Beruflich Dokumente

Kultur Dokumente

India Solar MAP 2019: Navigator

Hochgeladen von

Surendranath ChitturiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

India Solar MAP 2019: Navigator

Hochgeladen von

Surendranath ChitturiCopyright:

Verfügbare Formate

INDIA SOLAR

Lead sponsor Associate sponsors

MAP 2019

MARCH

www.bridgetoindia.com

5

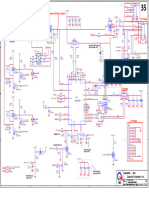

Total utility scale solar capacity as on 31 March, 20191

32

5

All figures in MW

35 NTPC offtake

8

3,337

28

State government tenders

Comm. 7,522 SECI offtake

Pipeline 835 4,485

1,130

1,180

465

1 5

Others

PSU development 130 PSU development

2 625 1,072

5 01

Commissioned 50 Others

225

Central 497

UTTAR PRADESH government Pipeline

Central

UTTARAKHAND tenders

10,365

17,887

Commissioned government

26,154 tenders

219 9,391

SECI offtake

6,610

5

8 16

State government

Commissioned tenders

PUNJAB

21

NTPC offtake 13,008

3,000 Others

Commissioned

845 3,755

16 5

16

22

Commissioned

8

68 821

Commissioned

HARYANA JHARKHAND 125

30 W

M BIHAR

0

84

W

12 120

M W

0M

1,2 5

0

1,35

00

10

RAJASTHAN

17

450 MW Pipeline

2,

1,1

66

10

6

16

05

18

Comm.

0M

3,108

270

50

82 360

4,910

6,910

500

91

W

Pipeline Commissioned

6,910

65 MW 85

0M

W

200 MW

52

WEST BENGAL

290

00 16

2,0 12

306

GUJARAT 200 22

MW

300

00

1,2

Comm. MW CHHATTISGARH

1,344

60

Pipeline 1,862

105

50 M

Commissioned

100

1,825

0

207

M

5

W

ODISHA

80

25

62

5

60

0 212

23 Pipeline 5

220 400 101

42

27

129 45430

0

68

13

25

Pipeline 3 Commissioned

30

58

Pipeline

0

383

3

166

2

152

35

MADHYA PRADESH

0

6

29

32

113

30

Commissioned

TELANGANA Commissioned

1

1,966

3,511

1,031 30

ANDHRA PRADESH 2,689

ANDAMAN &

NICOBAR ISLANDS

81

86 5

PUDUCHERRY

6

MAHARASHTRA

0

75 1,

7 14

Comm. 08

1,318 7

200

Pipeline

153

2,435

2,495

2

Pipeline

1,76

25

1,750

1,75

60

9

1,000

TAMIL NADU

400

Comm. Comm.

3,029 5

605

5 10

58 16

3

26

185 9

1,

13 54 1,092 18 Pipeline

93

4

1, 4 258

Ratio of utility scale solar

0

25

1

Pipeline

KARNATAKA

240

commissioned capacity to

5

1

241

1,654

96

Pipeline

22 KERALA Pipeline

1,511 12 March 2022 solar target

2

Commissioned

675

50

6,003

>100%

62

Commissioned Comm.

1,

24

82 2,421

550

3

61 - 80%

18

1,9

78

550

2,

2323

9 9 41-60%

21-40%

12

<20%

Leading players1

Projects commissioned in FY 2019 (4,810 MW)

Project developers Module suppliers Inverter suppliers EPC contractors O&M contractors

(estimated DC capacity - 6,146 MW) (total market size - 26,154 MW)

& WILSON

13.51% STERLING

ON

SH

SKYP EDCL 0. .62%

SUN

AP

OTHERS 4.642%

WILS

WBS RMA 00.79%%

OO LA GE

AD PA NER OUP

PHA BEL 0.83 1%

OTH

GIPCL 0 .52%

SC

OWER 62%

PH EST

RJ N E GR

ITY LL

HN

PR

NG &

E

NA 4.91%

I

ERS .49%

A B ON GY 1 1.1

ER

E

RGY

O

AR

GE

IDE

0

W

IRL JI 1 .04 4%

PG 0.9 04%

.5

I

L

ERLI

0.56

PO

T

SO

DE

NA

2

R2

ENE

L&

%

A . %

TA

LT

GS M

%

A TA

15.

