Beruflich Dokumente

Kultur Dokumente

The Difference Between Margin and Markup

Hochgeladen von

Ffrekgtreh FygkohkOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Difference Between Margin and Markup

Hochgeladen von

Ffrekgtreh FygkohkCopyright:

Verfügbare Formate

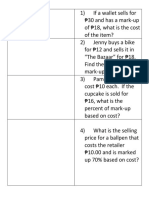

The difference between margin and markup

March 04, 2019

The difference between margin and markup is that margin is sales minus the cost of goods sold, while markup

is the the amount by which the cost of a product is increased in order to derive the selling price. A mistake in

the use of these terms can lead to price setting that is substantially too high or low, resulting in lost sales or

lost profits, respectively. There can also be an inadvertent impact on market share, since excessively high or

low prices may be well outside of the prices charged by competitors.

More detailed explanations of the margin and markup concepts are as follows:

Margin (also known as gross margin) is sales minus the cost of goods sold. For example, if a product sells for

$100 and costs $70 to manufacture, its margin is $30. Or, stated as a percentage, the margin percentage is 30%

(calculated as the margin divided by sales).

Markup is the amount by which the cost of a product is increased in order to derive the selling price. To use the

preceding example, a markup of $30 from the $70 cost yields the $100 price. Or, stated as a percentage, the

markup percentage is 42.9% (calculated as the markup amount divided by the product cost).

It is easy to see where a person could get into trouble deriving prices if there is confusion about the meaning of

margins and markups. Essentially, if you want to derive a certain margin, you have to markup a product cost

by a percentage greater than the amount of the margin, since the basis for the markup calculation is cost, rather

than revenue; since the cost figure should be lower than the revenue figure, the markup percentage must be

higher than the margin percentage.

The markup calculation is more likely to result in pricing changes over time than a margin -based price,

because the cost upon which the markup figure is based may vary over time; or its calculation may vary,

resulting in different costs which therefore lead to different prices.

The following bullet points note the differences between the margin and markup percentages at discrete

intervals:

To arrive at a 10% margin, the markup percentage is 11.1%

To arrive at a 20% margin, the markup percentage is 25.0%

To arrive at a 30% margin, the markup percentage is 42.9%

To arrive at a 40% margin, the markup percentage is 80.0%

To arrive at a 50% margin, the markup percentage is 100.0%

To derive other markup percentages, the calculation is:

Desired margin ÷ Cost of goods = Markup percentage

For example, if you know that the cost of a product is $7 and you want to earn a margin of $5 on it, the

calculation of the markup percentage is:

$5 Margin ÷ $7 Cost = 71.4%

If we multiply the $7 cost by 1.714, we arrive at a price of $12. The difference between the $12 price and the

$7 cost is the desired margin of $5.

Consider having the internal audit staff review prices for a sample of sale transactions, to see if the margin and

markup concepts were confused. If so, determine the amount of profit lost (if any) as a result of this issue, and

report it to management if the amount is significant.

If the difference between the two concepts continues to cause trouble for the sales staff, consider printing car ds

that show the markup percentages to use at various price points, and distributing the cards to the staff. The

cards should also define the difference between the margin and markup terms, and show examples of how

margin and markup calculations are derived.

Das könnte Ihnen auch gefallen

- Margin Vs Markup: Head To Head DifferencesDokument3 SeitenMargin Vs Markup: Head To Head Differences1abhishek1100% (1)

- Psychological Aspects of Pricing StrategiesDokument21 SeitenPsychological Aspects of Pricing StrategiesHanifah NabilahNoch keine Bewertungen

- For ReportingDokument6 SeitenFor ReportingColeen Rich - BobierNoch keine Bewertungen

- Gross MarginDokument4 SeitenGross MarginMihalis AristidouNoch keine Bewertungen

- Cost-oriented pricing journal articleDokument12 SeitenCost-oriented pricing journal articlepall12100% (1)

