Beruflich Dokumente

Kultur Dokumente

Form No.16 (See Rule 31 (1) (A) )

Hochgeladen von

Akash ShedgeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Form No.16 (See Rule 31 (1) (A) )

Hochgeladen von

Akash ShedgeCopyright:

Verfügbare Formate

FORM NO.

16

[See Rule 31(1) (a) ]

CERTIFICATE UNDER SECTION 203 OF THE INCOME-TAX ACT, 1961 FOR

TAX DEDUCTED AT SOURCE FROM INCOME CHARGEABLE UNDER THE HEAD “SALARIES”

Name and Address of the Employer Name and Designation of the Employee

PAN NO. of the Dedicator TAN NO. of the Dedicator PAN NO. of the Employee

Acknowledgement Nos of all quarterly statement of TDS under sub- PERIOD

section (3) of Section 200 as provided by TIN Facilitation Centre of

NSDL web-site From To

Quarter Acknowledgement No.

Assessment Year

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

1. Gross Salary

(a) Salary as per provisions contained in section 17(1) Rs…………………

(b) Value of perquisites under section 17(2) (As per Form

No. 12BA, Wherever applicable) Rs…………………

(c) Profits in lieu of salary under section 17(3) (As per Rs…………………

Form No. 12BA, Wherever applicable) Rs………………...

(d) Total

2. LESS: Allowance to the extent exempt under section 10

Allowance Rs. Rs………………… Rs…………………

Rs………………… Rs…………………

3. BALANCE (1-2) Rs… ……………..

4. DEDUCTIONS:

(a) Entertainment Allowance Rs. __________

Rs…………………

(b) Tax on Employment (PT) RS. ____________

5. Aggregate of 4 (a) to (b)

6. Income chargeable under the head “Salaries” (3-5) Rs………………… Rs………………….

7. Add: Any other income reported by the employee

Rs…………………

Rs…………………

Rs… ………………

8. Gross Total Income (6+7)

9. Deduction under VI-A

(A) Section 80C, 80CCC and 80CCD Gross Amount Deductible

a) Section 80C

Rs. ………………. Amount

(i) GROUP INSURANCE

(ii) LIC OF INDIA Rs. ……………….

(iii) KGID Rs. ………………

(iv) GENERAL PROVIDENT FOUND Rs. ………………..

(v) HOUSING LOAN PRINCIPAL Rs…………………..

(vi) CHILDRENS EDUCATION TUTION FEE Rs… ……………….

Rs… ……………….

(b) Section 80 CCC(Medical Insurance)

Rs… ………………

Rs………………….

(c) Section 80 CCD Rs. ………….………

Rs…………………

zÉÆw²æà Rs……………………

Note: 1. Aggregate amount deductible under section 80c shall not exceed one lakh rupees.

2. Aggregate amount deductible under the three sections, i.e., 80C, 80CCC and 80CCD shall not exceed one lakh rupees

(B) Other sections(for e.g., 80E, 80G etc.,)

a) Section…………………………………….. Rs………….. Rs………….. Rs…………..

b) Section…………………………………….. Rs………….. Rs………….. Rs…………..

c) Section…………………………………….. Rs………….. Rs………….. Rs…………..

d) Section…………………………………….. Rs………….. Rs………….. Rs…………..

e) Section………………………………....... Rs . …………. Rs…………..

10. Aggregate of deductible amount under Chapter VI-A Rs…………….. Rs………….. Rs…………..

11. Total Income (8-10)

Rs…………..

12. Tax on Total Income

13. Surcharge (on tax computed S.No.12) Rs………...

14. Education Cess @ 2% on (tax at S.No.12 plus Surcharge at

Sl.No.13) Rs…………

15. Tax Payable (12+13+14)

16. Relief under section 89 (Attach details)

17. Tax payable (15-16) Rs…………..

18. Less: (a) Tax deducted at source under section 192(1) (b)

Tax paid by employer on behalf of the employee under Rs………......

section 192(1A) on perquisites under section 17(2) Rs…………..

Rs…………..

19. Tax payable/refundable(17-18) Rs………….. Rs…………..

Rs…………..

Rs…………..

Rs…

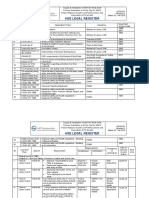

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT

Date on

Education Transfer

TDS Surcharge Total tax Cheque /DD BSR Code of which tax

Sl. No Cess Voucher/Chelan

Rs. Rs. deposited Rs. No. (if any) Bank Branch deposited

Rs. Identification No.

