (-) for the period (11- 12)

Net Net 11994.04 10536.67 23449.92 19958.97 43557 .51

quarter last month. If the slow pace of loan growth continues, 14. Paid-up equity share capital (Face Value of 5!-)

Banks loaned `7,133 crore in the fortnight the central bank’s estimates of 20% this year

67000 + Grade Pay-Rs.1O,000/- per month (Refer Note 3 below) 16846.84 5615.62 16846.84 5615.62 5615.62

15. Reserves excluding Revaluation Reserves 105854.96

ended October 22, down from ` 46,000 crore may have to be cut for the second straight to be filled bb

y deputation on foreign service 16. Earning Per Share (EPS) (Refer Note 4 below)

lent in the preceding fortnight. Banks follow year. Last year, RBI lowered the credit

unconventional methods to show higher growth projection twice, first from 22% to terms. The last date of receiving applications a) Bas & diluted EPS before Extraordinary iten in 3.58 3.12 6.96 5.92 12.93

loan numbers during the quarter-end that’s 20% and then to 18%. The data released in b) Bask & diluted EPS after Extiaordinary items in 3.56 3.12 6.96 5.92 12.93

for the post has been extended to 24th Public Shareholding

a formal record to measure their perform- central bank’s weekly statistical supplement

— —Number of Shares

ance against targets. shows that the year-to-date (between April 1 November, 2010. Detailed terms & conditions 66036060 5390400 66036060 5390400 5390400

— —Percentage of Share holding 19.599% 9.599% 19.599% 9.599% 9.599%

“Credit growth has not been as robust as and October 22) credit growth was at 7.2%

expected,” pointed out HDFC Bank MD and while that year-on year (YoY) was 21%. are available in website www.cercind.gov.in. Promoters and Promoter group Shareidding

a) Pledged/Encumbered

CEO Aditya Puri. Bank loans used to be one Most bankers believe that the third quar- The applications as per prescribed format — —Number of Shares

of the key gauges in the past to measure eco- ter will be crucial to achieve the target as a

nomic activity, but that is becoming less reli- busy season will kick in when most corpo- must reach the Assistant Secretary (P&A) , —— Percentage of Shares (as a % of the total

shareholding of promoter and promoter group)

able as alternative sources of funding such as rates borrow for expansion while individuals CERC by 6.00 P.M. of the extended last date. — —Percentage of Shares (as a % of the total

share of bonds and overseas loans for corpo- borrow during the festival season. “Al- share capital of the company)

rates increase. “The rise in bank credit to the though 20% growth may not be achievable, Candidates who have already submitted b) Non- encrnibered

commercial sector was also supplemented we may be able to achieve 18-19% growth

by the higher flow of funds from other in credit,” said Bank of India chairman and their applications in response to the earlier Number of Shares 270900540 50765700 270900540 50765700 50765700

— —Percentage of Shares (as a % of the total

sources,” RBI governor Duvvuri Subbarao managing director Alok Misra. advertisement need not apply again . shareholding of promoter and promoter group) 100% 100% 100% 100% 100%

— —Percentage of Shares (as a % of the total

share caoital of the comoanv) 80.401% 90.401% 80.401% 90.401% 90.401%

Parekh slams Particulars QUARTER ENDED HALF YEAR ENDED

( in lakhs r

Financial

builders’ 10% UU

npacking a new chapter ofgrowth...growth...

In 2009-10, we unveiled a new chapte r, of growth,aspirations and achievements.

_____________________________

_________ _________

Standalone

30-Sep.10 30-Sep-09 30-Sep-10 30-Sep-09

_________

year ended

___________

31-M -10

booking plans

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Audited)

We com pleted our expansion programme, increasing capacities from 5,500 MT

_____________________________________________

Segment Revenue

to 10 ,000 MT. The expanded capacities are operational and will propel our Consultancy & Engineering Projects 27244.85 25382.17 53993.50 48097.28 105533.14

Our Bureau growth to the next leve l, going forward. Lumpsum Turnkey Projects 3211645 21437.53 65971.53 37866.34 93846.56

