Beruflich Dokumente

Kultur Dokumente

An Empirical Study of Financial Performance of Mahindra and Mahindra Co. - A Comparative Analysis

Hochgeladen von

Vįňäý Ğøwđã VįñîOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

An Empirical Study of Financial Performance of Mahindra and Mahindra Co. - A Comparative Analysis

Hochgeladen von

Vįňäý Ğøwđã VįñîCopyright:

Verfügbare Formate

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 73

Volume 4, No. 3, March 2015

An Empirical Study of Financial Performance of Mahindra

and Mahindra Co. - A Comparative Analysis

Snehlata, G.C.W Bhodia Khera, Fatehabad, Haryana

ABSTRACT COMPANY PROFILE

The automobile industry has continued its growth Mahindra & Mahindra Limited (M&M) is an Indian

trajectory over the past few years. The Indian automobile multinational automobile manufacturing corporation

industry has vital role to play in the world’s automobile headquartered in Mumbai, Maharashtra, India. It is one of

market. With the increasing growth in demand on back of the largest vehicle manufacturers by production in India

rising income, expanding middle class and young and the largest seller of tractors across the world. It was

population base, large pool of skilled manpower and ranked as the 10th most trusted brand in India, by The

growing technology, will propel India to be among the Brand Trust Report, India Study 2014. It was ranked 21st

world's top five auto-producers by 2015. ‘Profit is the in the list of top companies of India in Fortune India 500

engine that drives the business enterprise”. There should in 2011. Its major competitors in the Indian market include

be enough profits to every firm or business enterprise to Maruti Suzuki, Tata Motors, Ashok Leyland, Toyota,

survive and grow in the long run. Financial analysis refers Hyundai, Mercedes-Benz (Merc) and others.

to an assessment of the viability, stability and profitability

of a business, sub-business or project. In this research Type Public

paper, ratio analysis has been done to compare the Founded 1945 (Ludhiana)

financial statements and balance sheets of Mahindra and Headquarters Mumbai, Maharashtra, India

Mahindra co. and offer suggestions for the improvement of Industry Automotive

efficiency in the company. Key people Anand Mahindra (MD)

Products Automobiles, commercial vehicles,

Keywords: two-wheelers

Advance, financial performance, Solvency, Leverage Parent Mahindra Group

Ratio. Subsidiaries Mahindra Two Wheelers limited

Ssang Yong Motor company

INTRODUCTION Website www.mahindra.com

Today a large section of people, who have minimal

financial literacy, are keen to know the financial Military Defence:

performance status of the companies where their deposits The Company has built and assembled military vehicles,

are vested. They may be as an investor, manager, commencing in 1947 with the importation of the Willys

employee, owner, lender, customer, government and Jeep that had been widely used in World War II. Its line of

public at large. Financial performance is not airily military vehicles includes the Axe. It also maintains a joint

available from the records and files in any organisation. It venture with BAE Systems, Defence Land Systems India.

has to be derived by the usage of financial statement

analysis techniques. The selection and usage of technique Consumer:

is subject to the option of the user. Some of the important Mahindra e2o, Mahindra Thar, Mahindra Bolero,

and commonly used techniques are: Ratio Analysis, Cross Mahindra Xylo, Mahindra Scorpio, Mahindra Scorpio

section analysis Comparative statement analysis, Time Getaway, Mahindra Verito, Mahindra XUV500,

series analysis, Common size analysis, and DuPont Mahindra Verito Vibe.

Analysis. The usefulness of ratios depends on skilful

interpretation and intelligence of the user. The present Farm equipment:

study is devoted to analyze the financial performance of Mahindra began manufacturing tractors for the Indian

Mahindra and Mahindra co. by using ratio analysis with a market during the early '60s. It is the top tractor company

view to give meaningful interpretations for the in the world (by volume) with annual sales totaling more

stakeholders of the selected company. than 200,000 tractors. Mahindra tractors are available in

40 countries Mahindra Tractors manufactures its products

at four plants in India, two in Mainland China, three in the

United States, and one in Australia. It has three major

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 74

Volume 4, No. 3, March 2015

subsidiaries: Mahindra USA, Mahindra (China) Tractor companies and suggested that a value-maximizing capital

Company, and Mahindra Yueda (Yancheng) Tractor structure.

Company (a joint venture with the Jiangsu Yueda Group).

In 2003, the Farm Equipment Sector of Mahindra & Hitchings (1999), in his study realized that ratio analysis

Mahindra won the Deming Application Prize and in 2007 is a sensitive and valuable tool in credit assessment which

it received the Japan Quality Medal for implementing is to forecast the ability of a borrower to meet its debt

Total Quality Management in its entire business obligations.

operations. In addition to tractors, Mahindra sells other

farm equipment. It has expanded its product-line to Zopounidis (2000) in his study proposed methodological

include farm-support services via Mahindra AppliTrac framework based on financial ratio analyses for estimating

(farm mechanisation products), Mahindra ShubhLabh small and medium size enterprises performance, Hsieh and

(seeds, crop protection, and market linkages and Wang (2001) in their study examined and stressed the

distribution), and the Samriddhi Initiative (farm need of selecting relevant financial ratios for the purpose

counseling and information services). of analysis. They proposed new approach for finding

useful financial ratio and also emphasized that industry

Energy: differs in product, in size and have its own unique business

Mahindra & Mahindra entered the energy sector in 2002, practices and internal and external environment thus

in response to growing demands for increased electric financial ratio analysis should be according to industry

power in India. Since then, more than 150,000 Mahindra which suit it the most.