(dd/mm/yy)

1 NIL NIL NIL NIL NIL NIL NIL NIL

I…………………………………………………………...………… Son of………………………………………………………………………………………

Working in the capacity of………..………………………….……………………(designation) do hereby certify that a sum of

Rs……………………….[Rupees………………………………..…………….…………………………………….………..(in words)] has been

deducted at source and paid to the credit of the Central Government. I further certify that the information

given above Is true and correct based on the book of account, documents and other available records.

……………………………………………………………………

Place:…………………………… Signature of the person responsible for deduction of tax

Date:……………………………. Full Name……………………………………………………

Designation…………………………………………………

zÉÆw²æÃ

Das könnte Ihnen auch gefallen

- Form 16aaDokument2 SeitenForm 16aaJayNoch keine Bewertungen

- Name and Address of The Employer Name and Designation of The EmployeeDokument4 SeitenName and Address of The Employer Name and Designation of The Employeeyogesh.b.lokhande9022Noch keine Bewertungen

- Form16 Applicable From 01.04Dokument3 SeitenForm16 Applicable From 01.04Vishaal TalwarNoch keine Bewertungen

- SALARY CERTIFICATE - MINISTRY OF FINANCE's Notification On FormatsDokument7 SeitenSALARY CERTIFICATE - MINISTRY OF FINANCE's Notification On FormatsShabeer UppotungalNoch keine Bewertungen

- Form No 16Dokument3 SeitenForm No 16thapalNoch keine Bewertungen

- AssignmentDokument5 SeitenAssignmentSuyash PrakashNoch keine Bewertungen

- Details of Salary Paid and Any Other Income and Tax DeductedDokument2 SeitenDetails of Salary Paid and Any Other Income and Tax DeductedPapar Rao GNoch keine Bewertungen

- AssignmentDokument5 SeitenAssignmentSuyash PrakashNoch keine Bewertungen

- Form No 16 - Ay0607Dokument4 SeitenForm No 16 - Ay0607api-3705645100% (1)

- (See Rule 31 (1) (A) ) : Form No. 16Dokument8 Seiten(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNoch keine Bewertungen

- Form No. 16: (See Rule 31 (1) (A) )Dokument5 SeitenForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNoch keine Bewertungen

- Form No 16Dokument2 SeitenForm No 16Anonymous 7KR8DpqNoch keine Bewertungen

- Form 16 Excel FormatDokument12 SeitenForm 16 Excel Formatankeet3Noch keine Bewertungen

- Form No.16 Aa-1Dokument2 SeitenForm No.16 Aa-1Vishnu Vardhan ANoch keine Bewertungen

- Tds 16 NDokument3 SeitenTds 16 Nssanju_bhatNoch keine Bewertungen

- Form 16 in Excel Format For AY 2020 21Dokument8 SeitenForm 16 in Excel Format For AY 2020 21Vikas PattnaikNoch keine Bewertungen

- Certified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Dokument4 SeitenCertified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Aravind ReddyNoch keine Bewertungen

- Form 16Dokument6 SeitenForm 16balaramappana2Noch keine Bewertungen

- 2018-19 - One97 Communications LTDDokument2 Seiten2018-19 - One97 Communications LTDBALBINDER MALLNoch keine Bewertungen

- Form 16Dokument3 SeitenForm 16Apte SatishNoch keine Bewertungen

- Calculation Sheet F.Y. 2022 - 23 NewDokument1 SeiteCalculation Sheet F.Y. 2022 - 23 Newmandalsomithmandal1986Noch keine Bewertungen

- Form 16 Part A: WWW - Taxguru.inDokument10 SeitenForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNoch keine Bewertungen

- Form16Rpt 169567-1Dokument3 SeitenForm16Rpt 169567-1ishalshamnasNoch keine Bewertungen

- Anb Form 16 ITR (Saral II) 2010 ModelDokument7 SeitenAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967Noch keine Bewertungen

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Dokument3 SeitenLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461Noch keine Bewertungen

- Form 16Dokument3 SeitenForm 16Vikas PandyaNoch keine Bewertungen

- Form 16Dokument2 SeitenForm 16Joyal JoseNoch keine Bewertungen

- Form No 16 in Excel With FormuleDokument3 SeitenForm No 16 in Excel With FormuleSayal Ji33% (6)