%

.49

% ST

EC KR

A

32

SEN

VI 2%

E

O

2.8

67%

L

%

NA

E TH

8.

CM

1.

JB

LIG MM ERS 7% 32 6.4

3%

5 HI

11.43

M L

2.0 6% 7.5

TA .76

NSO

% RI

A

HT VEE 1.2 CH ER %

E

OW -GE

8%

R

B

MAH FR 8%

ZU CE WAY 0.54 7% I8

TA P

IG

AB

IND V2 A .00 LAR

9.41

C 0 A

12.6

% %T O

RA S .08 6% D EP .57 % %S

%

FIRS

UST % 9.3 T SO AQO 00.57%% 7.84 4.94

79

EN 2 RGY

.

L . JINE

22

5

.91% HAN AR 1.067%

WHA % 6.83%

PHONO 1.33%

MYTRAH SOLAR

3.12% 1.79% 4.91% MAHINDRA TAQO

TATA POWER 2.03% % 5.84% VIKRAM SO

Self-E PC 42.41 LAR

8.32% APGENCO

GRT 3.53% JINKO 2.07% 6.75% L HUAWEI 11.09% 2.58%

VIKRA

ONG I 1.19 M SOL

2.10% 1.05 % JUW AR

OLAR 5.6

6% IAN S 17.0 5% 1.0 % J I

Y 4.1 CA N A D

2.12

% 7% MA 0 3% A K

ERG UN

SUN HIN 0 .90 RAY SON

G EN - S GRO 0 .74 % S

SPR

N 8.3 C

2.3

9% 6.1

3% W 2.

30

DR

AS 0.5.69%% BLANC POW

7% 2% LI RE % US 0. 7

54 % EN HEL O ER

4.3 NL G 3% KE TEN INF

YIN NE

2.

% L& RI

R C 2.8 RA

0. .38%% KE CNA S

C

WE

08

SO RA T CH

0 8 M ER

40

2.0

IN

%

N LA

0.3.38% OTH

%

PO

%

SU YS

0 06%

TE

% PE C IN LY B

.86

JAA N 0.022%

2.0

9%

1.

8%

ENE S 0.0 %

JA

90

5.8

TA LE RN

SWEL GY 0.043%

2.08 RAYS PO

HI S E TE

PO

ECT 0 %

1.14% BHEL

13

.40%

TA

4.9

2.

