Beruflich Dokumente

Kultur Dokumente

Notes On Average Due Date PDF

Hochgeladen von

Manjunath ManjuOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Notes On Average Due Date PDF

Hochgeladen von

Manjunath ManjuCopyright:

Verfügbare Formate

7

Average Due Date

Unit 1: Average Due Date

Question 1

A promissory note executed by Mr. X is due on 12.8.2007. What is the maturity date of the

promissory note including grace days? (2 Marks, May, 2007) (PCC)

Answer

Where the promissory note is due (including grace days) on public holiday, the preceding day

shall be the due date. Hence, the due date is 14.8.2007.

Question 2

Mr. A advanced ` 30,000 to Mr. B on 1.4.2008. The amount is repayable in 6 equal monthly

instalments commencing from 1.5.2008. Compute the average due date for the loan.

(2 Marks, May, 2008) (PCC)

Answer

Date of loan + Sum of months from the date of lending to repayment

Average due date =

No. of instalments

(1 + 2 + 3 + 4 + 5 + 6)

= 1.4.2008 +

6

= 1.4.2008 + 3.5 months = 16th July 2008

Question 3

R had the following bills receivable and bills payable against S. Calculate average due date

when the payment can be made or received without any loss or gain of interest to either party.

Bills Receivable Bills Payable

Date of the Bill Amount (`) Tenure in Date of bill Amount (`) Tenure in

months months

1.6.08 9,000 3 29.5.08 6,000 2

© The Institute of Chartered Accountants of India

Average Due Date 7.2

5.6.08 7,500 3 3.6.08 9,000 3

9.6.08 10,000 1 10.6.08 10,000 2

12.6.08 8,000 2 13.6.08 7,000 2

20.6.08 12,000 3 27.6.08 11,000 1

Holiday intervening in the period 15th August, 2008, 16th August, 2008, and 6th September, 2008.

(4 Marks, November, 2008) (PCC)

Answer

Calculation of Average Due Date (taking base date as 12th July, 2008)

Date Due date Amount (`) No. of Days Products (`) Remarks

including days from July 12

of grace

1.6.08 4.9.08 9,000 54 4,86,000 Bills Receivable

5.6.08 8.9.08 7,500 58 4,35,000

9.6.08 12.7.08 10,000 0 0

12.6.08 14.8.08 8,000 33 2,64,000

20.6.08 23.9.08 12,000 73 8,76,000

46,500 20,61,000

29.5.08 1.8.08 6,000 20 1,20,000 Bills Payable

3.6.08 5.9.08 9,000 55 4,95,000

10.6.08 13.8.08 10,000 32 3,20,000

13.6.08 14.8.08 7,000 33 2,31,000

27.6.08 30.7.08 11,000 18 1,98,000

43,000 13,64,000

Difference of Products = ` 20,61,000 – ` 13,64,000 = ` 6,97,000

Difference of Amount = ` 46,500 – ` 43,000 = ` 3,500

Average Due Date = Differenceof Pr oducts

Base Date +

Differenceof Amount

= 6,97,000

July 12 +

3,500

= July 12 + 199.14 or 199 days

= 27th January, 2009

Note:

(i) B/R of 12.6.08 Due date changed due to holidays

(ii) B/P of 3.6.08 Due date changed due to holidays

(iii) B/P of 13.6.08 Due date changed due to holidays

© The Institute of Chartered Accountants of India

7.3 Accounting

Question 4

Harish has the following bills due on different dates. It was agreed to settle the total amount

due by a single cheque payment. Find the date of the cheque.

(i) ` 5,000 due on 5.3.2009

(ii) ` 7,000 due on 7.4.2009

(iii) ` 6,000 due on 17.7.2009

(iv) ` 8,000 due on 14.9.2009 (4 Marks, November, 2009) (PCC)

Answer

Calculation of number of days from the base date

Due date Amount (` ) No. of days from 5.3.09 Product

5.3.2009 5,000 0 0

7.4.2009 7,000 33 2,31,000

17.7.2009 6,000 134 8,04,000

14.9.2009 8,000 193 15,44,000

26,000 25,79,000

Sum of Product

Average due date = Base date +

Sum of Amount

25,79,000

= 5.3.2009 + = 99 days

26,000

The date of the cheque will be 99 days from the base date i.e.12.6.2009. So on

12th June, 2009, all bills will be settled by a single cheque payment.

