Beruflich Dokumente

Kultur Dokumente

Annex B3

Hochgeladen von

Yna YnaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Annex B3

Hochgeladen von

Yna YnaCopyright:

Verfügbare Formate

Annex B3

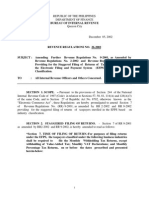

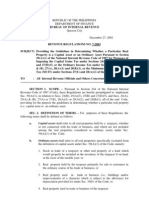

Estate Tax Return

CHECKLIST OF DOCUMENTARY REQUIREMENTS

Important:

1. Processing of transactions commence only upon submission of COMPLETE DOCUMENTS.

2. Mark “ ” for submitted documents and “X” for lacking documents.

Mandatory

Certified true copy of the Death Certificate;

TIN of decedent and heir/s

Notice of Death (only for death prior to January 1, 2018) duly received by the BIR, if gross taxable estate exceeds P20,000 for deaths occurring on

January 1, 1998 up to December 31, 2017; or if the gross taxable estate exceeds P3,000 for deaths occurring prior to January 1, 1998;

Any of the following: a) Affidavit of Self Adjudication; b) Deed of Extra-Judicial Settlement of the Estate, if the estate has been settled extra judicially;

c) Court order if settled judicially; d) Sworn Declaration of all properties of the Estate;

A certified copy of the schedule of partition and the order of the court approving the same within thirty (30) days after the promulgation of such

order, in case of judicial settlement.

Proof of Claimed Tax Credit, if applicable;

CPA Statement on the itemized assets of the decedent, itemized deductions from gross estate and the amount due if the gross value of the estate

exceeds five million pesos (P5,000,000) for decedent’s death on or after January 1, 2018 or two million pesos (P2,000,000) for decedent’s death from

January 1, 1998 to December 31, 2017.

Certification of the Barangay Captain for the claimed Family Home (If the family home is conjugal property and does not exceed Php10 Million, the

allowable deduction is one-half (1/2) of the amount only);

Duly notarized Promissory Note for "Claims Against the Estate" arising from Contract of Loan;

Accounting of the proceeds of loan contracted within three (3) years prior to death of the decedent;

Proof of the claimed "Property Previously Taxed";

Proof of the claimed "Transfer for Public Use";

Copy of Tax Debit Memo used as payment, if applicable.

For Real Properties, if any:

Certified true copy/ies of the Transfer/Original/Condominium Certificate/s of Title of real property/ies (front and back pages), if applicable;

Certified true copy of the Tax Declaration of real properties at the time of death, if applicable;

Certificate of No Improvement issued by the Assessor's Office where declared properties have no improvement;

For Personal Properties, if any:

Certificate of Deposit/Investment/Indebtedness owned by the decedent and the surviving spouse, if applicable;

Photocopy of Certificate of Registration of vehicles and other proofs showing the correct value of the same, if applicable;

Proof of valuation of shares of stock at the time of death, if applicable;

For shares of stocks not listed/not traded - Latest Audited Financial Statement of the issuing corporation with computation of the book

value per share

For shares of stocks listed/traded - Price index from the PSE/latest FMV published in the newspaper at the time of transaction

For club shares - Price published in newspapers on the transaction date or nearest to the transaction date

Photocopy of certificate of stocks, if applicable;

Proof of valuation of other types of personal property, if applicable;

Other Additional Requirements, if applicable:

Special Power of Attorney (SPA), if the person transacting/processing the transfer is not a party to the transaction and/or Sworn Statement if one of

the heirs is designated as executor/administrator

Certification from the Philippine Consulate if document is executed abroad

Location Plan/Vicinity map if zonal value cannot be readily determined from the documents submitted

Certificate of Exemption/BIR Ruling issued by the Commissioner of Internal Revenue or his authorized representative, if tax exempt

BIR-approved request for installment payment of Estate tax due

BIR-approved request for partial disposition of Estate

Such other documents as may be required by law/rulings/regulations/etc.

