Beruflich Dokumente

Kultur Dokumente

14959379

Hochgeladen von

chuchu0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

64 Ansichten21 Seitenlecture note

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenlecture note

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

64 Ansichten21 Seiten14959379

Hochgeladen von

chuchulecture note

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 21

Partnership Liquidation

Chapter 16

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 1

Installment Liquidation

An installment liquidation involves

the distribution of cash to partners

as it becomes available during the

liquidation period and before all

liquidation gains and losses

have been realized.

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 2

Installment Liquidation

Illustration

The partnership of Duro, Kemp, and Roth

is to be liquidated as soon as possible

after December 31, 2003.

All cash on hand, except for $20,000 is to

be distributed at the end of each month.

Profit and losses are shared 50%, 30%,

and 20% to Duro, Kemp, and Roth.

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 3

Installment Liquidation

Illustration

Duro, Kemp, and Roth Balance Sheet

December 31, 2003 (000)

Assets Liabilities and Equity

Cash $ 240 Accounts payable $ 300

A/R, net 280 Note payable 200

Loan to Roth 40 Loan from Kemp 20

Inventories 400 Duro, capital (50%) 340

Land 100 Kemp, capital (30%) 340

Equipment, net 300 Roth, capital (20%) 200

Goodwill 40

$1,400 $1,400

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 4

Installment Liquidation

Illustration

Statement of Partnership Non- Priority 50% 30% 20%

Liquidation for the Period cash Liabil- Duro Kemp Kemp Roth

1/1/2004 to 2/1/2002 (000) Cash Assets ities Capital Loan Capital Capital

Balances January 1 $240 $1,160 $500 $340 $20 $340 $200

Offset Roth loan (40) (40)

Write-off of goodwill (40) (20) (12) (8)

Collection of receivables 200 (200)

Sale of inventory items 200 (160) 20 12 8

Predistribution balances

January 31 $640 $ 720 $500 $340 $20 $340 $160

January distribution

Creditors (500) (500)

Kemp (120) (20) (100)

Balances February 1 $ 20 $ 720 $ 0 $340 $ 0 $240 $160

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 5

Installment Liquidation

Illustration

First Installment – 50% 30% Kemp 20%

Schedule of Safe Payments Possible Duro Capital Roth

January 31, 2004 (000) Losses Capital and Loan Capital

Partners’ equities January 31, 2004 $340 $360 $160

Possible loss on noncash assets $720 (360) (216) (144)

$ (20) $144 $ 16

Possible loss on contingencies:

cash withheld 20 (10) (6) (4)

$ (30) $138 $ 12

Possible loss from Duro: debit

balance allocated 60:40 30 (18) (12)

— $120 —

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 6

February Liquidation Events

Cash 60,000

Duro, Capital 10,000

Kemp, Capital 6,000

Roth, Capital 4,000

Equipment, net 80,000

To record sale of equipment at a $20,000 loss

Cash 180,000

Duro, Capital 30,000

Kemp, Capital 18,000

Roth, Capital 12,000

Inventories 240,000

To record sale of remaining inventory items at a $60,000 loss

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 7

February Liquidation Events

Duro, Capital 2,000

Kemp, Capital 1,200

Roth, Capital 800

Cash 4,000

To record payment of liquidation expenses

Duro, Capital 4,000

Kemp, Capital 2,400

Roth, Capital 1,600

Accounts Payable 8,000

To record identification of an unrecorded liability

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 8

February Liquidation Events

Accounts Payable 8,000

Cash 8,000

To record payment of accounts payable

Duro, Capital 84,000

Kemp, Capital 86,400

Roth, Capital 57,600

Cash 228,000

To record distribution of cash to partners

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 9

Learning Objective 5

Learn about cash distribution

plans for installment

liquidations.

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 10

Cash Distribution Plans

The development of a cash distribution plan

for the liquidation of a partnership involves

ranking the partners in terms of their

vulnerability to possible losses.

$$$

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 11

Vulnerability Ranking

Profit Loss Vulnerability

Partner’s Sharing Absorption Ranking (1 most

Equity Ratio Potential vulnerable)

Duro $340 ÷ 0.5 = $ 680 1

Kemp 360 ÷ 0.3 = 1,200 3

Roth 160 ÷ 0.2 = 800 2

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 12

Assumed Loss Absorption

A schedule of assumed loss

absorption is prepared as a

second step in developing

the cash distribution plan.

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 13

Assumed Loss Absorption

Schedule of Assumed Duro Kemp Roth

Loss Absorption (000) (50%) (30%) (20%) Total

Preliquidation equities $340 $360 $160 $860

Assumed loss to absorb Duro’s

equity (allocated 50:30:20) (340) (204) (136) (680)

Balances — $156 $ 24 $180

Assumed loss to absorb Roth’s

equity (allocated 60:40) (36) (24) (60)

Balances $120 — $120

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 14

Cash Distribution Plan

Priority Kemp

Liabilities Loan Duro Kemp Roth

First $500,000 100%

Next $20,000 100%

Next $100,000 100%

Next $60,000 60 40%

Remainder 50% 30 20

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 15

Learning Objective 6

Comprehend liquidations when

either the partnership or

partners are insolvent.

