Beruflich Dokumente

Kultur Dokumente

CRUZ-TaxFinals (Jonas)

Hochgeladen von

Jm Cruz0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten4 SeitenOriginaltitel

CRUZ-TaxFinals (Jonas).docx

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten4 SeitenCRUZ-TaxFinals (Jonas)

Hochgeladen von

Jm CruzCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

CIR vs. Eron Subic Power Corporation, GR No. 166387, 19 January 2009 bases of the assessment.

the assessment. Enron likewise questioned the substantive validity

of the assessment.

DOCTRINE: The Tax Code provides that a taxpayer shall be informed in

writing of the law and the facts on which the assessment is made; otherwise, CTA granted the ordered the cancellation of the assessment. The CIR insists

the assessment shall be void. The use of the word “shall” indicate the that an examination of the facts shows that Enron was properly apprised of its

mandatory nature of the requirement. tax deficiency. During the pre-assessment stage, the CIR advised Enron’s

representative of the tax deficiency, informed it of the proposed tax deficiency

In this case, the CIR merely issued a formal assessment and indicated therein assessment through a preliminary five-day letter and furnished Enron a copy

the supposed tax, surcharge, interest and compromise penalty due thereon. of the audit working paper14 allegedly showing in detail the legal and factual

The Revenue Officers of the [the CIR] in the issuance of the Final Assessment bases of the assessment. The CIR argues that these steps sufficed to inform

Notice did not provide Enron with the written bases of the law and facts on Enron of the laws and facts on which the deficiency tax assessment was

which the subject assessment is based. It did not bother to explain how it based.

arrived at such an assessment. Moreso, he failed to mention the specific

provision of the Tax Code or rules and regulations which were not complied ISSUE: W/N the advice of tax deficiency, given by the CIR to an employee of

with by Enron. The advice of tax deficiency, given by the CIR to an employee Enron, as well as the preliminary five-day letter, were valid substitutes for the

of Enron, as well as the preliminary five-day letter, were not valid substitutes mandatory notice in writing of the legal and factual bases of the assessment.

for the mandatory notice in writing of the legal and factual bases of the

assessment. RULING: NO. Both the CTA and the CA concluded that the deficiency tax

assessment merely itemized the deductions disallowed and included these in

The law requires that the legal and factual bases of the assessment be stated the gross income. It also imposed the preferential rate of 5% on some items

in the formal letter of demand and assessment notice. Thus, such cannot be categorized by Enron as costs. The legal and factual bases were, however,

presumed. Otherwise, the express provisions of Article 228 of the NIRC and not indicated.

RR No. 12-99 would be rendered nugatory. The alleged “factual bases” in the

advice, preliminary letter and “audit working papers” did not suffice. The Tax Code provides that a taxpayer shall be informed in writing of the law

and the facts on which the assessment is made; otherwise, the assessment

In view of the absence of a fair opportunity for Enron to be informed of the legal shall be void. The use of the word “shall” indicate the mandatory nature of the

and factual bases of the assessment against it, the assessment in question requirement. The law requires that the legal and factual bases of the

was void. assessment be stated in the formal letter of demand and assessment notice.

Thus, such cannot be presumed. Otherwise, the express provisions of Article

FACTS: Enron, a domestic corporation registered with the Subic Bay 228 of the NIRC and RR No. 12-99 would be rendered nugatory. The alleged

Metropolitan Authority as a freeport enterprise,2 filed its annual income tax “factual bases” in the advice, preliminary letter and “audit working papers” did

return for the year 1996 on April 12, 1997. It indicated a net loss of P7,684,948. not suffice.