- Setting Initial Prices Based on Costs, Competition and Customer ValueDokument29 SeitenSetting Initial Prices Based on Costs, Competition and Customer ValueKimshen TaboadaNoch keine Bewertungen

- Merchandising CostingDokument11 SeitenMerchandising CostingVishwajeet BhartiNoch keine Bewertungen

- Pricing StrategiesDokument16 SeitenPricing StrategiesLaysha MorenoNoch keine Bewertungen

- 3 Pricing Approaches for Maximizing ProfitsDokument7 Seiten3 Pricing Approaches for Maximizing ProfitsErick AloyceNoch keine Bewertungen

- Break-Even Point PDFDokument2 SeitenBreak-Even Point PDFFaisal Rao67% (3)

- Financial Plan: Start-Up FundingDokument6 SeitenFinancial Plan: Start-Up FundingAchilles Adrian AguilanNoch keine Bewertungen

- Financial Plan: Start-Up FundingDokument6 SeitenFinancial Plan: Start-Up FundingAchilles Adrian AguilanNoch keine Bewertungen

- Selling Price: Rate WorkDokument4 SeitenSelling Price: Rate WorkLara SinapiloNoch keine Bewertungen

- Chapter 4Dokument77 SeitenChapter 4Shruthi ShettyNoch keine Bewertungen

- Neo PriceDokument11 SeitenNeo Pricelaxave8817Noch keine Bewertungen

- #4 Pricing Strategy & TacticsDokument28 Seiten#4 Pricing Strategy & Tacticspriti_k019656Noch keine Bewertungen

- Markup and Margin ExplainedDokument4 SeitenMarkup and Margin ExplainedRafael RiveraNoch keine Bewertungen

- Gross Margin Is An Ambiguous Phrase That Expresses The Relationship Between Gross Profit and Sales RevenueDokument3 SeitenGross Margin Is An Ambiguous Phrase That Expresses The Relationship Between Gross Profit and Sales Revenuekishorepatil8887Noch keine Bewertungen

- Activity 6: Module 6: InflationDokument4 SeitenActivity 6: Module 6: InflationJoyce CastroNoch keine Bewertungen

- Financial Ratio & LeverageDokument25 SeitenFinancial Ratio & Leverageankushrasam700Noch keine Bewertungen

- Div 2Dokument20 SeitenDiv 2Divyesh NagarkarNoch keine Bewertungen

- Cara Menentukan Pricing StrategiesDokument12 SeitenCara Menentukan Pricing StrategiesRief RobyNoch keine Bewertungen

- Price-Setting Criteria For Digital ProductsDokument9 SeitenPrice-Setting Criteria For Digital ProductsVlad OnicaNoch keine Bewertungen

- New Microsoft Word DocumentDokument23 SeitenNew Microsoft Word DocumentVenky PoosarlaNoch keine Bewertungen

- Busmath 3 - Markup, Markdown, and Discounts - KimtiuDokument128 SeitenBusmath 3 - Markup, Markdown, and Discounts - KimtiuKim TNoch keine Bewertungen

- Break-Even Point Analysis ExplainedDokument6 SeitenBreak-Even Point Analysis ExplainedLouis FrongelloNoch keine Bewertungen

- Understand pricing strategies and cost analysisDokument28 SeitenUnderstand pricing strategies and cost analysisgraceNoch keine Bewertungen

- Day5 - Margin vs. MarkupDokument14 SeitenDay5 - Margin vs. MarkupFfrekgtreh FygkohkNoch keine Bewertungen

- Pricing DecisionsDokument34 SeitenPricing Decisionszombies_meNoch keine Bewertungen

- Lecture 4-Break Even and Contribution Margin AnalysisDokument13 SeitenLecture 4-Break Even and Contribution Margin AnalysisFathurrahman AnwarNoch keine Bewertungen

