Beruflich Dokumente

Kultur Dokumente

Contract Adjustment

Hochgeladen von

David BriggsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Contract Adjustment

Hochgeladen von

David BriggsCopyright:

Verfügbare Formate

#45155

DATE: JUNE 7, 2019

SUBJECT: DIREXION DAILY SMALL CAP BEAR 3X SHARES ‒ REVERSE

SPLIT

FUTURES SYMBOL: TZA1D

NEW SYMBOL: TZA2D

DATE: 6/28/19

Direxion Daily Small Cap Bear 3X Shares (TZA) has announced a 1-for-5 reverse stock split. As a result of

the reverse stock split, each TZA Share will be converted into the right to receive 0.20 (New) Direxion Daily

Small Cap Bear 3X Shares. The reverse stock split will become effective before the market open on June

28, 2019.

CONTRACT ADJUSTMENT

Pursuant to Article XII, Section 3, of OCC's By-Laws, all TZA1D Security Futures will be adjusted as

follows:

Effective Date: June 28, 2019

Futures Symbol: TZA1D changes to TZA2D

Settlement Prices: No Change

Multiplier: 100 (e.g., for premium extensions 1.00 will equal $100)

New Deliverable

Per Contract: 20 (New) Direxion Daily Small Cap Bear 3X Shares (TZA)

CUSIP: TZA (New): 25460E125

PRICING

The underlying price for TZA2D will be determined as follows:

TZA2D = 0.20 (TZA)

DISCLAIMER

This Information Memo provides an unofficial summary of the terms of corporate events affecting listed

options or futures prepared for the convenience of market participants. OCC accepts no responsibility for

the accuracy or completeness of the summary, particularly for information which may be relevant to

investment decisions. Option or futures investors should independently ascertain and evaluate all

information concerning this corporate event(s).

The determination to adjust options and the nature of any adjustment is made by OCC pursuant to OCC

By-Laws, Article VI, Sections 11 and 11A. The determination to adjust futures and the nature of any

adjustment is made by OCC pursuant to OCC By-Laws, Article XII, Sections 3, 4, or 4A, as applicable. For

both options and futures, each adjustment decision is made on a case by case basis. Adjustment

decisions are based on information available at the time and are subject to change as additional

information becomes available or if there are material changes to the terms of the corporate event(s)

occasioning the adjustment.

ALL CLEARING MEMBERS ARE REQUESTED TO IMMEDIATELY ADVISE ALL BRANCH OFFICES AND

CORRESPONDENTS ON THE ABOVE.

For questions regarding this memo, call Investor Services at 1-888-678-4667 or email

investorservices@theocc.com. Clearing Members may contact Member Services at 1-800-544-6091 or,

within Canada, at 1-800-424-7320, or email memberservices@theocc.com.

Das könnte Ihnen auch gefallen

- Narcissistic ParentDokument5 SeitenNarcissistic ParentChris Turner100% (1)

- Structural Analysis Cheat SheetDokument5 SeitenStructural Analysis Cheat SheetByram Jennings100% (1)

- Sample Forensic Loan Audit ReportDokument34 SeitenSample Forensic Loan Audit Reportmmeindl100% (1)

- IDCARDDokument5 SeitenIDCARDhoracio contrerasNoch keine Bewertungen

- 2023-10-18 EA Perez, J Auto DocaDokument3 Seiten2023-10-18 EA Perez, J Auto Doca88dianavargasNoch keine Bewertungen

- Financing The New VentureDokument46 SeitenFinancing The New VentureAnisha HarshNoch keine Bewertungen

- The Second Leg Down: Strategies for Profiting after a Market Sell-OffVon EverandThe Second Leg Down: Strategies for Profiting after a Market Sell-OffBewertung: 5 von 5 Sternen5/5 (1)

- Cosmetics: Methylglyoxal, The Major Antibacterial Factor in Manuka Honey: An Alternative To Preserve Natural Cosmetics?Dokument8 SeitenCosmetics: Methylglyoxal, The Major Antibacterial Factor in Manuka Honey: An Alternative To Preserve Natural Cosmetics?David BriggsNoch keine Bewertungen

- MA in Public Policy-Handbook-2016-17 (KCL)Dokument14 SeitenMA in Public Policy-Handbook-2016-17 (KCL)Hon Wai LaiNoch keine Bewertungen

- Declaration PageDokument2 SeitenDeclaration Pageluisalcantara12345678Noch keine Bewertungen

- IIT JEE Maths Mains 2000Dokument3 SeitenIIT JEE Maths Mains 2000Ayush SharmaNoch keine Bewertungen

