Beruflich Dokumente

Kultur Dokumente

Competition Results - Transforming Accountancy With AI Data Large Consortia PDF

Hochgeladen von

Jack PadiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Competition Results - Transforming Accountancy With AI Data Large Consortia PDF

Hochgeladen von

Jack PadiCopyright:

Verfügbare Formate

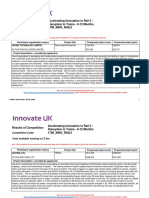

Results of Competition: Transforming Accountancy, Insurance and Legal Services with AI and Data (Large

Consortia Strand)

Competition Code: 1805_ISCF_NEXTGEN_CRD_LS

Total available funding is £6.16 million

Note: These proposals have succeeded in the assessment stage of this competition. All are subject to grant offer and conditions being met.

Participant organisation names Project title Proposed project costs Proposed project grant

GINIE AI LIMITED Enabling rapid adoption of artificial £987,379 £612,175

intelligence through an anonymized data

protocol and explainable models

BARCLAYS PLC £170,400 £85,200

Imperial College London £320,413 £320,413

PROFESSIONAL INSURANCE AGENTS LIMITED £300,945 £180,567

University of Oxford £239,454 £239,454

WITHERS LLP £203,284 £101,642

Note: you can see all Innovate UK-funded projects here: https://www.gov.uk/government/publications/innovate-uk-funded-projects

Use the Competition Code given above to search for this competition’s results

Funders Panel Date: 30/10/2018 1

Project description - provided by applicants

Two of the greatest obstacles towards adoption of artificial intelligence in UK services is the acquisition of confidential data, and the explainability of black-

box neural models. This research will draw on a number of academics from leading research institutions, large commercial partners and Ginie AI, a machine

learning startup to tackle these issues. In particular, commercial products that advance state of the art algorithms will be developed. These solutions will

draw on the latest body of research in computational privacy and machine learning. The technology will be researched, tested and trialled in a commercial

setting. In addition, key stakeholders and regulatory bodies will be engaged with to provide an industry wide protocol of how to enable access to data for the

rapid adoption of machine learning in services.

Note: you can see all Innovate UK-funded projects here: https://www.gov.uk/government/publications/innovate-uk-funded-projects

Use the Competition Code given above to search for this competition’s results

Funders Panel Date: 30/10/2018 2

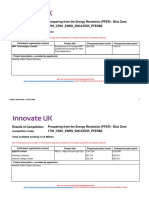

Results of Competition: Transforming Accountancy, Insurance and Legal Services with AI and Data (Large

Consortia Strand)

Competition Code: 1805_ISCF_NEXTGEN_CRD_LS

Total available funding is £6.16 million

Note: These proposals have succeeded in the assessment stage of this competition. All are subject to grant offer and conditions being met.

Participant organisation names Project title Proposed project costs Proposed project grant

ALTELIUM LIMITED Pozibot £690,200 £483,140

BRILL POWER LIMITED £458,151 £320,706

DELTA MOTORSPORT LIMITED £442,176 £309,523

Lancaster University £527,158 £527,158

QUANTUM BASE LIMITED £294,585 £206,210

Note: you can see all Innovate UK-funded projects here: https://www.gov.uk/government/publications/innovate-uk-funded-projects

Use the Competition Code given above to search for this competition’s results

Funders Panel Date: 30/10/2018 3

Project description - provided by applicants

Project Pozibot brings together prominent organisations involved in battery development from university to a battery pack manufacturer, to a BMS developer,

to a niche EV market manufacturer and a leading FCA regulated Insured Warranty provider from the LLoyds' and London insurance market. The aim of

Project Pozibot is to enable a new type of dynamic insured warranty to be developed, covering components too young for traditional history-based risk

calculations. It will enable partnerships between insurance providers and smaller (local) battery pack suppliers removing market entry barriers; Pozibot will

play a significant role in the development, and real-life rollout, of next generation batteries.

Battery packs need remote monitoring for predictive maintenance, to flag high-level information such as state-of-health, predictions of remaining asset value

and lifetime enabling a modern dynamic warranty insurance product which, with the help of AI, goes beyond traditional risk calculation and forecasting and

enables the insurance provider to conduct prescriptive analytics based on real-time battery health and usage data. Using patented quantum-based asset

tagging technology enables an unforgeable logging and monitoring system for battery packs.

Cells and battery level suppliers need a warranty to get their products to market. The warranty provider needs the data to provide the insured warranty.

Project Pozibot will deliver a warranty thus supporting a significant UK industry initiative at each point in the supply chain.

The project responds to many of the challenges on measurement needs within the battery industry identified by the National Physical Laboratory report on

Energy Transition: Measurement needs within the battery industry (c)NPL Management Ltd 2017\.

Note: you can see all Innovate UK-funded projects here: https://www.gov.uk/government/publications/innovate-uk-funded-projects

Use the Competition Code given above to search for this competition’s results

Funders Panel Date: 30/10/2018 4

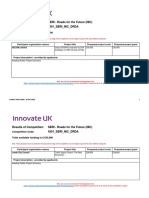

Results of Competition: Transforming Accountancy, Insurance and Legal Services with AI and Data (Large

Consortia Strand)

Competition Code: 1805_ISCF_NEXTGEN_CRD_LS

Total available funding is £6.16 million

Note: These proposals have succeeded in the assessment stage of this competition. All are subject to grant offer and conditions being met.

