Beruflich Dokumente

Kultur Dokumente

Audit Cash Exercises

Hochgeladen von

jhevesOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Audit Cash Exercises

Hochgeladen von

jhevesCopyright:

Verfügbare Formate

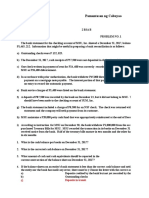

Exercises

AUD-Cash

You obtained the following information in connection with the audit of Bonsoir Company cash account as of

December 31, 20x1:

Outstanding checks, 11/30/20x1 P 16,250

Outstanding checks, 12/31/20x1 12,500

Deposit in transit, 11/30/20x1 12,500

Cash balance per general ledger, 12/31/20x1 37,500

Actual company collections from its customers during

December 152,500

Company checks paid by bank in December 130,000

Bank service charges recorded on the company books

in December 2,500

Bank service charges per December bank statement 3,250

Deposits credited by bank during December 145,000

November bank service charges recorded on company

books in December 1,500

The cash receipts book of December is underfooted by P 2,500.

The bank erroneously charged the company's account for a P3,750 check of another depositor. This bank error was

corrected in January 20x2.

Questions:

1. How much is the deposit in transit on December 31, 20x1?

2. What is the total unrecorded bank service charges as of December 31, 20x1?

3. What is the total book receipts in December?

4. What is the total amount of company checks issued in December?

5. What is the total book disbursements in December?

6. What is the book balance on November 30, 20x1?

7. What is the bank balance on November 30, 20x1?

8. What is the total bank receipts in December?

9. What is the total bank disbursements in December?

10. What is the bank balance on December 31, 20x1?

AUD 2

Bonjour Company

General and Petty Cash Count

Audit Year: 20x1

Date of Count: January 5, 20x2, 10:00am

Bills and Coins

Denomination Pieces

P 500 218

100 454

50 610

20 1,008

10 20

5 608

1 1,040

0.25 4,032

Checks

Maker Payee Date Amount

Tissot - Customer Bonjour Company 12/30/20x1 P 23,840

Castro - Customer Bonjour Company 12/26/20x1 25,010

Allez - Customer Bonjour Company 1/2/20x2 11,414

Petra - Customer Bonjour Company 12/21/20x1 26,700

Bonjour Company Bonne Chance Corp. 12/27/20x1 29,000

Salut - Officer Bearer 1/5/20x2 620

Bueno* Cash 12/29/20x1 520

*Amount is for a return of travel advance made to the employee in an earlier period.

Vouchers and IOUS

Paid to Date Amount

BWD 1/2/20x2 P 70

BENECO 12/20/20x1 300

Eurotel - Christmas Party 12/23/20x1 12,580

Vina - IOU 12/27/20x1 600

Additional Notes:

1. Cash sales invoice (all currencies, No. 17903 to 18112), P 201,000.

2. Official Receipts

Number Amount Form of Collection

31250 P 1,120 Cash

31251 25,010 Check

31252 2,404 Cash

31253 23,840 Check

31254 26,700 Check

3. Stamps of various denomination amounted to P 160.

4. A notation on an envelope is "Proceeds from employee contribution for Christmas Party, P 19,000".

5. Petty cash per ledger, P 30,000.

Questions:

1. How much is the petty cash shortage as of January 5, 20x2?

2. What is the credit adjustment to correct the petty cash fund?

3. What is the adjusted petty cash fund as of December 31, 20x1?

AUD- Inventory

You are engaged in the regular annual examination of the accounts and records of PRTC Manufacturing Co. for the

year ended December 31, 2012. To reduce the workload at year end, the company, upon your recommendation,

took its annual physical inventory on November 30, 2012. You observed the taking of the inventory and made tests

of the inventory count and the inventory records.

The company’s inventory account, which includes raw materials and work-in-process is on perpetual basis.

Inventories are valued at cost, first-in, first-out method. There is no finished goods inventory.

