Beruflich Dokumente

Kultur Dokumente

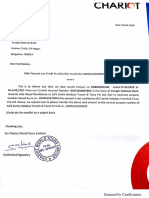

Insurance Copy.

Hochgeladen von

Ashok Kumar0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

193 Ansichten4 SeitenYuh

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenYuh

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

193 Ansichten4 SeitenInsurance Copy.

Hochgeladen von

Ashok KumarYuh

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

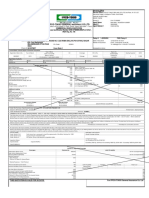

ORIGINAL FOR RECIPIENT/DUPLICATE FOR SUPPLIER.

TAX INVOICE/CERTIFICATE CUM POLICY SCHEDULE

(FORM 51 OF THE CENTRALMOTOR VEHICLES RULES, 1989)

Policy Type Package Policy( Private Vehicle ) Proposal No. & Date R61299220 / 06-Jun-2018

Policy No. & Type MOP5063161 Period of Insurance 00:00:00 AM 07-Jun-2018 to midnight on 06-Jun-2019

Policy Issued On 06-Jun-2018 (00:00) Vehicle Identification No. MA3EDKD1S00549138

Insured Name Mrs Saraswathi - Geographical Area INDIA

Invoice No MOP5063161 Accounting Code of Service 997134

Insured Address # 4 4TH CROSS MUNESHWARABLOCK SULTAN PALYAR T NAGAR POST,

BANGALORE-560032, Karnataka

Insured State & Code Karnataka-29 Place of Supply Karnataka GSTIN of Customer GSTUNREGISTERED

INSURED MOTOR VEHICLE DETAILS INSURED DECLARED VALUE (IDV) (in Rs.)

Make Maruti Vehicle 315015

Model & Variant Ritz LXI/MARUTI RITZ LXI Non Electrical Accessories 0

Registration No KA03MY2751 Electrical Accessories 0

Year of Manufacture 2016 CNG/ LPG Kit 0

Engine- Chassis No 7095836 - 549138 Total IDV 315015

Cubic Capacity 1197

Seating Capacity 5

Type Of Body Saloon

RTO Location KA03MY2751 / BANGALORE

Schedule Of Premium (Amount in Rs.)

OWN DAMAGE SECTION (A) LIABILITY SECTION (B)

Vehicle 4653 Basic Third Party Liability 2863

Elec. Accessories 0 Third Party Liability for Bi-fuel Kit 0

Non- Elec. Accessories 0 Compulsory PACover Premium 100

Kit (IMT-25) 0 PACover for 0 Person of Rs (0) each (IMT- 16 )

Extra Premium towards Inbuilt CNG/LPG NA Legal Liability (WC) to Driver (IMT-28) 50

Basic Premium 4653 Legal Liability to Employees (IMT-29) 0

Geographical Area Extn. (IMT-1) NA Legal Liability to Passenger (IMT 46) 0

Lamp, Tyres etc. (IMT 23) 0 Driving Tuition Loading On TP Premium (60%) NA

Driving Tuition Loading On OD Premium (60%) NA Net Liability Premium (B) 3013

Sub-Total Additions 0 Total Premium (A+B) 9755

Deductibles CGST @9% 878

Voluntary Deductibles (IMT 22A) 0 SGST @9% 878

Anti-Theft Device (IMT-10) 116 Gross Premium Paid 11511

AAI Membership (IMT-8) 0 Note :

No Claim Bonus 0 0

Discount for vehicles designed for handicapped NA 1. Policy Issuance is the subject to the realisation of cheque.