Participant organisation names Project title Proposed project costs Proposed project grant

FLUIDLY LIMITED The Development of an Artificial £1,689,382 £1,182,567

Intelligence Recommender System for

Advisory Service Provision at Scale

BALDWINS HOLDINGS LIMITED £467,119 £233,560

THE SAGE GROUP PLC. £218,728 £0

Note: you can see all Innovate UK-funded projects here: https://www.gov.uk/government/publications/innovate-uk-funded-projects

Use the Competition Code given above to search for this competition’s results

Funders Panel Date: 30/10/2018 5

Project description - provided by applicants

As data technologies and machine learning are increasingly being applied to accountancy software, more and more traditional accountancy functions are

becoming automated; from bookkeeping to reconciliations and reports.

The current challenge for accountancy companies is how to utilise technology and the deeper data insight capabilities on offer to create new opportunities to

engage with customers and to open new market channels -- to move from a compliance-based reporting service to an advisory service adding value by

providing actionable strategic advice to improve client's financial health and decision making.

The analysis of data is time-consuming and requires new skill sets. The challenge in offering an advisory service across the client base (which may run to

thousands of SME clients) is how to analyse the oceans of client data now available in real time, directly from cloud servers. How can timely strategic insight

and advice for clients be provided in a cost-effective way for the accountancy firms that is affordable for SMEs?

This project will develop a Client Advisory Insight Engine (CAIE), a web-based client engagement solution to enable resource efficient remote monitoring of

SME clients' financial performance across an Accountancy firm's client portfolio. CAIE prioritises clients based on key financial performance metrics,

produced automatically and in real time from a client's cloud accounting data. CAIE utilises AI to recommend advisory actions for accountants to open timely

advisory conversations with their clients. CAIE enables a cost-effective advisory service at scale.

Note: you can see all Innovate UK-funded projects here: https://www.gov.uk/government/publications/innovate-uk-funded-projects

Use the Competition Code given above to search for this competition’s results

Funders Panel Date: 30/10/2018 6

Results of Competition: Transforming Accountancy, Insurance and Legal Services with AI and Data (Large

Consortia Strand)

Competition Code: 1805_ISCF_NEXTGEN_CRD_LS

Total available funding is £6.16 million

Note: These proposals have succeeded in the assessment stage of this competition. All are subject to grant offer and conditions being met.

Participant organisation names Project title Proposed project costs Proposed project grant

INTELLIGENT VOICE LIMITED Automation and Transparency across £1,098,271 £615,032

Financial and Legal services: Mitigating

Risk, Enhancing Efficiency and Promoting

Customer Retention through the

Application of Voice and Emotional AI

STRENUUS LIMITED £433,428 £273,060

University of East London £473,479 £473,479

Note: you can see all Innovate UK-funded projects here: https://www.gov.uk/government/publications/innovate-uk-funded-projects

Use the Competition Code given above to search for this competition’s results

Funders Panel Date: 30/10/2018 7

Project description - provided by applicants

Insurance fraud costed the UK £3B in 2017, increasing 8% since 2015, equating to £10,400 per fraudulent claim. This causes an increase of £50 per policy.

Current manual processes to identify illegitimate claims are repetitive, time-consuming, inefficient, non-user friendly with no consideration for vulnerable

customers. This presents fraud identification as a primary target for developed AI capabilities.

The public are becoming increasingly aware of voice activated AI following the release of Amazon's Echo: a market leader in the 'voice-controlled home'.

Resultant scientific research surrounding this is focusing on adding intelligence to spoken commands for real-time information.

Current advanced emotional AI technologies capture (non-verbal) human expressions via computer vision, voice analysis and/or biometric sensors. These

lack processing speed and are unable to understand both vocalics and linguistics. No solution currently combines artificial intelligence and voice technology

for a true conversation with full explainability of its decision.

Addressing this gap, Intelligent Voice aim to develop an AI software that detects and interprets emotion and linguistics from voice. In collaboration with

behavioural analysis experts at Strenuus and deep neural networks academics at University of East London, this project aims to develop a vocal AI

technology for credibility/vulnerability assessment, key word spotting, in-call behavioural guidance and transparency of the decision-making process, trialled

by an insurance contact centre during live claims handling. This will offer a breakthrough technology for the anti-fraud sector, simultaneously providing

unique expertise to the UK in deep neural networks and AI with cross-sector potential.

All partners are well placed to exploit this opportunity: Intelligent Voice have an existing global client-base for their voice recognition/transcription software in

the financial/insurance services market, Strenuus completed Proof-of-Concept studies with their linguistic algorithms to assess credibility, successfully

identifying deception, UEL has demonstrable expertise in data analytics, machine learning architecture and AI explainability. Insurance software providers

are in place as in-kind contributors for exploitation.

With InnovateUK support, a 30-month programme of Industrial Research and Experimental Development is required to develop behavioural analysis

algorithms, explain the neural networks of the system, integrate the solution to ICE's existing platform and trial the technology in a controlled environment.

Project success will support commercialisation by 2021, to establish:

- Intelligent Voice at the forefront of the speech recognition software market, poised for significant growth;

- Strenuus as a leader in behavioural analysis with novel audio processing algorithms;

- UEL as a UK leading university with state-of-the-art explaining of DNNs.