Submitted by: ____________________________ Date: ____________

Name of Taxpayer

Received by: ____________________________ Date: ____________

Acknowledgement of applicant:

I _________________________ , of legal age, hereby acknowledge the identified lacking documentary requirement/s

(marked with “X”) which I commit to submit within five (5) working days. I understand that my application will only be processed upon

submission of complete document/s.

____________________________________ Date: ____________

Name of Taxpayer/Representative

(Signature over printed name)

NOTE: The BIR shall dispose all pending applications with incomplete requirements after thirty (30) calendar days from receipt of

application.

Das könnte Ihnen auch gefallen

- BIR Checklist Capital Gains TaxDokument2 SeitenBIR Checklist Capital Gains TaxJulliene Abat33% (6)

- Checklist For CRLS Subdivision...Dokument14 SeitenChecklist For CRLS Subdivision...Jhan Melch100% (1)

- Memorandum of AgreementDokument4 SeitenMemorandum of AgreementJoshuaLavegaAbrinaNoch keine Bewertungen

- Revenue Memorandum Order No. 15-2018: Bureau of Internal RevenueDokument15 SeitenRevenue Memorandum Order No. 15-2018: Bureau of Internal Revenuebayot limNoch keine Bewertungen

- Affidavit - Declaration of Gross SalesDokument5 SeitenAffidavit - Declaration of Gross SalesEGTAN BUSINESS SOLUTIONS INC.Noch keine Bewertungen

- Amendment To Real Estate MortgageDokument2 SeitenAmendment To Real Estate MortgageRaihanah Sarah Tucaben Macarimpas100% (1)

- Secretary's CertificateDokument1 SeiteSecretary's CertificateJil MacasaetNoch keine Bewertungen

- SEC Affidavit of Confirmation of CorrectionDokument1 SeiteSEC Affidavit of Confirmation of CorrectionJfm A Dazlac0% (1)

- Local Business Tax in Valenzuela CityDokument14 SeitenLocal Business Tax in Valenzuela CityRussel Barquin100% (1)

- Affidavit of Business ClosureDokument2 SeitenAffidavit of Business ClosureMarlon Gonzaga100% (1)

- BIR Ruling On How To Compute Book Value If There Is Unpaid SubscriptionDokument3 SeitenBIR Ruling On How To Compute Book Value If There Is Unpaid SubscriptionBobby LockNoch keine Bewertungen

- Save Money On Taxes: VAT Exemptions For Real Estate Sales And LeasesDokument5 SeitenSave Money On Taxes: VAT Exemptions For Real Estate Sales And Leasesenal92Noch keine Bewertungen

- Sample Board ResolutionDokument1 SeiteSample Board ResolutionDats FernandezNoch keine Bewertungen

- Petition For Dropping LTFRBDokument3 SeitenPetition For Dropping LTFRBMegan Camille SanchezNoch keine Bewertungen

- Affidavit of No Pending CaseDokument1 SeiteAffidavit of No Pending CaseManny SandichoNoch keine Bewertungen

- Reservation Agreement 132 SQM LoremarDokument1 SeiteReservation Agreement 132 SQM LoremarsherryannNoch keine Bewertungen

- Annex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Dokument4 SeitenAnnex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Kristel Anne LiwagNoch keine Bewertungen

- Non-Exclusive Authority to Sell LandDokument2 SeitenNon-Exclusive Authority to Sell LandPat Dela CruzNoch keine Bewertungen

- Bir Waiver of Defense of PrescriptionDokument3 SeitenBir Waiver of Defense of PrescriptionCha Ancheta Cabigas0% (1)

- Ord, 41-01 Fair Market Values - TaguigDokument32 SeitenOrd, 41-01 Fair Market Values - TaguigAldrinmarkquintana50% (4)

- CPA UNDERTAKES TO COOPERATE WITH BIRDokument1 SeiteCPA UNDERTAKES TO COOPERATE WITH BIRLimuel Balestramon RazonalesNoch keine Bewertungen

- PN RediscountingDokument2 SeitenPN Rediscountingrobin pilarNoch keine Bewertungen

