Beruflich Dokumente

Kultur Dokumente

State IncomeTax

Hochgeladen von

Mark RanzenbergerCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

State IncomeTax

Hochgeladen von

Mark RanzenbergerCopyright:

Verfügbare Formate

Case 1:05-cv-10296-TLL -CEB Document 271-7 Filed 11/09/10 Page 1 of 5

MEMORANDUM OF AGREEMENT

REGARDING INCOME-TAX RESOLUTION

BETWEEN

THE STATE OF MICHIGAN

AND

SAGINAW CHIPPEWA INDIAN TRIBE OF MICHIGAN

Introduction

This agreement (the “Agreement”) is between the State of Michigan (“State”) and the

Saginaw Chippewa Indian Tribe of Michigan (“Tribe”) (collectively, the “Parties”).

The State of Michigan (“State”) is a state within the United States of America, possessing

the full sovereign powers of a state government;

The Tribe is a federally recognized Indian tribe possessing inherent powers of self-

government, and is authorized to enter into this Agreement pursuant to Articles VI(1)(a),

(i), (j), (n), and (o) of its Amended Constitution and By-laws (approved Nov. 4, 1986).

Recitals

The Tribe and the State have determined, on a government-to-government basis, to enter

into this Memorandum of Agreement as part of an overall settlement of the above

referenced litigation more particularly described in the Order for Judgment entered by the

United States District Court for the Eastern District of Michigan in Saginaw Chippewa

Indian Tribe of Michigan v. Granholm, et al., Case No. 05-10296-BC (the “Court

Order”).

Accordingly, the Parties agree as follows:

Terms

1. Definitions

As used in this Agreement:

A. “Isabella Indian Reservation” or “Reservation” has the meaning specified in the

Court Order.

B. “Tribal Member” means an enrolled member of the Tribe.

C. “Income-Tax Liability” or “Liability” means any outstanding assessment, claim,

or charge made by the State regarding Michigan State income taxes, including but

not limited to State enforcement or collections notices or efforts regarding such

assessment, claim, or charge.

Exhibit E 1 of 5 SIGNATURE COPY

Case 1:05-cv-10296-TLL -CEB Document 271-7 Filed 11/09/10 Page 2 of 5

2. Scope of Agreement

A. The State will resolve under the terms described herein any outstanding Michigan

Income-Tax Liability, including those in the collection phase of the enforcement,

in those Tribal-Member cases where:

i. The Income-Tax Liability is solely dependent upon the boundaries of the

Isabella Reservation as set out in the Court Order; and

ii. The Liability also meets the exemption criteria established under federal

Indian doctrine principles.

B. In each of the cases identified in Paragraph 2(A), the following information must

be supplied to the State within 90 days of the entry of the Court Order:

i. With regards to each Liability, either the Tribe or the affected Tribal

Member must communicate the following information, where available, to

the Tribal Affairs Office of the State's Department of Treasury (“Tribal

Affairs”):

a. The Income-Tax Liability (i.e., tax year, a description of the

underlying issue);

b. The relevant State contact’s name and division or unit;

c. The Tribal Member’s name;

d. The Tribal Member’s address; and

e. The Tribal Member’s Social Security number.

ii. Where the specific Income-Tax Liability and relevant State contact

information described in Paragraph 2(B)(i)(a) and (b) is unknown or

unavailable:

a. The Tribe or Tribal Member must nevertheless provide the

State with the name, address, and Social Security number of

the Tribal Member; and

b. The State will, in good faith, make its best effort to identify the

Liability in question and resolve the issue. Where it cannot do

so, the State will have met its responsibility as outlined in this

agreement. Where an outstanding tax assessment exists, the

State will be able to identify the Liability and will resolve the

issue where only the name, address, and Social Security

number of the Tribal Member has been provided.

Exhibit E 2 of 5 SIGNATURE COPY

Case 1:05-cv-10296-TLL -CEB Document 271-7 Filed 11/09/10 Page 3 of 5

C. For those Income-Tax Liabilities addressed by this Agreement that were assessed

before November 21, 2005, the date that the underlying lawsuit was filed, the

State must resolve the Liability by dismissing or otherwise stopping collection of

the assessed Liability.

