Beruflich Dokumente

Kultur Dokumente

Ifrs 16 Example Initial Measurement of Right-Of-Use Asset and Lease Liability-Quarterly-Payments

Hochgeladen von

Ankit ShahOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ifrs 16 Example Initial Measurement of Right-Of-Use Asset and Lease Liability-Quarterly-Payments

Hochgeladen von

Ankit ShahCopyright:

Verfügbare Formate

last updated: 4/2/2019

IFRS 16 example: initial measurement of the right-of-use asset and lease liability (quarterly payments)

Below is an example that is a variation of the example available under the link below. In this variation, payments are ma

https://ifrscommunity.com/knowledge-base/ifrs-16-recognition-and-measurement-of-leases/#link-ifrs_16_example_initial

On IFRScommunity.com, years are written as 20X1, 20X2 etc., but this changes to 2001, 2002 etc. whenever a spreadsheet

Hence this example starts in 2001, but is NOT outdated at all :)

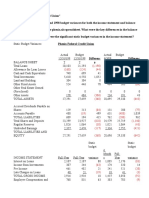

1/1/2001 commencement date discount rate

12/31/2002 end of lease term 5% per annum

payments at the commencement of the lease:

20,000 Initial direct costs

(5,000) Lease incentives

50,000 Upfront lease payment for Q1 2001

50,000 Subsequent quarterly upfront payments

future payments

quarter (Q) payment date of payment discount factor discounted amount

2 50,000 4/1/2001 0.9880 49,402.08

3 50,000 7/1/2001 0.9761 48,804.79

4 50,000 10/1/2001 0.9642 48,208.27

5 50,000 1/1/2002 0.9524 47,619.05

6 50,000 4/1/2002 0.9410 47,049.60

7 50,000 7/1/2002 0.9296 46,480.75

8 50,000 10/1/2002 0.9183 45,912.64

Liability Schedule before reassessment of lease term

333,477.18 Lease liability at initial recognition

quarter (Q) opening payment discount

1 333,477 - 4,036

2 337,513 (50,000) 3,519

3 291,032 (50,000) 2,982

4 244,014 (50,000) 2,401

5 196,415 (50,000) 1,772

6 148,187 (50,000) 1,202

7 99,389 (50,000) 611

8 50,000 (50,000) -

quarterly payments)

low. In this variation, payments are made quarterly.

of-leases/#link-ifrs_16_example_initial_measurement_of_right-of-use_asset_and_lease_liability

001, 2002 etc. whenever a spreadsheet formula needs a valid format date as an input.

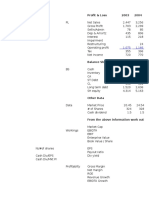

Asset Schedule before reassessment of lease term

Lease liability at initial recognition 398,477 Gross book value of the righ-of use asset at initial recognition

closing quarter (Q) NBV opening depreciation

337,513 1 398,477 (49,810)

291,032 2 348,668 (49,810)

244,014 3 298,858 (49,810)

196,415 4 249,048 (49,810)

148,187 5 199,239 (49,810)

99,389 6 149,429 (49,810)

50,000 7 99,619 (49,810)

- 8 49,810 (49,810)

415,000 Total payments

398,477 Depreciation expense

16,523 Discounting expense

415,000 Total expense

f lease term

use asset at initial recognition

NBV closing

348,668

298,858

249,048

199,239

149,429

99,619

49,810

-

Das könnte Ihnen auch gefallen

- Ifrs 16 Example Initial Measurement of Right-Of-use Asset and Lease LiabilityDokument4 SeitenIfrs 16 Example Initial Measurement of Right-Of-use Asset and Lease Liabilityaldwin006Noch keine Bewertungen

- Instructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadDokument7 SeitenInstructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadyshazwaniNoch keine Bewertungen

- EMI Calculator - Prepayment OptionDokument20 SeitenEMI Calculator - Prepayment OptionRahul JoshiNoch keine Bewertungen

- 12 Month Cash Flow Statement Template v.1.1Dokument1 Seite12 Month Cash Flow Statement Template v.1.1BOBANSO KIOKONoch keine Bewertungen

- New Heritage Doll Company: Capital Budgeting Exhibit 1 Selected Operating Projections For Match My Doll Clothing Line ExpansionDokument9 SeitenNew Heritage Doll Company: Capital Budgeting Exhibit 1 Selected Operating Projections For Match My Doll Clothing Line ExpansionIleana StirbuNoch keine Bewertungen