- 1 - PCAB - Application LetterDokument1 Seite1 - PCAB - Application LetterMardeOpamenNoch keine Bewertungen

- BIR Ruling DA - C-018 075-10Dokument2 SeitenBIR Ruling DA - C-018 075-10Mark Lord Morales BumagatNoch keine Bewertungen

- Authority To Sell TemplateDokument1 SeiteAuthority To Sell TemplateMao WatanabeNoch keine Bewertungen

- Reservation Agreement 13 04 16Dokument3 SeitenReservation Agreement 13 04 16Snooway Bong Duoble JjNoch keine Bewertungen

- 13 Deed of Absolute Sale SellerDokument2 Seiten13 Deed of Absolute Sale SellerClaudine ArrabisNoch keine Bewertungen

- Sworn Statement of Gross ReceiptsDokument1 SeiteSworn Statement of Gross ReceiptsJay Mark DimaanoNoch keine Bewertungen

- Affidavit of Undertaking For BIRDokument2 SeitenAffidavit of Undertaking For BIRREN OFFICIALNoch keine Bewertungen

- BIR LETTER - Request For TAMP NoticeDokument1 SeiteBIR LETTER - Request For TAMP NoticeLERAC Accounting100% (1)

- How To Process Land Transfer in The PhilippinesDokument9 SeitenHow To Process Land Transfer in The PhilippinesRonald O.Noch keine Bewertungen

- Deed of Assignment - Shares of StockDokument2 SeitenDeed of Assignment - Shares of StockDudin MoteNoch keine Bewertungen

- Spa. CarloDokument1 SeiteSpa. CarlogiovanniNoch keine Bewertungen

- Affidavit of CircumstancesDokument4 SeitenAffidavit of CircumstancesKristianne SipinNoch keine Bewertungen

- Revised MOA Paul Andrew Pilapil Lot 1181-BDokument3 SeitenRevised MOA Paul Andrew Pilapil Lot 1181-BttunacaoNoch keine Bewertungen

- BIR Order Streamlines Computerized Accounting System ApprovalDokument15 SeitenBIR Order Streamlines Computerized Accounting System Approvaljef comendadorNoch keine Bewertungen

- Deed of SaleDokument3 SeitenDeed of Salebhem silverio100% (1)

- Affidavit of No ProjectDokument1 SeiteAffidavit of No ProjectJude SampangNoch keine Bewertungen

- Lessees Information Statement For BIR 2Dokument2 SeitenLessees Information Statement For BIR 2Blue Heavens100% (1)

- Schedule of Accounts Receivables - TobesDokument1 SeiteSchedule of Accounts Receivables - TobesClarisse30100% (1)

- CANCELLATION OF AUTHORITY TO SELL-MataDokument1 SeiteCANCELLATION OF AUTHORITY TO SELL-MataDanielle Edenor Roque PaduraNoch keine Bewertungen

- Lease Contract for Sari-Sari StoreDokument2 SeitenLease Contract for Sari-Sari StoreJilian Kate Alpapara Bustamante100% (1)

- Resignation LetterDokument1 SeiteResignation LetterAntonio GanubNoch keine Bewertungen

- Annex F RR 11-2018Dokument1 SeiteAnnex F RR 11-2018Andoy Domingo Carullo100% (2)

- PRLD - Srs.002-A.00 - Sworn Registration Statement (Corporation)Dokument2 SeitenPRLD - Srs.002-A.00 - Sworn Registration Statement (Corporation)Chrisjoy Charitanne0% (1)

- RDO No. 56 - Calamba, LagunaDokument284 SeitenRDO No. 56 - Calamba, LagunaMarijo69% (16)

- Letter of Request For DeactivationDokument1 SeiteLetter of Request For DeactivationRonald LeabresNoch keine Bewertungen

- Affidavit of Non-RentalDokument2 SeitenAffidavit of Non-RentalEppie Severino0% (1)

- Request Lower Penalty ATP Late FilingDokument1 SeiteRequest Lower Penalty ATP Late FilingVher Christopher Ducay0% (2)

