Beruflich Dokumente

Kultur Dokumente

Spract 2 A

Hochgeladen von

Ronelaine MaputiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Spract 2 A

Hochgeladen von

Ronelaine MaputiCopyright:

Verfügbare Formate

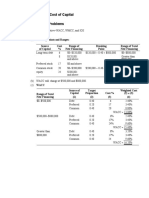

Solutions to Practice Problems for Decision Analysis

1. Luther Tai is thinking of buying a bankrupt private airport for $5 million. Assuming

he borrows the money, he expects to incur an annual cost of $500,000 to service his debt,

plus an additional cost of $200,000 per year to run the new venture. At a contemplated

landing fee of $100, the probabilities are 0.10, 0.50, and 0.40, respectively, that 6,000

planes, 7,000 planes, or 8,000 planes will land per year. Use a decision tree to determine

Luther’s optimal action, given his desire to maximize expected monetary value and

given the option not to make the investment at all.

First, we need a payoff table.

Basic Revenue Data:

States of Nature Probability Planes Revenue

s1 0.1 6000 $600,000

s2 0.5 7000 $700,000

s3 0.4 8000 $800,000

Basic Expense Data:

Debt Other Total

$500,000 $200,000 $700,000

Payoff Table:

States of Nature Revenue Expenses Net Income

s1 $600,000 $700,000 -$100,000

s2 $700,000 $700,000 $0

s3 $800,000 $700,000 +$100,000

Managerial Statistics 35 Prof. Juran

Now, we construct the decision tree:

6000 Planes 10.0%

-$100,000

Buy Airport TRUE Expected Value

0 $30,000

7000 Planes 50.0%

$0

8000 Planes 40.0%

$100,000

Luther Tai Expected Value

30000

6000 Planes 10.0%

$0

Don't Buy Airport FALSE Expected Value

0 0

7000 Planes 50.0%

$0

8000 Planes 40.0%

$0

On the basis of expected value, it looks like a good idea to buy the airport.

This is, of course, a simplistic model, in which we ignore the possibility that Luther will

have even better investments to consider. (This one has an expected annual return of

$30,000 / $700,000 = 4.3%.)

Managerial Statistics 36 Prof. Juran

2. Consider the following profit payoff table.

States of Nature

s1 s2 s3 s4

d1 14 9 10 5

Decision d2 11 10 8 7

Alternatives d3 9 10 10 11

d4 8 10 11 13

Suppose the decision maker obtains information that leads to four probability estimates:

P(s1) = 0.5, P(s2) = 0.2, P(s3) = 0.20, and P(s4) = 0.10.

(a) Use the expected value approach to determine the optimal decision.

The optimal decision alternative is d1, with an expected value of 11.3:

s1 50.0%

14

s2 20.0%

9

d1 TRUE Expected Value

0 11.3

s3 20.0%

10

s4 10.0%

5

s1 50.0%

11

s2 20.0%

10

d2 FALSE Expected Value

0 9.8

s3 20.0%

8

s4 10.0%

7

Problem 2 Expected Value

11.3

s1 50.0%

9

s2 20.0%

10

d3 FALSE Expected Value

0 9.6

s3 20.0%

10

s4 10.0%

11

s1 50.0%

8

s2 20.0%

10

d4 FALSE Expected Value

0 9.5

s3 20.0%

11

s4 10.0%

13

Managerial Statistics 37 Prof. Juran

(b) Now assume that the entries in the payoff table are costs; use the expected value

approach to determine the optimal decision.

The optimal decision alternative is d4, with an expected value of 9.5:

s1 50.0%

14

s2 20.0%

9

d1 FALSE Expected Value

0 11.3

s3 20.0%

10

s4 10.0%

5

s1 50.0%

11

s2 20.0%

10

d2 FALSE Expected Value

0 9.8

s3 20.0%

8

s4 10.0%

7

Problem 2 Expected Value

9.5

s1 50.0%

9

s2 20.0%

10

d3 FALSE Expected Value

0 9.6

s3 20.0%

10

s4 10.0%

11

s1 50.0%

8

s2 20.0%

10

d4 TRUE Expected Value

0 9.5

s3 20.0%

11

s4 10.0%

13

Managerial Statistics 38 Prof. Juran

3. The Bizri Manufacturing Company must decide whether it should purchase a component from

a supplier or manufacture the component at its Tuckahoe, New York, plant. If demand is high, it

would be to Bizri’s advantage to manufacture the component. However, if demand is low, Bizri’s

unit manufacturing cost will be high due to underutilization of equipment. The projected profit

figures in thousands of dollars for Bizri’s make-or-buy decision follow.

Demand

High Medium Low

Manufacture Component 100 40 -20

Decision Alternatives

Purchase Component 70 45 10

The states of nature have the following probabilities: P(high demand) = 0.30, P(medium

demand) = 0.35, and P(low demand) = 0.35.

(a) Use a decision tree to recommend a decision.

In this tree, we can see that the “purchase option has a higher expected profit ($40,250

as opposed to $37,000).

High 30.0%

100

Manufacture FALSE Manufacture

0 37.00

Medium 35.0%

40

Low 35.0%

-20

Bizri Make or Buy

40.25

High 30.0%

70

Purchase TRUE Purchase

0 40.25

Medium 35.0%

45

Low 35.0%

10

Managerial Statistics 39 Prof. Juran

The expected value calculations are as follows:

For manufacturing,

N

EV d 1 P s j v1 j

j 1

0.30 * $100 ,000 0.35 * $40 ,000 0.35 * $20 ,000

$30 ,000 $14 ,000 $7 ,000

$37 ,000

For purchasing,

N

EV d 2 P s j v2 j

j 1

0.30 * $70 ,000 0.35 * $45,000 0.35 * $10 ,000

$21,000 $15,750 $3 ,500

$40 ,250

(b) Use EVPI to determine whether Bizri should attempt to obtain a better estimate of

demand.

Demand Probabilities Net Profit Manufacture Net Profit Purchase Optimal Decision

High 0.30 $100,000 $70,000 Manufacture

Medium 0.35 $40,000 $45,000 Purchase

Low 0.35 $(20,000) $10,000 Purchase

We calculate the expected value with perfect information by summing up the probability-weighted best payoffs for

each state of nature.

EVwPI 0.30 * $100,000 0.35 * $45,000 0.35 * $10 ,000

$30 ,000 $15 ,750 $3 ,500

$49 ,250

The expected value of perfect information is $49,250 - $40,250 = $9,000.

Managerial Statistics 40 Prof. Juran

A test market study of the potential demand for the product is expected to indicate

either a favorable (I1) or unfavorable (I2) condition. The relevant conditional probabilities

follow.

