Beruflich Dokumente

Kultur Dokumente

Khenett Joyce A. Sarmiento. BSA IV-Nativity

Hochgeladen von

Khenett Joyce SarmientoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Khenett Joyce A. Sarmiento. BSA IV-Nativity

Hochgeladen von

Khenett Joyce SarmientoCopyright:

Verfügbare Formate

Khenett Joyce A. Sarmiento.

BSA IV- Nativity

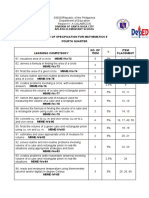

Multiple Choice

13-1 Which of the following is not a step in the short run decision making model?

E. All of these are steps in the short run decision making model

13-2 Cost that cannot be affected by any future actions are called

B. Sunk Costs

13-3 Refer to the information for Sandy above. Which of the following costs is irrelevant to Sandy’s

decision to stay in the apartment or move to the house?

E. The last two months of rent in the apartment

13-4 Refer to he information for Sandy above. Which of the following is a qualitative factor?

C. The noise in the apartment house

13-5 Refer to the information for Sandy above. Suppose that the apartment building was within

walking distance to campus and there house was five miles away. Sandy does not own a car.

How would that affect her decision?

B. It would make the apartment more desirable

13-6 Which of the following statements is false?

E. All of the above

13-7 In a make or buy decision,

C. The company would consider the purchase price of the externally provided good to be

relevant

13-8 Carroll Company, a manufacturer of vitamins and minerals, has been asked by a large drugstore

chain to provide bottles of vitamin E. The bottles would be labeled with the name of the drugstore

chain, and the chain would pay Carroll $2.30 per bottle rather than the $3.00 regular price. Which

type of decision this is?

B. Special Order

13-9 Jennings Hardware Store marks up its merchandise by 30%. If a part costs $25.00, which of the

following is true?

C. The price is $32.50

Khenett Joyce A. Sarmiento. BSA IV- Nativity

13-10 When a company faces a production constraint or scarce resource, it is important to

C. Produce the product with the highest contribution margin per unit of scarce resource

13-11 In the keep or drop decision, the company will find which of the following income statement

formats more useful?

A. A segmented income statement in the contribution margin format

13-12 In the sell or process further decision,

D. The most profitable outcome may be to further process some separately identifiable products

beyond the split off point, but sell others at split off point

Multiple Choice

14-1 Capital investments should

C. Earn back their original capital outlay plus a reasonable return

14-2 To make a capital investment decision, a management must

E. Do all of these

14-3 Mutually exclusive capital budgeting projects are those that

D. If accepted preclude the acceptance of all other competing projects

14-4 An investment of $6,000 produces a net annual cash inflow of $2,000 for each of 5 years. What is

the payback period?

D. Cannot be determined

14-5 An investment of $1,000 produces a net cash inflow of $500 in the first year and $750 in the

second year. What is the payback period?

A. 1.67 years

14-6 The payback period suffers from which of the following deficiencies?

D. It ignores the financial performance of a project beyond the payback period

14-7 The ARR has one specific advantage not possessed by the payback period in that

E. Considers the profitability of a project beyond the payback period

Khenett Joyce A. Sarmiento. BSA IV- Nativity

14-8 An investment of $2,000 provides an average net income of $400. Depreciation is $40 per year

with 0 salvage value. The ARR using the original investment is

C. 20%

14-9 If the NPV is positive, it signals

D. All of these

14-10 NPV measures

E. All of these

14-11 NPV is calculated by using

A. The required rate of return

14-12 Using NPV, a project is rejected if it is

B. Negative

14-13 If the present value of future cash flows is $4,200 for an investment that requires an outlay of

$3,000, the NPV

C. is $1,200

14-14 Assume that an investment of $1,000 produces a future cash flow of $1,000. The discount factor

for this future cash flow is 0.80. The NPV is

C. ($200)

14-15 Which of the following is not true regarding the IRR?

E. The IRR is the most reliable of the capital budgeting methods

14-16 Using IRR, a project is rejected if the IRR

B. Is less than the required rate of return

14-17 A postaudit

E. Does all of this

14-18 Postaudits of capital projects are useful because

D. They help to ensure that resources are used widely

Khenett Joyce A. Sarmiento. BSA IV- Nativity

14-19 For competing projects, NPV is preferred to IRR because

C. Choosing the project with the largest NPV maximizes the wealth of the shareholders

14-20 Assume that there are two competing projects, A and B. Project A has an NPV of $1,000 and an

IRR of 15%. Project B has an NPV of $800 and an IRR of 20%. Which of the following is true?

