Beruflich Dokumente

Kultur Dokumente

Representatives: Preliminary Information - Answer Each of These Questions

Hochgeladen von

brookewilliamsOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Representatives: Preliminary Information - Answer Each of These Questions

Hochgeladen von

brookewilliamsCopyright:

Verfügbare Formate

i! I I_ I i i i i ,.

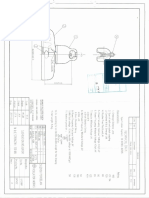

' UNITED STATES HOUSE OF REPRESENTATIVES FORM A Page1 of 21 " ; .......

' ]nl]l_]l-

"'"" "]i-_TI_i

....... .....

FINANCIAL DISCLOSURE STATEMENT FOR

I

CALENDAR YEAR 2002 For Use by Members,

I

officers,

I

and

I

employ_

I

_ uJ_JC.JJt V Jl_J _]_D

; ' MARY BONO • .E_!IS{.AT/VE

RESOURCE

tJENTER_

LC)

_) 64505 VIA AMANTE PALM SPRINGS, (FullName)

CA 92264 (202) 225-5330 ZOO3._Ay 15 A_0t2 _ /t.tc....-

(Mal[ing Address) Daytime Telephone: ,' o ,+ ',,_'t'..l_=..0_l:l_LOt_l_t "

.......... - -" "'T_'" vr t_t-P'/tESE_TATI:

Filer [] Member of the U.S. State: CA [] Officer Or Employing Office A $200 penalty shall-"

Status House of Representative District: 44 Employee HR MEMBER SERVICES be assessed against

anyone who files

+ Report Termination Date: more than 30 days i_

t [] Annual(May15) U Amendment [] Termination late.

i Type

i PRELIMINARY INFORMATION -- ANSWER EACH OF THESE QUESTIONS

i I I II T I I III

+ Did you or your spouse have "earned" Income (e.g., salaries or fees) of Did you, your spouse, or a dependent child receive any reportable gift In

f I. $200 or more from any source ln the reportlng podod? Yes [] No [] VI. ths raportlng podod (I.e., aggregaflng more than $285 and not otherwlse Yes [] No []

exempt)?

If yes, complete and attach Schedule I. If yes, complete and attach Schedule V!.

Did any Individual or organization make a donation to charity in lieu of Did you, your spouse, or a dependent child receive any reportable travel

m II. paying you for a speech, appearance, or article in the reporting period? Yes [] No [] VII. or reimbursements for travel In the reporting porlod (worth morethan Yes [] No []

$285 from one source)?

If yes, complete and attach Schedule II. If yes, complete and attach Schedule VII,

Did you, your spouse, or a dependent child receive "unearned" Income of Did you hold any reportable positions on or before the data Of filing In the

II1' more than $2001n the reportlng pedod or hold any reportable asset worth Yes [] No [] VIII. currsntcalendaryear? Yes [] No []

more than $t,000 at the end of the period?

If yes, complete and attach Schedule III. If yes, complete and attach Schedule VIII.

Did you, your spouse, or dependent child purchase, sell, or exchange any Did you have any reportable agreement or arrangement with an outside

IV. reportsbleassetlnetransactlonexcsedlng$t,000dudngthereporUng Yes [] No [] IX. entity? Yes [] No []

_erlod?

yes, complete and attach Schedule IV. If yes, complete and attach Schedule IX.

Did you, your spouse, or a dependent child have any reportable liability

V. (more than $10,000) during the reporting period? Yes [] No [] Each question in this part must be answered and the

If)tee, co, rnplete and attach Schedule V. appropriate schedule attached for each "Yes" response.

EXCLUSION OF SPOUSE, DEPENDENT, ORTRUST INFORMATION-- ANSWER EACH OF THESE QUESTIONS I I I I I

Trusts- Details regarding "Qualified Blind Trusts" approved by the Committee on Standards of Official Conduct and certain other "excepted

trusts" need not be disclosed. Have you excluded from this report details of such a trust benefiting you, your spouse, or dependent Yes [] No []

child?

Exemptions-- Have you excluded from this report any other assets, "unearned" Income, transactions, or liabilities of a spouse or dependent child

because they meet all three tests for exemption? Yea [] No []

, , , ,i, i ill ii i i i I I

CERTIFICATION -- THIS DOCUMENT MUST BE SIGNED BY THE REPORTING INDIVIDUAL AND DATED I I

This Financial Disclosure Statement is required by the Ethics in Government Act of 1978, as amended. The Statement will be available to any requesting person upon written

application and will be reviewed by the Committee on Standards of Official Conduct or Its designee. Any Individual who knowingly and willfully falsifies, or who knowingly and

wllfully falls tO file this report may be subject to civil penaiUes and criminal sancUons (See 5 U,S.C. app. 4, § 104 and U.S.C. § 1001).

II I I I

Certification Signature

of Repo.l_,;-u

,,,,,,,:,;,_1 Date(Month,Day,Year)

I CERTIFYthat thestatements

aretrue,complete I havemadeonthisformandall

andcorrecttothebestof myknowledge attachedschedules

andbelief. _' _)#_J_'_-

. I__ ,,_ " 13"_ II

t_p m

Brought to you by OpenSecrets.org

SCHEDULE ! - EARNED INCOME Name MARY BONO Page2of 21

List the source, type, and amount of earned Income from any source (other than the flier's current employment by the U.S. Government) totalling $200 Ormore

during the preceding calendar year. For a spouse, list the source and amount of any honoraria; list only the source for other spouse earned Income exceeding

$1,000.

