Beruflich Dokumente

Kultur Dokumente

Book1 Ps

Hochgeladen von

Vincent IgnacioOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Book1 Ps

Hochgeladen von

Vincent IgnacioCopyright:

Verfügbare Formate

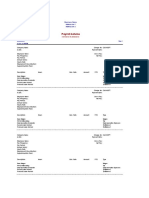

ALORICA TELESERVICES INC.

PAYSLIP ONLINE

PAY PERIOD 10-JUN-19 to 21-JUN-19

Employee Details Employee Details

Employee Name Bank Account Number Tax Code Employee Name

Leodora Ramirez Caña 109653087482 S Leodora Ramirez Ca

Portal ID Department SSS Portal ID

179234 Operations 3479526138 179234

Employee ID Team In TIN Employee ID

179234 Productions 482-720-041 179234

Hire Date Job Title Phil Health Hire Date

14-Jan-19 Agent-In Cust Svc 2 12504479836 14-Jan-19

Payments Deductions Payments

Description Hours Description Hours Amount Description Hours

Amount Pag Ibig Contribution 100. Amount

Taxable Income SSS Contribution 25 Taxable Income

Basic Salary 6,7 Phil Health Contribution 137. Basic Salary

Paid Leaves *BIR Withholding Paid Leaves

Special Holiday Adjust 67 tax computation Basic Salary Adjustment

Gross Taxable Income 7,387.97

Gross Taxable Income 7,387. Gross Taxable Income

Less: Total Satutory Deductions

Non Taxable Income SSS/Phil Health/Pag Ibig Non Taxable Income

Non Taxable Allowance Adjustment 137. Total Taxable Income 7,387. Non Taxable Allowance

Meal Allowance 50 Tax due computed as sum Meal Allowance

Laundry Allowance 375 of the following Laundry Allowance

Rice Allowance 2 825 Predetermined tax in compensation level Rice Allowance 1

Non Taxable Income 1,837. Tax on excess of compensation level Non Taxable Income

Total Gross Payments 9,225. Total Deductions 491 Total Gross Payments

NET PAYMENT 8,73 YTD NET Taxable Income 20,353 NET PAYMENT

YTD Net Payments 20,35 YTD Tax Deductions YTD Net Payments

This is a compter generated

payslip. Does not need signatures. payslip. Does not need s

ALORICA TELESERVICES INC.

PAYSLIP ONLINE

PAY PERIOD 27-MAY-19 to 07-JUN-19

oyee Details

Employee Name Bank Account Number Tax Code

eodora Ramirez Caña 109653087482 S

Portal ID Department SSS

179234 Operations 3479526138

Employee ID Team In TIN

179234 Productions 482-720-041

Hire Date Job Title Phil Health

14-Jan-19 Agent-In Cust Svc 2 12504479836

ents Deductions

ption Hours Description Hours Amount

nt Pag Ibig Contribution 100

le Income SSS Contribution 32

Salary 7,1 Phil Health Contribution 178.

eaves *BIR Withholding

Salary Adjustment 373 tax computation

Taxable Income 7,545.98

Gross Taxable Income 7,545.

Less: Total Satutory Deductions

axable Income SSS/Phil Health/Pag Ibig

axable Allowance Adjustment 137. Total Taxable Income 7,545.

Allowance 50 Tax due computed as sum

ry Allowance 25 of the following

llowance 1 75 Predetermined tax in compensation level

axable Income 1,637 Tax on excess of compensation level

Gross Payments 9,183. Total Deductions 60

AYMENT 8,57 YTD NET Taxable Income 28,931.9

et Payments 28,93 YTD Tax Deductions

This is a compter generated

p. Does not need signatures.

Das könnte Ihnen auch gefallen

- W2 PreviewDokument1 SeiteW2 Previewmrs merle westonNoch keine Bewertungen

- Self Employment Guidance - Form 1040 Schedule C IndividualsDokument2 SeitenSelf Employment Guidance - Form 1040 Schedule C IndividualsGlenda100% (1)

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDokument6 SeitenEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterBobbyNoch keine Bewertungen

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDokument144 SeitenLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNoch keine Bewertungen

- CPR 2022 Tax ReturnDokument1 SeiteCPR 2022 Tax ReturnUmair MughalNoch keine Bewertungen

- U.S. Individual Income Tax Return: Filing StatusDokument2 SeitenU.S. Individual Income Tax Return: Filing Statusfelix angomasNoch keine Bewertungen