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 16

Insolvent Partners and Partnerships

Ranking for claims against the separate

property of a bankrupt partner:

I Those owing to separate creditors

II Those owing to partnership creditors

III Those owing to partners by way of contribution

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 17

Partnership Solvent – One or More

Partners Personally Insolvent

In the liquidation of a solvent partnership,

partnership creditors are entitled to recover

the full amount of their claims

from partnership property.

West, York, and Zeff are partners sharing

profits 30%, 30%, and 40%, respectively.

West is personally insolvent with personal assets

of $50,000 and personal liabilities of $100,000.

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 18

Partnership Account Balances

Case A Case B Case C

Cash $60,000 — —

West, capital (30%) 18,000 $18,000 $21,000

York, capital (30%) 18,000 27,000 9,000

Zeff, capital (40%) 24,000 9,000 12,000

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 19

Insolvent Partnership

When a partnership is insolvent, the cash available

is not enough to pay partnership creditors.

Creditors will obtain partial recovery from

partnership assets and will call upon

individual partners to use their personal

resources to satisfy remaining claims.

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 20

End of Chapter 16

©2003 Prentice Hall Business Publishing, Advanced Accounting 8/e, Beams/Anthony/Clement/Lowensohn 16 - 21

Das könnte Ihnen auch gefallen

- Chapter IIDokument39 SeitenChapter IIDame NewNoch keine Bewertungen

- Chapter IIIDokument42 SeitenChapter IIIchuchuNoch keine Bewertungen

- 5.access Method and Data Link ControlDokument29 Seiten5.access Method and Data Link ControlchuchuNoch keine Bewertungen

- Chapter1 Part1Dokument27 SeitenChapter1 Part1chuchuNoch keine Bewertungen

- 6 InternetworkingDokument30 Seiten6 InternetworkingchuchuNoch keine Bewertungen

- Chapter OneDokument70 SeitenChapter OnechuchuNoch keine Bewertungen

- Management Chapter SixDokument8 SeitenManagement Chapter SixchuchuNoch keine Bewertungen

- 03 Basic Computer NetworkDokument36 Seiten03 Basic Computer Networknellaidenison3548Noch keine Bewertungen

- Puter NetworksDokument54 SeitenPuter NetworkschuchuNoch keine Bewertungen

- Chapter8 Part1Dokument29 SeitenChapter8 Part1chuchuNoch keine Bewertungen

- 1 IntroductionDokument34 Seiten1 IntroductionchuchuNoch keine Bewertungen

- Management Chapter FourDokument6 SeitenManagement Chapter FourchuchuNoch keine Bewertungen

- Chapter 1 IPDokument18 SeitenChapter 1 IPchuchuNoch keine Bewertungen

- 2.transmission MediaDokument27 Seiten2.transmission MediachuchuNoch keine Bewertungen

- Management Chapter FourDokument6 SeitenManagement Chapter FourchuchuNoch keine Bewertungen

- Management Chapter SixDokument8 SeitenManagement Chapter SixchuchuNoch keine Bewertungen

- Management Chapter OneDokument18 SeitenManagement Chapter OnechuchuNoch keine Bewertungen

- Introduction To Economics Unit 1Dokument40 SeitenIntroduction To Economics Unit 1chuchuNoch keine Bewertungen

- Management Chapter OneDokument18 SeitenManagement Chapter OnechuchuNoch keine Bewertungen

- Management Chapter ThreeDokument29 SeitenManagement Chapter ThreechuchuNoch keine Bewertungen

- Information Technology Cover Letter Sample MSWord DownloadDokument2 SeitenInformation Technology Cover Letter Sample MSWord DownloadchuchuNoch keine Bewertungen

- Management Chapter FiveDokument11 SeitenManagement Chapter FivechuchuNoch keine Bewertungen

- Financial Accounting 1 Unit 12Dokument24 SeitenFinancial Accounting 1 Unit 12humanity firstNoch keine Bewertungen

- Management Chapter SixDokument8 SeitenManagement Chapter SixchuchuNoch keine Bewertungen

- Financial Accounting 1 Unit 10Dokument21 SeitenFinancial Accounting 1 Unit 10chuchuNoch keine Bewertungen

- Financial Accounting 1 Unit 7Dokument28 SeitenFinancial Accounting 1 Unit 7chuchuNoch keine Bewertungen

- Financial Accounting 1 Unit 9Dokument23 SeitenFinancial Accounting 1 Unit 9chuchuNoch keine Bewertungen

- Financial Accounting 1 UnIt 5Dokument29 SeitenFinancial Accounting 1 UnIt 5chuchuNoch keine Bewertungen