D. For those Income-Tax Liabilities addressed by this Agreement that were assessed

on or after November 21, 2005, the State must resolve the Liability by dismissing

or otherwise stopping collection of the assessed Liability, and refunding to the

Tribal Member any Tribal Member funds that the State acquired through its

enforcement actions or collection efforts and subsequently applied to the Income-

Tax-Liability assessment. To receive a refund under this Paragraph, the Tribe or

the Tribal Member must submit a refund request to Tribal Affairs within 90 days

of entry of the Court Order.

E. The State, will not resolve any Income-Tax Liability, or refund any amount

identified under Paragraph 2(D), pursuant to the terms of this Agreement, where

the information or refund request is submitted beyond the 90-day timeframe

identified under Paragraph 2(B).

3. Retention of Legal Rights

This Agreement may not be construed as a waiver of either Party’s sovereign

immunity, except to the extent that both Parties waive their sovereign immunity to the

limited extent necessary to effectuate Paragraph 7 of this Agreement. These limited

waivers of sovereign immunity do not waive the immunity of any official, employee,

or agent of either Party.

4. Amendments

This Agreement may only be amended by a written instrument signed by the duly

authorized representative of each Party. The Parties do not require Court approval or

other filing to amend the Agreement under this provision.

5. Severability

The provisions of this Agreement are severable. If any provision of this Agreement is

held invalid or unenforceable, the remainder of the Agreement remains in effect,

unless terminated as provided for in this Agreement. However, if any provision of

this Agreement is severed from the Agreement, then the Parties must promptly meet

and negotiate in good faith to achieve the intended purpose of the severed provision

in a manner that is valid and enforceable under applicable law.

6. Relationship to Other Agreements

A. This Agreement constitutes the entire Agreement between the Parties.

B. If this Agreement conflicts with the Court Order, the terms of this Agreement

governs.

Exhibit E 3 of 5 SIGNATURE COPY

Case 1:05-cv-10296-TLL -CEB Document 271-7 Filed 11/09/10 Page 4 of 5

7. Dispute Resolution

The United States District Court for the Eastern District of Michigan retains

jurisdiction to enforce this Agreement in accordance with the Court Order.

8. Notices

Written notices required or permitted to be given under this Agreement are sufficient

if they are sent by registered or certified mail, or by other means mutually acceptable

to the Parties.

In the case of the State, notices must be sent to:

Michigan State Treasurer

Attn: Tribal Liaison

First Floor, Austin Building

Lansing, MI 48922

In the case of the Tribe, notices must be sent to:

Tribal Chief

Saginaw Chippewa Indian Tribe

7070 East Broadway

Mt. Pleasant, MI 48858

General Counsel

Legal Department

Saginaw Chippewa Indian Tribe

7070 East Broadway

Mt. Pleasant, MI 48858

9. Counterparts

This Agreement may be executed in several counterparts, each of which is an

original, but all of which together constitute a single instrument.

10. Authority

The undersigned represent that they are authorized to execute this Agreement on

behalf of the Tribe and State, respectively.

11. Preparation of Agreement

This Agreement was drafted and entered into after careful review and upon the advice

of competent counsel. It must be construed as if it were mutually drafted, and may

not be construed more strongly for or against either Party.

Exhibit E 4 of 5 SIGNATURE COPY

Case 1:05-cv-10296-TLL -CEB Document 271-7 Filed 11/09/10 Page 5 of 5

12. Effective Date

This Agreement is effective on the date that the Court Order is signed by the Court,

provided that the Court enters the Court Order as it was approved by the State and

Tribe. Changes to the form of the Court Order (e.g., pagination, fonts, margins, etc.)

do not affect the effective date of this Agreement, but this Agreement is not effective

and does not bind the parties if the language of the Court Order is not identical to the

language approved by the State and Tribe.