0.94%

KS

RAYS POWER BOSCH 0.44%

AA 0.5

8%

8.3

A

0.83% LAN

ORIANO 0.49% 0.51% ENRICH

LD N RN ARA

3%

AT

13.90% T

M 27.64%

HI

T W

%

.04

EXPERTS 0.45

ON

IO

5.53%

%

ER

A

2%

%M

L

6.34% RENEW

EC

EI

EN GIN ATI T

VIV NA

P

5.20

JA SOLAR 4.86%

ZN

FR

NA

D

4.25

A3

ES

TM

EX

NT

ER EER ONA

EN

L

S

SH

IN

PE

CNA

IN

BE

SU

GY S

EN

ADA

ER

L

L

IN

R

GC

REE

RT

TR

SE

BEA

U

NE

GIN

Self-O&

GY

S

LLY

ES

CO

L

AVA

WAA

RG

H

E

GEN

WER

ER

B

Y

HAR

S

PRO

L

INFR

AT

A

DOMESTIC MANUFACTURERS

India Solar Compass

Commissioned and pipeline capacity

Subscription packages Paid reports Capacity addition

India RE Weekly

India RE Weekly Indian Open Access Solar Market

Leading players

Tender progress updates

It’s raining tenders

Surge of new tenders and fall in module

prices bring hope to the sector

INDIA SOLAR

COMPASS 2018 Q1 India Solar Compass Indian Rooftop Solar Market Pricing updates

Funding

© BRIDGE TO INDIA, 2018 Page 1

India RE Policy Brief &

Solar park development in India

Lead sponsor

India RE Market Brief Policy and regulatory updates

INDIA RE CEO SURVEY 2018

Estimating Cost of Capital for Market trends and developments

Customized reports Customized reports

Indian Solar Projects

Subscription enquiries : marketing@bridgetoindia.com

India Solar

Navigator www.indiasolarnavigator.com

marketing@bridgetoindia.com | +91 124 420 4003

Lead sponsor Associate sponsors

Top 10 players Top 20 project developers

(projects commissioned in FY 2019)

Central government tenders

State government tenders

Others

Project developers Module suppliers Inverter suppliers EPC contractors 3,000

Current Company Previous Increase/ Company Previous Increase/ Company Previous Increase/ Company Previous Increase/

rank Name year rank Decrease Name year rank Decrease Name year rank Decrease Name year rank Decrease

Acme

1 Acme 3 Risen Energy 4 ABB 1 Sterling & Wilson 1 2,500

Total pipeline capacity, MW

2 Azure 9 Vikram Solar - Sungrow 3 L&T 5

2,000

3 APGENCO - Jinergy - TBEA 7 Tata Power 3 SB Energy Azure

4 NLC - Longi - TMEIC 4 Vikram Solar -

1,500

5 SB Energy - Renesola - Huawei 2 Mahindra Susten 2 ReNew

6 ReNew 2 Znshine - Hitachi 6 KEC International - Shapoorji Avaada

1,000

Pallonji

7 Avaada - GCL 5 Delta - Jackson - Ayana NLC

Renewable Fortum Sprng Adani

Energy Hero Future

8 Essel Infra - JA Solar 2 Schneider 8 Hild Energy - 500

Tata Power

Mahindra Susten

EDEN Engie NTPC

9 Tata Power 8 Waaree - GE 9 PES Engineers - Greenko

Mytrah

-

Essel Infra

-

10 Sprng Energy - Trina 3 SMA 5 McNally Bharat - 500 1,000 1,500 2,000 2,500

Total commissioned capacity, MW

Tender issuance and auctions, MW Capacity addition and investment³

60,000 10,000 400

9,143

FY 2019 witnessed an unprecedented surge in tender issuance but

Capacity addition and total investment fell

50,000 progress was marred by increasing instances of tender

sharply last year due to a number of factors

cancellation, undersubscription and execution bottlenecks

including execution delays, policy challenges

and uncertainty arising from implementation

Capacity, MW

40,000 8,000

of GST and safeguard duty

300

30,000

Tenders cancelled

Undersubscribed and/

20,000 or cancelled capacity

Capacity addition, MW

6,000 5,447

INR billion

10,000

4,810 200

-

FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 3,087

4,000

Tender issuance Successful auctions

Notes

100

1. Methodology c. Pipeline includes projects that have been allocated to g. Self-EPC denotes projects where EPC work is completed by

a. BRIDGE TO INDIA has conducted an extensive data collection developers but not yet commissioned. It includes cases where developers or their sister companies in-house which do not

exercise and relied on multiple market sources including the power purchase agreements may not have been signed.d. undertake any third-party EPC work. 2,000 1,098

project developers, contractors, equipment suppliers and d. States with less than 20 MW commissioned capacity are not 2. Acronyms used:

state nodal agencies to provide accurate, information as far shown on the map. a. SECI – Solar Energy Corporation of India Limited

as possible. Some suppliers were either unreachable or did e. All capacity numbers are specified in AC MW, unless noted b. PSU – Public Sector Units

not validate the data available with us. All data has been otherwise. For module suppliers’ market share analysis, we 3. Project investments are inclusive of GST and safeguard duty

cross-referenced with data provided by government have used DC capacity numbers, where available, and where applicable.

departments and other market players, where possible. increased AC capacity for other by 30%. 4. Total capacity bid includes 4,855 MW capacity that was cancelled

However, we do not guarantee completeness or accuracy of f. In many projects, EPC contractor role is split between post auction.