- Account Statement: Folio No.: 11325320 / 36Dokument2 SeitenAccount Statement: Folio No.: 11325320 / 36Inderpaal SinghNoch keine Bewertungen

- Elliot Kamilla - Literary Film Adaptation Form-Content DilemmaDokument14 SeitenElliot Kamilla - Literary Film Adaptation Form-Content DilemmaDavid SalazarNoch keine Bewertungen

- 2q19 Eaof LetterDokument13 Seiten2q19 Eaof LetterDavid BriggsNoch keine Bewertungen

- Bigger Capital Letter To Sysorex ShareholdersDokument26 SeitenBigger Capital Letter To Sysorex ShareholdersbiggercapitalNoch keine Bewertungen

- Financial Reporting For Financial Institutions MUTUAL FUNDS & NBFC'sDokument77 SeitenFinancial Reporting For Financial Institutions MUTUAL FUNDS & NBFC'sParvesh Aghi0% (1)

- Date Particulars Withdrawals Deposits BalanceDokument2 SeitenDate Particulars Withdrawals Deposits BalanceUrooj AhmedNoch keine Bewertungen

- Books by Amy and Arny MindellDokument24 SeitenBooks by Amy and Arny Mindellrameshprema100% (1)

- SDCS-02 Rev. 1 Part 1Dokument28 SeitenSDCS-02 Rev. 1 Part 1Ahmed Abozahrah100% (1)

- Atlassian Technical Account ManagementDokument4 SeitenAtlassian Technical Account ManagementDavid BriggsNoch keine Bewertungen

- Principles of Learning: FS2 Field StudyDokument8 SeitenPrinciples of Learning: FS2 Field StudyKel Li0% (1)

- Design ManagementDokument21 SeitenDesign ManagementKarishma Mittal100% (1)

- Contract AdjustmentDokument2 SeitenContract AdjustmentDavid BriggsNoch keine Bewertungen

- Contract Adjustment Effective Date: New MultiplierDokument2 SeitenContract Adjustment Effective Date: New MultiplierTaltson SunnyNoch keine Bewertungen

- Contract AdjustmentDokument2 SeitenContract AdjustmentTaltson SunnyNoch keine Bewertungen

- BIRMDokument2 SeitenBIRMboazmashimbaNoch keine Bewertungen

- Quotation Slip No. 276/ Permata - JKT/ FIRE / VI / 2016: Fire & Allied Indonesian Standard Fire Insurance PolicyDokument1 SeiteQuotation Slip No. 276/ Permata - JKT/ FIRE / VI / 2016: Fire & Allied Indonesian Standard Fire Insurance PolicyDiajeng RamadhanNoch keine Bewertungen

- Assignment Solution - Yield Curve and HedgingDokument12 SeitenAssignment Solution - Yield Curve and HedgingAkashNoch keine Bewertungen

- Insurance 2012-13 2Dokument3 SeitenInsurance 2012-13 2ademarbossNoch keine Bewertungen

- CryoCare Insurance Renewal (Revised)Dokument11 SeitenCryoCare Insurance Renewal (Revised)HaslindaNoch keine Bewertungen

- 500-1542314 08 05 2013 FundTransactionNoticeDokument2 Seiten500-1542314 08 05 2013 FundTransactionNoticeAjay Krishna DevulapalliNoch keine Bewertungen

- 3a614582 NabDokument16 Seiten3a614582 NabSaroj KhadangaNoch keine Bewertungen

- Annexure Shriram Tranche 2Dokument1 SeiteAnnexure Shriram Tranche 2Rajiv DuttNoch keine Bewertungen

- Premium Certificate Financial Year 2019-2020 To Whomsoever It May ConcernDokument3 SeitenPremium Certificate Financial Year 2019-2020 To Whomsoever It May ConcernVineet PahwaNoch keine Bewertungen

- BinderDokument3 SeitenBinderjackieNoch keine Bewertungen

- GPA PolicyDokument11 SeitenGPA PolicysravsofficalNoch keine Bewertungen

- Australia and New Zealand Banking Group Limited 6.736 Dated 17 Mar 23Dokument12 SeitenAustralia and New Zealand Banking Group Limited 6.736 Dated 17 Mar 23Mister MisterNoch keine Bewertungen

- Mutual FundDokument1 SeiteMutual FundAmith NMNoch keine Bewertungen

- Scan With QR Code ReaderDokument1 SeiteScan With QR Code ReaderZafar MirzaNoch keine Bewertungen