P I 1 s 1 =0.60 P I 2 s 1 =0.40

P I 1 s 2 =0.40 P I 2 s 2 =0.60

P I 1 s 3 =0.10 P I 2 s 3 =0.90

(c) What is the probability that the market research report will be favorable?

Probabilities

States Prior Conditional Joint Posterior

P sj I1

sj P sj

P I1 s j

P s j I1 P s j P I1 s j

P sj I1

P I 1

High 0.30 0.60 0.180 0.507

Medium 0.35 0.40 0.140 0.394

Low 0.35 0.10 0.035 0.099

Total P I 1 0.355

The total probability of a favorable report is 35.5%.

Similarly, for the unfavorable report:

Probabilities

States Prior Conditional Joint Posterior

P sj I2

sj P sj

P I2 sj

P sj I2 P sj P I2 sj

P sj I2

P I 2

High 0.30 0.40 0.120 0.186

Medium 0.35 0.60 0.210 0.326

Low 0.35 0.90 0.315 0.488

Total P I 2 0.645

The total probability of an unfavorable report is 64.5%.

Managerial Statistics 41 Prof. Juran

(d) What is Bizri’s optimal decision strategy?

In this tree diagram, we see that the best course of action is to manufacture if the report

is favorable, but to purchase if the report is unfavorable.

High 50.7%

100

Manufacture TRUE Manufacture

0 64.51

Medium 39.4%

40

Low 9.9%

-20

Favorable Report 35.5% Expected Value

0 64.51

High 50.7%

70

Purchase FALSE Purchase

0 54.23

Medium 39.4%

45

Low 9.9%

10

Bizri Expected Value

43.9

High 18.6%

100

Manufacture FALSE Manufacture

0 21.86

Medium 32.6%

40

Low 48.8%

-20

Unfavorable Report 64.5% Expected Value

32.56

High 18.6%

70

Purchase TRUE Purchase

0 32.56

Medium 32.6%

45

Low 48.8%

10

(e) What is the expected value of the market research information?

The expected value of the system with the report is $43,900. Without the report the

expected value was only $40,250, so the extra information is worth $3,650.

(f) What is the efficiency of the information?

$3,650/$9,000 = 0.4056, or about 41%.

Managerial Statistics 42 Prof. Juran

4. Witkowski TV Productions is considering a pilot for a comedy series for a major television

network. The network may reject the pilot and the series, or it may purchase the program for one

or two years. Witkowski may decide to produce the pilot or transfer the rights for the series to a

competitor for $100,000. Witkowski’s profits are summarized in the following profit ($1000s)

payoff table:

States of Nature

s1 = Reject s2 = 1 Year s3 = 2 Years

d1 -100 50 150

Produce Pilot

Sell to Competitor d2 100 100 100

(a) If the probability estimates for the states of nature are P(Reject) = 0.20, P(1 Year) =

0.30, and P(2 Years) = 0.50, what should Witkowski do?

On the basis of expected value, the best thing to do is to sell to the competitor:

Reject 20.0%

-100

Produce Pilot FALSE Expected Value

0 70

1 Year 30.0%

50

2 Years 50.0%

150

Witkowski Expected Value

100

Reject 20.0%

100

Sell to Competitor TRUE Expected Value

0 100

1 Year 30.0%

100

2 Years 50.0%

100

Managerial Statistics 43 Prof. Juran

For a consulting fee of $2,500, the O’Donnell agency will review the plans for the comedy series

and indicate the overall chance of a favorable network reaction.

P I 1 s 1 0.30 P I 2 s 1 0.70

P I 1 s 2 0.60 P I 2 s 2 0.40

P I 1 s 3 0.90 P I 2 s 3 0.10

(b) Show a decision tree to represent the revised problem.

A revised payoff table:

States of Nature

s1 = Reject s2 = 1 Year s3 = 2 Years

No d1 = Produce Pilot -100 50 150

Report

d2 = Sell to Competitor 100 100 100

d1 = Produce Pilot -102.5 47.5 147.5

I1 = Favorable Report

Get d2 = Sell to Competitor 97.5 97.5 97.5

Report

d1 = Produce Pilot -102.5 47.5 147.5

I2 = Unfavorable Report

d2 = Sell to Competitor 97.5 97.5 97.5

Probability calculations:

Probabilities

States Prior Conditional Joint Posterior

P sj I1

sj P sj

P I1 s j

P s j I1 P s j P I1 s j

P sj I1

P I 1

Reject 0.20 0.30 0.06 0.087

1 Year 0.30 0.60 0.18 0.261

2-Year 0.50 0.90 0.45 0.652

Total P I 1 0.69

The total probability of a favorable O’Donnell report is 69%.

Probabilities

States Prior Conditional Joint Posterior

P sj I2

sj P sj

P I2 sj

P sj I2 P sj P I2 sj

P sj I2

P I 2

Reject 0.20 0.70 0.14 0.452

1 Year 0.30 0.40 0.12 0.387

2-Year 0.50 0.10 0.05 0.161

Total P I 2 0.31

The total probability of an unfavorable O’Donnell report is 31%.

Managerial Statistics 44 Prof. Juran

Reject 8.7%

-102.5

Produce Pilot TRUE Expected Value

0.0 99.7

1 Year 26.1%

47.5

2 Years 65.2%

147.5

Favorable 0.7 Expected Value

0.0 99.7

Reject 8.7%

97.5

Sell to Competitor FALSE Expected Value

0.0 97.5

1 Year 26.1%

97.5

2 Years 65.2%

97.5

Get O'Donnell Report FALSE Expected Value

0.0 99.0

Reject 45.2%

-102.5

Produce Pilot FALSE Expected Value

0.0 -4.1

1 Year 38.7%

47.5

2 Years 16.1%

147.5

Unfavorable 0.3 Expected Value

0.0 97.5

Reject 45.2%

97.5

Sell to Competitor TRUE Expected Value

0.0 97.5

1 Year 38.7%

97.5

2 Years 16.1%

97.5

Witkowski Expected Value

100.0

Do Not Get O'Donnell Report TRUE Expected Value

0.0 100.0

Reject 20.0%

-100.0

Produce Pilot FALSE Expected Value

0.0 70.0

1 Year 30.0%

50.0

2 Years 50.0%

150.0

1.0 Expected Value

0.0 100.0

Reject 20.0%

100.0

Sell to Competitor TRUE Expected Value

0.0 100.0

1 Year 30.0%

100.0

2 Years 50.0%

100.0

(c) What should Witkowski’s strategy be? What is the expected value of this strategy?

