Beruflich Dokumente

Kultur Dokumente

FI Accurals

Hochgeladen von

shekarCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FI Accurals

Hochgeladen von

shekarCopyright:

Verfügbare Formate

ACCURAL/DEFFARLS:

ACCURELS :

1. Accrued Expenses

Accrued Expenses: Expenses incurred but not yet paid or recorded at the statement date are called

accrued expenses.

Ex: Interest incurred but not paid

Rent incurred but not yet paid

Salary incurred but not yet paid

Commission incurred but not yet paid

Salary Salary A/C Dr

To Salary Payable Account

Next Month Salary payable A/C Dr

To Bank Account

Rent Rent A/C Dr

To Rent Payable Account

Next Month Rent payable Account

To Bank Account

Commission Commission Account Dr

To Commission payable

Interest Interest A/C Dr

To Interest Payable A/C

SAP Process:

If Accrued expenses posted with purchase order:

Without GR and with only IR

Rent payable

IR Rent A/C Dr

To Rent Payable to Vendor A/C

Rent Payable to Vendor A/C Dr

To Bank Account

Commission Payable :

IR Commission A/C Dr

To Commission payable to Vendor A/C

Commission payable to Vendor A/C Dr

To Bank Account

Accrued Revenues :

Revenues for services performed but not yet recorded nor collected

Service revenue

Month end entry Revenue Receivable A/C Dr

To Revenue Account

Bank Account Dr

To Revenue Receivable A/C

PREPAID :

Prepaid Expenses :

When companies record payments of expenses that will benefit more than one

accounting period, they record an asset called prepaid expenses or prepayments

Examples :

1. Insurance

2. Rent

3. Advertising

4. Salary

Accounting Entry :

Insurance Prepaid insurance A/C Dr

TO Bank Account

Every Month Insurance A/C Dr

To Prepaid insurance

Rent Prepaid Rent A/C Dr

To Bank Account

Rent A/C Dr

To Prepaid Rent

.SAP PROCESS:

PO without GR and with IR

Prepaid Rent A/C Dr

To Vendor Account

Vendor A/C Dr

To Bank Account

Rent A/C Dr

To Prepaid Rent A/C

Prepaid income :

When companies receive cash before services are performed

Ex:

1. Advance salary received

2. Advance Rent received

Advance Salary

Bank Account Dr

To Advance Salary Account

Advance Salary Account Dr

To Salary Account

Das könnte Ihnen auch gefallen

- Vendor Ageing Analysis Through Report PainterDokument18 SeitenVendor Ageing Analysis Through Report PainterGayatri Panda0% (1)

- Report Painter COPADokument24 SeitenReport Painter COPAmiriam lopezNoch keine Bewertungen

- SAP S/4 HANA 2020 FICO For Complete Beginners: Gaurav Learning SolutionsDokument10 SeitenSAP S/4 HANA 2020 FICO For Complete Beginners: Gaurav Learning SolutionsJayshree PatilNoch keine Bewertungen

- Sap Fi Co ModuleDokument384 SeitenSap Fi Co ModuleAnupam BaliNoch keine Bewertungen

- DME - Payment Config DocumentDokument25 SeitenDME - Payment Config DocumentvenuNoch keine Bewertungen

- How To Create and Configure DME FileDokument3 SeitenHow To Create and Configure DME FilesairamsapNoch keine Bewertungen

- Master Budgeting ProblemsDokument6 SeitenMaster Budgeting ProblemsLayla MainNoch keine Bewertungen

- Sap Financial Supply Chain Management (FSCM) : System & Technology Model Finance SSC June 2019Dokument20 SeitenSap Financial Supply Chain Management (FSCM) : System & Technology Model Finance SSC June 2019fadliNoch keine Bewertungen

- FM-GM Troubleshooting TipsDokument37 SeitenFM-GM Troubleshooting TipsBAble996Noch keine Bewertungen

- Withholding Tax FinalDokument15 SeitenWithholding Tax FinalAshwani kumarNoch keine Bewertungen