- PricingDokument19 SeitenPricingAmal JoseNoch keine Bewertungen

- Break Even AnalysisDokument15 SeitenBreak Even AnalysisPawan BiswaNoch keine Bewertungen

- Business Mathematics Quarter 1 Week 6: NAME: - GRD. & SEC.Dokument10 SeitenBusiness Mathematics Quarter 1 Week 6: NAME: - GRD. & SEC.Nìcole NabasNoch keine Bewertungen

- Cost Volume Profit AnalysisDokument16 SeitenCost Volume Profit AnalysisManal AsgharNoch keine Bewertungen

- SMCCCD - Chapter 6 - Cost-Volume-Profit RelationshipsDokument8 SeitenSMCCCD - Chapter 6 - Cost-Volume-Profit RelationshipsJames CrombezNoch keine Bewertungen

- Cost-Volume-Profit Analysis: Fixed CostsDokument9 SeitenCost-Volume-Profit Analysis: Fixed CostsSatarupa BhoiNoch keine Bewertungen

- Retail Pricing Strategies To Increase ProfitabilityDokument4 SeitenRetail Pricing Strategies To Increase ProfitabilitykitkatNoch keine Bewertungen

- Pricing Policy: Policy Company Determines Wholesale Products ServicesDokument4 SeitenPricing Policy: Policy Company Determines Wholesale Products ServicesGhost_1990Noch keine Bewertungen

- Cost-Volume-Profit Relationships: Discussion Case 4-1Dokument85 SeitenCost-Volume-Profit Relationships: Discussion Case 4-1kasad jdnfrnasNoch keine Bewertungen

- Contribution Margin: Break Even AnalysisDokument2 SeitenContribution Margin: Break Even AnalysisArpita KapoorNoch keine Bewertungen

- Differentiate Mark-Up From MarginsDokument20 SeitenDifferentiate Mark-Up From MarginsAndrea GalangNoch keine Bewertungen

- Pricing Strategy Chapter 2 2Dokument16 SeitenPricing Strategy Chapter 2 2Elmer John BallonNoch keine Bewertungen

- SAP SD Pricing FundamentalsDokument14 SeitenSAP SD Pricing FundamentalsThiagoHanuschNoch keine Bewertungen

- Retail Math: Talking The Talk of Retail Business!Dokument29 SeitenRetail Math: Talking The Talk of Retail Business!Furqan DxNoch keine Bewertungen

- Transfer PricingDokument7 SeitenTransfer PricingWaqas RehanNoch keine Bewertungen

- SmartPhone Data AnalysisDokument6 SeitenSmartPhone Data AnalysisChakravarthy Narnindi SharadNoch keine Bewertungen

- How To Calculate Markup PercentageDokument4 SeitenHow To Calculate Markup Percentage7761430Noch keine Bewertungen

- When Transfer Prices Are NeededDokument3 SeitenWhen Transfer Prices Are NeededJasonNoch keine Bewertungen

- W8 1Price-StudentwithNotes (PBN)Dokument31 SeitenW8 1Price-StudentwithNotes (PBN)CharityChanNoch keine Bewertungen

- CVP AnalysisDokument5 SeitenCVP AnalysisRacheel SollezaNoch keine Bewertungen

- Ma Ch04 SlidesDokument47 SeitenMa Ch04 Slidesom namah shivay om namah shivayNoch keine Bewertungen

- Retail PricingDokument64 SeitenRetail PricingKalavathi KalyanaramanNoch keine Bewertungen

- Costing and Pricing SESSION TOPIC 5: Strategic Profitability Analysis Learning OutcomesDokument7 SeitenCosting and Pricing SESSION TOPIC 5: Strategic Profitability Analysis Learning OutcomesRowel Gaña BacarioNoch keine Bewertungen

- Disadvantages of Cost Plus Pricing and SummaryDokument2 SeitenDisadvantages of Cost Plus Pricing and SummaryLJBernardoNoch keine Bewertungen