Powerol engines and diesel generator sets (gensets) have

been installed in India, offering standard proper quality Dr. Sugan C.Jain (2002) in his study examined the

power, as do larger companies, in areas with arguably less performance of automobile industry. He used composite

reliable grid electricity. The inverters, batteries, and index approach to analyze the operational efficiency and

gensets are manufactured at three facilities in Pune profitability and suggested to strengthening the soundness,

(Maharashtra), Chennai (Tamil Nadu), and Delhi; and 160 profitability improvisation, working capital and in the

service points across India offer 24-7 support to most key performance of fixed assets.

markets. In 2006, it became a major market leader in the

telecom segment (and in 2011, its market share passed 45 Harrision (2003) conducted study and argued that

percent). In 2007, it won the Frost and Sullivan "Voice of financial ratio analyses are very useful. During his study

the Customer" award for best practices in telecom. he found that financial ratios analysis are also effective in

automobile industry, it guide governing body to determine

Employees: effective and efficient strategies and identify the weak

As on 31 March 2013, the company had 34,612 areas which need attention.

employees, out of which 699 were women (2%). It also

had around 16,000 temporary employees on the same date. Chen and Shimerda (1981) in their study noted that there

are 41 different financial ratios which were earlier used

REVIEW OF LITERATURE sufficiently in studies and conclude that it is difficult to

select ratio with the approximate and absolute factors

Ho and Zhu (2004) have reported that the evaluation of a loading as the representative financial ratio for the

company’s performance has been focusing the operational observed factors.

effectiveness and efficiency, which might influence the

company’s survival directly. Virtanen and Yli-Olli (1989) in their study tested the

temporal behavior of financial ratio distributions and

Furthermore, Gopinathan (2009) has presented that the found that business cycle affects the cross sectional

financial ratios analysis can spot better investment options financial ratio distributions.

for investors as the ratio analysis measures various aspects

of the performance and analyzes fundamentals of a Tippett (1990) in his study examined models financial

company or an institution. ratio in terms of stochastic processes and reveled that in

general inference normality will be the exception rather

Andrew and Schmidgall (1993) in their study classified than the rule.

financial ratios into five categories “liquidity ratios,

solvency ratios, activity ratios, profitability ratios, and STATEMENT OF PROBLEM

operating ratios”. They indicated that financial ratios

themselves do not provide valuable information about a No research is completed until it has formulated a specific

firm’s performance, Andrew (1993) in his study conducted problem. The problem of the study is to analyze the

on automobile industry investigated the leverage ratio of financial status of Mahindra and Mahindra.

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 75

Volume 4, No. 3, March 2015

OBJECTIVES OF THE STUDY Liquidity Ratios:

Liquidity Ratios are used to measure the short-term

solvency of a company. They show the ability of the

To assess the profitability.

company to quickly convert its assets into cash to pay its

To assess short and long-term solvency.

short-term debts. The higher the ratios, the more liquid the

To know the growth rate of the company in terms company and the less likely the company experience

of turnover, share capital, PAT, net worth, nets financial distress in short-term basis. To measure the

assets and investments during the study period. liquidity of a company the following ratios can be

To judge the utilization of its resources. calculated:

RESEARCH METHODOLOGY Current Ratio:

The current ratio is a liquidity and efficiency ratio that

In the present study, an attempt has been made to measure, measures a firm's ability to pay off its short-term liabilities

evaluate and compare the financial performance of with its current assets. The current ratio is an important

Mahindra and Mahindra Co. The study is based on measure of liquidity because short-term liabilities are due

secondary data that has been collected from annual reports within the next year. The ideal current ratio is 2:1 i.e.

of the respective company, magazines, journals, current assets must be twice of current liabilities. In case

documents, online database and other published this ratio is less that the ideal ratio of 2:1, the short term

information. The study covers the period of 5 years i.e. financial position is not supposed to be very sound. And in

from year 2009-10 to 2013-14. To analyze the data the case it is more than the ideal one, than it shows idleness of

standard tool ratio analysis is applied for the study for working capital. The current ratio is presented in table 3.

evaluating the financial performance and better controlling

the activities of the company. From the table 3 it has been observed that there are ups

and downs during the study period. The current ratio of

LIMITATION OF THE STUDY Mahindra and Mahindra co. is lower than the standard

norm (2:1) throughout the study period and shows the

company’s ability to pay its current liabilities is not sound

Due to constraints of time and resources, the study is

enough. The current ratio of the company for the study

likely to suffer from certain limitations. Some of these are

period are; 1.19, 1.02, .99, .97, 1.11 respectively. There is

mentioned here under so that the findings of the study may

high modulation in liquidity ratio of the bank. Hence, the

be understood in a proper perspective. The limitations of

analysis gives the exact result and provides a way to the

the study are:

management to take remedial steps to control and improve

The study is based on the secondary data and the

the extreme deviations the solvency position of the

limitation of using secondary data may affect the results.

company.

The secondary data was taken from the annual

reports of the company. It may be possible that the data

Quick Ratio/ Acid test ratio: The Quick Ratio attempts to

shown in the annual reports may be window dressed which

measure the ability of the firm to meet its obligations

does not show the actual position of the company.

relying solely on its more liquid Current Asset accounts

such as Cash and Accounts Receivable. This ratio is

DATA ANALYSIS AND FINDINGS calculated by dividing Current Assets less Inventories and

prepaid expenses by Current Liabilities. The ideal quick

The growth rate of the selected company in terms of Profit ratio is 1:1 i.e., liquid assets must be ideally equal to the

after Tax, turnover, share capital, net worth, investments, current liabilities. In case the ratio falls short of 1:1 than it

total assets are furnished in table 2. It is observed from the depicts weak short term financial position and vice versa.

table 2 that the growth rate of profit, share capital and The quick ratio of Mahindra and Mahindra co. for the

reserve & surplus over last five years are 119%, 4.31 % study period are shown in Table 3.

and 80.01% respectively.

From the table 3 it has been observed that the acid test

The financial performance of the Mahindra And Mahindra ratio of company is; .93, .77, .72, .73and .86 respectively

Co. has been analyzed by grouping the financial ratios in during the study period. This reveals the healthy sign in its

four broad categories viz; Liquidity ratios, leverage ratio solvency position because it’s financial position improving

profitability ratio and activity ratio as it is an important in last three years.

technique of financial statement analysis. They are useful

for understanding the financial position of the company. Leverage ratios:

The ratio used to calculate the financial leverage of a

company to get an idea of the company's methods of

financing or to measure its ability to meet financial

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 76

Volume 4, No. 3, March 2015

obligations. There are several different ratios, but the main the percentage of earnings paid to shareholders in

factors looked at include debt, equity, assets and interest dividends. The ratio has great importance to the

expenses. The Debt Ratio, Debt-Equity Ratio, and Equity shareholders and management. The higher the ratio, the

Multiplier are essentially three ways of looking at the better it is it means company paying more dividend to

same thing: the firm's use of debt to finance its assets. The shareholders that lead to high share price of company. The

most well known financial leverage ratio is the debt-to processed information pertaining to the Mahindra and

equity ratio (Total Debt to Owners Fund) viz. used in the Mahindra Co. is given in Table 3.

current study.