SAGINAW CHIPPEWA INDIAN STATE OF MICHIGAN

TRIBE OF MICHIGAN

s/ Dennis V. Kequom s/ Robert J. Kleine

Dennis Kequom, Sr. Robert J. Kleine

Tribal Chief Michigan State Treasurer

11/9/10 10 – 9 – 10

Date signed Date signed

The United States District Court for the Eastern District of Michigan entered the Order

for Judgment in Case No. 05-10296 on _____________________, 2010.

Exhibit E 5 of 5 SIGNATURE COPY

Das könnte Ihnen auch gefallen

- State TaxDokument103 SeitenState TaxMark RanzenbergerNoch keine Bewertungen

- City LocalRegsDokument7 SeitenCity LocalRegsMark RanzenbergerNoch keine Bewertungen

- Separation Agreement Between Humboldt County and Auditor-Controller Karen Paz DomingezDokument3 SeitenSeparation Agreement Between Humboldt County and Auditor-Controller Karen Paz DomingezRuth SchneiderNoch keine Bewertungen

- Settlement AgreementDokument12 SeitenSettlement AgreementYohana AriNoch keine Bewertungen

- Filed: Patrick FisherDokument10 SeitenFiled: Patrick FisherScribd Government DocsNoch keine Bewertungen

- rd1980-21 2-2013Dokument4 Seitenrd1980-21 2-2013api-196037134Noch keine Bewertungen

- John Dalaly Guilty PleaDokument15 SeitenJohn Dalaly Guilty PleaMLive.comNoch keine Bewertungen

- Peace Corps MS 775 Settlement of Claims Arising Abroad - January 2013Dokument6 SeitenPeace Corps MS 775 Settlement of Claims Arising Abroad - January 2013Accessible Journal Media: Peace Corps DocumentsNoch keine Bewertungen

- Vincent Brown Guilty PleaDokument14 SeitenVincent Brown Guilty PleaMLive.comNoch keine Bewertungen

- Ve - Settlementagreement 0Dokument31 SeitenVe - Settlementagreement 0perfectspores23Noch keine Bewertungen

- Confidential Settlement Agreement and General Release of All ClaimsDokument11 SeitenConfidential Settlement Agreement and General Release of All ClaimsAdam Justino50% (2)

- Money Order M Sisco Alaska Power3Dokument2 SeitenMoney Order M Sisco Alaska Power3Micheal90% (10)

- 2 REDEMPTION TENDER OF PAYMENT OFFERING Verizon Original Sample??Dokument10 Seiten2 REDEMPTION TENDER OF PAYMENT OFFERING Verizon Original Sample??D Moor100% (4)

- DPX SettlementDokument5 SeitenDPX SettlementAllie GrossNoch keine Bewertungen

- NoticeletterDokument4 SeitenNoticeletterRick Macosky100% (3)

- Real Estate Mortgage AgreementDokument3 SeitenReal Estate Mortgage AgreementKen BaxNoch keine Bewertungen

- Cohab Draft Sara ZahawiDokument8 SeitenCohab Draft Sara Zahawiapi-740333422Noch keine Bewertungen

- United States Court of Appeals, Fifth CircuitDokument7 SeitenUnited States Court of Appeals, Fifth CircuitScribd Government DocsNoch keine Bewertungen

- Account Opening Agreement And/or Loan Arrangement AgreementDokument15 SeitenAccount Opening Agreement And/or Loan Arrangement AgreementfamaraNoch keine Bewertungen

- United States Court of Appeals, Federal CircuitDokument12 SeitenUnited States Court of Appeals, Federal CircuitScribd Government DocsNoch keine Bewertungen

- Proof of Claim - IRS Form 4490Dokument6 SeitenProof of Claim - IRS Form 4490Wilde Child88% (16)

- Jul 3 0 Zofz: Received Time Aug. 7. 8:54AMDokument5 SeitenJul 3 0 Zofz: Received Time Aug. 7. 8:54AMpunktlichNoch keine Bewertungen

- Reconciliation AgreementDokument12 SeitenReconciliation AgreementCarla TaylorNoch keine Bewertungen