Subsequently, the Bureau of Internal Revenue, through a preliminary five-day

letter,3 informed it of a proposed assessment of an alleged P2,880,817.25 In this case, the CIR merely issued a formal assessment and indicated therein

deficiency income tax. Enron disputed the proposed deficiency assessment in the supposed tax, surcharge, interest and compromise penalty due thereon.

its first protest letter. The Revenue Officers of the [the CIR] in the issuance of the Final Assessment

Notice did not provide Enron with the written bases of the law and facts on

On May 26, 1999, Enron received from the CIR a formal assessment notice which the subject assessment is based. It did not bother to explain how it

requiring it to pay the alleged deficiency income tax of P2,880,817.25 for the arrived at such an assessment. Moreso, he failed to mention the specific

taxable year 1996. Enron protested this deficiency tax assessment. provision of the Tax Code or rules and regulations which were not complied

with by Enron. The advice of tax deficiency, given by the CIR to an employee

Due to the non-resolution of its protest within the 180-day period, Enron filed of Enron, as well as the preliminary five-day letter, were not valid substitutes

a petition for review in the Court of Tax Appeals (CTA). It argued that the for the mandatory notice in writing of the legal and factual bases of the

deficiency tax assessment disregarded the provisions of Section 228 of the assessment. In view of the absence of a fair opportunity for Enron to be

National Internal Revenue Code (NIRC), as amended,8 and Section 3.1.4 of informed of the legal and factual bases of the assessment against it, the

Revenue Regulations (RR) No. 12-999 by not providing the legal and factual assessment in question was void.

CIR vs. ASALUS CORPORATION, G.R. No. 221590, 22 Feb 2017

CTA En banc: It sustained the CTA Division decision.

DOCTRINE: When there is a showing that a taxpayer has substantially

underdeclared its sales, receipt or income, there is a presumption that it has The CIR, through the Office of the Solicitor General (OSG), argues that the

filed a false return. As such, the CIR need not immediately present evidence VAT assessment had yet to prescribe as the applicable prescriptive period is

to support the falsity of the return, unless the taxpayer fails to overcome the the ten (10)-year prescriptive period under Section 222 of the NIRC, and not

presumption against it. Here, there was a prima facie showing that the returns the three (3)-year prescriptive period under Section 203 thereof. It claims that

filed by Asalus were false, which it failed to controvert. Also, it was adequately Asalus was informed in the PAN of the ten (10)-year prescriptive period and

informed that it was being assessed within the extraordinary prescriptive that the FAN made specific reference to the PAN.

period. As such, the assessment was timely within the 10-year prescriptive ISSUE: W/N the VAT assessment had prescribed

period.

RULING: NO. Under Section 248(B) of the NIRC, there is a prima facie

FACTS: On December 16, 2010, respondent Asalus Corporation (Asalus) evidence of a false return if there is a substantial underdeclaration of taxable

received a Notice of Informal Conference from Revenue District Office (RDO) sales, receipt or income. The failure to report sales, receipts or income in an

No. 47 of the Bureau of Internal Revenue (BIR). It was in connection with the amount exceeding 30% what is declared in the returns constitute substantial

investigation conducted by Revenue Officer Fidel M. Bañares II (Bañares) on underdeclaration. A prima facie evidence is one which that will establish a fact

the Value-Added Tax (VAT) transactions of Asalus for the taxable year 2007. or sustain a judgment unless contradictory evidence is produced.

Asalus filed its Letter-Reply,5 dated December 29, 2010, questioning the basis

of Bañares’ computation for its VAT liability. In other words, when there is a showing that a taxpayer has substantially

underdeclared its sales, receipt or income, there is a presumption that it has

On January 10, 2011, petitioner Commissioner of Internal Revenue (CIR) filed a false return. As such, the CIR need not immediately present evidence

issued the Preliminary Assessment Notice (PAN) finding Asalus liable for to support the falsity of the return, unless the taxpayer fails to overcome the

deficiency VAT for 2007 in the aggregate amount of P413,378,058.11, presumption against it.