I I I

Source I I

Type Amount

AFTRA RETIREMENT FUND PENS ON $37,716

AFTRA RETIREMENT FUND PENSION $6,024

WYOMING WEST DESIGN, LLC SPOUSE K-I INCOME

Brought to you by OpenSecrets.org

SCHEDULE III - ASSETS AND "UNEARNED" INCOME

Name MARY BONO Page 3 of 21

T I " I I II r iii i i

BLOCK A BLOCK B BLOCK C BLOCK D BLOCK E

Asset and/or Income Source Year-End Type of Income Amount of Income Transaction

Identify (a) each asset held for Investment or production of Income with Value of Asset If other than one of the For retirement plans or Indicate If asset

a fair marketvalue excaedlng $1,000 at the end of the reporting period, listed categories, specify accounts that do not allow was purchased

and (b) any other asset or source of income which generated more than at close of reporting the type of Income by you to choose specific (P), sold (S), or

$200 in "unearned" Income during the year. For rental property or land, year. If you use a writing a brief description investments, you may writs exchanged (E)

provide an address. Provide full names of any mutual funds. For a self valuation method In this block. (For "NA" for Income. For all In reporting year.

directed IRA (I.e., one where you have the power to select the specific other than fair market example: Partnership other assets, Indicate the

Investments) provide Information on each asset in the account that value, please specify Income or Farm Income) category of Income by

exceeds the reporting threshold and the income earned for the account, the method used. If an checking the appropriate

For an IRA or retirement plan that is not self-directed, name the asset was sold and is box below. Dividends, even

Institution holding the account and provide Its value at the end of the Included only because if reinvested, should be

reporting period. For an active business that Is not publiclytraded, in it is generated income, listed as Income.

Block A state the nature of the business and its geographic location, the value should be

For additional information, see Instruction booklet for the reporting "None."

year.

Exclude: Your personal residence(s) (unless there !Is rental income);

any debt owed to you by your spouse, or by your orlyour spouse's child,

parent, or sibling; any deposits totaling $5,000 or leas in personal

savings accounts; any financial Interest in or Income derived from U.S.

Government retirement programs.

If you so choose, you may indicatethat an asset o¢_incomesource Is

that of your spouse (SP) or dependent child (DC) or is jointly held (JT),

in the optional column on the far left.

UNION BANK OF CALIFORNIA $15,001 - INTEREST $201 - $1,000

$5o,ooo

MERRILL LYNCH BANK $15,001 - INTEREST $1 - $200

DEPOSIT PROGRAM $50,000

BONO COLLECTION TRUST None INTEREST $201 - $1,000

SP WYOMING WEST DESIGN, None INTEREST $1 - $200

LLC

MERRILL LYNCH ISHARES None DIVIDENDS $1,001 - $2,500

MERRILL LYNCH CMA None DIVIDENDS $1 - $200

Brought to you by OpenSecrets.org

_ SCHEDULE Iii - ASSETS AND "UNEARNED" INCOME

i Name MARY BONO Page4of 21

MERRILL LYNCH CMA $1,001 - DIVIDENDS $1 - $200

$15,000

MERRILL LYNCH EQUITIES $100,001 - DIVIDENDS $201 - $1,000

$250,000

CALIFORNIA ST BOND, 6.1% $1,001 - INTEREST $201 - $1,000

$15,000

CALIFORNIA ST PUB WK $151001- INTEREST $1,001 - $2,500

BRD BOND, 5% $50,000

CALIFORNIA ST PRIN MTIGR $15,001 - INTEREST $1,001 - $2,500

SEN K BOND, 7% $50,000

SAN FRANCISCO CA ST_iBLG $15,001 " INTEREST $1,001 -.$2,500

BOND, 5.1% $50,000

CENTRAL VALLEY SCH $15,001 - INTEREST $2,501 - $5,000

DISTS BOND, 6.25% $50,000

MERRILL LYNCH-OlD None INTEREST $1,001 - $2,500

ML-RR CL l-IRA $1 - $1,000 DIVIDENDS $201 - $1,000

FINANCING CORP-IRA $50,001 - PAID ON PAID ON

$100,000 MATURiTY MATURITY

/

ML EQUITIES-IRA $100,001 - DIVIDENDS $1,001 - $2,500

$250,000

BONO COLLECTION TRUST $250,001 - ROYALTIES. $100,001 -

$500,000 $1,000,000

RECORDING IND. $50,001- ROYALTIES $1 -$200

ASSOCIATION $100,000

WARNER MUSIC GROUP $50,001 - ROYALTIES $5,001 - $15,000

$100,000

Brought to you by OpenSecrets.org

SCHEDULE III - ASSETS AND "UNEARNED" INCOME Name MARY BONO Page 5of21

ll,i i

DC UNION BANK OF CALIFORNIA $50,001 - INTEREST $201 - $1,000

$100,000

DC FEDERAL HOME LOAN $1,001 - INTEREST $201 - $1,000

MORTGAGE $15,000

DC FEDERAL HOME LOAN BANK $15,0011- INTEREST $201 - $1,000

$5o,ooo

DC ML BANK DEPOSIT $1- $1:000 INTEREST $1 - $200

PROGRAM

DC MERRILL LYNCH-OID None INTEREST $1,001 - $2,500

DC FEDERAL HOME LOAN None INTEREST $201 - $1,000

MORTGAGE

DC FEDERAL HOME LOAN BANK None INTEREST $201 - $1,000

DC MERRILL LYNCH-OlD None INTEREST $1,001 - $2,500

DC MERRILL LYNCH EQUITIES $50,001 - DIVIDENDS $201 - $1,000

$100,000

DC MERRILL LYNCH CMA $1,001 - DIVIDENDS $1 - $200

$15,000

DC LOS ANGELES CNTY CA $1,001 - INTEREST $201 - $1,000

COP MASTER RFDG BOND, $15,000

6.75%

DC U.S. TREASURY STRIPS $15,001 - PAID ON PAID ON

$50,000 MATURITY MATURITY

DC FINANCING CORP. STRIPS $15,001 - PAID ON PAID ON

$50,000 MATURITY MATURITY

DC ISHARES $1 - $1,000 DIVIDENDS $201 - $1,000

Brought to you by OpenSecrets.org

SCHEDULE III - ASSETS AND "UNEARNED" INCOME

Name MARY BONO Page6of 21

i i , luJ i

DC MERRILL LYNCH CMA $1,001 - DIVIDENDS $1 - $200

$15,ooo

DC ML READY ASSET TRUST None DIVIDENDS $1 - $200

DC •WARNER MUSIC GROUP $15,001 - ROYALTIES $2,501 - $5'000

CORP $50,000

DC BONO COLLECTION TRUST $100,001 - ROYALTIES $50,001 - $100;000

$250,000

DC BONO COLLECTION TRUST None INTEREST $1 - $200

DC BONO COLLECTION TRUST None INTEREST $1 -$200

DC BONO COLLECTION TRUST $100,00.1- ROYALTIES $50,001 - $100,000

$250,000

DC WARNER MUSIC GROUP $15,001 - ROYALTIES $2,501 - $5,000.