- Dee 80 Ed 6 FC 99Dokument5 SeitenDee 80 Ed 6 FC 99Mradula SinghNoch keine Bewertungen

- Ernest Amaechi Onwuzulike Ammmf 1122019 31122019Dokument1 SeiteErnest Amaechi Onwuzulike Ammmf 1122019 31122019onwuzuamNoch keine Bewertungen

- Important Information:: View Report Download PDFDokument3 SeitenImportant Information:: View Report Download PDFDavid AshNoch keine Bewertungen

- 3003 - 241595857 - 00 - B00 - Py Jashwant BhaiDokument3 Seiten3003 - 241595857 - 00 - B00 - Py Jashwant BhaiBhavesh RavalNoch keine Bewertungen

- Nxttjb1g4t 01 GL Policy 0000Dokument79 SeitenNxttjb1g4t 01 GL Policy 0000ruiz.alex03Noch keine Bewertungen

- 2b) Section 1-Compliance To MADokument2 Seiten2b) Section 1-Compliance To MAJR FOONoch keine Bewertungen

- Baneko Pilip - Nas: Ctrcutar No.1054Dokument2 SeitenBaneko Pilip - Nas: Ctrcutar No.1054Gilbert Aldana GalopeNoch keine Bewertungen

- Pulsar PSDokument23 SeitenPulsar PSLionel TanNoch keine Bewertungen

- Prospectus Velocityshares Us VolatilityDokument179 SeitenProspectus Velocityshares Us Volatilityafrodita99977Noch keine Bewertungen

- ZBB Energy Corporation: Form S-1Dokument53 SeitenZBB Energy Corporation: Form S-1Ankur DesaiNoch keine Bewertungen

- Man U IpoDokument258 SeitenMan U IpoMichael OzanianNoch keine Bewertungen

- US and Global MRC Slip Examples.Dokument49 SeitenUS and Global MRC Slip Examples.Yudhisthar SinghNoch keine Bewertungen

- Suspense AccountDokument1 SeiteSuspense AccountMetricNoch keine Bewertungen

- Commercial RFQ 6854Dokument2 SeitenCommercial RFQ 6854Goody Freking FuttonNoch keine Bewertungen

- SIVBDokument39 SeitenSIVBCharlie HouNoch keine Bewertungen

- Policy C001452519Dokument1 SeitePolicy C001452519Shuvam SarkarNoch keine Bewertungen

- Carmx 2023 3 Final Prospectus As PrintedDokument167 SeitenCarmx 2023 3 Final Prospectus As Printedfay0072014Noch keine Bewertungen

- Application Form (For Resident Applicants) Sakthi Finance LimitedDokument2 SeitenApplication Form (For Resident Applicants) Sakthi Finance LimitedraviNoch keine Bewertungen

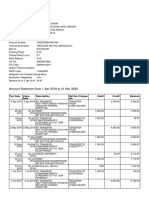

- Account Statement From 1 Apr 2019 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument3 SeitenAccount Statement From 1 Apr 2019 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceHarnek SinghNoch keine Bewertungen

- Contract AdjustmentDokument3 SeitenContract AdjustmentTaltson SunnyNoch keine Bewertungen

- Iffco Tokio General Insurance Co LTDDokument3 SeitenIffco Tokio General Insurance Co LTDFrisk Consulting Pvt LtdNoch keine Bewertungen

- U1258 Gr59ky94Dokument2 SeitenU1258 Gr59ky94АлександрNoch keine Bewertungen

- 23delgtks1850 1Dokument2 Seiten23delgtks1850 1ARKAJIT DEY-DMNoch keine Bewertungen

- Ilp AlterationDokument3 SeitenIlp AlterationJasper LeeNoch keine Bewertungen

- NoticeDokument3 SeitenNoticeNathan KingNoch keine Bewertungen

- Money MarketDokument21 SeitenMoney MarketNguyễn Thuỳ DungNoch keine Bewertungen

- Maintenance Cisco RFQDokument5 SeitenMaintenance Cisco RFQichan drumNoch keine Bewertungen

- MT-710 - India LC Gar 5800-5600kcalDokument6 SeitenMT-710 - India LC Gar 5800-5600kcalEzra FitriasNoch keine Bewertungen

- f8281 PDFDokument4 Seitenf8281 PDFMARSHA MAINESNoch keine Bewertungen

- With Logo (Onestop - Finexis - New Reno 360 Only)Dokument1 SeiteWith Logo (Onestop - Finexis - New Reno 360 Only)Khyne Nyein ChanNoch keine Bewertungen

