Beruflich Dokumente

Kultur Dokumente

Payslip 2018 2019 1 100000000421201 IGSL

Hochgeladen von

Arivu Akil0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

389 Ansichten1 SeiteH

Originaltitel

payslip-2018-2019-1-100000000421201-IGSL

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenH

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

389 Ansichten1 SeitePayslip 2018 2019 1 100000000421201 IGSL

Hochgeladen von

Arivu AkilH

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

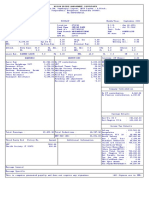

INTELENET GLOBAL SERVICES PRIVATE LIMITED

Intelenet House,Plot CST No 1406-A/28,Mindspace,Malad(West),Mumbai-400090,India

Payslip for the month of January 2019

Employee Code 100000000421201 PF Account Number HR/GGN/25297/167242

Employee Name Arivazhagan M Permanent Account Number CVJPA7977E

Location Bangalore Aadhar No 417367160040

Bank Name KOTAK MAHINDRA BANK LIMITED Grade Grade I

Payment Mode Cheque Designation CUSTOMER SERVICE ASSOCIATE-NON

VOICE

Bank Account Number 9112172452 Days Worked 29

Date of Joining 10 Jul 2018 Previous Monthly LOP -1

Date of Birth 13 Dec 1996 Paid Leave 0

UAN Number 101344895206 LOP 2

Esic Account Number 5040518428

Earnings Monthly Rate Current Month Arrears Total Deductions Amount

Basic Salary 6715.00 6282.00 -217.00 6065.00 Provident Fund 754.00

House Rent Allowance 3358.00 3141.00 -108.00 3033.00 ESIC 213.00

Transport Allowance 1600.00 1497.00 -52.00 1445.00 Arrears PF -26.0

FBP Allowance 1757.00 1644.00 -57.00 1587.00

Gross Earnings 12,130.00 Total Deductions 941.00

Net Salary : 11,189.00

In words : Eleven Thousand One Hundred Eighty Nine Only (All Amount Is In )

Income Tax Calculation for the financial Year 2018-2019

Particular Cumulative Projected Current Annual Details Of Exemption U/S 10

Basic Salary 37451.00 13430.00 6065.00 56946.00 Driver Allowance Exemption 0

House Rent 18729.00 6716.00 3033.00 28478.00 Gratuity Exemption 0

Allowance

Leave Travel Exemption 0

Transport 8923.00 3200.00 1445.00 13568.00

Allowance Telephone Exemption 0

FBP Allowance 9799.00 3514.00 1587.00 14900.00

Incentive1 1200.00 0.00 0.00 1200.00 Investment Details

National Holiday 434.00 0.00 0.00 434.00 PF + VPF 6887.00

Basic

National Holiday 434.00 0.00 0.00 434.00

Payment

NATIONALHOLID 36.00 0.00 0.00 36.00 LOP Dates

AYSTBONUS

Statutory Bonus 3118.00 1118.00 505.00 4741.00

25/12/2018 01/01/2019 13/01/2019

Salary For The Year 120737.00 Monthly Tax deducted in Salary

Month One Time Tax Monthly Tax Total Tax

Gross Salary 120737.00 January 0 0 0

Gross Taxable Income 120737.00

LESS : Profession Tax 200.00

Less : Standard Deduction 40000.00

LESS : Deduction Under section 80C 6887.00

Net Taxable Income (Rounded Off) 73650.00

Income Tax Deduction

87A 0.00

Income Tax Payable 0.00

Surcharge 0.00

Education Cess 0.00

Total Income Tax & Surcharge Payable 0.00

Esop Tax to be Recovered in this Month 0.00

Esop Tax Already Deducted 0.00

Less Tax Deducted at source till current month 0.00

Less Tax Deducted by Previous Employer 0.00

Balance Tax Payable/Refundable 0.00

Average Tax Payable per Month 0.00

Das könnte Ihnen auch gefallen

- SalarySlipwithTaxDetailsDokument2 SeitenSalarySlipwithTaxDetailsVivek ViviNoch keine Bewertungen

- Nov PayslipDokument1 SeiteNov Payslipsachikant swainNoch keine Bewertungen

- Salary Slip July 2023 - UnlockedDokument1 SeiteSalary Slip July 2023 - UnlockedPardeep AttriNoch keine Bewertungen