$50,000

DC UNION BANK OF CALIFORNIA $15,001 - INTEREST $201 .-$1,000

$50,00o

DC FEDERAL HOME LOAN BANK $15,001 - INTEREST $201 - $1,000

$5o,ooo

DC FEDERAL HOME LOAN $15,001 - INTEREST $201 - $1,000

MORTGAGE $50,000

DC FEDERAL HOME LOAN BANK $15,001- INTEREST $201 - $1,000

GLOBAL $50,000

DC FEDERAL HOME LOAN BANK None INTEREST $201 - $1,000

DC FEDERAL HOME LOAN None INTEREST $201 - $1,000

MORTGAGE

ii ,J i , i ,

Brought to you by OpenSecrets.org

i ,

SCHEDULE III - ASSETS AND "UNEARNED" INCOME

i Name MARY BONO Page 7 of 21

i

DC FEDERAL HOME LOAN BANK None INTEREST $201 - $1,000

GLOBAL

DC ML BANK DEPOSIT $1,001 - INTEREST $1 - $200

PROGRAM $15,000

DC MERRILL LYNCH EQUITIES $50,001 - DIVIDENDS $201 -$1,000

$100,000.

DC MERRILL LYNCH CMA $1,001,- DIVIDENDS $1- $200

$15,ooo

DC ISHARES $1 " $1,000 DIVIDENDS $201 - $1,000

DC MERRILL LYNCH CMA $1,001- DIVIDENDS $1- $200

$15,000

DC ML READY ASSETTRUST None DIVIDENDS $1 - $200

SP HGRR, LLC $1,001 - PARTNERSHIP NONE

$15,000

Brought to you by OpenSecrets.org

.i

SCHEDULE iV - TRANSACTIONS Name MARY

BONO Page8of21

.... . ,,.,,,, ,

Report any purchase, sale or exchange by you, your spouse, or dependent child durlng the reporting year of any real property, stocks, bonds, commodltles futures,

or other securltles when the amount of the transaction or serles of transactions exceeded $1,000. Include transacUonsthat resulted In a loss. Do not report a

transaction between

I

you, your spouse, or your dependent

I

chlld, or the purchase or sale of your personal

I

llllIlll

residence, unless

I

It is rented out.i ii

SP,

DC, Type of

JT ,w,, i

Asset Transaction Date

,, ,,

Amount of Transaction

ALLERGAN, INC. P 07-10-02 $1,001 - $15,000

ALCOA, INC. _ 07-10-02 $1,001 - $15,000

ADVANCE PCS P 07,10-02 $1,001 - $15,000

ADVANCE PCS = 08-22-02 $1,001 - $15,000

AMER INTERNATIONAL GROUP, INC. :) 07-10-02 $1,001 - $15,000

COMCAST CRP :_ 11-06-02 $1,001 - $15,000

COSTCO WHOLESALE :_ 08-22'02 $1,001 - $15,000

COSTCO WHOLESALE ::' 12-10-02 $1,001 - $15,000

CISCO SYSTEMS :_ 07-10-02 $1,001 - $15,000

CONAGRA FOODS = t2-10-02 $1,001 $15000

EXXON MOBIL :) 07-10-02 $1,001 - $t5,000

EXXON MOBIL P 12-10-02 $1,001 - $15,000

Brought to you by OpenSecrets.org

SCHEDULE IV - TRANSACTIONS Name MARY

BONO Page9of 21

Report any purchase, sale or exchange by you, your spouse, or dependent child during the reporting year of any real property, stocks, bonds, commodiUee futures,

or other securities when the amount of the transaction or series of transactions exceeded $1,000. Include transactions that resulted In a loss. Do not report a

transaction between you, your spouse, or your dependent child, or the purchase or sale of your personal residence, unless It Is rented out.

I I I

SP,

DC, Type of

JT Asset Transaction Date Amount of Transaction

FIRST DATA CORP P 07.10-02 $1,001 - $15,000

GALLAGHER ARTHUR J & CO. P 09.10-02 $1,001 - $15,000

GENENTECH INC. P 07-10'02 $1,001 - $15,000

HEALTH CARE PPTY P 11'06-02 $1,001 - $15,000

HEALTH CARE PPTY P 12-10-02 $1,001 - $15,000

IBM P 07-10-02 $15,001 - $50,000

JOHNSON & JOHNSON P 07-10-02 $1,001 - $15,000

L,3 COMMUNICATIONS P 11'06.02 $1,001 - $15,000

LOWES COMPANIES P 07-10-02 $1,001 - $15,000

PERFORMANCE FOOD GROUP P 07-10-02 $1,001 - $15,000

PITNEY BOWES, INC. P 07-10-02 $15,001 - $50,000

I

STERICYCLE INC. P 10-16-02 $1,001 - $15,000

Brought to you by OpenSecrets.org

SCHEDULE IV - TRANSACTIONS Name MARY BONO Page10of 2.1

Report any purchase, sale or exchange byyou, your spouse, Or dependent chlld during the reporting year of any real property, stocks, bonds, commodltles futures,

or other securltles when the amount of the transaction or series of transactlons exceeded $1,000. Include transactions that resulted in a loss. Do not report a