any information. multiple parties. We have used several criteria including final 5. This report has been sponsored by Longi (lead sponsor), Growatt

b. b. Only grid connected, ground-mounted projects above 1 MW responsibility for commissioning and value of contracts for and Huawei as associate sponsors. All editorial rights and

have been considered in this report. determining credits. copyrights remain with BRIDGE TO INDIA. - 0

FY 2015 FY 2016 FY 2017 FY 2018 FY 2019

Capacity bid by individual developers, MW4

150 120 70

(total capacity bid in FY 2019 - 35,745 MW) 110

375 250 250 245 220 200 180 170 100 60

5,100 4,875 3,400 3,400 3,350 3,085 2,300 1,050 1,050 840 790 520 500 400 300 250 250 225 200 200 175 129 50

100%

80%

60%

40%

20%

0%

SB Energy

Shapoorji Pallonji

Azure

Adani

Acme

ReNew

Avaada

Fortum

TATA Power

EDEN

Hero

Canadian Solar

Mahindra

Sprng

Ayana

NTPC

GSECL

Engie

Aditya Birla

UPC Solar

Think Energy

BHEL

Sukhbir Agro

Alfanar

Essel Infra

GIPCL

Mytrah

Sembcorp

Nisarga Renewable

Fortune Credit

Refex

Aqua Pumps

Orange

AT Capital

Asian Fab Tec

Global Coal Mining

Rays Power

Kalthia

Solar Arise

Shiv Solar

Jakson

Total capcity bid Winning bids % Losing bids %

INDIA SOLAR

Lead sponsor Associate sponsors

MAP2019 MARCH

Subscribe to the

deepest market insights

Pipeline

17,887 MW

Commissioned

26,154 MW

© BRIDGE TO INDIA Energy Private Limited P +91 124 4204003 Follow us on:

E marketing@bridgetoindia.com

C-8/5, DLF Phase 1,

W www.bridgetoindia.com

Gurugram - 122001 (HR), India

Das könnte Ihnen auch gefallen

- Termination Detail: 0.00 4.182 M ABU DHABI DATUMDokument1 SeiteTermination Detail: 0.00 4.182 M ABU DHABI DATUMAAMIR NISARNoch keine Bewertungen

- Polaris - Boku No Hero Academia Season 4fd OPDokument3 SeitenPolaris - Boku No Hero Academia Season 4fd OPAlcaNoch keine Bewertungen

- Minuet in F: K2 Wolfgang Amadeus MozartDokument1 SeiteMinuet in F: K2 Wolfgang Amadeus MozartCedric TutosNoch keine Bewertungen

- Shoukei To Shikabane No Michi - Shingeki No Kyojin Season 3 Part 2 OP FULLDokument8 SeitenShoukei To Shikabane No Michi - Shingeki No Kyojin Season 3 Part 2 OP FULLPelayo NevadoNoch keine Bewertungen

- Shoukei To Shikabane No Michi - Shingeki No Kyojin Season 3 Part 2 OP FULLDokument8 SeitenShoukei To Shikabane No Michi - Shingeki No Kyojin Season 3 Part 2 OP FULLVíctor González GaeteNoch keine Bewertungen

- Schematic Carte Moteur V7Dokument1 SeiteSchematic Carte Moteur V7Revidadina Dwi JunitaNoch keine Bewertungen

- PGD-1 0Dokument1 SeitePGD-1 0Srijon BrahmacharyNoch keine Bewertungen

- เธอเปลี่ยนไปแล้ว PianoAccom PDFDokument4 Seitenเธอเปลี่ยนไปแล้ว PianoAccom PDFNantavut Piano-Pop SenangnartNoch keine Bewertungen

- BQ24738H BQ738HDokument1 SeiteBQ24738H BQ738HjuliocunachiNoch keine Bewertungen

- Liquid Smooth MitskiDokument4 SeitenLiquid Smooth MitskiSylwia DrwalNoch keine Bewertungen

- Electrical LegendDokument1 SeiteElectrical LegendPearl Jane TABSINGNoch keine Bewertungen