Note: you can see all Innovate UK-funded projects here: https://www.gov.uk/government/publications/innovate-uk-funded-projects

Use the Competition Code given above to search for this competition’s results

Funders Panel Date: 30/10/2018 8

Das könnte Ihnen auch gefallen

- PDF Issue 1 PDFDokument128 SeitenPDF Issue 1 PDFfabrignani@yahoo.comNoch keine Bewertungen

- Principle Mining Economics01Dokument56 SeitenPrinciple Mining Economics01Teddy Dkk100% (3)

- Iraq-A New Dawn: Mena Oil Research - July 2021Dokument29 SeitenIraq-A New Dawn: Mena Oil Research - July 2021Beatriz RosenburgNoch keine Bewertungen

- Results of Competition: Women in Innovation 2018 Competition Code: 1806 - WOMEN - IN - INNOVATIONDokument18 SeitenResults of Competition: Women in Innovation 2018 Competition Code: 1806 - WOMEN - IN - INNOVATIONJack PadiNoch keine Bewertungen

- Results of Competition: Women in Innovation 2018 Competition Code: 1806 - WOMEN - IN - INNOVATIONDokument18 SeitenResults of Competition: Women in Innovation 2018 Competition Code: 1806 - WOMEN - IN - INNOVATIONJack PadiNoch keine Bewertungen

- Results of Competition: Faraday Battery Challenge: Innovation Feasibility Studies Round 3 Competition Code: 1809 - FS - MMM - ISCF - FARADAY - R3Dokument24 SeitenResults of Competition: Faraday Battery Challenge: Innovation Feasibility Studies Round 3 Competition Code: 1809 - FS - MMM - ISCF - FARADAY - R3Jack PadiNoch keine Bewertungen

- Results of Competition: APC 10: Advancing The UK's Low Carbon Automotive Capability Competition Code: 1804 - CRD1 - TRANS - APC10Dokument6 SeitenResults of Competition: APC 10: Advancing The UK's Low Carbon Automotive Capability Competition Code: 1804 - CRD1 - TRANS - APC10Jack PadiNoch keine Bewertungen

- Competition Results - Energy Catalyst R6 Transforming Energy Access PDFDokument36 SeitenCompetition Results - Energy Catalyst R6 Transforming Energy Access PDFJack PadiNoch keine Bewertungen

- Results of Competition: APC 11: Advancing The UK's Low Carbon Automotive Capability Competition Code: 1808 - CRD1 - TRANS - APC11Dokument6 SeitenResults of Competition: APC 11: Advancing The UK's Low Carbon Automotive Capability Competition Code: 1808 - CRD1 - TRANS - APC11Jack PadiNoch keine Bewertungen

- Results of Competition: Aerospace Technology Institute Batch 26 Competition Code: 1309 - SPEC - TRA - ATI - Batch26Dokument16 SeitenResults of Competition: Aerospace Technology Institute Batch 26 Competition Code: 1309 - SPEC - TRA - ATI - Batch26Jack PadiNoch keine Bewertungen

- Results of Competition: Faraday Battery Challenge: Innovation R&D Studies Round 3 Competition Code: 1809 - CRD - MMM - ISCF - FARADAY - R3Dokument26 SeitenResults of Competition: Faraday Battery Challenge: Innovation R&D Studies Round 3 Competition Code: 1809 - CRD - MMM - ISCF - FARADAY - R3Jack PadiNoch keine Bewertungen

- Wireless Electric Vehicle Charging For Commercial Users - FS - Competition Results PDFDokument19 SeitenWireless Electric Vehicle Charging For Commercial Users - FS - Competition Results PDFJack PadiNoch keine Bewertungen

- Results of Competition: Smart Local Energy Systems: Concepts and Designs Competition Code: 1804 - ISCF - SMART - ENERGY - DESIGNDokument26 SeitenResults of Competition: Smart Local Energy Systems: Concepts and Designs Competition Code: 1804 - ISCF - SMART - ENERGY - DESIGNJack PadiNoch keine Bewertungen

- Results of Competition: UKART: Fast-Track Collaborative R&D Round 1 Full Stage Competition Code: 1809 - CRD - FT - UKART - R1Dokument14 SeitenResults of Competition: UKART: Fast-Track Collaborative R&D Round 1 Full Stage Competition Code: 1809 - CRD - FT - UKART - R1Jack PadiNoch keine Bewertungen

- Results of Competition: Newton - UK-China Agri Tech Challenge 2017 Competition Code: 1706 - CRD1 - NEWTON - CHNBBSRCDokument19 SeitenResults of Competition: Newton - UK-China Agri Tech Challenge 2017 Competition Code: 1706 - CRD1 - NEWTON - CHNBBSRCJack PadiNoch keine Bewertungen

- Results of Competition: Robotics and AI: Inspect, Maintain and Repair in Extreme Environments Competition Code: 1805 - ROBOTICSDokument11 SeitenResults of Competition: Robotics and AI: Inspect, Maintain and Repair in Extreme Environments Competition Code: 1805 - ROBOTICSJack PadiNoch keine Bewertungen

- Results of Competition: Increase Productivity, Performance and Quality in UK Construction Competition Code: 1807 - ISCF - IPPQUKCDokument52 SeitenResults of Competition: Increase Productivity, Performance and Quality in UK Construction Competition Code: 1807 - ISCF - IPPQUKCJack PadiNoch keine Bewertungen

- Results of Competition: Commercialising Quantum Devices: Innovation R&D Competition Code: 1804 - CRD - CO - ISCF - QUANTUMDokument12 SeitenResults of Competition: Commercialising Quantum Devices: Innovation R&D Competition Code: 1804 - CRD - CO - ISCF - QUANTUMJack PadiNoch keine Bewertungen

- Competition Results - January 2018 Sector Competition - Strand 2 Emerging and Enabling PDFDokument83 SeitenCompetition Results - January 2018 Sector Competition - Strand 2 Emerging and Enabling PDFJack PadiNoch keine Bewertungen