Question 5

A trader allows his customers, credit for one week only beyond which he charges interest @

12% per annum. Anil, a customer buys goods as follows:

Date of Sale/Purchase Amount (` )

January 2, 2009 6,000

January 28, 2009 5,500

February 17, 2009 7,000

March 3, 2009 4,700

Anil settles his account on 31st March, 2009. Calculate the amount of interest payable by Anil

using average due date method. (8 Marks, November, 2009) (IPCC)

© The Institute of Chartered Accountants of India

Average Due Date 7.4

Answer

Let us assume 9th January, 2009 to be the base date:

Date of Sale Due date of Amount (` No. of days from 9th Product

payment ) January, 2009

Jan. 2 Jan. 9 6,000 0 0

Jan. 28 Feb. 4 5,500 26 1,43,000

Feb. 17 Feb. 24 7,000 46 3,22,000

March 3 March 10 4,700 60 2,82,000

23,200 7,47,000

Sum of Pr oduct

Average Due date = Base date +

Sum of amount

7,47,000

= 9th January, 2009 +

23,200

= 9th January 2009 + 32 days

i.e. 32 days from 9th January, 2009 = 10th February, 2009

Thus, average due date = 10th February, 2009

No. of days from 10th February, 2009 to 31st March, 2009 = 49 days.

Interest payable by Anil on ` 23,200 for 49 days @ 12% per annum

49 12

= ` 23,200 × × = ` 373.74

365 100

Question 6

Swaminathan owed to Subramanium the following sums :

` 5,000 on 20th January, 2009

` 8,000 on 3rd March, 2009

` 6,000 on 5th April, 2009

` 11,000 on 30th April, 2009

Ascertain the average due date. (2 Marks, May, 2010) (IPCC)

Answer

Calculation of average due date taking 20th January as the base date

Due Date Amount No. of days from 20th Product

` January

20th January 5,000 0 0

© The Institute of Chartered Accountants of India

7.5 Accounting

3rd March 8,000 42 3,36,000

5th April 6,000 75 4,50,000

30th April 11,000 100 11,00,000

30,000 18,86,000

Total Product

Average due date = 20th January +

Total Amount

18,86,000

= 20th January +

30,000

= 20th January, 2009 + 63 days (approx)

= 24th March, 2009

Question 7

From the following details find out the average due date:

Date of Bill Amount (`) Usance of Bill

29th January, 2009 5,000 1 month

20th March, 2009 4,000 2 months

12th July, 2009 7,000 1 month

10th August, 2009 6,000 2 months

(4 Marks, November, 2010) (IPCC)

Answer

Calculation of Average Due Date

(Taking 3rd March, 2009 as base date)

Date of bill 2009 Term Due date Amount No. of days Product

2009 from the base

date i.e. 3rd

March,2009

(`) (`) (`)

29th January 1 month 3rd March 5,000 0 0

20th March 2 months 23rd May 4,000 81 3,24,000

12th July 1month 14th Aug. 7,000 164 11,48,000

10th August 2 months 13th Oct. 6,000 224 13,44,000

22,000 28,16,000

© The Institute of Chartered Accountants of India

Average Due Date 7.6

Sum of Products

Average due date = Base date + Days equal to

Sum of Amounts

28,16,000

= 3rd March, 2009 +

22,000

= 3rd March, 2009 + 128 days

= 9th July, 2009

Working Note:

1. Bill dated 29th January, 2009 has the maturity period of one month, but there is no

corresponding date in February, 2009. Therefore, the last day of the month i.e. 28th

February, 2009 shall be deemed maturity date and due date would be 3rd March, 2009

(after adding 3 days of grace).

2. Bill dated 12th July, 2009 has the maturity period of one month, due date (after adding 3

days of grace) falls on 15th August, 2009. 15th August being public holiday, due date

would be preceding date i.e. 14th August, 2009.

Question 8

A and B are partners in a firm and share profits and losses equally. A has withdrawn the

following sum during the half year ending 30th June 2010:

Date Amount

`

January 15 5,000

February 10 4,000

April 5 8,000

May 20 10,000

June 18 9,000

Interest on drawings is charged @ 10% per annum. Find out the average due date and

calculate the interest on drawings to be charged on 30th June 2010.

(4 Marks, May, 2011) (IPCC)

Answer

Calculation of Average due date

(Base Date 15th Jan, 2010)

Date Amount No. of days Product

` `

January 15 5,000 0 0

© The Institute of Chartered Accountants of India

7.7 Accounting

February 10 4,000 26 1,04,000

April 5 8,000 80 6,40,000

May 20 10,000 125 12,50,000

June 18 9,000 154 13,86,000

36,000 33,80,000

Total product

Average due date = Base date + × days

Total amount

33,80,000

= 15th Jan + days

36,000

= 15th Jan + 94 days (approx.)