MUMBAI

Total 59361.30 46819.70 119965.03 85963.62 199379.70

U NAU DITED FINANCIAL RESULTS (PROVISIONAL) Segment Profit froni operations

HDFC chairman Deepak Parekh FOR THE 4TH QUARTER ENDED ON 30/09/2010 Consultancy & Engineering Projects 12637.78 8103.85 24539.78 17352.42 42423.98

has strongly criticised schemes in Lumpsum Turnkey Projects 3285.91 2096.20 6720.90 3413.68 9200.77

(Rs. n Lacs) Total (a) 15923.69 10200.05 31260.68 20766.10 51624.75

which builders offer to book

apartments at 10% of the prop- Prior period adjustments 0.00 79.43 0.00 80.45 79.96

erty value with balance to be paid Interest 0.20 17.05 0.27 17.05 129.08

on completion. SI. Other un allocable expenditure 1580.81 839.88 2663.45 1569.69 3735.02

PARTICULARS

“Within days of buying a plot, No. Total ,) 1581.01 936.36 2663.72 1667.19 3944.06

builders are putting out adver- Other Income (c) 3486.37 5940.79 6383.49 10393.77 18367.10

tisements accepting booking at Profit Before Tax (a.b+c) 17829.05 15204.48 34980.45 29492.68 66047.79

10% upfront payment,” said Mr Capital Employed * 134920.50 157492.62 134920.50 157492.62 111470.58

a. Net Income from Sales 2219 .61 3117 .60 ‘ 11332 .33 6805.57

Parekh. He questioned how it b . Other Operating Income 0.00 14.22 0.00 171.26 Fixed assets used in the compan s business orliabilitiescontracted have not been identified to any of the reportable segments,as the

was possible for developers to re- C. Increase/Decrease in stock (302.58) 79.92 (266.40) 297.54 fixed assets and support services are used interchangeably between segments. Accordingly, no disdosure relating to total segment

ceive all approvals overnight (d) TOTAL 1917.03 3211.74 11065.93 7274.37 assets and liabilities has been made.

and said the regulator should In Lumpsum Turnkey Projects of the company, margins do not accrue uniforml y yduring the year. Hence , the financial

Expenditures performance of the segments can be discerned onlyonth e basis of thefi gures for t hefu llyear.

not allow lenders to fund proj- a. Consumption of Raw Material 763.31 2478.39 8181.15 5521.39

ects unless all approvals have b. StaffCost 115.46 118.64 351.74 343.39

been received. c. Manufacturing Expenses 89.44 60.34 257.10 221.86 (? in lakhs

Mr Parekh’s statements were d. Other Expenses 18.64 15.78 64.74 115.00

in support of RBI’s move to en- a. Depreciation 184.28 20.23 351.08 221.15 Particulars AS ON

sure that banks lend only after 30-Sep.10 30-Sep-CO

f. TOTAL 1171.13 2693.38 9205.81 6422.79

potential home buyers bring in 20% of the property value. Although (Unaudite (Unaudited)

3 Profit from Operations before __________________________________________________________

most banks insist that borrowers bring in at least 15% of the proper- Other Income, Interestand Exceptional Items (1-2) 745.90 518.36 1860.12 851.58 SOURCES OF FUNDS

ty value, some banks in their eagerness to get large accounts have 4 Other Income 6.08 0.00 15.15 20.12 SHAREHOLDERS FUNDS:

funded borrowers after they brought in the initial 5% to 10% of the 5 Profit before Interest and Exceptional Items (3+4) 751.98 518.36 1875.27 871.70 (a) Capital 16846.84 5615.62

property value, with the understanding that they will bring their re- 6 Interest 0.58 0.72 8.93 5.79 (b) Reserves and Surplus 118073.66 151877.00

maining portion of the finance at a later day. 7 Profit after Interest but before Exceptional Items (5-6) 751.40 517.64 1866.34 865.91 LOAN FUNDS 0.00 0.00