inclusive of surcharge and interest. Asalus filed its protest against the PAN but

it was denied by the CIR. Applied in this case, the audit investigation revealed that there were

undeclared VATable sales more than 30% of that declared in Asalus’ VAT

On August 26, 2011, Asalus received the Formal Assessment Notice (FAN) returns. Moreover, Asalus’ lone witness testified that not all membership fees,

stating that it was liable for deficiency VAT for 2007 in the total amount of particularly those pertaining to medical practitioners and hospitals, were

P95,681,988.64, inclusive of surcharge and interest. Consequently, it filed its reported in Asalus’ VAT returns. The testimony of its witness, in trying to justify

protest against the FAN, dated September 6, 2011. Thereafter, Asalus filed a why not all of its sales were included in the gross receipts reflected in the VAT

supplemental protest stating that the deficiency VAT assessment had returns, supported the presumption that the return filed was indeed false

prescribed pursuant to Section 203 of the National Internal Revenue Code precisely because not all the sales of Asalus were included in the VAT returns.

(NIRC).

Hence, the CIR need not present further evidence as the presumption of falsity

On October 16, 2012, Asalus received the Final Decision on Disputed of the returns was not overcome. Asalus was bound to refute the presumption

Assessment8 (FDDA) showing VAT deficiency for 2007 in the aggregate of the falsity of the return and to prove that it had filed accurate returns. Its

amount of P106,761,025.17, inclusive of surcharge and interest and failure to overcome the same warranted the application of the ten (10)-year

P25,000.00 as compromise penalty. As a result, it filed a petition for review prescriptive period for assessment under Section 222 of the NIRC. To require

before the CTA Division. the CIR to present additional evidence in spite of the presumption provided in

Section 248(B) of the NIRC would render the said provision inutile.

CTA Division: The CTA Division ruled that the VAT assessment issued on

August 26, 2011 had prescribed and consequently deemed invalid. It opined As to the notice requirement, the CIR substantially complied with said

that the ten (10)-year prescriptive period under Section 222 of the NIRC was requisite.

inapplicable as neither the FAN nor the FDDA indicated that Asalus had filed

a false VAT return warranting the application of the ten (10)-year prescriptive It is true that neither the FAN nor the FDDA explicitly stated that the applicable

period. MR denied. prescriptive period was the ten (10)-year period set in Section 222 of the NIRC.

They, however, made reference to the PAN, which categorically stated that Bureau (EIIB), received confidential information that the respondent had

“[t]he running of the three-year statute of limitation as provided under Section imported synthetic resin amounting to P115,599,018.00 but only declared

203 of the 1997 National Internal Revenue Code (NIRC) is not applicable x x P45,538,694.57. According to the informer, based on photocopies of 77

x but rather to the ten (10)-year prescriptive period pursuant to Section 222(A) Consumption Entries furnished by another informer, the 1987 importations of

of the tax code x x x. the respondent were understated in its accounting records. Amoto submitted

a report to the EIIB Commissioner recommending that an inventory audit of

Thus, substantial compliance with the requirement as laid down under Section the respondent be conducted by the Internal Inquiry and Prosecution Office

228 of the NIRC suffices, for what is important is that the taxpayer has been (IIPO) of the EIIB.

sufficiently informed of the factual and legal bases of the assessment so that

it may file an effective protest against the assessment. In the case at bench, EIIB issued a Mission Order for the audit and investigation of the importations

Asalus was sufficiently informed that with respect to its tax liability, the of Hantex for 1987. The IIPO issued subpoena duces tecum and ad

extraordinary period laid down in Section 222 of the NIRC would apply. This testificandum for the president and general manager of the respondent to

was categorically stated in the PAN and all subsequent communications from appear in a hearing and bring the following:

the CIR made reference to the PAN. Asalus was eventually able to file a protest 1. Books of Accounts for the year 1987;

addressing the issue on prescription, although it was done only in its 2. Record of Importations of Synthetic Resin and Calcium Carbonate for the

supplemental protest to the FAN. year 1987;

3. Income tax returns & attachments for 1987; and

Considering the existing circumstances, the assessment was timely made 4. Record of tax payments.

because the applicable prescriptive period was the ten (10)-year prescriptive

period under Section 222 of the NIRC. To reiterate, there was a prima facie However, Hantex refused to comply.

showing that the returns filed by Asalus were false, which it failed to controvert.