2. Consolidate stump duty paid to State Exchequer

Sub - Total Deductibles 116 3. The Policy is subject to a compulsory Deductible of Rs 1000 (IMT -22)

Add - On Coverages 4. Voluntary excess Rs (0)

Depreciation waiver Clause 2205 5. Subject to Endorsements IMT ,7 10, 28,

Engine Protect 0

Return to Invoice 0

Net own Damage Premium (A) 6742

Nominee Details : Nominee Name HARSHA Age 26 Relation Son

Payment Method Cheque No./Transaction No. Bank Name Amount

Payment Detail

Auto Debit 24814336 HSBC BANK LTD 11511

Financier Type Financed Financier Name PUNJAB NATIONAL BANK. Financier Branch BANGALORE

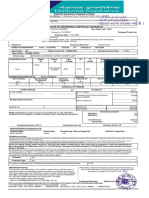

Limitations as to use:- The Policy covers use of the vehicle for any purpose other than: a) Hire or Reward, b) Carriage of goods (other than samples or personal luggage), c) Organized racing, d) Pace making, e) Speed

testing, f) Reliability Trials, g) Any purpose in connection with Motor Trade.

Driver: Any person including the insured, Provided that a person driving holds an effective driving license at the time of the accident and is not disqualified from holding or obtaining such a license; Provided also that the

person holding an effective learner's license may also drive the vehicle and that such a person satisfies the requirements of Rule 3 of the Central Motor Vehicles Rules, 1989.

Limits of Liability: Under Section II-1 (i) of the policy - Death of or bodily injury - Such amount as is necessary to meet there requirements of the Motor Vehicles Act, 1988. Under Section II -1(ii) of the Policy - Damage to

Third Party Property - Rs.7.5 lakhs - (as per IMT 20)in respect of any one claim or series of claims arising out of one event. Cover for Owner - Driver under section III (CSI) Rs. 200000 Deductible under section-I : Rs

1000(Compulsory Deductible Rs 1000 Imposed Deductible Rs. 0 and Voluntary Deductible Rs 0)

No Claim Bonus: : The insured is entitled for a No Claim Bonus (NCB) on the Own Damage section of the policy, if no claim is made or pending during the preceding year (s), as per the following: The preceding

year/20%, Preceding Two consecutive years/25%, Preceding Three consecutive years/35%, Preceding Four consecutive years/45%, Preceding Five consecutive years/50%. No Claim Bonus will only be allowed provided

the policy is renewed within 90 days of the expiry date of the previous policy.

IMPORTANT NOTICE: The Insured is not indemnified if the vehicle is used or driven otherwise than in accordance with this Schedule. Any payment made by the Company by reason of wider terms appearing in the

Certificate in order to comply with the Motor Vehicle Act, 1988 is recoverable from the Insured. See the clause headed "AVOIDANCE OF CERTAIN TERMS AND RIGHT OF RECOVERY". For Legal interpretation, English

version will hold good.

For information on ombudsman you may visit website : http://www.gbic.co.in/ombudsman.html

I / We hereby certify that the Policy to which this Certificate relates as well as this Certificate of Insurance are issued in accordance with the provisions of Chapter X and Chapter XI of M.V. Act, 1988.

For ROYAL SUNDARAM GENERAL INSURANCE CO. LIMITED

Authorized Signatory

Policy Issuing Office:-30, JNR City centre,Rajaram Mohan roy road, Sampangiram nagar, Bangalore.

GSTIN: 29AABCR7106G1ZF, CIN No.:U67200TN2000PLC045611

State Name : Karnataka

Das könnte Ihnen auch gefallen

- Schedule of Premium (Amount in RS.)Dokument4 SeitenSchedule of Premium (Amount in RS.)KiranNoch keine Bewertungen

- Schedule of Premium (Amount in RS.)Dokument4 SeitenSchedule of Premium (Amount in RS.)Ashish KumarNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Mûkêsh Kàñnâñ AJNoch keine Bewertungen

- GST Invoice Format For Services in ExcelDokument102 SeitenGST Invoice Format For Services in ExcelJugaadi BahmanNoch keine Bewertungen

- W Hero Scooty InsuranceDokument3 SeitenW Hero Scooty InsuranceVivek Kümär RNoch keine Bewertungen