- Results of Competition: Accelerating Innovation in Rail 5 - Disruption To Trains - 0-12 Months 1709 - INNV - RAIL5Dokument22 SeitenResults of Competition: Accelerating Innovation in Rail 5 - Disruption To Trains - 0-12 Months 1709 - INNV - RAIL5Jack PadiNoch keine Bewertungen

- Competition Results - Analysis For Innovators Round 3 - Mini Projects Phase 2 PDFDokument118 SeitenCompetition Results - Analysis For Innovators Round 3 - Mini Projects Phase 2 PDFJack PadiNoch keine Bewertungen

- Competition Results - Open Grant Funding Competition R3 PDFDokument102 SeitenCompetition Results - Open Grant Funding Competition R3 PDFJack PadiNoch keine Bewertungen

- Results of Competition: Newton Fund - China - Guangdong Province 1707 - CRD1 - NEWTON - CHNGDSTDokument10 SeitenResults of Competition: Newton Fund - China - Guangdong Province 1707 - CRD1 - NEWTON - CHNGDSTJack PadiNoch keine Bewertungen

- Results of Competition: Biomedical Catalyst 2018 Round 1 Feasibility Studies Competition Code: 1803 - BMC - R1 - FSDokument31 SeitenResults of Competition: Biomedical Catalyst 2018 Round 1 Feasibility Studies Competition Code: 1803 - BMC - R1 - FSJack PadiNoch keine Bewertungen

- Results of Competition: UKART: Collaborative R&D Round 1 Full Stage Competition Code: 1809 - CRD - UKART - R1Dokument8 SeitenResults of Competition: UKART: Collaborative R&D Round 1 Full Stage Competition Code: 1809 - CRD - UKART - R1Jack PadiNoch keine Bewertungen

- Results of Competition: Productive and Sustainable Crop and Ruminant Agricultural Systems Competition Code: 1808 - CRD - HLS - AFTFPDokument51 SeitenResults of Competition: Productive and Sustainable Crop and Ruminant Agricultural Systems Competition Code: 1808 - CRD - HLS - AFTFPJack PadiNoch keine Bewertungen

- Results of Competition: Agri-Tech Catalyst Colombia Competition Code: 1804 - AGRITECH - COLOMBIADokument14 SeitenResults of Competition: Agri-Tech Catalyst Colombia Competition Code: 1804 - AGRITECH - COLOMBIAJack PadiNoch keine Bewertungen

- Competition Results - ICURe Follow On Funding PDFDokument12 SeitenCompetition Results - ICURe Follow On Funding PDFJack PadiNoch keine Bewertungen

- Results of Competition: Digital Health Technology Catalyst Round 3: Collaborative R&D Competition Code: 1809 - CRD - HEAL - DHTC - R3Dokument29 SeitenResults of Competition: Digital Health Technology Catalyst Round 3: Collaborative R&D Competition Code: 1809 - CRD - HEAL - DHTC - R3Jack PadiNoch keine Bewertungen

- Results of Competition: Sustainable Urbanisation Global Initiative (SUGI) 1612 - EU - ERANET - URBANDokument7 SeitenResults of Competition: Sustainable Urbanisation Global Initiative (SUGI) 1612 - EU - ERANET - URBANJack PadiNoch keine Bewertungen

- Results of Competition: Icure: Open Competition For Spin-Out Companies Competition Code: 1804 - Icure - OpenDokument12 SeitenResults of Competition: Icure: Open Competition For Spin-Out Companies Competition Code: 1804 - Icure - OpenJack PadiNoch keine Bewertungen

- Results of Competition: VIA Project Energy Catalyst R5 Late Stage Competition Code: 1810 - CRD - CGI - ECSPECPRODokument2 SeitenResults of Competition: VIA Project Energy Catalyst R5 Late Stage Competition Code: 1810 - CRD - CGI - ECSPECPROJack PadiNoch keine Bewertungen

- Results of Competition: Innovation Loans: Infrastructure Systems 1711 - LOAN - INFRA - FOAKDokument13 SeitenResults of Competition: Innovation Loans: Infrastructure Systems 1711 - LOAN - INFRA - FOAKJack PadiNoch keine Bewertungen

- Results of Competition: Audience of The Future Demonstrators Competition Code: 1805 - ISCF - AUDIENCE - DEMODokument9 SeitenResults of Competition: Audience of The Future Demonstrators Competition Code: 1805 - ISCF - AUDIENCE - DEMOJack Padi100% (1)

- Competition Results - Transforming Accountancy With AI Data Small Consortia PDFDokument75 SeitenCompetition Results - Transforming Accountancy With AI Data Small Consortia PDFJack PadiNoch keine Bewertungen

- Results of Competition: Medicines Manufacturing Round 2: Challenge Fund Competition Code: 1803 - ISCF - ASHN - MEDMANR2Dokument22 SeitenResults of Competition: Medicines Manufacturing Round 2: Challenge Fund Competition Code: 1803 - ISCF - ASHN - MEDMANR2Jack PadiNoch keine Bewertungen

- Results of Competition: Icure Follow On Funding Round 4 Competition Code: 1901 - Fs - CRD - Co - Icure - R4Dokument6 SeitenResults of Competition: Icure Follow On Funding Round 4 Competition Code: 1901 - Fs - CRD - Co - Icure - R4Jack PadiNoch keine Bewertungen