From the table 3, it is observed that the range of DP Ratio

Total Debt to Owners Fund (DER): A measure of a is 22.94, 23.80, 26.65, 26.52, and 26.32 respectively. The

company's financial leverage calculated by dividing its DP ratio is declining over the years and reduction in

total liabilities by equity stockholders. It indicates what dividends paid is looked poorly upon by investors, and the

proportion of equity and debt the company is using to stock price usually depreciates as investors seek other

finance its assets. It measures the long term solvency of dividend-paying stocks.

the firm. Normally DER of 2:3 or 0.67 is considered as

satisfactory. The Total Debt to Owners Fund is shown in ROI (return on shareholder investment): this ratio has

Table 3. great importance to the present and prospective

shareholders as well as management of the company. As

From the table 3, The Total Debt to Owners Fund of this ratio reveals how well the resources of the company

Mahindra and Mahindra is .22, .22, .26, .23 and .37 are being used, higher the ratio, better are the results. It

respectively for the study period. By analyzing these gives an idea about prosperity, growth or deterioration in

figures it is clear that the company is not highly levered. A the company’s profitability and efficiency. The ROI of

firm can use more debt in there capital structure to Mahindra and Mahindra co. for the study period are shown

increase the earning of firm. in Table 3.

Profitability Ratios: From the table 3 it has been observed that the ROI ratio of

A profitability ratio is a measure of profitability, which is company is; 22.38, 22.87, 23.65, 25.81 and 26.74. Position

a way to measure a company's performance. It can be of the company was not good as the ratio decline year by

derived by either on sales or investments. Profitability is year.

simply the capacity to make a profit, and a profit is what is

left over from Income earned after deducted all costs and Activity Ratios:

expenses related to earning the income. In this study EPS, Activity ratios measure the efficiency or effectiveness with

Dividend pay out, ROI has been used to assess the which a firm manages its resources or assets. These are

profitability of the company. The processed information also known as turnover ratios because they indicate the

regarding these ratios has been furnished in Table 3. speed with which assets are converted or turned into sales

or generating revenues, cash, etc. from its resources. These

EPS (Earning Per Share): Earnings per share is generally includes debtor turnover ratio, inventory ratio and total

considered to be a vital variable in determining a share's assets turnover ratio. But in this paper Asset Turnover

price. It is also a major component used to calculate the Ratio and Total Assets Turnover Ratio were applied to test

price-to-earnings valuation ratio i.e. whether the company the effectiveness of the company.

is able to use its equity share capital effectively while

comparing with other companies in the industry. It is the Asset Turnover Ratio: The Asset Turnover ratio is an

portion of a company's profit allocated to each outstanding indicator of the efficiency with which a company is

share of common stock. Earnings per share serve as an deploying its assets. In other words, the amount of sales or

indicator of a company's profitability. revenues generated per unit of assets. It can be said that

the higher the ratio, the better it is, since it implies the

From table 3, it is observed that the growth of profit after company is generating more revenues per unit of assets.

tax is excellent throughout the study period. And EPS has The statistics regarding Asset turnover ratio is enlisted in

amplified from 36.89 to 61.02. Hence it can be inferred table 3.

that the company’s overall performance is quite good over

the years in effective utilization of its equity share capital. From table 3, it is observed that the range of Asset

While looking at EPS of the company, it is clear that it is Turnover Ratio of Mahindra and Mahindra co. is 2.11,

increasing progressively during the study period. 2.43, 2.28, 2.01 and 1.85 respectively which are increasing

and decline during study period and not a good sign.

Dividend Payout Ratio: The DP ratio provides an idea of

how well earnings support the dividend payments. More Total Assets Turnover Ratios: The Total Assets Turnover

mature companies tend to have a higher payout ratio. It is Ratio is a financial ratio that measures the efficiency of a

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 77

Volume 4, No. 3, March 2015

company's use of its assets in making sales revenue. This The DER is quite low the firm can increase their

ratio considers all assets, current and fixed. Those assets debts in the capital structure to avail the benefits of

include fixed assets, like plant and equipment, as well as borrowed funds.

inventory, accounts receivable, as well as any other A consistent improvement in the EPS figure year

current assets. The lower the total asset turnover ratio, as after year from 36.89 to 61.02 is the indication of

compared to historical data for the firm and industry data, continuous improvement in the earning power of

the more sluggish the firm's sales. This may indicate a the company. This increasing EPS is the sign of

problem with one or more of the asset categories higher earnings, strong financial position and,

composing total assets - inventory, receivables, or fixed therefore, a reliable firm to invest money.

assets. The Total Assets Turnover Ratio of Mahindra and Asset turnover ratio should be looked at together

Mahindra co. is shown in table 3. with the company's financing mix and its profit

margin for a better analysis. A lower turnover ratio

From the table 3, it is clear that the Total Assets Turnover means that the company is not using its assets

Ratio of the company is 1.99, 2.29, 2.11, 1.88 and 1.74 optimally.

respectively for the study period. This means the There should be a steady stream of sustainable

efficiency of the management has been improved a lot in dividends from a company, the dividend payout

last four years but in fifth year total asset turnover ratio ratio analysis is important. A consistent trend in this

decline that require management to pay attention to ratio is usually more important than a high or low

control on operations. ratio. Bank has fallen a percentage each year for the

last five years might indicate that the company can

FINDINGS AND SUGGESTIONS: no longer afford to pay such high dividends. This

could be an indication of poor operating

After the study of the components of current assets & performance.

current liabilities and the trends of working capital, it was

found that: Table 1: Share capital of Mahindra and Mahindra co.