The best thing to do is to forget about O’Donnell and sell the rights for $100,000.

(d) What is the expected value of the O’Donnell agency’s sample information? Is the

information worth the $2,500 fee?

The information has no value; no matter what O’Donnell’s report says, it won’t affect

Witkowski’s decision or improve the expected value of the situation.

(e) What is the efficiency of the O’Donnell’s sample information?

Zero.

Managerial Statistics 45 Prof. Juran

5. Decelles Oil Company can drill for oil on a given site now (with equal probability of

s1 = finding oil or s2 = not finding oil) or sell its rights to the site for $10 million. If

Decelles drills and finds oil, a net payoff of $100 million is expected; if no oil is found,

that payoff equals –$15 million.

Alternatively, Decelles can instead contract for a $10 million seismic test, performed by

the geologic firm of Dempsey & McKenna. If the test predicts oil, the company can drill

(and get a net payoff of $90 million if oil is in fact found and of -$25 million if none is

found) or sell the rights for $20 million. If the Dempsey & McKenna test predicts no oil,

Decelles can drill (and get a net payoff of $90 million if oil is in fact found and of -$25

million if none is found) or sell the rights for $1 million.

Dempsey & McKenna’s track record is given below:

Subsequent Events

D&M Report Issued s1 = Oil is Found s2 = Oil is Not Found

I1 = Oil Expected P I 1 s 1 0.60 P I 1 s 2 0.20

I2 = Oil Not Expected P I 2 s 1 0.40 P I 2 s 2 0.80

(a) Use a decision tree to formulate the problem. What should Decelles do?

First, some preliminary analysis. Here is a payoff table:

States of Nature

Decision Alternatives I Sample Information Decision Alternatives II Find Oil Find No Oil

Drill 100 -15

No Report (None)

Sell 10 10

Drill 90 -25

Report Predicts Oil

Sell 20 20

Get Report

Drill 90 -25

Report Predicts No Oil

Sell 1 1

Here are the calculations for the various probabilities of finding oil:

Probabilities

States Prior Conditional Joint Posterior

P sj I1

sj P sj

P I1 s j

P s j I1 P s j P I1 s j

P sj I1 P I 1

Oil 0.50 0.60 0.30 0.75

No Oil 0.50 0.20 0.10 0.25

Total P I 1 0.40

The total probability of a favorable report is 40%.

Managerial Statistics 46 Prof. Juran

Similarly, for the unfavorable report:

Probabilities

States Prior Conditional Joint Posterior

P sj I2

sj P sj

P I2 sj

P sj I2 P sj P I2 sj

P sj I2 P I 2

Oil 0.50 0.40 0.20 0.333

No Oil 0.50 0.80 0.40 0.667

Total P I 2 0.60

The total probability of an unfavorable report is 60%.

Here is the decision tree, which suggests that the best course of action is to forget about

the report and just go ahead and drill.

Oil 75.0%

$90,000,000

Drill TRUE Expected Value

90 $61,250,090

No Oil 25.0%

-$25,000,000

Report Predicts Oil 40.0% Expected Value

0 $61,250,090

Oil 75.0%

$20,000,000

Sell FALSE Expected Value

$20,000,000 $20,000,000

No Oil 25.0%

$20,000,000

Get Report FALSE Expected Value

0 $32,500,090

Oil 33.3%

$90,000,000

Drill TRUE Expected Value

90 $13,333,423

No Oil 66.7%

-$25,000,000

Report Predicts No Oil 60.0% Expected Value

0 $13,333,423

Oil 33.3%

$1,000,000

Sell FALSE Expected Value

$1,000,000 $1,000,000

No Oil 66.7%

$1,000,000

Decelles Expected Value

$42,500,090

Oil 50.0%

$100,000,000

Drill TRUE Expected Value

90 $42,500,090

No Oil 50.0%

-$15,000,000

No Report TRUE Expected Value

0 $42,500,090

Oil 50.0%

$10,000,000

Sell FALSE Expected Value

$10,000,000 $10,000,000

No Oil 50.0%

$10,000,000

Managerial Statistics 47 Prof. Juran

(b) If Decelles decides not to hire Dempsey & McKenna, what is the expected value of

perfect information?

We calculate the expected value with perfect information by summing up the probability-weighted best payoffs for

each state of nature.

EVwPI 0.50 * $100 ,000 ,000 0.50 * $10 ,000 ,000

$50 ,000 ,000 $5 ,000 ,000

$55 ,000 ,000

The expected value of perfect information is $55,000,000 - $42,500,000 = $12,500,000.

(c) What is the expected value of the sample information from Dempsey & McKenna?

The expected value of the system with the report is $32,500,000. Without the report the

expected value is $42,500,000, so the extra information is actually worth negative

$10,000. Dempsey & McKenna would have to cut the price of their seismic test by more

than $10,000 for it to be worth buying.

It is conventional in these types of problems to assume that the decision maker is

rational, and will always decide to go with the decision alternative with the highest

expected value (in this case, not to get the sample information). It is also conventional to

round any information with a negative expected value up to zero. So we would say that

the test has no value, as opposed to saying that it has a negative expected value.

Another way to see the worthlessness of the test is to observe that the information from

the test doesn’t change our decision, no matter what the information turns out to be. In

the tree, we see that we would drill whether or not the report predicts oil.

(d) What is the efficiency of the sample information from Dempsey & McKenna?

The efficiency of this information is zero.

Managerial Statistics 48 Prof. Juran

6. Use the payoff table below for this question. Assume that P(s1) = 0.80 and P(s2) = 0.20.

s1 s2

d1 15 10

d2 10 12

d3 8 20

(a) Find the optimal decision using a decision tree.

s1 80.0%

15

d1 TRUE Expected Value

0 14

s2 20.0%

10

Expected Value

14

s1 80.0%

10

d2 FALSE Expected Value

0 10.4

s2 20.0%

12

s1 80.0%

8

d3 FALSE Expected Value

0 10.4

s2 20.0%

20

As you can see, the optimal decision is d1, assuming we want to maximize the value.

(b) Find the expected value of perfect information.

State of Nature Optimal Decision Value

s1 d1 15

s2 d3 20

EVwPI 0.80 * 15 0.20 * 20

12 4

16

The expected value of perfect information (the difference in expected value between

perfect information and no information) is 2.

Managerial Statistics 49 Prof. Juran

(c) Suppose some indicator information I is obtained with P(I|s1) = 0.20 and P(I|s2) =

0.75.

(i) Find the posterior probabilities P(s1|I) and P(s2|I).

