Beruflich Dokumente

Kultur Dokumente

Our Lady of Fatima University Quezon City Campus: ST ST

Hochgeladen von

Its meh SushiOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Our Lady of Fatima University Quezon City Campus: ST ST

Hochgeladen von

Its meh SushiCopyright:

Verfügbare Formate

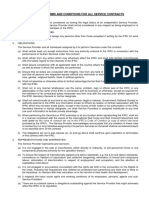

OUR LADY OF FATIMA UNIVERSITY

QUEZON CITY CAMPUS

COLLEGE OF BUSINESS AND ACCOUNTANCY

FUNDAMENTALS OF ACCOUNTING 2

PRELIM EXAMINATION

FIRST SEMESTER: A.Y.2017-2018

GENERAL INSTRUCTIONS:

1. Use no.2 pencil only.

2. Supply all the information needed in the answer card.

3. Read each question carefully.

4. Shade the circle that corresponds to your answer.

5. Do not use your mobile while the exam is going on.

6. Sign the attendance sheet before you leave the examination room.

1. 1st statement: A general partner is not 6. 1st statement: Cash contributions of partners

bound by the obligation of the partnership. are recorded at Fair value

2nd statement: Two or more persons may 2nd statement: Non-cash assets contributed

form a partnership for the exercise of to the partnership can be recorded at Fair

profession. Value.

a. Both are true a. Both are true

b. Both are false b. Both are false

c. 1st is true, 2nd is false c. 1st is true, 2nd is false

d. 1st is false, 2nd is true d. 1st is false, 2nd is true

2. 1st statement: A partnership begins from the 7. 1st statement: Skills contributed by an

time the partnership contract is registered industrial partner should be recorded by

with SEC. debiting an asset and crediting his capital.

2nd statement: A partnership has a juridical 2nd statement: An agreement stating that

personality separate and distinct from that one partner will not share in the profit is

of the partners. valid.

a. Both are true a. Both are true

b. Both are false b. Both are false

c. 1st is true, 2nd is false c. 1st is true, 2nd is false

d. 1st is false, 2nd is true d. 1st is false, 2nd is true

3. 1st statement: Partnership may exist for an 8. 1st statement: Five persons can for a

indefinite period time. partnership.

2nd statement: Partnership is created by 2nd statement: A partnership may be

voluntary agreement of the partners. dissolved at any time by any of the partners.

a. Both are true a. Both are true

b. Both are false b. Both are false

c. 1st is true, 2nd is false c. 1st is true, 2nd is false

d. 1st is false, 2nd is true d. 1st is false, 2nd is true

4. 1st statement: Partnership is formed to make 9. 1st statement: Liability of a partner assumed

profit. by the partnership is recorded by debiting

2nd statement: Partners can contribute only the liability and crediting his capital.

money or property to a common fund of a 2nd statement: Liability of a partner not

partnership assumed by the partnership is recorded by

a. Both are true crediting the liability and debiting his capital.

b. Both are false a. Both are true

c. 1st is true, 2nd is false b. Both are false

d. 1st is false, 2nd is true c. 1st is true, 2nd is false

5. 1st statement: The number of personalities d. 1st is false, 2nd is true

in a partnership is equal to the number of 10. 1st statement: if a partner received a bonus

partners. in the distribution of the partnership income,

2nd statement: all partners are liable up to he is entitled to receive that bonus in cash.

their personal properties. 2nd statement: The purpose, nature, and

a. Both are true other provision of the partnership are stated

b. Both are false in a public instrument called Articles of

c. 1st is true, 2nd is false Incorporation.

d. 1st is false, 2nd is true a. Both are true

b. Both are false

Fundamentals of Accounting 2 Page 1

c. 1st is true, 2nd is false PROBLEM 1: (Rounding off: 2 digits)

d. 1st is false, 2nd is true

11. One who contributes money or property to One June 1, 2017, Elsa and Anna decided

the partnership: to form a partnership. Elsa contributed a parcel of

a. Capital Partner c. Capitalist Partner land that cost her P20,000 and P500,000 cash.

b. General Partner d. Dormant Partner Anna contributed her inventories costing P300,000

12. Partnership in which no time is specified and P200,000 cash. The partners agreed that the

and not formed for specific undertaking: inventories should be write-down to its Net

a. Partnership of will c. Partnership at will Realizable Value of P250,000. The Fair Value of

b. Partnership in will d. Partnership at well Inventories is P275,000. Immediately after the