- FM-GM Troubleshooting TipsDokument38 SeitenFM-GM Troubleshooting TipsoliveNoch keine Bewertungen

- Accounting Entries: Search E.G. SAP ABAPDokument18 SeitenAccounting Entries: Search E.G. SAP ABAPHemant HomkarNoch keine Bewertungen

- Cost Element Part 2 Secondary Cost ElementDokument12 SeitenCost Element Part 2 Secondary Cost ElementNASEER ULLAHNoch keine Bewertungen

- AP Workflow FSD 07-19-10Dokument16 SeitenAP Workflow FSD 07-19-10mrnanduNoch keine Bewertungen

- F18 Serrala HO PDFDokument32 SeitenF18 Serrala HO PDFfrjaviarNoch keine Bewertungen

- Fixed Asset Process GuideDokument15 SeitenFixed Asset Process Guidekumar4868Noch keine Bewertungen

- License Comparison Chart For SAP Business OneDokument39 SeitenLicense Comparison Chart For SAP Business OneAndroNoch keine Bewertungen

- What Is Special GL TransactionDokument4 SeitenWhat Is Special GL TransactionRaj ShettyNoch keine Bewertungen

- Sap Data MigrationDokument4 SeitenSap Data MigrationAnasse SabaniNoch keine Bewertungen

- Sap Fico ConceptsDokument3 SeitenSap Fico ConceptsBaluOne AndOnly BaluNoch keine Bewertungen

- Lesson MMDokument60 SeitenLesson MMnbhaskar bhaskarNoch keine Bewertungen

- SAP - FI - Basics ConceptsDokument55 SeitenSAP - FI - Basics Conceptsganesanmani19850% (1)

- F-13 Vendor Automatic Account ClearingDokument6 SeitenF-13 Vendor Automatic Account ClearingDipak kumar PradhanNoch keine Bewertungen

- SAP Fiori Apps 1709Dokument3 SeitenSAP Fiori Apps 1709vairesatendra0% (1)

- BBP New Format Vendor MasterDokument21 SeitenBBP New Format Vendor Mastersowndarya vangalaNoch keine Bewertungen

- 250open Text VIM For SAP SolutionsDokument2 Seiten250open Text VIM For SAP SolutionsTheo van BrederodeNoch keine Bewertungen

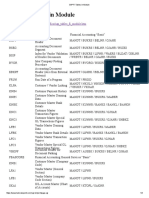

- SAP FI Tables in ModuleDokument3 SeitenSAP FI Tables in Modulessbhagat001Noch keine Bewertungen

- Asset Accounting User ManualDokument30 SeitenAsset Accounting User ManualImim Yoma0% (1)

- Functional Specification: FS - FI - VAT - Profit Center Jan - 18Dokument7 SeitenFunctional Specification: FS - FI - VAT - Profit Center Jan - 18Anonymous 0SLsR9Noch keine Bewertungen

- S4 HANA Group ReportingDokument36 SeitenS4 HANA Group ReportingHernan NovodvorskiNoch keine Bewertungen

- Simple Finance - The Convergence of The GL Account and The Cost ElementDokument12 SeitenSimple Finance - The Convergence of The GL Account and The Cost Elementjoseph davidNoch keine Bewertungen

- Landscape Scope Work Stream Object Type Complexity Ricefw Id Object Title Status Delivery Target % Done To Get To QA Comments As of 08-31-2016Dokument1 SeiteLandscape Scope Work Stream Object Type Complexity Ricefw Id Object Title Status Delivery Target % Done To Get To QA Comments As of 08-31-2016Kalikinkar LahiriNoch keine Bewertungen

- Raymond FMCG - Org - Structure V8Dokument46 SeitenRaymond FMCG - Org - Structure V8Vikram BhandeNoch keine Bewertungen

- AssetAccounting, Excise, Cash JournalDokument4 SeitenAssetAccounting, Excise, Cash JournalsrinivasNoch keine Bewertungen

- Capital Investment OrdersDokument7 SeitenCapital Investment OrdersSujith Kumar33% (3)