transactlon between you, your spouse, or your dependent child, or II

the purchase or sale of your personal resldence, IIIII

unless

IIIII

It Is rented out. IIII

SP,

DC, Type of

JT Asset Transaction ,,,

Date Amount of Transaction

SOUTHWEST AIRLINES P 07-10-02 $1,001 - $15,000

VIACOM INC CL B P 07-10-02 $1,001 - $15,000

ALLERGAN INC-IRA P 07-10-02 $1,001 . $15,000

ALCOA, INC,-IRA P 07-10-02 $1,001 - $15,000

ADVANCE PCS-IRA P 07-10-02 $1;001 - $15,000

AMER INTERNATIONAL GROUP-IRA P 07:10-02 $1,001 -$15,000

COMCAST CRP-IRA P. 11-06-02 $1,001 - $15,000

COSTCO WHOLESALE-IRA P 08-22-02 $1,001 - $15,000

CISCO SYSTEMS-IRA P 07-10-02 $1,001 - $15,000

CONAGRA FOODS-IRA P 12-10-02 $1,001 . $15,000

EXXON MOBIL-IRA P 07-10-02 $1,001 - $15,000

EXXON MOBIL-IRA P 12-10-02 $1,001 $15,000

Brought to you by OpenSecrets.org

SCHEDULE IV - TRANSACTIONS Name MARY

BONO Page 11of21

Report any purchesel sale or exchange by you, your spouse, or dependent child during the reporting year of any real property, stocks, bonds, commodities futures,

or other securities when the amount of the transaction or series of transactions exceeded $1,000. Include transactions that resulted in a loss. Do not report a

transaction between you, your spouse, or your dependent child, or the purchase or sale of your personal residence, unless it is rented out.

II II I

SP,

DC, Type of

JT Asset Transaction Date Amount of Transaction

FIRST DATA CORP'IRA P 07-10-02 $1,001 - $15,000

GALLAGHER ARTHUR J & CO.-IRA _ 09-10-02 $1,001. $15,000

GENENTECH INC.-IRA = 07-10-02 $1,001 - $15,000

HEALTH CARE PPTY-IRA P 11.06.02 $1,001 - $15,000

HEALTH CARE PPTY.IRA P 12-10-02 $1,001 - $15,000

IBM-IRA _ 07-10-02 $1,001 - $15,000

JOHNSON & JOHNSON-IRA _ 07-10-02 $t ,001 - $15,000

L-3 COMMUNICATIONS-IRA P 11-06-02 $1,001 - $15,000

LOWES COMPANIES-IRA P 07-10.02 $1,001 -$15,000

PERFORMANCE FOOD GROUP-IRA ::) 07-10-02 $1,001 - $15,000

PITNEY BOWES-IRA P 07-10-02 $1,001 $15,000

STERICYCLE INC-IRA P 10-16-02 $1,001 - $15,000

Brought to you by OpenSecrets.org

SCHEDULE IV - TRANSACTIONS Name MARY BONO Page 12of21

- ill i ,

Report any purchase, sale or exchange by you, your spouse, or dependent child during the reporting year of any real property, stocks, bonds, commodities futures,

or other securttles when the amount of the transaction or series of transactions exceeded $1,000. Include transactions that resulted In a loss. Do not report a

transaction between you, your spouse, or your dependent child,

I I

or

i

the purchase or sale

li

of your personal

i

residence, unless It Is rented out. I

SP,

DC, Type of

JT Asset Transaction Date Amount of Transaction

ii ii i f

SOUTHWEST AIRLINES-IRA P 07'10,02 $1,001 - $15,000

VIACOM INC CL B-IRA P 07-10-02 $1,001 - $15,000

DC ALLERGAN INC P 07-10.02 $1,001 . $15,000

DC ALCOA, INC. P 07-10-02 $1,001 - $15,000

DC ADVANCE PCS P 07-10-02 $1,001 - $15,000

DC AMER INTERNATIONAL GROUP P 07-10-02 _$1,001 - $15,000

DC COMCAST CRP P 11-06-02 $1,001 - $15,000

DC COSTCO WHOLESALE P 08-22-02 $1,001 - $15,000

DC CISCO SYSTEMS P 07-10-02 $1,001 - $15,000

DC CONAGRA FOODS INC. P 12-10,02 $1,001 . $15,000

DC EXXON MOBIL P 07-10-02 $1,001 - $15,000

DC FIRST DATA CORP P 07-10-02 $1,001 - $15,000

Brought to you by OpenSecrets.org

,i

SCHEDULE IV - TRANSACTIONS Name MARY BONO Page13of 21

i i

Report any purchase, sale or exchange by you, your spouse, or dependent child during the reporting year of any real property, stocks, bonds, commodities futures,

or other securities when the amount of the transaction or series of transactions exceeded $1,000. Include transactions that resulted In a loss. Do not report a

transaction between you,iiiii

youri i

spouse, or your dependent child, or the purchase or sale of your personal residence, unless it is rented out.

SP,

DC, Type of

JT Asset Transaction Date Amount of Transaction

DC GALLAGHER ARTHUR J & CO. = 09-10-02 $11001- $15,000

DC GENENTECH INC. _ 07-10.02 $1,001 - $15,000

,,, .

DC HEALTH CARE PPTY :_ 11-06-02 $1,001 - $15,000

DC IBM P 07-10-02 $1,001 - $15,000

DC JOHNSON & JOHNSON P 07-10'02 $1,001 - $15,000

DC L-3 COMMUNICATIONS P 11-06-02 : $1,001 - $15,000

DC LOWES COMPANIES P 07-10.02 $1,001- $15,000

DC PERFORMANCE FOOD GROUP P 07-10-02 $1,001 - $15,000

DC PITNEY BOWES P 07-10-02 $1,001 -$15,000

DC STERICYCLE INC P 10-1.6-02 $1,001 - $15,000

DC SOUTHWEST AIRLINES P 07,-10-02 $!,001 - $15,000

DC VIACOM INC CL B P 07-10.02 $1,001 - $15,000

Brought to you by OpenSecrets.org

SCHEDULE IV - TRANSACTIONS Name MARY BONO Page14of 21

Report any purchase, sale or exchange byyou, your spouse, or dependent child during the reporting year of any real property, stocks, bonds, commodities futures,

or other securities when the amount of the transaction or series of transactions exceeded $1,000. Include transactions that resulted in a loss. Do not report a

transaction between you, your spouse, or your dependent child, or the purchase or sale of your persona! residence, unless It Is rented out.