- DJ Smash - Moscow Never SlipsDokument2 SeitenDJ Smash - Moscow Never SlipsВладимир СамофаловNoch keine Bewertungen

- Yozora Night Sky DocumentaryDokument2 SeitenYozora Night Sky DocumentaryValentino PradillaNoch keine Bewertungen

- Magic Waltz: From 'The Legend of 1900'Dokument4 SeitenMagic Waltz: From 'The Legend of 1900'AronappleStudios55100% (2)

- User Guide AM400-CPU1608TP CPU Module: 5. Communication ConnectionDokument2 SeitenUser Guide AM400-CPU1608TP CPU Module: 5. Communication ConnectionManova JNoch keine Bewertungen

- JCB Paw 01 DRG Omc 03 100013 - BDokument1 SeiteJCB Paw 01 DRG Omc 03 100013 - BnimitNoch keine Bewertungen

- Do - SolDokument1 SeiteDo - SolCOORDINACION ACADEMICANoch keine Bewertungen

- Saiki K. Surely SomedayDokument1 SeiteSaiki K. Surely SomedayjoeNoch keine Bewertungen

- 刻在我心底的名字 鋼琴譜Dokument3 Seiten刻在我心底的名字 鋼琴譜Ting Yi Yap100% (2)

- One in A MillionDokument6 SeitenOne in A MillionTereza HemberováNoch keine Bewertungen

- Bolognesi - Claudio LeónDokument2 SeitenBolognesi - Claudio LeónMiguel SanchezNoch keine Bewertungen

- Rosemary Clooney - Suzy Snowflakes (1 Voice)Dokument7 SeitenRosemary Clooney - Suzy Snowflakes (1 Voice)Hesty F. P.Noch keine Bewertungen

- SummerDokument4 SeitenSummer山形優介Noch keine Bewertungen

- NAVE4 (1) (1) - ModelDokument1 SeiteNAVE4 (1) (1) - ModelCangatron 14Noch keine Bewertungen

- Corfid 0 CarrierDokument1 SeiteCorfid 0 CarrierRicardo SallesNoch keine Bewertungen

- Alouette 120bpmDokument3 SeitenAlouette 120bpmTùng HoàngNoch keine Bewertungen

- Ain T No Stoppin' Us! - 3rd TromboneDokument1 SeiteAin T No Stoppin' Us! - 3rd TromboneDana Díaz AcostaNoch keine Bewertungen

- SHD Cscec 18 F01 ST SC 01 Ex 05 0001 0000 01Dokument1 SeiteSHD Cscec 18 F01 ST SC 01 Ex 05 0001 0000 01Mohamed SherifNoch keine Bewertungen

- По лужам босикомDokument1 SeiteПо лужам босикомBraicov LuminițaNoch keine Bewertungen

- Near The EndDokument3 SeitenNear The EndKoen JagtNoch keine Bewertungen

- Fairy Tail Masayume ChasingDokument3 SeitenFairy Tail Masayume Chasingdarkmar_611Noch keine Bewertungen

- Where Is My Mind - Pixies Sheet MusicDokument2 SeitenWhere Is My Mind - Pixies Sheet MusicElisa OrlandoNoch keine Bewertungen

- Where Is My MindDokument2 SeitenWhere Is My MindbigfatbuddaNoch keine Bewertungen

- Grand Escape - Tenki No Ko Weathering With You OST FULLDokument7 SeitenGrand Escape - Tenki No Ko Weathering With You OST FULLLim Kai XuanNoch keine Bewertungen

- The Fairest of The Fair: MarzialeDokument1 SeiteThe Fairest of The Fair: MarzialeFundacion RapsodiaNoch keine Bewertungen

- All Creatures of Our God and King Lasst Uns Erfreuen Herzlich SehrDokument3 SeitenAll Creatures of Our God and King Lasst Uns Erfreuen Herzlich SehrCourage WellingtonNoch keine Bewertungen

- Sesuatu di Jogja "Guitar 2 Ensemble"Dokument2 SeitenSesuatu di Jogja "Guitar 2 Ensemble"Al FairusNoch keine Bewertungen