- ClaimDokument1 SeiteClaimMamoona SaeedNoch keine Bewertungen

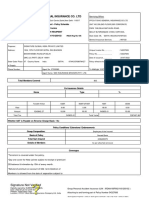

- PO No. 07/18/2354/2923/F DT: 30/11/2018: Signature Not VerifiedDokument3 SeitenPO No. 07/18/2354/2923/F DT: 30/11/2018: Signature Not Verifiedpreetty morNoch keine Bewertungen

- GPA PolicyDokument10 SeitenGPA Policyparas INSURANCENoch keine Bewertungen

- Mop 22F51933Dokument22 SeitenMop 22F51933paras INSURANCENoch keine Bewertungen

- Wywa - Garstang Primary SchoolDokument2 SeitenWywa - Garstang Primary SchoolDavid BriggsNoch keine Bewertungen

- 2011 - Survey and Evaluation of Audio Fingerprinting Schemes For Mobile Audio SearchDokument6 Seiten2011 - Survey and Evaluation of Audio Fingerprinting Schemes For Mobile Audio SearchDavid BriggsNoch keine Bewertungen

- List of New Books Arrivals 2018 - 24!12!18Dokument74 SeitenList of New Books Arrivals 2018 - 24!12!18David BriggsNoch keine Bewertungen

- Tapped in Over The YearsDokument16 SeitenTapped in Over The YearsDavid BriggsNoch keine Bewertungen

- RCH Terminating Plans WebDokument7 SeitenRCH Terminating Plans WebDavid BriggsNoch keine Bewertungen

- Employee Vetting and Protection White PaperDokument8 SeitenEmployee Vetting and Protection White PaperDavid BriggsNoch keine Bewertungen

- Patent Application Publication (10) Pub. No.: US 2005/0096759 A1Dokument11 SeitenPatent Application Publication (10) Pub. No.: US 2005/0096759 A1David BriggsNoch keine Bewertungen

- Local Rules v12 - Revised 7-1-16Dokument99 SeitenLocal Rules v12 - Revised 7-1-16David BriggsNoch keine Bewertungen

- Offloading Hybrid Cloud Management For Strategic Advantage: The 451 TakeDokument2 SeitenOffloading Hybrid Cloud Management For Strategic Advantage: The 451 TakeDavid BriggsNoch keine Bewertungen

- Continuous Diagnostics and Mitigation Program: How CDM WorksDokument2 SeitenContinuous Diagnostics and Mitigation Program: How CDM WorksDavid BriggsNoch keine Bewertungen

- Hotelsforheroes FactsheetDokument1 SeiteHotelsforheroes FactsheetDavid BriggsNoch keine Bewertungen

- PS 270 01 Voluntary Corporate ActionDokument2 SeitenPS 270 01 Voluntary Corporate ActionDavid BriggsNoch keine Bewertungen

- 10.2019 EMSD Active ManagementDokument5 Seiten10.2019 EMSD Active ManagementDavid BriggsNoch keine Bewertungen

- 8 Best Practices For Handling ERISA Benefit Claims: Portfolio Media. Inc. - 111 West 19Dokument9 Seiten8 Best Practices For Handling ERISA Benefit Claims: Portfolio Media. Inc. - 111 West 19David BriggsNoch keine Bewertungen

- Offloading Hybrid Cloud Management For Strategic Advantage: The 451 TakeDokument2 SeitenOffloading Hybrid Cloud Management For Strategic Advantage: The 451 TakeDavid BriggsNoch keine Bewertungen

- Case Study UECDokument7 SeitenCase Study UECDavid BriggsNoch keine Bewertungen

- Dark Trace Autonomous Response Threat Report 2019Dokument6 SeitenDark Trace Autonomous Response Threat Report 2019David BriggsNoch keine Bewertungen

- Evanston Alternative Opportunities Fact Sheet 10-01-2019Dokument5 SeitenEvanston Alternative Opportunities Fact Sheet 10-01-2019David BriggsNoch keine Bewertungen

- 2019 Global Brochure WebDokument4 Seiten2019 Global Brochure WebDavid BriggsNoch keine Bewertungen

- Https SV - Usembassy.gov Wp-Content Uploads Sites 202 PR7623027 RFQ-19ES6018Q0092Dokument13 SeitenHttps SV - Usembassy.gov Wp-Content Uploads Sites 202 PR7623027 RFQ-19ES6018Q0092David BriggsNoch keine Bewertungen

- SCC White PaperDokument15 SeitenSCC White PaperDavid BriggsNoch keine Bewertungen