= 19th April, 2010

Number of days from 19th April, 2010 to 30th June, 2010 = 72 days

Interest on drawings from 19th April to 30th June @10%:

72 10

= ` 36,000 × ×

365 100

= ` 710

Hence, interest on drawings ` 710 will be charged from A on 30th June, 2010.

Question 9

Mr. Black accepted the following bills drawn by Mr. White:

Date of Bill Period Amount (`)

09-03-2010 4 months 4,000

16-03-2010 3 months 5,000

07-04-2010 5 months 6,000

18-05-2010 3 months 5,000

He wants to pay all the bills on a single date. Interest chargeable is @ 18% p.a. and

Mr. Black wants to save ` 150 on account of interest payment. Find out the date on which he

has to effect the payment to save∗ interest of ` 150. Base date to be taken shall be the

earliest due date. (8 Marks, November, 2011) (IPCC)

∗

The word ‘save’ should be read as ‘earn’ for better understanding of the requirement of the question.

© The Institute of Chartered Accountants of India

Average Due Date 7.8

Answer

Calculation of Average Due Date taking base date as 19.06.2010

Date of Bill Period Maturity No. of days from the Amount Products

date base date (`)

09.03.2010 4 months 12.07.2010 23 4,000 92,000

16.03.2010 3 months 19.06.2010 0 5,000 0

07.04.2010 5 months 10.09.2010 83 6,000 4,98,000

18.05.2010 3 months 21.08.2010 63 5,000 3,15,000

20,000 9,05,000

Total of pr oduct

Average due date = Base date +

Total of amount

9,05,000

= 19.06.2010 + = 45 days (approx.)

20,000

= 3rd August, 2010.

Computation of date of payment to earn interest of ` 150

Interest per day = [` 20,000 x (18/100)]/365 days

= ` 3,600/365 = ` 10 per day (approx.)

To earn interest of ` 150, the payment should be made 15 days (` 150 / ` 10 per day) earlier

to the due date. Accordingly, the date of payment would be:

Date of payment to earn interest of ` 150 = 3rd August, 2010 –15 days

= 19th July, 2010.

Question 10

M/s Stairs & Co. draw upon M/s Marble & Co. several bills of exchange due for payment on

different dates as under :

Date of Bill Amount(`) Tenure of Bill

12th May 44,000 3 months

10th June 45,000 4 months

1st July 14,000 1 month

19th July 17,000 2 months

Find out the average due date on which payment may be made in one single amount by M/s

Marble & Co. to M/s Stairs & Co. 15th August, Independence Day, is national holiday and

22nd September declared emergency holiday, due to death of a national leader.

(4 Marks, May 2012) (IPCC)

© The Institute of Chartered Accountants of India

7.9 Accounting

Answer

Calculation of Average Due Date

(Taking 4th August as the base date)

Date of bill Term Due date Amount No. of days from Product

` the base date i.e.

4th August

12th May 3 months 14th August 44,000 10 4,40,000

10th June 4 months 13th October 45,000 70 31,50,000

1st July 1 month 4th August 14,000 0 0

19th July 2 months 23th September 17,000 50 8,50,000

1,20,000 44,40,000

Total of products

Average due date=Base date+ Days equal to

Total amount

44,40,000

= 4th August +

1,20,000

= 4th August +37 days = 10th September

Question 11

T owes to K the following amounts:

` 7,000 due on 15th March, 2012

` 12,000 due on 5th April, 2012

` 30,000 due on 25th April, 2012

` 20,000 due on 11 June, 2012

He desires to make the full payment on 30th June, 2012 along with interest @ 10% per annum

from the average due date. Find out the average due date and the amount of interest. Amount

of interest may be rounded off to the nearest rupee. (4 Marks, November 2012) (IPCC)

Answer

Calculation of Average Due Date taking 15th March, 2012 as the base date

Due date Amount No. of days from the base Product

date i.e. 15th March, 2012

`

15th March, 2012 7,000 0 0

5thApril, 2012 12,000 21 2,52,000

25th April, 2012 30,000 41 12,30,000

© The Institute of Chartered Accountants of India

Average Due Date 7.10

11th June 2012 20,000 88 17,60,000

69,000 32,42,000

Total of products

Average due date = Base date + Days equal to

Total amount

32,42,000

= 15th March, 2012 +

69,000

= 15th March, 2012 + 47 days (approx.) =1st May, 2012

Interest amount: Interest can be calculated on ` 69,000 from 1st May, 2012 to 30th June,

2012 at 10% p.a. i.e. interest on ` 69,000 for 60 days at 10%p.a. =` 69,000 x 10/100 x 60/366

= ` 1,131 (approx.)