SP,

DC, Type of

JT Asset Transaction Date Amount of Transaction

r =ll ii , i i i,

DC ALLERGAN INC P 07-10-02 $1,001 - $15,000

DC ALCOA INC P 07-10.02 $1,001 - $15,000

DC ADVANCE PCS P 07-10-02 $1,001 - $15,000

DC AMER INTERNATIONAL GROUP P 07-10-02 $1;001 - $15,000

DC COMCAST CRP P 11-06-02 $1,001 - $15,000

DC COSTCO WHOLESALE P '08-22-02 $1.001 - $15,000

DC CISCO SYSTEMS P 07-10-02 $1,001 -$15,000

DC CONAGRA FOODS P 12-10-02 $1,001 - $15,000

DC EXXON MOBIL P 07-10-02 $1,001 - $15,000

DC FIRST DATA CORP P 07-10-02 $1,001 - $15,000

DC GALLAGHER ARTHUR J & CO P 09-10-02 $1,001 - $15,000

DC GENENTECH INC P 07-10-02 $1,001 - $15,000

i ii i ill i i

Brought to you by OpenSecrets.org

SCHEDULE IV - TRANSACTIONS Name MARYBONO Page15of 21

Report any purchase, sale or exchange by you, your spouse, Or dependent child during the reporting year of any real property, stocks, bonds, commodities futures,

or other securities when the amount of the transaction or sedes of transactions exceeded $1,000. Include transactions that resulted In a loss. Do not report a

_ransactionbetween you, your spouse, or your dependent

I

child, or the purchase or sale of your personal residence, unlessIIIIIIt I is rented

I

out.

SP,

DC, Type of

JT Asset Transaction Date Amount of Transaction

,, , ,

DC HEALTH CARE PPTY P 11-06-02 $1,001 - $15,000

DC IBM P 07-10-02 $1,001 - $15,000

DC JOHNSON & JOHNSON P - 07-10-02 $1,001 - $15,000

DC L-3 COMMUNICATIONS P 11-06.02 $1,001 - $15,000

DC LOWES COMPANIES P 07-10-02 $1,001 - $15,000

i, DC PERFORMANCE FOOD GROUP P 07-10'02 $1,001 -$115,000

DC PITNEY BOWES P 07-10-02 $1,001 - $15,000

DC STERICYCLE INC. P 10-16-02 $1,001 - $15,000

DC SOUTHWEST AIRLINES P 07-10-02 $1,001 - $15,000

DC VIACOM INC CL B P 07-10-02 $1,001 - $15,000

APOLLO GROUP INC. S 10-16-02 $1,001 -$15,000

FREDDIE MAC S 08.22-02 $1,001 - $15,000

Brought to you by OpenSecrets.org

SCHEDULE IV - TRANSACTIONS Name MARY BONO Page16of 21

Report any purchase, sale or exchange by you, your spouse, or dependent chlld durlng the mp0rtlng year of any real property, stocks, bonds, commodltlea futures,

or other securities when the amount of the transactlon or series of transactlons exceeded $I;000. Include transactions that resulted in a loss. Do not report a

transaction between you, your spouse, or your dependent child, or the purchase or sale of your personal resldence, unless It is rented out.

SP,

DC, Type of

JT Asset Transaction Date Amount of Transaction

JOHNSON & JOHNSON S 11-06-02 $1,001 - $15,000

TORCHMARK CORP S 09-10.02 " $1,001 - $15,000

CALIFORNIA STREET BONDS S 10-03.02 $15,001 - $50.000

SAN FRANCISCO BONDS S 10-01-02 $1.5,001- $50,000

CALIFORNIA HEALTH BONDS S 09-11-02 $15,001 - $50,000

SAN FRANCISCO BONDS S 07-19-02 $1,001 - $15,000

ALLEGHENY TECH S 12.10-02 $1,001 - $15,000

ALLEGHENY TECH S 12-10-02 $1,001 - $15,000

BAXTER INTERNATIONAL S 11.06-02 $1,001 - $15,000

BEST BUY S 11.06-02 $1,001 - $15,000

BEST BUY S 11-06-02 $1,001 $15,000

CITIGROUP S 07-23-02 $1,001 - $15,000

Brought to you by OpenSecrets.org

SCHEDULE IV - TRANSACTIONS Name MARY BONO Page17of 21

..+,,

Repo_ any purchase, sale or exchange by you, your spouse, or dependent child during the reporting year of any real property, stocks, bonds, commodiUes futures,

or other securltles when the amount of the transactlon or serles of transactlons exceeded $I,000. Include transactlons that resulted In a loss. Do not report a

transaction between

I

you, your spouse, or your

II

dependent chlld, or the purchase or sale

I

of your personal residence, unless It is rented out.

SP,

DC, Type of

JT Asset Transaction Date Amount of Transaction

i

DONALDSON CO. S 11-06-02 $1,001 - $15,000

GENERAL ELECTRIC S 12-10-02 $1,001 - $15,000

ISHARES S 07-15-02 $100,001 -$250,000

ISHARES S 07-15-02 $1,001 - $15,000

ISHARES S 07-15-02 $50,001 - $100,000

ISHARES S 07-15-02 $1,001 - $15,000

CALIFORNIA ST. BONDS S 06-20-02 $1,001 - $15,000

CALl FORNIA ST. BONDS S 06-19-02 $15,001 - $50,000

SAN FRANCISCO BONDS S 06-19.02 $15,001 - $50,000

LOS ANGELES BONDS S 06-19-02 $15,001 -1550,000

DC APOLLO INC CL A S 10-16-02 $1,001 - $1.5,00.0

DC FREDDIE MAC S 08-22-02 $1,001 - $15,000

Brought to you by OpenSecrets.org

SCHEDULE IV - TRANSACTIONS Name MARY BONO Page18 of 21

Report any purchase, sale or exchange by you, your spouse, or dependent child during the reporting year of any real prop'erty,stocks, bonds, commodltles futures,

or other securlUes when the amount of the transaction or series of transactions exceeded $1,000. Include transactions that resulted in a loss. Do not report a

transaction between you, your spouse, or your dependent child, or the purchase or sale of your personal residence, unless It Is rented out.