- Pay Slip For January 2018: Cybage Software Private LimitedDokument1 SeitePay Slip For January 2018: Cybage Software Private LimitedSudheer0% (1)

- May PayslipDokument1 SeiteMay Payslipkuna gowthamkumarNoch keine Bewertungen

- Payslip 2018 2019 1 100000000439462 IGSLDokument1 SeitePayslip 2018 2019 1 100000000439462 IGSLMandeep Ranga100% (1)

- Sunil Kumar (DELS0210)Dokument1 SeiteSunil Kumar (DELS0210)SUNIL KUMARNoch keine Bewertungen

- Payslip 2023 2024 6 200000000029454 IGSLDokument1 SeitePayslip 2023 2024 6 200000000029454 IGSLMohit SagarNoch keine Bewertungen

- Ub23m03 561476Dokument1 SeiteUb23m03 561476Ratul KochNoch keine Bewertungen

- SRL Limited: Payslip For The Month of JANUARY 2019Dokument1 SeiteSRL Limited: Payslip For The Month of JANUARY 2019Giri PriyaNoch keine Bewertungen

- SalarySlipwithTaxDetails 2021 MayDokument1 SeiteSalarySlipwithTaxDetails 2021 MaySameer KulkarniNoch keine Bewertungen

- Servlet ControllerDokument1 SeiteServlet Controllermukesh sahuNoch keine Bewertungen

- SameeraDokument1 SeiteSameeraTabrez AhamadNoch keine Bewertungen

- FNP00765Dokument1 SeiteFNP00765Rajaram RayNoch keine Bewertungen

- Payslip Oct-2022 NareshDokument3 SeitenPayslip Oct-2022 NareshDharshan Raj0% (1)

- Payslip 11 2020Dokument1 SeitePayslip 11 2020Sk Sameer100% (1)

- Yogesh August PayslipDokument1 SeiteYogesh August Payslipशिवभक्त बाळासाहेब मोरेNoch keine Bewertungen

- UnknownDokument1 SeiteUnknownSDOT Ashta0% (1)

- Sep2022 STFC PayslipDokument1 SeiteSep2022 STFC PayslipAjith NandhaNoch keine Bewertungen

- Payslip For The Month of September-2021: Personal InformationDokument1 SeitePayslip For The Month of September-2021: Personal InformationDeep KoleyNoch keine Bewertungen

- Jun 2023Dokument1 SeiteJun 2023SRINIVASREDDY PIRAMALNoch keine Bewertungen

- Sandy Jan PayslipDokument1 SeiteSandy Jan PayslipJoginderNoch keine Bewertungen

- Payslip For The Month of January 2018: Earnings DeductionsDokument1 SeitePayslip For The Month of January 2018: Earnings DeductionsDevmalya ChandaNoch keine Bewertungen

- August 2021Dokument1 SeiteAugust 2021Zaynn17Noch keine Bewertungen

- Teleperformance Global Services Private Limited: Full and Final Settlement - December 2023Dokument3 SeitenTeleperformance Global Services Private Limited: Full and Final Settlement - December 2023vishal.upadhyay9279Noch keine Bewertungen

- Payslip Sep-2022 NareshDokument3 SeitenPayslip Sep-2022 NareshDharshan RajNoch keine Bewertungen

- Payslip Sep2022Dokument1 SeitePayslip Sep2022Raut AbhimanNoch keine Bewertungen

- PayslipDokument1 SeitePayslipSk Samim AhamedNoch keine Bewertungen

- Centillion Networks PVT LTD: Pay Slip For The Month March 2019Dokument1 SeiteCentillion Networks PVT LTD: Pay Slip For The Month March 2019Pruthvi RajuNoch keine Bewertungen

- Apr 2021Dokument1 SeiteApr 2021Suraj KadamNoch keine Bewertungen

- SalarySlipwithTaxDetails PDFDokument1 SeiteSalarySlipwithTaxDetails PDFRahul mishraNoch keine Bewertungen

- PDFReports PDFDokument1 SeitePDFReports PDFTuhin ChakrabortyNoch keine Bewertungen

- Amazon Development Center India Pvt. LTD: Akash SatputeDokument2 SeitenAmazon Development Center India Pvt. LTD: Akash SatputepyNoch keine Bewertungen