The company’s physical inventory revealed that the book inventory of P1,695,960 was understated by P84,000. To

avoid delay in completing its monthly financial statements, the company decided not to adjust the book inventory

until year-end except for obsolete inventory items.

Your examination disclosed the following information regarding the November 30 inventory: a. Pricing tests

showed that the physical inventory was overstated by P61,600.

b. An understatement of the physical inventory by P4,200 due to errors in footings and extensions.

c. Direct labor included in the inventory amounted to P280,000. Overhead was included at the rate of 200% of

direct labor. You have ascertained that the amount of direct labor was correct and that the overhead rate was proper.

d. The physical inventory included obsolete materials with a total cost of P7,000. During December, the obsolete

materials were written off by a charge to cost of sales.

Your audit also disclosed the following information about the December 31 inventory:

a. Total debits to the following accounts during December were: Cost of sales P1,920,800 Direct labor 338,800

Purchases 691,600

b. The cost of sales of P1,920,800 included direct labor of P386,400.

QUESTIONS:

Based on the above and the result of your audit, determine the following:

1. Adjusted amount of physical inventory at November 30, 2012

a. P1,715,560 b. P1,845,760 c. P1,631,560 d. P1,722,560

2. Adjusted amount of inventory at December 31, 2012

a. P1,509,760 b. P1,502,760 c. P1,516,760 d. P1,425,760

3. Cost of materials on hand, and materials included in work in process as of December 31, 2012

a. P819,560 b. P728,560 c. P812,560 d. P942,760

4. The amount of direct labor included in work in process as of December 31, 2012

a. P618,800 b. P338,800 c. P232,400 d. P386,400

5. The amount of factory overhead included in work in process as of December 31, 2012

a. P 772,800 b.P464,800 c. P1,237,600 d. P777,600

Das könnte Ihnen auch gefallen

- TaxDokument19 SeitenTaxjhevesNoch keine Bewertungen

- Audit of CashDokument4 SeitenAudit of CashRegi IceNoch keine Bewertungen

- ReSA Final Pre-Board Exam ReviewDokument24 SeitenReSA Final Pre-Board Exam ReviewLuna V100% (2)

- QUIZ Cash APDokument11 SeitenQUIZ Cash APJanelleNoch keine Bewertungen

- Basic of Accounting Principles PDFDokument23 SeitenBasic of Accounting Principles PDFMani KandanNoch keine Bewertungen

- Partnership and Corp Liquid TestbankDokument288 SeitenPartnership and Corp Liquid TestbankWendelyn Tutor80% (5)

- Intermediate Accounting 1 - Cash and Cash EquivalentsDokument14 SeitenIntermediate Accounting 1 - Cash and Cash EquivalentsKristine Jewel MirandaNoch keine Bewertungen

- TEST BANK FINANCIAL ACCOUNTING THEORYDokument15 SeitenTEST BANK FINANCIAL ACCOUNTING THEORYRod100% (2)

- ACC5116 - HOBA - Additional ProblemsDokument6 SeitenACC5116 - HOBA - Additional ProblemsCarl Dhaniel Garcia Salen100% (1)

- Apre 102 MidtermsDokument10 SeitenApre 102 MidtermsMa Angelica BalatucanNoch keine Bewertungen

- Cash and Cash Equivalents - ProblemsDokument47 SeitenCash and Cash Equivalents - Problemscommissioned homeworkNoch keine Bewertungen

- ReSA B43 FAR First PB Exam Questions Answers SolutionsDokument14 SeitenReSA B43 FAR First PB Exam Questions Answers Solutionsrtenaja100% (1)

- Rolito DionelaDokument40 SeitenRolito DionelaRolito Dionela50% (2)

- Ap9208 Cash 3Dokument4 SeitenAp9208 Cash 3Onids AbayaNoch keine Bewertungen

- Audit of Cash and Cash Equivalents 1Dokument9 SeitenAudit of Cash and Cash Equivalents 1nena cabañesNoch keine Bewertungen