In the months leading to the financial crisis, some private banks 8 Exceptional items-(Add)/Less 0.00 0.00 0.00 5.96 TOTAL 134920.50 157492.62

had come out with schemes where they offered 100% financing of 9 Profit (+)ILoss (—) from Ordinary Activities before tax (7+8) 751.40 517.64 1866.34 859.95 APPLICATION OF FUNDS

the property. Some of the banks had burnt their fingers as a result of 10 Provisionfor Taxation 0.00 0.00 0.00 1.35 FIXED ASSETS (NET) 7610.96 6724.35

such loans since borrowers had no equity in the property. Earlier, be- 11 Net Profit (+)/ Loss (—) from Ordinary Activities after INVESTMENTS 10137.84 3951.35

tax (9-10) 751.40 517.64 1866.34 858.60

fore the financial crisis, RBI, in order to discourage such lending, had 12 Extraordinary Item (net of tax expenses) 0.00 0.00 0.00 0.00 DEFERRED TAX ASSET (NET) 15814.30 13059.96

said banks needed to provide higher capital for loans where the bor- 13 Net Profit(+)I Loss(—) forthe period (11-12) 751.40 517 .64 1866.34 858.60 CURRENT ASSETS, LOANS AND ADVANCES

rower’s equity was less than 25%. 14 Paid-up Equity Share Capital 1995.28 1995.28 1995.28 1995.28 (a) Inventories 93.28 83.34

However, banks discovered a loophole after they found out that (Face Value: Rs. 10/- per Share) (b) Sundry Debtors 45344.36 31414.40

the excess capital has to be provided only as long as the outstanding 15 Reserve excluding revaluation reserves (as per Balance (c) Cash and Bank balances 177927.81 206390.41

loan is more than 75% of the property value. Now, with the strong Sheet) of previous accounting year to be given in column (5 7659.85 (d) Other currentassets 18328.01 22112,05

revival in housing demand, banks were again getting enthusiastic in 16 Basic and Diluted EPS for the period, for the year to (e) Loans and Advances 23569.70 23864.74

growing their mortgage portfolio. To curb this practice, the central date and for the previous year (Rs.) 3.77 2.59 9.35 4.30 LESS: CURRENT LIABILITIES AND PROVISIONS

bank said banks, henceforth, cannot lend more than 80% of the 17 Public Shareholding (a) Liabilities 140906.82 132263.88

property value. ——No. of shares 13373736 13395755 13373736 13395755 (b) Provisions 22998.94 17874.22

Mr Parekh said in the rush for market share, lenders should not set ——Percentage of shareholding 67.03 67.03 67.14 67.03 67.14

18 Promoters and Promoter Group NET CURRENT ASSETS 101357.40 133726.84

aside prudential lending norms. RBI has also discouraged banks from Shareholding MISCELLANEOUS EXPENDITURE (NOT WRITFEN OFF OR ADJUSTED) 0.00 30.12

lending for purchase of properties over `75 lakh by asking banks to a. Pledged / /Encumbered PROFif AND LOSS ACCOUNT 0.00 0.00

set aside more capital for such loans. Number of Shares Nil Nil Nil Nil TOTAL 134920.50 157492.62

Bankers, however, say the Indian mortgage market is a far cry Percentage of Shares Nil Nil Nil Nil NOTES:

from the US. Unlike the US, there is a huge housing shortage in India. (as a % of total shareholding of Promoter and I The above results have been reviewed by the Audit Committee and approved by tie Board of Directors at their meeting

Also, income levels are rising at a much faster rate. They point out Promoter Group) heldono4.1I .2010.

that in India, on an average, home loans are repaid in seven years and Percentage of Shares NA. NA. NA. N.A. 2 TheAuditorsofthe Companyhave carried out’Limited Review ’of theabovefinancial results.

the loan to property value ratio is less than 75%. (as a % of total share capital of the company) 3 Consequent to approval of Shareholders in their Extra ordinary General Meeting (EGM) held on 22nd April, 2010 for sub-division of each

b. Non-Encumbered equityshare offace vaIueof 101- each into2equitysharesof 51-eachand issueof bonus shares inthe ratio of 2:1,the paid up equity share

Number of Shares 6579083 6557064 6579083 6557064 capital of the Company as on 30th September, 10 consist of 336936600 equity shares having face value of 5!- each as against56l56lOO

Percentage of Shares 100.00 100.00 100.00 100.00 equity shares having face value of ’1O!- each ason 30th September ,2009 and 3lstMarc h , 2010.