- Commissioner v. Lester, 366 U.S. 299 (1961)Dokument6 SeitenCommissioner v. Lester, 366 U.S. 299 (1961)Scribd Government DocsNoch keine Bewertungen

- Letter of AgreementDokument2 SeitenLetter of Agreementjuliadouglas12121313Noch keine Bewertungen

- Antoinette L. Holahan v. Commissioner of Internal Revenue, 222 F.2d 82, 2d Cir. (1955)Dokument4 SeitenAntoinette L. Holahan v. Commissioner of Internal Revenue, 222 F.2d 82, 2d Cir. (1955)Scribd Government DocsNoch keine Bewertungen

- Elizabeth H. Bardwell v. Commissioner of Internal Revenue, 318 F.2d 786, 10th Cir. (1963)Dokument5 SeitenElizabeth H. Bardwell v. Commissioner of Internal Revenue, 318 F.2d 786, 10th Cir. (1963)Scribd Government DocsNoch keine Bewertungen

- Justin H. Kimball v. Commissioner of Internal Revenue, 853 F.2d 120, 2d Cir. (1988)Dokument7 SeitenJustin H. Kimball v. Commissioner of Internal Revenue, 853 F.2d 120, 2d Cir. (1988)Scribd Government DocsNoch keine Bewertungen

- United States v. Union Central Life Ins. Co., 368 U.S. 291 (1961)Dokument5 SeitenUnited States v. Union Central Life Ins. Co., 368 U.S. 291 (1961)Scribd Government DocsNoch keine Bewertungen

- Tax Levy, 1099, 1099c, 1096 +2193946+jamaica Customs AgencyDokument6 SeitenTax Levy, 1099, 1099c, 1096 +2193946+jamaica Customs Agencyshasha ann beyNoch keine Bewertungen

- 28 Usc 3002 Federal Debt Collection DefinitionsDokument10 Seiten28 Usc 3002 Federal Debt Collection Definitionsruralkiller100% (1)

- Prenuptial Agreement For Mutual Respect Entered Into in - On The Date ofDokument10 SeitenPrenuptial Agreement For Mutual Respect Entered Into in - On The Date ofKiaOraTorahNoch keine Bewertungen

- In Re: Curtis R. Catron, Debtor. v. Curtis R. Catron, Nancy L. Catron, 43 F.3d 1465, 4th Cir. (1994)Dokument8 SeitenIn Re: Curtis R. Catron, Debtor. v. Curtis R. Catron, Nancy L. Catron, 43 F.3d 1465, 4th Cir. (1994)Scribd Government DocsNoch keine Bewertungen

- Memorandum of Agreement - JL and CoFounders - v4Dokument18 SeitenMemorandum of Agreement - JL and CoFounders - v4Rafael JuicoNoch keine Bewertungen

- Hobbit ArbitrationDokument63 SeitenHobbit ArbitrationEriq GardnerNoch keine Bewertungen

- Proof of Claim by First Community BankDokument31 SeitenProof of Claim by First Community BankbdcoryellNoch keine Bewertungen

- Escambia County's Motion To Enforce SettlementDokument10 SeitenEscambia County's Motion To Enforce SettlementWEAR ABC 3Noch keine Bewertungen

- Peticion Quiebra TelexfreeDokument19 SeitenPeticion Quiebra TelexfreelordmiguelNoch keine Bewertungen

- Benjamin and Alice Fox v. United States, 510 F.2d 1330, 3rd Cir. (1975)Dokument9 SeitenBenjamin and Alice Fox v. United States, 510 F.2d 1330, 3rd Cir. (1975)Scribd Government DocsNoch keine Bewertungen

- Investors Complaint Against Northern Beef Packers in Bankruptcy ProceedingsDokument164 SeitenInvestors Complaint Against Northern Beef Packers in Bankruptcy ProceedingsJoeNoch keine Bewertungen

- Loan Agreement and Promissory NoteDokument5 SeitenLoan Agreement and Promissory Notereginald_sigua100% (1)