A. Project A should be chosen because it has a higher NPV

Das könnte Ihnen auch gefallen

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Von EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Von EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Noch keine Bewertungen

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Von EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Maxwell's EquationsDokument19 SeitenMaxwell's EquationsEr Ashish Baheti100% (1)

- Practice On NPV and Other Investment CriteriaDokument6 SeitenPractice On NPV and Other Investment CriteriaKim TividadNoch keine Bewertungen

- Midterm 3 AnswersDokument7 SeitenMidterm 3 AnswersDuc TranNoch keine Bewertungen

- Hull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 9: Xvas Multiple Choice Test BankDokument4 SeitenHull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 9: Xvas Multiple Choice Test BankKevin Molly KamrathNoch keine Bewertungen

- PDF Guerrero Advanced Accounting Solutions ManualDokument2 SeitenPDF Guerrero Advanced Accounting Solutions ManualJulius Antonio Gopita42% (12)

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- Capital Budgeting Techniques and DecisionsDokument39 SeitenCapital Budgeting Techniques and DecisionsCarla CarreonNoch keine Bewertungen

- Werner Miller - Deal, Mix and SpellDokument10 SeitenWerner Miller - Deal, Mix and Spellclubhippo100Noch keine Bewertungen

- Banggawan Answer KeyDokument17 SeitenBanggawan Answer Keyvallerie_lumantas76% (42)

- Fm202 Exam Questions 2013Dokument12 SeitenFm202 Exam Questions 2013Grace VersoniNoch keine Bewertungen

- MA Co Expansion Project Analysis and CAPM Model EvaluationDokument16 SeitenMA Co Expansion Project Analysis and CAPM Model EvaluationGeo DonNoch keine Bewertungen

- Test Bank Chapter12Dokument24 SeitenTest Bank Chapter12Jessa Mae Muñoz100% (2)

- Ch8 PDFDokument168 SeitenCh8 PDFjennyayumiNoch keine Bewertungen

- 03 Report Painter Report WriterDokument40 Seiten03 Report Painter Report Writerdeitron100% (3)

- Corporate Liquidation DisDokument4 SeitenCorporate Liquidation DisRenelyn DavidNoch keine Bewertungen

- Corporate Liquidation DisDokument4 SeitenCorporate Liquidation DisRenelyn DavidNoch keine Bewertungen

- Corporate Liquidation DisDokument4 SeitenCorporate Liquidation DisRenelyn DavidNoch keine Bewertungen

- 4th Periodical Test in Math 5-NewDokument9 Seiten4th Periodical Test in Math 5-NewMitchz Trinos100% (2)

- Examination 2Dokument64 SeitenExamination 2Leonie JeanNoch keine Bewertungen

- Other Topics in Capital Budgeting: Multiple Choice: ConceptualDokument33 SeitenOther Topics in Capital Budgeting: Multiple Choice: ConceptualAileen CempronNoch keine Bewertungen

- TRIAL QUESTION: CAUSE OF SHIFT IN COFFEE SUPPLY CURVEDokument19 SeitenTRIAL QUESTION: CAUSE OF SHIFT IN COFFEE SUPPLY CURVEAlyza C ArellanoNoch keine Bewertungen

- Consolidated Financial Statements (Reviewer)Dokument2 SeitenConsolidated Financial Statements (Reviewer)Erika50% (4)

- Advance Accounting Book 1Dokument206 SeitenAdvance Accounting Book 1genc22185% (13)

- Business Finance ReviewerDokument5 SeitenBusiness Finance ReviewerGela May SadianNoch keine Bewertungen

- Quiz Fin Statement Analysis AnswerDokument43 SeitenQuiz Fin Statement Analysis AnswerSharier Mohammad Musa100% (2)

- Chaper 1 - FS AuditDokument12 SeitenChaper 1 - FS AuditLouie De La Torre60% (5)

- Chaper 1 - FS AuditDokument12 SeitenChaper 1 - FS AuditLouie De La Torre60% (5)

- Understanding Futures, Forwards, Options and Hedging StrategiesDokument9 SeitenUnderstanding Futures, Forwards, Options and Hedging Strategiesjohndoe1234567890000Noch keine Bewertungen

- Exercises For The Hybrid MBA Corporate Finance CourseDokument28 SeitenExercises For The Hybrid MBA Corporate Finance Coursealex_bucNoch keine Bewertungen