Question 12

The following transactions took place between Thick and Thin. They desire to settle their

account on average due date.

Purchases by Thick from Thin (` )

9th July, 2013 7,200

14th August, 2013 12,200

Sales by Thick to Thin (` )

15th July, 2013 18,000

31st August, 2013 16,500

Calculate Average Due Date and the amount to be paid or received by Thick.

(4 Marks, November 2013) (IPCC)

Answer

Calculation of Average Due Date

Computation of products for Thick’s payments

(Taking 9.7.13 as base date)

Due Date Amount No. of days from base date to due date Product

` `

9.7.13 7,200 0 0

14.8.13 12,200 36 4,39,200

19,400 4,39,200

© The Institute of Chartered Accountants of India

7.11 Accounting

Computation of products for Thin’s payments (Base date = 9.7.13)

Due Date Amount No. of days from base date to due Product

date

` `

15.7.13 18,000 6 1,08,000

31.8.13 16,500 53 8,74,500

34,500 9,82,500

Excess of Thin’s products over Thick [9,82,500-4,39,200] 5,43,300

Excess of Thin’s amounts over Thick [34,500-19,400] 15,100

5,43,300

Number of days from base date to date of settlement is = = 36 days (approx.)

15,100

Hence, the date of settlement of the balance amount is 36 days after 9th July, i.e. 14th August.

Thus, on 14th August, 2013, Thin has to pay ` 15,100 to Thick.

Question 13

Define Average Due Date. List out the various instances when Average Due Date can be

used. (4 Mark, IPCC May, 2014)

Answer

In business enterprises, a large number of receipts and payments by and from a single party may

occur at different points of time. To simplify the calculation of interest involved for such

transactions, the idea of average due date has been developed. Average Due Date is a break-even

date on which the net amount payable can be settled without causing loss of interest either to the

borrower or the lender.

Few instances where average due date can be used:

(i) Calculation of interest on drawings made by the proprietors or partners of a business firm

at several points of time.

(ii) Settlement of accounts between a principal and an agent.

(iii) Settlement of contra accounts, that is, A and B sell goods to each other on different

dates.

Question 14

Kishanlal has made the following sales to Babulal. He allows a credit period of 10 days

beyond which he charges interest @ 12% per annum.

Date of Sales Amount (`)

26.05.14 12,000

© The Institute of Chartered Accountants of India

Average Due Date 7.12

18.07.14 18,000

02.08.14 16,500

28.08.14 9,500

09.09.14 15,500

17.09.14 13,500

Babulal wants to settle his accounts on 30-9-2014. Calculate the interest payable by him using

Average Due Date (ADD). If Babulal wants to save interest of ` 588, how many days before

30.9.2014 does he have to make payment? Also find the payment date in this case.

(4 Marks, IPCC November, 2015)

Answer

Calculation of Average Due date (Taking 05th June as the base date)

Date Due Date Amount No. of days from Product

` Base date `

26.05.2014 05.06.2014 12,000 0 0

18.07.2014 28.07.2014 18,000 53 9,54,000

02.08.2014 12.08.2014 16,500 68 11,22,000

280.8.2014 07.09.2014 9,500 94 8,93,000

09.09.2014 19.09.2014 15,500 106 16,43,000

17.09.2014 27.09.2014 13,500 114 15,39,000

85,000 61,51,000

61,51,000

Average due date = 5.6.14 + = 5.6.14 + 72 days (app.) = 16.08.2014

85,000

Interest if settlement is done on 30.9.14

45

85,000 x 12% x = ` 1,258 (approx.)

365

If Babulal wants to save interest of ` 588, then he has to make the payment following days

before 30.09.2014:

= 588/1258 X 45 days (16.08.2014 to 30.09.2014) = 21 days earlier

Payment date, in the above case, will be 09.09.2014.