- Financial Accounting 1 Unit 6Dokument27 SeitenFinancial Accounting 1 Unit 6chuchuNoch keine Bewertungen

- Financial Accounting 1 Unit 2Dokument22 SeitenFinancial Accounting 1 Unit 2AbdirahmanNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Grievance Redrassal ManagementDokument71 SeitenGrievance Redrassal ManagementAzaruddin Shaik B Positive0% (1)

- Judith Rivera Tarea 2.2 Acco 1050Dokument4 SeitenJudith Rivera Tarea 2.2 Acco 1050Judy RiveraNoch keine Bewertungen

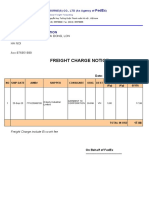

- Freight Charge Notice: To: Garment 10 CorporationDokument4 SeitenFreight Charge Notice: To: Garment 10 CorporationThuy HoangNoch keine Bewertungen

- Critically Discuss The Extent of Directors Duties and The Changes Made by The Companies Act 2006Dokument14 SeitenCritically Discuss The Extent of Directors Duties and The Changes Made by The Companies Act 2006Lingru WenNoch keine Bewertungen

- Problems in Bureaucratic SupplyDokument4 SeitenProblems in Bureaucratic Supplyatt_doz86100% (1)

- LG Market AnalysisDokument6 SeitenLG Market AnalysisPrantor ChakravartyNoch keine Bewertungen

- 1.introduction To Operations Management PDFDokument7 Seiten1.introduction To Operations Management PDFEmmanuel Okena67% (3)

- Section 114-118Dokument8 SeitenSection 114-118ReiZen UelmanNoch keine Bewertungen

- G12 ABM Marketing Lesson 1 (Part 1)Dokument10 SeitenG12 ABM Marketing Lesson 1 (Part 1)Leo SuingNoch keine Bewertungen

- Part & Process Audit: Summary: General Supplier InformationDokument20 SeitenPart & Process Audit: Summary: General Supplier InformationNeumar Neumann100% (1)

- New ISO 29990 2010 As Value Added To Non-Formal Education Organization in The FutureDokument13 SeitenNew ISO 29990 2010 As Value Added To Non-Formal Education Organization in The Futuremohamed lashinNoch keine Bewertungen

- Managing OperationsDokument18 SeitenManaging OperationsjaneNoch keine Bewertungen

- Virata V Wee To DigestDokument29 SeitenVirata V Wee To Digestanime loveNoch keine Bewertungen

- BSC Charting Proposal For Banglar JoyjatraDokument12 SeitenBSC Charting Proposal For Banglar Joyjatrarabi4457Noch keine Bewertungen

- APLI - Annual Report - 2016Dokument122 SeitenAPLI - Annual Report - 2016tugas noviaindraNoch keine Bewertungen

- One Point LessonsDokument27 SeitenOne Point LessonsgcldesignNoch keine Bewertungen

- Cultural Norms, Fair & Lovely & Advertising FinalDokument24 SeitenCultural Norms, Fair & Lovely & Advertising FinalChirag Bhuva100% (2)

- Entrepreneurship Internal Assessment Health Industry IaDokument10 SeitenEntrepreneurship Internal Assessment Health Industry IaCalm DownNoch keine Bewertungen

- Memphis in May Damage Repair Invoice - 080223Dokument54 SeitenMemphis in May Damage Repair Invoice - 080223Jacob Gallant0% (1)

- Overview of Stock Transfer Process in SAP WMDokument11 SeitenOverview of Stock Transfer Process in SAP WMMiguel TalaricoNoch keine Bewertungen

- Management Theory and Practice - Chapter 1 - Session 1 PPT Dwtv9Ymol5Dokument35 SeitenManagement Theory and Practice - Chapter 1 - Session 1 PPT Dwtv9Ymol5DHAVAL ABDAGIRI83% (6)

- Assignment Agreement1Dokument1 SeiteAssignment Agreement1Joshua Schofield100% (2)

- Ias 2Dokument29 SeitenIas 2MK RKNoch keine Bewertungen

- Neax 2000 Ips Reference GuideDokument421 SeitenNeax 2000 Ips Reference Guideantony777Noch keine Bewertungen

- Six Sigma Control PDFDokument74 SeitenSix Sigma Control PDFnaacha457Noch keine Bewertungen

- HPM 207Dokument7 SeitenHPM 207Navnit Kumar KUSHWAHANoch keine Bewertungen

- MBA Project Report On Dividend PolicyDokument67 SeitenMBA Project Report On Dividend PolicyMohit Kumar33% (3)

- Obayomi & Sons Farms: Business PlanDokument5 SeitenObayomi & Sons Farms: Business PlankissiNoch keine Bewertungen

- Idx Monthly StatsticsDokument113 SeitenIdx Monthly StatsticsemmaryanaNoch keine Bewertungen

- Income Tax Banggawan2019 Ch9Dokument13 SeitenIncome Tax Banggawan2019 Ch9Noreen Ledda83% (6)