The liquidity position of the company is not good. as on 31st March, 2014

The current ratio is below (current liabilities exceed Details Amount ( Rs. Crores)

current assets) for the study period, then the bank Authorized Share 600

may have problems paying its bills on time. capital

However, low values do not indicate a critical Issued and paid up 295.16

problem but should concern the management. capital

Table 2: Growth of Mahindra and Mahindra co. (Rs. Crores)

Years 2013-14 2012-13 2011-12 2010-11 2009-10

Total Assets 20,536.35 17,885.99 15,345.31 12,634.49 10,698.71

Equity Share Capital 295.16 295.16 294.52 293.62 282.95

Reserves & surplus 16,496.03 14,363.76 11,876.57 10,019.75 7,527.60

P/L Before Tax 4,369.43 4,447.09 3,605.89 3,519.61 2,774.26

Tax 611.08 1,094.27 727.00 857.51 759.00

P/L After Tax from Ordinary Activities 3,758.35 3,352.82 2,878.89 2,662.10 2,087.75

EPS 61.02 54.61 46.89 43.36 36.89

Investments 11,379.85 11,833.46 10,310.46 8,925.63 6,398.02

Net Worth 16,791.19 14,658.92 12,171.09 10,313.39 7,818.56

Table 3: Various Ratios of Mahindra and Mahindra co.

Years 2013-14 2012-13 2011-12 2010-11 2009-10

Current Ratio 1.19 1.02 .99 .97 1.11

Quick Ratio .93 .77 .72 .73 .86

Total debt to owner’s fund(DER) .22 .22 .26 .23 .37

EPS 61.02 54.61 46.89 43.36 36.89

Dividend Payout Ratio 22.94 23.80 26.65 26.52 26.32

ROI 22.38 22.87 23.65 25.81 26.74

Asset Turnover Ratio 2.11 2.43 2.28 2.01 1.85

Total Assets Turnover Ratios 1.99 2.29 2.11 1.88 1.74

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 78

Volume 4, No. 3, March 2015

Table 4: Standalone Profit & Loss account ------------------- in Rs. Cr. ------------

Mar '14 Mar '13 Mar '12 Mar '11 Mar '10

Income

Sales Turnover 40,508.50 40,441.16 31,853.52 23,460.26 20,323.63

Excise Duty 0.00 0.00 0.00 0.00 1,807.30

Net Sales 40,508.50 40,441.16 31,853.52 23,460.26 18,516.33

Other Income 770.78 639.79 574.06 551.63 285.09

Stock Adjustments 274.67 87.31 597.33 202.23 23.69

Total Income 41,553.95 41,168.26 33,024.91 24,214.12 18,825.11

Expenditure

Raw Materials 29,889.44 30,675.27 24,258.94 16,604.88 12,461.56

Power & Fuel Cost 221.35 206.39 175.78 143.93 120.97

Employee Cost 2,163.72 1,866.45 1,701.78 1,431.52 1,199.85

Other Manufacturing Expenses 0.00 0.00 0.00 0.00 96.92

Selling and Admin Expenses 0.00 0.00 0.00 0.00 1,439.26

Miscellaneous Expenses 3,787.45 3,071.06 2,543.63 2,027.83 264.21

Preoperative Exp Capitalised 0.00 0.00 0.00 0.00 -59.55

Total Expenses 36,061.96 35,819.17 28,680.13 20,208.16 15,523.22

Operating Profit 4,721.21 4,709.30 3,770.72 3,454.33 3,016.80

PBDIT 5,491.99 5,349.09 4,344.78 4,005.96 3,301.89

Interest 259.22 191.19 162.75 72.49 156.85

PBDT 5,232.77 5,157.90 4,182.03 3,933.47 3,145.04

Depreciation 863.34 710.81 576.14 413.86 370.78

Other Written Off 0.00 0.00 0.00 0.00 0.00

Profit Before Tax 4,369.43 4,447.09 3,605.89 3,519.61 2,774.26

Extra-ordinary items 0.00 0.00 0.00 0.00 72.49

PBT (Post Extra-ord Items) 4,369.43 4,447.09 3,605.89 3,519.61 2,846.75

Tax 611.08 1,094.27 727.00 857.51 759.00

Reported Net Profit 3,758.35 3,352.82 2,878.89 2,662.10 2,087.75

Total Value Addition 6,172.52 5,143.90 4,421.19 3,603.28 3,061.66

Preference Dividend 0.00 0.00 0.00 0.00 0.00

Equity Dividend 862.25 798.17 767.48 706.08 549.52

Corporate Dividend Tax 104.04 92.98 101.13 96.56 74.23

Per share data (annualised)