Also, it was adequately informed that it was being assessed within the IIPO forthwith secured certified copies of the Profit and Loss Statements for

extraordinary prescriptive period. 1987 filed by the respondent with the Securities and Exchange Commission

(SEC). However, the IIPO failed to secure certified copies of the respondent’s

CIR vs. Hantex Trading Co., Inc. G.R. No. 136975, 31 March 2005 1987 Consumption Entries from the Bureau of Customs since, according to

the custodian thereof, the original copies had been eaten by termites. IIPO

DOCTRINE: The “best evidence” envisaged in Section 16 of the 1977 NIRC, requested the Chief of the Collection Division, Manila International Container

as amended, includes the corporate and accounting records of the taxpayer Port, and the Acting Chief of the Collection Division, Port of Manila, to

who is the subject of the assessment process, the accounting records of other authenticate the machine copies of the import entries supplied by the

taxpayers engaged in the same line of business, including their gross profit informer. However, Chief of the Collection Division Merlita D. Tomas could not

and net profit sales. The best evidence obtainable under Section 16 of the do so because the Collection Division did not have the original copies of the

1977 NIRC, as amended, does not include mere photocopies of entries.

records/documents.

Bienvenido G. Flores, Chief of the Investigation Division, and Lt. Leo Dionela,

Here, the petitioner, in making a preliminary and final tax deficiency Lt. Vicente Amoto and Lt. Rolando Gatmaitan conducted an investigation.

assessment against a taxpayer, cannot anchor the said assessment on mere They relied on the certified copies of the respondent’s Profit and Loss

machine copies of records/documents. Mere photocopies of the Consumption Statement for 1987 and 1988 on file with the SEC, the machine copies of the

Entries have no probative weight if offered as proof of the contents thereof. Consumption Entries, Series of 1987, submitted by the informer, as well as

The reason for this is that such copies are mere scraps of paper and are of no excerpts from the entries certified by Tomas and Danganan.

probative value as basis for any deficiency income or business taxes against

a taxpayer. The rule is that in the absence of the accounting records of a Based on the documents/records on hand, inclusive of the machine copies of

taxpayer, his tax liability may be determined by estimation. However, rule does the Consumption Entries, the EIIB found that for 1987, the respondent had

not apply where the estimation is arrived at arbitrarily and capriciously. importations totaling P105,716,527.00 (inclusive of advance sales tax).

Compared with the declared sales based on the Profit and Loss Statements

FACTS: Sometime in October 1989, Lt. Vicente Amoto, Acting Chief of filed with the SEC, the respondent had unreported sales in the amount of

Counter-Intelligence Division of the Economic Intelligence and Investigation

P63,032,989.17, and its corresponding income tax liability was machine copies of records/documents. Mere photocopies of the Consumption

P41,916,937.78, inclusive of penalty charge and interests. Entries have no probative weight if offered as proof of the contents thereof.

The reason for this is that such copies are mere scraps of paper and are of no

CIR sent a Letter dated April 15, 1991 to the respondent demanding payment probative value as basis for any deficiency income or business taxes against

of its deficiency income tax of P13,414,226.40 and deficiency sales tax of a taxpayer.

P14,752,903.25, inclusive of surcharge and interest.