- Partition Piano Genso Suikoden - Main ThemeDokument2 SeitenPartition Piano Genso Suikoden - Main ThemeCyril KaleffNoch keine Bewertungen

- Produced by An Autodesk Educational Product: Female W.C Fire Exit Assistant Manager 1Dokument1 SeiteProduced by An Autodesk Educational Product: Female W.C Fire Exit Assistant Manager 1haiderdbNoch keine Bewertungen

- Minuetto in G Minor Sheet MusicDokument1 SeiteMinuetto in G Minor Sheet MusicFrancesco MiniaciNoch keine Bewertungen

- Cofraj FundatiiDokument1 SeiteCofraj FundatiiSalaru Andrei MariusNoch keine Bewertungen

- AdieuDokument4 SeitenAdieuMinja BerešNoch keine Bewertungen

- Monkey Island 2 - FireplaceDokument2 SeitenMonkey Island 2 - FireplacePlaF ErreapeNoch keine Bewertungen

- AdventuresoloDokument1 SeiteAdventuresoloLuke LippincottNoch keine Bewertungen

- Monkey Island 2 - FireplaceDokument2 SeitenMonkey Island 2 - FireplacePlaF ErreapeNoch keine Bewertungen

- BQ24738 With VoltagesDokument1 SeiteBQ24738 With VoltagesVISHALNoch keine Bewertungen

- Jänner 2023Dokument2 SeitenJänner 2023Rainer FalkNoch keine Bewertungen

- Theory of Everything Full VersionDokument7 SeitenTheory of Everything Full Versionflora xuNoch keine Bewertungen

- 2014cars PosterDokument1 Seite2014cars PosterMarco TristanNoch keine Bewertungen

- Metal DSDSDSGFDGDFDSDFGDFGFFDS: ComposerDokument1 SeiteMetal DSDSDSGFDGDFDSDFGDFGFFDS: ComposerNormanNoch keine Bewertungen

- Solo El AmorDokument3 SeitenSolo El AmorJosé Marcos MacielNoch keine Bewertungen

- Minuetto GiulianiDokument2 SeitenMinuetto GiulianiGerardoNoch keine Bewertungen

- Prelude No. 3Dokument3 SeitenPrelude No. 3VictorNoch keine Bewertungen

- Base PlateDokument1 SeiteBase Platebacha01Noch keine Bewertungen

- PDFDokument4 SeitenPDFannalisaNoch keine Bewertungen

- DayspastDokument2 SeitenDayspastMohammed AhmedNoch keine Bewertungen

- Avrv4 23 10 2013 PDFDokument1 SeiteAvrv4 23 10 2013 PDFĐoàn NguyênNoch keine Bewertungen

- Metal GFDGDFGDFDFDFGDSFDSFDSFDSDFG: ComposerDokument1 SeiteMetal GFDGDFGDFDFDFGDSFDSFDSFDSDFG: ComposerNormanNoch keine Bewertungen

- Twice - FancyDokument4 SeitenTwice - FancyVũ SơnNoch keine Bewertungen

- Instant Assessments for Data Tracking, Grade 5: Language ArtsVon EverandInstant Assessments for Data Tracking, Grade 5: Language ArtsNoch keine Bewertungen

- MR-JE - A SERVO AMPLIFIER INSTRUCTION MANUAL (Modbus RTU Protocol)Dokument114 SeitenMR-JE - A SERVO AMPLIFIER INSTRUCTION MANUAL (Modbus RTU Protocol)Aung Naing OoNoch keine Bewertungen

- PRN Maths Midterm QP Aug 18Dokument3 SeitenPRN Maths Midterm QP Aug 18JanakChandPNoch keine Bewertungen

- Mill Test Certificate: Jindal Stainless (Hisar) LimitedDokument1 SeiteMill Test Certificate: Jindal Stainless (Hisar) Limitedhemantmech09920050% (2)

- Gravimetric Analysis Lab ReportDokument5 SeitenGravimetric Analysis Lab Reportclaire_miller_16100% (1)