Probabilities

States Prior Conditional Joint Posterior

P sj I

sj P sj

P I sj

P sj I P sj P I sj

P sj I

P I

s1 0.80 0.20 0.16 0.516

s2 0.20 0.75 0.15 0.484

Total P I 0.31

The total probability of I is 31%.

The answer to the question is P(s1|I) = 0.516 and P(s2|I) = 0.484.

Similarly for I :

Probabilities

States Prior Conditional Joint Posterior

sj P sj

P I sj

P sj I P sj P I sj

P sj I

P sj I

PI

s1 0.80 0.80 0.64 0.928

s2 0.20 0.25 0.05 0.072

Total P I 0.69

The total probability of I is 69%.

Managerial Statistics 50 Prof. Juran

(ii) Recommend a decision alternative based on these probabilities.

s1 51.6%

15

d1 FALSE Expected Value

0 12.6

s2 48.4%

10

I 31.0% Expected Value

0 13.8

s1 51.6%

10

d2 FALSE Expected Value

0 11.0

s2 48.4%

12

s1 51.6%

8

d3 TRUE Expected Value

0 13.8

s2 48.4%

20

Expected Value

14.4

s1 92.8%

15

d1 TRUE Expected Value

0 14.6

s2 7.2%

10

Not I 69.0% Expected Value

0 14.6

s1 92.8%

10

d2 FALSE Expected Value

0 10.1

s2 7.2%

12

s1 92.8%

8

d3 FALSE Expected Value

0 8.9

s2 7.2%

20

The best course of action seems to be to get the sample information. Then, if I is true, go

with d3. If I is not true, then go with d1.

Managerial Statistics 51 Prof. Juran

7. Paulson Foods, Inc., produces Mystery Meat (a perishable food product) at a cost of

$10 per case. Mystery Meat sells for $15 per case. For planning purposes, the company

is considering possible demand of 100, 200, or 300 cases.

If demand is less than production, the excess production is lost. If demand is more than

production, the firm, in an attempt to maintain a good service image, will satisfy excess

demand with a special production run at a cost of $18 per case. Mystery Meat always

sells at $15 per case.

(a) Set up the payoff table for the Paulson Foods problem.

States of Nature

s1 s2 s3

100 cases 200 cases 300 cases

d1 = 100 (100*15) – [(100*10)] = $500 (200*15) – [(100*10) + (100*18)] = $200 (300*15) – [(100*10) + (200*18)] = -$100

d2 = 150 (100*15) – [(150*10)] = $0 (200*15) – [(150*10) + (50*18)] = $600 (300*15) – [(150*10) + (150*18)] = $300

d3 = 200 (100*15) – [(200*10)] = -$500 (200*15) – [(200*10)] = $1,000 (300*15) – [(200*10) + (100*18)] = $700

d4 = 250 (100*15) – [(250*10)] = -$1,000 (200*15) – [(250*10)] = $500 (300*15) – [(250*10) + (50*18)] = $1,100

d5 = 300 (100*15) – [(300*10)] = -$1,500 (200*15) – [(300*10)] = $0 (300*15) – [(300*10)] = $1,500

Managerial Statistics 52 Prof. Juran

(b) If P(100) = 0.20, P(200) = 0.20, and P(300) = 0.60, should the company produce 100,

200, or 300 cases?

The best decision, in terms of expected value, is to produce 300 cases of Mystery Meat.

The expected value of this decision is $600.

Demand = 100 20.0%

500

d1 FALSE Expected Value

0 80

Demand = 200 20.0%

200

Demand = 300 60.0%

-100

Demand = 100 20.0%

0

d2 FALSE Expected Value

0 300

Demand = 200 20.0%

600

Demand = 300 60.0%

300

Paulson Expected Value

600

Demand = 100 20.0%

-500

d3 FALSE Expected Value

0 520

Demand = 200 20.0%

1000

Demand = 300 60.0%

700

Demand = 100 20.0%

-1000

d4 FALSE Expected Value

0 560

Demand = 200 20.0%

500

Demand = 300 60.0%

1100

Demand = 100 20.0%

-1500

d5 TRUE Expected Value

0 600

Demand = 200 20.0%

0

Demand = 300 60.0%

1500

Managerial Statistics 53 Prof. Juran

(c) What is the expected value of perfect information?

Here is a simplified version of the payoff table, with the optimal decision alternative indicated for each state of

nature:

s1 s2 s3

100 200 300

d1 = 100 500 200 -100

d2 = 150 0 600 300

d3 = 200 -500 1000 700

d4 = 250 -1000 500 1100

d5 = 300 -1500 0 1500

Optimal Decision d1 d3 d5

EVwPI 0.20 * $500 0.20 * $1,000 0.60 * $1,500

$100 $200 $900

$1,200

The expected value of perfect information (the difference in expected value between

perfect information and no information) is $1,200 - $600 = $600.

(d) Say something intelligent about the riskiness of the various decision alternatives.

Even though d5 is the best choice for expected value, it is also the riskiest alternative, as

measured by standard deviation (see scatter plot below).

Each of the alternatives except for d1 is reasonable, depending on the decision maker’s

risk tolerance. For example d4 has a lower expected profit than d5, but is also

significantly less risky. For some people, that might be a more desirable choice. The

only unreasonable alternative is d1, because it is both riskier and less profitable than d2.

Note that d2 is the only alternative guaranteed not to ever lose money.

Risk vs. Return - Paulson Foods

$700

$600

Expected Return ($)

$500 Make 300 cases

Make 250 cases

$400

Make 200 cases

$300

$200 Make 150 cases

$100

Make 100 cases

$-

$- $200 $400 $600 $800 $1,000 $1,200 $1,400

Standard Deviation ($)

Managerial Statistics 54 Prof. Juran

8. Nomura Inc. has a contract with one of its customers, Mackenzie Tar & Grease to

supply a unique liquid chemical product that is used by Mackenzie in the manufacture

of a lubricant for aircraft engines. Because of the chemical process used by Nomura,

batch size for the liquid chemical product must be 1000 pounds.

Mackenzie has agreed to adjust manufacturing to the full batch quantities, and will

order either one, two, or three batches every three months. Since an aging process of

one month is necessary for the product, Nomura will have to make its production (how

much to make) decision before Mackenzie places an order. Thus, Nomura can list the

product demand alternatives of 1000, 2000, or 3000 pounds, but the exact demand is

unknown. Unfortunately, Nomura’s product cannot be stored more than two months

without degenerating into a viscous and highly corrosive toxic compound, linked in

laboratory tests to the Ebola virus.

