Beruflich Dokumente

Kultur Dokumente

Corporate Veil & Governance-1

Hochgeladen von

silvernitrate1953Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Corporate Veil & Governance-1

Hochgeladen von

silvernitrate1953Copyright:

Verfügbare Formate

CORPORATE VEIL

&

GOVERNANCE

PARDE MEIN REHNE DO PARDA NA UTHAO

The famous song from the movie, Shikar is the refrain of the

promoters, whereas the common investing public would much rather

sing “Parda Uthe Salaam Ho Jaaye” The courts have had to strike a

fine balance between the two.

Piercing of Corporate Veil under Statutory Provisions enshrined

under the Companies Act, 2013

The Veil of a company may be lifted in certain cases or pierced as per express

provisions of the Act. In other words, the advantages of ‘distinct entity’ and

‘limited liability’ may not be allowed to be enjoyed in certain circumstances.

The Companies Act, 2013 itself provides for certain cases in which the

directors or members of the company may be held personally liable. In

such cases, while the separate entity of the company is maintained, the

directors or members are held personally liable along with the company.

HISTORICAL PERSPECTIVE

The House of Lords in Salomon v Salomon1 affirmed the legal principle that,

upon incorporation, a company is generally considered to be a new legal

entity separate from its shareholders. The court did this in relation to what was

essentially a one person company. Windeyer J, in the High Court in Peate v

Federal Commissioner of Taxation, stated that a company represents:

“new legal entity, a person in the eye of the law. Perhaps it were better in some

cases to say a legal persona, for the Latin word in one of its senses means a

mask: Eriptur persona, manet res.”

Salomon v Salomon & Co [1897] AC 22

“Between the investor, who participates as a shareholder, and the

undertaking carried on, the law interposes another person, real though

artificial, the company itself, and the business carried on is the

business of that company, and the capital employed is its capital and

not in either case the business or the capital of the shareholders.

Assuming, of course, that the company is duly formed and is not a

sham...the idea that it is mere machinery for effecting the purposes of

the shareholders is a layman’s fallacy. It is a figure of speech, which

cannot alter the legal aspect of the facts.”

Lord Sumner in Gas Lighting Improvement Co Ltd v Inland

Revenue Commissioners (1923) AC 723

The separate legal entity principle has continued unexpurgated corporate law

for more than one hundred years. When a company acts it does so in its own

right and not just as an alias for its controllers. Similarly, shareholders are not

liable for the company’s debts beyond their initial capital investment, and have

no proprietary interest in the property of the company.

At the same time, courts have acknowledged that the corporate veil of a

company may be pierced to deny shareholders the protection that limited liability

normally provides. “Piercing the corporate veil” refers to the judicially imposed

exception to the separate legal entity principle, whereby courts disregard the

separateness of the corporation and hold a shareholder responsible for the actions

of the corporation as if it were the actions of the shareholder. A court may also pierce

the corporate veil where requested to do so by the company itself or shareholders in

the company, in order to afford a remedy that would otherwise be denied, create an

enforceable right, or lessen a penalty.

The object of incorporation as a distinct legal entity is to promote the widest

possible public participation in joint undertakings, with liability limited to the

investment in the undertaking. But, like all good things, the corporate personality has

also, unfortunately, lent itself to abuse in some cases, e.g., outwitting the Revenue or

defrauding creditors. There may also be unintended hardship where a fetish is made

of the legal form and an undertaking is denied the relief that is reasonably due to it.

Courts have not hesitated to look at the reality beyond the apparent, wherever

substantial justice has required it. While the Courts have been increasingly liberal,

the treatment of the concept of incorporation by the Legislature has also been getting

too casual for comfort, in recent years.

When courts pierce the corporate veil, they can remove the protection of

limited liability otherwise granted to shareholders. It is therefore relevant to

review the reasons why companies are granted limited liability.

Three reasons, based upon principles of economic efficiency, can be

provided for why companies are granted limited liability. First, limited liability

decreases the need for shareholders to monitor the managers of companies

in which they invest because the financial consequences of company failure

are limited. Shareholders may have neither the incentive (particularly if they

have only a small shareholding) nor the expertise to monitor the actions of

managers. The potential costs of operating companies are reduced because

limited liability makes shareholder diversification and passivity a more rational

strategy.

Secondly, limited liability provides incentives for managers to act efficiently

and in the interests of shareholders by promoting the free transfer of shares.

This argument has two parts to it. First, the free transfer of shares is promoted

by limited liability because under this principle the wealth of other

shareholders is irrelevant. If a principle of unlimited liability applied, the value

of shares would be determined partly by the wealth of shareholders. In other

words, the price at which an individual shareholder might purchase a share

would be determined in part by the wealth of that shareholder which was now

at risk because of unlimited liability. The second part of the argument (that

limited liability provides managers with incentives to act efficiently and in the

interests of shareholders) is derived from the fact that if a company is being

managed inefficiently, shareholders can be expected to be selling their shares

at a discount to the price which would exist if the company were being

managed efficiently. This creates the possibility of a takeover of the company

and the replacement of the incumbent management.