- 34 Wihh 504331 H 0714320240524151104202Dokument3 Seiten34 Wihh 504331 H 0714320240524151104202jamelmhunt22Noch keine Bewertungen

- CLR 2020 Tax ReturnDokument14 SeitenCLR 2020 Tax ReturnAlexander Barno AlexNoch keine Bewertungen

- U.S. Individual Income Tax Return: Filing StatusDokument3 SeitenU.S. Individual Income Tax Return: Filing StatuspyatetskyNoch keine Bewertungen

- ApplicationDokument2 SeitenApplicationFabian SandovalNoch keine Bewertungen

- NATH f1040Dokument2 SeitenNATH f1040Spencer NathNoch keine Bewertungen

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Dokument2 Seiten1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNoch keine Bewertungen

- Payroll08142020 PDFDokument2 SeitenPayroll08142020 PDFShana RushNoch keine Bewertungen

- 540 FinalDokument5 Seiten540 Finalapi-350796322Noch keine Bewertungen

- 1098T17Dokument2 Seiten1098T17RegrubdiupsNoch keine Bewertungen

- Profit or Loss From Business: Linda Gercken 156-56-8670Dokument2 SeitenProfit or Loss From Business: Linda Gercken 156-56-8670ROB100% (1)

- Wage and Tax StatementDokument4 SeitenWage and Tax StatementRich1781Noch keine Bewertungen

- TX 1Dokument1 SeiteTX 1Humayon MalekNoch keine Bewertungen

- Jul 192017Dokument1 SeiteJul 192017Anonymous qqE8o5QNoch keine Bewertungen

- Richard Pizzey Archive Cra 19 PDFDokument17 SeitenRichard Pizzey Archive Cra 19 PDFnancy2handsorNoch keine Bewertungen

- Sutherland Global Services Philippines, Inc. - Philippine BranchDokument3 SeitenSutherland Global Services Philippines, Inc. - Philippine BranchShunui SonodaNoch keine Bewertungen

- Pay Slip For July 2021Dokument1 SeitePay Slip For July 2021THE TECHNOSNoch keine Bewertungen

- PayslipDokument1 SeitePayslipsandovalelaine292Noch keine Bewertungen

- PayslipDokument1 SeitePayslipKathy DagunoNoch keine Bewertungen

- P45 Part 1A Details of Employee Leaving WorkDokument3 SeitenP45 Part 1A Details of Employee Leaving WorkCaleb PriceNoch keine Bewertungen

- P45 Part 1A Details of Employee Leaving WorkDokument6 SeitenP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNoch keine Bewertungen

- SIDS Health Care Pvt. LTD.: Payslip For January-2019Dokument1 SeiteSIDS Health Care Pvt. LTD.: Payslip For January-2019hitesh gandhiNoch keine Bewertungen

- DateDokument4 SeitenDatechatiresNoch keine Bewertungen

- Pce ExamDokument17 SeitenPce ExamPravin Vjai Aiyanakavandan100% (4)

- Montero Payment ReceiptDokument1 SeiteMontero Payment Receiptgelz110516Noch keine Bewertungen

- FD 941 Apr-Jun 2017 PDFDokument3 SeitenFD 941 Apr-Jun 2017 PDFScott WinklerNoch keine Bewertungen

- T1 - 2019 ReturnDokument8 SeitenT1 - 2019 ReturnYuan LiangNoch keine Bewertungen

- Pay Slip For The Month of OCt-09Dokument1 SeitePay Slip For The Month of OCt-09shah_rahul1981Noch keine Bewertungen

- View Completed FormsDokument10 SeitenView Completed FormsRui FariaNoch keine Bewertungen

- MarDokument1 SeiteMarDheeraj TippaniNoch keine Bewertungen

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDokument1 SeiteTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresNoch keine Bewertungen

- Tax Return 2018-19Dokument18 SeitenTax Return 2018-19Kasam ANoch keine Bewertungen

- View Payslip: Personal Information Job InformationDokument1 SeiteView Payslip: Personal Information Job InformationJeffreyNoch keine Bewertungen

- Kristina - MAY 22Dokument1 SeiteKristina - MAY 22bktsuna0201Noch keine Bewertungen

- Calibehr Business Support Services Pvt. LTD.: ITC Park 6th Floor Tower No.8 CBD Belapur Navi MumbaiDokument1 SeiteCalibehr Business Support Services Pvt. LTD.: ITC Park 6th Floor Tower No.8 CBD Belapur Navi MumbaiRram NagarNoch keine Bewertungen