SP,

DC, Type of

JT Asset Transaction Date Amount of Transaction

[)C JOHNSON & JOHNSON S 11-06-02 $1,001 - $15,000

I

DC TORCHMARK CORP S 09-10-02 $1,001 - $15,000

DC FINANCING CORP, S 01-25,02 $1,001 - $15,000

DC BAXTER INTERNATIONAL S 11-06-02 $1,001 - $15,000

DC BEST BUY S 11-06-02 $1,001 - $15,000

DC CITIGROUP S 07-23_02 $1,001 - $15,000

DC DONALDSON CO. S 11-06-02 $1,001 - $15,000

DC GENERAL ELECTRIC S 12-10.02 $1,00! - $15,000

DC ISHARES S 07-15-02 $15,001 - $50,000

DC ISHARES S 07-15-02 $1,001 - $15,000

DC ISHARES S 07-15-02 $15,001 - $50,000

DC APOLLO GROUP CL A S 10-16.02 $1,001 - $15,000

Brought to you by OpenSecrets.org

i •

SCHEDULE IV - TRANSACTIONS Name MARYBONO Page lgof 21

Report any purchase, saie or exchange by you, your spouse, or dependent child during the reporting year of any real property, stocks, bonds, commodities futures,

or other securities when the amount of the transaction or series of transactions exceeded $1,000. Include transacUonsthat resulted in a loss. Do not report a

transaction between you,your spouse, Ior your dependent child, or the purchase or sale IofI Iyour personal

I

residence, unless it is rented out.

SP,

DC, Type of

JT Asset Transaction Date Amount of Transaction

DC FREDDIE MAC S 08-22-02 $1,001 - $15,000

DC JOHNSON & JOHNSON S 11-06-02 $1,001 - $15,000

DC TORCHMARK S 09-10-02 $1,001 - $15,000

DC FEDERAL HOME LOAN MORTGAGE S 10-15-02 $1,001 - $15,000

DC BAXTER INTERNATIONAL S 11-06-02 $1,001 - $15,000

DC CITIGROUP S 07.23-02 $1,001 - $15,000

DC DONALDSON CO. S 11'06-02 $1,001 - $15,000

DC GENERAL ELECTRIC S 12-10-02 $1,001 - $15,000

DC ISHARES S 07-15-02 $15,001 - $50,000

DC ISHARES S 07-15-02 $1,001 - $15,000

DC ISHARES S 07-15-02 $15,001 - $50,000

CITIGROUP, INC.-IRA S 07.23-02 $1,001 - $15,O00

i i , ,

Brought to you by OpenSecrets.org

SCHEDULE IV - TRANSACTIONS Name MARY BONO Page.20of 21

Report any purchase, sale or exchange by you, your spouse, or dependent child during the reporting year of any real property, stocks, bonds, commodlUes futures,

or other securities when the amount of the transaction or series of transactions exceeded $1,000. Include transactions that resulted in a loss. Do not report a

transaction between you, your spouse, or your dependent child, or the purchase or saleI IIIof yourI personal residence, unless it is rented out.

I II

SP,

DC, Type of

JT Asset Transaction Date Amount of Transaction

ISHARES-IRA S 07-15-02 $50,001 - $100,000

ISHARES-IRA S 07-15-02 $1,001 - $15,000

FREDDIE MAC-IRA S 08-22-02 $1,001 - $15,000

TORCHMARK-IRA S 09-10-02 $1,001 - $15,000

APOLLO GROUP CL A-IRA S 10-16-02 $1,001 - $15,000

BAXTER INTERNATIONAL-IRA S 11-06-02 $1,001 - $15,000

BEST BUY-IRA S 11-06-02 $1,001 - $15,000

BEST BUY.IRA S 11-06-02 $1,001 - $15,000

DONALDSON CO.-IRA S 11-06-02 $1,001 - $15,000

JOHNSON & JOHNSON-IRA S 11'06'02 $1,001 - $15,000

ALLEGH ENY TECH-IRA S 12-10-02 $1,001 - $15,000

GENERAL ELECTRIC-IRA S 12-10-02 $1,001 - $15,000

ii i i i i i i • i i i

Brought to you by OpenSecrets.org

SCHEDULE VII - TRAVEL PAYMENTS AND REIMBURSEMENTS Name MARY BONO Page21 of 21

Identify the source and list travel Itinera_, dates, and nature of expenses provitlod for travel and travel.related expenses totalling more than $285 received by you,

your spouse, or a dependent child during the reporting period. Indicate whether a family member accompanied the traveler at the sponsor's expense, and the

amount of time, if any, that was not at the sponsor's expense. Disclosure Is required regardless of whether the expenses were relmburaed or paid direcUy by the

sponsor. Exclude: Travel-related expenses provided by federal, state, and local •governments, or by a foreign government required to be separately reported under

the Foreign Gifts and Decorations Act (5 U.S.C § 7342); political travel that Is required to be reported under the Federal Election Campaign Act; travel provided to a

spouse or dependent child that is totally independent of his or her relationship to you.

• II

II

Was a Family Any time not

Point of Departure-- Lodging'i Food? Member Included? at sponsor's

Source Date(s) Destination--Point of Return (Y/N) (Y/N) ill

(Y/N) i

expense

i

WOMEN'S NATIONAL APRIL 21- WASH. DC-NY, NY-WASH. Y N Y N/A

REPUBLICAN CLUB 23 DC

NATIONALCABLE & MAY 5-7 PALMSPRINGS, CA-NEW Y Y Y N/A

TELECOMMUNICATION ORLEANS, NEW ORLEANS-

S ASSOC. CONVENTION WASH, DC.