- AUTHORITY TO SELL LANDDokument10 SeitenAUTHORITY TO SELL LANDYumii LiNoch keine Bewertungen

- LRA Registration FeesDokument7 SeitenLRA Registration FeesNash Ortiz LuisNoch keine Bewertungen

- Affidavit of Additional Line of BusinessDokument1 SeiteAffidavit of Additional Line of BusinessMitzi Wamar100% (1)

- Request Letter For Compromise - KbindustrialDokument1 SeiteRequest Letter For Compromise - KbindustrialJedah Ibarra VillaflorNoch keine Bewertungen

- Affidavit of ConsentDokument3 SeitenAffidavit of ConsentOtenciano Mautganon100% (1)

- Zonal Values Notice for RDO 57 - Biñan CityDokument298 SeitenZonal Values Notice for RDO 57 - Biñan CitySu San100% (1)

- Annex 'B'-Standards For Regularization of EmploymentDokument1 SeiteAnnex 'B'-Standards For Regularization of EmploymentJL TAX BOOKKEEPINGNoch keine Bewertungen

- Special power of attorney documentDokument2 SeitenSpecial power of attorney documentTina Severo50% (2)

- Branch Office Expression of Interest For Amnesty of Fines and Penalties at SECDokument2 SeitenBranch Office Expression of Interest For Amnesty of Fines and Penalties at SECcsb1683100% (1)

- Estate Tax Is A Tax On The Right of The Deceased Person To Transmit His/her Estate To His/her Lawful Heirs andDokument4 SeitenEstate Tax Is A Tax On The Right of The Deceased Person To Transmit His/her Estate To His/her Lawful Heirs andRey PerosaNoch keine Bewertungen

- Annex B4Dokument1 SeiteAnnex B4Idan AguirreNoch keine Bewertungen

- RR 13-2010Dokument5 SeitenRR 13-2010Felora MangawangNoch keine Bewertungen

- Revenue Memorandum Order 26-2010Dokument2 SeitenRevenue Memorandum Order 26-2010Jayvee OlayresNoch keine Bewertungen

- Revenue Regulations No. 9-2001Dokument6 SeitenRevenue Regulations No. 9-2001Anonymous GMUQYq8Noch keine Bewertungen

- IT - RMO 2-2018 Microfinance NGO PDFDokument7 SeitenIT - RMO 2-2018 Microfinance NGO PDFMark Lord Morales BumagatNoch keine Bewertungen

- Revenue Memorandum Circular No. 17-2011Dokument3 SeitenRevenue Memorandum Circular No. 17-2011Orlando O. CalundanNoch keine Bewertungen

- RMO - No. 14-2017 PDFDokument2 SeitenRMO - No. 14-2017 PDFYna YnaNoch keine Bewertungen

- Bureau of Internal RevenueDokument4 SeitenBureau of Internal RevenueYna YnaNoch keine Bewertungen

- Revenue Memorandum Circular UnknownDokument2 SeitenRevenue Memorandum Circular UnknownJohnsenAlejandroNoch keine Bewertungen

- RMC No 74-2013-Tax On CoopDokument6 SeitenRMC No 74-2013-Tax On CoopYna YnaNoch keine Bewertungen

- RR 09-2004 of The Bureau of Internal RevenueDokument13 SeitenRR 09-2004 of The Bureau of Internal RevenuecompaddictNoch keine Bewertungen

- BIR expands withholding tax coverage to top 20k corporationsDokument4 SeitenBIR expands withholding tax coverage to top 20k corporationsJoyceNoch keine Bewertungen

- 1710rr26 02Dokument4 Seiten1710rr26 02HaneeBlueNoch keine Bewertungen

- RMO No.30-2018 Refund of CGT and CWT PDFDokument1 SeiteRMO No.30-2018 Refund of CGT and CWT PDFYna YnaNoch keine Bewertungen

- 57 2015Dokument4 Seiten57 2015Carlo100% (1)

- BIR RR 07-2003Dokument8 SeitenBIR RR 07-2003Brian BaldwinNoch keine Bewertungen