Shares in issue (lakhs) 6,158.92 6,139.81 6,139.75 6,139.40 5,659.08

Earning Per Share (Rs) 61.02 54.61 46.89 43.36 36.89

Equity Dividend (%) 280.00 260.00 250.00 230.00 190.00

Book Value (Rs) 272.63 238.75 198.23 167.99 138.02

Source: Dion Global Solutions Limited

Table 5: Standalone Balance Sheet ------------------- in Rs. Cr. ---------------

Mar '14 Mar '13 Mar '12 Mar '11 Mar '10

Sources Of Funds

Total Share Capital 295.16 295.16 294.52 293.62 282.95

Equity Share Capital 295.16 295.16 294.52 293.62 282.95

Share Application Money 0.00 0.00 0.00 0.02 8.01

Preference Share Capital 0.00 0.00 0.00 0.00 0.00

Reserves 16,496.03 14,363.76 11,876.57 10,019.75 7,527.60

Net worth 16,791.19 14,658.92 12,171.09 10,313.39 7,818.56

Secured Loans 294.10 266.67 400.18 407.23 602.45

Unsecured Loans 3,451.06 2,960.40 2,774.04 1,913.87 2,277.70

Total Debt 3,745.16 3,227.07 3,174.22 2,321.10 2,880.15

Total Liabilities 20,536.35 17,885.99 15,345.31 12,634.49 10,698.71

Application Of Funds

Gross Block 10,242.58 8,602.96 7,502.36 5,858.26 4,866.18

i-Explore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 79

Volume 4, No. 3, March 2015

Less: Revaluation Reserves 0.00 0.00 0.00 0.00 11.67

Less: Accum. Depreciation 4,365.63 3,645.10 3,216.34 2,725.35 2,537.77

Net Block 5,876.95 4,957.86 4,286.02 3,132.91 2,316.74

Capital Work in Progress 1,228.44 863.48 794.73 773.68 1,374.31

Investments 11,379.85 11,833.46 10,310.46 8,925.63 6,398.02

Inventories 2,803.63 2,419.77 2,358.39 1,694.21 1,188.78

Sundry Debtors 2,509.84 2,208.35 1,988.36 1,260.31 1,258.08

Cash and Bank Balance 2,950.39 1,781.41 1,188.43 614.64 475.17

Total Current Assets 8,263.86 6,409.53 5,535.18 3,569.16 2,922.03

Loans and Advances 4,539.55 3,389.26 2,985.59 3,138.40 2,034.47

Fixed Deposits 0.00 0.00 0.00 0.00 1,268.06

Total CA, Loans & 12,803.41 9,798.79 8,520.77 6,707.56 6,224.56

Advances

Deferred Credit 0.00 0.00 0.00 0.00 0.00

Current Liabilities 8,678.28 7,662.13 6,721.40 5,223.75 3,822.50

Provisions 2,074.02 1,905.47 1,845.27 1,681.54 1,796.54

Total CL & Provisions 10,752.30 9,567.60 8,566.67 6,905.29 5,619.04

Net Current Assets 2,051.11 231.19 -45.90 -197.73 605.52

Miscellaneous Expenses 0.00 0.00 0.00 0.00 4.12

Total Assets 20,536.35 17,885.99 15,345.31 12,634.49 10,698.71

Contingent Liabilities 6,421.09 87.20 2,307.66 1,893.85 2,307.70

Book Value (Rs) 272.63 238.75 198.23 167.99 138.02

Source: Dion Global Solutions Limited

REFERENCES

[5] Mittal, R.K: “Management Accounting & Financial

[1] Khan, M.Y. and Jain, P.K. “Financial Accounting,” V.K Publication.

management”, sixth edition, Tata Mc-Grawhill [6] Annual reports of Mahindra and Mahindra co. from

Publishing company Ltd. 2009 to 2014.

[2] Pandey, I. M. (IIMA),”Financial Management

(theory and practices)”. Websites

[3] R. P. Rustugi: “Financial management”. www.moneycontrol.com

[4] Gupta, Shashi K.and Sharma, R.K, “Management www.mahindra.com

Accounting- Principles & Practises,” Kalyani www.wikipedio.com

Publishers, Ludhiana, New Delhi. www.slideshare.com

i-Explore International Research Journal Consortium www.irjcjournals.org

Das könnte Ihnen auch gefallen

- Model answer: Launching a new business in Networking for entrepreneursVon EverandModel answer: Launching a new business in Networking for entrepreneursNoch keine Bewertungen

- Financial Performance of Indian Automobile Companies: January 2018Dokument7 SeitenFinancial Performance of Indian Automobile Companies: January 2018DebitCredit Accounts LearningNoch keine Bewertungen

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItVon EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNoch keine Bewertungen

- Financial Performance in Maruti SuzukiDokument8 SeitenFinancial Performance in Maruti Suzukikms195kds2007Noch keine Bewertungen

- EXPLORING KEY FACTORS THAT INFLUENCE TALENT MANAGEMENTVon EverandEXPLORING KEY FACTORS THAT INFLUENCE TALENT MANAGEMENTNoch keine Bewertungen

- Financial Performance Analysis of Maruti SuzukiDokument8 SeitenFinancial Performance Analysis of Maruti Suzukishivam singhNoch keine Bewertungen

- Industry 5.0: Mastering AI for Smart Manufacturing ExcellenceVon EverandIndustry 5.0: Mastering AI for Smart Manufacturing ExcellenceNoch keine Bewertungen

- Financial Performance in Maruti Suzuki: August 2019Dokument8 SeitenFinancial Performance in Maruti Suzuki: August 2019shivam singhNoch keine Bewertungen

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessVon EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNoch keine Bewertungen

- International Investments AnalysisDokument13 SeitenInternational Investments AnalysisBogles Paul-AdrianNoch keine Bewertungen

- Aman MISDokument15 SeitenAman MISAli AhmadNoch keine Bewertungen

- B2B MarketingDokument14 SeitenB2B MarketingAshok KumarNoch keine Bewertungen

- Business Strategy: A Case Study of Auto Giant Mahindra & Mahindra LTDDokument5 SeitenBusiness Strategy: A Case Study of Auto Giant Mahindra & Mahindra LTDGulatiNoch keine Bewertungen

- Supply Chain Management of Mahindra Automobile: A Project Report OnDokument19 SeitenSupply Chain Management of Mahindra Automobile: A Project Report OnSumedh BhagwatNoch keine Bewertungen

- Supplier development at Maruti Suzuki IndiaDokument15 SeitenSupplier development at Maruti Suzuki Indiasps fetrNoch keine Bewertungen

- Supplier Development in the Indian Auto Industry: A Case Study of Maruti Suzuki India LimitedDokument15 SeitenSupplier Development in the Indian Auto Industry: A Case Study of Maruti Suzuki India LimitedITR 2017Noch keine Bewertungen

- Mahindra&mahindraDokument95 SeitenMahindra&mahindraAshik R GowdaNoch keine Bewertungen

- Report Format SipaDokument23 SeitenReport Format SipaBeastly BNoch keine Bewertungen

- Hindra G Mahindra & Ma Roup: Presented By:-Wasim AkramDokument61 SeitenHindra G Mahindra & Ma Roup: Presented By:-Wasim AkramKavyaNoch keine Bewertungen

- Second Help of Eco AssignmentDokument15 SeitenSecond Help of Eco AssignmentITR 2017Noch keine Bewertungen