- Amazon AtlasDokument20 SeitenAmazon AtlasLeomidas7Noch keine Bewertungen

- Cvs Hi Final 3 2 16 PDFDokument4 SeitenCvs Hi Final 3 2 16 PDFDavid BriggsNoch keine Bewertungen

- Voya Compass Hospital Confinement Indemnity InsuranceDokument4 SeitenVoya Compass Hospital Confinement Indemnity InsuranceDavid BriggsNoch keine Bewertungen

- Next Decade Manifesto: We Commit Ourselves: We RejectDokument1 SeiteNext Decade Manifesto: We Commit Ourselves: We RejectDavid BriggsNoch keine Bewertungen

- VOYA Hospital Indemnity Brochure FINALDokument5 SeitenVOYA Hospital Indemnity Brochure FINALDavid BriggsNoch keine Bewertungen

- VOYA USG Accident-Hospital IndemnityDokument37 SeitenVOYA USG Accident-Hospital IndemnityDavid BriggsNoch keine Bewertungen

- Tugas Week 6 No 8.23Dokument5 SeitenTugas Week 6 No 8.23Mikael MuhammadNoch keine Bewertungen

- Form No. 61: (See Proviso To Clause (A) of Rule 114C (1) )Dokument1 SeiteForm No. 61: (See Proviso To Clause (A) of Rule 114C (1) )Vinayak BhatNoch keine Bewertungen

- Alumni - 1997Dokument132 SeitenAlumni - 1997GSL Medical CollegeNoch keine Bewertungen

- Tugas Pak Hendro PoemDokument24 SeitenTugas Pak Hendro PoemLaila LalaNoch keine Bewertungen

- The Discovery of The Tun Huang Library and Its Effect On Chinese StudiesDokument21 SeitenThe Discovery of The Tun Huang Library and Its Effect On Chinese Studiesfabricatore_21639575Noch keine Bewertungen

- Power Semiconductor DevicesDokument11 SeitenPower Semiconductor DevicesBhavesh Kaushal100% (1)

- Thesis Statement For Moral CourageDokument7 SeitenThesis Statement For Moral CourageMonica Franklin100% (2)

- Meditation Club of RUET Asif EEE 17 PDFDokument2 SeitenMeditation Club of RUET Asif EEE 17 PDFShovonNoch keine Bewertungen

- Muhammad Fa'iz Annur: Daftar Hasil Studi Dan Yudisium (Dhsy)Dokument1 SeiteMuhammad Fa'iz Annur: Daftar Hasil Studi Dan Yudisium (Dhsy)osamafania nadiumaraNoch keine Bewertungen

- Contract ManagementDokument26 SeitenContract ManagementGK TiwariNoch keine Bewertungen

- Oils and Lard by Fourier Transform Infrared Spectroscopy. Relationships Between Composition and Frequency of Concrete Bands in The Fingerprint Region.Dokument6 SeitenOils and Lard by Fourier Transform Infrared Spectroscopy. Relationships Between Composition and Frequency of Concrete Bands in The Fingerprint Region.Nong NakaNoch keine Bewertungen

- Delhi Public School, Agra: The HolocaustDokument3 SeitenDelhi Public School, Agra: The Holocaustkrish kanteNoch keine Bewertungen

- Lesson 8 Fact and Opinion: ExampleDokument10 SeitenLesson 8 Fact and Opinion: ExampleAlmirante Gilberto JoséNoch keine Bewertungen

- Module 7 Weeks 14 15Dokument9 SeitenModule 7 Weeks 14 15Shīrêllë Êllézè Rīvâs SmïthNoch keine Bewertungen

- Content 1. Knowing Oneself: Leyte National High SchoolDokument6 SeitenContent 1. Knowing Oneself: Leyte National High SchoolMaria Theresa Deluna MacairanNoch keine Bewertungen

- Internal Job Posting 1213 - Corp Fin HyderabadDokument1 SeiteInternal Job Posting 1213 - Corp Fin HyderabadKalanidhiNoch keine Bewertungen

- Cambridge International Advanced Subsidiary LevelDokument12 SeitenCambridge International Advanced Subsidiary LevelMayur MandhubNoch keine Bewertungen

- Synopss Orignal of Ambuja CementDokument25 SeitenSynopss Orignal of Ambuja CementLovely Garima JainNoch keine Bewertungen

- TNR Evaluation RD 2Dokument7 SeitenTNR Evaluation RD 2api-302840901Noch keine Bewertungen

- The Hollow ManDokument13 SeitenThe Hollow ManAya ArmandoNoch keine Bewertungen