- Article XI 1987 Philippine ConstitutionDokument3 SeitenArticle XI 1987 Philippine ConstitutionreseljanNoch keine Bewertungen

- Audit of Cash and Cash EquivalentsDokument9 SeitenAudit of Cash and Cash Equivalentspatricia100% (1)

- Ia-Carp Q1 W2 PDFDokument16 SeitenIa-Carp Q1 W2 PDFLaurenceFabialaNoch keine Bewertungen

- IT Audit CH 1Dokument8 SeitenIT Audit CH 1mimi96100% (4)

- Business Law and TaxationDokument15 SeitenBusiness Law and TaxationKhim Dagangon100% (1)

- Principles of Economics 7th Edition Gregory Mankiw Solutions ManualDokument25 SeitenPrinciples of Economics 7th Edition Gregory Mankiw Solutions ManualJacquelineHillqtbs100% (60)

- Audit Cash Bank Reconciliation ProblemsDokument5 SeitenAudit Cash Bank Reconciliation ProblemsEjoyce KimNoch keine Bewertungen

- PCF ProblemDokument2 SeitenPCF ProblemSamantha DoradoNoch keine Bewertungen

- Intermediate Accounting I - Cash and Cash EquivalentsDokument4 SeitenIntermediate Accounting I - Cash and Cash EquivalentsJoovs JoovhoNoch keine Bewertungen

- Saviour Exam 7Dokument1 SeiteSaviour Exam 7BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- Lesson 2 AP: Audit of Cash - Problem C QuestionsDokument1 SeiteLesson 2 AP: Audit of Cash - Problem C QuestionsXandae MempinNoch keine Bewertungen

- Saviour Exam 6Dokument1 SeiteSaviour Exam 6BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- Audit of Cash - SW8Dokument7 SeitenAudit of Cash - SW8d.pagkatoytoyNoch keine Bewertungen

- Aud 1 and Aud 2 ProblemsDokument6 SeitenAud 1 and Aud 2 ProblemsRomelie M. NopreNoch keine Bewertungen

- Audit Adjusting Entries for Cash and Cash EquivalentsDokument5 SeitenAudit Adjusting Entries for Cash and Cash EquivalentsKenneth Christian WilburNoch keine Bewertungen

- Finals Pom HandoutDokument7 SeitenFinals Pom HandoutFlorenz AmbasNoch keine Bewertungen

- Ap9208 Cash 2Dokument2 SeitenAp9208 Cash 2Onids AbayaNoch keine Bewertungen

- Problem SolvingDokument4 SeitenProblem SolvingsunflowerNoch keine Bewertungen

- Handout - Cash and Cash EquivalentsDokument5 SeitenHandout - Cash and Cash Equivalentsandrea arapocNoch keine Bewertungen

- Assignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundDokument6 SeitenAssignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundThricia Mae Lorenzo IgnacioNoch keine Bewertungen

- Audprob QuizzersDokument12 SeitenAudprob QuizzersDenezzy Manongas RicafrenteNoch keine Bewertungen

- AudprobDokument3 SeitenAudprobJonalyn MoralesNoch keine Bewertungen

- ACC 140 1 Period - Quiz 2Dokument7 SeitenACC 140 1 Period - Quiz 2Rica Mille MartinNoch keine Bewertungen

- Cash Problem 1Dokument3 SeitenCash Problem 1Dawson Dela CruzNoch keine Bewertungen

- Quiz No. 2Dokument5 SeitenQuiz No. 2VernnNoch keine Bewertungen

- Acctg 205A Cash & Receivables Quiz 10-10-20Dokument3 SeitenAcctg 205A Cash & Receivables Quiz 10-10-20Darynn LinggonNoch keine Bewertungen

- Auditing Exercises SolutionsDokument4 SeitenAuditing Exercises Solutionsbjay chuyNoch keine Bewertungen