- Buisness Valuation Final PresentationDokument13 SeitenBuisness Valuation Final PresentationJoydeep GoraiNoch keine Bewertungen

- Mahindra Group's Strategic Business Units, Companies and SWOT AnalysisDokument61 SeitenMahindra Group's Strategic Business Units, Companies and SWOT AnalysisShazz532Noch keine Bewertungen

- A Comparative Study of Mahindra and ToyotaDokument28 SeitenA Comparative Study of Mahindra and ToyotaShashank Agrawal0% (1)

- Mahindra and Mahindra WST SchemeDokument50 SeitenMahindra and Mahindra WST Schemeohsagar20000% (1)

- Mahindra and Mahindra Report-2021Dokument30 SeitenMahindra and Mahindra Report-2021Àñshùl Ràñgárí100% (2)

- RaneDokument30 SeitenRaneHEMANTH CHANDRASHEKARNoch keine Bewertungen

- Case Study Mahindra PDFDokument18 SeitenCase Study Mahindra PDFGourav ChoudhuryNoch keine Bewertungen

- A Study On Analysis of Product Positioning Strategies of Different Models of HyundaiDokument8 SeitenA Study On Analysis of Product Positioning Strategies of Different Models of HyundaiAlbin LawrenceNoch keine Bewertungen

- Mahindra GroupDokument31 SeitenMahindra GroupShubham GuptaNoch keine Bewertungen

- A Study On Financial Analysis of Automobile IndustriesDokument6 SeitenA Study On Financial Analysis of Automobile IndustriesKshama KadwadNoch keine Bewertungen

- MahindraDokument15 SeitenMahindraAbhay KNoch keine Bewertungen

- MahindraDokument21 SeitenMahindraAnonymous ty7mAZNoch keine Bewertungen

- Mahindra & MahindraDokument6 SeitenMahindra & MahindraAbhishek MishraNoch keine Bewertungen

- Mahindra MahindraDokument6 SeitenMahindra Mahindravedant tyagiNoch keine Bewertungen

- Consumer behaviour research in automobile industryDokument16 SeitenConsumer behaviour research in automobile industryshakti shankerNoch keine Bewertungen

- Executive SummaryDokument3 SeitenExecutive SummaryAmar VamanNoch keine Bewertungen

- Legal Aspects FinanceDokument52 SeitenLegal Aspects FinanceManish JaiswalNoch keine Bewertungen

- Mahindra RiseDokument13 SeitenMahindra RiseAnushka SharmaNoch keine Bewertungen

- Analysis of Mahindra and Mahindra and Its Subsidiary CompaniesDokument12 SeitenAnalysis of Mahindra and Mahindra and Its Subsidiary CompaniesPratap SinghNoch keine Bewertungen

- MSIL's Marketing Strategies and PerformanceDokument31 SeitenMSIL's Marketing Strategies and PerformanceneonstaNoch keine Bewertungen

- Analysis of Mahindra and Mahindra and Its Subsidiary CompaniesDokument12 SeitenAnalysis of Mahindra and Mahindra and Its Subsidiary CompaniesMd MajidNoch keine Bewertungen

- Final (1)Dokument70 SeitenFinal (1)koolvansh692Noch keine Bewertungen

- Force One Vs Other SUVsDokument11 SeitenForce One Vs Other SUVsarpit_saraswat89Noch keine Bewertungen

- Analysis of Mahindra and Mahindra and Its Subsidiary CompaniesDokument12 SeitenAnalysis of Mahindra and Mahindra and Its Subsidiary CompaniesAyush RajputNoch keine Bewertungen

- A Study On Organisational Culture and It's Impact On Employees' Behaviour in Automobile IndustryDokument4 SeitenA Study On Organisational Culture and It's Impact On Employees' Behaviour in Automobile IndustrysreejithNoch keine Bewertungen

- A Study On Organisational Culture and It's Impact On Employees' Behaviour in Automobile IndustryDokument4 SeitenA Study On Organisational Culture and It's Impact On Employees' Behaviour in Automobile Industryrohith aradhyaNoch keine Bewertungen

- Mahindra & Mahindra Limited (M&M) Is An IndianDokument4 SeitenMahindra & Mahindra Limited (M&M) Is An IndianChanthru viswaNoch keine Bewertungen

- Marketing Strategies of Mahindra TractorsDokument62 SeitenMarketing Strategies of Mahindra TractorsAnil Puniya90% (10)

- 2 9 40 367 PDFDokument7 Seiten2 9 40 367 PDFAnish BhatNoch keine Bewertungen

- Mahindra Rise Case StudyDokument19 SeitenMahindra Rise Case Studylalitprrasadsingh100% (1)

- Creating Value From WasteDokument11 SeitenCreating Value From WastePooja SharmaNoch keine Bewertungen

- Fundamental Analysis For Investment Decisions On TWO AUTOMOBILE COMPANIES 25Dokument14 SeitenFundamental Analysis For Investment Decisions On TWO AUTOMOBILE COMPANIES 25Ramesh KumarNoch keine Bewertungen

- Marketing Strategies of Mahindra TractorsDokument62 SeitenMarketing Strategies of Mahindra TractorssurjitNoch keine Bewertungen

- 1-9 A Fundamental Analysis of Indian Automobile Industry With Special Reference To Tata, Maruti & Mahindra & MahindraDokument10 Seiten1-9 A Fundamental Analysis of Indian Automobile Industry With Special Reference To Tata, Maruti & Mahindra & MahindraharryNoch keine Bewertungen

- Marketing Management 1Dokument10 SeitenMarketing Management 1NIKHIL NAIRNoch keine Bewertungen

- Project On Work Environment in Hero HondaDokument80 SeitenProject On Work Environment in Hero HondaMahesh BabuNoch keine Bewertungen

- A Study On Finanacial Analysis of Hero Motocorp LimitedDokument6 SeitenA Study On Finanacial Analysis of Hero Motocorp LimitedVivek NambiarNoch keine Bewertungen