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDokument4 SeitenForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNoch keine Bewertungen

- Form No 16Dokument4 SeitenForm No 16Md ZhidNoch keine Bewertungen

- Time Allowed: 3 Hours Maximum Mark: 100: Executive ProgrammeDokument18 SeitenTime Allowed: 3 Hours Maximum Mark: 100: Executive ProgrammeDevendra AryaNoch keine Bewertungen

- Form 16 Part A: WWW - Taxguru.inDokument5 SeitenForm 16 Part A: WWW - Taxguru.inDarshan PatelNoch keine Bewertungen

- Tech Mahindra Business Services Limited: Tax Return E-Filing ServiceDokument5 SeitenTech Mahindra Business Services Limited: Tax Return E-Filing ServiceDavidroy MunimNoch keine Bewertungen

- None - FORM IV - KA - PWDokument2 SeitenNone - FORM IV - KA - PWKishore KanthrajNoch keine Bewertungen

- GAR44 EditedDokument1 SeiteGAR44 EditedKapil SoodNoch keine Bewertungen

- 317 Form16 (2005 06)Dokument6 Seiten317 Form16 (2005 06)sachin584Noch keine Bewertungen

- New Form 16 AY 11 12Dokument5 SeitenNew Form 16 AY 11 12RMD Financial ServicesNoch keine Bewertungen

- 38 - 16 & I6a (A.y.2009-10) With MarginalDokument4 Seiten38 - 16 & I6a (A.y.2009-10) With Marginalrajudutta11Noch keine Bewertungen

- Form 16 TDS CertificateDokument4 SeitenForm 16 TDS Certificateqwerty9999499949Noch keine Bewertungen

- Form 16Dokument2 SeitenForm 16jwadje1Noch keine Bewertungen

- G Vittal 16 FrontDokument1 SeiteG Vittal 16 FrontSRINIVAS MNoch keine Bewertungen

- Form 16Dokument6 SeitenForm 16Ravi DesaiNoch keine Bewertungen

- Form No 16 (By Sagar Goyal)Dokument3 SeitenForm No 16 (By Sagar Goyal)sagarNoch keine Bewertungen

- Master File of CalculationDokument4 SeitenMaster File of Calculationjitendriyasahoo994Noch keine Bewertungen

- UntitledDokument1 SeiteUntitledTarini prasad DashNoch keine Bewertungen

- The Fallout of War: The Regional Consequences of the Conflict in SyriaVon EverandThe Fallout of War: The Regional Consequences of the Conflict in SyriaNoch keine Bewertungen

- Institutional Investment in Infrastructure in Emerging Markets and Developing EconomiesVon EverandInstitutional Investment in Infrastructure in Emerging Markets and Developing EconomiesNoch keine Bewertungen

- Middle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesVon EverandMiddle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesNoch keine Bewertungen

- Container Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortVon EverandContainer Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortNoch keine Bewertungen

- Urban China: Toward Efficient, Inclusive, and Sustainable UrbanizationVon EverandUrban China: Toward Efficient, Inclusive, and Sustainable UrbanizationNoch keine Bewertungen

- Associate Business Process Consultant - S - 4HANA Finance (Location - Gurgaon)Dokument4 SeitenAssociate Business Process Consultant - S - 4HANA Finance (Location - Gurgaon)Akash ShedgeNoch keine Bewertungen

- Bio PitoDokument2 SeitenBio PitoAkash ShedgeNoch keine Bewertungen

- 2 PDFDokument11 Seiten2 PDFAkash ShedgeNoch keine Bewertungen

- 2 PDFDokument11 Seiten2 PDFAkash ShedgeNoch keine Bewertungen

- Expectancy Theory - Priyanka ChaudharyDokument9 SeitenExpectancy Theory - Priyanka Chaudharynajihah radziNoch keine Bewertungen

- Work Monitor Malaysia 2024 ReportDokument20 SeitenWork Monitor Malaysia 2024 ReportDesmond AnthonyNoch keine Bewertungen

- OBRA and State Line ServicesDokument4 SeitenOBRA and State Line ServicesIndiana Family to FamilyNoch keine Bewertungen

- Iqn HRM Book 2016Dokument168 SeitenIqn HRM Book 2016David Havens100% (3)

- Recruitment and Selection M1Dokument37 SeitenRecruitment and Selection M1cindyNoch keine Bewertungen

- Managerial Economics BookDokument345 SeitenManagerial Economics BookBabasab Patil (Karrisatte)Noch keine Bewertungen

