Beruflich Dokumente

Kultur Dokumente

Jeevan Saral

Hochgeladen von

Harish ChandCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Jeevan Saral

Hochgeladen von

Harish ChandCopyright:

Verfügbare Formate

HARISH CHAND

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

Jeevan Saral Plan Presentation

Date : 27/07/2010

HIGHLIGHTS

LIC’s Jeevan Saral is a unique plan having good features of the conventional plans and

the flexibility of unit linked plans. To the policyholder it provides —

· higher cover

· a smooth return,

· liquidity and

· a lot of flexibility

BENEFITS:

On death:

· 250 times the monthly premium, plus

· return of premiums excluding extra/rider premium and first year premium,

plus

· the loyalty addition, if any.

On Maturity:

· Maturity sum assured, plus

· The Loyalty Additions, if any

Special Features:

· High risk cover at low premium

· Extended risk cover for one year after 3 years premium payment.

· Optional higher cover through Term Riders

· The policyholder can choose a maximum term but can surrender at any time

without any surrender penalty or loss after 5 years

· Any number of withdrawals through partial surrendering

ELIGIBILITY CONDITIONS AND OTHER RESTRICTIONS:

· Age at entry : Minimum 12 (completed) and maximum 60 years nearest

· Age at maturity: Maximum 70 years.

· Term : All terms from 10 to 35 years.

· Premium : Minimum premium of Rs.250/- per month for entry age

upto 49 years and Rs.400/- per month for entry age 50

years and above. There will be no limit on the maximum

premium per month.

· Mode : Yearly, Half-yearly, Quarterly and Monthly under Salary

Saving Scheme

In case of term rider, minimum and maximum age at entry will be 18 and 50 years

respectively. Further minimum sum assured will be Rs.1 lakh.

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

HARISH CHAND

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

Jeevan Saral Plan Presentation

Jeevan Saral Plan Continued ... Pg. 2

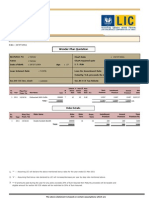

Name

Mr.:Sharma Age : 30 years

Term :

15 Years Mode : Monthly

Premium Budget p. m. : 2000 Installment Premium : 2000

Term Rider : 0 Term Rider Premium : 0

DAB : 500000 DAB Premium : 42

Total Installment Premium : 2042 Total Annual Premium : 24504

Section 80 CCE Invst. Limit : 100000 Section 80 CCE Tax Savings : 33.99 %

Risk Cover Benefits

DEATH BENEFIT

Variable Total

Annual Tax Nett Total

Year Age Premium Saved Premium Premium Paid Guaranteed Scenario1 Scenario2 Scenario1 Scenario2

2010 30 24504 8329 16175 16175 500000 0 0 500000 500000

2011 31 24504 8329 16175 32350 524000 0 0 524000 524000

2012 32 24504 8329 16175 48525 548000 0 0 548000 548000

2013 33 24504 8329 16175 64700 572000 0 0 572000 572000

2014 34 24504 8329 16175 80875 596000 0 0 596000 596000

2015 35 24504 8329 16175 97050 620000 0 0 620000 620000

2016 36 24504 8329 16175 113225 644000 0 0 644000 644000

2017 37 24504 8329 16175 129400 668000 0 0 668000 668000

2018 38 24504 8329 16175 145575 692000 0 0 692000 692000

2019 39 24504 8329 16175 161750 716000 35000 90000 751000 806000

2020 40 24504 8329 16175 177925 740000 40000 100000 780000 840000

2021 41 24504 8329 16175 194100 764000 45500 115000 809500 879000

2022 42 24504 8329 16175 210275 788000 51500 137500 839500 925500

2023 43 24504 8329 16175 226450 812000 58000 167500 870000 979500

2024 44 24504 8329 16175 242625 836000 65000 205000 901000 1041000

367560 124935 242625

Note : The figures in columns Scenario 1 and Scenario 2 above are non-guaranteed. They are estimated on the assumption of

LIC’s projected investment rate of return of 6% and 10% respectively on the investible portion of the premium.

The Investible portion of the premium is calculated as per LIC's benefit Illustration.

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

HARISH CHAND

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

Jeevan Saral Plan Presentation

Jeevan Saral Plan Continued ... Pg. 3

Name

Mr.:Sharma Age : 30 years

Term :

15 Years Mode : Monthly

Premium Budget p. m. : 2000 Installment Premium : 2000

Term Rider : 0 Term Rider Premium : 0

DAB : 500000 DAB Premium : 42

Total Installment Premium : 2042 Total Annual Premium : 24504

Section 80 CCE Invst. Limit : 100000 Section 80 CCE Tax Savings : 33.99 %

Maturity / Surrender Value Benefits

MATURITY / SURRENDER VALUE BENEFIT

Variable Total

Annual Tax Nett Total

Year Age Premium Saved Premium Premium Paid Guaranteed Scenario1 Scenario2 Scenario1 Scenario2

2010 30 24504 8329 16175 16175 0 0 0 0 0

2011 31 24504 8329 16175 32350 0 0 0 0 0

2012 32 24504 8329 16175 48525 40976 0 0 40976 40976

2013 33 24504 8329 16175 64700 65592 0 0 65592 65592

2014 34 24504 8329 16175 80875 94520 0 0 94520 94520

2015 35 24504 8329 16175 97050 117580 0 0 117580 117580

2016 36 24504 8329 16175 113225 141620 0 0 141620 141620

2017 37 24504 8329 16175 129400 166680 0 0 166680 166680

2018 38 24504 8329 16175 145575 192940 0 0 192940 192940

2019 39 24504 8329 16175 161750 221060 35000 90000 256060 311060

2020 40 24504 8329 16175 177925 250980 40000 100000 290980 350980

2021 41 24504 8329 16175 194100 280920 45500 115000 326420 395920

2022 42 24504 8329 16175 210275 313280 51500 137500 364780 450780

2023 43 24504 8329 16175 226450 348020 58000 167500 406020 515520

2024 44 24504 8329 16175 242625 386000 65000 205000 451000 591000

367560 124935 242625

Note : The figures in columns Scenario 1 and Scenario 2 above are non-guaranteed. They are estimated on the assumption of

LIC’s projected investment rate of return of 6% and 10% respectively on the investible portion of the premium.

The Investible portion of the premium is calculated as per LIC's benefit Illustration.

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Corporate AgentsDokument1.023 SeitenCorporate AgentsVivek Thota0% (1)

- 16 Year at 41 AgeDokument4 Seiten16 Year at 41 AgeHarish ChandNoch keine Bewertungen

- Multi - Plan Chart: Harish ChandDokument3 SeitenMulti - Plan Chart: Harish ChandHarish ChandNoch keine Bewertungen

- Jeevan Anand: Harish ChandDokument4 SeitenJeevan Anand: Harish ChandHarish ChandNoch keine Bewertungen

- Rad 28 E72Dokument1 SeiteRad 28 E72Harish ChandNoch keine Bewertungen

- Mrs. Nirali Mehta: Insurance Proposal ForDokument5 SeitenMrs. Nirali Mehta: Insurance Proposal ForHarish ChandNoch keine Bewertungen

- Mr. Gupta: Harish ChandDokument4 SeitenMr. Gupta: Harish ChandHarish ChandNoch keine Bewertungen

- Multi - Plan Chart: Harish ChandDokument3 SeitenMulti - Plan Chart: Harish ChandHarish ChandNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)