- Equitable RemittanceDokument10 SeitenEquitable RemittanceSamantha Fenter92% (62)

- Loan Agreement and Promissory NoteDokument4 SeitenLoan Agreement and Promissory NoteSGR 2119.Noch keine Bewertungen

- United States Court of Appeals Third CircuitDokument5 SeitenUnited States Court of Appeals Third CircuitScribd Government DocsNoch keine Bewertungen

- Bond Demand Proof of Bond Agreement With Child Support AgencyDokument6 SeitenBond Demand Proof of Bond Agreement With Child Support AgencyEric Lathrop100% (1)

- United States Court of Appeals: For The First CircuitDokument16 SeitenUnited States Court of Appeals: For The First CircuitScribd Government DocsNoch keine Bewertungen

- Kay M. Offutt v. Commissioner of Internal Revenue, 276 F.2d 471, 4th Cir. (1960)Dokument7 SeitenKay M. Offutt v. Commissioner of Internal Revenue, 276 F.2d 471, 4th Cir. (1960)Scribd Government DocsNoch keine Bewertungen

- George Papadopoulos Plea AgreementDokument9 SeitenGeorge Papadopoulos Plea AgreementNational Content Desk100% (3)

- Trina Health Case Gilbert Plea AgreementDokument15 SeitenTrina Health Case Gilbert Plea AgreementMike CasonNoch keine Bewertungen

- United States Court of Appeals: For The First CircuitDokument44 SeitenUnited States Court of Appeals: For The First CircuitScribd Government DocsNoch keine Bewertungen

- Law School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesVon EverandLaw School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesNoch keine Bewertungen

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionVon EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNoch keine Bewertungen

- The Self-Help Guide to the Law: Contracts and Sales Agreements for Non-Lawyers: Guide for Non-Lawyers, #5Von EverandThe Self-Help Guide to the Law: Contracts and Sales Agreements for Non-Lawyers: Guide for Non-Lawyers, #5Noch keine Bewertungen

- Chapter 13 Bankruptcy in the Western District of TennesseeVon EverandChapter 13 Bankruptcy in the Western District of TennesseeNoch keine Bewertungen

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemVon EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNoch keine Bewertungen

- Isabella Primary Voters Guide 2012Dokument12 SeitenIsabella Primary Voters Guide 2012Mark RanzenbergerNoch keine Bewertungen

- National Federation of Independent Business v. SebeliusDokument193 SeitenNational Federation of Independent Business v. SebeliusCasey SeilerNoch keine Bewertungen

- November UnemploymentDokument1 SeiteNovember UnemploymentMark RanzenbergerNoch keine Bewertungen

- Union Township Water NoticeDokument1 SeiteUnion Township Water NoticeMark RanzenbergerNoch keine Bewertungen

- 2011-12 MidMichigan MEAPDokument2 Seiten2011-12 MidMichigan MEAPMark RanzenbergerNoch keine Bewertungen

- Bennett Assault ComplaintDokument3 SeitenBennett Assault ComplaintMark RanzenbergerNoch keine Bewertungen

- Primary Voter Guide 2012Dokument13 SeitenPrimary Voter Guide 2012Mark RanzenbergerNoch keine Bewertungen

- Motion of No ConfidenceDokument1 SeiteMotion of No ConfidenceMark RanzenbergerNoch keine Bewertungen

- Greater MT Pleasant Area Non MotorizedDokument339 SeitenGreater MT Pleasant Area Non MotorizedMark RanzenbergerNoch keine Bewertungen

- Michigan's 2011 Lowest-Achieving SchoolsDokument4 SeitenMichigan's 2011 Lowest-Achieving SchoolsMark RanzenbergerNoch keine Bewertungen

- Oct 2011 UnemploymentDokument1 SeiteOct 2011 UnemploymentMark RanzenbergerNoch keine Bewertungen

- September UnemploymentDokument1 SeiteSeptember UnemploymentMark RanzenbergerNoch keine Bewertungen

- CMU-FA Fact Finder Report 11-01-2011Dokument8 SeitenCMU-FA Fact Finder Report 11-01-2011Mark RanzenbergerNoch keine Bewertungen