- Clarifying Capital Gains Tax on Real Property SalesDokument1 SeiteClarifying Capital Gains Tax on Real Property SalesYna YnaNoch keine Bewertungen

- 05 April 2017: Press StatementDokument1 Seite05 April 2017: Press StatementYna YnaNoch keine Bewertungen

- BIR issues eCARs for Balikatan Property Holdings propertiesDokument1 SeiteBIR issues eCARs for Balikatan Property Holdings propertiesYna YnaNoch keine Bewertungen

- Lch-To The: '?DLB of Eircular "Enjoining Officials and Prohibition Against GoingDokument3 SeitenLch-To The: '?DLB of Eircular "Enjoining Officials and Prohibition Against GoingYna YnaNoch keine Bewertungen

- CAATTs COMPLIANCE REPORTDokument16 SeitenCAATTs COMPLIANCE REPORTErika delos SantosNoch keine Bewertungen

- Automobiles RR 2-2016Dokument3 SeitenAutomobiles RR 2-2016Romer LesondatoNoch keine Bewertungen

- IT - RMO 2-2018 Microfinance NGO PDFDokument7 SeitenIT - RMO 2-2018 Microfinance NGO PDFMark Lord Morales BumagatNoch keine Bewertungen

- Republic of The Philippines Department of FinanceDokument3 SeitenRepublic of The Philippines Department of FinanceYna YnaNoch keine Bewertungen

- NDokument2 SeitenNYna YnaNoch keine Bewertungen

- RMO 16-2017 amends VAT provisions for wheat importersDokument2 SeitenRMO 16-2017 amends VAT provisions for wheat importersYna YnaNoch keine Bewertungen

- Annex "B": - (Date)Dokument2 SeitenAnnex "B": - (Date)Yna YnaNoch keine Bewertungen

- Automobiles RR 2-2016Dokument3 SeitenAutomobiles RR 2-2016Romer LesondatoNoch keine Bewertungen

- Republic of The Philippines Department of FinanceDokument3 SeitenRepublic of The Philippines Department of FinanceYna YnaNoch keine Bewertungen

- Annex "C": Republic of The Philippines Department of Finance Quezon CityDokument2 SeitenAnnex "C": Republic of The Philippines Department of Finance Quezon CityYna YnaNoch keine Bewertungen

- 26928rmo05 29anxbDokument2 Seiten26928rmo05 29anxbYna YnaNoch keine Bewertungen

- 150 Most Common Regular VerbsDokument4 Seiten150 Most Common Regular VerbsyairherreraNoch keine Bewertungen

- HDFDJH 5Dokument7 SeitenHDFDJH 5balamuruganNoch keine Bewertungen

- Swot AnalysisDokument6 SeitenSwot AnalysisSneha SinhaNoch keine Bewertungen

- Leaflet STP2025 LightDokument2 SeitenLeaflet STP2025 LightNoel AjocNoch keine Bewertungen

- Redminote5 Invoice PDFDokument1 SeiteRedminote5 Invoice PDFvelmurug_balaNoch keine Bewertungen

- Motivate! 2 End-Of-Term Test Standard: Units 1-3Dokument6 SeitenMotivate! 2 End-Of-Term Test Standard: Units 1-3Oum Vibol SatyaNoch keine Bewertungen

- Sen. Jinggoy Estrada vs. Office of The Ombudsman, Et. Al.Dokument2 SeitenSen. Jinggoy Estrada vs. Office of The Ombudsman, Et. Al.Keziah HuelarNoch keine Bewertungen

- The Big Banana by Roberto QuesadaDokument257 SeitenThe Big Banana by Roberto QuesadaArte Público Press100% (2)

- Vaccination Consent Form: Tetanus, Diphtheria / Inactivated Polio Vaccine (DTP) & Meningococcal ACWY (Men ACWY)Dokument2 SeitenVaccination Consent Form: Tetanus, Diphtheria / Inactivated Polio Vaccine (DTP) & Meningococcal ACWY (Men ACWY)meghaliNoch keine Bewertungen