Nomura’s manufacturing costs are $150 per pound, and the product sells at the fixed

contract price of $200 per pound. If Mackenzie orders more than Nomura has produced,

Nomura has agreed to absorb the added cost of filling the order by purchasing a higher

quality substitute product from Miyamoto, another chemical firm. The substitute

Miyamoto product, including transportation expenses, will cost Nomura $240 per

pound. Since the product cannot be stored more than two months, Nomura cannot

inventory excess production until Mackenzie’s next three-month order. Therefore, if

Mackenzie’s current order is less than Nomura has produced, the excess production

will be reprocessed and valued at $50 per pound.

The inventory decision in this problem is how much Nomura should produce given the costs and

the possible demands of 1000, 2000, and 3000 pounds. From historical data and an analysis of

Mackenzie’s future demands, Nomura has assessed the probability distribution for demand

shown in the table below.

Demand Probability

1000 0.30

2000 0.50

3000 0.20

Managerial Statistics 55 Prof. Juran

(a) Develop a payoff table for the Nomura problem.

States of Nature

s1 s2 s3

1000 pounds 2000 pounds 3000 pounds

[(2000*200)] – [(3000*200)] –

d1 = 1000 [(1000*200)] – [(1000*150)] = $50,000

[(1000*150)+(1000*240)] = $10,000 [(1000*150)+(2000*240)] = -$30,000

[(1000*200)+(1000*50)]– [(2000*150)] [(3000*200)] –

d2 = 2000 = -$50,000

[(2000*200)] – [(2000*150)] = $100,000

[(2000*150)+(1000*240)] = $60,000

[(1000*200)+(2000*50)]– [(3000*150)] [(2000*200)+(1000*50)] – [(3000*150)]

d3 = 3000 = -$150,000 = $0

[(3000*200)] – [(3000*150)] = $150,000

(b) How many batches should Nomura produce every three months?

The best course of action is to produce 2,000 pounds, with an expected value of $47,000.

s1 = Sell 1000 30.0%

$50,000

d1 = Make 1000 FALSE Expected Value

0 $14,000

s2 = Sell 2000 50.0%

$10,000

s3 = Sell 3000 20.0%

-$30,000

Nomura Expected Value

$47,000

s1 = Sell 1000 30.0%

-$50,000

d2 = Make 2000 TRUE Expected Value

0 $47,000

s2 = Sell 2000 50.0%

$100,000

s3 = Sell 3000 20.0%

$60,000

s1 = Sell 1000 30.0%

-$150,000

d3 = Make 3000 FALSE Expected Value

0 -$15,000

s2 = Sell 2000 50.0%

$0

s3 = Sell 3000 20.0%

$150,000

Managerial Statistics 56 Prof. Juran

(c) How much of a discount should Nomura be willing to allow Mackenzie for

specifying in advance exactly how many batches will be purchased?

This question is the same as asking for the expected value of perfect information.

Demand Probabilities Profit d1 Profit d2 Profit d3 Optimal Decision

1000 0.30 $50,000 -$50,000 -$150,000 d1

2000 0.50 $10,000 $100,000 $0 d2

3000 0.20 -$30,000 $60,000 $150,000 d3

We calculate the expected value with perfect information by summing up the probability-weighted best payoffs for

each state of nature.

EVwPI 0.30 * $50 ,000 0.50 * $100 ,000 0.20 * $150 ,000

$15,000 $50 ,000 $30 ,000

$95 ,000

The expected value of perfect information is $95,000 - $47,000 = $48,000.

Nomura has detected a pattern in the demand for the product based on Mackenzie’s previous

order quantity. Let

I1 = Mackenzie’s last order was 1000 pounds

I2 = Mackenzie’s last order was 2000 pounds

I3 = Mackenzie’s last order was 3000 pounds

The conditional probabilities are as follows:

P I 1 s 1 0.10 P I 2 s 1 0.40 P I 3 s 1 0.50

P I 1 s 2 0.22 P I 2 s 2 0.68 P I 3 s 2 0.10

P I 1 s 3 0.80 P I 2 s 3 0.20 P I 3 s 3 0.00

(d) Develop an optimal decision strategy for Nomura.

If Mackenzie’s last order was for 1000 pounds:

Probabilities

States Prior Conditional Joint Posterior

P sj I1

sj P sj

P I1 s j

P s j I1 P s j P I1 s j

P sj I1 P I 1

s1 0.30 0.10 0.030 0.100

s2 0.50 0.22 0.110 0.367

s3 0.20 0.80 0.160 0.533

Total P I 1 0.300

The total probability that Mackenzie’s last order was for 1000 pounds is 30%, which is

consistent with what we already know and reassures us that we have calculated the

joint probabilities correctly.

Managerial Statistics 57 Prof. Juran

Similarly, for I2 (that Mackenzie’s last order was for 2000 pounds):

Probabilities

States Prior Conditional Joint Posterior

P sj I2

sj P sj

P I2 sj

P sj I2 P sj P I2 sj

P sj I2

P I 2

s1 0.30 0.40 0.120 0.24

s2 0.50 0.68 0.340 0.68

s3 0.20 0.20 0.040 0.08

Total P I 2 0.500

Finally, for I3 (that Mackenzie’s last order was for 3000 pounds):

Probabilities

States Prior Conditional Joint Posterior

P sj I3

sj P sj

P I3 sj

P sj I3 P sj P I3 sj

P sj I3

P I 3

s1 0.30 0.50 0.15 0.75

s2 0.50 0.10 0.05 0.25

s3 0.20 0.00 0.00 0

Total P I 2 0.200

Using these probabilities, we can revise our decision tree (see next page).

The optimal strategy is to look at the most recent order, and then proceed as follows:

Mackenzie’s Last Order Next Production Run Expected Value

1000 3000 $65,000

2000 2000 $60,800

3000 1000 $40,000

(e) What is the expected value of sample information?

The expected value of this strategy is:

EVwSI 0.30 * $65 ,000 0.50 * $60 ,800 0.20 * $40 ,000

$57 ,900

There fore, the expected value of the sample information is $57,900 – $47,000 = $10,900.

(f) What is the efficiency of the information for the most recent order?

$10,900 / $48,000 = 0.227, or 22.7%.

Managerial Statistics 58 Prof. Juran

Decision tree for Nomura:

Managerial Statistics 59 Prof. Juran

9. A quality-control procedure involves 100% inspection of parts received from a supplier.

Historical records indicate that the defect rates shown in the table below have been observed.

Percent Defective Probability

0 0.15

1 0.25

2 0.40

3 0.20

The cost to inspect 100% of the parts received is $250 for each shipment of 500 parts. If

the shipment is not 100% inspected, defective parts will cause rework problems later in

the production process. The rework cost is $25 for each defective part.