- Alorica - Angelo May 13Dokument1 SeiteAlorica - Angelo May 13bktsuna0201Noch keine Bewertungen

- Y3 and Personal Data Form 2Dokument5 SeitenY3 and Personal Data Form 2Shakil AhmedNoch keine Bewertungen

- 2021 FullDokument14 Seiten2021 FullDamian MikaNoch keine Bewertungen

- P60single 2Dokument1 SeiteP60single 2Claira JervisNoch keine Bewertungen

- P45 Part 1A Details of Employee Leaving WorkDokument3 SeitenP45 Part 1A Details of Employee Leaving WorkDan NolanNoch keine Bewertungen

- Ion Onl Y: Copy For HM Revenue & CustomsDokument4 SeitenIon Onl Y: Copy For HM Revenue & CustomsM Muneeb SaeedNoch keine Bewertungen

- Franco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)Dokument1 SeiteFranco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)abdul mannan bhuiyanNoch keine Bewertungen

- Myob Payslip TemplateDokument1 SeiteMyob Payslip Templateapi-384163101Noch keine Bewertungen

- Black BookDokument75 SeitenBlack BookShruti HargudeNoch keine Bewertungen

- Notes - (Law) Cases and GSIS LawDokument10 SeitenNotes - (Law) Cases and GSIS LawBackup FilesNoch keine Bewertungen

- hrm648 Individu - Nursyazwani - 2019333999Dokument14 Seitenhrm648 Individu - Nursyazwani - 2019333999Syazwani Omar100% (4)

- Concentrix Daksh Services India Private Limited Payslip For The Month of September - 2021Dokument1 SeiteConcentrix Daksh Services India Private Limited Payslip For The Month of September - 2021Prity PandeyNoch keine Bewertungen

- SGS Technical Services Pvt. LTD.: Attendance Details ValueDokument1 SeiteSGS Technical Services Pvt. LTD.: Attendance Details Valueshalabh chopraNoch keine Bewertungen

- ShowDokument2 SeitenShowBrianna Jean-BaptisteNoch keine Bewertungen

- ECDC 2009 Tax ReturnDokument27 SeitenECDC 2009 Tax ReturnNC Policy WatchNoch keine Bewertungen

- Form IL-941: 2020 Illinois Withholding Income Tax ReturnDokument2 SeitenForm IL-941: 2020 Illinois Withholding Income Tax ReturnArnawama LegawaNoch keine Bewertungen

- November 2020 - PaySlipDokument1 SeiteNovember 2020 - PaySlipShikhar GuptaNoch keine Bewertungen

- Hillside Children's Center, New York 2014 IRS ReportDokument76 SeitenHillside Children's Center, New York 2014 IRS ReportBeverly TranNoch keine Bewertungen

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDokument3 SeitenTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNoch keine Bewertungen

- Tax - 2020-2021 PDFDokument2 SeitenTax - 2020-2021 PDFShanto ChowdhuryNoch keine Bewertungen

- Windward Fund's 2018 Tax FormsDokument49 SeitenWindward Fund's 2018 Tax FormsJoe SchoffstallNoch keine Bewertungen

- Statement of Account: Dap-Dap Blk-40 Lot-32 Anupul Bamban TarlacDokument1 SeiteStatement of Account: Dap-Dap Blk-40 Lot-32 Anupul Bamban TarlacJoyce Gregorio ZamoraNoch keine Bewertungen

- 2021 - TaxReturn 2pagessignedDokument3 Seiten2021 - TaxReturn 2pagessignedDedrick RiversNoch keine Bewertungen

- Aaron Berg w2Dokument2 SeitenAaron Berg w2kevin kuhnNoch keine Bewertungen

- Statement of Account: 678170259 16-Jul-2019 588.84 PDokument2 SeitenStatement of Account: 678170259 16-Jul-2019 588.84 PIvy PantalunanNoch keine Bewertungen

- Yabut Bigasan and GroceryDokument2 SeitenYabut Bigasan and GroceryVincent IgnacioNoch keine Bewertungen

- Yabut Bigasan and GroceryDokument2 SeitenYabut Bigasan and GroceryVincent IgnacioNoch keine Bewertungen