- LEA Perricone June 24 SurveyDokument6 SeitenLEA Perricone June 24 SurveyMark RanzenbergerNoch keine Bewertungen

- Unemployment Analysis - November 2010Dokument1 SeiteUnemployment Analysis - November 2010Mark RanzenbergerNoch keine Bewertungen

- Compassionate Apothecary DecisionDokument17 SeitenCompassionate Apothecary DecisionMark RanzenbergerNoch keine Bewertungen

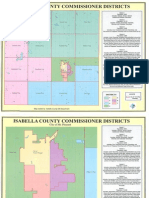

- The 2012 Redistricting PlansDokument4 SeitenThe 2012 Redistricting PlansMark RanzenbergerNoch keine Bewertungen

- Report On Officer-Involved ShootingDokument5 SeitenReport On Officer-Involved ShootingMark RanzenbergerNoch keine Bewertungen

- Mid Michigan Labor MarketDokument1 SeiteMid Michigan Labor MarketMark RanzenbergerNoch keine Bewertungen

- Midland County Medical Marijuana OpinionDokument27 SeitenMidland County Medical Marijuana OpinionMark RanzenbergerNoch keine Bewertungen

- Isabella County 2011 Reapportionment PlanDokument2 SeitenIsabella County 2011 Reapportionment PlanMark RanzenbergerNoch keine Bewertungen

- Mt. Pleasant Schools Superintendent ForumsDokument1 SeiteMt. Pleasant Schools Superintendent ForumsMark RanzenbergerNoch keine Bewertungen

- Bland Summary JudgmentDokument15 SeitenBland Summary JudgmentMark RanzenbergerNoch keine Bewertungen

- El Sawi ResignationDokument11 SeitenEl Sawi ResignationMark RanzenbergerNoch keine Bewertungen

- Compassionate Apothecary OpinionDokument8 SeitenCompassionate Apothecary OpinionMark RanzenbergerNoch keine Bewertungen

- The CMU Stadium Holiday Inn ProposalDokument10 SeitenThe CMU Stadium Holiday Inn ProposalMark RanzenbergerNoch keine Bewertungen

- Union Township Draft Master Plan, 20Dokument118 SeitenUnion Township Draft Master Plan, 20Mark RanzenbergerNoch keine Bewertungen

- Unemployment Analysis - November 2010Dokument1 SeiteUnemployment Analysis - November 2010Mark RanzenbergerNoch keine Bewertungen

- October 2010 Unemployment in Mid-MichiganDokument1 SeiteOctober 2010 Unemployment in Mid-MichiganMark RanzenbergerNoch keine Bewertungen

- Mins 09080305 Ohio State Board of Pharmacy Minutes, Courtesy of Lindon & LindonDokument35 SeitenMins 09080305 Ohio State Board of Pharmacy Minutes, Courtesy of Lindon & LindonJames LindonNoch keine Bewertungen

- WMM Cf-43 Iom & Parts June 2010Dokument127 SeitenWMM Cf-43 Iom & Parts June 2010Sandison stlNoch keine Bewertungen

- LINCARE HOLDINGS INC 10-K (Annual Reports) 2009-02-25Dokument91 SeitenLINCARE HOLDINGS INC 10-K (Annual Reports) 2009-02-25http://secwatch.comNoch keine Bewertungen

- WPM in IndiaDokument12 SeitenWPM in IndiaSharath Das100% (1)

- Children of Incarcerated ParentsDokument18 SeitenChildren of Incarcerated ParentsRen TagaoNoch keine Bewertungen

- G.R. No. 147561 June 22, 2006 Stronghold Insurance Company, Inc., Petitioner, Republic-Asahi Glass Corporation, RespondentDokument6 SeitenG.R. No. 147561 June 22, 2006 Stronghold Insurance Company, Inc., Petitioner, Republic-Asahi Glass Corporation, RespondentPiayaNoch keine Bewertungen