- Financials of NYSE For The Period Between Fys 2003-2005 and NYSE Euronext For The FY 2007-2009Dokument2 SeitenFinancials of NYSE For The Period Between Fys 2003-2005 and NYSE Euronext For The FY 2007-2009BasappaSarkarNoch keine Bewertungen

- 4019 XLS EngDokument4 Seiten4019 XLS EngRish JayNoch keine Bewertungen

- Cash Flow Projection: Project Name: No. of Units 261 670 90Dokument1 SeiteCash Flow Projection: Project Name: No. of Units 261 670 90Reden Mejico PedernalNoch keine Bewertungen

- Consolidated Financial Statements Mar 09Dokument15 SeitenConsolidated Financial Statements Mar 09Naseer AhmadNoch keine Bewertungen

- Takaful Companies - Overall: ItemsDokument6 SeitenTakaful Companies - Overall: ItemsZubair ArshadNoch keine Bewertungen

- Construction and CafeDokument25 SeitenConstruction and Cafeassefamenelik1Noch keine Bewertungen

- ' in LakhsDokument53 Seiten' in LakhsParthNoch keine Bewertungen

- Spyder Student ExcelDokument21 SeitenSpyder Student ExcelNatasha PerryNoch keine Bewertungen

- El Sewedy Electric financial projectionsDokument6 SeitenEl Sewedy Electric financial projectionsMohand ElbakryNoch keine Bewertungen

- Financial Model of A Medical Software For ClinicsDokument16 SeitenFinancial Model of A Medical Software For ClinicsAl KeyNoch keine Bewertungen

- Financials VTL FinalDokument19 SeitenFinancials VTL Finalmuhammadasif961Noch keine Bewertungen

- 58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentDokument4 Seiten58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentKartheek DevathiNoch keine Bewertungen

- Ifrs 16 Example Lease Rent Free PeriodDokument4 SeitenIfrs 16 Example Lease Rent Free Periodaldwin006Noch keine Bewertungen

- Commercial Real Estate Valuation Model1Dokument2 SeitenCommercial Real Estate Valuation Model1cjsb99Noch keine Bewertungen

- Total Initial Investment and Production CostDokument3 SeitenTotal Initial Investment and Production CosthabtamuNoch keine Bewertungen

- MAN ACC ProjectDokument7 SeitenMAN ACC ProjectNurassylNoch keine Bewertungen

- Summary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Dokument1 SeiteSummary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Fuaad DodooNoch keine Bewertungen

- Newfield QuestionDokument8 SeitenNewfield QuestionFaizan YousufNoch keine Bewertungen

- Performance at A GlanceDokument4 SeitenPerformance at A GlanceabhikakuNoch keine Bewertungen

- 2004 Annual ReportDokument10 Seiten2004 Annual ReportThe Aspen InstituteNoch keine Bewertungen

- Sun Microsystems Financials and ValuationDokument6 SeitenSun Microsystems Financials and ValuationJasdeep SinghNoch keine Bewertungen

- Annual Report 2020 Balance SheetDokument1 SeiteAnnual Report 2020 Balance Sheetghayur khanNoch keine Bewertungen

- TML q4 Fy 21 Consolidated ResultsDokument6 SeitenTML q4 Fy 21 Consolidated ResultsGyanendra AryaNoch keine Bewertungen

- Exihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)Dokument22 SeitenExihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)JuanNoch keine Bewertungen

- TUI AG Bericht 2019 ENDokument48 SeitenTUI AG Bericht 2019 ENgoggsNoch keine Bewertungen

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Dokument14 SeitenSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Nilupul BasnayakeNoch keine Bewertungen

- Summary of Investment Analysis Xyz HOTEL Hotel Name, Location: Radisson Plaza, Udaipur Year of Opening: Jul-08Dokument28 SeitenSummary of Investment Analysis Xyz HOTEL Hotel Name, Location: Radisson Plaza, Udaipur Year of Opening: Jul-08dheeraj_cfaNoch keine Bewertungen

- Rent-Way Rentavision Pro Forma Adjustments Pro FormaDokument6 SeitenRent-Way Rentavision Pro Forma Adjustments Pro FormaBassoonDude05Noch keine Bewertungen

- Anavar AprilDokument3 SeitenAnavar AprilIsna IslamuddinNoch keine Bewertungen

- T V S Motor Co. Ltd. profits and appropriation analysis 2017-2021Dokument4 SeitenT V S Motor Co. Ltd. profits and appropriation analysis 2017-2021Rahul DesaiNoch keine Bewertungen

- Balance Sheet and Income Statement AnalysisDokument9 SeitenBalance Sheet and Income Statement AnalysisHarshit MalviyaNoch keine Bewertungen