Brought to you by OpenSecrets.org

Das könnte Ihnen auch gefallen

- 002 Discharge ValveDokument2 Seiten002 Discharge Valvehanco17858Noch keine Bewertungen

- l'1IJ'j' - : 4 PK Variety Onesies-Girl Ref#OP213727EKDokument20 Seitenl'1IJ'j' - : 4 PK Variety Onesies-Girl Ref#OP213727EKMartha LandazuryNoch keine Bewertungen

- Ebook PDF Understanding Learning and Learners Custom Edition 2e PDFDokument41 SeitenEbook PDF Understanding Learning and Learners Custom Edition 2e PDFferne.bass217100% (30)

- Clinical findings and treatment of a patient with renal failureDokument4 SeitenClinical findings and treatment of a patient with renal failureJaytone HernandezNoch keine Bewertungen

- Extracellular MatrixDokument8 SeitenExtracellular MatrixAkanksha dograNoch keine Bewertungen

- Winter SweetDokument4 SeitenWinter SweetChiara LiuzziNoch keine Bewertungen

- Ansh BSDK WalaDokument13 SeitenAnsh BSDK WalapranavNoch keine Bewertungen

- Er Final WorksheetDokument4 SeitenEr Final WorksheetdujalshahNoch keine Bewertungen

- Insulator Type FOGDokument2 SeitenInsulator Type FOGApongNoch keine Bewertungen

- MRPL Lisega Constant Hangers CatalogueDokument1 SeiteMRPL Lisega Constant Hangers CataloguerajuNoch keine Bewertungen

- Akai Orion ct1420ck 2020 2021 2120 Mono-Plus2Dokument6 SeitenAkai Orion ct1420ck 2020 2021 2120 Mono-Plus2marcellobbNoch keine Bewertungen

- Keats' Concept of Death: Lehigh PreserveDokument100 SeitenKeats' Concept of Death: Lehigh PreserveKomal khanNoch keine Bewertungen

- Early Twentieth Century MusicDokument176 SeitenEarly Twentieth Century MusicAlternate Picking100% (2)

- Docking Plan History SheetDokument3 SeitenDocking Plan History SheetBorysNoch keine Bewertungen

- Is 1608 - 2005 - 18Dokument1 SeiteIs 1608 - 2005 - 18SvapneshNoch keine Bewertungen

- Kids Web 2 CoursebookDokument105 SeitenKids Web 2 CoursebookFederico Guillermo Ten50% (2)

- Worded Problems With Number SentencesDokument2 SeitenWorded Problems With Number SentencesRashida MaynardNoch keine Bewertungen

- BR V Brochure 2023 Hires 0223Dokument7 SeitenBR V Brochure 2023 Hires 0223aalalalalNoch keine Bewertungen

- chp3 Modernfilters Novo PDFDokument13 Seitenchp3 Modernfilters Novo PDFAndré BertoniNoch keine Bewertungen

- Grade 10 Mathematics February 2024Dokument9 SeitenGrade 10 Mathematics February 2024nkateko.maluleke2018Noch keine Bewertungen

- SL (Oda T05S, T05 1,: 120 L, 120 Le, 120 Ls and 120 LseDokument238 SeitenSL (Oda T05S, T05 1,: 120 L, 120 Le, 120 Ls and 120 LsejptuningNoch keine Bewertungen

- 320th Engineer Battalion 1942-1945Dokument103 Seiten320th Engineer Battalion 1942-1945Jerry BuzzNoch keine Bewertungen

- Wondro! Js . !ve - .. .., ( - :-..: 2'95 Triduum H - NDokument2 SeitenWondro! Js . !ve - .. .., ( - :-..: 2'95 Triduum H - NErnest BisongNoch keine Bewertungen

- Mars A1011Dokument2 SeitenMars A1011Marsi BaniNoch keine Bewertungen

- Cannon Anchorage To ConcreteDokument47 SeitenCannon Anchorage To ConcreteKen SuNoch keine Bewertungen

- How many gallons in a tankDokument1 SeiteHow many gallons in a tankfcordNoch keine Bewertungen

- Crown of MajestyDokument14 SeitenCrown of MajestyMorgan BNoch keine Bewertungen

- Functional Group TestsDokument10 SeitenFunctional Group TestsPriyansh VermaNoch keine Bewertungen

- Flight (Male)Dokument10 SeitenFlight (Male)Lloyd RusselNoch keine Bewertungen

- Dryer HeDokument1 SeiteDryer HeEngkos MawarNoch keine Bewertungen

- Gorilla1 EVEN Page 11Dokument1 SeiteGorilla1 EVEN Page 11nicoz75Noch keine Bewertungen

- 10th or Equivalent Examination Proof - CompressedDokument1 Seite10th or Equivalent Examination Proof - Compressedganesh786786Noch keine Bewertungen

- จดหมายโต้วาทีDokument9 Seitenจดหมายโต้วาทีTi SuNoch keine Bewertungen

- Barometric Pressure Chart and TableDokument1 SeiteBarometric Pressure Chart and TableHsein WangNoch keine Bewertungen

- Indian Philosophy PDFDokument6 SeitenIndian Philosophy PDFRock KrishnaNoch keine Bewertungen

- Anna University Guindy Campus Fee StructureDokument1 SeiteAnna University Guindy Campus Fee Structurejohn251067Noch keine Bewertungen

- Adobe Scan 05 Jul 2023Dokument5 SeitenAdobe Scan 05 Jul 2023Asha JyothiNoch keine Bewertungen

- Ain't It A Pretty NightDokument5 SeitenAin't It A Pretty NightDani Honeyman100% (3)

- Adobe Scan 06-Mar-2024 (1)Dokument20 SeitenAdobe Scan 06-Mar-2024 (1)Janmay PatelNoch keine Bewertungen

- 1855 ATreatiseOnTheScrewPropeller BourneDokument353 Seiten1855 ATreatiseOnTheScrewPropeller BourneMarco FreitasNoch keine Bewertungen

- ETI 1978-10 OctoberDokument132 SeitenETI 1978-10 OctoberCarlos SoaresNoch keine Bewertungen