IDBI Bank raises $125m via bonds (as a % of total shareholding of Promoter and 4 As per requirement of AS-20,the Basic and Diluted Earning per share has been adjusted for all periods presented on the basis of new number

ofequity shares aftersplitand bonus i.e. 336936600equi1y shares of 51- each.

Promote r Gro up)

MUMBAI: Public sector lender IDBI Bank has raised $125 million Percentage of Shares 32.97 32.86 32.97 32.86 5 During the current quarter, “Further Public Offer’ of 33693660 equity shares of 51- each of the Company through an offer for sale by the

foreign currency syndicated loan from the Singapore market to (as a % of total share capital of the company) President of India, acting through Ministry of Petroleum & Natural Gas, Government of India was made through the 100% book building

meet the growing demand from domestic corporates for foreign — — __________ __________ __________ __________

process. Consequently. Sliareholding ofGovernmentof India reducedto 80.401% from 90.401%

NOTES: 6 Therewer eno investor s ’ complaints pending at the beginningofquarter. Dufng the current quarter companyhadreceived6l complaints

currency funds. “As part of our $1.5-billion medium term note

1. The Audft Committee reviewed the above results arid the same were taken on record by the Board of Directors at their and samewere resolved during the quarter.

(MTN) programme for this fiscal, we have raised $125 million meeting held on 01.11.2010. By Order of the Board

through a three-year bond issue. We mobilised this fund on 2. Segment reporting prescribed with respect to products underAS - 17 is not applicable. For Eng ineers India Limited

November 1 in Singapore. With this, so far we have issued bonds 3. 3.Details of Investor complaints during the Quarter ended 30/09/2010 Sd!-

worth $475 million so far this fiscal,” IDBI Bank chief financial Opening: 0 Received: 2 Disposed: 2 Balance: 0 Place :: New

Place New Delhi (Ram Singh)

officer P Sitaram said here on Thursday. He further said the issue 2010

Dated : 4th November , 2010 Director (Finance)

For SHARP INDUSTRIES LIMITED Please visit our website at http ://www .engi neersind ia.com

had an overwhelming response as more than a dozen foreign Plac e: Mumba i -Sd-

bankers were keen to participate. Date : 01.11.2010 DIRECTOR Delivering Excellence through People

Das könnte Ihnen auch gefallen

- Motilal Oswal Value Strategy FundDokument27 SeitenMotilal Oswal Value Strategy FundFountainheadNoch keine Bewertungen

- Insider Trading Data - SKS MicrofinanceDokument2 SeitenInsider Trading Data - SKS MicrofinanceFountainheadNoch keine Bewertungen

- Nifty Beat 02 Nov 2010Dokument1 SeiteNifty Beat 02 Nov 2010FountainheadNoch keine Bewertungen

- HPC in The Cloud With RDokument5 SeitenHPC in The Cloud With RFountainheadNoch keine Bewertungen

- Economist Raghuram Rajan Warns of Currency ConflictDokument6 SeitenEconomist Raghuram Rajan Warns of Currency ConflictFountainheadNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Commercial Bank: Definition, Function, Credit Creation and SignificancesDokument8 SeitenCommercial Bank: Definition, Function, Credit Creation and SignificancesfendaNoch keine Bewertungen

- FCA Approach Payment Services Electronic Money 2017Dokument238 SeitenFCA Approach Payment Services Electronic Money 2017CrowdfundInsiderNoch keine Bewertungen

- BAJAJ Statement of AccountDokument1 SeiteBAJAJ Statement of AccountSurya Prakash100% (1)

- SodapdfDokument8 SeitenSodapdfr6540073Noch keine Bewertungen

- Shell Financial Data BloombergDokument48 SeitenShell Financial Data BloombergShardul MudeNoch keine Bewertungen

- Investments:: True or FalseDokument9 SeitenInvestments:: True or FalseXienaNoch keine Bewertungen