- Ac20 Exercise 1 DGC PDFDokument5 SeitenAc20 Exercise 1 DGC PDFmusic niNoch keine Bewertungen

- AUD02 - 05 Audit of Cash and Cash EquivalentsDokument3 SeitenAUD02 - 05 Audit of Cash and Cash EquivalentsMark BajacanNoch keine Bewertungen

- Audit of Cash Problems (Seatwork)Dokument5 SeitenAudit of Cash Problems (Seatwork)LorraineMartinNoch keine Bewertungen

- Pilate Limited Income StatementDokument13 SeitenPilate Limited Income Statementouo So方Noch keine Bewertungen

- Audit of Cash: Problem No. 1Dokument4 SeitenAudit of Cash: Problem No. 1Kathrina RoxasNoch keine Bewertungen

- Assignment No. 1 Audit of CashDokument5 SeitenAssignment No. 1 Audit of CashMa Tiffany Gura RobleNoch keine Bewertungen

- Calculating Cash and Cash EquivalentsDokument4 SeitenCalculating Cash and Cash EquivalentsGlydell MapayeNoch keine Bewertungen

- REVIEWer Take Home QuizDokument3 SeitenREVIEWer Take Home QuizNeirish fainsan0% (1)

- Audit Cash Equivalents Receivables NotesDokument11 SeitenAudit Cash Equivalents Receivables NotesEdemson NavalesNoch keine Bewertungen

- End of Chapter Problems 3-1 (Cash Count)Dokument3 SeitenEnd of Chapter Problems 3-1 (Cash Count)Exzyl Vixien Iexsha LoxinthNoch keine Bewertungen

- Audit Cash Equivalents ProblemsDokument4 SeitenAudit Cash Equivalents ProblemsElaine Antonio100% (1)

- AP Handout 01 Audit of Cash PDFDokument6 SeitenAP Handout 01 Audit of Cash PDFTherese AlmiraNoch keine Bewertungen

- Assignment - Cash and CEDokument4 SeitenAssignment - Cash and CEAleah Jehan AbuatNoch keine Bewertungen

- Financial Statement AnalysisDokument5 SeitenFinancial Statement AnalysisChi ChiNoch keine Bewertungen

- Chapter 2 - Cash and Cash Equivalents (Problems)Dokument2 SeitenChapter 2 - Cash and Cash Equivalents (Problems)Lea Victoria PronuevoNoch keine Bewertungen

- Prelim-Pr 2a14fb4488c3b5b235Dokument11 SeitenPrelim-Pr 2a14fb4488c3b5b235Romina LopezNoch keine Bewertungen

- PRELIM Quiz 1 Cash, CE, PCF, Bank ReconDokument8 SeitenPRELIM Quiz 1 Cash, CE, PCF, Bank ReconApril Faye de la CruzNoch keine Bewertungen

- 3-Cash and Cash Equiv ExercisesDokument8 Seiten3-Cash and Cash Equiv ExercisesAngelica CastilloNoch keine Bewertungen

- Audit of Cash - SeatworkDokument4 SeitenAudit of Cash - SeatworkTEOPE, EMERLIZA DE CASTRONoch keine Bewertungen

- Problem 1Dokument4 SeitenProblem 1Live LoveNoch keine Bewertungen

- Audit of Cash and Cash EquivalentsDokument6 SeitenAudit of Cash and Cash Equivalentsphoebelyn acdogNoch keine Bewertungen

- Iii-Ama: Bornasal Audit of Cash and Cash Equivalents (13 Feb 2021)Dokument20 SeitenIii-Ama: Bornasal Audit of Cash and Cash Equivalents (13 Feb 2021)nena cabañesNoch keine Bewertungen

- Audit of Cash and Cash EquivalentDokument5 SeitenAudit of Cash and Cash EquivalentGONZALES, MICA ANGEL A.Noch keine Bewertungen