13. A partnership that complied with all legal formation of the Partnership, the land was sold for

requirements: P35,000.

a. De Hure c. De Jure On July 31, Elsa made an additional

b. De Fecto d. De facto investment of P150,000. Anna withdrew P50,000

14. One whose liability extends to his separate cash on September 1 and made an additional

personal property: investment of P150,000 on October 31.

a. Limited Partner c. General Partner

b. Unlimited Partner d. Major Partner On December 31, 2017, the partnership

15. One who contributes labor, skills, talent or earned P800,000 of income. The partners agreed

service: to divide the profit by providing monthly salaries of

a. Industrious Partner P20,000 to Elsa and P25,000 to Anna, 10% interest

b. Skillful Partner on weighted average capital to each partners, a

c. Talented Partner bonus of 20% of income after salaries and interest

d. Industrial Partner but before bonus should be given to Elsa and the

16. One who is designated to wind up or settle balance is to be divided equally.

the affairs of the partnership after

dissolution:

a. Managing Partner

1. How much is the capital credited to Anna on

b. Liquidating Partner

June 1, 2017?

c. Dissolution Partner

2. How much is the capital credited to Elsa on

d. Silent Partner

June 1, 2017?

17. One who is liable only to the extent of his

3. How much is the total asset of the

Capital Contribution:

partnership after formation on June 1,

a. Dormant Partner c. Unlimited Partner

2017?

b. Limited Partner d. Secret Partner

4. How much is the total Interest distributed to

18. On June 1, 2017, Pahe and Nante formed

the partners?

Fajenante Partnership. Pahe contributed a

5. How much is the bonus given to Elsa?

land that cost him P10, 000. Nante

6. How much is the share of Elsa in the

contributed P30, 000 cash. Four hours after

partnership’s income?

the formation of the partnership, the land

7. How much is the share of Anna in the

was sold for P30, 000. How much should be

partnership’s income?

recorded in Pahe’s Capital account on

formation of the partnership?

a. P30, 000 c. P25, 000

b. P15, 000 d. 10, 000

19. There cannot a partnership without

contribution of money, property or industry:

a. Co-ownership of asset

b. Mutual agency

c. Mutual Contribution

d. limited life

20. Sometimes termed Dormant Partner.

a. Limited Partner c. Capitalist Partner

b. Secret Partner d. None of the above

Fundamentals of Accounting 2 Page 2

PROBLEM 2: PROBLEM 3:

On January 1, 2017, James and Jones On January 1, 2017, A and B agreed to

formed a partnership. James invested P500,000 form a partnership contributing their respective

cash while Jones contributed his equipment with a assets and equities subject to adjustments. On that

mortgage payable that the partnership will date, the following were provided:

assumed. Mortgage payable is P120,000 while the

equipment has a carrying value amount of A B

P750,000. The partners agreed that the equipment Cash P28,000 P62,000

should be measured at P680,000. Accounts Receivable 200,000 600,000

At the end of the year, the partnership has a Inventories 120,000 200,000

profit of P575,000. The following are their Land 600,000

agreement with regards to division of profit and Building 500,000

loss: Furniture and Fixtures 50,000 35,000

Intangible assets 2,000 3,000

a. Annual salary or P90,000 and P60,000 to Accounts Payable 180,000 250,000

James and Jones respectively. Other Liabilities 200,000 350,000

b. interest of 10% based on initial capital Capital 620,000 800,000

c. 15% bonus to James on excess income

after salaries, interest and bonus.

d. Jones will receive twice the amount of what The following adjustments were agreed upon:

James will receive in the remaining balance.

a. Accounts receivable of P20,000 and

1. How much is the total assets of the partnership P40,000 are uncollectible in A’s and B’s

after formation? respective books.

2. How much is the share of James in the b. Inventories of P6,000 and P7,000 are

partnership’s profit? worthless in A’s and B’s respective books.

c. Intangible assets are to be written off in both

3. How much is the share of Jones in the books.

partnership’s profit?

The partners agreed that monthly salary of P12,000

4. If the partnership profit is P256,000, how much is and P15,000 is to be given A and B respectively,

the share of James? 10% interest on initial investment for each partners,

a 12% bonus to A on excess income after salaries

5. based on No. 4, how much is the share of and interest but before bonus and the balance in

Jones? 1:2 ratio for A & B respectively.

The partnership’s profit at year end is P900,000.