- Payslip 2023 2024 5 100000000546055 IGSL PDFDokument1 SeitePayslip 2023 2024 5 100000000546055 IGSL PDFKapilNoch keine Bewertungen

- Salary Slip - Anas - Sept 2021Dokument1 SeiteSalary Slip - Anas - Sept 2021Sadiya KhanNoch keine Bewertungen

- Anuja Tejinkar3Dokument1 SeiteAnuja Tejinkar3javed9890Noch keine Bewertungen

- PaySlip1 OctDokument1 SeitePaySlip1 Octjesten jadeNoch keine Bewertungen

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDokument1 Seite175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020Noch keine Bewertungen

- Earnings Deductions: B9 Beverages LimitedDokument1 SeiteEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNoch keine Bewertungen

- India Payslip January 2022Dokument1 SeiteIndia Payslip January 2022Mir KazimNoch keine Bewertungen

- PayslipDokument6 SeitenPayslipmohamed arabathNoch keine Bewertungen

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDokument1 SeitePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNoch keine Bewertungen

- Vistaar Financial Services Private Limited: Payslip For The Month of February 2018Dokument1 SeiteVistaar Financial Services Private Limited: Payslip For The Month of February 2018AlleoungddghNoch keine Bewertungen

- SalarySlipwithTaxDetailsDokument2 SeitenSalarySlipwithTaxDetailsN Quinton SinghNoch keine Bewertungen

- 5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Dokument1 Seite5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Shreyash SahayNoch keine Bewertungen

- June 2022 - AjithkumarDokument1 SeiteJune 2022 - AjithkumarDharshan RajNoch keine Bewertungen

- EPF Universal Account NumberDokument1 SeiteEPF Universal Account NumberetrshillongNoch keine Bewertungen

- Dec PayslipDokument1 SeiteDec PayslipAlphaj Yazor MaseeḥNoch keine Bewertungen

- Salary Slip - February 2023 - Gurjeet Singh SainiDokument1 SeiteSalary Slip - February 2023 - Gurjeet Singh SainiGurjeet SainiNoch keine Bewertungen

- DDICGDIAP72DINOV22Dokument1 SeiteDDICGDIAP72DINOV22raghav bharadwajNoch keine Bewertungen

- Salary Slip EDIT-JULYDokument4 SeitenSalary Slip EDIT-JULYpathyashisNoch keine Bewertungen

- Dec07 PDFDokument1 SeiteDec07 PDFomkassNoch keine Bewertungen

- Salma Saifi May SlipDokument2 SeitenSalma Saifi May Slipsalma saifiNoch keine Bewertungen

- Javed JuyDokument1 SeiteJaved JuyVikas JangidNoch keine Bewertungen

- Uni-Com India PVT - LTDDokument1 SeiteUni-Com India PVT - LTDcredit cardNoch keine Bewertungen

- Afzal Khan - Payslip (May 2021)Dokument1 SeiteAfzal Khan - Payslip (May 2021)afzal khanNoch keine Bewertungen

- PAY May 2022Dokument1 SeitePAY May 2022Rohit raagNoch keine Bewertungen

- Barcela, John Christian 13634019 80031904 10,000.00 02/15/2023 02/15/2023Dokument1 SeiteBarcela, John Christian 13634019 80031904 10,000.00 02/15/2023 02/15/2023JCNoch keine Bewertungen

- Slip PDFDokument1 SeiteSlip PDFPratikDuttaNoch keine Bewertungen

- 100000000494378Dokument1 Seite100000000494378Dalbir SinghNoch keine Bewertungen

- Supercal 539: Universal Compact Heat MeterDokument6 SeitenSupercal 539: Universal Compact Heat MeterVladimir ZaljevskiNoch keine Bewertungen

- 1654403-1 Press Fit ConnectorsDokument40 Seiten1654403-1 Press Fit ConnectorsRafael CastroNoch keine Bewertungen

- Windows Crash Dump AnalysisDokument11 SeitenWindows Crash Dump Analysisbetatest12Noch keine Bewertungen

- Hukbalahap: March 16, 2019 Godwin M. Rarama Readings in The Philippine History Seat No. 35Dokument2 SeitenHukbalahap: March 16, 2019 Godwin M. Rarama Readings in The Philippine History Seat No. 35Godwin RaramaNoch keine Bewertungen