- Policy No 26020531196210020451 Proposal No. & Date Policy Issued On Period of Insurance Insured Name Previous Policy No. Insured Add Previous InsurerDokument2 SeitenPolicy No 26020531196210020451 Proposal No. & Date Policy Issued On Period of Insurance Insured Name Previous Policy No. Insured Add Previous InsurerSanjay SharmaNoch keine Bewertungen

- Tax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraDokument1 SeiteTax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraSHANTANU PATHAKNoch keine Bewertungen

- Delivery Summary: Order DateDokument4 SeitenDelivery Summary: Order Datemahi vaniNoch keine Bewertungen

- physicalCustomerInvoice-6398687421-10716-192da0e2 599e 4098 9c28 fcc28e7a7c19vvMlJd6GfJ-4402661336Dokument1 SeitephysicalCustomerInvoice-6398687421-10716-192da0e2 599e 4098 9c28 fcc28e7a7c19vvMlJd6GfJ-4402661336karthik gunashekharNoch keine Bewertungen

- Access - KA-51-AB-6862Dokument10 SeitenAccess - KA-51-AB-6862Subhan ShaikhNoch keine Bewertungen

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDokument1 Seite(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountSreedharNoch keine Bewertungen

- Vrpower Equipments PVT LTD BhartiDokument8 SeitenVrpower Equipments PVT LTD BhartiMADHUKAR JHANKALNoch keine Bewertungen

- Washing Machine InvoiceDokument1 SeiteWashing Machine InvoiceAmeet ParekhNoch keine Bewertungen

- Bajaj Allianz General Insurance Company LTD.: Vehicle QuoteDokument4 SeitenBajaj Allianz General Insurance Company LTD.: Vehicle QuoteLucky RawatNoch keine Bewertungen

- Tax Invoice: Duplicate For BuyerDokument1 SeiteTax Invoice: Duplicate For BuyerakhlaquemdNoch keine Bewertungen

- Commercial Vehicle Package Policy-5Dokument3 SeitenCommercial Vehicle Package Policy-5Sunil KumarNoch keine Bewertungen

- InvoicesDokument148 SeitenInvoicesBijak DataNoch keine Bewertungen

- Energy SDokument1 SeiteEnergy SROHIT SHARMA DEHRADUNNoch keine Bewertungen

- SKT - 2017 - 16 - 1214Dokument1 SeiteSKT - 2017 - 16 - 1214DJ SethNoch keine Bewertungen

- InvoiceDokument1 SeiteInvoicevikas bhatiNoch keine Bewertungen

- CustomerInvoice PDFDokument1 SeiteCustomerInvoice PDFNamrata GundiahNoch keine Bewertungen

- Bajaj Allianz General Insurance CompanyDokument2 SeitenBajaj Allianz General Insurance Companysarath potnuriNoch keine Bewertungen

- Jeanson RenewalDokument1 SeiteJeanson RenewaljeansonNoch keine Bewertungen

- Bike PolicyDokument2 SeitenBike PolicyAdhwareshBharadwaj100% (2)

- MedicalDokument1 SeiteMedicalsoma mondalNoch keine Bewertungen

- InvoiceDokument1 SeiteInvoiceAmazon CompaniesNoch keine Bewertungen

- INVDokument1 SeiteINVGulshan KumarNoch keine Bewertungen

- Sri Vasavi Medical Agencies Invoice Rpaug002Dokument1 SeiteSri Vasavi Medical Agencies Invoice Rpaug002amareshNoch keine Bewertungen

- Motor Insurance - Two Wheeler Comprehensive PolicyDokument3 SeitenMotor Insurance - Two Wheeler Comprehensive PolicyMANTEL TELECOMNoch keine Bewertungen

- The Oriental Insurance Company Limited: Particulars of Insured VehicleDokument3 SeitenThe Oriental Insurance Company Limited: Particulars of Insured VehicleJohn TalNoch keine Bewertungen