- Auto TrendsDokument9 SeitenAuto TrendsDemi GodNoch keine Bewertungen

- Marketing Strategy Adopted by Mahindra ScorpioDokument80 SeitenMarketing Strategy Adopted by Mahindra ScorpioManuj Singh100% (3)

- SDM Project FinalDokument9 SeitenSDM Project Finalanon_700727161Noch keine Bewertungen

- Job Description HR PositionDokument1 SeiteJob Description HR PositionVįňäý Ğøwđã VįñîNoch keine Bewertungen

- Summary O. F Findings, Conclusion: and SuggestionsDokument18 SeitenSummary O. F Findings, Conclusion: and SuggestionsVįňäý Ğøwđã VįñîNoch keine Bewertungen

- Job Description (Accountant)Dokument1 SeiteJob Description (Accountant)Vįňäý Ğøwđã VįñîNoch keine Bewertungen

- Job Description - Paraplanning - AUDokument2 SeitenJob Description - Paraplanning - AUVįňäý Ğøwđã VįñîNoch keine Bewertungen

- Bank Loan and Advances: Antidote For Restructuring The Agricultural Sector in Nigeria, 1985-2012Dokument10 SeitenBank Loan and Advances: Antidote For Restructuring The Agricultural Sector in Nigeria, 1985-2012Vįňäý Ğøwđã VįñîNoch keine Bewertungen

- Bindhu Title Pages 1-5 PDFDokument4 SeitenBindhu Title Pages 1-5 PDFVįňäý Ğøwđã VįñîNoch keine Bewertungen

- Drive 61 MuthootDokument3 SeitenDrive 61 MuthootVįňäý Ğøwđã VįñîNoch keine Bewertungen

- HR Staffing Coordinator - Job DescriptionDokument1 SeiteHR Staffing Coordinator - Job DescriptionVįňäý Ğøwđã VįñîNoch keine Bewertungen

- Nandni & Arun KUmar PDFDokument2 SeitenNandni & Arun KUmar PDFVįňäý Ğøwđã VįñîNoch keine Bewertungen

- Digital India and Its Impact On The SocietyDokument7 SeitenDigital India and Its Impact On The SocietyRenuka SharmaNoch keine Bewertungen

- Drive 61 MuthootDokument3 SeitenDrive 61 MuthootVįňäý Ğøwđã VįñîNoch keine Bewertungen

- McKinsey 7S Framework of Analysis ForDokument4 SeitenMcKinsey 7S Framework of Analysis Forkktpradeep50% (2)

- Janalakshmi Annual Report Highlights Strong Growth and Focus on Human CapitalDokument156 SeitenJanalakshmi Annual Report Highlights Strong Growth and Focus on Human CapitalAdityaDhanrajSinghNoch keine Bewertungen

- Pillar 3 Disclosures (Consolidated) : As On 31.03.2018Dokument27 SeitenPillar 3 Disclosures (Consolidated) : As On 31.03.2018Vįňäý Ğøwđã VįñîNoch keine Bewertungen

- A Comparative Analysis of Loans and Advances in Selected Urban Co-Operative BanksDokument12 SeitenA Comparative Analysis of Loans and Advances in Selected Urban Co-Operative BanksHiren ChauhanNoch keine Bewertungen

- Review of The Literature: Chapter - IIIDokument10 SeitenReview of The Literature: Chapter - IIIVįňäý Ğøwđã VįñîNoch keine Bewertungen

- BankerVerificationLetter PDFDokument1 SeiteBankerVerificationLetter PDFVįňäý Ğøwđã VįñîNoch keine Bewertungen

- SBI AGM Notice 2018Dokument1 SeiteSBI AGM Notice 2018Vįňäý Ğøwđã VįñîNoch keine Bewertungen

- Notice For Savings Account Interest RateDokument1 SeiteNotice For Savings Account Interest RateVįňäý Ğøwđã VįñîNoch keine Bewertungen

- FAQsDokument5 SeitenFAQsSāĦılKukrējāNoch keine Bewertungen

- Financial Structure Analysis of Indian Companies Literature ReviewDokument9 SeitenFinancial Structure Analysis of Indian Companies Literature ReviewVįňäý Ğøwđã VįñîNoch keine Bewertungen

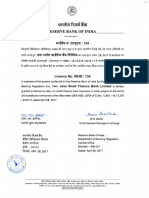

- RBI Approved BankDokument1 SeiteRBI Approved BankVįňäý Ğøwđã VįñîNoch keine Bewertungen

- Job Description NRLM PDFDokument1 SeiteJob Description NRLM PDFVįňäý Ğøwđã VįñîNoch keine Bewertungen

- Deng401 Advanced Communication Skills PDFDokument274 SeitenDeng401 Advanced Communication Skills PDFVįňäý Ğøwđã VįñîNoch keine Bewertungen

- Deng401 Advanced Communication Skills PDFDokument274 SeitenDeng401 Advanced Communication Skills PDFVįňäý Ğøwđã VįñîNoch keine Bewertungen

- Synopsis of Companies Act, 2013Dokument10 SeitenSynopsis of Companies Act, 2013Ankit Srivastava0% (1)

- AAT Paper 2 FinanceDokument4 SeitenAAT Paper 2 FinanceRay LaiNoch keine Bewertungen

- Hindenburg Research Report On AdaniDokument5 SeitenHindenburg Research Report On Adanikuljeetsingh2789Noch keine Bewertungen

- Mechanics of Currency Dealing and Exchange Rate QuotationsDokument6 SeitenMechanics of Currency Dealing and Exchange Rate Quotationsvijayadarshini vNoch keine Bewertungen

- 4 Bir Ruling 370 2011Dokument13 Seiten4 Bir Ruling 370 2011Isabella GamuloNoch keine Bewertungen

- World Transfer Pricing 2016Dokument285 SeitenWorld Transfer Pricing 2016Hutapea_apynNoch keine Bewertungen

- Starting a Chocolate Company Business PlanDokument26 SeitenStarting a Chocolate Company Business PlanYummy Choc83% (6)