(a) Complete the following payoff table, where the entries represent the total cost of

inspection and rework.

Note that the total rework costs without inspection are $25 times the number of defective parts

(out of 500):

Defect Rate Number of Defective Parts Rework Cost

0% 0 $0

1% 5 $125

2% 10 $250

3% 15 $375

Percent Defective

0 1 2 3

100% Inspection $250 $250 $250 $250

Inspection

No Inspection $0 $125 $250 $375

(b) Karim Nazer, the plant manager, is considering eliminating the inspection process to

save the $250 inspection cost per shipment. Do you support this action? Why or why

not?

On the basis of expected value, Nazer is correct; the inspection is not cost-effective.

Managerial Statistics 60 Prof. Juran

(c) Show a decision tree representing this problem.

0% Defects 15.0%

$250

1% Defects 25.0%

$250

100% Inspection FALSE Expected Value

0 $250

2% Defects 40.0%

$250

3% Defects 20.0%

$250

Nazer Expected Value

$206

0% Defects 15.0%

$0

1% Defects 25.0%

$125

No Inspection TRUE Expected Value

0 $206

2% Defects 40.0%

$250

3% Defects 20.0%

$375

(d) Suppose a sample of five parts is selected from the shipment and one defect is

found. Let I = 1 defect in a sample of five. Use the binomial probability distribution

to compute P I s 1 , P I s 2 , P I s 3 , and P I s 4 , where the state of nature

identifies the value for p in the binomial distribution. (For example, if the state of

nature is s1, then the p in the binomial is 0.00, etc.)

% defective Probability of 1 Defective out of 5

n x 5

s1 0.00 p 1 p n x 0.00 1 1 0.00 4 = 0.0000

x 1

n x 5

s2 0.01 p 1 p n x 0.01 1 1 0.01 4 = 0.0480

x 1

n x 5

s3 0.02 p 1 p n x 0.02 1 1 0.02 4 = 0.0922

x 1

n x 5

s4 0.03 p 1 p n x 0.03 1 1 0.03 4 = 0.1328

x 1

Managerial Statistics 61 Prof. Juran

(e) If I occurs, what are the revised probabilities for the states of nature?

Probabilities

States Prior Conditional Joint Posterior

P sj I

sj P sj

P I sj

P sj I P sj P I sj

P sj I

P I

s0 0.15 0.0000 0.0000 0.0000

s1 0.25 0.0480 0.0120 0.1591

s2 0.40 0.0922 0.0369 0.4889

s3 0.20 0.1328 0.0266 0.3520

Total P I 0.0755

(f) Should the entire shipment be 100% inspected whenever one defect is found in a

sample of size five?

If this happens, then it is cost-effective to perform 100% inspection. Here is a decision

tree, conditional upon having found one defect in the test sample of five parts:

0% Defects 0.0%

$250

1% Defects 15.9%

$250

100% Inspection TRUE Expected Value

0 $250

2% Defects 48.9%

$250

3% Defects 35.2%

$250

Nazer Expected Value

$250

0% Defects 0.0%

$0

1% Defects 15.9%

$125

No Inspection FALSE Expected Value

0 $274

2% Defects 48.9%

$250

3% Defects 35.2%

$375

Managerial Statistics 62 Prof. Juran

Of course, this ignores the other possibility, that we will find zero defects out of the five

parts.1

Let’s analyze the probabilities associated with I2, the event that zero defects are found:

% defective Probability of 0 Defective out of 5

n x 5

s1 0.00 p 1 p n x 0.00 0 1 0.00 5 = 1.0000

x 0

n x 5

s2 0.01 p 1 p n x 0.01 0 1 0.01 5 = 0.9510

x 0

n x 5

s3 0.02 p 1 p n x 0.02 0 1 0.02 5 = 0.9039

x 0

n x 5

s4 0.03 p 1 p n x 0.03 0 1 0.03 5 = 0.8587

x 0

Probabilities

States Prior Conditional Joint Posterior

P sj I2

sj P sj

P I2 sj

P sj I2 P sj P I2 sj

P sj I2 P I 2

s0 0.15 1.0000 0.1500 0.1629

s1 0.25 0.9510 0.2377 0.2581

s2 0.40 0.9039 0.3616 0.3926

s3 0.20 0.8587 0.1717 0.1865

Total P I 2 0.9211

The optimal strategy is to take the sample of five and see if there is at least one defect in

the sample. If not, accept the whole lot with no further inspection. If one defect is found,

then proceed with 100% inspection (see decision tree on the next page).

Information from Sample Decision Alternatives Expected Value Optimal Decision

d1 = 100% inspection $250.00

I1 = 1 defect found d1

d2 = no inspection $274.10

d1 = 100% inspection $250.00

I1 = 0 defects found d2

d2 = no inspection $200.33

1

We will ignore the probability of finding more than 1 out of five, which is less than 1% for all of the

percent defect rates in this problem.

Managerial Statistics 63 Prof. Juran

Decision tree for Karim Nazer problem:

0% Defects 0.0%

$250

1% Defects 15.9%

$250

100% Inspection TRUE Expected Value

0 $250.00

2% Defects 48.9%

$250

3% Defects 35.2%

$250

1 Defect Found 7.5% Expected Value

0 $250.00

0% Defects 0.0%

$0

1% Defects 15.9%

$125

No Inspection FALSE Expected Value

0 $274.10

2% Defects 48.9%

$250

3% Defects 35.2%

$375

Nazer Expected Value

$204.09

0% Defects 16.3%

$250

1% Defects 25.8%

$250

100% Inspection FALSE Expected Value

0 $250.00

2% Defects 39.3%

$250

3% Defects 18.6%

$250

0 Defects Found 92.1% Expected Value

0 $200.33

0% Defects 16.3%

$0

1% Defects 25.8%

$125

No Inspection TRUE Expected Value

0 $200.33

2% Defects 39.3%

$250

3% Defects 18.6%

$375

(g) What is the cost savings associated with having the sample information? In other

words, what is it worth to have the sample of five taken as opposed to having no

inspection or having 100% inspection?

As shown in the decision tree, there is a $250.00 - $204.09 = $45.91 expected cost

reduction when the sample of five is inspected.