- Agent Name Khivraj Motors Agent Code MIS1000132 Agent Contact No 9108694880Dokument2 SeitenAgent Name Khivraj Motors Agent Code MIS1000132 Agent Contact No 9108694880SanthoshNoch keine Bewertungen

- Suzuki Access InsuranceDokument2 SeitenSuzuki Access InsuranceRaki GowdaNoch keine Bewertungen

- Comercial InvoiceDokument1 SeiteComercial Invoicepatel vimalNoch keine Bewertungen

- Hospital Invoice TemplateDokument1 SeiteHospital Invoice TemplateAakash HoskotiNoch keine Bewertungen

- ISHRAT AFZA National Insurance Certificate of Insurance Cum Policy Shedule Ok TestedDokument1 SeiteISHRAT AFZA National Insurance Certificate of Insurance Cum Policy Shedule Ok TestedAnil SharmaNoch keine Bewertungen

- Biller Details GTPL Broadband PVT LTD.: Terms & ConditionsDokument1 SeiteBiller Details GTPL Broadband PVT LTD.: Terms & ConditionsRajeev SinghNoch keine Bewertungen

- Reliance Activa Insurance PolicyDokument6 SeitenReliance Activa Insurance PolicydsethiaimtnNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Srinath YadavNoch keine Bewertungen

- OD115563023203880000Dokument2 SeitenOD115563023203880000rajasekhar1babu1swarNoch keine Bewertungen

- TelephoneBill 040100678686 ApDokument2 SeitenTelephoneBill 040100678686 ApSaurav Adhikari0% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Navdeep MinhasNoch keine Bewertungen

- Tax Invoice: 1046.17 Total Invoice Amount RsDokument2 SeitenTax Invoice: 1046.17 Total Invoice Amount RsAayush AggarwalNoch keine Bewertungen

- Realme 7 (Mist White, 64 GB) : Grand Total 12145.00Dokument2 SeitenRealme 7 (Mist White, 64 GB) : Grand Total 12145.00Sachin JaiswalNoch keine Bewertungen

- 7883Dokument8 Seiten7883Rakhi YadavNoch keine Bewertungen

- Final Motor Insurance Claim Form Two Aug2018 - 0 PDFDokument1 SeiteFinal Motor Insurance Claim Form Two Aug2018 - 0 PDFShiva SinghNoch keine Bewertungen

- InvoiceDokument1 SeiteInvoiceJanhvii tiwariNoch keine Bewertungen

- Job Card PreinvoiceDokument3 SeitenJob Card Preinvoicewm. mfcskhairNoch keine Bewertungen

- Stationery BillsDokument1 SeiteStationery BillsAbhishek SinghNoch keine Bewertungen

- Reliance General Insurance Company Limited: Reliance Two Wheeler Package Policy-BundledDokument6 SeitenReliance General Insurance Company Limited: Reliance Two Wheeler Package Policy-Bundledu want some then come and get someNoch keine Bewertungen

- aGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceDokument2 SeitenaGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceSandeep KumarNoch keine Bewertungen

- Your Policy Is Due For Renewal On 27/06/2017: Royal Sundaram General Insurance Co. LimitedDokument3 SeitenYour Policy Is Due For Renewal On 27/06/2017: Royal Sundaram General Insurance Co. LimitedPrachi BhosaleNoch keine Bewertungen

- PolycyDokument10 SeitenPolycyShivamDave100% (1)

- Oocl Invoice Inv Afl-6948 BL Oolu2726566460 Los Angeles 1x40 RHDokument1 SeiteOocl Invoice Inv Afl-6948 BL Oolu2726566460 Los Angeles 1x40 RHsnowmine666Noch keine Bewertungen

- Keyboard InvoiceDokument1 SeiteKeyboard InvoiceMohit SharmaNoch keine Bewertungen