- Results of Competition: Faraday Battery Challenge: Innovation Feasibility Studies - Round 2 1801 - FS - TRANS - BATTERY - R2Dokument14 SeitenResults of Competition: Faraday Battery Challenge: Innovation Feasibility Studies - Round 2 1801 - FS - TRANS - BATTERY - R2Jack PadiNoch keine Bewertungen

- Competition Results - SBRI First of A Kind 2 - Demonstrating Tomorrow S PDFDokument20 SeitenCompetition Results - SBRI First of A Kind 2 - Demonstrating Tomorrow S PDFJack PadiNoch keine Bewertungen

- Results of Competition: Newton - UK-India Industrial Biotechnology (BBSRC) 1706 - Crd1 - Newton - IndbbsrcDokument8 SeitenResults of Competition: Newton - UK-India Industrial Biotechnology (BBSRC) 1706 - Crd1 - Newton - IndbbsrcJack PadiNoch keine Bewertungen

- Results of Competition: Electric Vehicle Charging For Public Spaces: Feasibility Studies Competition Code: 1807 - FS - OLEV - ELEC - ST1Dokument45 SeitenResults of Competition: Electric Vehicle Charging For Public Spaces: Feasibility Studies Competition Code: 1807 - FS - OLEV - ELEC - ST1Jack PadiNoch keine Bewertungen

- Results of Competition: UK-Sweden EUREKA Proposals For Aerospace Research and Development Competition Code: 1807 - EURNET - SWEDENDokument10 SeitenResults of Competition: UK-Sweden EUREKA Proposals For Aerospace Research and Development Competition Code: 1807 - EURNET - SWEDENJack PadiNoch keine Bewertungen

- Results of Competition: Robotics and AI in Extreme Environments 1806 - ROB - AIDokument1 SeiteResults of Competition: Robotics and AI in Extreme Environments 1806 - ROB - AIJack PadiNoch keine Bewertungen

- Results of Competition: Regulators Pioneer Fund Competition Code: 1807 - REG - PFDokument30 SeitenResults of Competition: Regulators Pioneer Fund Competition Code: 1807 - REG - PFJack PadiNoch keine Bewertungen

- Results of Competition: DCMS Cyber Security Academic Startup Programme Phase 2 1804 - FS - DCMS - CSASP2Dokument18 SeitenResults of Competition: DCMS Cyber Security Academic Startup Programme Phase 2 1804 - FS - DCMS - CSASP2Jack PadiNoch keine Bewertungen

- Results of Competition: Business Basics: Boosting SME Productivity (Proof of Concept Strand) Competition Code: 1806 - CRD - BEIS - BB1 - POCDokument30 SeitenResults of Competition: Business Basics: Boosting SME Productivity (Proof of Concept Strand) Competition Code: 1806 - CRD - BEIS - BB1 - POCJack PadiNoch keine Bewertungen

- Results of Competition: Establishing A Core Innovation Hub To Transform UK Construction Competition Code: 1803 - ISCF - TCCIHDokument2 SeitenResults of Competition: Establishing A Core Innovation Hub To Transform UK Construction Competition Code: 1803 - ISCF - TCCIHJack PadiNoch keine Bewertungen

- Results of Competition: November 2017 Sector Competition Strand 2: Infrastructure Systems - 3 To 12 Months 1711 - MM - INFRA - R4 - ST2 - 12MDokument32 SeitenResults of Competition: November 2017 Sector Competition Strand 2: Infrastructure Systems - 3 To 12 Months 1711 - MM - INFRA - R4 - ST2 - 12MJack PadiNoch keine Bewertungen

- Results of Competition: UKI2S Accelerator Programme For Technology Development Projects: Round 3 Competition Code: 1809 - UKI2S - R3Dokument6 SeitenResults of Competition: UKI2S Accelerator Programme For Technology Development Projects: Round 3 Competition Code: 1809 - UKI2S - R3Jack PadiNoch keine Bewertungen

- Demonstrator For Robotics and AI in Extreme and Challenging Environments Phase 2 - Competition Results PDFDokument18 SeitenDemonstrator For Robotics and AI in Extreme and Challenging Environments Phase 2 - Competition Results PDFJack PadiNoch keine Bewertungen

- Results of Competition: SBRI: Protecting Nuclear Decommissioning Operators Competition Code: 1804 - SBRI - SELLAFIELDDokument26 SeitenResults of Competition: SBRI: Protecting Nuclear Decommissioning Operators Competition Code: 1804 - SBRI - SELLAFIELDJack PadiNoch keine Bewertungen

- Results of Competition: Prospering From The Energy Revolution (PFER) - Blue Zone 1703 - CRD1 - ENRG - ENCATES5 - PFERBZDokument22 SeitenResults of Competition: Prospering From The Energy Revolution (PFER) - Blue Zone 1703 - CRD1 - ENRG - ENCATES5 - PFERBZJack PadiNoch keine Bewertungen

- Results of Competition: SBRI - Roads For The Future (NIC) 1801 - SBRI - NIC - DRDADokument5 SeitenResults of Competition: SBRI - Roads For The Future (NIC) 1801 - SBRI - NIC - DRDAJack PadiNoch keine Bewertungen

- Results of Competition: Advanced Therapy Treatment Centres: Network Projects Competition Code: 1806 - ATTC - NETWORKDokument5 SeitenResults of Competition: Advanced Therapy Treatment Centres: Network Projects Competition Code: 1806 - ATTC - NETWORKJack PadiNoch keine Bewertungen

- Design Foundations Round 1 2018 - Competition Results PDFDokument74 SeitenDesign Foundations Round 1 2018 - Competition Results PDFJack PadiNoch keine Bewertungen