Thirdly, limited liability assists the efficient operation of the securities markets

because the prices at which shares trade does not depend upon an

evaluation of the wealth of individual shareholders.

The paper of which above is the first part draws upon legal expertise of a

number of authorities all of whom cannot be individually acknowledged. To

repeat Aristotle: “ART IS IMITATION”

Das könnte Ihnen auch gefallen

- Corporate Governance 4 5Dokument5 SeitenCorporate Governance 4 5silvernitrate1953Noch keine Bewertungen

- Corporate Governance-4-3Dokument4 SeitenCorporate Governance-4-3silvernitrate1953Noch keine Bewertungen

- Corporate Governance 2Dokument4 SeitenCorporate Governance 2silvernitrate1953Noch keine Bewertungen

- Corporate Governance 4 AbDokument3 SeitenCorporate Governance 4 Absilvernitrate1953Noch keine Bewertungen

- Corporate Governance 4aDokument5 SeitenCorporate Governance 4asilvernitrate1953Noch keine Bewertungen

- Corporate Governance 3Dokument4 SeitenCorporate Governance 3silvernitrate1953Noch keine Bewertungen

- Forensic Accounting 14Dokument3 SeitenForensic Accounting 14silvernitrate1953Noch keine Bewertungen

- Forensic Accounting-20Dokument4 SeitenForensic Accounting-20silvernitrate1953Noch keine Bewertungen

- Forensic Accounting 11Dokument4 SeitenForensic Accounting 11silvernitrate1953Noch keine Bewertungen

- Forensic Accounting 15Dokument4 SeitenForensic Accounting 15silvernitrate1953Noch keine Bewertungen

- Corporate Veil 4Dokument3 SeitenCorporate Veil 4silvernitrate1953Noch keine Bewertungen

- The Substance v. Form Debate: Forensic Accounting Avoidance Versus EvasionDokument5 SeitenThe Substance v. Form Debate: Forensic Accounting Avoidance Versus Evasionsilvernitrate1953Noch keine Bewertungen

- Forensic Accounting 16Dokument6 SeitenForensic Accounting 16silvernitrate1953Noch keine Bewertungen

- Forensic Accounting 2Dokument3 SeitenForensic Accounting 2silvernitrate1953Noch keine Bewertungen

- Forensic Accounting How Books Are Fudged 1. Accelerating RevenuesDokument3 SeitenForensic Accounting How Books Are Fudged 1. Accelerating Revenuessilvernitrate1953Noch keine Bewertungen

- Corporate Veil & Governance Parde Mein Rehne Do Parda Na UthaoDokument4 SeitenCorporate Veil & Governance Parde Mein Rehne Do Parda Na Uthaosilvernitrate1953Noch keine Bewertungen

- Corporate Veil & Governance Parde Mein Rehne Do Parda Na UthaoDokument3 SeitenCorporate Veil & Governance Parde Mein Rehne Do Parda Na Uthaosilvernitrate1953Noch keine Bewertungen

- Forensic Accounting 1Dokument4 SeitenForensic Accounting 1silvernitrate1953Noch keine Bewertungen

- Forensic Accounting 19Dokument3 SeitenForensic Accounting 19silvernitrate1953Noch keine Bewertungen

- Corporate Veil & Governance: Parda Uthe Salaam Ho JaayeDokument6 SeitenCorporate Veil & Governance: Parda Uthe Salaam Ho Jaayesilvernitrate1953Noch keine Bewertungen

- Corporate Veil & Governance Parde Mein Rehne Do Parda Na UthaoDokument5 SeitenCorporate Veil & Governance Parde Mein Rehne Do Parda Na Uthaosilvernitrate1953Noch keine Bewertungen

- Corporate Veil & Governance Parde Mein Rehne Do Parda Na UthaoDokument3 SeitenCorporate Veil & Governance Parde Mein Rehne Do Parda Na Uthaosilvernitrate1953Noch keine Bewertungen

- Corporate Veil & Governance Parda Uthe Sallam Ho JaayeDokument4 SeitenCorporate Veil & Governance Parda Uthe Sallam Ho Jaayesilvernitrate1953Noch keine Bewertungen

- Corporate Veil & Governance Parde Mein Rehne Do Parda Na UthaoDokument3 SeitenCorporate Veil & Governance Parde Mein Rehne Do Parda Na Uthaosilvernitrate1953Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- English 4 IT. Praktyczny Kurs Języka Angielskiego Dla Specjalistów IT I Nie Tylko PDFDokument283 SeitenEnglish 4 IT. Praktyczny Kurs Języka Angielskiego Dla Specjalistów IT I Nie Tylko PDFFranciszek Franko100% (4)