- Matrix Consolidation in Ifrs Starter KitDokument16 SeitenMatrix Consolidation in Ifrs Starter KitlentinenNoch keine Bewertungen

- 5.7 AA Asset Fiscal Year Closing - AJABDokument9 Seiten5.7 AA Asset Fiscal Year Closing - AJABvaishaliak2008Noch keine Bewertungen

- Transaction Code CESU Business Process Master List - FICODokument4 SeitenTransaction Code CESU Business Process Master List - FICOJit GhoshNoch keine Bewertungen

- Functional Specification - Enhancement: Enhancement ID: Enhancement NameDokument7 SeitenFunctional Specification - Enhancement: Enhancement ID: Enhancement NamesapeinsNoch keine Bewertungen

- Sap Fi-Ar - DunningDokument18 SeitenSap Fi-Ar - DunningswayamNoch keine Bewertungen

- Accounts ReceivablesDokument49 SeitenAccounts ReceivablesKrishna SukhwalNoch keine Bewertungen

- Vendor Down PaymentDokument32 SeitenVendor Down PaymentManjunath RaoNoch keine Bewertungen

- Addon Integration ModuleDokument19 SeitenAddon Integration ModuleRajib Bose100% (1)

- ABST2 Preparation For Year-End Closing - Account ReconcilatiDokument13 SeitenABST2 Preparation For Year-End Closing - Account ReconcilatiOkikiri Omeiza RabiuNoch keine Bewertungen

- 1909 How To Configuration Content S4HGR V5Dokument138 Seiten1909 How To Configuration Content S4HGR V5Angela LuNoch keine Bewertungen

- Using The SBO SP TransactionNotification Stored ProcedureDokument25 SeitenUsing The SBO SP TransactionNotification Stored ProcedureVeera ManiNoch keine Bewertungen

- FI/CO Frequently Used Transactions: General LedgerDokument7 SeitenFI/CO Frequently Used Transactions: General LedgerShijo PrakashNoch keine Bewertungen

- KDS For Fica PDFDokument21 SeitenKDS For Fica PDFShaktiprasad DashNoch keine Bewertungen

- Controlling Full Configuration Part 2 Shrinivas Kasireddy PDFDokument255 SeitenControlling Full Configuration Part 2 Shrinivas Kasireddy PDFbikash dasNoch keine Bewertungen

- Finance ExtenDokument15 SeitenFinance Extensmile1alwaysNoch keine Bewertungen

- 3.4 FunctionalSpecificationDokument12 Seiten3.4 FunctionalSpecificationDinbandhu TripathiNoch keine Bewertungen

- Consultancy For Customization and Configuration of SAP FI and MM at FBRDokument29 SeitenConsultancy For Customization and Configuration of SAP FI and MM at FBRFurqanNoch keine Bewertungen

- SAP S4HANA 2021 Financial Closing & CockpitDokument39 SeitenSAP S4HANA 2021 Financial Closing & CockpitYinka FaluaNoch keine Bewertungen

- Madan Reddy - SAP FICODokument4 SeitenMadan Reddy - SAP FICOkal kastNoch keine Bewertungen

- Sanad Wfrice Master List: SR No Object Id Object Object Purpose Tcode Object Sub CategoryDokument12 SeitenSanad Wfrice Master List: SR No Object Id Object Object Purpose Tcode Object Sub CategoryAmr IsmailNoch keine Bewertungen

- Asset Class Company Code Asset DescriptionDokument13 SeitenAsset Class Company Code Asset DescriptionJit GhoshNoch keine Bewertungen

- MMFIDokument3 SeitenMMFImayoorNoch keine Bewertungen

- BAI File Format ExplanationDokument12 SeitenBAI File Format ExplanationThatra K ChariNoch keine Bewertungen

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsVon EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNoch keine Bewertungen

- SAP Transactional Banking A Clear and Concise ReferenceVon EverandSAP Transactional Banking A Clear and Concise ReferenceNoch keine Bewertungen

- Asset Accounting Class3Dokument10 SeitenAsset Accounting Class3shekarNoch keine Bewertungen