- Books by Rev. W. V. Grant: Dallas, Box TexasDokument18 SeitenBooks by Rev. W. V. Grant: Dallas, Box TexasPriceNoch keine Bewertungen

- Standorti - Ibersicht TU Wien: Tuljnivercity 2015Dokument1 SeiteStandorti - Ibersicht TU Wien: Tuljnivercity 2015Patrick KnaackNoch keine Bewertungen

- Khách S N Tư NhânDokument13 SeitenKhách S N Tư Nhânđạt nguyễnNoch keine Bewertungen

- Proforma For Self Certification by The Government Employee For LTC Bilingual 20211202125357Dokument2 SeitenProforma For Self Certification by The Government Employee For LTC Bilingual 20211202125357hanipay tinamisanNoch keine Bewertungen

- Join the Upsc Group online or via hard copyDokument99 SeitenJoin the Upsc Group online or via hard copyPrashant KushwahaNoch keine Bewertungen

- Juki Babylock EF-405Dokument21 SeitenJuki Babylock EF-405dhanayajoyNoch keine Bewertungen

- Scan 30 Jan 2020Dokument2 SeitenScan 30 Jan 2020Carlo CaravaggiNoch keine Bewertungen

- Proposal Layout Design-ModelDokument1 SeiteProposal Layout Design-Modelabhay sharmaNoch keine Bewertungen

- In His Presence Tunney PDFDokument8 SeitenIn His Presence Tunney PDFMichael Angelo HernandezNoch keine Bewertungen

- O-P Manual Motor VerticalDokument31 SeitenO-P Manual Motor VerticalJean CorimayaNoch keine Bewertungen

- Laryngology PDFDokument25 SeitenLaryngology PDFOne PieceNoch keine Bewertungen

- 7 Cells Structure and Functions A L1 L3Dokument26 Seiten7 Cells Structure and Functions A L1 L3tabassum karatelaNoch keine Bewertungen

- Making Manifestations (Building The Commercial Seance) by Lee Earle PDFDokument35 SeitenMaking Manifestations (Building The Commercial Seance) by Lee Earle PDFRamona BălanNoch keine Bewertungen

- Ectoplasms, Evanescence PhotographyDokument13 SeitenEctoplasms, Evanescence PhotographyDaria IoanNoch keine Bewertungen

- Kenwood tm-733 CircuitoDokument10 SeitenKenwood tm-733 CircuitopaulwaveNoch keine Bewertungen

- Fema P-1078Dokument1 SeiteFema P-1078Ronny FortaNoch keine Bewertungen

- Fema P-1078 PDFDokument1 SeiteFema P-1078 PDFeerrddeemmNoch keine Bewertungen

- House Oversight Committee - Preliminary Staff ReportDokument97 SeitenHouse Oversight Committee - Preliminary Staff ReportbrookewilliamsNoch keine Bewertungen

- Mercatus Testimony 2-10-11Dokument72 SeitenMercatus Testimony 2-10-11brookewilliamsNoch keine Bewertungen

- Larry Brady TravelDokument22 SeitenLarry Brady TravelbrookewilliamsNoch keine Bewertungen

- OGR Committee List 1-19-11Dokument2 SeitenOGR Committee List 1-19-11brookewilliamsNoch keine Bewertungen

- Mercatus Response To IssaDokument2 SeitenMercatus Response To IssabrookewilliamsNoch keine Bewertungen

- BonoMackFD 1997Dokument5 SeitenBonoMackFD 1997brookewilliamsNoch keine Bewertungen

- Moore Grimm PaperDokument12 SeitenMoore Grimm PaperbrookewilliamsNoch keine Bewertungen

- Mercatus 2-9-11 TestimonyDokument13 SeitenMercatus 2-9-11 TestimonybrookewilliamsNoch keine Bewertungen

- MercatusCenter 990 08Dokument26 SeitenMercatusCenter 990 08brookewilliamsNoch keine Bewertungen

- KochCharitableFnd 990 08Dokument39 SeitenKochCharitableFnd 990 08brookewilliamsNoch keine Bewertungen

- BonoMackFD 1998Dokument9 SeitenBonoMackFD 1998brookewilliamsNoch keine Bewertungen

- Alliance of Automobile Manufacturers Letter To Chairman Issa - January 11, 2011Dokument4 SeitenAlliance of Automobile Manufacturers Letter To Chairman Issa - January 11, 2011CREWNoch keine Bewertungen

- BonoMackFD 2000Dokument13 SeitenBonoMackFD 2000brookewilliamsNoch keine Bewertungen

- BonoMackFD 1999Dokument9 SeitenBonoMackFD 1999brookewilliamsNoch keine Bewertungen

- Representatives: Preliminary Information - Answer Each of These QuestionsDokument21 SeitenRepresentatives: Preliminary Information - Answer Each of These QuestionsbrookewilliamsNoch keine Bewertungen

- BonoMackFD 2001Dokument11 SeitenBonoMackFD 2001brookewilliamsNoch keine Bewertungen

- BonoMackFD 1997Dokument5 SeitenBonoMackFD 1997brookewilliamsNoch keine Bewertungen

- BonoMackFD 2001Dokument11 SeitenBonoMackFD 2001brookewilliamsNoch keine Bewertungen

- WarnerMusic10 QDokument125 SeitenWarnerMusic10 QbrookewilliamsNoch keine Bewertungen

- BonoMackFD 2009Dokument23 SeitenBonoMackFD 2009brookewilliamsNoch keine Bewertungen

- FPPC Kruer InvestDokument1 SeiteFPPC Kruer InvestbrookewilliamsNoch keine Bewertungen

- Kruer FD08Dokument28 SeitenKruer FD08brookewilliamsNoch keine Bewertungen

- Sworn Complaint Form: Lp. Elp3Dokument4 SeitenSworn Complaint Form: Lp. Elp3brookewilliamsNoch keine Bewertungen

- Accreditation ReportDokument165 SeitenAccreditation ReportbrookewilliamsNoch keine Bewertungen