- Results of Competition: Innovation in Health and Life Sciences Round 3 - Up To 12 Months 1710 - HLS - R3 - 12MDokument56 SeitenResults of Competition: Innovation in Health and Life Sciences Round 3 - Up To 12 Months 1710 - HLS - R3 - 12MJack PadiNoch keine Bewertungen

- Results of Competition: Cyber Security Academic Start-Up Accelerator Programme Year 3 Phase 1 Competition Code: 1902 - FS - DCMS - CYBERASAP - P1Dokument52 SeitenResults of Competition: Cyber Security Academic Start-Up Accelerator Programme Year 3 Phase 1 Competition Code: 1902 - FS - DCMS - CYBERASAP - P1Jack PadiNoch keine Bewertungen

- Results of Competition: Planning Rail Capacity Through Automated Infrastructure Design Competition Code: 1810 - CRD - NETWORKRAILDokument8 SeitenResults of Competition: Planning Rail Capacity Through Automated Infrastructure Design Competition Code: 1810 - CRD - NETWORKRAILJack PadiNoch keine Bewertungen

- Results of Competition: Biomedical Catalyst 2018 Round 2 Late Stage Competition Code: 1808 - BMC - R2 - LSDokument18 SeitenResults of Competition: Biomedical Catalyst 2018 Round 2 Late Stage Competition Code: 1808 - BMC - R2 - LSJack PadiNoch keine Bewertungen

- Results of Competition: UKRI and Sky Ocean Ventures Plastics Innovation and Investment Fund Competition Code: 1901 - IA - MMM - SKY - SOVPDokument2 SeitenResults of Competition: UKRI and Sky Ocean Ventures Plastics Innovation and Investment Fund Competition Code: 1901 - IA - MMM - SKY - SOVPJack PadiNoch keine Bewertungen

- Results of Competition: SBRI: Protecting Nuclear Decommissioning Operators - Phase 2 Competition Code: 1901 - SBRI - SELLAFIELD - PH2Dokument6 SeitenResults of Competition: SBRI: Protecting Nuclear Decommissioning Operators - Phase 2 Competition Code: 1901 - SBRI - SELLAFIELD - PH2Jack PadiNoch keine Bewertungen

- Audience of The Future Design Foundations - Competition Results PDFDokument67 SeitenAudience of The Future Design Foundations - Competition Results PDFJack PadiNoch keine Bewertungen

- Results of Competition: Biomedical Catalyst 2018 Round 1: Early Stage Award Competition Code: 1803 - BMC - R1 - EARLYDokument18 SeitenResults of Competition: Biomedical Catalyst 2018 Round 1: Early Stage Award Competition Code: 1803 - BMC - R1 - EARLYJack PadiNoch keine Bewertungen

- Energy Storage: Legal and Regulatory Challenges and OpportunitiesVon EverandEnergy Storage: Legal and Regulatory Challenges and OpportunitiesNoch keine Bewertungen

- Results of Competition: November 2017 Sector Competition Strand 2: Infrastructure Systems - 3 To 12 Months 1711 - MM - INFRA - R4 - ST2 - 12MDokument32 SeitenResults of Competition: November 2017 Sector Competition Strand 2: Infrastructure Systems - 3 To 12 Months 1711 - MM - INFRA - R4 - ST2 - 12MJack PadiNoch keine Bewertungen

- Results of Competition: Increase Productivity, Performance and Quality in UK Construction Competition Code: 1807 - ISCF - IPPQUKCDokument52 SeitenResults of Competition: Increase Productivity, Performance and Quality in UK Construction Competition Code: 1807 - ISCF - IPPQUKCJack PadiNoch keine Bewertungen

- Results of Competition: November 2017 Sector Competition Strand 1: Materials and Manufacturing - Up To 12 Months 1711 - MM - INFRA - R4 - ST1 - 12MDokument44 SeitenResults of Competition: November 2017 Sector Competition Strand 1: Materials and Manufacturing - Up To 12 Months 1711 - MM - INFRA - R4 - ST1 - 12MJack PadiNoch keine Bewertungen

- Results of Competition: Support For Smes To Evaluate Innovative Medical Technologies 1801 - CRD - Ols - SmeimtDokument15 SeitenResults of Competition: Support For Smes To Evaluate Innovative Medical Technologies 1801 - CRD - Ols - SmeimtJack PadiNoch keine Bewertungen

- Results of Competition: Innovation in Health and Life Sciences Round 3 - Up To 12 Months 1710 - HLS - R3 - 12MDokument56 SeitenResults of Competition: Innovation in Health and Life Sciences Round 3 - Up To 12 Months 1710 - HLS - R3 - 12MJack PadiNoch keine Bewertungen

- Results of Competition: SBRI: Protecting Nuclear Decommissioning Operators Competition Code: 1804 - SBRI - SELLAFIELDDokument26 SeitenResults of Competition: SBRI: Protecting Nuclear Decommissioning Operators Competition Code: 1804 - SBRI - SELLAFIELDJack PadiNoch keine Bewertungen

- Results of Competition: Electric Vehicle Charging For Public Spaces: Feasibility Studies Competition Code: 1807 - FS - OLEV - ELEC - ST1Dokument45 SeitenResults of Competition: Electric Vehicle Charging For Public Spaces: Feasibility Studies Competition Code: 1807 - FS - OLEV - ELEC - ST1Jack PadiNoch keine Bewertungen