- FM 1-Final Exam-2015 RoyalDokument2 SeitenFM 1-Final Exam-2015 Royalbereket nigussieNoch keine Bewertungen

- Noida Institute of EngeneeringDokument6 SeitenNoida Institute of EngeneeringKESHAV JHANoch keine Bewertungen

- Financial Accounting A Critical Approach CANADIAN Canadian 4th Edition John Friedlan Test Bank DownloadDokument71 SeitenFinancial Accounting A Critical Approach CANADIAN Canadian 4th Edition John Friedlan Test Bank DownloadSandra Joyce100% (28)

- TB Chapter12Dokument33 SeitenTB Chapter12Jacques Leo MonedaNoch keine Bewertungen

- Financial Management Comprehensive ExamDokument15 SeitenFinancial Management Comprehensive ExamDetox FactorNoch keine Bewertungen

- Calculate IRR, NPV and investment recommendationsDokument3 SeitenCalculate IRR, NPV and investment recommendationsSharath KumarNoch keine Bewertungen

- CF Self Assess QuestionsDokument6 SeitenCF Self Assess QuestionsLeo Danes100% (1)

- Other Topics in Capital Budgeting: Multiple Choice: ConceptualDokument33 SeitenOther Topics in Capital Budgeting: Multiple Choice: ConceptualAarti JNoch keine Bewertungen

- Personal Financial Planning 2Nd Edition Altfest Test Bank Full Chapter PDFDokument34 SeitenPersonal Financial Planning 2Nd Edition Altfest Test Bank Full Chapter PDFdanielkellydegbwopcan100% (7)

- Personal Financial Planning 2nd Edition Altfest Test BankDokument13 SeitenPersonal Financial Planning 2nd Edition Altfest Test Bankcivilianpopulacy37ybzi100% (28)

- Corporate Finance Trial Questions 2Dokument11 SeitenCorporate Finance Trial Questions 2Sylvia Nana Ama DurowaaNoch keine Bewertungen

- Test 1 QuizzDokument7 SeitenTest 1 QuizzEleni AnastasovaNoch keine Bewertungen

- FM 108 Topic 1 QuizDokument5 SeitenFM 108 Topic 1 QuizJean Ashley Napoles AbarcaNoch keine Bewertungen

- Chapter 7Dokument36 SeitenChapter 7Mai PhamNoch keine Bewertungen

- Dfa1035y 1 2018 2 F PDFDokument9 SeitenDfa1035y 1 2018 2 F PDFbugmenomoreNoch keine Bewertungen

- Grade 11 EntrepreneurshipquizDokument7 SeitenGrade 11 Entrepreneurshipquizapi-35040061760% (5)

- Practicing Financial Planning For Professionals and CFP Aspirants 12Th Edition Mittra Test Bank Full Chapter PDFDokument36 SeitenPracticing Financial Planning For Professionals and CFP Aspirants 12Th Edition Mittra Test Bank Full Chapter PDFtintiedraweropw9100% (9)

- Practicing Financial Planning For Professionals and CFP Aspirants 12th Edition Mittra Test BankDokument15 SeitenPracticing Financial Planning For Professionals and CFP Aspirants 12th Edition Mittra Test Banktauriddiastyleon6100% (29)

- Haramaya University Financial Management AssignmentDokument8 SeitenHaramaya University Financial Management AssignmentNitinNoch keine Bewertungen

- Capital Budgeting Decisions: Mcgraw-Hill/IrwinDokument38 SeitenCapital Budgeting Decisions: Mcgraw-Hill/Irwinrayjoshua12Noch keine Bewertungen

- Winter 2010 Midterm With SolutionsDokument11 SeitenWinter 2010 Midterm With Solutionsupload55Noch keine Bewertungen

- Business Finance: Time Value of Money Concepts and CalculationsDokument8 SeitenBusiness Finance: Time Value of Money Concepts and CalculationsHASSAN AHMADNoch keine Bewertungen

- Chap 11Dokument67 SeitenChap 11Reina Erasmo SulleraNoch keine Bewertungen

- Chapter 11 Capital Budgeting SolutionsDokument10 SeitenChapter 11 Capital Budgeting SolutionssaniyahNoch keine Bewertungen

- 2102 Practice Exam 1 Fall07Dokument9 Seiten2102 Practice Exam 1 Fall07John ShinNoch keine Bewertungen

- Test Bank Chapter 16 Payout Policy Multiple Choice QuestionsDokument31 SeitenTest Bank Chapter 16 Payout Policy Multiple Choice QuestionsHuyenKhanhNoch keine Bewertungen