The rule assumes more importance in this case since the xerox copies of the

Respondent later filed a protest. The respondent questioned the assessment Consumption Entries furnished by the informer of the EIIB were furnished by

on the ground that the EIIB representative failed to present the original, or yet another informer. While the EIIB tried to secure certified copies of the said

authenticated, or duly certified copies of the Consumption and Import Entry entries from the Bureau of Customs, it was unable to do so because the said

Accounts, or excerpts thereof if the original copies were not readily available; entries were allegedly eaten by termites. The Court can only surmise why the

or, if the originals were in the official custody of a public officer, certified copies EIIB or the BIR, for that matter, failed to secure certified copies of the said

thereof as provided for in Section 12, Chapter 3, Book VII, Administrative entries from the Tariff and Customs Commission or from the National Statistics

Procedure, Administrative Order of 1987. It stated that the only copies of the Office which also had copies thereof.

Consumption Entries submitted to the Hearing Officer were mere machine

copies furnished by an informer of the EIIB. The rule is that in the absence of the accounting records of a taxpayer, his tax

liability may be determined by estimation. The petitioner is not required to

CTA: denied. respondent was burdened to prove not only that the assessment compute such tax liabilities with mathematical exactness. However, rule does

was erroneous, but also to adduce the correct taxes to be paid by it. not apply where the estimation is arrived at arbitrarily and capriciously. All

presumptions are in favor of the correctness of a tax assessment. It is to be

CA: reversed. income and sales tax deficiency assessments issued by the presumed, however, that such assessment was based on sufficient evidence.

petitioner were unlawful and baseless since the copies of the import entries

relied upon in computing the deficiency tax of the respondent were not duly In fine, the petitioner based her finding that the 1987 importation of the

authenticated by the public officer charged with their custody, nor verified respondent was underdeclared in the amount of P105,761,527.00 on the

under oath by the EIIB and the BIR investigators. worthless machine copies of the Consumption Entries. Aside from such

copies, the petitioner has no other evidence to prove that the respondent

ISSUE: W/N the assessments made were valid. imported goods costing P105,761,527.00. The petitioner cannot find solace on

the certifications of Tomas and Danganan because they did not authenticate

RULING: NO. The “best evidence” envisaged in Section 16 of the 1977 NIRC, the machine copies of the Consumption Entries, and merely indicated therein

as amended, includes the corporate and accounting records of the taxpayer the entry numbers of Consumption Entries and the dates when the Bureau of

who is the subject of the assessment process, the accounting records of other Customs released the same. The certifications of Tomas and Danganan do

taxpayers engaged in the same line of business, including their gross profit not even contain the landed costs and the advance sales taxes paid by the

and net profit sales. Best evidence obtainable may consist of hearsay importer, if any. Comparing the certifications of Tomas and Danganan and the

evidence, such as the testimony of third parties or accounts or other records machine copies of the Consumption Entries, only 36 of the entry numbers of

of other taxpayers similarly circumstanced as the taxpayer subject of the such copies are included in the said certifications; the entry numbers of the

investigation, hence, inadmissible in a regular proceeding in the regular rest of the machine copies of the Consumption Entries are not found therein.

courts.72 Moreover, the general rule is that administrative agencies such as

the BIR are not bound by the technical rules of evidence. It can accept Thus, the computations of the EIIB and the BIR on the quantity and costs of

documents which cannot be admitted in a judicial proceeding where the Rules the importations of the respondent in the amount of P105,761,527.00 for 1987

of Court are strictly observed. It can choose to give weight or disregard such have no factual basis, hence, arbitrary and capricious. As such, SC remanded

evidence, depending on its trustworthiness. However, the best evidence the case to the CTA for further proceedings, to enable the petitioner to adduce

obtainable under Section 16 of the 1977 NIRC, as amended, does not include in evidence certified true copies or duplicate original copies of the

mere photocopies of records/documents. Consumption Entries for the respondent’s 1987 importations, if there be any,

and the correct tax deficiency assessment thereon, without prejudice to the

Here, the petitioner, in making a preliminary and final tax deficiency right of the respondent to adduce controverting evidence, so that the matter