© The Institute of Chartered Accountants of India

7.13 Accounting

Unit 2: Account Current

Question 1

What is meant by ‘Red-Ink interest’ in an Account Current? (2 Marks) (November, 2007) (PCC)

Answer

In an Account Current, interest is calculated on the amount of a bill from the date of

transaction to the closing date of the period concerned. In case the due date of the bill falls

after the closing date of the account, then no interest is allowed for that period. However, it is

customarily followed that interest from the date of closing to the due date is written in red ink

in the appropriate side of the Account Current. This interest is called Red-Ink Interest. This

Red-Ink interest is treated as negative interest.

Question 2

What is Account current? (2 Marks, May, 2008) (PCC)

Answer

Account current is a running statement of transactions between parties, maintained in the form

of a ledger account, for a given period of time and includes interest allowed or charged on

various items. It is prepared when transactions regularly take place between two parties. An

account current has two parties – one who renders the account and the other to whom the

account is rendered.

Question 3

Roshan has a current account with partnership firm. It has debit balance of ` 75,000 as on

01-07-2012. He has further deposited the following amounts:

Date Amount (`)

14-07-2012 1,38,000

18-08-2012 22,000

He withdrew the following amounts :

Date Amount (`)

29-07-2012 97,000

09-09-2012 11,000

Show Roshan's A/c in the ledger of the firm. Interest is to be calculated at 10% on debit

balance and 8% on credit balance. You are required to prepare current account as on 30th

September, 2012. (4 Marks, November 2013) (IPCC)

© The Institute of Chartered Accountants of India

Average Due Date 7.14

Answer

Roshan’s Current Account with Partnership firm (as on 30.9.2012)

Date Particulars Dr Cr Balance Dr. Days Dr Product Cr

or (`) Product

(`) (`) (`) Cr. (`)

01.07.12 To Bal b/d 75,000 75,000 Dr. 13 9,75,000

14.07.12 By Cash A/c 1,38,000 63,000 Cr. 15 9,45,000

29.07.12 To Self 97,000 34,000 Dr. 20 6,80,000

18.08.12 By Cash A/c 22,000 12,000 Dr. 22 2,64,000

09.09.12 To Self 11,000 23,000 Dr. 22 5,06,000

30.09.12 To Interest A/c 457 23,457 Dr.

30.09.12 By Bal. c/d 23,457

1,83,457 1,83,457 24,25,000 9,45,000

Interest Calculation:

On ` 24,25,000x 10% x 1/365 = ` 664

On ` 9,45,000 x 8% x 1/365 = (` 207)

Net interest to be debited = (` 457)

Note: The above current account has been prepared by means of product of balances method.

Question 4

From the following particulars prepare a current account∗, as sent by Mr. Ram to Mr. Siva as

on 31st October 2014 by means of product method charging interest @ 5% p.a.

2014 Particulars `

1st July Balance due from Siva 750

15th August Sold goods to Siva 1250

20th August Goods returned by Siva 200

22nd Sep Siva paid by cheque 800

15th Oct Received cash from Siva 500

(4 Marks, IPCC November, 2014)

∗

‘Current Account’ to be read as ‘Account Current’

© The Institute of Chartered Accountants of India

7.15 Accounting

Answer

Siva in Account Current with Ram as on 31st Oct, 2014

Dr. Cr.

` Days Product ` Days Product

(`) (`)

01.07.14 To Bal. b/d 750 123 92,250 20.08.14 By Sales 200 72 14,400

Returns

15.8.14 To Sales 1,250 77 96,250 22.09.14 By Bank 800 39 31,200

31.10.14 To Interest 18.48 15.10.14 By Cash 500 16 8,000

By Balance 1,34,900

of Products

_____ ______ 31.10.14 By Bal. c/d 518.48 ______

2018.48 1,88,500 2018.48 1,88,500

5 1

Interest = ` 1,34,900 x × = ` 18.48

100 365

© The Institute of Chartered Accountants of India

Das könnte Ihnen auch gefallen

- Final Accounts ProblemDokument21 SeitenFinal Accounts Problemkramit1680% (10)

- ICAI MCQ's INCOME TAX CA INTER MAY - NOV 2024Dokument49 SeitenICAI MCQ's INCOME TAX CA INTER MAY - NOV 2024Anil Reddy100% (1)

- Chapter 6 & 7 - Kapoor: Consumer CreditDokument24 SeitenChapter 6 & 7 - Kapoor: Consumer CreditPaulo Lucas Guillot100% (1)

- BDO Unibank: H1 Statement of ConditionDokument1 SeiteBDO Unibank: H1 Statement of ConditionBusinessWorldNoch keine Bewertungen

- Company Final Accounts - ProblemsDokument5 SeitenCompany Final Accounts - ProblemsDhinesh0% (1)