- Capital Budgeting - Homework-2 AnswersDokument3 SeitenCapital Budgeting - Homework-2 AnswersYasmine GouyNoch keine Bewertungen

- Ordinary AnnuityDokument12 SeitenOrdinary AnnuityAhmed Mukthar AliNoch keine Bewertungen

- Cap Budgeting ExerciseDokument5 SeitenCap Budgeting ExerciseripplerageNoch keine Bewertungen

- Chapter 14Dokument56 SeitenChapter 141210848Noch keine Bewertungen

- FIN1FOF Practice Exam QuestionsDokument7 SeitenFIN1FOF Practice Exam QuestionsNăm Trần TrọngNoch keine Bewertungen

- PD1 2023-1Dokument5 SeitenPD1 2023-1Mile León MezaNoch keine Bewertungen

- Corporate Finance Canadian 7th Edition Ross Test BankDokument35 SeitenCorporate Finance Canadian 7th Edition Ross Test Bankbillyaprilwmiev100% (23)

- Chapter 4 - Concept Questions and ExercisesDokument5 SeitenChapter 4 - Concept Questions and ExercisesTranh Meow MeowNoch keine Bewertungen

- Chapter 4 - Time Value of MoneyDokument5 SeitenChapter 4 - Time Value of MoneyLayla MainNoch keine Bewertungen

- QUIZ_9901_3: Miller Brothers Hardware Dividend QuizDokument7 SeitenQUIZ_9901_3: Miller Brothers Hardware Dividend QuizHo Yuen TangNoch keine Bewertungen

- Final ExamDokument6 SeitenFinal ExamOnat PNoch keine Bewertungen

- ES 4 Final QuestionsDokument2 SeitenES 4 Final QuestionsEarl AradoNoch keine Bewertungen

- FINANCE AND BANKING Question PaperDokument14 SeitenFINANCE AND BANKING Question Paperisha peerthyNoch keine Bewertungen

- Summative Exam Bus. Finance 2nd QuarterDokument6 SeitenSummative Exam Bus. Finance 2nd QuarterEmelyn GalamayNoch keine Bewertungen

- New Doc 2020-02-22 18.44.16 - 20200227092823Dokument31 SeitenNew Doc 2020-02-22 18.44.16 - 20200227092823Khenett Joyce SarmientoNoch keine Bewertungen

- New Doc 2020-02-12 22.23.57 - 20200227093430Dokument5 SeitenNew Doc 2020-02-12 22.23.57 - 20200227093430Khenett Joyce SarmientoNoch keine Bewertungen

- Khenett Joyce A. Sarmiento. BSA IV-NativityDokument4 SeitenKhenett Joyce A. Sarmiento. BSA IV-NativityKhenett Joyce SarmientoNoch keine Bewertungen

- Corp PDFDokument1 SeiteCorp PDFKhenett Joyce SarmientoNoch keine Bewertungen

- New Doc 2020-02-14 19.48.58 - 20200214195052 PDFDokument7 SeitenNew Doc 2020-02-14 19.48.58 - 20200214195052 PDFKhenett Joyce SarmientoNoch keine Bewertungen

- Section 36-38 Revised CorporationDokument7 SeitenSection 36-38 Revised CorporationKhenett Joyce SarmientoNoch keine Bewertungen

- DocumentDokument1 SeiteDocumentKhenett Joyce SarmientoNoch keine Bewertungen

- DocumentDokument1 SeiteDocumentKhenett Joyce SarmientoNoch keine Bewertungen

- Khenett Joyce A. Sarmiento. BSA IV-NativityDokument4 SeitenKhenett Joyce A. Sarmiento. BSA IV-NativityKhenett Joyce SarmientoNoch keine Bewertungen

- Khenett Joyce Sarmiento - Ojt1Dokument9 SeitenKhenett Joyce Sarmiento - Ojt1Khenett Joyce SarmientoNoch keine Bewertungen

- TheoDokument1 SeiteTheoKhenett Joyce SarmientoNoch keine Bewertungen

- Pest Analysis of A Tutorial CenterDokument1 SeitePest Analysis of A Tutorial CenterKhenett Joyce SarmientoNoch keine Bewertungen

- Pest Analysis of A Tutorial CenterDokument1 SeitePest Analysis of A Tutorial CenterKhenett Joyce SarmientoNoch keine Bewertungen

- Urriculum Itae Et TudiorumDokument21 SeitenUrriculum Itae Et TudiorumEnricoNoch keine Bewertungen