- Commercial Cooking Activity Sheets No. 1Dokument3 SeitenCommercial Cooking Activity Sheets No. 1Kathy KldNoch keine Bewertungen

- Solutions Manual Chapter 4 Cost-Volume-Profit RelationshipsDokument85 SeitenSolutions Manual Chapter 4 Cost-Volume-Profit RelationshipsMynameNoch keine Bewertungen

- Unit Economics - 2Dokument9 SeitenUnit Economics - 2Sai TejaNoch keine Bewertungen

- Markup MorotsiDokument3 SeitenMarkup MorotsimonnakeyoNoch keine Bewertungen

- Employability Skills: Brush Up Your Business StudiesVon EverandEmployability Skills: Brush Up Your Business StudiesNoch keine Bewertungen

- Day5 - Margin vs. MarkupDokument14 SeitenDay5 - Margin vs. MarkupFfrekgtreh FygkohkNoch keine Bewertungen

- MARKUP and MARKDOWN ExamplesDokument9 SeitenMARKUP and MARKDOWN ExamplesFfrekgtreh FygkohkNoch keine Bewertungen

- Mark-Up Class ActivityDokument3 SeitenMark-Up Class ActivityFfrekgtreh FygkohkNoch keine Bewertungen

- MARKUP and MARKDOWN ExamplesDokument9 SeitenMARKUP and MARKDOWN ExamplesFfrekgtreh FygkohkNoch keine Bewertungen

- Day4a - Goals of Anthropology, Political Science, and SociologyDokument42 SeitenDay4a - Goals of Anthropology, Political Science, and SociologyFfrekgtreh Fygkohk100% (1)

- The Difference Between Margin and MarkupDokument2 SeitenThe Difference Between Margin and MarkupFfrekgtreh FygkohkNoch keine Bewertungen

- Mark-Up Class ActivityDokument3 SeitenMark-Up Class ActivityFfrekgtreh FygkohkNoch keine Bewertungen

- Understanding the Relationship Between Culture, Society and PoliticsDokument30 SeitenUnderstanding the Relationship Between Culture, Society and PoliticsFfrekgtreh FygkohkNoch keine Bewertungen

- Day3 - Ratios and ProportionsDokument29 SeitenDay3 - Ratios and ProportionsFfrekgtreh FygkohkNoch keine Bewertungen

- Social Sciences - Anthropology, Sociology, Political ScienceDokument10 SeitenSocial Sciences - Anthropology, Sociology, Political ScienceFfrekgtreh Fygkohk100% (1)

- Day 3 - Social Change - in DepthDokument36 SeitenDay 3 - Social Change - in DepthFfrekgtreh FygkohkNoch keine Bewertungen

- Day1 - Operaitons With FractionsDokument14 SeitenDay1 - Operaitons With FractionsFfrekgtreh FygkohkNoch keine Bewertungen

- Understanding the Relationship Between Culture, Society and PoliticsDokument30 SeitenUnderstanding the Relationship Between Culture, Society and PoliticsFfrekgtreh FygkohkNoch keine Bewertungen

- What Is Cultural RelativismDokument1 SeiteWhat Is Cultural RelativismFfrekgtreh FygkohkNoch keine Bewertungen

- Culture and SocietyDokument47 SeitenCulture and SocietyFfrekgtreh FygkohkNoch keine Bewertungen

- ANNEX O of GAMDokument15 SeitenANNEX O of GAMKelvin CaldinoNoch keine Bewertungen

- Unit 4:: Incident Commander and Command Staff FunctionsDokument16 SeitenUnit 4:: Incident Commander and Command Staff FunctionsAntonio Intia IVNoch keine Bewertungen

- 1 Compania MaritimaDokument7 Seiten1 Compania MaritimaMary Louise R. ConcepcionNoch keine Bewertungen

- Transfer of Property Act - Ramesh Chand Vs Suresh Chand, Delhi High CourtDokument18 SeitenTransfer of Property Act - Ramesh Chand Vs Suresh Chand, Delhi High CourtLatest Laws TeamNoch keine Bewertungen