1. How much is the partnership’s total capital

after formation?

2. How much is the share of A in the

partnership’s profit?

3. How much is the share of B in the

partnership’s profit?

4. If the income summary has a debit balance

of P50,000 before closing, How much is the

ending capital of A?

5. Based on No. 4, How much is the share of

B?

Fundamentals of Accounting 2 Page 3

PROBLEM 4:

On January 1, 2017, Carla and Carlo

decided to form a partnership.

The following is the agreement of partners Carla

and Carlos with regards to the division of profit or

loss of their partnership:

a. Carla will receive annual salary of 120, 000

while Carlo will have P7, 500 monthly.

b. Each partner will receive P25, 000 as

interest on their initial capital.

c. Balance is to be divided in a ratio of 1:3 for

Carla and Carlo respectively.

1. If Carla’s Capital was debited for P40,000

after the division of profit or loss, How much

is the partnership’s Profit or Loss?

2. Based on No. 1, How much is the share of

Carlo?

3. If Carla’s capital is neither to be debited nor

credited after the division of profit or loss,

how much is the partnership’s profit or loss?

4. Assuming that the partners agreed to give

Carla a bonus of 5% on excess income after

salaries, interest and bonus, how much is

the partnership’s profit if the bonus allocated

to Carla is P5, 000?

5. Based on No. 4, how much is the share of

Carlo?

PREPARED BY:

JAY RODANTE NANO

Faculty/CBA

CHECKED AND APPROVED BY:

VICTOR JEROD ANDRES

Program Head-Accountancy

Fundamentals of Accounting 2 Page 4

Fundamentals of Accounting 2 Page 5

Das könnte Ihnen auch gefallen

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Von EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Noch keine Bewertungen

- Real Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsVon EverandReal Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsNoch keine Bewertungen

- BAM241 BusinesslawandregulationDokument3 SeitenBAM241 BusinesslawandregulationKathleen J. GonzalesNoch keine Bewertungen

- Partnership Mock ExamDokument15 SeitenPartnership Mock ExamPerbielyn BasinilloNoch keine Bewertungen

- RFBT Drill 2 (Partnership, Corpo, and Nego)Dokument13 SeitenRFBT Drill 2 (Partnership, Corpo, and Nego)ROMAR A. PIGA100% (1)

- Instructions:: Part 1: Nature and FormationDokument10 SeitenInstructions:: Part 1: Nature and FormationBilly Vince Alquino100% (3)

- 2018A QE Part 3 Partnerships PracticeDokument11 Seiten2018A QE Part 3 Partnerships PracticeNicole Andrea TuazonNoch keine Bewertungen

- University of Mindanao Panabo College: Items 12-13Dokument3 SeitenUniversity of Mindanao Panabo College: Items 12-13Jessa BeloyNoch keine Bewertungen

- CRC AceDokument3 SeitenCRC AceNaSheengNoch keine Bewertungen

- The Law On Partnership: Business LawsDokument4 SeitenThe Law On Partnership: Business LawsLFGS FinalsNoch keine Bewertungen

- Partnership and CorporationDokument16 SeitenPartnership and CorporationYuki kuranNoch keine Bewertungen

- Business Law and Regulation Quiz 2Dokument6 SeitenBusiness Law and Regulation Quiz 2Jennica Mae RuizNoch keine Bewertungen

- AFARDokument2 SeitenAFARAlisonNoch keine Bewertungen

- Final ExamDokument9 SeitenFinal ExamFrancis MallariNoch keine Bewertungen

- Business Law and Regulation Quiz 2Dokument6 SeitenBusiness Law and Regulation Quiz 2Jennica Mae RuizNoch keine Bewertungen

- Answer Key On Sample Questions of Partnership LawDokument8 SeitenAnswer Key On Sample Questions of Partnership LawHannah Jane Umbay100% (2)

- Partnership PrelimsDokument10 SeitenPartnership PrelimsEcho Claros0% (1)

- Partnership - ANSWERS TO DIAGNOSTIC EXERCISESDokument20 SeitenPartnership - ANSWERS TO DIAGNOSTIC EXERCISESBrent LigsayNoch keine Bewertungen

- RFBTDokument14 SeitenRFBTcherry blossomNoch keine Bewertungen

- B Law Review P-Corp-coop 2022Dokument43 SeitenB Law Review P-Corp-coop 2022Joyce Ann CortezNoch keine Bewertungen