- Conversion of Partnership Firm Into CompanyDokument8 SeitenConversion of Partnership Firm Into CompanyAthulya MDNoch keine Bewertungen

- Final AccountsDokument9 SeitenFinal AccountsBhuvaneshwari Palani0% (2)

- General JournalDokument2 SeitenGeneral JournalJacob SnyderNoch keine Bewertungen

- Single Entry System Assignment +1Dokument10 SeitenSingle Entry System Assignment +1Gautam KhanwaniNoch keine Bewertungen

- Acc Ch-7 Average Due Date SaDokument15 SeitenAcc Ch-7 Average Due Date SaShivaSrinivas100% (3)

- CA Foundation Accounts Module I Average Due Date Without AnswersDokument19 SeitenCA Foundation Accounts Module I Average Due Date Without AnswersVivek ChauhanNoch keine Bewertungen

- Unit 6: Average Due Date: Learning OutcomesDokument21 SeitenUnit 6: Average Due Date: Learning OutcomesAshish SultaniaNoch keine Bewertungen

- Ca Foundation All English HandoutsDokument17 SeitenCa Foundation All English HandoutsAditi DhimanNoch keine Bewertungen

- 5 6168179598107345065Dokument14 Seiten5 6168179598107345065Madhan Aadhvick0% (1)

- NpoDokument30 SeitenNpoSaurabh AdakNoch keine Bewertungen

- CH 5 MCQ AccDokument7 SeitenCH 5 MCQ AccabiNoch keine Bewertungen

- Hire Purchase Notes 10 YrDokument80 SeitenHire Purchase Notes 10 YrLalitKukreja100% (2)

- Accounting Round 1 Ans KeyDokument21 SeitenAccounting Round 1 Ans KeyMalhar ShahNoch keine Bewertungen

- As 16Dokument11 SeitenAs 16Harsh PatelNoch keine Bewertungen

- Particulars: Rs. RsDokument7 SeitenParticulars: Rs. RsAnmol ChawlaNoch keine Bewertungen

- 7 - Conversion of Single Entry To Double Entry PDFDokument6 Seiten7 - Conversion of Single Entry To Double Entry PDFmiftah fauzi100% (2)

- Study Note 4.3, Page 198-263Dokument66 SeitenStudy Note 4.3, Page 198-263s4sahithNoch keine Bewertungen

- Financial StatementsDokument3 SeitenFinancial StatementsSoumendra RoyNoch keine Bewertungen

- Amalgamation, Absorption Etc PDFDokument21 SeitenAmalgamation, Absorption Etc PDFYashodhan MithareNoch keine Bewertungen

- Chapter 6 Dissolution OF Partnership Firm: Case/Source Based Questions S.N oDokument9 SeitenChapter 6 Dissolution OF Partnership Firm: Case/Source Based Questions S.N oabi100% (1)

- CBSE Class 11 Accounting-Vouchers and Their Preparation PDFDokument13 SeitenCBSE Class 11 Accounting-Vouchers and Their Preparation PDFDiksha60% (5)

- Accountancy Question BankDokument146 SeitenAccountancy Question BankSiddhi Jain100% (1)

- Paper - 3: Cost and Management Accounting Questions Material CostDokument31 SeitenPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNoch keine Bewertungen

- Unit 5: Account Current: Learning OutcomesDokument16 SeitenUnit 5: Account Current: Learning OutcomessajedulNoch keine Bewertungen

- 5 Debenture Material3619080524732228932Dokument14 Seiten5 Debenture Material3619080524732228932Prabin stha100% (1)

- Fin Account-Sole Trading AnswersDokument10 SeitenFin Account-Sole Trading AnswersAR Ananth Rohith BhatNoch keine Bewertungen

- Chapter 9 Accounting For Branches Including Foreign Branches PDFDokument61 SeitenChapter 9 Accounting For Branches Including Foreign Branches PDFAkshansh MahajanNoch keine Bewertungen

- 7948final Adv Acc Nov05Dokument16 Seiten7948final Adv Acc Nov05Kushan MistryNoch keine Bewertungen

- Bos 28432 CP 14Dokument53 SeitenBos 28432 CP 14Basant Ojha100% (1)

- Accountancy Class 11 Most Important Sample Paper 2023-2024Dokument12 SeitenAccountancy Class 11 Most Important Sample Paper 2023-2024Hardik ChhabraNoch keine Bewertungen