- Audit Cash TransactionsDokument6 SeitenAudit Cash TransactionsAlyna JNoch keine Bewertungen

- Libyae Lustare - Audit Cash & Equivalents Under 40 CharactersDokument1 SeiteLibyae Lustare - Audit Cash & Equivalents Under 40 CharactersAna Mae HernandezNoch keine Bewertungen

- Advanced Accounting PDokument4 SeitenAdvanced Accounting PMaurice Agbayani100% (1)

- Economic & Budget Forecast Workbook: Economic workbook with worksheetVon EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNoch keine Bewertungen

- DocumentDokument1 SeiteDocumentjhevesNoch keine Bewertungen

- Project Simulation On Audit of Financial Statements: Sta. Clara Multi-Purpose CooperativeDokument1 SeiteProject Simulation On Audit of Financial Statements: Sta. Clara Multi-Purpose CooperativejhevesNoch keine Bewertungen

- Tìm Hiểu Về KSNBDokument21 SeitenTìm Hiểu Về KSNBTrần Văn TẹoNoch keine Bewertungen

- #19 PPE (Notes For 6203)Dokument4 Seiten#19 PPE (Notes For 6203)Claudine DuhapaNoch keine Bewertungen

- MAS QuizzerDokument37 SeitenMAS QuizzerJohn Carlo PeruNoch keine Bewertungen

- January to December 2022 CalendarDokument12 SeitenJanuary to December 2022 CalendarZenel Yap100% (1)

- June 2014 Bibliography PDFDokument5 SeitenJune 2014 Bibliography PDFKenncyNoch keine Bewertungen

- FederalismDokument2 SeitenFederalismjhevesNoch keine Bewertungen

- Solution AP Test Bank 1Dokument8 SeitenSolution AP Test Bank 1ima100% (1)

- ACC 6303 Applied Auditing Course OverviewDokument10 SeitenACC 6303 Applied Auditing Course OverviewjhevesNoch keine Bewertungen

- Audit Evidences PDFDokument45 SeitenAudit Evidences PDFkevior2Noch keine Bewertungen

- MAS QuizzerDokument37 SeitenMAS QuizzerJohn Carlo PeruNoch keine Bewertungen

- Overall Audit Plan and Audit ProgramDokument22 SeitenOverall Audit Plan and Audit Programjohnstone kennedyNoch keine Bewertungen

- Overall Audit Plan and Audit ProgramDokument22 SeitenOverall Audit Plan and Audit Programjohnstone kennedyNoch keine Bewertungen

- TOS FAR RevisedDokument7 SeitenTOS FAR RevisedAdmin ElenaNoch keine Bewertungen

- PPL Cup AverageDokument60 SeitenPPL Cup AveragejhevesNoch keine Bewertungen

- Tìm Hiểu Về KSNBDokument21 SeitenTìm Hiểu Về KSNBTrần Văn TẹoNoch keine Bewertungen

- 17 AppendixDokument9 Seiten17 AppendixjhevesNoch keine Bewertungen

- Draft of The Audit ProgramDokument2 SeitenDraft of The Audit ProgramjhevesNoch keine Bewertungen

- Prac 1 Average ReviewerDokument5 SeitenPrac 1 Average ReviewerHadassahFayNoch keine Bewertungen

- 12 Years a Slave ReactionDokument2 Seiten12 Years a Slave ReactionjhevesNoch keine Bewertungen

- Accounting Information System 12edition Romney Solution Manual Chapter 13Dokument34 SeitenAccounting Information System 12edition Romney Solution Manual Chapter 13Bayoe Ajip67% (3)

- Accounting Information System 12edition Romney Solution Manual Chapter 13Dokument34 SeitenAccounting Information System 12edition Romney Solution Manual Chapter 13Bayoe Ajip67% (3)

- Vascon Engineers - Kotak PCG PDFDokument7 SeitenVascon Engineers - Kotak PCG PDFdarshanmadeNoch keine Bewertungen