- DL5/DL6 With CBD6S: User ManualDokument32 SeitenDL5/DL6 With CBD6S: User ManualMeOminGNoch keine Bewertungen

- Dislocations and StrenghteningDokument19 SeitenDislocations and StrenghteningAmber WilliamsNoch keine Bewertungen

- Funny AcronymsDokument6 SeitenFunny AcronymsSachinvirNoch keine Bewertungen

- SPOUSES DAVID B. CARPO & and RECHILDA S. CARPO V. ELEANOR CHUA and ELMA DY NGDokument3 SeitenSPOUSES DAVID B. CARPO & and RECHILDA S. CARPO V. ELEANOR CHUA and ELMA DY NGRengie GaloNoch keine Bewertungen

- CollectionsDokument42 SeitenCollectionsNaveen KumarNoch keine Bewertungen

- Common Metallurgical Defects in Grey Cast IronDokument9 SeitenCommon Metallurgical Defects in Grey Cast IronRolando Nuñez Monrroy100% (1)

- Leyson vs. OmbudsmanDokument12 SeitenLeyson vs. OmbudsmanDNAANoch keine Bewertungen

- 2 - McCullough HospitalDokument2 Seiten2 - McCullough HospitalGuru Charan ChitikenaNoch keine Bewertungen

- MN502 Lecture 3 Basic CryptographyDokument45 SeitenMN502 Lecture 3 Basic CryptographySajan JoshiNoch keine Bewertungen

- Bare Copper & Earthing Accessories SpecificationDokument14 SeitenBare Copper & Earthing Accessories SpecificationJayantha SampathNoch keine Bewertungen

- Ps 6013 Geometric Dimensioning and Tolerancing Symbology Method, Usage and Definitions 2013-08-01 (G)Dokument18 SeitenPs 6013 Geometric Dimensioning and Tolerancing Symbology Method, Usage and Definitions 2013-08-01 (G)maheshmbelgaviNoch keine Bewertungen

- SMB Marketing PlaybookDokument18 SeitenSMB Marketing PlaybookpramodharithNoch keine Bewertungen

- Legal DraftingDokument28 SeitenLegal Draftingwadzievj100% (1)

- 1-10 Clariant - Prasant KumarDokument10 Seiten1-10 Clariant - Prasant Kumarmsh43Noch keine Bewertungen

- Surveillance of Healthcare-Associated Infections in Indonesian HospitalsDokument12 SeitenSurveillance of Healthcare-Associated Infections in Indonesian HospitalsRidha MardiyaniNoch keine Bewertungen

- Marine Products: SL-3 Engine ControlsDokument16 SeitenMarine Products: SL-3 Engine ControlsPedro GuerraNoch keine Bewertungen

- Serial Number Microsoft Office Professioanal 2010Dokument6 SeitenSerial Number Microsoft Office Professioanal 2010Kono KonoNoch keine Bewertungen

- TelekomDokument2 SeitenTelekomAnonymous eS7MLJvPZCNoch keine Bewertungen

- Implementation of BS 8500 2006 Concrete Minimum Cover PDFDokument13 SeitenImplementation of BS 8500 2006 Concrete Minimum Cover PDFJimmy Lopez100% (1)

- Dell PowerEdge M1000e Spec SheetDokument2 SeitenDell PowerEdge M1000e Spec SheetRochdi BouzaienNoch keine Bewertungen

- Catalogo AMF Herramientas para AtornillarDokument76 SeitenCatalogo AMF Herramientas para Atornillarabelmonte_geotecniaNoch keine Bewertungen

- Human Resource Information Systems 2nd Edition Kavanagh Test BankDokument27 SeitenHuman Resource Information Systems 2nd Edition Kavanagh Test BankteresamckenzieafvoNoch keine Bewertungen

- ManagementLetter - Possible PointsDokument103 SeitenManagementLetter - Possible Pointsaian joseph100% (3)

- PPR 8001Dokument1 SeitePPR 8001quangga10091986Noch keine Bewertungen

- BNBC 2017 Volume 1 DraftDokument378 SeitenBNBC 2017 Volume 1 Draftsiddharth gautamNoch keine Bewertungen

- 5d814c4d6437b300fd0e227a - Scorch Product Sheet 512GB PDFDokument1 Seite5d814c4d6437b300fd0e227a - Scorch Product Sheet 512GB PDFBobby B. BrownNoch keine Bewertungen