- Asset Retirement by Sales OrderDokument4 SeitenAsset Retirement by Sales OrdershekarNoch keine Bewertungen

- Asset Retirement by Sales OrderDokument1 SeiteAsset Retirement by Sales OrdershekarNoch keine Bewertungen

- Steps To Configure The Interest Calculation Procedure For Vendor and CustomerDokument2 SeitenSteps To Configure The Interest Calculation Procedure For Vendor and CustomershekarNoch keine Bewertungen

- Asset Retirement by Sales OrderDokument2 SeitenAsset Retirement by Sales OrdershekarNoch keine Bewertungen

- Asset Retirement by Sales OrderDokument2 SeitenAsset Retirement by Sales OrdershekarNoch keine Bewertungen

- What Is Asset AccountDokument3 SeitenWhat Is Asset AccountshekarNoch keine Bewertungen

- Account Assignment Group For AccuralsDokument1 SeiteAccount Assignment Group For AccuralsshekarNoch keine Bewertungen

- Ctivation-Of-Material-Ledger-On-Sap-S4-Hana-1511-Finance/ MLDokument13 SeitenCtivation-Of-Material-Ledger-On-Sap-S4-Hana-1511-Finance/ MLshekarNoch keine Bewertungen

- Ifrs 15Dokument3 SeitenIfrs 15shekarNoch keine Bewertungen

- Asset Accounting Class3Dokument1 SeiteAsset Accounting Class3shekarNoch keine Bewertungen

- R - KSBT Activity Type Price On Cost CenterDokument7 SeitenR - KSBT Activity Type Price On Cost CentershekarNoch keine Bewertungen

- Asset Blog PDFDokument76 SeitenAsset Blog PDFshekarNoch keine Bewertungen

- FadDokument16 SeitenFadkhunsasiNoch keine Bewertungen

- What Is Asset AccountDokument1 SeiteWhat Is Asset AccountshekarNoch keine Bewertungen

- Substitution RuleDokument2 SeitenSubstitution RuleshekarNoch keine Bewertungen

- Substitution RuleDokument2 SeitenSubstitution RuleshekarNoch keine Bewertungen

- SAP ABAP .Data DictionaryDokument6 SeitenSAP ABAP .Data DictionarySantosh Ravindra NadagoudaNoch keine Bewertungen

- Asset Blog PDFDokument76 SeitenAsset Blog PDFshekarNoch keine Bewertungen

- Business Requirement: Accrual Accounting Matching Principle Accounting Period Revenues ExpensesDokument8 SeitenBusiness Requirement: Accrual Accounting Matching Principle Accounting Period Revenues ExpensesshekarNoch keine Bewertungen

- You Cannot Post To Asset in Company Code 1800 Fiscal Year 2017Dokument5 SeitenYou Cannot Post To Asset in Company Code 1800 Fiscal Year 2017shekarNoch keine Bewertungen

- Sap R/3 Abap/4 - F A Q: By: C.Rajasekhar Topic: User ExitsDokument1 SeiteSap R/3 Abap/4 - F A Q: By: C.Rajasekhar Topic: User ExitsDeweshChandraNoch keine Bewertungen

- CO Related TDokument9 SeitenCO Related TshekarNoch keine Bewertungen

- Ss Operational ExcellenceDokument20 SeitenSs Operational ExcellenceshekarNoch keine Bewertungen

- Power Your Profitability Insights: With SAP Performance Management For Financial ServicesDokument37 SeitenPower Your Profitability Insights: With SAP Performance Management For Financial ServicesshekarNoch keine Bewertungen

- Ss Operational ExcellenceDokument20 SeitenSs Operational ExcellenceshekarNoch keine Bewertungen

- LoioDokument178 SeitenLoioshekarNoch keine Bewertungen

- S7 Capital Structure Online VersionDokument34 SeitenS7 Capital Structure Online Versionconstruction omanNoch keine Bewertungen

- Chap 006Dokument24 SeitenChap 006Xeniya Morozova Kurmayeva100% (12)

- EPS I Class Handout 2021Dokument3 SeitenEPS I Class Handout 2021JesseNoch keine Bewertungen