assessment against a taxpayer, cannot anchor the said assessment on mere may be resolved once and for all by the CTA.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Apb Barops2021 LMT Remedial LawDokument7 SeitenApb Barops2021 LMT Remedial LawJm CruzNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Apb Barops2021 LMT EthicsDokument7 SeitenApb Barops2021 LMT EthicsJm CruzNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- UST - QAMTO 2021 - 01 - Political LawDokument149 SeitenUST - QAMTO 2021 - 01 - Political Lawfreegalado94% (16)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Apb Barops2021 LMT Civil LawDokument5 SeitenApb Barops2021 LMT Civil LawJm CruzNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Apb Barops2021 LMT Commercial LawDokument6 SeitenApb Barops2021 LMT Commercial LawJm CruzNoch keine Bewertungen

- Neypes Rule Fresh Period RuleDokument4 SeitenNeypes Rule Fresh Period RuleJm CruzNoch keine Bewertungen

- 2019 Notes On Legal and Judicial Ethics by Prof. Erickson H. BalmesDokument9 Seiten2019 Notes On Legal and Judicial Ethics by Prof. Erickson H. BalmesJm CruzNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Case List For Election Law (2018)Dokument2 SeitenCase List For Election Law (2018)Jm CruzNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Constitutional Law Review: Atty. Norieva D. de Vega First Semester, SY 2018-2019Dokument1 SeiteConstitutional Law Review: Atty. Norieva D. de Vega First Semester, SY 2018-2019Jm CruzNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Poli AteneoDokument330 SeitenPoli AteneoJm Cruz50% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Apprac CaseDokument7 SeitenApprac CaseJm CruzNoch keine Bewertungen

- Small ClaimsDokument8 SeitenSmall ClaimsJm CruzNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- 01 FAT KEE Computer Systems V Online Networks InternationalDokument20 Seiten01 FAT KEE Computer Systems V Online Networks InternationalJm CruzNoch keine Bewertungen

- Abakada v. ErmitaDokument351 SeitenAbakada v. ErmitaJm CruzNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Rules On Appeals-Rule 40, 41, 42, 43, 45Dokument1 SeiteRules On Appeals-Rule 40, 41, 42, 43, 45Jm CruzNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- CRIMjm - Digest5 (Mitigating)Dokument3 SeitenCRIMjm - Digest5 (Mitigating)Jm CruzNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Rem-Tranquil Syllabus PDFDokument25 SeitenRem-Tranquil Syllabus PDFJm CruzNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- 01 US V Gomez JesusDokument14 Seiten01 US V Gomez JesusJm CruzNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- 08 PNB V PerezDokument19 Seiten08 PNB V PerezJm CruzNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Multiple Linear RegressionDokument26 SeitenMultiple Linear RegressionMarlene G Padigos100% (2)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Biosphere Noo Sphere Infosphere Epistemo PDFDokument18 SeitenBiosphere Noo Sphere Infosphere Epistemo PDFGeorge PetreNoch keine Bewertungen

- Delaware Met CSAC Initial Meeting ReportDokument20 SeitenDelaware Met CSAC Initial Meeting ReportKevinOhlandtNoch keine Bewertungen

- 1 - HandBook CBBR4106Dokument29 Seiten1 - HandBook CBBR4106mkkhusairiNoch keine Bewertungen

- Stockholm KammarbrassDokument20 SeitenStockholm KammarbrassManuel CoitoNoch keine Bewertungen

- Drapeau Resume May09Dokument5 SeitenDrapeau Resume May09drmark212Noch keine Bewertungen

- Calcined Clays For Sustainable Concrete Karen Scrivener, AurÇlie Favier, 2015Dokument552 SeitenCalcined Clays For Sustainable Concrete Karen Scrivener, AurÇlie Favier, 2015Débora BretasNoch keine Bewertungen

- RWE Algebra 12 ProbStat Discrete Math Trigo Geom 2017 DVO PDFDokument4 SeitenRWE Algebra 12 ProbStat Discrete Math Trigo Geom 2017 DVO PDFハンター ジェイソンNoch keine Bewertungen