- Easy RoundDokument5 SeitenEasy RoundMarianNoch keine Bewertungen

- Eac Integ AcctgnfinalsDokument6 SeitenEac Integ AcctgnfinalsDave C PeraltaNoch keine Bewertungen

- BLDokument6 SeitenBLArwind ReyesNoch keine Bewertungen

- Accounting For Partnership: I. TheoriesDokument10 SeitenAccounting For Partnership: I. TheoriesyowatdafrickNoch keine Bewertungen

- Partnership TheoriesDokument5 SeitenPartnership TheoriesThomas MarianoNoch keine Bewertungen

- AAO - SNITCH-ParCor Reviewer QuestionsDokument39 SeitenAAO - SNITCH-ParCor Reviewer Questionsby ScribdNoch keine Bewertungen

- Theories: Far Eastern University - Manila Quiz No. 1Dokument6 SeitenTheories: Far Eastern University - Manila Quiz No. 1Kenneth Christian WilburNoch keine Bewertungen

- BSA BL2 Prelims 2022Dokument6 SeitenBSA BL2 Prelims 2022Joy Consigene100% (1)

- Pre 1Dokument5 SeitenPre 1Mitchiejash Cruz100% (1)

- SafariDokument11 SeitenSafariAShley NIcoleNoch keine Bewertungen

- RFBT 2nd Monthly AssessmentDokument11 SeitenRFBT 2nd Monthly AssessmentCiena Mae AsasNoch keine Bewertungen

- Drill 1 Partnership PDFDokument2 SeitenDrill 1 Partnership PDFMaeNoch keine Bewertungen

- Quiz MidtermDokument4 SeitenQuiz MidtermKyla DizonNoch keine Bewertungen

- Acctg 202A Final ExamDokument8 SeitenAcctg 202A Final ExamYameteKudasaiNoch keine Bewertungen

- Quiz No. 1 - PrelimDokument6 SeitenQuiz No. 1 - Prelimstar lightNoch keine Bewertungen

- RFBT 4-Partnership Post-TestDokument5 SeitenRFBT 4-Partnership Post-TestCharles D. FloresNoch keine Bewertungen

- Law On Partnership and Corporation ReviewerDokument8 SeitenLaw On Partnership and Corporation ReviewerNoreen Delizo100% (1)

- BLT Final Pre-Boards NCPARDokument12 SeitenBLT Final Pre-Boards NCPARlorenceabad07Noch keine Bewertungen

- Cup - Regulatory Framework For Business TransactionDokument6 SeitenCup - Regulatory Framework For Business TransactionJerauld BucolNoch keine Bewertungen

- PartnershipDokument8 SeitenPartnershipAnonymous 03JIPKRkNoch keine Bewertungen

- Business Law - PARTNERSHIPDokument24 SeitenBusiness Law - PARTNERSHIPNina Vallerie Toledo100% (24)

- Saint Vincent College of CabuyaoDokument4 SeitenSaint Vincent College of CabuyaoRovic OrdonioNoch keine Bewertungen

- CPAR Taxation Estate and TrustsDokument8 SeitenCPAR Taxation Estate and TrustsMary Joy SameonNoch keine Bewertungen

- Accounting For Partnerships and CorporationsDokument6 SeitenAccounting For Partnerships and CorporationsHelena MontgomeryNoch keine Bewertungen

- 2019 RFBT 02 70mcqDokument24 Seiten2019 RFBT 02 70mcqJessa Mae Caballero JagnaNoch keine Bewertungen

- BLR 2022 Prelim Exam Questions For ReproductionDokument12 SeitenBLR 2022 Prelim Exam Questions For ReproductionRence MarcoNoch keine Bewertungen

- Chapter 17 TaxDokument15 SeitenChapter 17 TaxEmmanuel Penullar0% (1)

- Adv Acc NADokument31 SeitenAdv Acc NAimianmoralesNoch keine Bewertungen

- Abm QuizDokument5 SeitenAbm QuizCastleclash CastleclashNoch keine Bewertungen

- ACC 311 ReviewDokument2 SeitenACC 311 ReviewMaricar DimayugaNoch keine Bewertungen

- BSA2 Prelim Exam - TheoriesDokument4 SeitenBSA2 Prelim Exam - TheoriesDan RyanNoch keine Bewertungen

- Partnership ExerciseDokument11 SeitenPartnership ExerciseCris Tarrazona Casiple0% (1)