Managerial Statistics 64 Prof. Juran

Das könnte Ihnen auch gefallen

- Memory Plus Gold For Mas5Dokument8 SeitenMemory Plus Gold For Mas5Ashianna KimNoch keine Bewertungen

- Chapter 7: Optimal Risky Portfolios: Problem SetsDokument13 SeitenChapter 7: Optimal Risky Portfolios: Problem SetsAlyse97Noch keine Bewertungen

- SILAN LabAct4Dokument3 SeitenSILAN LabAct4La MarieNoch keine Bewertungen

- CH 8 Solutions To Selected End of Chapter Problems4Dokument9 SeitenCH 8 Solutions To Selected End of Chapter Problems4bobhamilton3489Noch keine Bewertungen

- Govind Narayan HarvesterDokument6 SeitenGovind Narayan Harvesterrashidsilwani01Noch keine Bewertungen

- Capital Budgeting-ClassDokument91 SeitenCapital Budgeting-ClassAditi AgrawalNoch keine Bewertungen

- Chapter 7Dokument1 SeiteChapter 7Quant TradingNoch keine Bewertungen

- BKM Chapter 7Dokument13 SeitenBKM Chapter 7IshaNoch keine Bewertungen

- Company Financial ManagementDokument8 SeitenCompany Financial ManagementMiconNoch keine Bewertungen

- Excel WorkBookDokument60 SeitenExcel WorkBookArnavNoch keine Bewertungen

- Bill Swelbar FAA 2011Dokument40 SeitenBill Swelbar FAA 2011Addison SchonlandNoch keine Bewertungen

- Chapter 11: The Cost of Capital Solutions To ProblemsDokument2 SeitenChapter 11: The Cost of Capital Solutions To Problemsjhoana_seseNoch keine Bewertungen

- Chapter 4 - Cost of CapitalDokument8 SeitenChapter 4 - Cost of CapitalParth GargNoch keine Bewertungen

- Calculaiton of PI Index AT 10%Dokument4 SeitenCalculaiton of PI Index AT 10%shivaniNoch keine Bewertungen

- Chapter 7 SolutionsDokument4 SeitenChapter 7 SolutionsAna SaggioNoch keine Bewertungen

- Quiz 3032Dokument4 SeitenQuiz 3032PG93Noch keine Bewertungen

- This Study Resource Was: Chapter 8 Risk and ReturnDokument3 SeitenThis Study Resource Was: Chapter 8 Risk and ReturnKevinNoch keine Bewertungen

- RRR ProblemDokument3 SeitenRRR ProblemRezzan Joy MejiaNoch keine Bewertungen

- 15 Numerical RAROCDokument1 Seite15 Numerical RAROCVenkatsubramanian R IyerNoch keine Bewertungen

- Ipm Question SDokument7 SeitenIpm Question SAamir AwanNoch keine Bewertungen

- Calculate Portfolio Beta After Stock SaleDokument8 SeitenCalculate Portfolio Beta After Stock SaleMiconNoch keine Bewertungen

- Internal Rate of Return (IRR) CalculationDokument7 SeitenInternal Rate of Return (IRR) Calculationiram juttNoch keine Bewertungen

- 9 Portfolio Analysis 2.0 WorkbookDokument2 Seiten9 Portfolio Analysis 2.0 WorkbookJohn SmithNoch keine Bewertungen

- Capital StructureDokument13 SeitenCapital Structureruchit guptaNoch keine Bewertungen

- Extra Material On CFDokument127 SeitenExtra Material On CFPanosMavrNoch keine Bewertungen

- Suggested - FM Eco - Test 1Dokument8 SeitenSuggested - FM Eco - Test 1Ritam chaturvediNoch keine Bewertungen

- Simulation of Newsvendor Model: Order Size (Units)Dokument8 SeitenSimulation of Newsvendor Model: Order Size (Units)Aparna JRNoch keine Bewertungen

- Simulation model profit analysisDokument8 SeitenSimulation model profit analysisJiancia WangNoch keine Bewertungen

- Risk Analysis (Divya Jadi Booti)Dokument48 SeitenRisk Analysis (Divya Jadi Booti)Michael AdhikariNoch keine Bewertungen

- Q 36-41Dokument6 SeitenQ 36-41mahisacNoch keine Bewertungen

- Chapter 7: Optimal Risky Portfolios: Problem SetsDokument14 SeitenChapter 7: Optimal Risky Portfolios: Problem SetsnouraNoch keine Bewertungen

- Ratio Analysis AssignmentDokument3 SeitenRatio Analysis Assignmentasinha_30Noch keine Bewertungen

- Study Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Dokument1 SeiteStudy Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Rajib Dahal50% (2)

- Capital Investment/Net Present Value: Interest Rate DataDokument9 SeitenCapital Investment/Net Present Value: Interest Rate DataWILLAM FABIAN PASTUÑA CAISAGUANONoch keine Bewertungen

- HW 6 - AkDokument6 SeitenHW 6 - AkBenjamin PangNoch keine Bewertungen

- 3.0 PV, FV, NPV, Irr & MirrDokument8 Seiten3.0 PV, FV, NPV, Irr & MirrIshrat Jahan DiaNoch keine Bewertungen

- Tutorial 3 Efficient Diversification Chapter 6Dokument7 SeitenTutorial 3 Efficient Diversification Chapter 6Noah Maratua ResortNoch keine Bewertungen

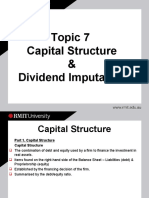

- Capital Structure & Dividend ImputationDokument53 SeitenCapital Structure & Dividend Imputationsir bookkeeperNoch keine Bewertungen

- 6-Risk and Managerial (Real) Options in Capital Budgeting-Chapter FourteenDokument17 Seiten6-Risk and Managerial (Real) Options in Capital Budgeting-Chapter FourteenSharique KhanNoch keine Bewertungen

- Jayaram HarvesterDokument13 SeitenJayaram Harvesterrashidsilwani01Noch keine Bewertungen

- Financial Management 2 AssignmentDokument9 SeitenFinancial Management 2 AssignmentLindiwe MhlangaNoch keine Bewertungen

- Calculating Breakeven Point and Capital Structure ImpactDokument3 SeitenCalculating Breakeven Point and Capital Structure Impactsultan altamashNoch keine Bewertungen

- 3.1 Workshop 7 Capital Structure 2021Dokument2 Seiten3.1 Workshop 7 Capital Structure 2021bobhamilton3489Noch keine Bewertungen

- CAPITAL STRUCTURE Sums OnlinePGDMDokument6 SeitenCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNoch keine Bewertungen

- Project Plan For Law Firms1Dokument6 SeitenProject Plan For Law Firms1Gray stoneNoch keine Bewertungen

- Expected Returns and Standard Deviations of Multi-Asset PortfoliosDokument4 SeitenExpected Returns and Standard Deviations of Multi-Asset PortfoliosJohn SmithNoch keine Bewertungen