- Rivera F. Lorenza: 8085 Progreso St. Guadalupe Viejo, Makati City Contact No: 09507858706Dokument1 SeiteRivera F. Lorenza: 8085 Progreso St. Guadalupe Viejo, Makati City Contact No: 09507858706Vincent IgnacioNoch keine Bewertungen

- Arellano University: Senior High School DepartmentDokument1 SeiteArellano University: Senior High School DepartmentVincent IgnacioNoch keine Bewertungen

- CS Form No. 212 Revised Personal Data Sheet 2Dokument13 SeitenCS Form No. 212 Revised Personal Data Sheet 2ferosiacNoch keine Bewertungen

- Unit 3 Life Insurance Products: ObjectivesDokument24 SeitenUnit 3 Life Insurance Products: ObjectivesPriya ShindeNoch keine Bewertungen

- Social Welfare LegislationDokument12 SeitenSocial Welfare LegislationMarianita CenizaNoch keine Bewertungen

- Practice QuestionDokument1 SeitePractice QuestionKhalid IMRANNoch keine Bewertungen

- 2 Libby 9e Guided Examples Chapter 9 ExercisesDokument4 Seiten2 Libby 9e Guided Examples Chapter 9 Exercisesthanh subNoch keine Bewertungen

- Pre-Screening: Tenant ApplicationDokument10 SeitenPre-Screening: Tenant ApplicationAlex ErschenNoch keine Bewertungen

- 06 PHILAMLIFE v. CTA (1995)Dokument4 Seiten06 PHILAMLIFE v. CTA (1995)Cathy LopezNoch keine Bewertungen

- Quiz 1 Akhand TomarDokument2 SeitenQuiz 1 Akhand TomarmstomarNoch keine Bewertungen

- Montgomery County Public Schools Trustee Candidate - Selection Process 2021Dokument1 SeiteMontgomery County Public Schools Trustee Candidate - Selection Process 2021Marshay HallNoch keine Bewertungen

- Department of Education: Second Quarter Examination Business MathematicsDokument3 SeitenDepartment of Education: Second Quarter Examination Business MathematicsGlaiza FloresNoch keine Bewertungen

- Impact of Fringe BenefitsDokument66 SeitenImpact of Fringe Benefitsarchana2089Noch keine Bewertungen

- Module 6Dokument13 SeitenModule 6Keara Jermain RellenteNoch keine Bewertungen

- Aging and Financial Markets.Dokument12 SeitenAging and Financial Markets.Angela JaspeNoch keine Bewertungen

- 1996-97 Pension Circular PDFDokument37 Seiten1996-97 Pension Circular PDFanon_707904122Noch keine Bewertungen

- CA Final DT Super 30 QuestionsDokument65 SeitenCA Final DT Super 30 Questionsambica mahabhashyamNoch keine Bewertungen

- Income Tax DepartmentDokument92 SeitenIncome Tax Departmentkajal100% (1)

- Personal Finance 2Nd Edition by Jane King Full ChapterDokument41 SeitenPersonal Finance 2Nd Edition by Jane King Full Chaptermargret.brennan669100% (25)

- Aasara 57Dokument3 SeitenAasara 57Khaleel ShaikNoch keine Bewertungen

- Corrected ReportDokument31 SeitenCorrected ReportHamidur Rahman Hany100% (1)

- Solved Adrian Was Awarded An Academic Scholarship To State University For PDFDokument1 SeiteSolved Adrian Was Awarded An Academic Scholarship To State University For PDFAnbu jaromiaNoch keine Bewertungen

- Taxation Chap 1 2 Tabag GarciaDokument4 SeitenTaxation Chap 1 2 Tabag GarciaZedie Leigh VioletaNoch keine Bewertungen

- Withdrawal Due To Superannuation IncapacitationDokument6 SeitenWithdrawal Due To Superannuation IncapacitationPUNAM RNDNoch keine Bewertungen

- Accounting 3rd Year Solman Chapter 25Dokument3 SeitenAccounting 3rd Year Solman Chapter 25Bianca LizardoNoch keine Bewertungen

- Solved David A Cpa For A Large Accounting Firm Often WorksDokument1 SeiteSolved David A Cpa For A Large Accounting Firm Often WorksAnbu jaromiaNoch keine Bewertungen

- CPT Math StatsDokument63 SeitenCPT Math StatsVivek Vincent86% (7)

- Last Three Drawn Salary Slips - PAY SLIP MAY-23Dokument1 SeiteLast Three Drawn Salary Slips - PAY SLIP MAY-23platonic amigo100% (1)