- CCASBCP030Dokument64 SeitenCCASBCP030Swati KaleNoch keine Bewertungen

- Chapter 19 Business Finance Needs and SourcesDokument5 SeitenChapter 19 Business Finance Needs and SourcesSol CarvajalNoch keine Bewertungen

- Chapter: Bond FundamentalsDokument28 SeitenChapter: Bond FundamentalsUtkarsh VardhanNoch keine Bewertungen

- List of Accredited Collections Agencies As of March 2014 For CCAP WebsiteDokument3 SeitenList of Accredited Collections Agencies As of March 2014 For CCAP WebsiteMarlon Rondain100% (1)

- FUnding Requirement OnlineDokument1 SeiteFUnding Requirement OnlineSadu OmkarNoch keine Bewertungen

- Understanding Life Insurance Products From PivotDokument4 SeitenUnderstanding Life Insurance Products From PivotYekini KazeemNoch keine Bewertungen

- Tutorial 5Dokument2 SeitenTutorial 5Aqilah Nur15Noch keine Bewertungen

- BDO V Equitable BankDokument18 SeitenBDO V Equitable BankKresnie Anne BautistaNoch keine Bewertungen

- Key Features: A Oke9Wjwm36Onlmr&Redirect Signup A Oke9Wjwm36OnlmrDokument5 SeitenKey Features: A Oke9Wjwm36Onlmr&Redirect Signup A Oke9Wjwm36OnlmrVicard GibbingsNoch keine Bewertungen

- Step 1: Analysis of The Subsidiary's Net AssetsDokument10 SeitenStep 1: Analysis of The Subsidiary's Net AssetsJulie Mae Caling MalitNoch keine Bewertungen

- Important RemindersDokument3 SeitenImportant RemindersBlessa Marel CaasiNoch keine Bewertungen

- Internship Report On Loan & Advances of Bank Asia LimitedDokument48 SeitenInternship Report On Loan & Advances of Bank Asia LimitedFahim100% (6)

- Tata Coffee Q2 Financial Results FY2021 22Dokument18 SeitenTata Coffee Q2 Financial Results FY2021 22Arushi BhansaliNoch keine Bewertungen

- Depreciation ChartDokument2 SeitenDepreciation ChartRakesh DangiNoch keine Bewertungen

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDokument13 SeitenTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNoch keine Bewertungen

- CASA Statement 1544844333068 PDFDokument3 SeitenCASA Statement 1544844333068 PDFAlviNoch keine Bewertungen

- Dian Sari (A031171703) Tugas Akl IiDokument3 SeitenDian Sari (A031171703) Tugas Akl Iidian sariNoch keine Bewertungen

- Ntp-Asac ASALUS Corporation: Ap Voucher Vendor Code: Vendor NameDokument8 SeitenNtp-Asac ASALUS Corporation: Ap Voucher Vendor Code: Vendor NameEloiza Lajara RamosNoch keine Bewertungen

- How Much Should Beasley Record As Total Assets Acquired inDokument1 SeiteHow Much Should Beasley Record As Total Assets Acquired inMiroslav GegoskiNoch keine Bewertungen

- Forex Operations: Prof S P GargDokument25 SeitenForex Operations: Prof S P GargProf S P Garg100% (2)

- Co-Operative Banks Identity Through Brand Building: Presented By: Presented byDokument10 SeitenCo-Operative Banks Identity Through Brand Building: Presented By: Presented byRajiv ChoudharyNoch keine Bewertungen

- IFRS 17 Discount Rates and Cash Flow Considerations For Property and Casualty Insurance ContractsDokument45 SeitenIFRS 17 Discount Rates and Cash Flow Considerations For Property and Casualty Insurance ContractsWubneh AlemuNoch keine Bewertungen

- Performance of Etfs and Index Funds: A Comparative Analysis: Post-Graduate Student Research ProjectDokument18 SeitenPerformance of Etfs and Index Funds: A Comparative Analysis: Post-Graduate Student Research ProjectAvneetPalSinghNoch keine Bewertungen

- Study - Id116072 - Digital Payments in Vietnam PDFDokument44 SeitenStudy - Id116072 - Digital Payments in Vietnam PDFhà thànhNoch keine Bewertungen