- THE LAW OF - John Searl Solution PDFDokument50 SeitenTHE LAW OF - John Searl Solution PDFerehov1100% (1)

- Thesis Statement VampiresDokument6 SeitenThesis Statement Vampireslaurasmithdesmoines100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Distributing Business Partner Master Data From SAP CRMDokument28 SeitenDistributing Business Partner Master Data From SAP CRMJarko RozemondNoch keine Bewertungen

- Conversational Maxims and Some Philosophical ProblemsDokument15 SeitenConversational Maxims and Some Philosophical ProblemsPedro Alberto SanchezNoch keine Bewertungen

- Thermal Physics Questions IB Question BankDokument43 SeitenThermal Physics Questions IB Question BankIBBhuvi Jain100% (1)

- Ad1 MCQDokument11 SeitenAd1 MCQYashwanth Srinivasa100% (1)

- Graphic Organizers As A Reading Strategy: Research FindDokument9 SeitenGraphic Organizers As A Reading Strategy: Research Findzwn zwnNoch keine Bewertungen

- S - BlockDokument21 SeitenS - BlockRakshit Gupta100% (2)

- Form No. 10-I: Certificate of Prescribed Authority For The Purposes of Section 80DDBDokument1 SeiteForm No. 10-I: Certificate of Prescribed Authority For The Purposes of Section 80DDBIam KarthikeyanNoch keine Bewertungen

- Digital Sytems Counters and Registers: Dce DceDokument17 SeitenDigital Sytems Counters and Registers: Dce DcePhan Gia AnhNoch keine Bewertungen

- ASME-Y14.5.1M 1994 Mathematical Definition of Dimensioning and Tolerancing Principles PDFDokument89 SeitenASME-Y14.5.1M 1994 Mathematical Definition of Dimensioning and Tolerancing Principles PDFwulfgang66Noch keine Bewertungen

- DissertationDokument59 SeitenDissertationFatma AlkindiNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Oda A La InmortalidadDokument7 SeitenOda A La InmortalidadEmy OoTeam ClésNoch keine Bewertungen

- Some Problems in Determining The Origin of The Philippine Word Mutya' or Mutia'Dokument34 SeitenSome Problems in Determining The Origin of The Philippine Word Mutya' or Mutia'Irma ramosNoch keine Bewertungen

- EIS Summary NotsDokument62 SeitenEIS Summary NotsKESHAV DroliaNoch keine Bewertungen

- AMCAT All in ONEDokument138 SeitenAMCAT All in ONEKuldip DeshmukhNoch keine Bewertungen

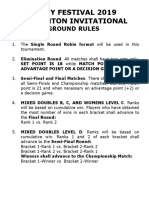

- Ground Rules 2019Dokument3 SeitenGround Rules 2019Jeremiah Miko LepasanaNoch keine Bewertungen

- Database Programming With SQL Section 2 QuizDokument6 SeitenDatabase Programming With SQL Section 2 QuizJosé Obeniel LópezNoch keine Bewertungen

- NetStumbler Guide2Dokument3 SeitenNetStumbler Guide2Maung Bay0% (1)

- PSYC1111 Ogden Psychology of Health and IllnessDokument108 SeitenPSYC1111 Ogden Psychology of Health and IllnessAleNoch keine Bewertungen

- Administrator's Guide: SeriesDokument64 SeitenAdministrator's Guide: SeriesSunny SaahilNoch keine Bewertungen

- Right Hand Man LyricsDokument11 SeitenRight Hand Man LyricsSteph CollierNoch keine Bewertungen

- Getting to Yes: How to Negotiate Agreement Without Giving InVon EverandGetting to Yes: How to Negotiate Agreement Without Giving InBewertung: 4 von 5 Sternen4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Von EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineVon EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNoch keine Bewertungen