- 403Dokument12 Seiten403al hikmahNoch keine Bewertungen

- What Dubai Silicon Oasis DSO Free Zone OffersDokument3 SeitenWhat Dubai Silicon Oasis DSO Free Zone OffersKommu RohithNoch keine Bewertungen

- Specialization Project Report FinalDokument49 SeitenSpecialization Project Report FinalANCHURI NANDININoch keine Bewertungen

- M1 C2 Case Study WorkbookDokument25 SeitenM1 C2 Case Study WorkbookfenixaNoch keine Bewertungen

- MG 201 Assignment 1 s11145116Dokument4 SeitenMG 201 Assignment 1 s11145116sonam sonikaNoch keine Bewertungen

- AmulDokument109 SeitenAmulrajeshkutiwariNoch keine Bewertungen

- Action Plan and Contribution LogDokument30 SeitenAction Plan and Contribution LogdasunNoch keine Bewertungen

- Mcqs Cuet Ch-1 Acc 12Dokument7 SeitenMcqs Cuet Ch-1 Acc 12khushisingh9972Noch keine Bewertungen

- Castle (Met BKC)Dokument38 SeitenCastle (Met BKC)aashishpoladiaNoch keine Bewertungen

- SYBCO AC FIN Financial Accounting Special Accounting Areas IIIDokument249 SeitenSYBCO AC FIN Financial Accounting Special Accounting Areas IIIctfworkshop2020Noch keine Bewertungen

- Course Work: Official NameDokument4 SeitenCourse Work: Official NameEnio E. DokaNoch keine Bewertungen

- FinanceanswersDokument24 SeitenFinanceanswersAditi ToshniwalNoch keine Bewertungen

- How Businesses Have Adapted Their Corporate Social Responsibility Amidst the PandemicDokument7 SeitenHow Businesses Have Adapted Their Corporate Social Responsibility Amidst the PandemicJapsay Francisco GranadaNoch keine Bewertungen

- Inner Circle Trader Ict Forex Ict NotesDokument110 SeitenInner Circle Trader Ict Forex Ict NotesBurak AtlıNoch keine Bewertungen

- Introduction and Company Profile: Retail in IndiaDokument60 SeitenIntroduction and Company Profile: Retail in IndiaAbhinav Bansal0% (1)

- ADMS 3585 Course Outline Fall 2019 Keele CampusDokument16 SeitenADMS 3585 Course Outline Fall 2019 Keele CampusjorNoch keine Bewertungen

- How To Win The BSGDokument29 SeitenHow To Win The BSGβασιλης παυλος αρακας100% (1)

- Budget Execution Is The Process by Which The Financial Resources Made Available To An AgencyDokument4 SeitenBudget Execution Is The Process by Which The Financial Resources Made Available To An Agencyruby ann rojalesNoch keine Bewertungen

- Accounting For Decision MakersDokument33 SeitenAccounting For Decision MakersDuminiNoch keine Bewertungen

- Chapter 5 - Organizational Analysis and Competitive AdvantageDokument24 SeitenChapter 5 - Organizational Analysis and Competitive AdvantageVy KhánhNoch keine Bewertungen

- Journal entries for lamp production costs and inventoryDokument2 SeitenJournal entries for lamp production costs and inventoryLucy HeartfiliaNoch keine Bewertungen

- Fybcom Acc PDFDokument441 SeitenFybcom Acc PDFaayush rathi100% (1)

- Clutch Auto PDFDokument52 SeitenClutch Auto PDFHarshvardhan KothariNoch keine Bewertungen

- k4 Form PDFDokument2 Seitenk4 Form PDFHarshavardhanReddyKNoch keine Bewertungen

- Poster-Nike and BusinessDokument2 SeitenPoster-Nike and BusinessK. PaulNoch keine Bewertungen

- Is Services India's Growth EngineDokument42 SeitenIs Services India's Growth EngineDivya SreenivasNoch keine Bewertungen