- Fy2023 Analysis of Revenue and ExpenditureDokument24 SeitenFy2023 Analysis of Revenue and ExpenditurePutri AgustinNoch keine Bewertungen

- RBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Dokument3 SeitenRBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Fuaad DodooNoch keine Bewertungen

- Q2 Results Bal 2021 22Dokument11 SeitenQ2 Results Bal 2021 22Suraj PatilNoch keine Bewertungen

- Comparing Cash Flows and Net Present Values of Two ProjectsDokument5 SeitenComparing Cash Flows and Net Present Values of Two ProjectsSohaib RiazNoch keine Bewertungen

- GDP by Expenditure at Constant PricesDokument2 SeitenGDP by Expenditure at Constant PricesIzzuddin AbdurrahmanNoch keine Bewertungen

- NIKE Inc Ten Year Financial History FY19Dokument1 SeiteNIKE Inc Ten Year Financial History FY19Moisés Ríos RamosNoch keine Bewertungen

- Cash Flow Analysis Love VermaDokument8 SeitenCash Flow Analysis Love Vermalove vermaNoch keine Bewertungen

- Consolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)Dokument62 SeitenConsolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)MUHAMMAD ISMAILNoch keine Bewertungen

- Consolidated Balance Sheet (Rs. in MN)Dokument24 SeitenConsolidated Balance Sheet (Rs. in MN)prernagadiaNoch keine Bewertungen

- E 00175Dokument114 SeitenE 00175Lieven VermeulenNoch keine Bewertungen

- EMI Calculator - Prepayment OptionDokument16 SeitenEMI Calculator - Prepayment Optionyashwanthakur96Noch keine Bewertungen

- Trade and PaymentsDokument17 SeitenTrade and PaymentsmazamniaziNoch keine Bewertungen

- Nesco 19.05.20Dokument19 SeitenNesco 19.05.20Miku DhanukaNoch keine Bewertungen

- Ceres Gardening CalculationsDokument9 SeitenCeres Gardening CalculationsJuliana Marques0% (2)

- Rent vs Buy: Which is betterDokument10 SeitenRent vs Buy: Which is bettersabah8800Noch keine Bewertungen

- Rent Vs Buy Calculator - AssetyogiDokument10 SeitenRent Vs Buy Calculator - Assetyogijayonline_4uNoch keine Bewertungen

- Super Gloves 2Dokument6 SeitenSuper Gloves 2anon_149445490Noch keine Bewertungen

- Financial MStatements Ceres MGardening MCompanyDokument11 SeitenFinancial MStatements Ceres MGardening MCompanyRodnix MablungNoch keine Bewertungen

- Rent Vs Buy Calculator - AssetyogiDokument10 SeitenRent Vs Buy Calculator - AssetyogiAshish SukhdaneNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Revenue:: AssumptionsDokument38 SeitenRevenue:: AssumptionsusmanthesaviorNoch keine Bewertungen

- Corporate Actions: A Guide to Securities Event ManagementVon EverandCorporate Actions: A Guide to Securities Event ManagementNoch keine Bewertungen

- Manufacturing Surface Technology: Surface Integrity and Functional PerformanceVon EverandManufacturing Surface Technology: Surface Integrity and Functional PerformanceBewertung: 5 von 5 Sternen5/5 (1)

- Answer 1: Munn N.L Defines Learning As The Process of Having One's Behavior Modified, MoreDokument7 SeitenAnswer 1: Munn N.L Defines Learning As The Process of Having One's Behavior Modified, MoreAnkit ShahNoch keine Bewertungen

- IFRS 16 Example: Initial Measurement of The Right-Of-Use Asset and Lease Liability (Quarterly Payments)Dokument4 SeitenIFRS 16 Example: Initial Measurement of The Right-Of-Use Asset and Lease Liability (Quarterly Payments)Ankit ShahNoch keine Bewertungen

- IFRS 16 Example: Initial Measurement of The Right-Of-Use Asset and Lease Liability (Quarterly Payments)Dokument4 SeitenIFRS 16 Example: Initial Measurement of The Right-Of-Use Asset and Lease Liability (Quarterly Payments)Ankit ShahNoch keine Bewertungen

- IFRS 16 Example: Initial Measurement of The Right-Of-Use Asset and Lease Liability (Quarterly Payments)Dokument4 SeitenIFRS 16 Example: Initial Measurement of The Right-Of-Use Asset and Lease Liability (Quarterly Payments)Ankit ShahNoch keine Bewertungen

- WePROMOTE EditedDokument9 SeitenWePROMOTE EditedBrian BlazerNoch keine Bewertungen