- 67229bos54127 Inter P8aDokument16 Seiten67229bos54127 Inter P8aSANDEEP MADANNoch keine Bewertungen

- Capital Budgeting SumsDokument14 SeitenCapital Budgeting Sumssunny patwaNoch keine Bewertungen

- Cash Flow Statement 30Dokument18 SeitenCash Flow Statement 30romeeNoch keine Bewertungen

- FINANCIAL MANAGEMENT Sesi 5Dokument4 SeitenFINANCIAL MANAGEMENT Sesi 5hestiyaaNoch keine Bewertungen

- Assignment 1ADokument6 SeitenAssignment 1AAlex GarmaNoch keine Bewertungen

- FFM15, CH 11 - CapBud - , Chapter Model, 2-08-18Dokument12 SeitenFFM15, CH 11 - CapBud - , Chapter Model, 2-08-18maaz01888Noch keine Bewertungen

- Net Income ApprochDokument11 SeitenNet Income ApprochMahedrz GavaliNoch keine Bewertungen

- QUIZ 3Dokument2 SeitenQUIZ 3Jaypee BignoNoch keine Bewertungen

- Microsoft Company Overview and ForecastDokument46 SeitenMicrosoft Company Overview and ForecastSAHEB SAHANoch keine Bewertungen

- By The Sea Biscuit Company - Case Analysis - Group 6 - Section G - PGDM 1Dokument12 SeitenBy The Sea Biscuit Company - Case Analysis - Group 6 - Section G - PGDM 1Pranav Dev SinghNoch keine Bewertungen

- Ambati Meharish - Classwork - 11 May 2021Dokument9 SeitenAmbati Meharish - Classwork - 11 May 2021विशाल कुमारNoch keine Bewertungen

- Chapter 5 Solutions - FinmanDokument8 SeitenChapter 5 Solutions - Finmanhannah villanuevaNoch keine Bewertungen

- TNB Handbook: Prepared By: COE Investor RelationsDokument35 SeitenTNB Handbook: Prepared By: COE Investor Relationsmuhd faizNoch keine Bewertungen

- Central Bank of SudanDokument12 SeitenCentral Bank of SudanYasmin AhmedNoch keine Bewertungen

- MGT 490 Case Study 2Dokument14 SeitenMGT 490 Case Study 2Hasan AveeNoch keine Bewertungen

- Chapter 01 Introduction To OMDokument31 SeitenChapter 01 Introduction To OMmehdiNoch keine Bewertungen

- Risk and Return 2Dokument2 SeitenRisk and Return 2Nitya BhakriNoch keine Bewertungen

- Joijamison 2019taxes PDFDokument26 SeitenJoijamison 2019taxes PDFrose ownes100% (1)

- A Study of Training Program Characteristics and Training Effectiveness Among Organizations Receiving Services From External Training ProvidersDokument193 SeitenA Study of Training Program Characteristics and Training Effectiveness Among Organizations Receiving Services From External Training ProvidersbhuvaneshkmrsNoch keine Bewertungen

- Studio Accommodation Studio Accommodation Studio AccommodationDokument4 SeitenStudio Accommodation Studio Accommodation Studio AccommodationNISHA BANSALNoch keine Bewertungen

- Intermediate Accounting 1a Cash and Cash EquivalentsDokument8 SeitenIntermediate Accounting 1a Cash and Cash EquivalentsGinalyn FormentosNoch keine Bewertungen

- Social Entrepreneurship Success Story of Project SukanyaDokument4 SeitenSocial Entrepreneurship Success Story of Project SukanyaHimanshu sahuNoch keine Bewertungen

- Calculating outstanding arrears for civil servantsDokument5 SeitenCalculating outstanding arrears for civil servantsAdnanRasheedNoch keine Bewertungen

- Assignment Ishan SharmaDokument8 SeitenAssignment Ishan SharmaIshan SharmaNoch keine Bewertungen

- PS3 SolutionDokument8 SeitenPS3 Solutionandrewlyzer100% (1)

- Senario Case StudyDokument19 SeitenSenario Case Studymaya100% (1)

- Trade Discount and Trade Discount Series.Dokument31 SeitenTrade Discount and Trade Discount Series.Anne BlanquezaNoch keine Bewertungen

- Presented by Gaurav Pathak Nisheeth Pandey Prateek Goel Sagar Shah Shubhi Gupta SushantDokument17 SeitenPresented by Gaurav Pathak Nisheeth Pandey Prateek Goel Sagar Shah Shubhi Gupta SushantSagar ShahNoch keine Bewertungen

- Essay About MonopolyDokument15 SeitenEssay About MonopolyNguyễn Lan HươngNoch keine Bewertungen

- Balaji Wafers (FINAL)Dokument38 SeitenBalaji Wafers (FINAL)Urja BhavsarNoch keine Bewertungen

- AIS Prelim ExamDokument4 SeitenAIS Prelim Examsharielles /Noch keine Bewertungen

- Market Failure Case StudyDokument2 SeitenMarket Failure Case Studyshahriar sayeedNoch keine Bewertungen

- Variations in Construction ContractsDokument20 SeitenVariations in Construction Contractsahmedmushtaq041Noch keine Bewertungen

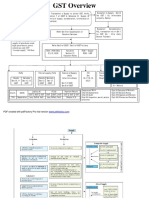

- GST OverviewDokument17 SeitenGST Overviewprince2venkatNoch keine Bewertungen

- ProspectingDokument40 SeitenProspectingCherin Sam100% (1)

- Final Project Example NissanDokument19 SeitenFinal Project Example NissanAliceJohnNoch keine Bewertungen

- General Administration, HR, IR, and Operations ExperienceDokument4 SeitenGeneral Administration, HR, IR, and Operations ExperienceDeepak MishraNoch keine Bewertungen

- Risk Appetite Framework for South African InstituteDokument19 SeitenRisk Appetite Framework for South African Institutemuratandac3357Noch keine Bewertungen

- Seed Working Paper No. 28: Series On Innovation and Sustainability in Business Support Services (FIT)Dokument61 SeitenSeed Working Paper No. 28: Series On Innovation and Sustainability in Business Support Services (FIT)helalhNoch keine Bewertungen

- 2021 Playbook For Credit Risk ManagementDokument41 Seiten2021 Playbook For Credit Risk ManagementAbNoch keine Bewertungen

- Umang PDF Fo MathDokument24 SeitenUmang PDF Fo MathAlok RajNoch keine Bewertungen

- A2 Sample Chapter Inventory Valuation PDFDokument19 SeitenA2 Sample Chapter Inventory Valuation PDFRafa BentolilaNoch keine Bewertungen