- Proceedings of National Conference on Landslides held in LudhianaDokument8 SeitenProceedings of National Conference on Landslides held in LudhianaAniket PawarNoch keine Bewertungen

- Nitration of Methyl BenzoateDokument3 SeitenNitration of Methyl BenzoateDaniel McDermottNoch keine Bewertungen

- Steel StaircaseDokument17 SeitenSteel StaircaseKarthick CrazeiNoch keine Bewertungen

- Vapour Bar Exchange IMFL PackageDokument4 SeitenVapour Bar Exchange IMFL PackageNishank AgarwalNoch keine Bewertungen

- Ch1 PDFDokument54 SeitenCh1 PDFChristian Jegues100% (2)

- Refraction Through Lenses & Optical Instruments5Dokument144 SeitenRefraction Through Lenses & Optical Instruments5geniusamahNoch keine Bewertungen

- Natural Law Theory ApproachDokument35 SeitenNatural Law Theory ApproachseventhwitchNoch keine Bewertungen

- FHM Espana 2010 12 PDFDokument2 SeitenFHM Espana 2010 12 PDFBrandenNoch keine Bewertungen

- Vertical Jaw Relation Recording MethodsDokument17 SeitenVertical Jaw Relation Recording MethodsHarish VsNoch keine Bewertungen

- Unit explores Christian morality and conscienceDokument1 SeiteUnit explores Christian morality and conscienceRose Angela Mislang Uligan100% (1)

- 2nd - Science-Second-Quarter-Week-1Dokument37 Seiten2nd - Science-Second-Quarter-Week-1Arlene AranzasoNoch keine Bewertungen

- 20 N 60 C 3Dokument13 Seiten20 N 60 C 3rashidmirzaNoch keine Bewertungen

- Parameters Governing Predicted and Actual RQD Estimation - FINAL - PUBLISHED - VERSIONDokument14 SeitenParameters Governing Predicted and Actual RQD Estimation - FINAL - PUBLISHED - VERSIONKristian Murfitt100% (1)

- Tween 80Dokument11 SeitenTween 80fvdxrgNoch keine Bewertungen

- SAFETY AND LOSS PREVENTION FOR CHEMICAL PROCESS FACILITIESDokument13 SeitenSAFETY AND LOSS PREVENTION FOR CHEMICAL PROCESS FACILITIESKinosraj KumaranNoch keine Bewertungen

- Fane 121Dokument3 SeitenFane 121Johan BonillaNoch keine Bewertungen

- Operator Manual T2100-ST2 - ST1Dokument50 SeitenOperator Manual T2100-ST2 - ST1Nurul FathiaNoch keine Bewertungen

- Shariff NDokument4 SeitenShariff NKruu ChinnuNoch keine Bewertungen

- ###Questions Model PDFDokument2 Seiten###Questions Model PDFDave DMNoch keine Bewertungen

- Earthbag House For HaitiDokument22 SeitenEarthbag House For HaitiRaymond KatabaziNoch keine Bewertungen

- Overview of Pathophysiology of Hypoxemia and HypoxiaDokument15 SeitenOverview of Pathophysiology of Hypoxemia and HypoxiaMARY ANN CAGATANNoch keine Bewertungen

- VGHV NBV GH fc7fvbn BN NGCJHGDokument16 SeitenVGHV NBV GH fc7fvbn BN NGCJHGRahul GNoch keine Bewertungen

- Hydraulic Power Steering System Design PDFDokument16 SeitenHydraulic Power Steering System Design PDFAdrianBirsan100% (1)

- 3 Valvula Modular Serie 01Dokument42 Seiten3 Valvula Modular Serie 01Leandro AguiarNoch keine Bewertungen

- Inkontinensia Urin: Dr. Adhi Permana, SPPDDokument35 SeitenInkontinensia Urin: Dr. Adhi Permana, SPPDTiara KhairinaNoch keine Bewertungen

- Eng ThreePDokument192 SeitenEng ThreePMr Ahmed AbdallahNoch keine Bewertungen