- Internship Report On: "Investment Modes and Mechanism of Islami Bank Bangladesh Limited" A Study at Uttara BranchDokument36 SeitenInternship Report On: "Investment Modes and Mechanism of Islami Bank Bangladesh Limited" A Study at Uttara Branchminhaz abirNoch keine Bewertungen

- Final 2022 Budget Call CircularDokument44 SeitenFinal 2022 Budget Call CircularShadreck MaxwellNoch keine Bewertungen

- OpTransactionHistory13 06 2020Dokument2 SeitenOpTransactionHistory13 06 2020MssNoch keine Bewertungen

- What Is Wholesale Banking ?Dokument10 SeitenWhat Is Wholesale Banking ?Anonymous So5qPSnNoch keine Bewertungen

- INVOICE-SummaryDokument1 SeiteINVOICE-SummaryManis KmrNoch keine Bewertungen

- Chapter 1.1 Why Study Money Banking and Financial Markets Sv3.0Dokument27 SeitenChapter 1.1 Why Study Money Banking and Financial Markets Sv3.0Linh AhNoch keine Bewertungen

- O.M Scoott and Sons Case Study HarvardDokument6 SeitenO.M Scoott and Sons Case Study Harvardnicole rodríguezNoch keine Bewertungen

- Entrepreneurship Unit 3Dokument10 SeitenEntrepreneurship Unit 3Mohammad NizamudheenpNoch keine Bewertungen

- Earnings Statement: Pay Period Hours and EarningsDokument1 SeiteEarnings Statement: Pay Period Hours and EarningsAileen StuerNoch keine Bewertungen

- Kaplan Constructed Response Workshop on Equity and Fixed Income Portfolio ManagementDokument16 SeitenKaplan Constructed Response Workshop on Equity and Fixed Income Portfolio Managementhammad haqNoch keine Bewertungen

- RFPDokument9 SeitenRFPSanjayThakkarNoch keine Bewertungen

- Baby Bulls Mega Sectoral AnalysisDokument10 SeitenBaby Bulls Mega Sectoral Analysisdaddyyankee995Noch keine Bewertungen

- 10 Best Practices For Implementing New GLDokument51 Seiten10 Best Practices For Implementing New GLraghu100% (3)

- Msci World Small Cap IndexDokument3 SeitenMsci World Small Cap IndexrichardsonNoch keine Bewertungen

- Receipt 32Dokument1 SeiteReceipt 32Angga DwiNoch keine Bewertungen

- The Banking Companies Rules 1963Dokument4 SeitenThe Banking Companies Rules 1963Jia BilalNoch keine Bewertungen

- Macroeconomics Canadian 6th Edition Abel Test BankDokument25 SeitenMacroeconomics Canadian 6th Edition Abel Test BankNancyWilliamsoeyskxcn100% (50)

- BankingWeb3 - Lecture 2Dokument38 SeitenBankingWeb3 - Lecture 2jk.hoipan.kNoch keine Bewertungen

- 1962 - Malkiel - Expectations, Bond Prices, and The Term Structure of Interest RatesDokument23 Seiten1962 - Malkiel - Expectations, Bond Prices, and The Term Structure of Interest Ratesjoydiv4Noch keine Bewertungen

- Question Bank Series: (Class - 2)Dokument13 SeitenQuestion Bank Series: (Class - 2)Abhijit HoroNoch keine Bewertungen

- Chapter 3 - Investment Appraisal - DCFDokument37 SeitenChapter 3 - Investment Appraisal - DCFInga ȚîgaiNoch keine Bewertungen

- Quotation for Safety ShoesDokument2 SeitenQuotation for Safety ShoesAlbert LioeNoch keine Bewertungen

- FAR Handout Depreciation Part 2Dokument7 SeitenFAR Handout Depreciation Part 2Chesca Marie Arenal Peñaranda100% (1)

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EVon EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EBewertung: 4.5 von 5 Sternen4.5/5 (6)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 3.5 von 5 Sternen3.5/5 (8)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Von EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Bewertung: 4.5 von 5 Sternen4.5/5 (86)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthVon EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNoch keine Bewertungen

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistVon EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistBewertung: 4.5 von 5 Sternen4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsVon EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNoch keine Bewertungen

- Financial Risk Management: A Simple IntroductionVon EverandFinancial Risk Management: A Simple IntroductionBewertung: 4.5 von 5 Sternen4.5/5 (7)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 4.5 von 5 Sternen4.5/5 (18)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityVon EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Von EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingVon EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingBewertung: 4.5 von 5 Sternen4.5/5 (17)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Product-Led Growth: How to Build a Product That Sells ItselfVon EverandProduct-Led Growth: How to Build a Product That Sells ItselfBewertung: 5 von 5 Sternen5/5 (1)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorVon EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNoch keine Bewertungen

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialBewertung: 4.5 von 5 Sternen4.5/5 (32)

- Key Performance Indicators: Developing, Implementing, and Using Winning KPIsVon EverandKey Performance Indicators: Developing, Implementing, and Using Winning KPIsNoch keine Bewertungen

- Corporate Strategy: A Handbook for EntrepreneursVon EverandCorporate Strategy: A Handbook for EntrepreneursBewertung: 4 von 5 Sternen4/5 (1)

- LLC or Corporation?: Choose the Right Form for Your BusinessVon EverandLLC or Corporation?: Choose the Right Form for Your BusinessBewertung: 3.5 von 5 Sternen3.5/5 (4)

- The Fundraising Strategy Playbook: An Entrepreneur's Guide To Pitching, Raising Venture Capital, and Financing a StartupVon EverandThe Fundraising Strategy Playbook: An Entrepreneur's Guide To Pitching, Raising Venture Capital, and Financing a StartupNoch keine Bewertungen

- Startup Money Made Easy: The Inc. Guide to Every Financial Question About Starting, Running, and Growing Your BusinessVon EverandStartup Money Made Easy: The Inc. Guide to Every Financial Question About Starting, Running, and Growing Your BusinessBewertung: 4.5 von 5 Sternen4.5/5 (9)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 5 von 5 Sternen5/5 (2)

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionVon EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionBewertung: 5 von 5 Sternen5/5 (3)