- Santogold - Trademark Letter As of Date of SuitDokument5 SeitenSantogold - Trademark Letter As of Date of SuitonthecoversongsNoch keine Bewertungen

- Chapter 4 - HeatDokument23 SeitenChapter 4 - HeatAnonymous IyNfIgG4Z100% (1)

- AAA v. BBBDokument2 SeitenAAA v. BBBAnonymous eiIIL2Gk3sNoch keine Bewertungen

- Litonjua Shipping V National Seamen BoardDokument1 SeiteLitonjua Shipping V National Seamen BoardVener Angelo MargalloNoch keine Bewertungen

- Offer To Plead Guilty To A Lesse CrimeDokument4 SeitenOffer To Plead Guilty To A Lesse CrimeNestoni M. SenarillosNoch keine Bewertungen

- 25-26-27 Sale of Goods ActDokument68 Seiten25-26-27 Sale of Goods ActFarhan HasanNoch keine Bewertungen

- Asma Jilani Vs Government of The PunjabDokument124 SeitenAsma Jilani Vs Government of The PunjabKaren MalsNoch keine Bewertungen

- Consumer RightsDokument6 SeitenConsumer RightsthinkiitNoch keine Bewertungen

- EDS 08-0143 - Customer LV Supplies Above 100A PDFDokument29 SeitenEDS 08-0143 - Customer LV Supplies Above 100A PDFRajendra Prasad ShuklaNoch keine Bewertungen

- Universal Jurisdiction PDFDokument3 SeitenUniversal Jurisdiction PDFNovie AmorNoch keine Bewertungen

- Db2012 UCC Security Agreement TemplateDokument26 SeitenDb2012 UCC Security Agreement TemplateMaryann Wallace100% (5)

- MGB07-1-Appln-for-FTAA (Application For Financial and Technical Assistance Agreement (FTAA) )Dokument3 SeitenMGB07-1-Appln-for-FTAA (Application For Financial and Technical Assistance Agreement (FTAA) )Vyiel Gerald Ledesma CawalingNoch keine Bewertungen

- Gil Miguel Vs Dircetor of Burea of PrisonsDokument10 SeitenGil Miguel Vs Dircetor of Burea of PrisonsCatherine CapanangNoch keine Bewertungen

- PP Vs Morato El AlDokument7 SeitenPP Vs Morato El AlAnton BongcawelNoch keine Bewertungen

- General Rules On GamblingDokument4 SeitenGeneral Rules On GamblingEmily Lee100% (1)

- John Doe V Oberlin - ComplaintDokument57 SeitenJohn Doe V Oberlin - ComplaintLegal InsurrectionNoch keine Bewertungen

- Maritime Liens Revisited: From Historical Development To Contemporary National Law A Journey Towards International UnificationDokument26 SeitenMaritime Liens Revisited: From Historical Development To Contemporary National Law A Journey Towards International UnificationTafsir JohanssonNoch keine Bewertungen

- ENOVIAReportGenerator AdminDokument94 SeitenENOVIAReportGenerator AdminAmaç GüvendikNoch keine Bewertungen

- SS Lotus CaseDokument4 SeitenSS Lotus CaseRafael James RobeaNoch keine Bewertungen

- PlaintDokument31 SeitenPlaintHarneet Kaur100% (1)

- United States v. Domenico D'Agostino A/K/A Domenick D'agostino, A/K/A Domenick Dagostino, Niagara Falls, New York, 338 F.2d 490, 2d Cir. (1964)Dokument4 SeitenUnited States v. Domenico D'Agostino A/K/A Domenick D'agostino, A/K/A Domenick Dagostino, Niagara Falls, New York, 338 F.2d 490, 2d Cir. (1964)Scribd Government DocsNoch keine Bewertungen

- Memorandum of Understanding (Mou)Dokument7 SeitenMemorandum of Understanding (Mou)Jhake Bayuga Pascua100% (1)

- Contract LabourDokument6 SeitenContract LabourwertyderryNoch keine Bewertungen

- Citizen Rule BookDokument44 SeitenCitizen Rule BookSonne IsraelNoch keine Bewertungen