- Fmii - Icmd 2009 (B04)Dokument4 SeitenFmii - Icmd 2009 (B04)IshidaUryuuNoch keine Bewertungen

- Comprehensive Problem Excel SpreadsheetDokument23 SeitenComprehensive Problem Excel Spreadsheetapi-237864722100% (3)

- Chap. 20Dokument45 SeitenChap. 20Nguyễn Lê ThủyNoch keine Bewertungen

- 6d25add230 7bab8cc98f PDFDokument140 Seiten6d25add230 7bab8cc98f PDFRiskaAprilliaNoch keine Bewertungen

- 03-PSU-ACC 202 - Principles of Accounting 2 - 2022F - Lecture SlidesDokument56 Seiten03-PSU-ACC 202 - Principles of Accounting 2 - 2022F - Lecture SlidesThanh ThùyNoch keine Bewertungen

- Fredun PharmaDokument37 SeitenFredun PharmaBandaru NarendrababuNoch keine Bewertungen

- Capital Structure Analysis of Hero Honda, For The Year 2005 To 2010Dokument7 SeitenCapital Structure Analysis of Hero Honda, For The Year 2005 To 2010pushpraj rastogiNoch keine Bewertungen

- Capital Budgeting 2Dokument4 SeitenCapital Budgeting 2Nicole Daphne FigueroaNoch keine Bewertungen

- Unit 7: Ind AS-40: Investment PropertyDokument13 SeitenUnit 7: Ind AS-40: Investment PropertySavya SachiNoch keine Bewertungen

- Auditing Problems Finals Exam 2020Dokument9 SeitenAuditing Problems Finals Exam 2020VictorioLazaro0% (1)

- KietPHMSS170832 ACC101 Individual AssignmentDokument17 SeitenKietPHMSS170832 ACC101 Individual AssignmentMinh Kiet Pham HuuNoch keine Bewertungen

- Bikaji Foods International LTD Ipo Date, PriceDokument1 SeiteBikaji Foods International LTD Ipo Date, PriceJatin JainNoch keine Bewertungen

- FR - Study Hub - Flash CardsDokument14 SeitenFR - Study Hub - Flash CardsFalguni PurohitNoch keine Bewertungen

- Practice Set 1 ABC-3Dokument3 SeitenPractice Set 1 ABC-3reiNoch keine Bewertungen

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Dokument15 SeitenCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNoch keine Bewertungen

- Claypool Hardware Is The Only Hardware Store in A RemoteDokument1 SeiteClaypool Hardware Is The Only Hardware Store in A Remotetrilocksp SinghNoch keine Bewertungen

- Past Paper NSODokument18 SeitenPast Paper NSORana AwaisNoch keine Bewertungen

- 40Chpt 12&13FINDokument20 Seiten40Chpt 12&13FINthe__wude8133Noch keine Bewertungen

- Accounts Case Study On Ratio AnalysisDokument6 SeitenAccounts Case Study On Ratio AnalysisRADHIKA.J 19MCO033Noch keine Bewertungen

- Chapter 17: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsDokument28 SeitenChapter 17: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsZee GuillebeauxNoch keine Bewertungen

- Exercise Sheet 2 With SolutionsDokument8 SeitenExercise Sheet 2 With SolutionsFlaminiaNoch keine Bewertungen

- Partnership DissolutionDokument3 SeitenPartnership DissolutionDan RyanNoch keine Bewertungen

- MODULE Session 13 - The Role of AccountantsDokument24 SeitenMODULE Session 13 - The Role of AccountantsOlivioNoch keine Bewertungen

- Management Accounting Notes1Dokument170 SeitenManagement Accounting Notes1Anish Gambhir100% (1)

- Which of The Following Matters Do Auditors Need Not Communicate To The Audit Committee of A Public Company?Dokument3 SeitenWhich of The Following Matters Do Auditors Need Not Communicate To The Audit Committee of A Public Company?lie SielNoch keine Bewertungen

- 3Dokument2 Seiten3Carlo ParasNoch keine Bewertungen