- Iltil - Il Il - Rillil LL Illflll Llil Il Ffil LTR Il LilDokument1 SeiteIltil - Il Il - Rillil LL Illflll Llil Il Ffil LTR Il LilJay SriramNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Jyoti MorkundeNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)RMNoch keine Bewertungen

- Schedule of Premium (Amount in RS.)Dokument4 SeitenSchedule of Premium (Amount in RS.)Gang StarNoch keine Bewertungen

- Schedule of Premium (Amount in RS.)Dokument5 SeitenSchedule of Premium (Amount in RS.)Sruthi T SNoch keine Bewertungen

- Schedule of Premium (Amount in RS.)Dokument4 SeitenSchedule of Premium (Amount in RS.)ashokkandoiNoch keine Bewertungen

- 12 Types of VotersDokument13 Seiten12 Types of VotersAshok KumarNoch keine Bewertungen

- 1Dokument3 Seiten1Ashok KumarNoch keine Bewertungen

- HSE - General Awareness - Environmental Management - Completion - Certificate PDFDokument1 SeiteHSE - General Awareness - Environmental Management - Completion - Certificate PDFAshok KumarNoch keine Bewertungen

- Employee Details Payment & Leave Details: Arrears Current AmountDokument1 SeiteEmployee Details Payment & Leave Details: Arrears Current AmountAshok KumarNoch keine Bewertungen

- DefaultDokument1 SeiteDefaultAshok KumarNoch keine Bewertungen

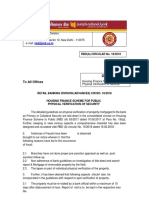

- Circle: Bangalore: Circle Head: Shri Ramdas HegdeDokument1 SeiteCircle: Bangalore: Circle Head: Shri Ramdas HegdeAshok KumarNoch keine Bewertungen

- SVR - Constable Prelims KeyDokument6 SeitenSVR - Constable Prelims KeyAshok KumarNoch keine Bewertungen

- Reg: Comparative Analysis of Customized Health Insurance Products Being Offered by All Four General Insurance Channel PartnersDokument2 SeitenReg: Comparative Analysis of Customized Health Insurance Products Being Offered by All Four General Insurance Channel PartnersAshok KumarNoch keine Bewertungen

- (Parliament Election 2019) (1) (1Dokument2 Seiten(Parliament Election 2019) (1) (1Ashok KumarNoch keine Bewertungen

- Parliament Election 2019Dokument8 SeitenParliament Election 2019Ashok KumarNoch keine Bewertungen

- To All Offices: RBD@PNB - Co.inDokument4 SeitenTo All Offices: RBD@PNB - Co.inAshok KumarNoch keine Bewertungen

- New Doc 2018-04-27Dokument1 SeiteNew Doc 2018-04-27Ashok KumarNoch keine Bewertungen

- Mazda 3 J638CDokument1.571 SeitenMazda 3 J638CAlexe VictorNoch keine Bewertungen

- Elite Auto Parts Zoomer Air CleanerDokument2 SeitenElite Auto Parts Zoomer Air CleaneredwinNoch keine Bewertungen

- SB 1358 - Fuel Probe Modification Kit 2021-03-24 NA by SNDokument2 SeitenSB 1358 - Fuel Probe Modification Kit 2021-03-24 NA by SNAlexander GraytrousesNoch keine Bewertungen

- RISK ASSESSMENT - CG-4706-offloading The 40 Feet Container and Offloading The MaterialsDokument6 SeitenRISK ASSESSMENT - CG-4706-offloading The 40 Feet Container and Offloading The Materialsnsadnan100% (5)

- Citroen Ds3 Plus BrochureDokument8 SeitenCitroen Ds3 Plus BrochuresaurabhbectorNoch keine Bewertungen

- Kanpur Central JN To New Delhi Indian Railway TrainsDokument2 SeitenKanpur Central JN To New Delhi Indian Railway TrainspranjulNoch keine Bewertungen