- FAC4764 Study Pack 2Dokument41 SeitenFAC4764 Study Pack 2Muvhusi NethonondaNoch keine Bewertungen

- Hampton Machine Tool CoDokument13 SeitenHampton Machine Tool CoArdi del Rosario100% (12)

- Problems Revenues FR Contracts With CustomersDokument17 SeitenProblems Revenues FR Contracts With CustomersJane DizonNoch keine Bewertungen

- Fabm 2-2Dokument37 SeitenFabm 2-2Bettina GiereNoch keine Bewertungen

- Annex - 25 - Life Cycle Cost Comparison of Different STP ProcessesDokument10 SeitenAnnex - 25 - Life Cycle Cost Comparison of Different STP ProcessesDien NoelNoch keine Bewertungen

- FI Data ExtractionDokument19 SeitenFI Data ExtractionEmanuelPredescu100% (1)

- Estimation of Project Cash FlowsDokument26 SeitenEstimation of Project Cash Flowssupreet2912Noch keine Bewertungen

- Formula:: (No of Shares Outstanding Before The Buy Back)Dokument5 SeitenFormula:: (No of Shares Outstanding Before The Buy Back)Bushra Syed0% (1)

- Fabm Group 4. Closing EntriesDokument11 SeitenFabm Group 4. Closing Entriesjoel phillip GranadaNoch keine Bewertungen

- đề đk kttc1Dokument16 Seitenđề đk kttc1nam ohNoch keine Bewertungen

- (LO2,3) (Preparation of Operating Activities Section-Indirect Method, Periodic Inventory)Dokument37 Seiten(LO2,3) (Preparation of Operating Activities Section-Indirect Method, Periodic Inventory)novio vioNoch keine Bewertungen

- Chapter 2Dokument32 SeitenChapter 2monicaescobarroaNoch keine Bewertungen

- Group 2 - CaseStudy Bigger Isnt Always Better - FINMA1 - BDokument14 SeitenGroup 2 - CaseStudy Bigger Isnt Always Better - FINMA1 - BAccounting 201Noch keine Bewertungen

- Partnership Formation AdjustmentsDokument20 SeitenPartnership Formation AdjustmentsAngerica BongalingNoch keine Bewertungen

- Dividends and stockholders' equity quizDokument3 SeitenDividends and stockholders' equity quizLLYOD FRANCIS LAYLAYNoch keine Bewertungen

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Dokument8 SeitenCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- Relevant Costing With Highlighted Answer KeyDokument32 SeitenRelevant Costing With Highlighted Answer KeyRed Christian Palustre0% (1)

- Solution Manual For Corporate Finance Foundations Global Edition 15th Edition by Block Hirt Danielsen ISBN 007716119X 9780077161194Dokument36 SeitenSolution Manual For Corporate Finance Foundations Global Edition 15th Edition by Block Hirt Danielsen ISBN 007716119X 9780077161194stephanievargasogimkdbxwn100% (20)

- ABC Chapter 5 Accounting For Business Combinations by Millan 2020Dokument25 SeitenABC Chapter 5 Accounting For Business Combinations by Millan 2020Nayoung LeeNoch keine Bewertungen

- Ratio Analysis at JK Tyre Industries LTDDokument54 SeitenRatio Analysis at JK Tyre Industries LTDsanthoshchandu.santhoshmohanNoch keine Bewertungen

- Siyaram Cloth ReportDokument76 SeitenSiyaram Cloth ReportBipin Kumar100% (4)

- Income Statement Format and PresentationDokument52 SeitenIncome Statement Format and PresentationIvern BautistaNoch keine Bewertungen

- Problem 8 14 To To 8 18Dokument24 SeitenProblem 8 14 To To 8 18Hendriech Del Mundo62% (13)

- Chapter07 XlssolDokument49 SeitenChapter07 XlssolEkhlas AmmariNoch keine Bewertungen

- Sample FsDokument3 SeitenSample FsLocel Maquiran LamosteNoch keine Bewertungen

- MCom Acc-Specialization 4-Financial Reporting and AnalysisDokument2 SeitenMCom Acc-Specialization 4-Financial Reporting and AnalysisJunaid Iqbal MastoiNoch keine Bewertungen

- FINANCIAL MANAGEMENT full module (1) (1)Dokument72 SeitenFINANCIAL MANAGEMENT full module (1) (1)negamedhane58Noch keine Bewertungen

- Partnership Operations and Dissolution AnalysisDokument33 SeitenPartnership Operations and Dissolution Analysislavender hazeNoch keine Bewertungen

- Accounting ReviewerDokument6 SeitenAccounting ReviewerFictional PlayerNoch keine Bewertungen