- IPA QUESTION BANK Use Code IGSIR / INDRESH For Unacademy SubscriptionDokument21 SeitenIPA QUESTION BANK Use Code IGSIR / INDRESH For Unacademy SubscriptionNitesh Patel100% (2)

- CA Notes Sale of Goods On Approval or Return Basis PDFDokument14 SeitenCA Notes Sale of Goods On Approval or Return Basis PDFBijay Aryan Dhakal100% (1)

- Dissolutioni of Partnership FirmDokument69 SeitenDissolutioni of Partnership FirmbinuNoch keine Bewertungen

- CA Foundation Accounts Recodring of Transactions StudentsDokument57 SeitenCA Foundation Accounts Recodring of Transactions StudentsRockyNoch keine Bewertungen

- Bos 58983Dokument20 SeitenBos 58983Kartik0% (1)

- FR ConsolidationDokument31 SeitenFR Consolidationvignesh_vikiNoch keine Bewertungen

- CA Foundation Accounts Suggested Answer May 2022Dokument23 SeitenCA Foundation Accounts Suggested Answer May 2022Himanshu RayNoch keine Bewertungen

- Partnership NotesDokument68 SeitenPartnership NotesSandeepNoch keine Bewertungen

- Valuation of Inventories: Dangal QuestionsDokument28 SeitenValuation of Inventories: Dangal Questionsmonudeep aggarwalNoch keine Bewertungen

- Accounting For Share Capital Mcq's XiiDokument5 SeitenAccounting For Share Capital Mcq's XiiNssnehNoch keine Bewertungen

- NaMo Case StudyDokument4 SeitenNaMo Case StudyManish ShawNoch keine Bewertungen

- Special Purpose BooksDokument19 SeitenSpecial Purpose BooksJasmine SainiNoch keine Bewertungen

- @ProCA - Inter Contract Act RTP Question BankDokument6 Seiten@ProCA - Inter Contract Act RTP Question BankMr. indigoNoch keine Bewertungen

- Amalgamation SummaryDokument26 SeitenAmalgamation SummaryPrashant SharmaNoch keine Bewertungen

- Xii Mcqs CH - 4 Change in PSRDokument4 SeitenXii Mcqs CH - 4 Change in PSRJoanna GarciaNoch keine Bewertungen

- Accountancy Chapter 5 - Retirement & Death of A Partner: Kvs Ziet Bhubaneswar 12/10/2021Dokument4 SeitenAccountancy Chapter 5 - Retirement & Death of A Partner: Kvs Ziet Bhubaneswar 12/10/2021abiNoch keine Bewertungen

- Chapter 2 Hire Purchase & Installment SystemDokument26 SeitenChapter 2 Hire Purchase & Installment SystemSuku Thomas Samuel100% (1)

- Pranav Sir Most Expected MCQs MathsDokument13 SeitenPranav Sir Most Expected MCQs MathsAryan Agarwal100% (2)

- Assertion Reasoning Questions: Chapter 2 - Accounting For Partnership: FundamentalsDokument71 SeitenAssertion Reasoning Questions: Chapter 2 - Accounting For Partnership: Fundamentalsabhi yadavNoch keine Bewertungen

- Partnership PDFDokument28 SeitenPartnership PDFBasant OjhaNoch keine Bewertungen

- Insurance Claim AccountDokument12 SeitenInsurance Claim AccountKadam Kartikesh50% (2)

- Income From Other SourcesDokument11 SeitenIncome From Other Sourcessrocky2000100% (1)

- As-2 Inventory Valuation: 1) IntroductionDokument17 SeitenAs-2 Inventory Valuation: 1) IntroductionDipen AdhikariNoch keine Bewertungen

- Inter QuestionnareDokument23 SeitenInter QuestionnareAnsh NayyarNoch keine Bewertungen

- Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaDokument53 SeitenAccounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaHarikrishna100% (1)

- 4 5805514475188521061Dokument8 Seiten4 5805514475188521061Gena HamdaNoch keine Bewertungen

- BE Chap 9Dokument3 SeitenBE Chap 9TIÊN NGUYỄN LÊ MỸNoch keine Bewertungen

- Dbb1202 - Financial AccountingDokument5 SeitenDbb1202 - Financial AccountingVansh JainNoch keine Bewertungen

- Chapter IIDokument15 SeitenChapter IIbhagathnagarNoch keine Bewertungen

- Financial Inclusion in India An Appraisa PDFDokument11 SeitenFinancial Inclusion in India An Appraisa PDFCristian Cucos CucosNoch keine Bewertungen