- Parcor QuizzerDokument5 SeitenParcor QuizzerMirelle OpizNoch keine Bewertungen

- Partnership Liquidation SW1Dokument3 SeitenPartnership Liquidation SW1JEWELL ANN PENARANDANoch keine Bewertungen

- Quiz 1Dokument3 SeitenQuiz 1wivada75% (4)

- Business Law and Regulations Quiz: Partnerships 2Dokument15 SeitenBusiness Law and Regulations Quiz: Partnerships 2Gabriela Marie F. Palatulan100% (1)

- Quiz 2 SolutionsDokument5 SeitenQuiz 2 SolutionsAngel Alejo AcobaNoch keine Bewertungen

- Q1Dokument3 SeitenQ1Joylyn CombongNoch keine Bewertungen

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Von EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Unit 4 Injustice, Liberalism and Gomburza Martyrdom LEARNING OUTCOMES: The Learners Are Expected ToDokument4 SeitenUnit 4 Injustice, Liberalism and Gomburza Martyrdom LEARNING OUTCOMES: The Learners Are Expected ToIts meh SushiNoch keine Bewertungen

- Reading and WritingDokument5 SeitenReading and WritingIts meh SushiNoch keine Bewertungen

- 10-A-Training-Institutional-Evaluation-Form 2Dokument2 Seiten10-A-Training-Institutional-Evaluation-Form 2Its meh SushiNoch keine Bewertungen

- Introduction To Corporate GovernanceDokument13 SeitenIntroduction To Corporate GovernanceIts meh SushiNoch keine Bewertungen

- Corporate Governance Responsibilities and AccountabilitiesDokument5 SeitenCorporate Governance Responsibilities and AccountabilitiesIts meh SushiNoch keine Bewertungen

- Topic23 3p3 Galvin 2017 Short PDFDokument32 SeitenTopic23 3p3 Galvin 2017 Short PDFIts meh SushiNoch keine Bewertungen

- Lease Accounting LessorDokument13 SeitenLease Accounting LessorIts meh SushiNoch keine Bewertungen

- Vii. Board of Directors and Trustees: A. Doctrine of Centralized ManagementDokument13 SeitenVii. Board of Directors and Trustees: A. Doctrine of Centralized ManagementIts meh SushiNoch keine Bewertungen

- Philippines: A.1. Corporate Income TaxDokument6 SeitenPhilippines: A.1. Corporate Income TaxIts meh SushiNoch keine Bewertungen

- Lease Acctg ExerciseDokument12 SeitenLease Acctg ExerciseIts meh SushiNoch keine Bewertungen

- Asset For A Period of Time in Exchange For Consideration (IFRS #16)Dokument6 SeitenAsset For A Period of Time in Exchange For Consideration (IFRS #16)Its meh SushiNoch keine Bewertungen

- Cfas Finals Quiz 1 A4 Set C With Answers PDFDokument4 SeitenCfas Finals Quiz 1 A4 Set C With Answers PDFIts meh SushiNoch keine Bewertungen

- Investment in Equity Securities Summary - A Project of Barters PHDokument2 SeitenInvestment in Equity Securities Summary - A Project of Barters PHIts meh SushiNoch keine Bewertungen

- Corporate PowerDokument8 SeitenCorporate PowerIts meh Sushi100% (1)

- Keystadi Ni LaraDokument17 SeitenKeystadi Ni LaraIts meh SushiNoch keine Bewertungen

- Obligations and Contracts (Chapter 3 Sec 5)Dokument3 SeitenObligations and Contracts (Chapter 3 Sec 5)LeeshNoch keine Bewertungen

- G.R. No.183204, G.R. No. 209969, G.R. Nos. 198729-30Dokument2 SeitenG.R. No.183204, G.R. No. 209969, G.R. Nos. 198729-30MACNoch keine Bewertungen

- EPCADokument373 SeitenEPCAAnonymous ciKyr0t0% (1)

- Test of Common Carrier Vlasons ShippingDokument4 SeitenTest of Common Carrier Vlasons ShippingMarkyHeroiaNoch keine Bewertungen

- Partnership Report Art. 1839-1850Dokument5 SeitenPartnership Report Art. 1839-1850Nehemiah MontecilloNoch keine Bewertungen

- Dela Fuente v. Fortune Life Insurance Co., Inc., - BATAANDokument2 SeitenDela Fuente v. Fortune Life Insurance Co., Inc., - BATAANJulia Kristia100% (1)