- Pamantasan NG Lungsod NG Valenzuela: Poblacion II, Malinta, Valenzuela CityDokument13 SeitenPamantasan NG Lungsod NG Valenzuela: Poblacion II, Malinta, Valenzuela CityJoseph DegamoNoch keine Bewertungen

- Intern VivaDokument12 SeitenIntern VivaAnirudhKasthuriNoch keine Bewertungen

- UOIT Academic Calendar 2010Dokument306 SeitenUOIT Academic Calendar 2010uoitNoch keine Bewertungen

- Chap 001Dokument41 SeitenChap 001ms_cherriesNoch keine Bewertungen

- Basics of EntrepreneurshipDokument51 SeitenBasics of EntrepreneurshipGanesh Kumar100% (1)

- Rate of Return Analysis (Online Version)Dokument35 SeitenRate of Return Analysis (Online Version)samiyaNoch keine Bewertungen

- Final Order Case 30 Sanjay Dhande Vs ICICI Bank & Ors - SignDokument24 SeitenFinal Order Case 30 Sanjay Dhande Vs ICICI Bank & Ors - SignLive Law100% (1)

- What It Takes To Be An EntrepreneurDokument3 SeitenWhat It Takes To Be An EntrepreneurJose FrancisNoch keine Bewertungen

- Taxation LawDokument4 SeitenTaxation Lawvisha183240Noch keine Bewertungen

- Jamal Sherazi Resume - ME Materials Engineer PakistanDokument2 SeitenJamal Sherazi Resume - ME Materials Engineer PakistanShakeel AhmedNoch keine Bewertungen

- Media Gateway SoftswitchDokument10 SeitenMedia Gateway SoftswitchMahmoud Karimi0% (1)

- Qatar Online Business DirectoryDokument13 SeitenQatar Online Business DirectoryTed LiptakNoch keine Bewertungen

- Daftar Periksan ISO TS 17021 Part 3Dokument4 SeitenDaftar Periksan ISO TS 17021 Part 3Alex Ramadhan SabananyoNoch keine Bewertungen

- CH05Dokument30 SeitenCH05FachrurroziNoch keine Bewertungen

- N-KOM Shipping Master Guide (2016) PDFDokument14 SeitenN-KOM Shipping Master Guide (2016) PDFGirish GopalakrishnanNoch keine Bewertungen

- Asme BPVC BrochureDokument24 SeitenAsme BPVC BrochurekanchanabalajiNoch keine Bewertungen

- Losyco ProductcataloqueDokument12 SeitenLosyco ProductcataloqueRadomir NesicNoch keine Bewertungen

- Template16 1 12-1Dokument90 SeitenTemplate16 1 12-1ManeNoch keine Bewertungen

- McGill IT Services Change Management Process GuideDokument81 SeitenMcGill IT Services Change Management Process Guidediego_sq100% (1)

- Insurance Marketing in Indian EnvironmentDokument6 SeitenInsurance Marketing in Indian EnvironmentPurab MehtaNoch keine Bewertungen

- Part 3 4 SPECS CONTRACTSDokument45 SeitenPart 3 4 SPECS CONTRACTSKristin ArgosinoNoch keine Bewertungen

- Nelcast LimitedDokument3 SeitenNelcast LimitedShivram Dhillon100% (1)

- The Science of Ship ValuationDokument10 SeitenThe Science of Ship ValuationWisnu KertaningnagoroNoch keine Bewertungen

- SimDokument12 SeitenSimLuis Villarruel100% (2)

- Hedge Funds AustraliaDokument9 SeitenHedge Funds Australiae_mike2003Noch keine Bewertungen

- Kenya: IEBC Polling Stations Without 3GDokument161 SeitenKenya: IEBC Polling Stations Without 3GWanjikũRevolution Kenya100% (1)