- Results of Competition: SBRI: Antimicrobial Resistance (AMR) in Humans Competition Code: 1807 - SBRI - ANTIMICROBIALDokument26 SeitenResults of Competition: SBRI: Antimicrobial Resistance (AMR) in Humans Competition Code: 1807 - SBRI - ANTIMICROBIALJack PadiNoch keine Bewertungen

- Results of Competition: Prospering From The Energy Revolution (PFER) - Blue Zone 1703 - CRD1 - ENRG - ENCATES5 - PFERBZDokument22 SeitenResults of Competition: Prospering From The Energy Revolution (PFER) - Blue Zone 1703 - CRD1 - ENRG - ENCATES5 - PFERBZJack PadiNoch keine Bewertungen

- Results of Competition: First of A Kind: Demonstrating Tomorrow's Trains Today 1710 - SBRI - FOAK - RAILDokument17 SeitenResults of Competition: First of A Kind: Demonstrating Tomorrow's Trains Today 1710 - SBRI - FOAK - RAILJack PadiNoch keine Bewertungen

- Results of Competition: Robotics and AI in Extreme Environments 1806 - ROB - AIDokument1 SeiteResults of Competition: Robotics and AI in Extreme Environments 1806 - ROB - AIJack PadiNoch keine Bewertungen

- Competition Results - SBRI First of A Kind 2 - Demonstrating Tomorrow S PDFDokument20 SeitenCompetition Results - SBRI First of A Kind 2 - Demonstrating Tomorrow S PDFJack PadiNoch keine Bewertungen

- Results of Competition: Innovation Loans: Manufacturing and Materials Readiness Competition Code: 1802 - LOAN - MMDokument16 SeitenResults of Competition: Innovation Loans: Manufacturing and Materials Readiness Competition Code: 1802 - LOAN - MMJack PadiNoch keine Bewertungen

- Results of Competition: SBRI - Roads For The Future (NIC) 1801 - SBRI - NIC - DRDADokument5 SeitenResults of Competition: SBRI - Roads For The Future (NIC) 1801 - SBRI - NIC - DRDAJack PadiNoch keine Bewertungen

- Design Foundations Round 1 2018 - Competition Results PDFDokument74 SeitenDesign Foundations Round 1 2018 - Competition Results PDFJack PadiNoch keine Bewertungen

- Results of Competition: Newton - UK-China Agri Tech Challenge 2017 Competition Code: 1706 - CRD1 - NEWTON - CHNBBSRCDokument19 SeitenResults of Competition: Newton - UK-China Agri Tech Challenge 2017 Competition Code: 1706 - CRD1 - NEWTON - CHNBBSRCJack PadiNoch keine Bewertungen

- Wireless Electric Vehicle Charging For Commercial Users - FS - Competition Results PDFDokument19 SeitenWireless Electric Vehicle Charging For Commercial Users - FS - Competition Results PDFJack PadiNoch keine Bewertungen

- Results of Competition: Sustainable Urbanisation Global Initiative (SUGI) 1612 - EU - ERANET - URBANDokument7 SeitenResults of Competition: Sustainable Urbanisation Global Initiative (SUGI) 1612 - EU - ERANET - URBANJack PadiNoch keine Bewertungen

- Results of Competition: Young Innovators' Awards Batch 1 1802 - CRD - YOUNG - INNOV - 1Dokument24 SeitenResults of Competition: Young Innovators' Awards Batch 1 1802 - CRD - YOUNG - INNOV - 1Jack PadiNoch keine Bewertungen

- Results of Competition: Precision Medicine Technologies: Shaping The Future Competition Code: 1805 - CRD - ASHN - PREC - MEDDokument39 SeitenResults of Competition: Precision Medicine Technologies: Shaping The Future Competition Code: 1805 - CRD - ASHN - PREC - MEDJack PadiNoch keine Bewertungen

- Results of Competition: Newton Fund - China - Guangdong Province 1707 - CRD1 - NEWTON - CHNGDSTDokument10 SeitenResults of Competition: Newton Fund - China - Guangdong Province 1707 - CRD1 - NEWTON - CHNGDSTJack PadiNoch keine Bewertungen

- Results of Competition: Newton - UK-India Industrial Biotechnology (BBSRC) 1706 - Crd1 - Newton - IndbbsrcDokument8 SeitenResults of Competition: Newton - UK-India Industrial Biotechnology (BBSRC) 1706 - Crd1 - Newton - IndbbsrcJack PadiNoch keine Bewertungen

- January 2018 Sector Competition - Strand 1 Health and Life Sciences - Competition Results PDFDokument63 SeitenJanuary 2018 Sector Competition - Strand 1 Health and Life Sciences - Competition Results PDFJack PadiNoch keine Bewertungen

- Results of Competition: Medicines Manufacturing Round 2: Challenge Fund Competition Code: 1803 - ISCF - ASHN - MEDMANR2Dokument22 SeitenResults of Competition: Medicines Manufacturing Round 2: Challenge Fund Competition Code: 1803 - ISCF - ASHN - MEDMANR2Jack PadiNoch keine Bewertungen

- Results of Competition: Faraday Battery Challenge: Innovation Feasibility Studies - Round 2 1801 - FS - TRANS - BATTERY - R2Dokument14 SeitenResults of Competition: Faraday Battery Challenge: Innovation Feasibility Studies - Round 2 1801 - FS - TRANS - BATTERY - R2Jack PadiNoch keine Bewertungen

- Results of Competition: Innovation Loans: Infrastructure Systems 1711 - LOAN - INFRA - FOAKDokument13 SeitenResults of Competition: Innovation Loans: Infrastructure Systems 1711 - LOAN - INFRA - FOAKJack PadiNoch keine Bewertungen