- W. P. Carey School of BusinessDokument5 SeitenW. P. Carey School of BusinessgvsfansNoch keine Bewertungen

- Phuket Beach Hotel Case Analysis: Corporate Finance F3, 2015Dokument9 SeitenPhuket Beach Hotel Case Analysis: Corporate Finance F3, 2015Ashadi CahyadiNoch keine Bewertungen

- Crown Cork and SealDokument33 SeitenCrown Cork and SealRena SinghiNoch keine Bewertungen

- Economics Report Group 4Dokument14 SeitenEconomics Report Group 4AKSHAY SURANA100% (1)

- Module - 4 Money Market & Capital Market in IndiaDokument11 SeitenModule - 4 Money Market & Capital Market in IndiaIshan GoyalNoch keine Bewertungen

- Choosing A Wrong Career PathDokument46 SeitenChoosing A Wrong Career PathMrutyunjay MishraNoch keine Bewertungen

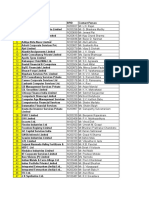

- Presentation On HSBC BaNKDokument12 SeitenPresentation On HSBC BaNKmaruthi_rokzs19Noch keine Bewertungen

- Keiretsu OS Presentation - FinalDokument27 SeitenKeiretsu OS Presentation - FinalJaison JosephNoch keine Bewertungen

- Mechanics of Financial Accounting RevisedDokument4 SeitenMechanics of Financial Accounting RevisedalakshendraNoch keine Bewertungen

- Rothschild - The Hidden Sovereign Power Behind BISDokument1 SeiteRothschild - The Hidden Sovereign Power Behind BISquartzstatisticsNoch keine Bewertungen

- Competitiveness of The Industries Based On Porter's Diamond ModelDokument15 SeitenCompetitiveness of The Industries Based On Porter's Diamond ModelDennisWarrenNoch keine Bewertungen

- Data Analysis and InterpretationDokument12 SeitenData Analysis and Interpretationsaimhatre1122004Noch keine Bewertungen

- Transcript / Minutes of Conference Call (Company Update)Dokument20 SeitenTranscript / Minutes of Conference Call (Company Update)Shyam SunderNoch keine Bewertungen

- Union Glass Vs SECDokument17 SeitenUnion Glass Vs SECjjjzosaNoch keine Bewertungen

- The Fair Value Option ASC 825 (FAS159) Student Ver S10Dokument21 SeitenThe Fair Value Option ASC 825 (FAS159) Student Ver S10andri juniawanNoch keine Bewertungen

- Content/Discussion Partnership Defined: Attributes of A PartnershipDokument30 SeitenContent/Discussion Partnership Defined: Attributes of A PartnershipAnneShannenBambaDabuNoch keine Bewertungen

- Enron An Examination of Agency ProblemsDokument15 SeitenEnron An Examination of Agency ProblemsuummulkhairNoch keine Bewertungen

- Corporate Finance File 2Dokument11 SeitenCorporate Finance File 2Jai ShreeramNoch keine Bewertungen

- Creuk Radio Business Plan: President Aaron Cavanaugh 7245 SW Ashdale Drive Portland, OR 97223 503-841-4198Dokument18 SeitenCreuk Radio Business Plan: President Aaron Cavanaugh 7245 SW Ashdale Drive Portland, OR 97223 503-841-4198Rahul RoyNoch keine Bewertungen

- Smart Buildings ReportDokument17 SeitenSmart Buildings ReportmohitkalraNoch keine Bewertungen

- PM Term SheetDokument19 SeitenPM Term SheetVidya AdsuleNoch keine Bewertungen

- Formalities For Setting Up Small BusinessDokument37 SeitenFormalities For Setting Up Small BusinessNitya GuptaNoch keine Bewertungen

- Introduction of The in Duplum Rule in KenyaDokument15 SeitenIntroduction of The in Duplum Rule in KenyaMacduff RonnieNoch keine Bewertungen

- Case StudyDokument12 SeitenCase StudyRohit GadgeNoch keine Bewertungen

- Dipartimento: Economia E Management Cattedra: Economiaaziendale (Business Administration)Dokument56 SeitenDipartimento: Economia E Management Cattedra: Economiaaziendale (Business Administration)Kanak MishraNoch keine Bewertungen

- Contact Details of RTAsDokument18 SeitenContact Details of RTAsmugdha janiNoch keine Bewertungen

- Assistant Accountant CV TemplateDokument3 SeitenAssistant Accountant CV TemplateAhmed TallanNoch keine Bewertungen

- Braeutigam Ronald - Optimal Policies For Natural MonopoliesDokument58 SeitenBraeutigam Ronald - Optimal Policies For Natural MonopoliesMaximiliano FerrarisNoch keine Bewertungen

- Sun Hung Kai CaseDokument17 SeitenSun Hung Kai CaseHienka TranNoch keine Bewertungen