- Updated: JANUARY 2016 List of AttorneysDokument21 SeitenUpdated: JANUARY 2016 List of AttorneysPawan ShroffNoch keine Bewertungen

- Aquintey Vs Sps TibongDokument15 SeitenAquintey Vs Sps TibongBeya Marie F. AmaroNoch keine Bewertungen

- Tort Law Problem QuestionDokument8 SeitenTort Law Problem QuestionCamille Onette100% (1)

- 2 Legarda and Prieto vs. SaleebyDokument4 Seiten2 Legarda and Prieto vs. SaleebyNat DuganNoch keine Bewertungen

- Sales AssDokument5 SeitenSales AssPASCHALNoch keine Bewertungen

- PASCUAL COSO, Petitioner-Appellant, vs. FERMINA FERNANDEZ DEZA ET AL.,objectors-appelleesDokument5 SeitenPASCUAL COSO, Petitioner-Appellant, vs. FERMINA FERNANDEZ DEZA ET AL.,objectors-appelleesYollaine GaliasNoch keine Bewertungen

- Chua Guan Vs Samahang MagsasakaDokument12 SeitenChua Guan Vs Samahang MagsasakaDexter CircaNoch keine Bewertungen

- In The United States Bankruptcy Court For The District of DelawareDokument43 SeitenIn The United States Bankruptcy Court For The District of DelawareMichael AliNoch keine Bewertungen

- KMC Quitclaim - Jesly SaliganDokument2 SeitenKMC Quitclaim - Jesly Saliganjercon vince olisNoch keine Bewertungen

- Torres-Madrid Brokerage, Inc. vs. FEB Mitsui Marine Insurance Co., Inc.Dokument8 SeitenTorres-Madrid Brokerage, Inc. vs. FEB Mitsui Marine Insurance Co., Inc.Maria LopezNoch keine Bewertungen

- CA51015 Departmentals Quiz 1, 2, and 3Dokument37 SeitenCA51015 Departmentals Quiz 1, 2, and 3artemisNoch keine Bewertungen

- Mr. Honey's Banking DictionaryGerman-English by Honig, WinfriedDokument222 SeitenMr. Honey's Banking DictionaryGerman-English by Honig, WinfriedGutenberg.orgNoch keine Bewertungen

- Cla 3Dokument2 SeitenCla 3Von Andrei MedinaNoch keine Bewertungen

- Bugbook IIADokument60 SeitenBugbook IIAcyclicprefixNoch keine Bewertungen

- AUSL Pre-Week Review On Civil Law II (Reduced Bar Coverage) Notes For RevieweesDokument163 SeitenAUSL Pre-Week Review On Civil Law II (Reduced Bar Coverage) Notes For RevieweesKristine Fallarcuna-TristezaNoch keine Bewertungen

- Khasra 24Dokument1 SeiteKhasra 24RohitNemaNoch keine Bewertungen

- Distribution, Supply and Confidentiality AgreementDokument15 SeitenDistribution, Supply and Confidentiality Agreementoscar bohorquezNoch keine Bewertungen

- Dragonball Z Budokai 3 - ManualDokument14 SeitenDragonball Z Budokai 3 - ManualFelipe MarquesNoch keine Bewertungen

- R Andd PDFDokument388 SeitenR Andd PDFTejash PatelNoch keine Bewertungen

- Ifrc General Terms and Conditions For All Service ContractsDokument4 SeitenIfrc General Terms and Conditions For All Service ContractsJaime PinedaNoch keine Bewertungen

- Book Keeping Agreement (New) 18OCT23Dokument5 SeitenBook Keeping Agreement (New) 18OCT23kcatolico00Noch keine Bewertungen

- LRS Indeminity Bond PDFDokument2 SeitenLRS Indeminity Bond PDFRamana Reddy100% (1)

- Lyceum of The Philippines University: College of Law 109 LP Leviste ST., Salcedo Village Makati City, Metro ManilaDokument42 SeitenLyceum of The Philippines University: College of Law 109 LP Leviste ST., Salcedo Village Makati City, Metro ManilaLance MorilloNoch keine Bewertungen

- Sugandh Sir'S Notes On Family Law 2: A Hindu Joint Family ImmaterialDokument12 SeitenSugandh Sir'S Notes On Family Law 2: A Hindu Joint Family ImmaterialMAHIJA SINHA 1950354Noch keine Bewertungen