- TEST 1. TrigonometryDokument2 SeitenTEST 1. TrigonometrySonia AroraNoch keine Bewertungen

- Reference Manual Standard Interface Command ... - Mettler Toledo PDFDokument92 SeitenReference Manual Standard Interface Command ... - Mettler Toledo PDFRastiNoch keine Bewertungen

- Asynchronous Activity 4: Case 1Dokument3 SeitenAsynchronous Activity 4: Case 1John Carlo TolentinoNoch keine Bewertungen

- Fun The Mystery of The Missing Kit Maths AdventureDokument7 SeitenFun The Mystery of The Missing Kit Maths AdventureJaredNoch keine Bewertungen

- How Rebar Distribution Affects Concrete Beam Flexural StrengthDokument10 SeitenHow Rebar Distribution Affects Concrete Beam Flexural Strengthtoma97Noch keine Bewertungen

- Unit 4 DeadlocksDokument14 SeitenUnit 4 DeadlocksMairos Kunze BongaNoch keine Bewertungen

- Métodos de Fı́sica Teórica II - CF367 Lista de Exercı́cios I Dirac delta function propertiesDokument1 SeiteMétodos de Fı́sica Teórica II - CF367 Lista de Exercı́cios I Dirac delta function propertiesFernando Bazílio de LimaNoch keine Bewertungen

- K Means QuestionsDokument2 SeitenK Means QuestionsShakeeb ParwezNoch keine Bewertungen

- The Relationship Between Capital Structure and Firm Performance - New Evidence From PakistanDokument12 SeitenThe Relationship Between Capital Structure and Firm Performance - New Evidence From Pakistanhammadshah786Noch keine Bewertungen

- Nigel Warburton - Cum Sa Gandim Corect Si EficientDokument221 SeitenNigel Warburton - Cum Sa Gandim Corect Si EficientRoxanita RoxNoch keine Bewertungen

- Writing Scientific NotationDokument2 SeitenWriting Scientific NotationkolawoleNoch keine Bewertungen

- Head Nurses Leadership Skills Mentoring and Motivating Staff Nurses On Rendering High-Quality Nursing CareDokument23 SeitenHead Nurses Leadership Skills Mentoring and Motivating Staff Nurses On Rendering High-Quality Nursing CareDaniel RyanNoch keine Bewertungen

- F Distribution - TableDokument2 SeitenF Distribution - TableanupkewlNoch keine Bewertungen

- Journal of Food Engineering: V.R. Vasquez, A. Braganza, C.J. CoronellaDokument12 SeitenJournal of Food Engineering: V.R. Vasquez, A. Braganza, C.J. CoronellaRamiro De Aquino GarciaNoch keine Bewertungen

- CV Dr Mohammad ShahzadDokument5 SeitenCV Dr Mohammad ShahzadTarique WaliNoch keine Bewertungen

- Matrix Operations / ManipulationDokument4 SeitenMatrix Operations / ManipulationRyan5443Noch keine Bewertungen

- BMS Sem 1 DSC Ge Sec Vac (Edit)Dokument27 SeitenBMS Sem 1 DSC Ge Sec Vac (Edit)VISHESH 0009Noch keine Bewertungen

- Math6338 hw1Dokument5 SeitenMath6338 hw1Ricardo E.Noch keine Bewertungen

- Jyothi Swarup's SAS Programming ResumeDokument4 SeitenJyothi Swarup's SAS Programming Resumethiru_lageshetti368Noch keine Bewertungen

- Lecture 5Dokument7 SeitenLecture 5sivamadhaviyamNoch keine Bewertungen

- CV Iqbal Wahyu SaputraDokument1 SeiteCV Iqbal Wahyu SaputraIqbal WahyuNoch keine Bewertungen

- Rangka Batang RhezaDokument11 SeitenRangka Batang RhezaKABINET JALADARA NABDANoch keine Bewertungen

- Optimal f ratio for inverter chainDokument6 SeitenOptimal f ratio for inverter chainVIKAS RAONoch keine Bewertungen

- Essentials of Chemical Reaction Engineering 1st Edition Fogler Solutions ManualDokument35 SeitenEssentials of Chemical Reaction Engineering 1st Edition Fogler Solutions Manualnancycarrollaocprizwen100% (11)

- Arfaoui - Et - Al - 2018 - An Optimal Multiscale Approach To Interpret Gravity DataDokument28 SeitenArfaoui - Et - Al - 2018 - An Optimal Multiscale Approach To Interpret Gravity DataVinicius AntunesNoch keine Bewertungen