- 20 Reasons Composers Fail 2019 Reprint PDFDokument30 Seiten20 Reasons Composers Fail 2019 Reprint PDFAlejandroNoch keine Bewertungen

- 5.3.2 Generation of Dislocations: Dislocations in The First Place!Dokument2 Seiten5.3.2 Generation of Dislocations: Dislocations in The First Place!Shakira ParveenNoch keine Bewertungen

- Buckling of Thin Metal Shells 58Dokument1 SeiteBuckling of Thin Metal Shells 58pawkomNoch keine Bewertungen

- Metatron AustraliaDokument11 SeitenMetatron AustraliaMetatron AustraliaNoch keine Bewertungen

- 5.1 Physical Farming Constraints in Southern CaliforniaDokument1 Seite5.1 Physical Farming Constraints in Southern CaliforniaTom ChiuNoch keine Bewertungen

- FeistGorman - 1998-Psychology of Science-Integration of A Nascent Discipline - 2Dokument45 SeitenFeistGorman - 1998-Psychology of Science-Integration of A Nascent Discipline - 2Josué SalvadorNoch keine Bewertungen

- Thompson Industrial Products Inc Is A DiversifiedDokument4 SeitenThompson Industrial Products Inc Is A DiversifiedKailash KumarNoch keine Bewertungen

- The Emergence of India's Pharmaceutical IndustryDokument41 SeitenThe Emergence of India's Pharmaceutical Industryvivekgupta2jNoch keine Bewertungen

- Aaps Pronouns-ExplainedDokument2 SeitenAaps Pronouns-Explainedapi-277377140Noch keine Bewertungen

- SOG 5 Topics With SOPDokument2 SeitenSOG 5 Topics With SOPMae Ann VillasNoch keine Bewertungen

- Noise Blinking LED: Circuit Microphone Noise Warning SystemDokument1 SeiteNoise Blinking LED: Circuit Microphone Noise Warning Systemian jheferNoch keine Bewertungen

- GRADE 8 English Lesson on Indian LiteratureDokument3 SeitenGRADE 8 English Lesson on Indian LiteratureErold TarvinaNoch keine Bewertungen

- Chrome Blue OTRFDokument4 SeitenChrome Blue OTRFHarsh KushwahaNoch keine Bewertungen

- 2006 - Bykovskii - JPP22 (6) Continuous Spin DetonationsDokument13 Seiten2006 - Bykovskii - JPP22 (6) Continuous Spin DetonationsLiwei zhangNoch keine Bewertungen

- Ko vs. Atty. Uy-LampasaDokument1 SeiteKo vs. Atty. Uy-LampasaMaria Janelle RosarioNoch keine Bewertungen

- American Buffalo - DAVID MAMETDokument100 SeitenAmerican Buffalo - DAVID MAMETRodrigo Garcia Sanchez100% (10)

- Vdoc - Pub Parrys Valuation and Investment TablesDokument551 SeitenVdoc - Pub Parrys Valuation and Investment TablesWan Rosman100% (1)

- Jamaica's Unemployment Aims, Causes and SolutionsDokument23 SeitenJamaica's Unemployment Aims, Causes and Solutionsnetzii300067% (3)

- Review For Development of Hydraulic Excavator Attachment: YANG Cheng Huang Kui LI Yinwu WANG Jingchun ZHOU MengDokument5 SeitenReview For Development of Hydraulic Excavator Attachment: YANG Cheng Huang Kui LI Yinwu WANG Jingchun ZHOU MengZuhaib ShaikhNoch keine Bewertungen

- Text Detection and Recognition in Raw Image Dataset of Seven Segment Digital Energy Meter DisplayDokument11 SeitenText Detection and Recognition in Raw Image Dataset of Seven Segment Digital Energy Meter DisplaykkarthiksNoch keine Bewertungen

- Homeroom Guidance - Activity For Module 1Dokument3 SeitenHomeroom Guidance - Activity For Module 1Iceberg Lettuce0% (1)