- Results of Competition: UK-China Collaboration To Tackle Antimicrobial Resistance Competition Code: 1802 - CRD - DH - CHN - AMRDokument28 SeitenResults of Competition: UK-China Collaboration To Tackle Antimicrobial Resistance Competition Code: 1802 - CRD - DH - CHN - AMRJack PadiNoch keine Bewertungen

- Results of Competition: DCMS Cyber Security Academic Startup Programme Phase 2 1804 - FS - DCMS - CSASP2Dokument18 SeitenResults of Competition: DCMS Cyber Security Academic Startup Programme Phase 2 1804 - FS - DCMS - CSASP2Jack PadiNoch keine Bewertungen

- December 2017 Sector Competition - Open - Competition Results Up - To - 12 - Months PDFDokument22 SeitenDecember 2017 Sector Competition - Open - Competition Results Up - To - 12 - Months PDFJack PadiNoch keine Bewertungen

- Marking SchemeDokument8 SeitenMarking Schememohamed sajithNoch keine Bewertungen

- Lord Chief Justice Speech On Jury TrialsDokument10 SeitenLord Chief Justice Speech On Jury TrialsThe GuardianNoch keine Bewertungen

- NSBM Student Well-Being Association: Our LogoDokument4 SeitenNSBM Student Well-Being Association: Our LogoMaithri Vidana KariyakaranageNoch keine Bewertungen

- Yahoo Tabs AbbDokument85 SeitenYahoo Tabs AbbKelli R. GrantNoch keine Bewertungen

- RAN16.0 Optional Feature DescriptionDokument520 SeitenRAN16.0 Optional Feature DescriptionNargiz JolNoch keine Bewertungen

- PotwierdzenieDokument4 SeitenPotwierdzenieAmina BerghoutNoch keine Bewertungen

- Timeline of American OccupationDokument3 SeitenTimeline of American OccupationHannibal F. Carado100% (3)

- Methodology For Rating General Trading and Investment CompaniesDokument23 SeitenMethodology For Rating General Trading and Investment CompaniesAhmad So MadNoch keine Bewertungen

- Inversion in Conditional SentencesDokument2 SeitenInversion in Conditional SentencesAgnieszka M. ZłotkowskaNoch keine Bewertungen

- Muhammad Naseem KhanDokument2 SeitenMuhammad Naseem KhanNasim KhanNoch keine Bewertungen

- Prayer For World Teachers Day: Author: Dr. Anthony CuschieriDokument1 SeitePrayer For World Teachers Day: Author: Dr. Anthony CuschieriJulian ChackoNoch keine Bewertungen

- Specific Relief Act, 1963Dokument23 SeitenSpecific Relief Act, 1963Saahiel Sharrma0% (1)

- Roof Structure Collapse Report - HongkongDokument11 SeitenRoof Structure Collapse Report - HongkongEmdad YusufNoch keine Bewertungen

- People Vs MaganaDokument3 SeitenPeople Vs MaganacheNoch keine Bewertungen

- BPV Installation Inspection Request Form With Payment AuthorizationDokument2 SeitenBPV Installation Inspection Request Form With Payment AuthorizationBoriche DivitisNoch keine Bewertungen

- Baseball Stadium Financing SummaryDokument1 SeiteBaseball Stadium Financing SummarypotomacstreetNoch keine Bewertungen

- XZNMDokument26 SeitenXZNMKinza ZebNoch keine Bewertungen

- Organizational Behavior: L. Jeff Seaton, Phd. Murray State UniversityDokument15 SeitenOrganizational Behavior: L. Jeff Seaton, Phd. Murray State UniversitySatish ChandraNoch keine Bewertungen

- About Debenhams Company - Google SearchDokument1 SeiteAbout Debenhams Company - Google SearchPratyush AnuragNoch keine Bewertungen

- Mandatory Minimum Requirements For Security-Related Training and Instruction For All SeafarersDokument9 SeitenMandatory Minimum Requirements For Security-Related Training and Instruction For All SeafarersDio Romero FariaNoch keine Bewertungen

- Actividad N°11 Ingles 4° Ii Bim.Dokument4 SeitenActividad N°11 Ingles 4° Ii Bim.jamesNoch keine Bewertungen

- Questionnaire of Personal and Organizational Values Congruence For Employee (Q-POVC-115)Dokument6 SeitenQuestionnaire of Personal and Organizational Values Congruence For Employee (Q-POVC-115)Kowshik SNoch keine Bewertungen

- Daftar Ebook-Ebook Manajemen Bisnis MantapDokument3 SeitenDaftar Ebook-Ebook Manajemen Bisnis MantapMohamad Zaenudin Zanno AkilNoch keine Bewertungen

- Retail Strategy: MarketingDokument14 SeitenRetail Strategy: MarketingANVESHI SHARMANoch keine Bewertungen

- sc2163 ch1-3 PDFDokument40 Seitensc2163 ch1-3 PDFSaeed ImranNoch keine Bewertungen

- The Overseas Chinese of South East Asia: Ian Rae and Morgen WitzelDokument178 SeitenThe Overseas Chinese of South East Asia: Ian Rae and Morgen WitzelShukwai ChristineNoch keine Bewertungen

- PRCSSPBuyer Can't See Catalog Items While Clicking On Add From Catalog On PO Line (Doc ID 2544576.1 PDFDokument2 SeitenPRCSSPBuyer Can't See Catalog Items While Clicking On Add From Catalog On PO Line (Doc ID 2544576.1 PDFRady KotbNoch keine Bewertungen