- Employee Leave PolicyDokument3 SeitenEmployee Leave Policyladdu30Noch keine Bewertungen

- The Acceptability of Mooc Certificates in The Workplace: Christina Banks and Edward MeinertDokument4 SeitenThe Acceptability of Mooc Certificates in The Workplace: Christina Banks and Edward MeinertDebdeep GhoshNoch keine Bewertungen

- Cambridge O Level: Business Studies 7115/21 May/June 2022Dokument18 SeitenCambridge O Level: Business Studies 7115/21 May/June 2022Tinevimbo ChimusuwoNoch keine Bewertungen

- Assignment 4 GlobalizationDokument2 SeitenAssignment 4 GlobalizationSheena ChanNoch keine Bewertungen

- Freelancer Contract Format RitikDokument5 SeitenFreelancer Contract Format RitikMukesh DeviNoch keine Bewertungen

- Universal Textile Mills Vs NLRCDokument4 SeitenUniversal Textile Mills Vs NLRCMabelle ArellanoNoch keine Bewertungen

- Puja Rahangdale HR 16Dokument2 SeitenPuja Rahangdale HR 16Luis VivasNoch keine Bewertungen

- Advisory No - 006-12 (PDOS For HSWs Bound For Saudi Arabia)Dokument1 SeiteAdvisory No - 006-12 (PDOS For HSWs Bound For Saudi Arabia)Franchise AlienNoch keine Bewertungen

- Bhoopendra Gwalior Offer LetterDokument7 SeitenBhoopendra Gwalior Offer LetterBhuvan BhargavaNoch keine Bewertungen

- MGT420Dokument41 SeitenMGT420Mujahid KadirNoch keine Bewertungen

- What Is International Human Trafficking?: Definitions and StatisticsDokument25 SeitenWhat Is International Human Trafficking?: Definitions and StatisticsSuvedhya ReddyNoch keine Bewertungen

- Annual Performance Review Process Procedure: Goal Detailed ProceduresDokument4 SeitenAnnual Performance Review Process Procedure: Goal Detailed ProceduresRachna TomarNoch keine Bewertungen

- Digest No 112 Labor Herrerra Vs ST Ouis ScholasticaDokument3 SeitenDigest No 112 Labor Herrerra Vs ST Ouis Scholasticaejusdem generisNoch keine Bewertungen

- Study Guide For Labor Law Review 2013-14Dokument21 SeitenStudy Guide For Labor Law Review 2013-14Bikoy EstoqueNoch keine Bewertungen

- STATUTORY BENEFITS - WE SHOULD BE PROACTIVE - Dato'Seri DR T DevarajDokument26 SeitenSTATUTORY BENEFITS - WE SHOULD BE PROACTIVE - Dato'Seri DR T Devarajmalaysianhospicecouncil6240100% (2)

- Entrepreneurial MobilityDokument6 SeitenEntrepreneurial MobilityAbhishek Vanigotha100% (5)

- TN MIN WAGES REVISION EFFECTIVE 100719Dokument3 SeitenTN MIN WAGES REVISION EFFECTIVE 100719GHANNESHNoch keine Bewertungen

- 17.3 - The New DealDokument2 Seiten17.3 - The New DealPablo DavidNoch keine Bewertungen

- Legal Register Evaluation Feb '20Dokument61 SeitenLegal Register Evaluation Feb '20Priyanka J100% (6)

- Resume Format For Freshers - Sample Resume For Freshers - Freshers CV Format - BiodataDokument6 SeitenResume Format For Freshers - Sample Resume For Freshers - Freshers CV Format - BiodataDiwakar Pratap SinghNoch keine Bewertungen

- Education and Training in The Hospitality IndustryDokument31 SeitenEducation and Training in The Hospitality Industryaireenclores0% (1)

- ESPRD-AEP-FORM-Revised Application Form-20210422-v2.6-MECODokument3 SeitenESPRD-AEP-FORM-Revised Application Form-20210422-v2.6-MECOrec serranoNoch keine Bewertungen

- 2019MCNo.4 Sustainability Reporting Guidelines Annex A Reporting TemplateDokument26 Seiten2019MCNo.4 Sustainability Reporting Guidelines Annex A Reporting TemplateThuong PhanNoch keine Bewertungen

- UAP CaseDokument6 SeitenUAP CaseMary Nove PatanganNoch keine Bewertungen