- Codificación para Envio de TramasDokument149 SeitenCodificación para Envio de TramasAlison VelascoNoch keine Bewertungen

- Financial Market: Interest RatesDokument18 SeitenFinancial Market: Interest RatesAMNoch keine Bewertungen

- FNB Aspire AccountDokument44 SeitenFNB Aspire Accountjessicaheyns5Noch keine Bewertungen

- PC 2013 06Dokument15 SeitenPC 2013 06BruegelNoch keine Bewertungen

- Sbi Ifsc CodeDokument1.141 SeitenSbi Ifsc CodeManoj K C0% (1)

- Kauna - Effect of Credit Risk Management Practices On Financial Performance of Commercial Banks in KenyaDokument68 SeitenKauna - Effect of Credit Risk Management Practices On Financial Performance of Commercial Banks in KenyaGizachew100% (1)

- 2.negotiable Instruments Act, 1881 - Q&ADokument16 Seiten2.negotiable Instruments Act, 1881 - Q&AJuhi RamnaniNoch keine Bewertungen

- Pay Offline: Learn About Changes To Your IELTS Test Arrangements Due To Coronavirus (COVID-19)Dokument2 SeitenPay Offline: Learn About Changes To Your IELTS Test Arrangements Due To Coronavirus (COVID-19)k.a.awan889950Noch keine Bewertungen

- Canada Wide Savings, Loan and Trust Company - For WriterDokument17 SeitenCanada Wide Savings, Loan and Trust Company - For WriterunveiledtopicsNoch keine Bewertungen

- Holyoke Property Receivership ListDokument2 SeitenHolyoke Property Receivership ListMike PlaisanceNoch keine Bewertungen

- Federal Summer Internship Project Report: "Market Trend Analysis and Sourcing of Car Loan Through Dealer Channel"Dokument37 SeitenFederal Summer Internship Project Report: "Market Trend Analysis and Sourcing of Car Loan Through Dealer Channel"Srikrishna SNoch keine Bewertungen

- RDInstallment Report 01!06!2023Dokument1 SeiteRDInstallment Report 01!06!2023PRADEEP KUMARNoch keine Bewertungen

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument3 SeitenStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRithvik MallikarjunaNoch keine Bewertungen

- CGAP MFI Appraise WorksheetDokument85 SeitenCGAP MFI Appraise WorksheetleekosalNoch keine Bewertungen

- EP2EMV+Multi Custom+12 11 2009Dokument187 SeitenEP2EMV+Multi Custom+12 11 2009MohitNoch keine Bewertungen

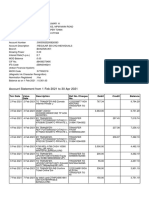

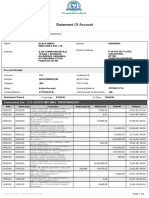

- Account Statement From 1 Feb 2021 To 30 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument11 SeitenAccount Statement From 1 Feb 2021 To 30 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceUday AbhiNoch keine Bewertungen

- Datos Bancarios FincasDokument42 SeitenDatos Bancarios FincasEve MoralesNoch keine Bewertungen

- 4.1.banker Customer - Possible RelationshipDokument11 Seiten4.1.banker Customer - Possible RelationshipMadan ShresthaNoch keine Bewertungen

- Export FinanceDokument59 SeitenExport FinanceSagarNoch keine Bewertungen

- OpTransactionHistoryUX307 11 2020Dokument4 SeitenOpTransactionHistoryUX307 11 2020Ajay MauryaNoch keine Bewertungen

- International Finance Ass.Dokument4 SeitenInternational Finance Ass.SahelNoch keine Bewertungen

- Project-Kotak BankDokument63 SeitenProject-Kotak BankAli SaqlainNoch keine Bewertungen

- Bankaool Bank Architecting An Online-Only Financial BrandDokument10 SeitenBankaool Bank Architecting An Online-Only Financial BrandVially RachmanNoch keine Bewertungen

- Assessment Task 2-Bank Reconciliation QuestionsDokument14 SeitenAssessment Task 2-Bank Reconciliation QuestionsDaisy Ann Cariaga SaccuanNoch keine Bewertungen

- ST Aloysius College (Autonomous) Mangaluru I Internal Exam - July 2019 B.B.A. - Semester I Financial Accounting - IDokument3 SeitenST Aloysius College (Autonomous) Mangaluru I Internal Exam - July 2019 B.B.A. - Semester I Financial Accounting - IAnanth RohithNoch keine Bewertungen