- CPS-02系列扫查架说明书 - DCY4.021.277SS - V1.0A-E- 英文20190715Dokument36 SeitenCPS-02系列扫查架说明书 - DCY4.021.277SS - V1.0A-E- 英文20190715YURI EDGAR GIRALDO MACHADONoch keine Bewertungen

- Fullrun Truck Tyre Catalogue PDFDokument17 SeitenFullrun Truck Tyre Catalogue PDFjonathan ortizNoch keine Bewertungen

- R4a 51Dokument4 SeitenR4a 51marneilrivera96Noch keine Bewertungen

- Original Bill Required at Destination: ShipperDokument1 SeiteOriginal Bill Required at Destination: ShipperEmma SinotransNoch keine Bewertungen

- RFD Daily Incident Report 7/18/21Dokument2 SeitenRFD Daily Incident Report 7/18/21inforumdocsNoch keine Bewertungen

- VW Transporter T6 Current Flow DiagramDokument1.505 SeitenVW Transporter T6 Current Flow DiagramRuican AlexandruNoch keine Bewertungen

- TMI: Trek To Harishchandragad Via Nali Chi Vaat On 5th and 6th Jan '13Dokument4 SeitenTMI: Trek To Harishchandragad Via Nali Chi Vaat On 5th and 6th Jan '13swaranjali moreNoch keine Bewertungen

- Cycling Risk AssessmentDokument2 SeitenCycling Risk AssessmentNicholasNoch keine Bewertungen

- Scope of The Railway ProjectDokument35 SeitenScope of The Railway ProjectTAHER AMMARNoch keine Bewertungen

- DOST Tour ReflectionDokument2 SeitenDOST Tour ReflectionChristian EstebanNoch keine Bewertungen

- Cesna 172Dokument7 SeitenCesna 172eng13Noch keine Bewertungen

- Annexure B - Standard Technical SpecificationDokument157 SeitenAnnexure B - Standard Technical SpecificationYohannes GirmaNoch keine Bewertungen

- 2016 BMW R 1200 GS Adventure - Owner's ManualDokument213 Seiten2016 BMW R 1200 GS Adventure - Owner's ManualIvan Gavrilovic67% (3)

- MR - David MakDokument50 SeitenMR - David MakEdouard LiangNoch keine Bewertungen

- InstructivoDokument5 SeitenInstructivoPapeleria-ciber LoscompasNoch keine Bewertungen

- Flight Attendance Vocab. BookletDokument6 SeitenFlight Attendance Vocab. Bookletإيهاب غازيNoch keine Bewertungen

- Haris2016 2Dokument5 SeitenHaris2016 2VanHieu LuyenNoch keine Bewertungen

- Evidencia 1 Writing and Essay About Logistics CostsDokument4 SeitenEvidencia 1 Writing and Essay About Logistics CostsYennyNoch keine Bewertungen

- Exercise 2 10CSL57 DBMS LAB PROGRAM 2Dokument11 SeitenExercise 2 10CSL57 DBMS LAB PROGRAM 2Kiran Kumar100% (1)

- IATA Hand Book TAH818G-English 2014Dokument438 SeitenIATA Hand Book TAH818G-English 2014Jose Luis Castro AltamiranoNoch keine Bewertungen

- Group 6 - RA 344 Accessibility LawDokument45 SeitenGroup 6 - RA 344 Accessibility LawRoji VillacortaNoch keine Bewertungen

- Site Location: Maharana Pratap Isbt Kashm Gate, DelhiDokument6 SeitenSite Location: Maharana Pratap Isbt Kashm Gate, DelhiMukesh SharmaNoch keine Bewertungen

- Abdurehman MuletaDokument124 SeitenAbdurehman MuletaHundee Hundumaa100% (1)

- Subaru Outback 2023 Quick Reference GuideDokument24 SeitenSubaru Outback 2023 Quick Reference GuideOlegas LesinasNoch keine Bewertungen